Chevron Unocal Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exhibits and Financial Statement Schedules 149

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K [ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 1-16417 NUSTAR ENERGY L.P. (Exact name of registrant as specified in its charter) Delaware 74-2956831 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2330 North Loop 1604 West 78248 San Antonio, Texas (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code (210) 918-2000 Securities registered pursuant to Section 12(b) of the Act: Common units representing partnership interests listed on the New York Stock Exchange. Securities registered pursuant to 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Doe V. Unocal Decision

Volume 1 of 2 FOR PUBLICATION UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT JOHN DOE I, individually & as Administrator of the Estate of his deceased child Baby Doe I, & on behalf of all others similarly situated; JANE DOE I, on behalf of herself, as Adminstratrix of the Estate of her deceased child Baby Doe I, & on behalf of all others similarly situated; JOHN DOE II; JOHN DOE III; JOHN DOE IV; JOHN DOE V; JANE DOE II; JANE DOE III; JOHN DOE VI; JOHN DOE VII; JOHN Nos. 00-56603 DOE VIII; JOHN DOE IX; JOHN DOE 00-57197 X; JOHN DOE XI, on behalf of D.C. No. themselves & all others similarly CV-96-06959- situated & Louisa Benson on RSWL behalf of herself & the general public, Plaintiffs-Appellants, v. UNOCAL CORPORATION, a California Corporation; TOTAL S.A., a Foreign Corporation; JOHN IMLE, an individual; ROGER C. BEACH, an individual, Defendants-Appellees. 14187 14188 DOE I v. UNOCAL CORP. JOHN ROE III; JOHN ROE VII; JOHN Nos. 00-56628 ROE VIII; JOHN ROE X, 00-57195 Plaintiffs-Appellants, D.C. No. v. CV-96-06112- UNOCAL CORPORATION; UNION OIL RSWL COMPANY OF CALIFORNIA, OPINION Defendants-Appellees. Appeal from the United States District Court for the Central District of California Richard A. Paez and Ronald S.W. Lew, District Judges, Presiding1 Argued and Submitted December 3, 2001—Pasadena, California Filed September 18, 2002 Before: Harry Pregerson, Stephen Reinhardt, and A. Wallace Tashima, Circuit Judges. Opinion by Judge Harry Pregerson; Concurrence by Judge Reinhardt 1Judge Paez initially authored the orders granting in part and denying in part Defendants’ Motions to Dismiss. -

CNOOC's Failed Bid to Purchase Unocal Michael Petrusic

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of North Carolina School of Law NORTH CAROLINA LAW REVIEW Volume 84 | Number 4 Article 9 5-1-2006 Oil and National Security: CNOOC's Failed Bid to Purchase Unocal Michael Petrusic Follow this and additional works at: http://scholarship.law.unc.edu/nclr Part of the Law Commons Recommended Citation Michael Petrusic, Oil and National Security: CNOOC's Failed Bid to Purchase Unocal, 84 N.C. L. Rev. 1373 (2006). Available at: http://scholarship.law.unc.edu/nclr/vol84/iss4/9 This Note is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Law Review by an authorized editor of Carolina Law Scholarship Repository. For more information, please contact [email protected]. Oil and the National Security: CNOOC's Failed Bid To Purchase Unocal On August 2, 2005, the China National Offshore Oil Company ("CNOOC") withdrew its bid to purchase U.S. oil company Unocal in response to significant political opposition.! CNOOC's bid aroused intense opposition from Members of Congress and outside observers. Within weeks of the bid's announcement, the House of Representatives urged the Bush administration to review the bid on national security grounds.2 The House based its arguments on the Exon-Florio Amendment to the Omnibus Trade and Competitiveness Act of 1988 (the "Amendment"),3 legislation designed to provide for the review and restriction of foreign direct investment in -

Chevron 2006 Annual Report

2006 Annual Report LETTER TO STOCKHOLDERS 2 EMERGING ENERGY 10 OPERATING HIGHLIGHTS 18 FIVE-YEAR OPERATING SUMMARY 85 THE ENERGY PORTFOLIO: EFFICIENT ENERGY 12 GLOSSARY OF ENERGY FIVE-YEAR FINANCIAL SUMMARY 86 CONVENTIONAL ENERGY 6 HUMAN ENERGY 14 AND FINANCIAL TERMS 24 BOARD OF DIRECTORS 1 0 1 UNCONVENTIONAL ENERGY 8 CHEVRON PERSPECTIVES 16 FINANCIAL REVIEW 25 CORPORATE OFFICERS 102 Demand for energy continues to rise, posing a clear challenge for our industry: how to develop new and better ways to produce, process, use and deliver all forms of energy — from conventional crude oil and natural gas to the emerging sources of the future. At Chevron, we recognize the world needs all the energy we can develop, in every potential form. We’re managing our energy portfolio to deliver that energy — and to create growth and value for our stockholders, our customers, our business partners and the communities where we do business. The energy portfolio CONVENTIONAL UNCONVENTIONAL EMERGING EFFICIENT HUMAN ENERGY ENERGY ENERGY ENERGY ENERGY 6 8 10 12 14 TO OUR STOCKHOLDERS 2006 was an exceptional year for our company. We continued to deliver value to our stockholders and to make strategic investments that will drive sustained, superior performance over the long term. We reported record net income of $17.1 billion on sales and other operating revenues of approximately $205 billion. For the year, total stockholder return was 33.8 percent, which was more than double the rate of return delivered by the S&P 500. Return on capital employed was a strong 22.6 percent. We continued to return cash to stock- holders through our stock buyback program, purchasing $5 billion worth of shares in the open market, and we increased our annual dividend for the 19th year in a row. -

Valero Port Arthur Refinery Presents $750000 to Local Children's Charities

FOR IMMEDIATE RELEASE: VALERO PORT ARTHUR REFINERY PRESENTS $750,000 TO LOCAL CHILDREN’S CHARITIES Despite tournament’s cancellation, community support endures PORT ARTHUR, Texas, October 9, 2020 — The COVID-19 pandemic canceled the Valero Texas Open, like it did so many prominent events across the country, but it didn’t stop the tournament’s legacy of giving back. Business partners, sponsors and individual donors of the tournament and related events including the Valero Benefit for Children still contributed more than $14 million in net proceeds for charitable organizations across the United States, including those in the Port Arthur area. The Valero Port Arthur Refinery will distribute $750,000 to local charities with funds raised through the Valero Energy Foundation and the 2020 Valero Texas Open and Benefit for Children. “This is really positive news for our local nonprofit organizations, many of whom are facing challenges as a result of the pandemic,” said Mark Skobel, Vice President and General Manager of the Valero Port Arthur Refinery. “We know how important it is to continue supporting these agencies and the work they do for the children in our community.” The 2020 Valero Benefit for Children local recipients are: • Port Arthur Independent School District • Gulf Coast Health Center • YMCA of Southeast Texas • Communities in Schools of Southeast Texas • CASA of Southeast Texas • Southeast Texas Food Bank • Garth House, Mickey Mehaffy Children’s Advocacy Program • Richard Shorkey Education and Rehabilitation Center “We are blessed by our long-standing relationships with our tournament and Benefit for Children top sponsors,” said Joe Gorder, Valero Chairman and Chief Executive Officer. -

How to Improve U.S.-China Relations in the Wake of CNOOC

63 How to Improve U.S.-China Relations in the Wake of CNOOC James A. Dorn Abstract The increasingly confrontational approach the U.S. Congress is taking toward China, as witnessed by the surge of anti-China legislation and by the excessive politicization of the proposed merger between CNOOC Ltd., a subsidiary of state-owned China National Offshore Oil Company, and Unocal is leading to “creeping protectionism,” often in the guise of protecting U.S. national security. Although it is proper to criticize China for its human rights violations and its lack of a transparent legal system, we should not ignore the substantial progress China has made since it embarked on economic liberalization in 1978. A policy of engagement—or what Hu Jintao, president of the People’s Republic of China, calls “peaceful development”—is a necessary condition for constructive U.S.-China relations. Although China’s competitiveness does pose a threat to certain U.S. economic interests, it also benefits American consumers and exporters. Protectionism would harm both the United States and China and would increase the likelihood of conflict. Hardliners would gain at the expense of more reasonable voices. To avert the risk of conflict, the United States needs to treat China as a normal great power, not as an adversary, and ensure that only those commercial transactions that genuinely threaten national security are blocked. The Korean Journal of Defense Analysis, Vol. XVII, No. 3, Winter 2005 64 How to Improve U.S.-China Relations in the Wake of CNOOC James A. Dorn 65 Introduction Such fears are evident in the flurry of anti-China resolutions and bills introduced by members of Congress around the time of the In its 2005 Annual Report to Congress on the Military Power of the CNOOC-Unocal bid. -

Suncor Energy – Annual Report 2005

Suncor05ARcvr 3/8/06 1:33 PM Page 1 SUNCOR ENERGY INC. 2005 ANNUAL REPORT > growing strategically Suncor’s large resource base, growing production capacity and access to the North American energy market are the foundation of an integrated strategy aimed at driving profitable growth, a solid return on capital investment and strong returns for our shareholders. A staged approach to increasing our crude oil production capacity allows Suncor to better manage capital costs and incorporate new ideas and new technologies into our facilities. production 50,000 bpd 110,000 bpd (capacity) resources Third party bitumen 225,000 bpd Mining 260,000 bpd 350,000 bpd 500,000 bpd In-situ 500,000 – 550,000 bpd OUR PLANS TO GROW TO HALF A MILLION BARRELS PER DAY IN 2010 TO 2012* x Tower Natural gas Vacuum 1967 – Upgrader 1 1998 – Expand Upgrader 1, Vacuum Tower Future downstream integrat 2001 – Upgrader 2 Other customers 2005 – Expand Upgrader 2, 2008 – Further Expansion of Upgrader 2 2010-2012 – Upgrader 3 Denver refinery ion Sarnia refinery markets To provide greater North American markets reliability and flexibility to our feedstock supplies, we produce bitumen through our own mining and in-situ recovery technologies, and supplement that supply through innovative third-party agreements. Suncor takes an active role in connecting supply to consumer demand with a diverse portfolio of products, downstream assets and markets. Box 38, 112 – 4th Avenue S.W., Calgary, Alberta, Canada T2P 2V5 We produce conventional natural Our investments in renewable wind tel: (403) 269-8100 fax: (403) 269-6217 [email protected] www.suncor.com gas as a price hedge against the energy are a key part of Suncor’s cost of energy consumption. -

Toward an Expanded Use of Rule 10B-5

SECURITIES LAWS AND CORPORATE SOCIAL RESPONSIBILITY: TOWARD AN EXPANDED USE OF RULE 1OB-5 RACHEL CHERINGTON* 1. INTRODUCTION As U.S. companies expand overseas, in search of a larger cus- tomer base and the cheaper labor available in developing coun- tries, there has been concomitant concern that such transnational corporations ("TNCs") are subordinating human rights and other social responsibilities to the pursuit of higher corporate profit. Numerous corporations have been accused of violations of la- bor rights, such as the use of forced and child labor.' More egre- gious human rights violations include those alleged against Royal Dutch Petroleum ("Royal Dutch Shell") and Unocal Corporation. Royal Dutch Shell has been accused of complicity in the execution of Nigerian dissidents who protested the company's environ- mental policies. 2 Unocal Corporation has been sued in California for hiring the military of Myanmar (formerly Burma) to provide security for its pipeline project there, despite allegedly knowing that the military had tortured Burmese citizens in order to compel 3 their labor on the Unocal pipeline project. *J.D. Candidate, 2005, University of Pennsylvania Law School. I would like to thank Adam Bochenek for his insightful comments, Laura Leitner for her support during the writing of this Comment, and the editors of the University of Pennsyl- vania Journal of International Economic Law. Finally, I would like to thank my family for their love and support. 1See Beth Stephens, The Amorality of Profit: TransnationalCorporations and Hu- man Rights, 20 BERKELEY J.INT'L L. 45, 51-2 (2002) (giving examples of corporations, including Enron Corporation, Royal Dutch Shell, and Unocal, who participate in human rights abuses in pursuit of profits). -

Complaint Filed Against Different Companies of The

April 29, 2003 VIA FACSIMILE and U.S. MAIL Mr. Wesley Scholz Director, Office of Investment Affairs and National Contact Point for the OECD Guidelines for Multinational Enterprises Department of State 2201 C Street NW Washington, DC 20520 Dear Mr. Scholz: Friends of the Earth-United States is raising a specific instance against Unocal Corporation, ConocoPhillips, and Amerada Hess Corporation (the “U.S. Companies”) for breaching the OECD Guidelines for Multinational Enterprises (the “Guidelines”) with respect to the Baku-T’bilisi- Ceyhan oil pipeline1 (the “BTC”). The specific areas of concern we raise here relate to the BTC Consortium, of which the U.S. Companies are a part. It is held that the Consortium: y exerted undue influence on the regulatory framework; y sought or accepted exemptions related to social, labor, tax and environmental laws; y failed to operate in a manner contributing to the wider goals of sustainable development; y failed to adequately consult with project-affected communities on pertinent matters; and y undermined the host governments’ ability to mitigate serious threats to the environment, human health and safety. Applicability of the Guidelines to the U.S. Companies As a signatory to the Guidelines, the U.S. government has committed itself to encouraging multinational companies operating on its territory to observe the Guidelines wherever they operate. The U.S. companies’ operations in Azerbaijan, Georgia and Turkey are therefore subject to the Guidelines by virtue of the fact that each enterprise is incorporated and headquartered in the United States and has its primary securities’ listing on the New York Stock Exchange. -

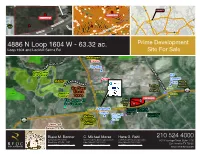

10 4886 N Loop 1604 W

1 02 2 4 9 1 2 0 26 8 10 0 24 4 1 1 0 024 22 1 1024 9 8 6 Hope Center Church 1 9 022 8 1 8 1 0 L 0 2 1 2 L Budget Blinds, Lush Rooftop, Amore Cafe, 1 0 0 L 0 E 8 L Rodrigo Pinheiro BJJ, Pure Fun, Picks Bar, E M 1 M 1022 0 U 0 The Brazilian Capoeira Academy: San Antonio 4 2 9 9 U 4 9 O 2 10 9 2 O L 4 1 L 0 2 10 1 0 00 1 1 2 0 0 4 1 Æþ281 10 022 1 10 00 10 2 06 1020 1 1 8 0 1 06 0 0 0 0 1 1 0 1100 4 !$" 2 # 16 SUBJECT 10 1014 BBQ 2 012 00 1 1 1 0 0 08 Outfitters 4 10 B 2 9 9 2 1000 Not100 Available B Ridge Shopping 99 8 990 Center 996 9 994 9 Not Available 2 9 1604 86 UV 9 1 8 1 4 0 1 0 3355 4 0 !$" 2 # 2 1 4 3 4 0 1 4 0 6 4 0 3 1 0 2 D 8 9 8 1604 R 4 82 9 S 3 UV S 0 E 1 CC UV53 0 A 3 1 0 0 W 1 0 90 4 2 98 9 2 6 0 98 0 8 2 992 Teralta 6 2 10 281 1 0 994 Æþ P V 1 6 218 O 84 8 UV 9 16 O I 80 9 UV L A 9 88 4 Corporate N 9 82 4 9 96 98 1100 98 00 9 #$!" S 10 98 A 32 A D 9 H 10 R Park A S S 02 V CE 10 1604 AC 04 AN 10 UV O W 1008 6 v 4 0 60 10 978 537 1 1 1 UV 0 0 0 OP 10 8 0 O 0 6 6 L 2 1 9 97 W 10 N 01 7 4 10 1 8 1604 60 1 1 0 UV W 6 OP 3 04 98 441100 LO 6 P 16 #$!" N LOO 6 L 4 12 101 N 9 97 L 10 O 76 014 O 1 1 C 0 345 C 3 K UV 8 1604 980 K UV H 0 v 102 1018 H H.E.B Federal IL 9 8 2 8 I 102 2 L 2 441100 02 7 L 1 - 9 #$!" 368 1020 S 9 UV L 8 Credit Union E 0 - 4 S 4 102 L 4 3355 University Oaks 102 26 8 9 $!" 10 30 # E 10 6 M 4 8 L 2 A 9 9 10 0 8 M 32 1 6 Camp Bullis Church of Christ R 9 A 1034 D 9 8 8 8 R 8 Subject D 103 K 421 1 8 1036 A UV 04 K 0 8 O A 2 Y 2 Ft Elevation Lines 4 0 O T 9 7 1 I 7 9 Y 1 BACON RD S 8 0 BACON RD T 4 R 100 Year FEMA Floodplain I 2 E S 1 1 Prime Development V 0 I R 0 1604 4 N 6 1100 E 2 97 151 " 4 UV #$! 6 U 9 UV 8 [email protected] PPIVG Paints 990 0 N Apria CBD 4886 N LoopU 1604 W - 63.32 ac. -

PBF Energy Inc. 2016 Annual Report the PBF Energy Refining System At-A Glance

PBF Energy Inc. 2016 Annual Report The PBF Energy Refining System At-a glance PADD 4 Tolededoed Paulsboro PADD 2 PADD 5 Delaware City PADD 1 Torrance PADD 3 Chalmette Chalmette Refinery The Chalmette refinery, in Louisiana, is a 189,000 barrel per day, dual-train coking refinery with a Nelson Complexity of 12.7 and is capable of processing both light and heavy crude oil. The facility is strategically positioned on the Gulf Coast with strong logistics connectivity that offers flexible raw material sourcing and product distribution opportunities, including the potential to export products. Delaware City Refinery The Delaware City refinery has a throughput capacity of 190,000 bpd and a Nelson complexity rating of 11.3. As a result of its configuration and petroleum refinery processing units, Delaware City has the capability to process a diverse heavy slate of crudes with a high concentration of high sulfur crudes making it one of the largest and most complex refineries on the East Coast. Cover: Torrance Refinery PBF Energy (“PBF”) is a growth-oriented independent petroleum refiner and supplier of unbranded petroleum products. We are committed to the safe, reliable and environmentally responsible operations of our five domestic oil refineries, and related assets, with a combined processing capacity of approximately 900,000 bpd and a weighted average Nelson Complexity Index of 12.2. PBF Energy also owns approximately 44% of PBF Logistics LP (NYSE: PBFX). PBF Logistics LP, headquartered in Parsippany, New Jersey, is a fee-based, growth-oriented, publicly-traded, master limited partnership formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined petroleum products, terminals, pipelines, storage facilities and similar logistics assets. -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance.