L O G I T E C H 2 0 0 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nextgen WEALTH MANAGERS 30.06.2020

ESG Swiss Equities Certificate NextGen WEALTH MANAGERS 30.06.2020 Objective & Strategy ESG Swiss Equities certificate invests in a financial and ESG criteria scored weighted index. The index tracks Swiss financially sound companies that generate investment performance and integrate corporate social responsability, ethics and sustainability characteristics in order to have a long term positive environmental, social, governance (ESG) impact. It aims to be a reference by providing a specific solution that allows capital markets to redirect investment flows toward a more sustainable economy. Only companies with a financial and ESG score equal or above the median are eligible for inclusion in the ESG Swiss Equities Index. The dynamic strategy is based upon a synthetic notional investment allocation and reallocation in the Index Components following a specific and monitored process of eligibility defined by NextGen Wealth Managers SA. Monthly Comment Classification In June, the ESG Swiss Equities certificate registered a performance of 2.78% compared to Asset Type Equities May's 2.78%. The certificate’s benchmark, the Swiss Performance Index (SPI), performed Region Switzerland positively at 1.55% against 2.86% in the previous month. Since the beginning of the year, the Style ESG Systematic two baskets stand at -8.11% for the certificate and -3.13% for the benchmark. Since inception, cumulated performances are respectively at 12.34% and 34.73% (representing annualized performances of 2.72% and 7.12%) for annualized volatilities of 13.07% and 9.59%. The portfolio's allocation in large capitalization companies remains around 36% against 9% in middle capitalization companies and 54% in small capitalization companies. -

United States Securities and Exchange Commission Form

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ☒ For the fiscal year ended March 31, 2020 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT ☐ OF 1934 For the Transition Period from to Commission File Number: 0-29174 LOGITECH INTERNATIONAL S.A. (Exact name of registrant as specified in its charter) Canton of Vaud, Switzerland None (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Logitech International S.A. EPFL - Quartier de l'Innovation Daniel Borel Innovation Center 1015 Lausanne, Switzerland c/o Logitech Inc. 7700 Gateway Boulevard Newark, California 94560 (Address of principal executive offices and zip code) (510) 795-8500 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Registered Shares par value CHF 0.25 per share The Nasdaq Global Select Market; SIX Swiss Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Julius Baer Multistock

JULIUS BAER MULTISTOCK A SICAV UNDER LUXEMBOURG LAW PROSPECTUS 31 DECEMBER 2011 Subscriptions are validly made only on the basis of this Prospectus or the Key Investor Information Document in conjunction with the most recent annual report and the most recent semi-annual report where this is published after the annual report. No information other than that contained in this Prospectus or the Key Investor Information Document may be given. PROSPECTUS - 2 - JULIUS BAER MULTISTOCK TABLE OF CONTENTS 1. Introduction..................................................................................................................................................5 2. Organisation and management...................................................................................................................8 3. Investment objectives and policy..................................................................................................................10 4. Investor profile...........................................................................................................................................34 5. Investment limits........................................................................................................................................35 6. Special investment techniques and financial instruments ........................................................................41 6.1 Options on securities.................................................................................................................................... -

2007 ANNUAL REPORT Fiscal Year 2003 2004 2005 2006 2007 (U.S

2007 ANNUAL REPORT Fiscal Year 2003 2004 2005 2006 2007 (U.S. dollars in thousands, except per share amounts) Total Revenues $ 1,100,288 $ 1,268,470 $ 1,482,626 $ 1,796,715 $ 2,066,569 Gross Margin 33.1% 32.2% 34.0% 32.0% 34.3% FY07 Non-GAAP Gross Margin 34.4% Operating Income $ 123,882 $ 145,554 $ 171,674 $ 198,911 $ 230,862 FY07 Non-GAAP Operating Income $ 250,326 Operating Margin 11.3% 11.5% 11.6% 11.1% 11.2% FY07 Non-GAAP Operating Margin 12.1% Net Income $ 98,843 $ 132,153 $ 149,266 $ 181,105 $ 229,848 FY07 Non-GAAP Net Income $ 244,786 Earnings per diluted share $ 0.49 $ 0.67 $ 0.77 $ 0.92 $ 1.20 FY07 Non-GAAP Earnings per diluted share $ 1.27 Diluted number of shares (in millions) 205,638 200,639 198,250 198,770 190,991 Cash Flow from Operations $ 145,108 $ 166,460 $ 213,674 $ 152,217 $ 305,681 Capital Expenditures $ 28,657 $ 24,718 $ 40,541 $ 54,102 $ 47,246 Cash & Cash Equivalents net of Short-Term Debt $ 208,632 $ 280,624 $ 331,402 $ 230,943 $ 398,966 Shareholders’ Equity $ 365,562 $ 457,080 $ 526,149 $ 685,176 $ 844,525 Fiscal Year-end Market Capitalization (in billions) $ 1.40 $ 2.17 $ 2.92 $ 3.80 $ 5.32 NOTE: The Fiscal Year 2007 Non-GAAP gross margin, operating income, operating margin, net income and earnings per diluted share fi gures exclude the cost or net cost of share- based compensation in Fiscal Year 2007, the fi rst year we refl ected this expense in our fi nancial results. -

Rising Yields Benefit Rotation Trade

Global CIO Office Rising yields benefit rotation trade Investment Monthly | Japan edition / Credit Suisse Securities (Japan) Ltd. | March 2021 Japan investment strategy Japan asset allocation Global investment strategy Reduce risk for a stable investment Neutral on global equities Paring back some risk portfolio page 3 page 5 page 9 Important Information This report represents the views of the Investment Strategy Department of CS and has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. It is not a product of the Credit Suisse Research Department even if it contains published research recommendations. CS has policies in place to manage conflicts of interest including policies relating to dealing ahead of the dis- semination of investment research. These policies do not apply to the views of Investment Strategists contained in this report. Please find further important information at the end of this material. Singapore: For accredited investors only. Hong Kong: For professional investors only. Australia: For wholesale clients only. Editorial In this issue Japan investment strategy 3 Reduce risk for a stable investment portfolio Japan asset allocation 5 Neutral on global equities Michael Strobaek Burkhard Varnholt Investment solutions 7 Global Chief Investment Officer Chief Investment Officer – Swiss Univer- Japan investment theme 2021: Pushing for a sal Bank carbon-free society In recent weeks, bond yields have stolen the limelight. In the Economics 8 USA, rapid progress with vaccinations and substantial addi- Much improved US outlook has driven global yields up tional fiscal stimulus led to a sharply improved growth outlook, lifting government bond yields there as well as globally. -

Insight MFR By

Manufacturers, Publishers and Suppliers by Product Category 11/6/2017 10/100 Hubs & Switches ASCEND COMMUNICATIONS CIS SECURE COMPUTING INC DIGIUM GEAR HEAD 1 TRIPPLITE ASUS Cisco Press D‐LINK SYSTEMS GEFEN 1VISION SOFTWARE ATEN TECHNOLOGY CISCO SYSTEMS DUALCOMM TECHNOLOGY, INC. GEIST 3COM ATLAS SOUND CLEAR CUBE DYCONN GEOVISION INC. 4XEM CORP. ATLONA CLEARSOUNDS DYNEX PRODUCTS GIGAFAST 8E6 TECHNOLOGIES ATTO TECHNOLOGY CNET TECHNOLOGY EATON GIGAMON SYSTEMS LLC AAXEON TECHNOLOGIES LLC. AUDIOCODES, INC. CODE GREEN NETWORKS E‐CORPORATEGIFTS.COM, INC. GLOBAL MARKETING ACCELL AUDIOVOX CODI INC EDGECORE GOLDENRAM ACCELLION AVAYA COMMAND COMMUNICATIONS EDITSHARE LLC GREAT BAY SOFTWARE INC. ACER AMERICA AVENVIEW CORP COMMUNICATION DEVICES INC. EMC GRIFFIN TECHNOLOGY ACTI CORPORATION AVOCENT COMNET ENDACE USA H3C Technology ADAPTEC AVOCENT‐EMERSON COMPELLENT ENGENIUS HALL RESEARCH ADC KENTROX AVTECH CORPORATION COMPREHENSIVE CABLE ENTERASYS NETWORKS HAVIS SHIELD ADC TELECOMMUNICATIONS AXIOM MEMORY COMPU‐CALL, INC EPIPHAN SYSTEMS HAWKING TECHNOLOGY ADDERTECHNOLOGY AXIS COMMUNICATIONS COMPUTER LAB EQUINOX SYSTEMS HERITAGE TRAVELWARE ADD‐ON COMPUTER PERIPHERALS AZIO CORPORATION COMPUTERLINKS ETHERNET DIRECT HEWLETT PACKARD ENTERPRISE ADDON STORE B & B ELECTRONICS COMTROL ETHERWAN HIKVISION DIGITAL TECHNOLOGY CO. LT ADESSO BELDEN CONNECTGEAR EVANS CONSOLES HITACHI ADTRAN BELKIN COMPONENTS CONNECTPRO EVGA.COM HITACHI DATA SYSTEMS ADVANTECH AUTOMATION CORP. BIDUL & CO CONSTANT TECHNOLOGIES INC Exablaze HOO TOO INC AEROHIVE NETWORKS BLACK BOX COOL GEAR EXACQ TECHNOLOGIES INC HP AJA VIDEO SYSTEMS BLACKMAGIC DESIGN USA CP TECHNOLOGIES EXFO INC HP INC ALCATEL BLADE NETWORK TECHNOLOGIES CPS EXTREME NETWORKS HUAWEI ALCATEL LUCENT BLONDER TONGUE LABORATORIES CREATIVE LABS EXTRON HUAWEI SYMANTEC TECHNOLOGIES ALLIED TELESIS BLUE COAT SYSTEMS CRESTRON ELECTRONICS F5 NETWORKS IBM ALLOY COMPUTER PRODUCTS LLC BOSCH SECURITY CTC UNION TECHNOLOGIES CO FELLOWES ICOMTECH INC ALTINEX, INC. -

We Love What We Do 2014 Annual Report 2014 Annual Report Annual 2014

We love what we do 2014 Annual Report 2014 Annual Report Annual 2014 Straumann Holding AG Peter Merian-Weg 12 4002 Basel Switzerland www.straumann.com 00_00_STR_GB2014_GB_Umschlag_en.indd 1 09.03.2015 16:44:50 About Straumann Straumann is a global leader in tooth replacement solu- tions including dental implants, prosthetics and regener- ative products. Headquartered in Basel, Switzerland, the Group is present in more than 70 countries through its broad network of distribution subsidiaries and partners. 1 Rebecca Hesse SAP Coordinator 2 Susan-Ann Welzbacher Corporate Safety Officer 3 Julia Hirtle Spend Coordinator 4 Roland Scacchi Administrator 5 Alessandro Annicchiarico IT Support 4 7 1 2 3 5 6 8 9 6 Heather Stanton Web Editor IMPRINT Published by: Institut Straumann AG, Basel 7 Dave Koster Lab Business Development Concept and realization: PETRANIX Corporate and Financial Communications AG, Adliswil/Zurich 8 Raul Perez Talent Management Photography: AMX Studio, Alex Stiebritz, Karlsruhe Consultant on sustainability: sustainserv, Zurich and Boston 9 Sandra Schürmann Events Coordinator Certain design elements by Eclat, Erlenbach/Zurich Print: Neidhart + Schön AG, Zurich Basel, 26 February 2015 We have a global culture with more than 28 nationalities represented at our headquarters alone. The front cover shows a few examples. ©2015, Straumann Holding AG 00_00_STR_GB2014_GB_Umschlag_en.indd 2 09.03.2015 16:45:02 We love what we do 2014 Annual Report Highly motivated, creative employees, together with innovative products, solutions and commercial ap- proach es are the keys to Straumann’s ambition of being the provider of choice in tooth replacement. The theme photographs in this report all feature products that we introduced or rolled out in 2014 alongside some of the talented people who have been involved in bringing them to customers and patients. -

Redline GT Manual

Flat Panel Television and Flight Controls Not Included Display Requirements: 32” to 42” Television with HDMI Input 4616 W. 19th Street, Cicero, IL 60804 (800) 379-9776 Rev 1.0 Redline GTTM Thank you for purchasing Chicago Gaming Company’s Redline GT. We strongly recommend that you follow the instructions and procedures as presented in this Owner’s Manual and that it be read in its entirety before setting up your game. 1. LEGAL INFORMATION 1.1 SAFETY PROCEDURES The following guidelines will help protect you and your Redline GT. Caution: For your safety follow these instructions. Caution: Shock hazard if instructions are not followed. • Read these instructions. • Keep these instructions. • Heed all warnings. • Follow all instructions. • Do not use this apparatus near water. • Clean only with a dry cloth. • Do not block any ventilation openings. Install in accordance with manufacturer’s instructions. • Do not install near any heat sources such as radiators, heat registers, stoves, or other apparatus (including amplifiers) that produce heat. • Do not defeat the safety purpose of the polarized or grounding-type plug. A polarized plug has two blades with one wider than the other. A grounding type plug has two blades and a third grounding prong. The wide blade and third prong are provided for your safety. If the provided plug does not fit into your outlet, consult an electrician for replacement of the obsolete outlet. • Protect the power cord from being walked on or pinched particularly at plugs, convenience receptacles, and the point where they exit from the apparatus. • Only use attachments/accessories specified from the manufacturer. -

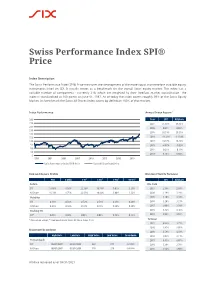

Swiss Performance Index SPI® Price

Swiss Performance Index SPI® Price Index Description The Swiss Performance Index SPI® Price measures the development of the more liquid and therefore tradable equity instruments listed on SIX. It usually serves as a benchmark for the overall Swiss equity market. The index has a variable number of components - currently 218, which are weighted by their freefloat market capitalisation. The index is standardised at 100 points on June 01, 1987. As of today the index covers roughly 99% of the Swiss Equity Market. Its benchmark the Swiss All Shares Index covers by definition 100% of that market. Index Performance Annual Index Return¹ 300 Year SPI All Share 270 2021 25.98% 26.13% 240 2020 0.61% 0.66% 210 2019 26.51% 26.51% 180 150 2018 -11.43% -11.34% 120 2017 16.37% 16.28% 90 2016 -4.67% -5.02% 60 2015 -0.25% -0.13% 30 2014 9.73% 9.80% 0 1998 2001 2004 2007 2010 2013 2016 2019 Swiss Performance Index SPI® Price Swiss All Share Index Price Risk and Return Profile Dividend Yield & Turnover YTD 3 Mths 1 Yr¹ 3 Yrs¹ 7 Yrs¹ 15 Yrs¹ SPI All Share Return Div. Yield SPI 16.65% 8.68% 22.59% 10.78% 6.01% 3.23% 2021 2.58% 2.58% All Share 16.74% 8.75% 22.65% 10.84% 6.00% 3.22% 2020 3.19% 3.19% Volatility 2019 3.10% 3.10% SPI 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2018 3.20% 3.21% All Share 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2017 3.09% 3.10% Tracking Err. -

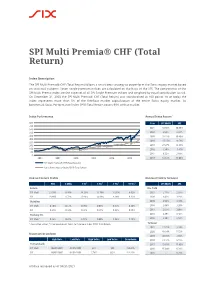

SPI Multi Premia® CHF (Total Return)

SPI Multi Premia® CHF (Total Return) Index Description The SPI Multi Premia® CHF (Total Return) follows a smart beta strategy to outperform the Swiss equity market based on statistical patterns. Seven single-premium indices are calculated on the basis of the SPI. The components of the SPI Multi Premia index are the superset of all SPI Single Premium indices and weighted by equal contribution to risk. On December 31, 2003 the SPI Multi Premia® CHF (Total Return) was standardised at 100 points. As of today the index represents more than 5% of the freefloat market capitalization of the entire Swiss equity market. Its benchmark Swiss Performance Index SPI® Total Return covers 99% of that market. Index Performance Annual Index Return¹ 800 Year SPI Multi SPI 720 2021 33.93% 30.89% 640 560 2020 4.98% 3.82% 480 2019 28.25% 30.40% 400 2018 -15.55% -8.59% 320 240 2017 27.27% 19.98% 160 2016 7.54% -1.41% 80 2015 8.32% 2.68% 0 2004 2007 2010 2013 2016 2019 2014 12.12% 13.00% SPI Multi Premia® CHF (Total Return) Swiss Performance Index SPI® Total Return Risk and Return Profile Dividend Yield & Turnover YTD 3 Mths 1 Yr¹ 3 Yrs¹ 7 Yrs¹ 15 Yrs¹ SPI Multi SPI Return Div. Yield SPI Multi 21.50% 6.16% 34.28% 11.76% 11.05% 9.02% 2021 2.15% 2.58% SPI 19.66% 8.72% 25.98% 14.08% 9.28% 6.32% 2020 3.42% 3.19% Volatility 2019 2.96% 3.10% SPI Multi 0.70% 0.57% 0.76% 0.63% 0.37% 0.26% 2018 2.68% 3.20% SPI 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2017 2.67% 3.09% Tracking Err. -

Equities Switzerland Small & Mid Caps

31 August 2021 Swiss Life Investment Foundation Equities Switzerland Small & Mid Caps Net Asset Value (NAV) in CHF (m): 65.73 Net asset value per entitlement in CHF: 142.34 Investment Strategy Performance Investment in equity securities from companies that are tracked by the Swiss Performance Index Extra. Active sector and securities selection. Company limitation: 5% (exception: if represented in the benchmark, max. 5% points above the benchmark weighting). Implementation via investment in Swiss Life iFunds (CH) Equity Switzerland Small & Mid Cap (CHF); investment funds under Swiss law in the category "Other funds for traditional investments". Evolution in reference currency (base value 100) Product information Swiss security number: 39561890 ISIN: CH0395618900 LEI: 254900QGENUS1GIJ4549 Bloomberg Code: SWLASMC SW Benchmark: SPI Extra TR Index (CHF) Currency: CHF Domicile: Switzerland Launch Date: 01/02/2018 Initial subscription price: 100.00 End of financial year: 30.09 Past performance is no indication of current or future performance. Issuing/Redemption: daily Deadline: 14.30 Issuing/redemption commission: none Performance in reference currency Distribution policy: Profit retention CUMULATIVE PERFORMANCE ANNUALISED PERFORMANCE Asset Manager according to Swiss Life Best Select Invest Plus®: YTD 1 MONTH 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. Privatbank Von Graffenried AG INVESTMENT GROUP 23.55% 2.43% 34.56% 11.31% - - 10.36% External consultation: PPCmetrics provide the following services: BENCHMARK 23.70% 2.49% 34.90% 11.60% - - 10.11% Advisory services relating to suitable mandate structure Support with selection of suitable asset managers and support with Statistical information ongoing monitoring of asset managers and 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. -

2017 Annual General Meeting Invitation, Proxy Statement And

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report WorldReginfo - 4e536cf4-5c72-4c8d-b147-7d71ee804b22 WorldReginfo - 4e536cf4-5c72-4c8d-b147-7d71ee804b22 TO OUR SHAREHOLDERS WE’VE COME A LONG WAY… So, we have come a long way. Which gives us an opportunity to put this company - now in its 35th year - When we meet people from outside Logitech, we often into a broader perspective as we look ahead. For both hear, “Wow, you really had a terrific year!”, or “What a of us, it’s an anniversary of sorts this year. Guerrino turnaround this past year or two!”. celebrates 20 years at Logitech in a few months and Bracken celebrates his first five. Let’s step back and think The truth is we started down this road five years ago. about the world in which we now play. After all, you’re That was Fiscal Year 2013, when retail sales in constant reading this because you’re interested in what’s ahead. currency fell -7% year on year. TOOLS ENHANCE OUR LIVES We made changes to our strategy, our culture and our team. And since then we’ve systematically and Let’s step way back to the dawn of humanity; even before Letter to Shareholders passionately worked toward our goal to become a design history was recorded. Our earliest tools were knives, company. A design company is not one focused on spears, the wheel, jugs and more. They enabled us to do fashion or beautiful products (although our products are things we couldn’t do on our own and became stepping beautiful).