Press Release Must Be Accompanied by a Statement Identifying J.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contacts in Japan Contacts in Asia

TheDirectoryof JapaneseAuto Manufacturers′ WbrldwidePurchaslng ● Contacts ● トOriginalEqulpment ● トOriginalEqulpment Service トAccessories トMaterials +RmR JA払NAuTOMOBILEMANUFACTURERSAssocIATION′INC. DAIHATSU CONTACTS IN JAPAN CONTACTS IN ASIA OE, Service, Accessories and Material OE Parts for Asian Plants: P.T. Astra Daihatsu Motor Daihatsu Motor Co., Ltd. JL. Gaya Motor 3/5, Sunter II, Jakarta 14350, urchasing Div. PO Box 1166 Jakarta 14011, Indonesia 1-1, Daihatsu-cho, Ikeda-shi, Phone: 62-21-651-0300 Osaka, 563-0044 Japan Fax: 62-21-651-0834 Phone: 072-754-3331 Fax: 072-751-7666 Perodua Manufacturing Sdn. Bhd. Lot 1896, Sungai Choh, Mukim Serendah, Locked Bag No.226, 48009 Rawang, Selangor Darul Ehsan, Malaysia Phone: 60-3-6092-8888 Fax: 60-3-6090-2167 1 HINO CONTACTS IN JAPAN CONTACTS IN ASIA OE, Service, Aceessories and Materials OE, Service Parts and Accessories Hino Motors, Ltd. For Indonesia Plant: Purchasing Planning Div. P.T. Hino Motors Manufacturing Indonesia 1-1, Hinodai 3-chome, Hino-shi, Kawasan Industri Kota Bukit Indah Blok D1 No.1 Tokyo 191-8660 Japan Purwakarta 41181, Phone: 042-586-5474/5481 Jawa Barat, Indonesia Fax: 042-586-5477 Phone: 0264-351-911 Fax: 0264-351-755 CONTACTS IN NORTH AMERICA For Malaysia Plant: Hino Motors (Malaysia) Sdn. Bhd. OE, Service Parts and Accessories Lot P.T. 24, Jalan 223, For America Plant: Section 51A 46100, Petaling Jaya, Hino Motors Manufacturing U.S.A., Inc. Selangor, Malaysia 290 S. Milliken Avenue Phone: 03-757-3517 Ontario, California 91761 Fax: 03-757-2235 Phone: 909-974-4850 Fax: 909-937-3480 For Thailand Plant: Hino Motors Manufacturing (Thailand)Ltd. -

Dolz Applicazione Listino A084 A-084 Tapa A-183 28,20 A112 A

DOLZ APPLICAZIONE LISTINO A084 A-084 TAPA A-183 28,20 A112 A-112 SAVA JO-4 C/LARGO 59,00 A113 A-113 SAVA JO-4 C/CORTO 37,20 A115 A-115 SAVA JO-4 5730 40,60 A116 A-116 SAVA JO-4 1.000 70,60 A117 A-117 SAVA JO-4 1.000M 67,60 A121 A-121 BMC MARINA 1.5D 39,40 A122 A-122 LEYLAND SHERPA 70,60 A123 A-123 AUSTIN MARINA 62,50 A124 A-124 LEYLAND TM15/TM30 70,60 A131 A-131 ALFA 33 1.8 TD 77,20 A131ST A-131ST ALFA33 1.8TD INTER 51,60 A134 A-134 A.R.ALFETTA GT 85,00 A135 A-135 ALFA ROMEO 1750 101,00 A138 A-138 ALFA ROMEO 2.0 129,00 A139 A-139 ALFA ROMEO ALFA SUD 41,30 A140 A-140 ALFA ROMEO 164 2.0 44,60 A141 A-141 ALFA ROMEO 2.5 TD 54,60 A145 A-145 A.R.ALFETTA 1.5-1.8 55,80 A146 A-146 ALFA 75 2.5 - 3.0 91,00 A147 A-147 ALFA 33 1.8 TD 47,80 A148 A-148 ALFA 164 3.0 6V 84,00 A149 A-149 ALFA 155 1.8 - 2.0 60,50 A150 A-150 VW PASSAT 37,50 A151 A-151 VW PASSAT 35,60 A151RS A-151RS VW PASSAT DIESEL 39,50 A152 A-152 AUDI 100 GASOLINA 54,10 A153 A-153 AUDI 100 LS-GL 54,00 A154 A-154 AUDI 100 DIESEL 52,20 A158 A-158 AUDI 80-90 2000- 58,80 A159 A-159 AUDI 50 LS-50 47,60 A160 A-160 AUDI COUPE 1600- 74,30 A161 A-161 AUDI COUPE 1600 70,30 A161RS A-161RS VW PASSAT DIESEL 73,90 A162 A-162 VOLKSWAGEN LT 4X4 57,00 A164 A-164 VOLKSWAGEN POLO 1.3 48,10 A165 A-165 VOLKSW. -

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D. Power Finds Honda Ranks Highest for Initial Quality for First Time TOKYO: 19 Aug. 2020 — While new-vehicle owners report fewer problems overall with their new vehicle this year and initial vehicle quality has further improved, more problems are reported in two areas than in previous years, according to the J.D. Power 2020 Japan Initial Quality StudySM (IQS), released today. “Initial vehicle quality in Japan has clearly improved due to efforts by every automobile manufacturer,” said Koichi Urayama, director of the automotive division at J.D. Power. “Despite those efforts, however, there’s still work to be done because customer satisfaction has not increased since 2014. It is critical that manufacturers find ways to decrease the number of reported problems with safety features and the advanced technology-related functions. Both of these areas represent emerging quality issues, and such improvements will not only increase initial quality satisfaction among current owners but also among those who switch from other brands. Presenting the market with solutions to these challenges will be the first step toward a competitive advantage strategy.” The study, now in its 10th year, examines problems experienced by owners of new 2020 model-year vehicles during the first 90 days of ownership. Initial quality is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality. Following are some key findings of the 2020 study: The fewest number of problems are reported since the study’s redesign in 2014: Initial quality in 2020 averages 60 PP100. -

Presentation Material(PDF 2.15MB)

Machinery & & Infrastructure Shingo Sato Integrated Transportation Systems Business Unit Ⅰ Copyright © MITSUI & CO., LTD. ALL RIGHTS RESERVED. 30 Quantitative Targets Profit(PAT)/Core Operating Cash Flow Unit:¥bn ■ Profit (PAT) 158.8 ■ Core Operating 105.0 Cash Flow 89.6 90.0 85.0 85.0 Mar/2018 Mar/2019 Mar/2020 (Actual) Medium-term Management Plan Copyright © MITSUI & CO., LTD. ALL RIGHTS RESERVED. 31 Competitive Advantages Developing comprehensive business through extensive customer base and coordination with top-level partners Coordination with 160 affiliate companies ■Automobiles ■Construction equipment ■Shipping ■Aerospace ■Transportation Development & Expansion Copyright © MITSUI & CO., LTD. ALL RIGHTS RESERVED. 32 Competitive Advantages Existing infrastructure assets backed by stable demand Increase in value through productivity streamlining, and portfolio optimization through asset recycling Africa Asia, Renewable energy 7% Australia Power generation capacity 9.3GW 16% Middle East 34% Power Well-balanced region/fuel portfolio By 26% By Operatorship Coal fuel region 22% Gas Americas 62% 32% Solid cooperative structure with MODEC Offshore Proven results with abundance of projects for Brazilian firm Petrobras oil&gas Stable income from 18 FPSO/FSO vessels (investment scale: ¥80 bn) © MODEC Gas Strong relationship with Petrobras distribution Approximately 50% share of Brazil gas supply (Operating in 19 of 26 states) Copyright © MITSUI & CO., LTD. ALL RIGHTS RESERVED. 33 Business Environment Climate change Mobility market Technological bringing heightened expansion and innovation and awareness of the business model digital revolution environment change Low-carbon society Strengthening of Accelerated change Shift from owning to using environmental regulations in industrial structure (lease, rental, sharing) New business opportunities Copyright © MITSUI & CO., LTD. -

Small Suvs, Minicars Make Big Gains in 2006 the Renault Megane CC (Shown) Ended Peugeot’S 5-Year Reign at the Top of Luca Ciferri the Fastest-Growing Segment

AN_070402_18&19good.qxd 13.04.2007 8:58 Uhr Page 18 PAGE 18 · www.autonewseurope.com April 2, 2007 Market analysis by segment, European sales ROADSTER & CONVERTIBLE Small SUVs, minicars make big gains in 2006 The Renault Megane CC (shown) ended Peugeot’s 5-year reign at the top of Luca Ciferri the fastest-growing segment. Changing segments the roadster and convertible seg- Automotive News Europe Minicars, the No. 3 segment last year in ment. Peugeot’s 307 CC was No. 1 in terms of growth, increased 22.1 percent to Europe’s 2006 winners and losers 2004; the 206 CC led the other years. Rising fuel costs, growing concerns about 992,227 units thanks largely to strong Small SUV +63.6 2006 2005 % Change Seg. share % CO2 and a flurry of new products sparked sales of three cars built at Toyota and Upper premium +26.4 Renault Megane 32,344 42,514 -23.9% 13.4% a sales surge for small SUVs and minicars PSA/Peugeot-Citroen’s plant in Kolin, Minicar +22.1 Peugeot 307CC/306C 31,786 39,640 -19.8% 13.1% in Europe last year. Czech Republic. Peugeot 206 CC 29,833 43,518 -31.4% 12.3% The arrival of three new small SUVs Europe’s largest segment, small cars, Small minivan -13.6 VW Eos 21,759 59 – 9.0% helped the segment grow 63.6 percent to rose 7.0 percent to 3,811,009 units. The Premium roadster & convertible -10.9 Opel/Vauxhall Tigra TwinTop 20,406 32,633 -37.5% 8.4% 94,153 units in 2006, according to UK- second-biggest segment – lower-medium Lower medium -8.2 Mazda MX-5 19,288 9,782 97.2% 8.0% based market researcher JATO Dynamics. -

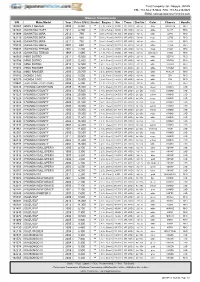

Manual Transmission S/N Make,Model Year Price (US$) Grade Engine Km Trans

Trust Company Ltd., Nagoya, JAPAN TEL: +81-52-219-9024 FAX: +81-52-219-9025 EMAIL:[email protected] Manual Transmission S/N Make,Model Year Price (US$) Grade Engine Km Trans. Drs/Sts Color Chassis Handle 180968 BMW 3 SERIES 2008 6,880 ** 2.0 L Petrol 97,000 MT, 2WD 4d / 5s blue WBAVG76 RHD 182342 DAIHATSU HIJET 2012 4,700 ** 0.66 L Petrol 36,000 MT, 4WD 2d / 2s white S211P RHD 181699 DAIHATSU MIRA 2012 790 ** 0.66 L Petrol 151,000 MT, 2WD 3d / 4s white L275V RHD 182115 DAIHATSU MIRA 2008 890 ** 0.66 L Petrol 138,000 MT, 2WD 5d / 4s beige L275S RHD 182449 DAIHATSU MIRA 2011 790 ** 0.66 L Petrol 179,000 MT, 2WD 3d / 4s silver L275V RHD 179832 DAIHATSU MOVE 2007 650 ** 0.66 L Petrol 183,000 MT, 4WD 5d / 4s white L185S RHD 179697 DAIHATSU TERIOS 2001 2,200 ** 1.3 L Petrol 99,000 MT, 4WD 5d / 5s black J102G RHD 182018 DAIHATSU TERIOS 1998 1,690 ** 1.3 L Petrol 97,000 MT, 4WD 5d / 5s white/silver J100G RHD 180569 HINO DUTRO 2011 15,500 ** 4.0 L Diesel 193,000 MT, 2WD 2d / 3s white XZC710 RHD 180756 HINO DUTRO 2007 12,800 ** 4.0 L Diesel 130,000 MT, 2WD 2d / 3s white XZU554 RHD 181123 HINO DUTRO 2010 12,500 ** 4.0 L Diesel 104,000 MT, 2WD 2d / 3s white XZU508 RHD 178382 HINO RANGER 2006 12,500 ** 6.4 L Diesel 202,000 MT, 2WD 2d / 3s white FD7JKW RHD 180544 HINO RANGER 2006 20,700 ** 6.4 L Diesel 56,000 MT, 2WD 2d / 2s white FC7JJW RHD 178582 HONDA CIVIC 2002 5,500 ** 2.0 L Petrol 100,000 MT, 2WD 3d / 4s white EP3 RHD 180275 HONDA CIVIC 2008 10,900 ** 2.0 L Petrol 102,000 MT, 2WD 4d / 4s white FD2 RHD 179841 HONDA INTEGRA (ACURA INTEGRA) -

Daihatsu Mira E:S Mini Passenger Car Undergoes Minor Model Upgrade Achieves Best Fuel Efficiency for a Gasoline Engine Vehicle*1Of 35.2 Km/L*2

July 9, 2014 (1/3) Daihatsu Mira e:S Mini Passenger Car Undergoes Minor Model Upgrade Achieves best fuel efficiency for a gasoline engine vehicle*1of *2 35.2 km/L Mira e:S G “SA” Daihatsu Motor Co., Ltd. (“Daihatsu”) is pleased to announce a minor upgrade to the Mira e:S mini passenger car, which will be released nationwide on Wednesday, July 9. The Mira e:S has been gaining the support of customers in a wide range of age groups as the “third eco-friendly car” that pursues high fuel efficiency and affordability, which are the essence of a mini passenger car. With the latest refinements, the e:S technology has evolved further, achieving improved fuel efficiency. In terms of power train evolution, combustion efficiency has been improved through a higher compression ratio and the adoption of Atkinson cycle technology*3 and a dual injector. In terms of energy management evolution, regenerative power has been increased through the improvement of Eco Power Generation Control, achieving fuel efficiency of 35.2 km/L, the best for a gasoline engine vehicle in all grades of 2WD vehicles. In addition, the Black Interior Package, an option that comes with a black-based interior, including black seat upholstery, has been added to some grades, creating a high quality, relaxing interior space. Daihatsu considers high fuel efficiency and affordability to be the essential features of all mini passenger cars, and it will continue to proactively pursue these aspects. *1: As of July 9, 2014, among gasoline engine cars, excluding hybrids (based on research undertaken by Daihatsu) *2: 2WD vehicles; JC08 mode fuel efficiency (Ministry of Land, Infrastructure, Transport and Tourism inspection value) *3: Internal combustion that achieves improved combustion efficiency by allowing the expansion ratio to be higher than the compression ratio (2/3) Outline ◆Through the evolution of e:S technology, fuel efficiency of 35.2 km/L has been achieved, the highest for a gasoline engine vehicle. -

Daihatsu Mira Cocoa Mini Passenger Car Undergoes Minor Changes

August 26, 2014 (1/4) Daihatsu Mira Cocoa Mini Passenger Car Undergoes Minor Changes The fun of finding a favorite vehicle by selecting from 160 different styles and plus α Mira Cocoa Plus X Interior color (Ivory x Brown) Daihatsu Motor Co., Ltd. is pleased to announce minor changes to the Mira Cocoa mini passenger car, which will be released nationwide on August 26. The Mira Cocoa, under the concept of “My perfect, smart and happy partner,” has been gaining the support of a large number of female customers due to its design, which makes outings enjoyable, and its compact style, offering ease of handling. With the latest minor changes, under the keywords, “Creating vehicles that suit customers’ tastes,” in addition to improvements in the attractiveness of the exterior design, the Mira Cocoa has become a vehicle that achieves the fun of selection and enables customers to express their personalities and individuality by offering 160 variations, the largest number available for a mini passenger car*1, including the selection of a total of 15 body colors*2 and 9 different interior colors*3, and by offering the plus α (special models limited to each region). Moreover, in addition to achieving a fuel efficiency of 29.0 km/L*4 through the application of e:S technology, the fundamental performance of the Mira Cocoa has been improved, including the achievement of a more comfortable ride and high driving tranquility. *1: As of August 2014; based on research undertaken by Daihatsu *2: Excluding the Cocoa L *3: Standard features of the Cocoa Plus X (including Smart Selection SN) *4: 2WD vehicles; JC08 mode fuel efficiency (2/4) Outline Creating vehicles that suit customers’ tastes ◆ In planning and development, the basic specifications were determined based on thorough research into the opinions of female customers. -

The Global Market for Compact Cars

a look at The global market for compact cars The search for fuel-saving solutions has led to a trend for acquiring smaller and lighter cars. Small compact cars, whether powered by internal combustion or electric engines, have gained and are continuing to gain market share, in both mature automobile markets such as Europe or Japan and emerging markets such as India. In Europe and in France, automotive A and B segments These cars have the highest market share in Europe, and categorize: this share has been increasing since the 1990s. Today, 4 cars out of 10 sold in Europe are in the A and B segments, I mini cars for the A segment, such as the Fiat 500, compared with 3 out of 10 in the early 1990s (Fig. 1). No Peugeot 108, Renault Twingo and Citroën C-Zero. other range has seen such growth over this period. Very compact, their length varies between 3.1 m and 3.6 m in Europe; The C segment is small family cars, the D segment large family cars, and the H segment luxury saloon cars I supermini cars or “subcompacts” for the B segment, and tourers. such as the Toyota Yaris, Citroën DS3, Renault Clio and Peugeot 208. Slightly bigger than A segment cars, they are still very easy to handle due to their Fig. 2 – Sub-A segment cars length, often under 4 meters, but their 5 seats make Tata Nano Renault Twizy them more versatile. Fig. 1 – Breakdown of the European automobile market by range of vehicles % 9 . 45% 0 4 40% Kia Pop Lumeneo Neoma % % 2 9 . -

Q4 09 Japan Sales.Qxp

Japan vehicle sales, 4th quarter & YTD Japan’s top 10 sellers (For selected companies) 4th qtr. 4th qtr. 12 mos. 12 mos. 4th quarter 2009 2009 2008 2009 2008 1. Toyota Prius 76,327 DOMESTIC Japan-built ...................................... 395,085 296,210 1,336,340 1,428,193 2. Honda Fit 46,564 Import .............................................. 1,772 3,526 10,079 15,142 3. Suzuki Wagon R* 39,583 Toyota Division ......................... 396,857 299,736 1,346,419 1,443,335 4. Daihatsu Move* 36,796 Japan-built ...................................... 1,667 1,372 7,914 7,300 Minivehicle ...................................... 138,751 145,346 588,301 635,164 5. Suzuki Carry/Every* 34,540 Daihatsu ................................. 140,418 146,718 596,215 642,464 6. Toyota Vitz 33,962 Hino ...................................... 6,421 8,145 24,434 40,666 7. Daihatsu Mira* 31,136 Lexus ..................................... 12,190 5,777 28,167 25,945 TOYOTA MOTOR CORP. ................ 555,886 460,376 1,995,235 2,152,410 8. Daihatsu Tanto* 29,392 Japan-built ...................................... 143,145 89,984 461,738 421,050 9. Daihatsu Hijet* 28,592 Minivehicle ...................................... 39,118 50,252 162,154 200,919 10. Honda Insight 28,427 Import .............................................. 1,291 392 1,624 2,578 HONDA MOTOR CO. .................... 183,554 140,628 625,516 624,547 *Minivehicle with engine under 660cc Japan-built ...................................... 12,072 14,700 59,436 77,823 Source: JADA (car), Zenkeijikyo (minicar) Minivehicle ...................................... 132,264 134,176 552,394 590,280 and FOURIN Inc. Import .............................................. 1,065 1,835 5,399 1,835 SUZUKI MOTOR CO. .................... 145,401 150,711 617,229 669,938 Japan-built ..................................... -

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D. Power Finds Honda Ranks Highest for Initial Quality for First Time TOKYO: 19 Aug. 2020 — While new-vehicle owners report fewer problems overall with their new vehicle this year and initial vehicle quality has further improved, more problems are reported in two areas than in previous years, according to the J.D. Power 2020 Japan Initial Quality StudySM (IQS), released today. “Initial vehicle quality in Japan has clearly improved due to efforts by every automobile manufacturer,” said Koichi Urayama, senior director of the automotive division at J.D. Power. “Despite those efforts, however, there’s still work to be done because customer satisfaction has not increased since 2014. It is critical that manufacturers find ways to decrease the number of reported problems with safety features and the advanced technology-related functions. Both of these areas represent emerging quality issues, and such improvements will not only increase initial quality satisfaction among current owners but also among those who switch from other brands. Presenting the market with solutions to these challenges will be the first step toward a competitive advantage strategy.” The study, now in its 10th year, examines problems experienced by owners of new 2020 model-year vehicles during the first 90 days of ownership. Initial quality is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality. Following are some key findings of the 2020 study: The fewest number of problems are reported since the study’s redesign in 2014: Initial quality in 2020 averages 60 PP100. -

Jan. 29, 2016 Company Notice Regarding Making Daihatsu Motor

[Reference Translation] January 29, 2016 To Whom It May Concern: Company Name: Toyota Motor Corporation Name and Title of Representative: Akio Toyoda, President (Code Number: 7203 Securities Exchanges throughout Japan) Name and Title of Contact Person: Yasushi Kyoda General Manager, Accounting Division (Telephone Number: 0565-28-2121) Company Name: Daihatsu Motor Co., Ltd. Name and Title of Representative: Masanori Mitsui, President (Code Number: 7262, The First Section of the Tokyo Stock Exchange) Name and Title of Contact Person: Norihide Bessho Chief Officer, Group CF, and Senior Executive Officer (Telephone Number: 072-754-3062) Notice Regarding Making Daihatsu Motor Co., Ltd. a Wholly-Owned Subsidiary of Toyota Motor Corporation through a Share Exchange Toyota Motor Corporation (“Toyota”) and Daihatsu Motor Co., Ltd. (“Daihatsu”) announced today that Toyota and Daihatsu signed a share exchange agreement (the “Share Exchange Agreement”) to conduct a share exchange (the “Share Exchange”) in which Daihatsu will become a wholly-owned subsidiary of Toyota and Toyota will become the parent company owning all of the shares of Daihatsu as described below, after both companies adopted resolutions approving the Share Exchange at their respective meetings of the board of directors held today. The Share Exchange is subject to the approval of the Share Exchange Agreement by shareholders of Daihatsu at its annual general meeting of shareholders scheduled to be held in late June 2016, after which the Share Exchange is expected to become effective on August 1, 2016. Toyota is not required to obtain approval from shareholders at a shareholders’ meeting, as Toyota will consummate the Share Exchange by means of the “simple share exchange” process under Article 796, Paragraph 2 of the Companies Act of Japan (Act No.