PDF 2 August 2019 2018/19 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IN TAX LEADERS WOMEN in TAX LEADERS | 4 AMERICAS Latin America

WOMEN IN TAX LEADERS THECOMPREHENSIVEGUIDE TO THE WORLD’S LEADING FEMALE TAX ADVISERS SIXTH EDITION IN ASSOCIATION WITH PUBLISHED BY WWW.INTERNATIONALTAXREVIEW.COM Contents 2 Introduction and methodology 8 Bouverie Street, London EC4Y 8AX, UK AMERICAS Tel: +44 20 7779 8308 4 Latin America: 30 Costa Rica Fax: +44 20 7779 8500 regional interview 30 Curaçao 8 United States: 30 Guatemala Editor, World Tax and World TP regional interview 30 Honduras Jonathan Moore 19 Argentina 31 Mexico Researchers 20 Brazil 31 Panama Lovy Mazodila 24 Canada 31 Peru Annabelle Thorpe 29 Chile 32 United States Jason Howard 30 Colombia 41 Venezuela Production editor ASIA-PACIFIC João Fernandes 43 Asia-Pacific: regional 58 Malaysia interview 59 New Zealand Business development team 52 Australia 60 Philippines Margaret Varela-Christie 53 Cambodia 61 Singapore Raquel Ipo 54 China 61 South Korea Managing director, LMG Research 55 Hong Kong SAR 62 Taiwan Tom St. Denis 56 India 62 Thailand 58 Indonesia 62 Vietnam © Euromoney Trading Limited, 2020. The copyright of all 58 Japan editorial matter appearing in this Review is reserved by the publisher. EUROPE, MIDDLE EAST & AFRICA 64 Africa: regional 101 Lithuania No matter contained herein may be reproduced, duplicated interview 101 Luxembourg or copied by any means without the prior consent of the 68 Central Europe: 102 Malta: Q&A holder of the copyright, requests for which should be regional interview 105 Malta addressed to the publisher. Although Euromoney Trading 72 Northern & 107 Netherlands Limited has made every effort to ensure the accuracy of this Southern Europe: 110 Norway publication, neither it nor any contributor can accept any regional interview 111 Poland legal responsibility whatsoever for consequences that may 86 Austria 112 Portugal arise from errors or omissions, or any opinions or advice 87 Belgium 115 Qatar given. -

2021 Indirect Tax Leaders Guide and May Not Be Used for Any Other Purpose

INDIRECT TAX LEADERS THECOMPREHENSIVEGUIDE TO THE WORLD’S LEADING INDIRECT TAX ADVISERS NINTH EDITION IN ASSOCIATION WITH PUBLISHED BY WWW.INTERNATIONALTAXREVIEW.COM BECOME PART OF THE ITR COMMUNITY. CONNECT WITH US TODAY. Facebook “Like” us on Facebook at www.facebook.com/internationaltaxreview f and connect with our editorial team and fellow readers. LinkedIn Join our group, International Tax Review, to meet your peers in and get incomparable market coverage. Twitter Follow us at @IntlTaxReview for exclusive research and t ranking insight, commentary, analysis and opinions. To subscribe, contact: Jack Avent Tel: +44 (0) 20 7779 8379 | Email: [email protected] www.internationaltaxreview.com Contents 2 Introduction and methodology 8 Bouverie Street, London EC4Y 8AX, UK Tel: +44 20 7779 8308 AMERICAS Fax: +44 20 7779 8500 Editor, World Tax and World TP 11 Argentina 18 Costa Rica Jonathan Moore 11 Bolivia 18 Ecuador 11 Brazil 19 Mexico Researchers 14 Canada 19 Peru Jason Howard Lovy Mazodila 17 Chile 20 United States Annabelle Thorpe 18 Colombia 21 Uruguay Production editor João Fernandes ASIA-PACIFIC Business development team 30 Australia 44 Philippines Margaret Varela-Christie 32 China 45 Singapore Raquel Ipo 32 Hong Kong SAR 46 South Korea Alexandra Strick 33 India 46 Sri Lanka Managing director, LMG Research 39 Indonesia 46 Taiwan Tom St. Denis 41 Japan 47 Thailand © Euromoney Trading Limited, 2020. The copyright of all 42 Malaysia 47 Vietnam editorial matter appearing in this Review is reserved by the 43 New Zealand publisher. No matter contained herein may be reproduced, duplicated EUROPE, MIDDLE EAST & AFRICA or copied by any means without the prior consent of the 63 Austria 77 Netherlands holder of the copyright, requests for which should be 63 Azerbaijan 80 Norway addressed to the publisher. -

Devoir De Vigilance: Reforming Corporate Risk Engagement

Devoir de Vigilance: Reforming Corporate Risk Engagement Copyright © Development International e.V., 2020 ISBN: 978-3-9820398-5-5 Authors: Juan Ignacio Ibañez, LL.M. Chris N. Bayer, PhD Jiahua Xu, PhD Anthony Cooper, J.D. Title: Devoir de Vigilance: Reforming Corporate Risk Engagement Date published: 9 June 2020 Funded by: iPoint-systems GmbH www.ipoint-systems.com 1 “Liberty consists of being able to do anything that does not harm another.” Article 4, Declaration of the Rights of the Man and of the Citizen of 1789, France 2 Executive Summary The objective of this systematic investigation is to gain a better understanding of how the 134 confirmed in-scope corporations are complying with – and implementing – France’s progressive Devoir de Vigilance law (LOI n° 2017-399 du 27 Mars 2017).1 We ask, in particular, what subject companies are doing to identify and mitigate social and environmental risk/impact factors in their operations, as well as for their subsidiaries, suppliers, and subcontractors. This investigation also aims to determine practical steps taken regarding the requirements of the law, i.e. how the corporations subject to the law are meeting these new requirements. Devoir de Vigilance is at the legislative forefront of the business and human rights movement. A few particular features of the law are worth highlighting. Notably, it: ● imposes a duty of vigilance (devoir de vigilance) which consists of a substantial standard of care and mandatory due diligence, as such distinct from a reporting requirement; ● sets a public reporting requirement for the vigilance plan and implementation report (compte rendu) on top of the substantial duty of vigilance; ● strengthens the accountability of parent companies for the actions of subsidiaries; ● encourages subject companies to develop their vigilance plan in association with stakeholders in society; ● imposes civil liability in case of non-compliance; ● allows stakeholders with a legitimate interest to seek injunctive relief in the case of a violation of the law. -

Economic Framework Sourcing List

Pan-Regulators’ Framework for Economic, Financial & Related Consultancy Services Final Sourcing Lists 2015 Introduction The purpose of this document is to give an overview of the final sourcing lists of the new Pan-Regulator’s Framework for Economic, Financial and Related Consultancy Services and to inform users of the range and choice of suppliers available. The new Framework will come into effect from 1st September 2015 and will be valid until 31st August 2018 (with a one year extension option). Lot 1. Energy Advice Relating to Economic and Environmental Areas This Lot covers consultancy on all aspects of specialised economic and environmental advice relating to energy. Advice may relate to establishment of suitable strategies, policies, processes and organisation of economic responsibilities within an organisation. Sub-Lot 1A. Regulatory and Incentive Design Ability to analyse various proposals in relation to regulatory policy development balancing consumer interest over short term and over the longer term Understanding of financial and economic incentives to encourage implementation of effective and efficient programmes by the company Understanding of the historical development of the current GB energy market arrangements, and ability to draw implications for policy design using relevant economic models. Ability to review alternative options and provide detailed cost benefit analysis Economic assessment of options so that the incentive scheme satisfies the economic efficiency criteria for the users of the system Development -

2018 Analyser. Débattre. Agir. 1 Sommaire

INSTITUT MONTAIGNE 2018 ANALYSER. DÉBATTRE. AGIR. 1 SOMMAIRE LES MOTS DU PRÉSIDENT, HENRI DE CASTRIES 5 LE POINT DE VUE DE LAURENT BIGORGNE 6 L’INSTITUT MONTAIGNE 9 SAISIR LES ENJEUX DU NUMÉRIQUE 15 AFFRONTER LES DÉFIS DE NOTRE TERRITOIRE 35 COOPÉRER À L’ÉCHELLE EUROPÉENNE 55 COMPRENDRE LE MONDE 67 NOUS LES AVONS REÇUS 81 QUI SOMMES-NOUS ? 99 ILS NOUS SOUTIENNENT 105 NOUS REJOINDRE 109 3 LES MOTS DU PRÉSIDENT HENRI DE CASTRIES 18 bougies : l’Institut Mais cette mue est exigeante et répond avant Montaigne, fondé tout à une nécessité, celle de faire émerger des en 2000 par Claude acteurs capables de prendre le temps de la Bébéar, atteint cette réflexion, d’écouter toutes les parties prenantes, année le stade de sa de répondre aux interrogations des citoyens. De majorité. Plus qu’un ce fait, l’accroissement des activités de l’Institut âge symbolique, ces dix-huit années de travail Montaigne en région, porté par l’adhésion auront permis de faire d’un think tank français, d’entreprises attachées à leur territoire, permet dans un écosystème national peu accoutumé à ce de faire émerger des expertises qui nous type de structures, un acteur clé de la définition enrichissent. des politiques publiques. Au-delà de cette longévité et d’une place désormais solidement Cet ancrage renforce les valeurs de notre reconnue en France, ce sont trois paliers majeurs think tank, parmi lesquelles l’indépendance que l’Institut a franchis en 2018. de financement - puisque nous ne souhaitons percevoir aucun financement public - et la Un palier géographique : historiquement pluralité des points de vue. -

Baromètre Edhec - Cadremploi Jeunes Diplômés Master

BAROMÈTRE EDHEC - CADREMPLOI JEUNES DIPLÔMÉS MASTER 23ème édition Juin 2016 BAROMÈTRE EDHEC - CADREMPLOI JEUNES DIPLÔMÉS MASTER Quelles sont les tendances du marché de l’emploi des jeunes diplômés de niveau Master ? Voilà la question à laquelle nous répondons 3 fois par an depuis janvier 2009. Cette 23ème édition du baromètre EDHEC est réalisée en collaboration avec CADREMPLOI, premier site emploi privé pour les cadres et les dirigeants en France. EDHEC NewGen Talent Centre © & CADREMPLOI - Juin 2016 - 23ème édition du BAROMÈTRE EDHEC - CADREMPLOI 2 150 ENTREPRISES PARTICIPENT AU BAROMÈTRE EDHEC - CADREMPLOI ABASE - ACCENTURE - ADVENTS - AELIA - LS TRAVEL RETAIL - AEROPORTS DE LA COTE D'AZUR - AIR LIQUIDE GROUPE - ALINEA - ALTER&GO - APPROACH PEOPLE - RECRUITMENT - ARKEMA - ARM France - ARROW ECS - ASPEN - ATOS - AUCHAN - AXA - BANQUE DE FRANCE - BANQUE FRANCAISE COMMERCIAL OCEAN INDIEN - BARCLAYS - BDO ADVISORY - BETC - BILLIERES BUSINESS SCHOOL - BURSON MARSTELLER - CAISSE D'EPARGNE COTE D'AZUR - CAPGEMINI CONSULTING - CAPTALENTS - CARREFOUR - CARTIER - CASTORAMA - CCI NICE COTE D'AZUR - CGI BUSINESS CONSULTING - CHAMPAGNE MOET - HENNESSY & CHANDON MHCS - CHARLES RICHARDSON - CHECKPOINT SYSTEMS FRANCE SAS - COCA COLA - COFIDIS PARTICIPATIONS GROUPE - COGEDIS - COLOMBUS CONSULTING - CONVICTIONS RH - CREDIT AGRICOLE - CREDIT DU NORD - CSC COMPUTER SCIENCES - DAMARTEX - DATACET - DELFOSSE - DELOITTE - DFDS SEAWAYS - EIGHT ADVISORY - ENESCO - EUROFEU - EUROPACORP TELEVISION - EUROTEKNIKA - EXPER - EXXON CHEMICAL FRANCE - EY GROUPE - FAURECIA -

EVALUATION of the RISKS of COLLECTIVE DOMINANCE in the AUDIT INDUSTRY in FRANCE Olivier Billard* Bredin Prat Marc Ivaldi* Toulou

EVALUATION OF THE RISKS OF COLLECTIVE DOMINANCE IN THE AUDIT INDUSTRY IN FRANCE Olivier Billard* Bredin Prat Marc Ivaldi* Toulouse School of Economics Sébastien Mitraille* Toulouse Business School (University of Toulouse) May 18, 2011 (revised June 7, 2012) Summary: The financial crisis drew attention to the crucial role of transparency and the independence of financial certification intermediaries, in particular, statutory auditors. Now any anticompetitive practice involving coordinated increases in prices or concomitant changes in quality that impacts financial information affects the effectiveness of this intermediation. It is therefore not surprising that the competitive analysis of the audit market is a critical factor in regulating financial systems, all the more so as this market is marked by various barriers to entry, such as the incompatibility of certification tasks with the preparation of financial statements or consulting, the expertise on (and the ability to apply) international standards for the presentation of financial information, the need to attract top young graduates, the prohibition of advertising, or the two-sided nature of this market where the quality of financial information results from the interaction between the reputation of auditors and audited firms. Against this backdrop, we propose a legal and economic study of the risks of collective dominance in the statutory audit market in France using the criteria set by Airtours case and, in particular, by analyzing how regulatory obligations incumbent on statutory auditors may favour the appearance of tacit collusion. Our analysis suggests that nothing prevents collective dominance of the auditors of the Big Four group in France to exist, which is potentially detrimental to the economy as a whole as the audit industry may fail to provide the optimal level of financial information. -

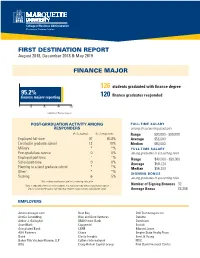

First Destination Report Finance Major

FIRST DESTINATION REPORT August 2018, December 2018 & May 2019 FINANCE MAJOR 126 students graduated with finance degree 95.2% finance majors reporting 120 finance graduates responded 0 50 75 100 150 175 200 number of finance majors POST-GRADUATION ACTIVITY AMONG FULL-TIME SALARY RESPONDERS among all accounting graduates # of students % of responses Range $30,000 - $90,000 Employed full-time 97 80.8% Average $58,600 Enrolled in graduate school 12 10% Median $60,000 Military * *% FULL-TIME SALARY Post-gradudate service 0 0% among graduates in accounting roles Employed part-time * *% Range $40,000 - $90,000 School part-time 0 0% Average $58,124 Planning to attend gradaute school * *% Median $56,250 Other1 * *% SIGNING BONUS Seeking 6 5% among graduates in accounting roles 1 Not seeking employment and not continuing education. *Data is reported when 5 or more students in a major pursued the post-graduation option. Number of Signing Bonuses 32 Data is collected through a self-reported student survey, faculty and LinkedIn input. Average Bonus $5,258 EMPLOYERS Americaneagle.com Best Buy Dell Technologies Inc. AndCo Consulting Blue and Gold Ventures Deloitte Arthur J. Gallagher BMO Harris Bank Dominium AssetMark Capgemini Ecolab Associated Bank CBRE Edward Jones AXA Partners Chase Empire State Realty Trust Baird Clarity Insights Ernst & Young Baker Tilly Virchow Krause, LLP Colliers International FDIC BDO Craig-Hallum Capital Group First Bank Financial Center EMPLOYERS (CONTINUED) First Business Financial Services Marshall & Stevens Scotiabank -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

"SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V

Erkende referenten / Recognised sponsors Arbeid Regulier en Kennismigranten / Regular labour and Highly skilled migrants Naam bedrijf/organisatie Inschrijfnummer KvK Name company/organisation Registration number Chamber of Commerce "@1" special projects payroll B.V. 70880565 "SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V. 82701695 01-10 Architecten B.V. 24257403 100 Grams B.V. 69299544 10X Genomics B.V. 68933223 12Connect B.V. 20122308 180 Amsterdam BV 34117849 1908 Acquisition B.V. 60844868 2 Getthere Holding B.V. 30225996 20Face B.V. 69220085 21 Markets B.V. 59575417 247TailorSteel B.V. 9163645 24sessions.com B.V. 64312100 2525 Ventures B.V. 63661438 2-B Energy Holding 8156456 2M Engineering Limited 17172882 30MHz B.V. 61677817 360KAS B.V. 66831148 365Werk Contracting B.V. 67524524 3D Hubs B.V. 57883424 3DUniversum B.V. 60891831 3esi Netherlands B.V. 71974210 3M Nederland B.V. 28020725 3P Project Services B.V. 20132450 4DotNet B.V. 4079637 4People Zuid B.V. 50131907 4PS Development B.V. 55280404 4WEB EU B.V. 59251778 50five B.V. 66605938 5CA B.V. 30277579 5Hands Metaal B.V. 56889143 72andSunny NL B.V. 34257945 83Design Inc. Europe Representative Office 66864844 A. Hak Drillcon B.V. 30276754 A.A.B. International B.V. 30148836 A.C.E. Ingenieurs en Adviesbureau, Werktuigbouw en Electrotechniek B.V. 17071306 A.M. Best (EU) Rating Services B.V. 71592717 A.M.P.C. Associated Medical Project Consultants B.V. 11023272 A.N.T. International B.V. 6089432 A.S. Watson (Health & Beauty Continental Europe) B.V. 31035585 A.T. Kearney B.V. -

2018 Global Go to Think Tank Index Report1

University of Pennsylvania Masthead Logo ScholarlyCommons TTCSP Global Go To Think aT nk Index Reports Think aT nks and Civil Societies Program (TTCSP) 1-2019 2018 Global Go To Think aT nk Index Report James G. McGann University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/think_tanks Part of the International and Area Studies Commons McGann, James G., "2018 Global Go To Think aT nk Index Report" (2019). TTCSP Global Go To Think Tank Index Reports. 16. https://repository.upenn.edu/think_tanks/16 2019 Copyright: All rights reserved. No part of this report may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by information storage or retrieval system, without written permission from the University of Pennsylvania, Think aT nks and Civil Societies Program. All requests, questions and comments should be sent to: James G. McGann, Ph.D. Senior Lecturer, International Studies Director, Think aT nks and Civil Societies Program The Lauder Institute University of Pennsylvania Email: [email protected] This paper is posted at ScholarlyCommons. https://repository.upenn.edu/think_tanks/16 For more information, please contact [email protected]. 2018 Global Go To Think aT nk Index Report Abstract The Thinka T nks and Civil Societies Program (TTCSP) of the Lauder Institute at the University of Pennsylvania conducts research on the role policy institutes play in governments and civil societies around the world. Often referred to as the “think tanks’ think tank,” TTCSP examines the evolving role and character of public policy research organizations. -

Religious Discrimination in Access to Employment: a Reality

Religious discrimination in access to employment: a reality Marie-Anne Valfort POLICY PAPER OCTOBER 2015 The Institut Montaigne is an independent think tank founded in 2000 by Claude Bébéar and directed by Laurent Bigorgne. It has no partisan ties and its highly diversified funding is from private sources only; no single contribution accounts for more than 2% of the annual budget. It brings together business leaders, senior civil servants, academics and representatives of civil society from different backgrounds and with diverse experiences. Institut Montaigne’s work focuses on four areas of research: Social cohesion (primary and secondary education, youth and older people’s employment, corporate governance, equal opportunity, social mobility, housing) Modernising public action (pension system, legal system, healthcare system) Economic competitiveness (entrepreneurship, energy & climate change, emerging states, corporate financing, intellectual property, transportation) Public finance (Tax system, social protection) Thanks to both its associated experts and its study groups, the Institut Montaigne pro- duces practical long-term proposals on the substantial challenges that our contemporary societies are facing. It therefore helps shaping the evolutions of social consciousness. Its recommendations are based on a rigorous and critical method of analysis. These recommendations are then actively promoted to decision-making governmental officials. Throughout its publications, lectures and conferences, the Institut Montaigne aims to be a key contributor to the democratic debate. The Institut Montaigne ensures the scientific validity, accuracy and the quality of the work that it produces, yet the opinions portrayed by the authors are those of their own and not necessarily the Institut’s. The authorial opinions are therefore not to be attributed to the Institut nor to its governing bodies.