Corruption in Southeast Asia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 20 Year S Ser Vin G the Na Tion

ANNUAL REPORT 2014 LAPORAN TAHUNAN Laporan Tahunan 2014 Annual Report 20 YEARS SERVING THE NATION PT MNC SKY VISION TBK Hotline : 500 900 (local call from all cities) from call Hotline : 500 900 (local +62 21 582 8000 Ext. 9230 Telp: : +62 21 582 5440 Fax : www.indovision.tv website PT MNC SKY VISION TBK Wisma Indovision Z / III Blok Panjang Jl. Raya 11520 Jakarta Garden, Green Indonesia Daftar Isi ContentTable of 02 12 Penjelasan Tema Peristiwa Penting 2014 Splash Page 2014 Events Hightight 04 18 Sekilas Pintas Kinerja 2014 Highlight Page 2014 Performance 06 24 Sejarah dan Jejak Laporan Dewan Komisaris Langkah Perseroan dan Direksi Company History and Milestones Report of Board of Commissioners and Board of Directors PT MNC SKY VISION TBK PT MNC SKY VISION TBK 2 2 52 132 Profil Perusahaan Tanggung Jawab Company Profile Sosial Perusahaan Corporate Social Responsibility 72 167 Analisis dan Laporan Keuangan Pembahasan Manajemen Konsolidasi Management Discussion and Analysis Consolidated Financial Statements 94 Tata Kelola Perusahaan Corporate Governance PT MNC SKY VISION TBK 1 PENJELASAN SPLASH TEMA PAGE Selama dua puluh tahun kepeloporannya dalam industri Pioneering in national Pay TV industry for twenty years, televisi berlangganan nasional, PT MNC Sky Vision Tbk PT MNC Sky Vision Tbk (MSKY) continues to deliver best (MSKY) senantiasa memberikan layanan terbaik bagi services for millions of family in Indonesia. Through its three jutaan keluarga Indonesia. Melalui ketiga merek televisi Pay TV brands, Indovision, TopTV, and OkeVision, MSKY berlangganannya yakni Indovision, TopTV, dan OkeVision, consistently provides world-quality programs which not MSKY secara konsisten menghadirkan tayangan berkualitas only entertain but also educate, and empower the nation’s dunia yang tidak hanya menghibur tapi juga mendidik, character. -

Kinerja Perseroan Informasi Tambahan Laporan

P 01-10 Kinerja Perseroan Company Performance Analisa dan Pembahasan Manajemen Management Discussion and Analysis Sumber Daya Manusia Human Resources Tata Kelola Perusahaan Good Corporate Governance Laporan Komite Audit Audit Committee Report Kegiatan Sosial Perseroan Corporate Social Activities Strategi di Tahun 2013 Strategy in 2013 P 15-20 Informasi Tambahan Auxiliary Information Keterbukaan Informasi Information Disclosure Press Release Press Release Daftar Anak Perusahaan List of Subsidiaries P .119 Laporan Keuangan Konsolidasi Consolidated Financial Statements PT MNC Sky Vision Tbk 1 Laporan Tahunan 2012 Annual Report DELIVERING PERFORMANCE BEYOND EXPECTATIONS PT MNC Sky Vision Tbk. (MSV) telah melalui tahun PT MNC Sky Vision Tbk. (MSV) has ended 2012 2012 dengan sangat baik. Perseroan berhasil with significant results. The Company managed to memanfaatkan pertumbuhan ekonomi Indonesia take advantage of Indonesia’s economic growth in yang pada tahun 2012 bertumbuh sebesar 6,23% 2012 that expanded by 6.23%. Expansion of sales dengan sempurna. Perluasan jaringan penjualan network and technical services with 23 new cities dan layanan teknis di 23 kota-kota baru di across Indonesia, especially small cities whose seluruh Indonesia terutama kota kota kecil yang economies just starting to emerge, delivered perekonomiannya mulai menggeliat memberikan significant contribution to the Company’s growth. kontribusi signifikan bagi pertumbuhan Perseroan. Hal ini terlihat dari pertumbuhan jumlah pelanggan. This can be seen from the growing number of Melalui tiga merek yang dikelola, Perseroan customers. Capitalizing on three brands, the berhasil meningkatkan jumlah pelanggan sebesar Company successfully increased the number 48% atau 558.000 pelanggan, sehingga pada of subscribers by 48% or 558,000 subscribers, akhir bulan Desember 2012 jumlah pelanggan bringing the total number of subscribers to 1.72 menjadi 1,72 juta pelanggan. -

Intermedika Brochure V4

Business & Brand Strategy Business Reviews and Assessments Investor Support Healthcare for Hospitality Medical Tourism www.intermedikaconsulting.com InterMedika is… A company providing advisory Intermedika’s principals are the services to healthcare and business and brand architects that transformed Bumrungrad International hospitality companies around Hospital from a 250-bed general the world. We specialize in hospital in Bangkok, Thailand into one business strategy, business of Asia’s premier hospitals and the process improvement and world’s leading medical travel destination. developing innovative solutions that drive growth and Our work has been featured in the Economist, NY Times, 60 Minutes, profitability. Businessweek and Fast Company. Our team is comprised of C-level We have decades of experience management, marketing and designing, commissioning, operating, information technology professionals marketing and branding private with a proven track record of building, hospitals, clinics and academic operating, and branding healthcare and medical centers in the USA, Middle hospitality assets around East, Latin America and Asia. the world. We are unique because we have deep experience in both healthcare and hospitality. We help investors, owners and operators identify market opportunities and provide a full range of services to support business generation, optimization and transformation. Clients Choose Us Because… We are senior executives We work as a who understand the cross-functional team with realities of running more eyes to look at the healthcare businesses issues and more minds to internationally. offer solutions. We built one of the most We work with leading successful international sovereign wealth funds, healthcare businesses and investment companies and brands in the market today. -

Singapore 2017 19-20 July • Westin Singapore

7th Annual Private Equity & Venture Forum Singapore 2017 19-20 July • Westin Singapore GLOBAL PERSPECTIVE, LOCAL OPPORTUNITY avcjsingapore.com Southeast Asia: The next Keynote chapter in the Asia growth story Ming Maa After China and India, Southeast Asia is poised to become Group President the next battleground for private equity and venture investors, GRAB as global players are looking to expand into the region. The investment thesis is brimming with potential but in practice market fragmentation and political instabilities have made barriers to entry problematic and minimised deal opportunity. However, deal activity is increasing and investor appetite for exposure to Southeast Asia is on the rise. Strategically, companies in the region offer a number of opportunities serving the local market and as an exporter of goods in demand across the region. The 7th annual AVCJ Singapore Forum will provide an unrivalled in-depth analysis and debate on the latest trends, challenges and opportunities for private markets investors attracted to Southeast Asia, as the next destination in their quest for diversifying their portfolios and delivering alpha. 2016 Forum key statistics: 295+ 50 130+ 17 12 165 Participants Speakers Limited Countries Exclusive Panel Compa nies Partners Represented Discussions Represented REGISTER ONLINE: avcjsingapore.com EMAIL: [email protected] PHONE: +852 2158 9636 NOW! Join your peers #avcjsingapore avcjsingapore.com Sponsors Asia Series Sponsor Co-Sponsors Legal Sponsor VC Legal Sponsor Exhibitors SPONSORSHIP ENQUIRIES: -

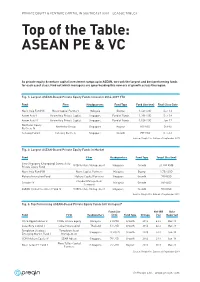

Top of the Table: ASEAN PE & VC

PRIVATE EQUITY & VENTURE CAPITAL IN SOUTHEAST ASIA – LEAGUE TABLES Top of the Table: ASEAN PE & VC As private equity & venture capital investment ramps up in ASEAN, we rank the largest and best performing funds for each asset class. Find out which managers are spearheading this new era of growth across the region. Fig. 1: Largest ASEAN-Based Private Equity Funds Closed in 2014-2019 YTD Fund Firm Headquarters Fund Type Fund Size (mn) Final Close Date Navis Asia Fund VII Navis Capital Partners Malaysia Buyout 1,423 USD Dec-14 Axiom Asia V Axiom Asia Private Capital Singapore Fund of Funds 1,399 USD Dec-18 Axiom Asia IV Axiom Asia Private Capital Singapore Fund of Funds 1,028 USD Jan-17 Northstar Equity Northstar Group Singapore Buyout 810 USD Oct-15 Partners IV Gateway Fund I Gateway Partners Singapore Growth 757 USD Dec-16 Source: Preqin Pro. Data as of September 2019 Fig. 2: Largest ASEAN-Based Private Equity Funds in Market Fund Firm Headquarters Fund Type Target Size (mn) Sino-Singapore (Chongqing) Connectivity UOB Venture Management Singapore Growth 20,000 RMB Private Equity Fund Navis Asia Fund VIII Navis Capital Partners Malaysia Buyout 1,750 USD Makara Innovation Fund Makara Capital Partners Singapore Growth 700 USD Creador Management Creador IV Malaysia Growth 550 USD Company ASEAN China Investment Fund IV UOB Venture Management Singapore Growth 500 USD Source: Preqin Pro. Data as of September 2019 Fig. 3: Top Performing ASEAN-Based Private Equity Funds (All Vintages)* Fund Size Net IRR Date Fund Firm Headquarters (mn) Fund Type Vintage (%) Reported COPE Opportunities 2 COPE Private Equity Malaysia 61 MYR Growth 2012 43.2 Mar-19 Lakeshore Capital I Lakeshore Capital Thailand 61 USD Growth 2014 42.2 Mar-19 Templeton Strategic Templeton Asset Singapore 133 USD Growth 2005 34.3 Jun-19 Emerging Market Fund II Management SEAVI Advent Equity IV SEAVI Advent Singapore 70 USD Growth 2004 29.9 Jun-19 Novo Tellus Capital Novo Tellus PE Fund 1 Singapore 25 USD Buyout 2011 28.9 Mar-19 Partners Source: Preqin Pro. -

Appointment of Additional Director 26 March 2019

'unlv/mBuild a Better Life UJJIVAN/SE/2018—19/52 March 26, 2019 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Bandra Kurla Complex, P.J. Tower, Bandra (East), Dalal Street Mumbai 400 051 Mumbai 400 001 Kind Attention: Manager, Listing Department Kind Attention: Manager, Listing Compliance Trading Symbol: UJJIVAN SCRIP CODE: 539874 Subject: Appointment of Additional Director Dear Sir/Madam, Please be inform that our Board of Directors at their meeting held today, March 26, 2019, based on the recommendation of the Nomination and Remuneration Committee, has unanimously approved the appointment of Mr. Anand Narayan (DIN: 02110727) as an Additional Director (Non-Executive, Non-Independent) with effect from May 01, 2019 subject to the approval of the Reserve Bank of India. Further, please be informed that the Nomination Committee while considering the appointment of Mr. Anand Narayan as an Additional director has verified that Mr. Anand Narayan is not debarred from holding the office of director pursuant to any SEBI order. Accordingly, the Company hereby affirms that Mr. Anand Narayan is not debarred from holding the office of director by virtue of any SEBI order or any other such authority. Further, Mr. Anand Narayan is not related to any other Director of the Company. Please find enclosed the brief profile and other requisite details in connection with the appointment of Mr. Anand Narayan in Annexure 1. This disclosure is being made pursuant to Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. Please take the above on record. Thanking You, Yours faithfully, For Ujjivan Financial Services Limited Barnwa Sanjee _ Secretar : ‘.nce0fficer Compmy \6, _ Encl: Annexure I lVAn Ujjivan Financial Services Limited Office: Garden, No. -

Member Brief Sarona Asset Management AGM

Member Brief Sarona Asset Management AGM Report 11 May 2015 Washington D.C. Background Sarona Asset Management (Sarona) is one of the 300 funds reviewed during an extensive survey of impact investment funds Completed by the Centre for SoCial Innovation & Impact Investing in 2014 and was one of the funds shortlisted for investment. Two PacifiC Impact Investor Network (PIIN) members—Phil Swift and Amin Lalji—made a signifiCant investment into the Sarona Frontier Markets Fund 2 (SFMF2) and were invited to attend the Sarona AGM in May 2015. Fund overview Fund Management Company: Sarona Asset Management Track Record: New fund. Manager has strong track reCord. Asset Class: Fund of Funds Target IRR: 20% Target Geography: Global, emerging markets Impact Theme: ACCess to finance—SMEs, Green teChnology/CleanteCh, Bottom of Pyramid Fees: 1% MF, 10% Carried interest Inception Year: 2012 Ratings: IA50 Domicile (HQ office): Cayman Islands (Canada) Minimum investment into fund (USD): $1 mill USD Committed capital: $126,000,000 USD Target AUM: $200,000,000 USD Status: Open, Committed Capital (CC) Stage: Growth Investment Thesis FoCused primarily on seCtors that serve domestiC demand (agribusiness, Consumer goods, eduCation, finanCial serviCes, healthCare, light manufacturing, logistiCs and transportation, professional serviCes, teChnology) in emerging markets where the middle-inCome populations that are Consumers of these serviCes is fastest growing. Their strategy is to find top loCal fund managers in target Countries that are typiCally loCal but with foreign eduCation and experienCe, and have a strong understanding of fund struCturing Member Brief—Sarona Asset Management AGM Report, May 2015 and meChanisms. Currently they are adding a mentorship program for the purpose of matching suCCessful North AmeriCan fund managers with frontier market fund managers. -

52067-001: Creador IV, LP

Initial Poverty and Social Analysis September 2018 REG: Equity Investment Creador IV, LP This document is being disclosed to the public in accordance with ADB’s Public Communications Policy 2011. INITIAL POVERTY AND SOCIAL ANALYSIS Country: Regional Project Title: Creador IV, LP Lending/Financing FI Department/ Private Sector Operations Modality: Division: Department/Investment Funds and Special Initiatives Division I. POVERTY IMPACT AND SOCIAL DIMENSIONS A. Links to the National Poverty Reduction Strategy and Country Partnership Strategy Creador IV will be similar to the investments of Creador III, an ADB approved project focusing on the following industries: (i) financial services (banks, finance companies); (ii) consumer goods and services (healthcare, education, media, retail); and (iii) business services (business to business services, outsourcing, payment processing, logistics). The proposed investment is aligned with ADB’s Strategy 20301, which aims to address poverty and reduce inequalities by generating quality jobs and achieving better health for all. Creador is uniquely positioned to deliver more investments that promote financial inclusion, affordable healthcare targeting lower and emerging middle-income populations and assistance to companies to expand regionally. B. Poverty Targeting: General intervention Individual or household (TI-H) Geographic (TI-G) Non-income MDGs (TI-M1, M2, etc.) The proposed investment will continue to support equity and equity-linked investments in middle market companies across the financial services, consumer goods, services and business service sectors in Malaysia, Indonesia, India, the Philippines, and Sri Lanka. C. Poverty and Social Analysis 1. Key issues and potential beneficiaries. The fund’s focus on financial services, consumer goods and services and business services supports socially inclusive sectors creating economic opportunities and expanding access to underserved communities. -

The Forex Efiect

AVCJ Private Equity & Venture Forum 2012 AVCJ Private Equity & Venture Forum 2012 china hong Kong 30 - 31 may 2012 13 - 16 november 2012 avcjchina.com www.avcjforum.com ASIAN VENTURE CAPITAL JOURNAL Asia’s Private Equity News Source avcj.com May 15 2012 Volume 25 Number 18 Editor’s ViEwpoint The surge in service providers and PRIVATE EQUITY ASIA secondaries houses as Asia’s PE industry matures Page 3 nEws ASK Pravi, Baring, Blackstone, Goldstone, GSR Ventures, IndoUS, M&A ASIA Inventus Capital, KKR, JAFCO, L Capital, Mandarin Capital, Oak, Ojas, PAG, Permira, Unison, Warburg Pincus Page 4 fund of thE wEEk Armstrong targets $150m for Southeast The forex eff ect Asia’s maiden clean energy vehicle Currency risks are proving to be a game changer for Asian GPs Page 7 Page 9 fund of thE wEEk foCus CIPEF raises $3b India’s infra defi cit CIPEF closes emerging markets fund VI Page 9 Trouble’s ahead for infrastructure funds Page 10 YourYour NewNew CapitalCapital PartnerPartner UOB Mezzanine Capital - your preferred alternative capital provider We deliver flexible capital solutions to support your transaction and enhance your returns. Our team has in-depth understanding of Asian markets and their regulatory environments. Your corporation will be able to leverage the extensive network and resources of the UOB Group to support your corporation's strategic plans. We have the capacity to provide solutions in local currencies and US dollar in most jurisdictions in Asia, including China. United Overseas Bank is a leading bank in Asia. It provides a wide range of financial services through its global network of more than 500 offices in 19 countries and territories in Asia Pacific, Western Europe and North America, including banking subsidiaries in Singapore, Malaysia, Indonesia, Thailand and mainland China. -

Private Equity Briefing: Southeast Asia

Private equity briefing: Southeast Asia June 2020 Private Equity briefing: SEA 1 This briefing offers you a roundup of the private equity and venture capital deals along with capital activities across major sectors in the quarter. It also covers the trends that are shaping investment decisions today. It distills the perspectives of the teams of subject-matter professionals in the region into pertinent insights to keep you ahead in navigating the private equity landscape. Private Equity briefing: SEA 2 Table of contents 1. Outlook 04 2. Investments 06 3. Exits 08 4. Fundraising 10 5. Stimulus Response Tool 12 6. Singapore-Indonesia Tax Treaty 13 7. Working Capital 16 8. EY Contact 19 1 Outlook Private equity (PE) and venture capital (VC) investment activity across Southeast Asia (SEA) was slow in 1Q20 amid COVID-19 pandemic-led crisis. Deals worth US$1.4b were announced, 65% lower from last year. Exit activity remained almost muted during the past quarter. Notably, dry powder reached record levels of US$439b by mid of May 2020. While 2Q 2020 is also likely to be slow, we see private equity playing an active role as the economies begin to reopen and recover. We expect to see activity around key themes such as structured finance, public to private, capital recycling, non core divestments and sector and segment consolidation. Markets across SEA witnessed a marginal decline in fundraising levels, with value of funds raised declining from US$1.3b across five funds in 1Q20, compared to US$1.4b across eight funds in 1Q19. The decline can primarily be attributed to increased COVID-19-related uncertainties. -

Aggressive Buyers Fostering Innovation, and VC, in Singapore M&A-Hungry Corporates Redraw Southeast Asia’S Trade Sale Landscape Page 8 Page 13

Asia’s Private Equity News Source avcj.com July 08 2014 Volume 27 Number 25 EDITOR’S VIEWPOINT Local angles still the lynchpin in SE Asia’s integrating markets Page 3 NEWS ADB, Carlyle, Cathay Capital, CITIC Capital, Equis, Fidelity, GIC, Goldman, Greenwoods, Haitong Capital, IFC, MSPEA, Multiples, NewQuest, NSSF, Olympus, Rakuten, TPG, Warburg Pincus Page 5 INDUSTRY Q&A Steve Leonard of IDA on Aggressive buyers fostering innovation, and VC, in Singapore M&A-hungry corporates redraw Southeast Asia’s trade sale landscape Page 8 Page 13 FOCUS ANALYSIS Great expectations Untapped potential Big ambitions for Singapore start-ups Page 11 Opportunities in Malaysia’s mid-market Page 14 PRE-CONFERENCE ISSUE AVCJ PRIVATE EQUITY AND VENTURE CAPITAL FORUM SINGAPORE 2014 Anything is possible if you work with the right partner Unlocking liquidity for private equity investors www.collercapital.com London, New York, Hong Kong EDITOR’S VIEWPOINT [email protected] Managing Editor Tim Burroughs (852) 3411 4909 Staff Writers Andrew Woodman (852) 3411 4852 Winnie Liu (852) 3411 4907 The ASEAN angle Creative Director Dicky Tang Designers Catherine Chau, Edith Leung, Mansfield Hor, Tony Chow Senior Research Manager Helen Lee Research Associates Herbert Yum, Isas Chu, AMBITIONS OF BUILDING SCALE Aman Lakhaney highlighted Crossland Logistics, Jason Chong, Kaho Mak underpin many private equity investments a Thailand-based transportation player and a Circulation Manager in Southeast Asia. It is remarkable – although portfolio company since 2012. Crossland was in Sally Yip perhaps unsurprising – how few have succeeded. the process of completing bolt-on acquisitions Circulation Administrator Prudence Lau So far, at least. -

A Tiger Awakens: E-Commerce in Vietnam

A TIGER AWAKENS: E-COMMERCE IN VIETNAM A GUIDE FOR AUSTRALIAN BUSINESS CONTENTS A tiger awakens: Vietnam’s internet economy landscape 05 Rapid Growth 05 Low revenue per capita 08 Key drivers 10 The rise of a connected, mobile-first population 10 A dramatic increase in licensed e-commerce platforms 11 Proactive participation of SMEs in e-commerce 12 Future potential 14 The golden population structure and an emerging middle class 14 Consistent inflow of foreign direct investment (FDI) 14 Government policy and regulation frameworks 15 Improving logistics 15 Challenges 17 Key players in Vietnam’s e-commerce industry 20 Vietnam’s biggest e-commerce platforms 21 Vietnam’s online consumers 24 Purchasing on mobile 24 High-value items 25 Instant gratification market 26 High social media usage and video consumption 26 Cash on delivery preferred 27 Popular e-commerce product categories 30 Entry points for Australian businesses 35 Existing relationships 35 No existing relationships 35 Cross-border online exporting 35 Conclusion 36 How Austrade can help 37 References 39 Disclaimer Copyright © Commonwealth of Australia 2019 This report has been prepared by the Commonwealth of Australia represented by the Australian Trade and Investment Commission (Austrade). The report is a general overview and is not intended to provide exhaustive coverage of the topic. The information is made available on The material in this document is licensed under a Creative Commons the understanding that the Commonwealth of Australia is not providing Attribution – 4.0 International licence, with the exception of: professional advice. • the Australian Trade and Investment Commission’s logo While care has been taken to ensure the information in this report is • any third party material accurate, the Commonwealth does not accept any liability for any loss • any material protected by a trade mark arising from reliance on the information, or from any error or omission, in • any images and photographs.