Suncor Energy – Annual Report 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exhibits and Financial Statement Schedules 149

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K [ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 1-16417 NUSTAR ENERGY L.P. (Exact name of registrant as specified in its charter) Delaware 74-2956831 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2330 North Loop 1604 West 78248 San Antonio, Texas (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code (210) 918-2000 Securities registered pursuant to Section 12(b) of the Act: Common units representing partnership interests listed on the New York Stock Exchange. Securities registered pursuant to 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Suncor Q3 2020 Investor Relations Supplemental Information Package

SUNCOR ENERGY Investor Information SUPPLEMENTAL Published October 28, 2020 SUNCOR ENERGY Table of Contents 1. Energy Sources 2. Processing, Infrastructure & Logistics 3. Consumer Channels 4. Sustainability 5. Technology Development 6. Integrated Model Calculation 7. Glossary SUNCOR ENERGY 2 SUNCOR ENERGY EnergyAppendix Sources 3 202003- 038 Oil Sands Energy Sources *All values net to Suncor In Situ Mining Firebag Base Plant 215,000 bpd capacity 350,000 bpd capacity Suncor WI 100% Suncor WI 100% 2,603 mmbbls 2P reserves1 1,350 mmbbls 2P reserves1 Note: Millennium and North Steepank Mines do not supply full 350,000 bpd of capacity as significant in-situ volumes are sent through Base Plant MacKay River Syncrude 38,000 bpd capacity Syncrude operated Suncor WI 100% 205,600 bpd net coking capacity 501 mmbbls 2P reserves1 Suncor WI 58.74% 1,217 mmbbls 2P reserves1 Future opportunities Fort Hills ES-SAGD Firebag Expansion Suncor operated Lewis (SU WI 100%) 105,000 bpd net capacity Meadow Creek (SU WI 75%) Suncor WI 54.11% 1,365 mmbbls 2P reserves1 First oil achieved in January 2018 SUNCOR ENERGY 1 See Slide Notes and Advisories. 4 1 Regional synergy opportunities for existing assets Crude logistics Upgrader feedstock optionality from multiple oil sands assets Crude feedstock optionality for Edmonton refinery Supply chain Sparing, warehousing & supply chain management Consolidation of regional contracts (lodging, busing, flights, etc.) Operational optimizations Unplanned outage impact mitigations In Situ Turnaround planning optimization Process -

Valero Port Arthur Refinery Presents $750000 to Local Children's Charities

FOR IMMEDIATE RELEASE: VALERO PORT ARTHUR REFINERY PRESENTS $750,000 TO LOCAL CHILDREN’S CHARITIES Despite tournament’s cancellation, community support endures PORT ARTHUR, Texas, October 9, 2020 — The COVID-19 pandemic canceled the Valero Texas Open, like it did so many prominent events across the country, but it didn’t stop the tournament’s legacy of giving back. Business partners, sponsors and individual donors of the tournament and related events including the Valero Benefit for Children still contributed more than $14 million in net proceeds for charitable organizations across the United States, including those in the Port Arthur area. The Valero Port Arthur Refinery will distribute $750,000 to local charities with funds raised through the Valero Energy Foundation and the 2020 Valero Texas Open and Benefit for Children. “This is really positive news for our local nonprofit organizations, many of whom are facing challenges as a result of the pandemic,” said Mark Skobel, Vice President and General Manager of the Valero Port Arthur Refinery. “We know how important it is to continue supporting these agencies and the work they do for the children in our community.” The 2020 Valero Benefit for Children local recipients are: • Port Arthur Independent School District • Gulf Coast Health Center • YMCA of Southeast Texas • Communities in Schools of Southeast Texas • CASA of Southeast Texas • Southeast Texas Food Bank • Garth House, Mickey Mehaffy Children’s Advocacy Program • Richard Shorkey Education and Rehabilitation Center “We are blessed by our long-standing relationships with our tournament and Benefit for Children top sponsors,” said Joe Gorder, Valero Chairman and Chief Executive Officer. -

Secure Fuels from Domestic Resources ______Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development

5th Edition Secure Fuels from Domestic Resources ______________________________________________________________________________ Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development Prepared by INTEK, Inc. For the U.S. Department of Energy • Office of Petroleum Reserves Naval Petroleum and Oil Shale Reserves Fifth Edition: September 2011 Note to Readers Regarding the Revised Edition (September 2011) This report was originally prepared for the U.S. Department of Energy in June 2007. The report and its contents have since been revised and updated to reflect changes and progress that have occurred in the domestic oil shale and tar sands industries since the first release and to include profiles of additional companies engaged in oil shale and tar sands resource and technology development. Each of the companies profiled in the original report has been extended the opportunity to update its profile to reflect progress, current activities and future plans. Acknowledgements This report was prepared by INTEK, Inc. for the U.S. Department of Energy, Office of Petroleum Reserves, Naval Petroleum and Oil Shale Reserves (DOE/NPOSR) as a part of the AOC Petroleum Support Services, LLC (AOC- PSS) Contract Number DE-FE0000175 (Task 30). Mr. Khosrow Biglarbigi of INTEK, Inc. served as the Project Manager. AOC-PSS and INTEK, Inc. wish to acknowledge the efforts of representatives of the companies that provided information, drafted revised or reviewed company profiles, or addressed technical issues associated with their companies, technologies, and project efforts. Special recognition is also due to those who directly performed the work on this report. Mr. Peter M. Crawford, Director at INTEK, Inc., served as the principal author of the report. -

Facts About Alberta's Oil Sands and Its Industry

Facts about Alberta’s oil sands and its industry CONTENTS Oil Sands Discovery Centre Facts 1 Oil Sands Overview 3 Alberta’s Vast Resource The biggest known oil reserve in the world! 5 Geology Why does Alberta have oil sands? 7 Oil Sands 8 The Basics of Bitumen 10 Oil Sands Pioneers 12 Mighty Mining Machines 15 Cyrus the Bucketwheel Excavator 1303 20 Surface Mining Extraction 22 Upgrading 25 Pipelines 29 Environmental Protection 32 In situ Technology 36 Glossary 40 Oil Sands Projects in the Athabasca Oil Sands 44 Oil Sands Resources 48 OIL SANDS DISCOVERY CENTRE www.oilsandsdiscovery.com OIL SANDS DISCOVERY CENTRE FACTS Official Name Oil Sands Discovery Centre Vision Sharing the Oil Sands Experience Architects Wayne H. Wright Architects Ltd. Owner Government of Alberta Minister The Honourable Lindsay Blackett Minister of Culture and Community Spirit Location 7 hectares, at the corner of MacKenzie Boulevard and Highway 63 in Fort McMurray, Alberta Building Size Approximately 27,000 square feet, or 2,300 square metres Estimated Cost 9 million dollars Construction December 1983 – December 1984 Opening Date September 6, 1985 Updated Exhibit Gallery opened in September 2002 Facilities Dr. Karl A. Clark Exhibit Hall, administrative area, children’s activity/education centre, Robert Fitzsimmons Theatre, mini theatre, gift shop, meeting rooms, reference room, public washrooms, outdoor J. Howard Pew Industrial Equipment Garden, and Cyrus Bucketwheel Exhibit. Staffing Supervisor, Head of Marketing and Programs, Senior Interpreter, two full-time Interpreters, administrative support, receptionists/ cashiers, seasonal interpreters, and volunteers. Associated Projects Bitumount Historic Site Programs Oil Extraction demonstrations, Quest for Energy movie, Paydirt film, Historic Abasand Walking Tour (summer), special events, self-guided tours of the Exhibit Hall. -

Chevron Unocal Analysis

ANALYSIS OF PROPOSED CONSENT ORDER TO AID PUBLIC COMMENT IN THE MATTER OF CHEVRON CORPORATION AND UNOCAL CORPORATION, FILE NO. 051-0125 I. Introduction The Federal Trade Commission (“Commission” or “FTC”) has issued a complaint (“Complaint”) alleging that the proposed merger of Chevron Corporation (“Chevron,” formerly ChevronTexaco Corporation) and Unocal Corporation (“Unocal”) (collectively “Respondents”) would violate Section 7 of the Clayton Act, as amended, 15 U.S.C. § 18, and Section 5 of the Federal Trade Commission Act, as amended, 15 U.S.C. § 45, and has entered into an agreement containing consent order (“Agreement Containing Consent Order”) pursuant to which Respondents agree to be bound by a proposed consent order (“Proposed Consent Order”). The Proposed Consent Order remedies the likely anticompetitive effects arising from Respondents’ proposed merger, as alleged in the Complaint. II. Description of the Parties and the Transaction A. Chevron Chevron is a major international energy firm with operations in North America and about 180 foreign countries in Europe, Africa, South America, Central America, Indonesia, and the Asia-Pacific region. Its petroleum operations consist of exploring for, developing and producing crude oil and natural gas; refining crude oil into finished petroleum products; marketing crude oil, natural gas, and various finished products derived from petroleum; and transporting crude oil, natural gas, and finished petroleum products by pipeline, marine vessels, and other means. The company operates light petroleum refineries for products such as gasoline, jet fuel, kerosene and fuel oil at Pascagoula, Mississippi; El Segundo, California; Richmond, California; Salt Lake City, Utah; and Kapolei, Hawaii. Chevron is a major refiner and marketer of gasoline that meets the requirements of the California Air Resources Board (“CARB”). -

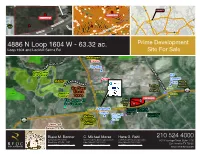

10 4886 N Loop 1604 W

1 02 2 4 9 1 2 0 26 8 10 0 24 4 1 1 0 024 22 1 1024 9 8 6 Hope Center Church 1 9 022 8 1 8 1 0 L 0 2 1 2 L Budget Blinds, Lush Rooftop, Amore Cafe, 1 0 0 L 0 E 8 L Rodrigo Pinheiro BJJ, Pure Fun, Picks Bar, E M 1 M 1022 0 U 0 The Brazilian Capoeira Academy: San Antonio 4 2 9 9 U 4 9 O 2 10 9 2 O L 4 1 L 0 2 10 1 0 00 1 1 2 0 0 4 1 Æþ281 10 022 1 10 00 10 2 06 1020 1 1 8 0 1 06 0 0 0 0 1 1 0 1100 4 !$" 2 # 16 SUBJECT 10 1014 BBQ 2 012 00 1 1 1 0 0 08 Outfitters 4 10 B 2 9 9 2 1000 Not100 Available B Ridge Shopping 99 8 990 Center 996 9 994 9 Not Available 2 9 1604 86 UV 9 1 8 1 4 0 1 0 3355 4 0 !$" 2 # 2 1 4 3 4 0 1 4 0 6 4 0 3 1 0 2 D 8 9 8 1604 R 4 82 9 S 3 UV S 0 E 1 CC UV53 0 A 3 1 0 0 W 1 0 90 4 2 98 9 2 6 0 98 0 8 2 992 Teralta 6 2 10 281 1 0 994 Æþ P V 1 6 218 O 84 8 UV 9 16 O I 80 9 UV L A 9 88 4 Corporate N 9 82 4 9 96 98 1100 98 00 9 #$!" S 10 98 A 32 A D 9 H 10 R Park A S S 02 V CE 10 1604 AC 04 AN 10 UV O W 1008 6 v 4 0 60 10 978 537 1 1 1 UV 0 0 0 OP 10 8 0 O 0 6 6 L 2 1 9 97 W 10 N 01 7 4 10 1 8 1604 60 1 1 0 UV W 6 OP 3 04 98 441100 LO 6 P 16 #$!" N LOO 6 L 4 12 101 N 9 97 L 10 O 76 014 O 1 1 C 0 345 C 3 K UV 8 1604 980 K UV H 0 v 102 1018 H H.E.B Federal IL 9 8 2 8 I 102 2 L 2 441100 02 7 L 1 - 9 #$!" 368 1020 S 9 UV L 8 Credit Union E 0 - 4 S 4 102 L 4 3355 University Oaks 102 26 8 9 $!" 10 30 # E 10 6 M 4 8 L 2 A 9 9 10 0 8 M 32 1 6 Camp Bullis Church of Christ R 9 A 1034 D 9 8 8 8 R 8 Subject D 103 K 421 1 8 1036 A UV 04 K 0 8 O A 2 Y 2 Ft Elevation Lines 4 0 O T 9 7 1 I 7 9 Y 1 BACON RD S 8 0 BACON RD T 4 R 100 Year FEMA Floodplain I 2 E S 1 1 Prime Development V 0 I R 0 1604 4 N 6 1100 E 2 97 151 " 4 UV #$! 6 U 9 UV 8 [email protected] PPIVG Paints 990 0 N Apria CBD 4886 N LoopU 1604 W - 63.32 ac. -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance. -

PBF Energy Inc. 2017 Annual Report 2017 At-A-Glance

PBF Energy Inc. 2017 Annual Report 2017 At-A-Glance PBF Energy (“PBF”) is a growth-oriented independent petroleum refiner and supplier of unbranded petroleum products. We are committed to the safe, reliable and environmentally responsible operations of our five domestic oil refineries, and related assets, with a combined processing capacity of approximately 900,000 barrels per day (bpd) and a weighted-average Nelson Complexity Index of 12.2. PBF Energy also owns approximately 44% of PBF Logistics LP (NYSE: PBFX). PBF Logistics LP, headquartered in Parsippany, New Jersey, is a fee-based, growth-oriented master limited partnership formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined petroleum products, terminals, pipelines, storage facilities and similar logistics assets. Nelson Complexity Chalmette Refinery The Chalmette Refinery, in Louisiana, is a 189,000 bpd, dual-train coking refinery with a Nelson Complexity Index of 12.7 and is capable of processing both light and heavy crude oil. The facility is strategically positioned on the Gulf Coast with strong logistics connectivity that offers flexible raw material sourcing and product distribution opportunities, including the potential to export products. 12.7 Nelson Complexity Delaware City Refinery The Delaware City refinery has a throughput capacity of 190,000 bpd and a Nelson Complexity Index of 11.3. As a result of its configuration and petroleum refinery processing units, Delaware City has the capability to process a diverse heavy slate of crudes with a high concentration of high sulfur crudes making it one of the largest and most complex refineries on the East Coast. -

Diversity in Corporate Governance

DIVERSITY IN CORPORATE GOVERNANCE A Quantitive Analysis of Diversity and Inclusion in Texas’ Fortune 1000 Companies March 2018 DIVERSITY IN CORPORATE GOVERNANCE A Quantitative Analysis of Diversity and Inclusion in Texas’ Fortune 1000 Companies with an analysis comparing data from 2016 to 2018 and an analysis of the Oil & Gas Industry March 2018 FOREWORD In the last twenty years there has been an abundance of evidence showing that diversity promotes growth, creativity, and business innovation. We have also seen the disastrous consequences of homogenous thinking, as revealed during the national economic recession of 2008. We are fortunate to live in Texas, one of the most diverse states in the country, and that diversity offers us the potential for growing our markets, improving the ways we work, and leaving better lives for future generations. However, today this potential for growth and improvement is still not fully realized. We at the National Diversity Council invite you to review and contemplate this research on diversity in the corporate governance of Texas companies. In this report you will find that our workforce is highly diverse, but women and People of Color are not succeeding at comparable rates to their white and male peers. The executive leadership and board membership of our most successful companies are still largely homogenous, as demonstrated by the lack of racial, ethnic, and gender diversity in those leadership positions. Though all companies need to implement organizational and structural changes, we can improve the economic and social successes in our state and nation by working together to increase diversity and inclusion in our corporations. -

Emissions Preparation for High-Resolution Air Quality Modelling Over the Athabasca Oil Sands Region of Alberta, Canada

Emissions Preparation for High-Resolution Air Quality Modelling over the Athabasca Oil Sands Region of Alberta, Canada J. Zhang1, Q. Zheng1, M.D. Moran1, P.A. Makar1, A. Akingunola1, S.-M. Li1, G. Marson1, K. Chiu1, N. Dulong1, M. Gordon 2, R. Melick3, and S. Cho3 1. Air Quality Research Division, Environment Canada, Canada 2. Department of Earth and Space Science and Engineering, York U., Toronto, ON, Canada 3. Alberta Environment & Sustainable Resource Development, Edmonton, AB, Canada 2015 International Emission Inventory Conference, San Diego, California, 13-16 Apr. 2015 Presentation Overview • Joint Oil Sands Monitoring (JOSM) Plan: - Joint federal and Alberta governments initiative - One sub-project: creation of emissions files for air quality (AQ) modelling in this region • Topics to be covered: - Introduction to Alberta’s oil sands and main sources of emissions - 2013 summer field study in this region - Methodology applied to emissions preparation for AQ modeling - One example showing AQ model forecast for flight planning during the field study - One example showing how aircraft measurements can help in emissions estimates 1 Introduction to Athabasca Oil Sands • Oil sands (OS) are a natural mixture of sand, clay, and water, saturated with bitumen • 71% of global OS reserves are in Alberta, Canada. • Two primary methods of extraction: - open-pit surface mining - in-situ techniques • Due to the nature of the extraction methodology, emissions are mostly from the surface mining area over the Athabasca Oil Sands Region (AOSR) of northeastern -

Public-Interest Benefit Evaluation of Partial-Upgrading Technology*†

Volume 10 • Issue 1 • January 2017 PUBLIC-INTEREST BENEFIT EVALUATION OF PARTIAL-UPGRADING TECHNOLOGY*† This paper was originally issued on 2017/01/05 with a reissue on 2017/01/15 (reflecting a change to the emissions intensity assumptions). This version represents a subsequent reissue for the purposes of removing references to a paper redacted since the 2017/01/15 reissue. This has no impact on any of the analysis or conclusions. G. Kent Fellows, Robert Mansell, Ronald Schlenker and Jennifer Winter SUMMARY Approximately 60 per cent of Alberta’s oil sands production is non-upgraded bitumen which, after being mixed with a diluting agent (diluent) to allow transport, is exported. A popular view within Alberta — and particularly among Albertan politicians — is that a much larger share of oil sands bitumen should be upgraded in the province. However, without public subsidies or government underwriting, it is uneconomic to build and operate new facilities in Alberta to fully upgrade the bitumen into synthetic crude oil. But there are new partial upgrading technologies being developed that, subject to successful testing at a larger (commercial) pilot scale, can prove to be not only economic in Alberta, but also generate large social and economic benefits for the province. The advantages include a much smaller capital investment, a significant increase in the value of the product and market for the product and, even more importantly, a dramatic reduction in the need for large amounts of expensive diluent to transport the product to market. Indeed, the only diluent required will be that to move the bitumen from the production site to the partial upgrader and this can be continually recycled.