IC Alpha Philweekly 231020.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A TRANSFORMED OUTLOOK Paul Mcdonald

AVON RUBBER P.L.C. UNAUDITED PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2019 A TRANSFORMED OUTLOOK Paul McDonald, Chief Executive Officer: “2019 has been a transformational year for Avon Rubber. We have delivered strong results ahead of expectations, secured $340m of long-term contracts, announced the $91m acquisition of 3M’s ballistic protection business, and continued to build our order book to provide excellent visibility for 2020. These results reflect the success of our strategic focus on growing our presence in our core markets and investing further in our product portfolio to meet more of the requirements of our expanding customer base. In the last two years, we have built visibility and breadth within our contract portfolio, enabling us to deliver another record performance, and we enter the new year from a position of strength. The acquisition of 3M’s ballistic protection business will significantly bolster our personal protection offering and accelerate our long-term growth prospects. The transformation during the year leaves us well positioned to deliver further success in 2020 and beyond.” 30 Sept 30 Sept % Increase % Increase 2019 2018 Reported Constant Currency Orders received £181.9m £173.3m 5.0% 1.4% Closing order book £40.4m £37.8m 6.9% (0.7%) Revenue £179.3m £165.5m 8.3% 4.2% Adjusted1 operating profit £31.3m £27.3m 14.7% 10.4% Operating profit £14.4m £22.8m (36.8%) (39.4%) Adjusted1 profit before tax £31.4m £27.2m 15.4% 11.2% Profit before tax £13.7m £21.6m (36.6%) (39.2%) Adjusted1 basic earnings per share2 91.7p 77.1p 18.9% 14.1% Basic earnings per share2 46.9p 64.9p (27.7%) (37.3%) Diluted basic earnings per share2 46.5p 64.4p (27.8%) (37.3%) Dividend per share 20.83p 16.02p 30.0% 30.0% Net cash £48.3m £46.5m Operational highlights • $91m agreement to acquire 3M’s ballistic protection business expected to complete during H120 • First deliveries under the $246m, 5-year M53A1 mask and powered air system contract with the U.S. -

Download the 2020 Annual Report

ANNUAL REPORT AND ACCOUNTS 2020 Focusing on protection Avon Rubber p.l.c. | Annual Report & Accounts 2020 Overview Governance 152 Parent Company Balance Sheet 01 Highlights 58 Board of Directors 153 Parent Company Statement 02 At a Glance 60 Corporate Governance Report of Changes in Equity 04 Strategy in Action 64 Nomination Committee Report 154 Parent Company Accounting Policies 10 Why Invest in Avon Rubber? 66 Audit Committee Report 157 Notes to the Parent Company 12 Chair’s Statement 71 Remuneration Report Financial Statements 96 Directors’ Report 162 Glossary of Financial Terms Strategic Report 163 Abbreviations 16 Military Market Financial Statements 18 First Responder Market 102 Independent Auditor’s Report Other Information 20 Product Portfolio 110 Consolidated Statement 164 Notice of Annual General Meeting 22 Delivering Our Strategy of Comprehensive Income 172 Shareholder Information 24 Chief Executive Officer’s Review 111 Consolidated Balance Sheet 30 Financial Review 112 Consolidated Cash Flow Statement 38 How We Measure Our Performance 113 Consolidated Statement 40 Principal Risks and Risk Management of Changes in Equity 46 Environmental, Social 114 Accounting Policies and Critical For the latest investor relations information, and Governance Accounting Judgements go to our website at: 54 Section 172(1) Statement 120 Notes to the Group Financial Statements www.avon-rubber.com/investors Overview Highlights £160.8m £79.8m £168.0m £124.6m £129.8m £128.4m £115.7m £35.3m £36.7m 18 19 20 18 19 20 18 19 20 Orders received Closing order book Revenue £160.8 m £79.8m £168.0m £30.2m £16.3m £93.2m £22.6m £18.3m £9.9m £34.3m £35.4m £5.9m 18 19 20 18 19 20 18 19 20 Adjusted operating profit Operating profit Net cash £30.2m £5.9m £93.2m 76.5p 447.4p 27.08p 67.2p 20.83p 52.3p 16.02p 46.1p 46.2p 18 19 20 18 19 20 18 19 20 Adjusted basic earnings per share Basic earnings per share Dividend per share 76.5p 4 47.4 p 27.08 p The Directors believe that adjusted measures provide a more useful comparison of business trends and performance. -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Building a Brighter Future

Avon RubberAvon p.l.c. Annual Report 2017 BUILDING A BRIGHTER FUTURE Corporate Headquarters Hampton Park West Semington Road Melksham Wiltshire SN12 6NB England ANNUAL REPORT Telephone: +44 (0) 1225 896 800 AND ACCOUNTS Email: [email protected] www.avon-rubber.com 2017 OVERVIEW Contents Highlights Overview 01 Highlights We are an innovative technology group Group highlights 02 At a Glance 04 Why Invest in Avon Rubber? specialising in respiratory protection ORDERS RECEIVED 06 Chairman’s Statement 2017 £173.9m systems and milking point solutions 2016 £142.3m STRATEGIC REPORT Strategic Report 2015 £121.2m 10 Our Strategy through our two businesses, Avon £173.9m 12 Our Business Model 14 Our Divisional Strategy Protection and milkrite | InterPuls. 18 How We Measure REVENUE 2017 £163.2m Our Performance We design, test and manufacture 2016 £142.9m 20 Chief Executive Officer’s Review specialist products and services £163.2m 2015 £134.3m 22 Divisional Review 22 Avon Protection to maximise the performance and 24 milkrite | InterPuls ADJUSTED OPERATING PROFIT 2017 £25.8m 26 Financial Review capabilities of our customers. 32 Principal Risks and 2016 (Restated)* £20.9m Risk Management £25.8m 2015 (Restated)* £19.2m 36 Environment and Corporate Social Responsibility GOVERNANCE OPERATING PROFIT Governance 2017 £19.8m 42 Board of Directors 2016 (Restated)* £16.8m 43 Corporate Governance 2015 (Restated)* £17.9m Report £19.8m 48 Nomination Committee Report 50 Audit Committee Report NET CASH 2017 £24.7m 53 Remuneration Report 2016 £2.0m 75 Directors’ -

Proxy Vote Record-February 2018

Company Name Country Meeting Date Proposal Text Vote Instruction Avon Rubber plc United Kingdom 01-Feb-18 Accept Financial Statements and Statutory Reports For Avon Rubber plc United Kingdom 01-Feb-18 Approve Remuneration Report For Avon Rubber plc United Kingdom 01-Feb-18 Approve Final Dividend For Avon Rubber plc United Kingdom 01-Feb-18 Re-elect David Evans as Director For Avon Rubber plc United Kingdom 01-Feb-18 Elect Paul McDonald as Director For Avon Rubber plc United Kingdom 01-Feb-18 Elect Nick Keveth as Director For Avon Rubber plc United Kingdom 01-Feb-18 Reappoint PricewaterhouseCoopers LLP as Auditors For Avon Rubber plc United Kingdom 01-Feb-18 Authorise Board to Fix Remuneration of Auditors For Avon Rubber plc United Kingdom 01-Feb-18 Authorise Issue of Equity with Pre-emptive Rights For Avon Rubber plc United Kingdom 01-Feb-18 Authorise Issue of Equity without Pre-emptive Rights For Avon Rubber plc United Kingdom 01-Feb-18 Authorise Issue of Equity without Pre-emptive Rights in Connection with an Acquisition or Other Capital Investment For Avon Rubber plc United Kingdom 01-Feb-18 Authorise Market Purchase of Ordinary Shares For Avon Rubber plc United Kingdom 01-Feb-18 Authorise the Company to Call General Meeting with Two Weeks' Notice For Beazer Homes USA, Inc. USA 01-Feb-18 Elect Director Elizabeth S. Acton For Beazer Homes USA, Inc. USA 01-Feb-18 Elect Director Laurent Alpert For Beazer Homes USA, Inc. USA 01-Feb-18 Elect Director Brian C. Beazer For Beazer Homes USA, Inc. -

STOXX UK 180 Selection List

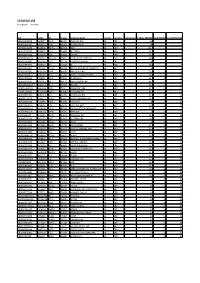

STOXX UK 180 Last Updated: 20210301 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) GB00B10RZP78 B10RZP7 ULVR.L 091321 UNILEVER PLC GB GBP Y 113 1 1 GB0009895292 0989529 AZN.L 098952 ASTRAZENECA GB GBP Y 105 2 2 GB0005405286 0540528 HSBA.L 040054 HSBC GB GBP Y 101.6 3 3 GB0007188757 0718875 RIO.L 071887 RIO TINTO GB GBP Y 76.5 4 7 GB0002374006 0237400 DGE.L 039600 DIAGEO GB GBP Y 75.8 5 4 GB00B03MLX29 B09CBL4 RDSa.AS B09CBL ROYAL DUTCH SHELL A GB EUR Y 69.3 6 8 GB0009252882 0925288 GSK.L 037178 GLAXOSMITHKLINE GB GBP Y 69 7 5 GB0007980591 0798059 BP.L 013849 BP GB GBP Y 68.3 8 9 GB0002875804 0287580 BATS.L 028758 BRITISH AMERICAN TOBACCO GB GBP Y 62 9 6 GB00BH0P3Z91 BH0P3Z9 BHPB.L 005666 BHP GROUP PLC. GB GBP Y 55.2 10 11 GB00B24CGK77 B24CGK7 RB.L 072769 RECKITT BENCKISER GRP GB GBP Y 50.9 11 10 GB0007099541 0709954 PRU.L 070995 PRUDENTIAL GB GBP Y 42.3 12 14 GB00B1XZS820 B1XZS82 AAL.L 490151 ANGLO AMERICAN GB GBP Y 40.5 13 15 GB00B2B0DG97 B2B0DG9 REL.L 073087 RELX PLC GB GBP Y 38.6 14 12 GB00BH4HKS39 BH4HKS3 VOD.L 071921 VODAFONE GRP GB GBP Y 37.7 15 13 JE00B4T3BW64 B4T3BW6 GLEN.L GB10B3 GLENCORE PLC GB GBP Y 36.5 16 18 GB00BDR05C01 BDR05C0 NG.L 024282 NATIONAL GRID GB GBP Y 32.7 17 16 GB0008706128 0870612 LLOY.L 087061 LLOYDS BANKING GRP GB GBP Y 31.8 18 22 GB0031348658 3134865 BARC.L 007820 BARCLAYS GB GBP Y 30 19 23 GB00BD6K4575 BD6K457 CPG.L 053315 COMPASS GRP GB GBP Y 29.9 20 21 GB00B0SWJX34 B0SWJX3 LSEG.L 095298 LONDON STOCK EXCHANGE GB GBP Y 25.2 21 17 GB00B19NLV48 B19NLV4 -

FTSE 350 Companies Audited by KPMG

FTSE 350 companies audited by KPMG KPMG LLP1 expects to issue an audit report for 67 FTSE 350 companies within the next 12 months Data as at 30 June 2021 Company FTSE Index2 Industry classification (ICB Supersector)2 3i Group Plc FTSE 100 Financial services Aggreko Plc FTSE 250 Industrial goods and services AO World Plc FTSE 250 Retail Ascential Plc FTSE 250 Technology Ashmore Group Plc FTSE 250 Financial services Auto Trader Group Plc FTSE 100 Technology AVI Global Trust plc FTSE 250 Financial services Avon Rubber Plc FTSE 250 Industrial goods and services B&M European Value Retail SA FTSE 100 Retail Baillie Gifford Japan Trust Plc FTSE 250 Financial services Baillie Gifford Shin Nippon FTSE 250 Financial services Baillie Gifford US Growth Trust FTSE 250 Financial services Balfour Beatty Plc FTSE 250 Consumer products and services Barclays Plc FTSE 100 Banks Berkeley Group Holdings (The) Plc FTSE 100 Consumer products and services Big Yellow Group plc FTSE 250 Real estate British American Tobacco Plc FTSE 100 Food, beverage and tobacco BT Group Plc FTSE 100 Telecommunications Capita Plc FTSE 250 Industrial goods and services Chemring Group Plc FTSE 250 Industrial goods and services Compass Group Plc FTSE 100 Consumer products and services Computacenter Plc FTSE 250 Technology Croda International Plc FTSE 100 Basic resources Entain Plc FTSE 100 Travel and leisure Experian Plc FTSE 100 Industrial goods and services Grainger Plc FTSE 250 Real estate HICL Infrastructure Plc FTSE 250 Financial services International Consolidated Airlines Group -

Invitation List of Attending Companies (Subject to Change)

INVITATION LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Tuesday 8th October Wednesday 9th October Thursday 10th October Applegreen plc Alpha Financial Markets Consulting PLC Anglo Pacific Group plc Avon Rubber plc Clipper Logistics plc Base Resources Ltd Hibernia REIT plc Connect Group plc CareTech Holdings plc Huntsworth plc Eddie Stobart Logistics plc Central Asia Metals plc IG Design Group plc Glenveagh Properties plc Ceres Power Holdings plc IntegraFin Holdings plc GlobalData plc discoverIE Group plc IP Group plc Global Ports Holding plc Marlowe IRES REIT plc Goco Group plc MJ Gleeson plc John Menzies plc Kainos Group plc Morgan Advanced Materials plc JPJ Group plc Learning Technologies Group plc Polypipe Group plc Pets at Home Group plc Midwich Group plc Resolute Mining Ltd PPHE Hotel Group Ltd Staffline Group plc Tekmar Group plc Sabre Insurance Group plc Tharisa plc Sirius Real Estate Ltd Trifast plc The City Pub Group plc Yellow Cake plc Victoria plc If you would like to register for the conference or require further information on the attending companies, please refer to www.berenberg.com/en/conference.html Registration deadline: Monday 16th September 2019 BERENBERG is delighted to invite you to its UK OPPORTUNITIES CONFERENCE 2019 on Tuesday 8th – Thursday 10th October 2019 at Berenberg 60 Threadneedle Street • London • EC2R 8HP • United Kingdom JOH. BERENBERG, GOSSLER & CO. KG Neuer Jungfernstieg 20 • 20354 Hamburg • Germany • Phone +49 40 350 60-0 60 Threadneedle Street • London EC2R 8HP • United Kingdom • Phone +44 20 3207 7800. -

January Illuminator Update Last Month the Illuminator Has Outperformed

January Illuminator update The Illuminator is a proprietary database and stock selection tool that identifies high-quality companies based on 10 characteristics. We have now published The Illuminator for over ten years. We adhere to the fundamental premise that, over the medium to long term, quality companies outperform the market. Since its inception in July 2008, the Illuminator has returned more than 1,000% compared to the UK All Share index return of 129% over the same period. Last month the Illuminator has outperformed the broader market by 2.2%. In the four weeks to 13 January 2020, the main Illuminator screen of 10 stocks gained 5.5% compared to a 3.3% increase in the UK All Share index. Since the beginning of the year, the Illuminator has slightly underperformed the overall market, having delivered a relative outperformance of 971% since its inception. Since our last update in December 2019, there was one change in the list of the top 10 names that make up the Illuminator, with Avon Rubber replacing Plus500. Illuminator performance: Cumulative returns Year to Three Since One month Six months One year Three years date months inception Illuminator UK 0.42% 5.51% 19.34% 20.77% 58.26% 72.05% 1100.00% UK All Share 0.72% 3.30% 6.55% 5.22% 16.13% 19.77% 128.75% Illuminator relative -0.30% 2.21% 12.79% 15.55% 42.13% 52.28% 971.25% Top 10 Illuminator Stocks Market cap Company Ticker Sector (£m) Free float, % YTD, % Coats Group COA Divers. Industrials 1107 99.8 5 4Imprint Group FOUR Media Agencies 932 98.2 -3 Rightmove RMV Consumer Digital Svs 5665 99.5 3 Fdm Group FDM Computer Services 1120 80.1 -4 Gamma Communications GAMA Telecom. -

Saracen Growth Fund

TB SARACEN UK ALPHA FUND 31 January 2017 Fund Objective and Policy FOR PROFESSIONAL The objective is to achieve a higher rate of return than the MSCI UK All Cap INVESTORS ONLY Index by investing in a portfolio of primarily UK equity securities with the Retail investors should consult their potential for long term growth. financial advisers Fund Performance Since Inception* FUND DETAILS (as at 31 January 2017) Fund size: £25m Launch date: 05/03/99 No. of holdings: 29 Active share: 91% Beta: 0.74 Volatility: 16.73 Source: Factset as at 31/1/17 Denomination: GBP Valuation point: 12.00 noon Fund prices: A Accumulation: 391.38p *Source: Factset B Accumulation: 629.76p Total Return, Bid to Bid, GBP terms. Past performance is not a reliable indicator of future results. The value of your investment and the income derived from it can go down as well as up and you may not get back the money you invested. Policy is not to charge a dilution levy except in exceptional circumstances. Cumulative Performance after all ongoing charges to last valuation point in January 2017 ACD: Since 1 month 1 year 3 years 5 years T. Bailey Fund Services Limited launch* TB Saracen UK 0.6% 11.7% 17.5% 82.0% 529.8% Alpha B Acc Fund Manager MSCI UK All -0.3% 20.4% 21.5% 55.1% 107.5% Cap Index (TR) Sector Average 0.6% 17.6 % 20.5% 63.9% 148.3% Quartile 2 4 3 2 1 Ranking Source: Financial Express; * launch date 05 March 1999 Sector: IA Sector (UK All Companies) Fund Breakdown by Market Cap 70% Craig Yeaman joined Saracen in 2008 from 60% Aberdeen Asset 50% Management. -

Standard Life UK Smaller Companies Trust Plc Half Yearly Report 31 December 2014 Contents

Standard Life UK Smaller Companies Trust plc Half Yearly Report 31 December 2014 Contents Investment Objective and Investment Policy 1 Financial Highlights 2 Strategic Report 4 Manager’s Report 10 Top Twenty Investments at 31 December 2014 16 Sector Distribution at 31 December 2014 17 Income Statement 18 Reconciliation of Movements in Shareholders’ Funds 20 Balance Sheet 24 Cash Flow Statement 25 Notes to the Financial Statements 27 Directors’ Responsibility Statement 34 How to Invest in Standard Life UK Smaller Companies Trust 35 Company Information and Contact Details 37 Investment Objective To achieve long term capital growth by investment in UK quoted smaller companies. Investment Policy The Company intends to achieve its investment objective by investing in a diversified portfolio consisting mainly of UK quoted smaller companies. The portfolio will normally comprise around 60 individual holdings representing the Investment Manager’s highest conviction investment ideas. In order to reduce risk in the Company without compromising flexibility, no holding within the portfolio should exceed 5 per cent. of total assets at the time of acquisition. The Company may use derivatives for portfolio hedging purposes (i.e. only for the purpose of reducing, transferring or eliminating the investment risks in its investments in order to protect the Company’s portfolio). Within the Company’s Articles of Association, the maximum level of gearing is 100% of net assets. The Directors have set parameters of between 5% net cash and 25% net gearing (at time of drawdown) for the level of gearing that can be employed in normal market conditions. The Directors have delegated responsibility to the Investment Manager for the operation of the gearing level within the above parameters.