12 12 China Top Sellers.Qxp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Annual Report

ANNUAL REPORT 2016 年 報 2016 年報 ANNUAL REPORT 2016 Contents Corporate Profile 02 Corporate Information 04 Our Products 06 Business Overview 10 Financial Highlights 20 Chairman’s Statement 22 Management Discussion and Analysis 24 Directors and Senior Management 33 Directors’ Report 41 Corporate Governance Report 58 Independent Auditor’s Report 69 Consolidated Balance Sheet 76 Consolidated Income Statement 78 Consolidated Statement of Comprehensive Income 79 Consolidated Statement of Changes in Equity 80 Consolidated Statement of Cash Flows 81 Notes to the Consolidated Financial Statements 82 Five Years’ Financial Summary 146 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2016 02 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, advanced driver assistance systems (ADAS) and autonomous vehicle technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full service supplier. Our vision is to remain a leader in intuitive motion control – leveraging our strengths in advanced steering and driveline systems. We maintain product focus on electric power steering (EPS), a socially responsible technology that offers automakers increased fuel economy and reduced emissions. Nexteer Automotive has put more than 40 million EPS units on the road, since 1999, saving more than 4 billion gallons of fuel. Our ability to integrate our systems seamlessly into automotive original equipment manufacturer (OEM) vehicles is a testament of our 110-year heritage of vehicle integration expertise and product craftsmanship. -

ANNUAL REPORT 2017 Hkex Stock Code : 305 ANNUAL REPORT 2017 CORPORATE PROFILE

WULING MOTORS HOLDINGS LIMITED 五菱汽車集團控股有限公司 (Incorporated in Bermuda with limited liability) ENTERING THE ERA OF HIGH PERFORMANCE WITH CLEAN ENERGY ANNUAL REPORT 2017 HKEx Stock Code : 305 ANNUAL REPORT 2017 CORPORATE PROFILE Wuling Motors Holdings Limited (“Wuling Motors Holdings” or the “Company”) and its subsidiaries (collectively referred to as the “Wuling Group” or the “Group”) are principally engaged in the businesses of trading and manufacturing of automotive components, engines and specialized vehicles. Our Group’s corporate goal is to grasp the tremendous business opportunities arising from the rapidly growing automobile industry in China and Asia. We supply engines and automotive components to commercial-type mini-vehicles and passenger vehicles. We are also a qualified enterprise for manufacturing electrical mini-truck in China. The Group’s main production facilities are located in Liuzhou, Qingdao, Chongqing and Indonesia. Since 2011, we have been ranked as one of the Fortune China 500 Enterprises. GROUP STRUCTURE DRAGON HILL GUANGXI AUTOMOBILE 13.7% WULING MOTORS 60.6% HOLDINGS HKEx:305 60.9% 39.1% WULING INDUSTRIAL ENGINES AND AUTOMOTIVE SPECIALIZED RELATED PARTS COMPONENTS VEHICLES AND (INCLUDING NEW OTHER INDUSTRIAL ENERGY VEHICLES) SERVICES Wuling Motors Holdings Limited > Annual Report 2017 CONTENTS Corporate Profi le Group Structure 2 Chairman’s Statement 10 Report of the CEO 14 Operation Review Main Business Segments Engines and Automotive Specialized Related Parts Components Vehicles and Other (including Industrial -

Factbook Volkswagen

Volkswagen Group – Factbook 2011 1 "With our commitment to innovation, perfection and responsible action by 2018 we want to transform the Volkswagen Group into the world’s leading automaker – economically and ecologically.” Prof. Dr. Martin Winterkorn Chairman of the Board of Management 2 Content Volkswagen at a Glance 3 Our Brands & Products 8 Our Markets 22 Financials & Outlook 31 Strategy 2018 41 Excellence in Production 48 Focus on R&D 54 Forming an Integrated Automotive Group with Porsche 62 Shareholder Information 68 Team 74 Volkswagen at a Our Brands & Our Markets Financials & Strategy 2018 Excellence in Focus on R&D Forming an Shareholder Glance Products Outlook Production Integrated Group Information 3 Volkswagen at a Glance The Volkswagen Group with its headquarters in Wolfsburg is one of the world‘s leading automobile manufacturers and the largest carmaker in Europe. Around the world, nearly 400,000 employees produce about 30,000 vehicles or are Headquarters Dec. 1945 start of 9 brands from 7 400,000 62 production Wolfsburg series production European countries employees plants worldwide involved in vehicle-related services each working day. The Volkswagen Group sells its vehicles in more than 150 countries. In 2010, the Group increased the number of vehicles delivered to customers to 7.2 million (2009: 6.3 million), corresponding to a 30,000 vehicles a Ca. 200 models 7.2 m deliveries to Active in more than Profit before tax: share of 11.4 percent of the day customers 150 countries €9 bn world passenger car market. Note: 2010 figures Volkswagen at a Our Brands & Our Markets Financials & Strategy 2018 Excellence in Focus on R&D Forming an Shareholder Glance Products Outlook Production Integrated Group Information 4 Group Structure – Two Strong Divisions The Volkswagen Group consists of two divisions: the Automotive Division and the Financial Services Division. -

© Gary Darkas 2012 © Gary Darkas 2012 CONTENTS

© Gary Darkas 2012 © Gary Darkas 2012 CONTENTS Sections INTRODUCTION IDENTITY TYPE BRANDING WOLFSBURG EDITION TYPOGRAPHY CORPORATE INFORMATION KEYFRAME MOMENTS PRODUCTION PLANTS VOLKSWAGEN ADVERTISING KEY PRODUCTS REFERENCE © Gary Darkas 2012 INTRODUCTION VOLKSWAGEN HISTORY The History Of The VW 1936-2012 1936 The Birth Of A Company And Its Name he word “volkswagen” means Ferdinand Porsche to make changes T“people’s car.” The Volkswagen to Porsche’s original 1931 design to Aktiengesellschaft (VAG), also make it more suited for the working known as Volkswagen Group or as man. (Béla Barényi is credited with VW, is an automobile manufacturer having conceived the basic design and mobility organisation based in five years earlier.) Hans Ledwinka Wolfsburg, Lower Saxony, Germany discussed his ideas with Ferdinand and is the pioneer brand within the Porsche, who used many Tatra Volkswagen Group, which contains design features in the 1938 “KdF- the car brands Audi AG, Bentley Wagen”, later known as the VW Motors Ltd., Automobiles Bugatti Käfer-or Volkswagen Beetle. On 22 SA, Automobili Lamborghini, June 1934, Dr. Ferdinand Porsche SEAT, Škoda Auto and heavy agreed to create the “People’s Car” goods vehicle manufacturer Scania for Hitler’s mother. AB. The Supervisory Board of Prototypes of the car called the Volkswagen Aktiengesellschaft “KdF-Wagen” (German: Kraft durch (VAG) has endorsed the creation Freude - “strength through joy”), of an integrated automotive group appeared from 1936 onwards (the with Porsche under the leadership of first cars had been produced in Volkswagen. Stuttgart. On 28 May 1937. Adolf Hitler had a keen interest in DR. FERDINAND PORSCHE cars even though he did not like to drive, as he was especially inspired by the American automotive giant Henry Ford, who Hitler referred to as Heinrich Ford. -

Annual Report 2019

Contents Corporate Profile 2 Corporate Information 4 Our Products 6 Business Overview 13 Financial Highlights 32 CEO’s Statement 33 Management Discussion and Analysis 36 Directors and Senior Management 48 Directors’ Report 56 Corporate Governance Report 74 Independent Auditor’s Report 86 Consolidated Balance Sheet 92 Consolidated Income Statement 94 Consolidated Statement of Comprehensive Income 95 Consolidated Statement of Changes in Equity 96 Consolidated Statement of Cash Flows 97 Notes to the Consolidated Financial Statements 98 Five Years’ Financial Summary 168 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2019 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, as well as advanced driver assistance systems (ADAS) and automated driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage our design, development and manufacturing strengths in advanced steering and driveline systems that provide differentiated and value-added solutions to our customers. We develop solutions that enable a new era of safety and performance for traditional and varying levels of ADAS/AD. Overall, we are making driving safer, more fuel-efficient and fun for today’s world and an automated future. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship. -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

12 11 China Top Sellers.Qxp

China’s top 5 sellers by market segment – Dec. 2011 Top 5 minicars Top 5 luxury cars Dec. 12 mos. Dec. 12 mos. Dec. % change 12 mos. % change Dec. % change 12 mos. % change 2011 from 2010 2011 from 2010 2011 from 2010 2011 from 2010 1. Chery QQ 13,502 2% 150,769 –6% 1. Audi A6L 8,931 –13% 111,806 –3% 2. Changan Benben Mini 3,433 –66% 88,599 44% 2. Audi A4L 7,049 73% 87,262 49% 3. BYD F0 2,824 –81% 82,603 –44% 3. BMW 5 series 5,704 16% 65,494 60% 4. Chevrolet Spark 5,710 –25% 70,258 –10% 4. Mercedes-Benz E class 10,406 212% 44,994 307% 5. Suzuki Wagon R+/Beidouxin 7,150 0% 58,158 –18% 5. BMW 7 series 3,826 73% 37,025 56% Segment total 48,950 –32% 623,254 –8% Segment total 64,557 40% 597,966 30% Top 5 sub-compact cars Top 5 SUVs Dec. 12 mos. Dec. 12 mos. Dec. % change 12 mos. % change Dec. % change 12 mos. % change 2011 from 2010 2011 from 2010 2011 from 2010 2011 from 2010 1. Chevrolet New Sail 18,852 15% 197,888 51% 1. Honda CR-V 17,380 47% 160,003 14% 2. Volkswagen Polo 21,670 29% 168,083 34% 2. Great Wall Hover H3/H5 16,621 18% 133,519 14% 3. Hyundai Verna 11,884 13% 138,525 212% 3. Volkswagen Tiguan 6,790 630% 129,172 83% 4. Xiali Xiali N3 9,508 –24% 133,595 1% 4. -

2018 Annual Report and Highlight a Few of the Year’S Increase Product Exposure with Current Customers

Contents Corporate Profile 2 Corporate Information 4 Our Products 7 Business Overview 14 Financial Highlights 27 CEO’s Statement 28 Management Discussion and Analysis 30 Directors and Senior Management 40 Directors’ Report 48 Corporate Governance Report 66 Independent Auditor’s Report 78 Consolidated Balance Sheet 84 Consolidated Income Statement 86 Consolidated Statement of Comprehensive Income 87 Consolidated Statement of Changes in Equity 88 Consolidated Statement of Cash Flows 89 Notes to the Consolidated Financial Statements 90 Five Years’ Financial Summary 156 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2018 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, advanced driver assistance systems (ADAS) and autonomous driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage strengths in advanced steering and driveline systems that provide value-added solutions to our customers. We maintain product focus on electric power steering (EPS) systems – a socially responsible technology that offers automakers increased fuel economy and reduced emissions. As just one example, Nexteer Automotive has put more than 60 million EPS units on the road since 1999, saving enough fuel to fill the equivalent of 48 billion 16-oz. water bottles. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship. -

Sc7038 Control Arm 39021716 Buick/Chevrolet Buick Verano /Flagship Cruze

SC7038 CONTROL ARM 39021716 BUICK/CHEVROLET BUICK VERANO /FLAGSHIP CRUZE SC7039 CONTROL ARM 9063362 BUICK/CHEVROLET CHEVROLET CLASSICS CRUZE 15‐ SC7040 CONTROL ARM 9063363 BUICK/CHEVROLET CHEVROLET CLASSICS CRUZE 15‐ SC7041 CONTROL ARM BUICK/CHEVROLET GL8 17 SC7042 CONTROL ARM BUICK/CHEVROLET GL8 17 SC7043 CONTROL ARM 26252503 BUICK/CHEVROLET GL6 SC7044 CONTROL ARM 26252504 BUICK/CHEVROLET GL6 SC7045 CONTROL ARM 22730775 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7046 CONTROL ARM 22730776 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7047 CONTROL ARM 22924235 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7048 CONTROL ARM 22924236 BUICK/CHEVROLET 16NEW LACROSSE /16MALIBU XL SC7049 CONTROL ARM 26249755 BUICK 18 EXCELLE GT SC7050 CONTROL ARM 26249756 BUICK 18 EXCELLE GT SC7051 CONTROL ARM 88955493 CADILLAC SRX 10‐ SC7052 CONTROL ARM 88955494 CADILLAC SRX 10‐ SC7053SATISFACTION CONTROL ARM 22833483 CADILLAC SRX 10‐ SC7054 CONTROL ARM 22833484 CADILLAC SRX 10‐ SC7055 CONTROL ARMWARRANTY 22905357 CADILLAC XTS SC7056 CONTROL ARM 22905358 CADILLAC XTS SC7057 CONTROL ARM 20759935 CADILLAC ATS/ATS L/NEW CTS 127 SC7058 CONTROL ARM 20759936 CADILLAC ATS/ATS L/NEW CTS SC7059 CONTROL ARM 20759980 CADILLAC ATS/ATS L/NEW CTS SC7060 CONTROL ARM 20759981 CADILLAC ATS/ATS L/NEW CTS SC7061 CONTROL ARM 25752929 CADILLAC CTS 05‐07 SC7062 CONTROL ARM 25752930 CADILLAC CTS 05‐07 SC7063 CONTROL ARM 25758282 CADILLAC CTS 05‐07 SC7064 CONTROL ARM 25758283 CADILLAC CTS 05‐07 SC7065 CONTROL ARM 15219467 CADILLAC CTS 08‐13 SC7066 CONTROL ARM 15219468 CADILLAC CTS -

On the Road to Success

Volkswagen Group: On the Road to Success Christian Klingler Member of the Board of Management, Volkswagen AG, Group Sales & Marketing Exane BNP Paribas 14th European CEO Seminar, Paris 14 June 2012 Disclaimer This presentation contains forward-looking statements and information on the business development of the Volkswagen Group. These statements may be spoken or written and can be recognized by terms such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “will” or words with similar meaning. These statements are based on assumptions relating to the development of the economies of individual countries, and in particular of the automotive industry, which we have made on the basis of the information available to us and which we consider to be realistic at the time of going to press. The estimates given involve a degree of risk, and the actual developments may differ from those forecast. Consequently, any unexpected fall in demand or economic stagnation in our key sales markets, such as in Western Europe (and especially Germany) or in the USA, Brazil or China, will have a corresponding impact on the development of our business. The same applies in the event of a significant shift in current exchange rates relative to the US dollar, sterling, yen, Brazilian real, Chinese rinminbi and Czech koruna. If any of these or other risks occur, or if the assumptions underlying any of these statements prove incorrect, the actual results may significantly differ from those expressed or implied by such statements. We do not update forward-looking statements retrospectively. Such statements are valid on the date of publication and can be superceded. -

ANNUAL REPORT 2016 Hkex Stock Code : 305 CORPORATE PROFILE

五菱汽車集團控股有限公司 (Incorporated in Bermuda with limited liability) ANNUAL REPORT 2016 HKEx Stock Code : 305 CORPORATE PROFILE Wuling Motors Holdings Limited (“Wuling Motors Holdings” or the “Company”) and its subsidiaries (collectively referred to as the “Wuling Group” or the “Group”) are principally engaged in the businesses of trading and manufacturing of automotive components, engines and specialized vehicles in China. Our Group’s corporate goal is to grasp the tremendous business opportunities arising from the rapidly growing automobile industry in China and Asia. We supply engines and automotive components to commercial-type mini-vehicles and passenger vehicles. We are also a qualified enterprise for manufacturing electrical mini-truck in China. The Group’s main production facilities are located in Liuzhou, Qingdao and Chongqing. Since 2011, we have been ranked as one of the Fortune China 500 Enterprises. GROUP STRUCTURE GUANGXI DRAGON HILL WULING MOTORS AUTOMOBILE 15.3% HOLDINGS 56.0% HKEx:305 54.9% 45.1% WULING INDUSTRIAL AUTOMOTIVE SPECIALIZED ENGINES AND COMPONENTS VEHICLES RELATED PARTS AND (INCLUDING NEW OTHER INDUSTRIAL ENERGY VEHICLES) SERVICES Wuling Motors Holdings Limited / Annual Report 2016 CONTENTS Corporate Profile Group Structure 2 Chairman’s Statement 8 Report of the CEO 13 Operation Review Main Business Segments Engines and Related Parts Automotive Components and Other Industrial Services Specialized Vehicles (including New Energy Vehicles) 24 Financial Review 27 Environmental, Social and Governance Review 38 Directors’ and Senior Management’s Biographies 46 Corporate Governance Report 60 Report of the Directors 73 Independent Auditor’s Report 77 Consolidated Statement of Profit or Loss and Other Comprehensive Income 78 Consolidated Statement of Financial Position 80 Consolidated Statement of Changes in Equity 81 Consolidated Statement of Cash Flows 83 Notes to the Consolidated Financial Statements Corporate Information 01 Wuling Motors Holdings Limited / Annual Report 2016 CHAIRMAN’SAIRMAN’S SSTATEMENTTATEMENT Mr. -

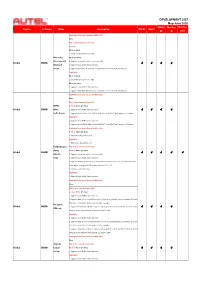

DEVELOPMENT LIST May-June 2020 MX808 Maxisys Maxisys Region Software Make Description IM508 IM608 IM IM Elite

DEVELOPMENT LIST May-June 2020 MX808 MaxiSys MaxiSys Region Software Make Description IM508 IM608 IM IM Elite Highlights have been released in May 2020: None Plan to be released in June 2020: Version: V4.20 (6 June) 1. Smart 453 all keys lost via OBD. Mercedes V4.30 (30 June) Mercedes LD 1. Supports automatic vehicle selection mode. Global IMMO √ √ √ √ Maybach 2. Supports Scan IMMO Status function. Smart 3. Supports Add Blade Key function for Sprinter [2006-2018] in North America. Highlights: V4.20 (6 June) 1. Smart 453 all keys lost via OBD. V4.30 (30 June) 1. Supports Scan IMMO Status function. 2. Supports Add Blade Key function for Sprinter [2006-2018] in North America. Highlights have been released in May 2020: None Plan to be released in June 2020: BMW, Version: V3.00 (29 June) Global IMMO Mini, 1. Supports Scan IMMO Status function. √ √ √ √ Rolls-Royce 2. Supports Read ISN via OBD of MSV90, MSD87, and MSD85 type engines of F chassis. Highlights: 1. Supports Scan IMMO Status function. 2. Supports Read ISN via OBD of MSV90, MSD87, and MSD85 type engines of F chassis. Highlights have been released in May 2020: Version: V4.20 (31 May) 1. MQB Smart Key All Keys Lost. Highlights: 1. MQB Smart Key All Keys Lost. Volkswagen, Plan to be released in June 2020: Audi, Version: V4.30 (30 June) Global IMMO √ √ √ √ √ Skoda, 1. Supports automatic vehicle selection mode. Seat 2. Supports Scan IMMO Status function. 3. Supports Write Key Via Dump, including MAGOTAN/CC 2005-2015, Audi A8 2002-2008, Volkswagen Touareg and Volkswagen Phaeton 2002-2008.