State Street UK Equity Tracker Fund State Street UK Equity Tracker Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Monks Investment Trust

WhatSupplement February 2021 Investment TRUST A ONCE IN A LIFETIME CHANCE Nine opportunities to pick up promising trusts that you will not want to miss out on Gresham House’s Richard Staveley talks investment philosophy; and TEMIT’s Chetan Sehgal on innovative EMs THINK: GROWTH If you’re thinking about your future, • 3 long-term growth trends drive our research think Martin Currie Global Portfolio Trust. • World-class sustainability ratings Our specialist team hand pick stocks with a focus on Find out more at martincurrieglobal.com long-term growth drivers, offering investors access to a Capital at risk. Values can go up and down. We do not target diversified portfolio of between 25 and 40 of the world’s particular sustainability outcomes. leading companies. Sustainability Rating: Martin Currie Investment Management Limited, registered in Scotland (no SC066107). Registered office: Saltire Court, 20 Castle Terrace, Edinburgh EHES. Authorised and regulated by the Financial Conduct Authority. Please note that calls to the above number may be recorded. Tel: 0808 100 2125 www.martincurrie.com © 2020 Morningstar, Inc. All rights reserved. Morningstar Rating as of 22-12-20. GPTpressAds2021.indd 2 05/01/2021 10:47 THINK: GROWTH If you’re thinking about your future, • 3 long-term growth trends drive our research think Martin Currie Global Portfolio Trust. • World-class sustainability ratings Our specialist team hand pick stocks with a focus on Find out more at martincurrieglobal.com long-term growth drivers, offering investors access to a Capital at risk. Values can go up and down. We do not target > diversified portfolio of between 25 and 40 of the world’s particular sustainability outcomes. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Annual Report and Audited Financial Statements

Annual report and audited financial statements BlackRock Charities Funds • BlackRock Armed Forces Charities Growth & Income Fund • BlackRock Catholic Charities Growth & Income Fund • BlackRock Charities Growth & Income Fund • BlackRock Charities UK Bond Fund • BlackRock Charities UK Equity ESG Fund • BlackRock Charities UK Equity Fund • BlackRock Charities UK Equity Index Fund For the financial period ended 30 June 2020 Contents General Information 2 About the Trust 3 Charity Authorised Investment Fund 4 Charity Trustees’ Investment Responsibilities 4 Fund Manager 4 Significant Events 4 Investment Report 5 Report on Remuneration 15 Accounting and Distribution Policies 21 Financial Instruments and Risks 24 BlackRock Armed Forces Charities Growth & Income Fund 37 BlackRock Catholic Charities Growth & Income Fund 56 BlackRock Charities Growth & Income Fund 74 BlackRock Charities UK Bond Fund 95 BlackRock Charities UK Equity ESG Fund 111 BlackRock Charities UK Equity Fund 125 BlackRock Charities UK Equity Index Fund 138 Statement of Manager’s and Trustee’s Responsibilities 162 Independent Auditor’s Report 165 Supplementary Information 169 1 General Information Advisory Committee Members - BlackRock manager of the Funds, each of which is an alternative Armed Forces Charities Growth & Income investment fund for the purpose of the Alternative Fund: Investment Fund Managers Directive. Mr Michael Baines (Chairman) Mr Guy Davies Directors of the Manager Major General A Lyons CBE G D Bamping* Major General Ashley Truluck CB, CBE M B Cook Colonel -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

A TRANSFORMED OUTLOOK Paul Mcdonald

AVON RUBBER P.L.C. UNAUDITED PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2019 A TRANSFORMED OUTLOOK Paul McDonald, Chief Executive Officer: “2019 has been a transformational year for Avon Rubber. We have delivered strong results ahead of expectations, secured $340m of long-term contracts, announced the $91m acquisition of 3M’s ballistic protection business, and continued to build our order book to provide excellent visibility for 2020. These results reflect the success of our strategic focus on growing our presence in our core markets and investing further in our product portfolio to meet more of the requirements of our expanding customer base. In the last two years, we have built visibility and breadth within our contract portfolio, enabling us to deliver another record performance, and we enter the new year from a position of strength. The acquisition of 3M’s ballistic protection business will significantly bolster our personal protection offering and accelerate our long-term growth prospects. The transformation during the year leaves us well positioned to deliver further success in 2020 and beyond.” 30 Sept 30 Sept % Increase % Increase 2019 2018 Reported Constant Currency Orders received £181.9m £173.3m 5.0% 1.4% Closing order book £40.4m £37.8m 6.9% (0.7%) Revenue £179.3m £165.5m 8.3% 4.2% Adjusted1 operating profit £31.3m £27.3m 14.7% 10.4% Operating profit £14.4m £22.8m (36.8%) (39.4%) Adjusted1 profit before tax £31.4m £27.2m 15.4% 11.2% Profit before tax £13.7m £21.6m (36.6%) (39.2%) Adjusted1 basic earnings per share2 91.7p 77.1p 18.9% 14.1% Basic earnings per share2 46.9p 64.9p (27.7%) (37.3%) Diluted basic earnings per share2 46.5p 64.4p (27.8%) (37.3%) Dividend per share 20.83p 16.02p 30.0% 30.0% Net cash £48.3m £46.5m Operational highlights • $91m agreement to acquire 3M’s ballistic protection business expected to complete during H120 • First deliveries under the $246m, 5-year M53A1 mask and powered air system contract with the U.S. -

The Art of Investing in Smaller Companies – P 30

www.whatinvestment.co.ukWhat FOR Investment A WEALTHIER FUTURE Issue 424 July 2018 £4.50 The art of investing in smaller companies – P 30 Emerging Profit from Wine Markets How looking beyond the China and India are catching blockbuster vintages can the US, but are they worth deliver corking returns investing in? – Page 36 – Page 50 WI.JULY.2018.Cover.indd 1 21/06/2018 16:07 NEED INVESTMENT GUIDANCE? Why not join thousands of investors and benefi t from all our independent analysis and insight? Subscribe www.whatinvestment.co.ukWhat FOR Investment A WEALTHIER FUTURE Issue 423 June 2018 £4.50 and get Britain’s Buffetts issues How can you profit 12 from the UK managers inspired by the legendary American investor for the price – P 14 of 10 > Unit Trusts 1 | >| The Last Word | Peter Elston behaviour of, say, numbers or Hubris is the greatest challenge planets or elementary particles or rocks or plants or people. Our new columnist argues that being a non- Successful investing, on the other conformist and not following the crowd can be hand, necessitates disagreement. The Aging bull The Empire Trust For me to give myself a chance uncomfortable but can also produce good returns of beating my competitors, and thus the market, the last thing I should do is agree with them. I The bull market might be The British Empire Trust I am not exactly sure how I have one was just lucky. Probably seek out where they are huddled ended up as a chief investment best to assume you were lucky. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance BB Healthcare Trust BBH Closed End Investments — GBP 1.964 at close 20 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE 6.0 EV/EBITDA 5.4 PB 1.1 PCF -ve Div Yield 2.6 Price/Sales 5.7 Net Debt/Equity 0.0 Div Payout 15.4 ROE 21.6 DESCRIPTION Data unavailable The Company is a closed-ended investment company which to invest in a concentrated portfolio of listed or quoted equities in the global healthcare industry. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: BB Healthcare Trust 20 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 31-Mar-2021 31-Mar-2021 31-Mar-2021 25 25 1.5 1.4 20 20 +1SD 1.3 +1SD +1SD 1.2 Avg 15 15 1.1 Avg Avg -1SD 1 10 10 0.9 -1SD -1SD 5 5 0.8 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Murray International Trust (Ord) 120.0 Murray International Trust (Ord) 100.0 CVC Credit Partners European Opportunities (GBP) 2.3 European Opportunities Trust 120.0 European Opportunities Trust 100.0 Hipgnosis Songs Fund 2.2 Law Debenture Corp 120.0 Law Debenture Corp 100.0 Pacific Horizon Investment Trust 2.0 HICL Infrastructure 64.6 HICL Infrastructure 64.5 Scottish -

Market Beating Organic Growth

Market 4imprint Group plc Beating Organic Growth Annual Report and Accounts 2016 Annual Report and Accounts 2016 ABOUT 4IMPRINT Contents Overview We are the leading 01 2016 Highlights 02 At a Glance 04 Chairman’s Statement direct marketer of Strategic Report 06 Chief Executive’s Review 08 Strategy promotional products 09 Market Overview 10 Business Model 11 Key Performance Indicators 12 Financial Review in the USA, Canada, 16 Principal Risks & Uncertainties 19 Corporate & Social Responsibility Report the UK and Ireland. Governance 22 Board of Directors Most of our revenue is generated in North America, serviced from the 24 Directors’ Report 26 Statement on Corporate principal office in Oshkosh, Wisconsin. Customers in the UK and Irish Governance markets are served out of an office in Manchester, UK. 32 Annual Statement by the Chairman of the Remuneration Committee Operations are focused around a highly developed direct marketing 34 Remuneration Report 40 Statement of Directors’ business model which provides millions of potential customers with Responsibilities access to tens of thousands of customised products. Financial Statements 41 Independent Auditors’ Report Organic growth is delivered by using a wide range of data-driven, offline – Group and online direct marketing techniques to capture market share in the 46 Group Income Statement 47 Group Statement of large and fragmented promotional product markets that we serve. Comprehensive Income 48 Group Balance Sheet 49 Group Statement of Changes in Shareholders’ Equity 50 Group Cash Flow -

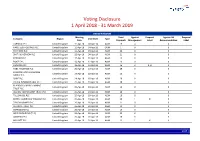

Global Voting Activity Report to March 2019

Voting Disclosure 1 April 2018 - 31 March 2019 UNITED KINGDOM Meeting Total Against Proposal Against ISS Proposal Company Region Vote Date Type Date Proposals Management Label Recommendation Label CARNIVAL PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 19 0 0 HANSTEEN HOLDINGS PLC United Kingdom 11-Apr-18 04-Apr-18 OGM 1 0 0 RIO TINTO PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 22 0 0 SMITH & NEPHEW PLC United Kingdom 12-Apr-18 04-Apr-18 AGM 21 0 0 PORVAIR PLC United Kingdom 17-Apr-18 10-Apr-18 AGM 15 0 0 BUNZL PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 19 0 0 HUNTING PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 16 2 3, 8 0 HSBC HOLDINGS PLC United Kingdom 20-Apr-18 13-Apr-18 AGM 29 0 0 LONDON STOCK EXCHANGE United Kingdom 24-Apr-18 18-Apr-18 AGM 26 0 0 GROUP PLC SHIRE PLC United Kingdom 24-Apr-18 18-Apr-18 AGM 20 0 0 CRODA INTERNATIONAL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 18 0 0 BLACKROCK WORLD MINING United Kingdom 25-Apr-18 19-Apr-18 AGM 15 0 0 TRUST PLC ALLIANZ TECHNOLOGY TRUST PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 10 0 0 TULLOW OIL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 16 0 0 BRITISH AMERICAN TOBACCO PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 20 1 8 0 TAYLOR WIMPEY PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 21 0 0 ALLIANCE TRUST PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 13 0 0 SCHRODERS PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 19 0 0 WEIR GROUP PLC (THE) United Kingdom 26-Apr-18 20-Apr-18 AGM 23 0 0 AGGREKO PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 20 0 0 MEGGITT PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 22 1 4 0 1/47 -

Download the 2020 Annual Report

ANNUAL REPORT AND ACCOUNTS 2020 Focusing on protection Avon Rubber p.l.c. | Annual Report & Accounts 2020 Overview Governance 152 Parent Company Balance Sheet 01 Highlights 58 Board of Directors 153 Parent Company Statement 02 At a Glance 60 Corporate Governance Report of Changes in Equity 04 Strategy in Action 64 Nomination Committee Report 154 Parent Company Accounting Policies 10 Why Invest in Avon Rubber? 66 Audit Committee Report 157 Notes to the Parent Company 12 Chair’s Statement 71 Remuneration Report Financial Statements 96 Directors’ Report 162 Glossary of Financial Terms Strategic Report 163 Abbreviations 16 Military Market Financial Statements 18 First Responder Market 102 Independent Auditor’s Report Other Information 20 Product Portfolio 110 Consolidated Statement 164 Notice of Annual General Meeting 22 Delivering Our Strategy of Comprehensive Income 172 Shareholder Information 24 Chief Executive Officer’s Review 111 Consolidated Balance Sheet 30 Financial Review 112 Consolidated Cash Flow Statement 38 How We Measure Our Performance 113 Consolidated Statement 40 Principal Risks and Risk Management of Changes in Equity 46 Environmental, Social 114 Accounting Policies and Critical For the latest investor relations information, and Governance Accounting Judgements go to our website at: 54 Section 172(1) Statement 120 Notes to the Group Financial Statements www.avon-rubber.com/investors Overview Highlights £160.8m £79.8m £168.0m £124.6m £129.8m £128.4m £115.7m £35.3m £36.7m 18 19 20 18 19 20 18 19 20 Orders received Closing order book Revenue £160.8 m £79.8m £168.0m £30.2m £16.3m £93.2m £22.6m £18.3m £9.9m £34.3m £35.4m £5.9m 18 19 20 18 19 20 18 19 20 Adjusted operating profit Operating profit Net cash £30.2m £5.9m £93.2m 76.5p 447.4p 27.08p 67.2p 20.83p 52.3p 16.02p 46.1p 46.2p 18 19 20 18 19 20 18 19 20 Adjusted basic earnings per share Basic earnings per share Dividend per share 76.5p 4 47.4 p 27.08 p The Directors believe that adjusted measures provide a more useful comparison of business trends and performance.