UBS 100 Index Price

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nextgen WEALTH MANAGERS 30.06.2020

ESG Swiss Equities Certificate NextGen WEALTH MANAGERS 30.06.2020 Objective & Strategy ESG Swiss Equities certificate invests in a financial and ESG criteria scored weighted index. The index tracks Swiss financially sound companies that generate investment performance and integrate corporate social responsability, ethics and sustainability characteristics in order to have a long term positive environmental, social, governance (ESG) impact. It aims to be a reference by providing a specific solution that allows capital markets to redirect investment flows toward a more sustainable economy. Only companies with a financial and ESG score equal or above the median are eligible for inclusion in the ESG Swiss Equities Index. The dynamic strategy is based upon a synthetic notional investment allocation and reallocation in the Index Components following a specific and monitored process of eligibility defined by NextGen Wealth Managers SA. Monthly Comment Classification In June, the ESG Swiss Equities certificate registered a performance of 2.78% compared to Asset Type Equities May's 2.78%. The certificate’s benchmark, the Swiss Performance Index (SPI), performed Region Switzerland positively at 1.55% against 2.86% in the previous month. Since the beginning of the year, the Style ESG Systematic two baskets stand at -8.11% for the certificate and -3.13% for the benchmark. Since inception, cumulated performances are respectively at 12.34% and 34.73% (representing annualized performances of 2.72% and 7.12%) for annualized volatilities of 13.07% and 9.59%. The portfolio's allocation in large capitalization companies remains around 36% against 9% in middle capitalization companies and 54% in small capitalization companies. -

Julius Baer Multistock

JULIUS BAER MULTISTOCK A SICAV UNDER LUXEMBOURG LAW PROSPECTUS 31 DECEMBER 2011 Subscriptions are validly made only on the basis of this Prospectus or the Key Investor Information Document in conjunction with the most recent annual report and the most recent semi-annual report where this is published after the annual report. No information other than that contained in this Prospectus or the Key Investor Information Document may be given. PROSPECTUS - 2 - JULIUS BAER MULTISTOCK TABLE OF CONTENTS 1. Introduction..................................................................................................................................................5 2. Organisation and management...................................................................................................................8 3. Investment objectives and policy..................................................................................................................10 4. Investor profile...........................................................................................................................................34 5. Investment limits........................................................................................................................................35 6. Special investment techniques and financial instruments ........................................................................41 6.1 Options on securities.................................................................................................................................... -

Rising Yields Benefit Rotation Trade

Global CIO Office Rising yields benefit rotation trade Investment Monthly | Japan edition / Credit Suisse Securities (Japan) Ltd. | March 2021 Japan investment strategy Japan asset allocation Global investment strategy Reduce risk for a stable investment Neutral on global equities Paring back some risk portfolio page 3 page 5 page 9 Important Information This report represents the views of the Investment Strategy Department of CS and has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. It is not a product of the Credit Suisse Research Department even if it contains published research recommendations. CS has policies in place to manage conflicts of interest including policies relating to dealing ahead of the dis- semination of investment research. These policies do not apply to the views of Investment Strategists contained in this report. Please find further important information at the end of this material. Singapore: For accredited investors only. Hong Kong: For professional investors only. Australia: For wholesale clients only. Editorial In this issue Japan investment strategy 3 Reduce risk for a stable investment portfolio Japan asset allocation 5 Neutral on global equities Michael Strobaek Burkhard Varnholt Investment solutions 7 Global Chief Investment Officer Chief Investment Officer – Swiss Univer- Japan investment theme 2021: Pushing for a sal Bank carbon-free society In recent weeks, bond yields have stolen the limelight. In the Economics 8 USA, rapid progress with vaccinations and substantial addi- Much improved US outlook has driven global yields up tional fiscal stimulus led to a sharply improved growth outlook, lifting government bond yields there as well as globally. -

We Love What We Do 2014 Annual Report 2014 Annual Report Annual 2014

We love what we do 2014 Annual Report 2014 Annual Report Annual 2014 Straumann Holding AG Peter Merian-Weg 12 4002 Basel Switzerland www.straumann.com 00_00_STR_GB2014_GB_Umschlag_en.indd 1 09.03.2015 16:44:50 About Straumann Straumann is a global leader in tooth replacement solu- tions including dental implants, prosthetics and regener- ative products. Headquartered in Basel, Switzerland, the Group is present in more than 70 countries through its broad network of distribution subsidiaries and partners. 1 Rebecca Hesse SAP Coordinator 2 Susan-Ann Welzbacher Corporate Safety Officer 3 Julia Hirtle Spend Coordinator 4 Roland Scacchi Administrator 5 Alessandro Annicchiarico IT Support 4 7 1 2 3 5 6 8 9 6 Heather Stanton Web Editor IMPRINT Published by: Institut Straumann AG, Basel 7 Dave Koster Lab Business Development Concept and realization: PETRANIX Corporate and Financial Communications AG, Adliswil/Zurich 8 Raul Perez Talent Management Photography: AMX Studio, Alex Stiebritz, Karlsruhe Consultant on sustainability: sustainserv, Zurich and Boston 9 Sandra Schürmann Events Coordinator Certain design elements by Eclat, Erlenbach/Zurich Print: Neidhart + Schön AG, Zurich Basel, 26 February 2015 We have a global culture with more than 28 nationalities represented at our headquarters alone. The front cover shows a few examples. ©2015, Straumann Holding AG 00_00_STR_GB2014_GB_Umschlag_en.indd 2 09.03.2015 16:45:02 We love what we do 2014 Annual Report Highly motivated, creative employees, together with innovative products, solutions and commercial ap- proach es are the keys to Straumann’s ambition of being the provider of choice in tooth replacement. The theme photographs in this report all feature products that we introduced or rolled out in 2014 alongside some of the talented people who have been involved in bringing them to customers and patients. -

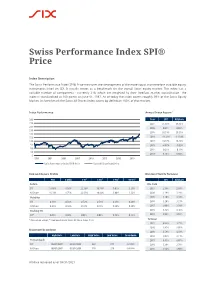

Swiss Performance Index SPI® Price

Swiss Performance Index SPI® Price Index Description The Swiss Performance Index SPI® Price measures the development of the more liquid and therefore tradable equity instruments listed on SIX. It usually serves as a benchmark for the overall Swiss equity market. The index has a variable number of components - currently 218, which are weighted by their freefloat market capitalisation. The index is standardised at 100 points on June 01, 1987. As of today the index covers roughly 99% of the Swiss Equity Market. Its benchmark the Swiss All Shares Index covers by definition 100% of that market. Index Performance Annual Index Return¹ 300 Year SPI All Share 270 2021 25.98% 26.13% 240 2020 0.61% 0.66% 210 2019 26.51% 26.51% 180 150 2018 -11.43% -11.34% 120 2017 16.37% 16.28% 90 2016 -4.67% -5.02% 60 2015 -0.25% -0.13% 30 2014 9.73% 9.80% 0 1998 2001 2004 2007 2010 2013 2016 2019 Swiss Performance Index SPI® Price Swiss All Share Index Price Risk and Return Profile Dividend Yield & Turnover YTD 3 Mths 1 Yr¹ 3 Yrs¹ 7 Yrs¹ 15 Yrs¹ SPI All Share Return Div. Yield SPI 16.65% 8.68% 22.59% 10.78% 6.01% 3.23% 2021 2.58% 2.58% All Share 16.74% 8.75% 22.65% 10.84% 6.00% 3.22% 2020 3.19% 3.19% Volatility 2019 3.10% 3.10% SPI 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2018 3.20% 3.21% All Share 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2017 3.09% 3.10% Tracking Err. -

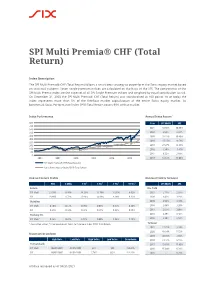

SPI Multi Premia® CHF (Total Return)

SPI Multi Premia® CHF (Total Return) Index Description The SPI Multi Premia® CHF (Total Return) follows a smart beta strategy to outperform the Swiss equity market based on statistical patterns. Seven single-premium indices are calculated on the basis of the SPI. The components of the SPI Multi Premia index are the superset of all SPI Single Premium indices and weighted by equal contribution to risk. On December 31, 2003 the SPI Multi Premia® CHF (Total Return) was standardised at 100 points. As of today the index represents more than 5% of the freefloat market capitalization of the entire Swiss equity market. Its benchmark Swiss Performance Index SPI® Total Return covers 99% of that market. Index Performance Annual Index Return¹ 800 Year SPI Multi SPI 720 2021 33.93% 30.89% 640 560 2020 4.98% 3.82% 480 2019 28.25% 30.40% 400 2018 -15.55% -8.59% 320 240 2017 27.27% 19.98% 160 2016 7.54% -1.41% 80 2015 8.32% 2.68% 0 2004 2007 2010 2013 2016 2019 2014 12.12% 13.00% SPI Multi Premia® CHF (Total Return) Swiss Performance Index SPI® Total Return Risk and Return Profile Dividend Yield & Turnover YTD 3 Mths 1 Yr¹ 3 Yrs¹ 7 Yrs¹ 15 Yrs¹ SPI Multi SPI Return Div. Yield SPI Multi 21.50% 6.16% 34.28% 11.76% 11.05% 9.02% 2021 2.15% 2.58% SPI 19.66% 8.72% 25.98% 14.08% 9.28% 6.32% 2020 3.42% 3.19% Volatility 2019 2.96% 3.10% SPI Multi 0.70% 0.57% 0.76% 0.63% 0.37% 0.26% 2018 2.68% 3.20% SPI 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2017 2.67% 3.09% Tracking Err. -

Equities Switzerland Small & Mid Caps

31 August 2021 Swiss Life Investment Foundation Equities Switzerland Small & Mid Caps Net Asset Value (NAV) in CHF (m): 65.73 Net asset value per entitlement in CHF: 142.34 Investment Strategy Performance Investment in equity securities from companies that are tracked by the Swiss Performance Index Extra. Active sector and securities selection. Company limitation: 5% (exception: if represented in the benchmark, max. 5% points above the benchmark weighting). Implementation via investment in Swiss Life iFunds (CH) Equity Switzerland Small & Mid Cap (CHF); investment funds under Swiss law in the category "Other funds for traditional investments". Evolution in reference currency (base value 100) Product information Swiss security number: 39561890 ISIN: CH0395618900 LEI: 254900QGENUS1GIJ4549 Bloomberg Code: SWLASMC SW Benchmark: SPI Extra TR Index (CHF) Currency: CHF Domicile: Switzerland Launch Date: 01/02/2018 Initial subscription price: 100.00 End of financial year: 30.09 Past performance is no indication of current or future performance. Issuing/Redemption: daily Deadline: 14.30 Issuing/redemption commission: none Performance in reference currency Distribution policy: Profit retention CUMULATIVE PERFORMANCE ANNUALISED PERFORMANCE Asset Manager according to Swiss Life Best Select Invest Plus®: YTD 1 MONTH 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. Privatbank Von Graffenried AG INVESTMENT GROUP 23.55% 2.43% 34.56% 11.31% - - 10.36% External consultation: PPCmetrics provide the following services: BENCHMARK 23.70% 2.49% 34.90% 11.60% - - 10.11% Advisory services relating to suitable mandate structure Support with selection of suitable asset managers and support with Statistical information ongoing monitoring of asset managers and 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2015 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the key investor information, in conjunction with the latest annual report and the latest semi- annual report if published thereafter. The articles of association, the valid prospectus and the key investor information, the annual and semi-annual reports, as well as the information based on the SFAMA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: GAM Investment Management (Switzerland) AG, Hardstraße 201, P.O. Box, CH - 8037 Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, P.O. Box, CH - 8010 Zurich Paying agent in Germany: DekaBank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt / Main Information agent in Germany: GAM (Deutschland) AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Trade and Companies Register number: R.C.S. Luxembourg B-32188 Contents Page Organisation and Management 4 Information on risk management (unaudited) 6 Audit Report 7 Report of the Board of Directors 9 Notes to the Annual Report -

Swiss Performance Index Spi Price Index

BENCHMARK INDICES 1 SWISS PERFORMANCE INDEX SPI PRICE INDEX Stated objective Key facts "The SPI Family comprises various indices compiled and published » "In order to achieve the stated index objective SIX Swiss Exchange by the SIX Swiss Exchange. The underlying share universe includes defines the general principles that govern the index methodology. approximately 230 equity issues. For a companys shares to be SIX Swiss Exchange publishes the index objective and rules for all included in the SPI universe, the company must be primary listed in indices. Switzerland and the shares must have a free float equal to or greater than 20 %. In 1998, all investment companies were taken out of the » Representative: the development of the market is represented by SPI Family and put into the specially designed Investment Index." the index » Tradable: the index components are tradable in terms of company size and market » Replicable: the development of the index can be replicated in practise with a portfolio » Stable: high index continuity » Rules-based: index changes and calculations are rule-based » Projectable: changes in rules are with appropriate lead time (usually at least 2 trading days) no retrospective rule changes" Descriptive statistics Index Market cap (CHF bn.) Components (CHF bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months Swiss Performance Index SPI Price Index 1,374,397. 1,218,423. 5886.1 485.4 239767. 1.6 19.7 0.0 N/A Swiss All Share Index Price Index 1,427,211.1 1,230,610. 5304.4 406.1 239767. 0.3 19.5 0.0 N/A Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y Swiss Performance Index SPI Price Index 52,65 55614. -

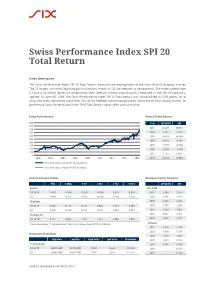

Swiss Performance Index SPI 20 Total Return

Swiss Performance Index SPI 20 Total Return Index Description The Swiss Performance Index SPI 20 Total Return measures the development of the Swiss Blue Chip equity market. The 20 largest and most liquid equity instruments traded at SIX are selected as components. The index composition is fixed to 20 shares which are weighted by their freefloat market capitalisation. Compared to the SMI no capping is applied. On June 30, 1988, the Swiss Performance Index SPI 20 Total Return was standardised at 1500 points. As of today the index represents more than 78% of the freefloat market capitalization of the entire Swiss equity market. Its benchmark Swiss Performance Index SPI® Total Return covers 99% of that market. Index Performance Annual Index Return¹ 900 Year SPI 20 TR SPI 810 2021 29.20% 30.89% 720 630 2020 2.79% 3.82% 540 2019 30.43% 30.40% 450 2018 -6.31% -8.59% 360 270 2017 17.79% 19.98% 180 2016 -3.38% -1.41% 90 2015 1.15% 2.68% 0 1996 1999 2002 2005 2008 2011 2014 2017 2020 2014 12.94% 13.00% Swiss Performance Index SPI 20 Total Return Swiss Performance Index SPI® Total Return Risk and Return Profile Dividend Yield & Turnover YTD 3 Mths 1 Yr¹ 3 Yrs¹ 7 Yrs¹ 15 Yrs¹ SPI 20 TR SPI Return Div. Yield SPI 20 TR 18.63% 8.94% 23.83% 14.68% 8.61% 6.03% 2021 2.80% 2.58% SPI 19.66% 8.72% 25.98% 14.08% 9.28% 6.32% 2020 3.36% 3.19% Volatility 2019 3.24% 3.10% SPI 20 TR 0.63% 0.53% 0.74% 0.60% 0.38% 0.29% 2018 3.45% 3.20% SPI 0.61% 0.50% 0.72% 0.58% 0.36% 0.28% 2017 3.29% 3.09% Tracking Err. -

Ishares ETF (CH) Umbrella Fund Under Swiss Law of the “Other Funds for Traditional Investments” Type

iShares ETF (CH) Umbrella Fund under Swiss Law of the “Other Funds for Traditional Investments” Type Prospectus with Integrated Fund Contract September 2018 Distribution in Switzerland and Liechtenstein iShares ETF (CH) Umbrella Fund under Swiss Law of the “Other Funds for Traditional Investments” Type Part 1: Prospectus This prospectus with integrated fund contract, the key investor information document (KIID) and the most recent annual or semi- annual report (if published after the latest annual report) serve as the basis for all subscriptions of units in the subfunds. Only the information contained in the prospectus, the key investor information document (KIID) and the fund contract will be deemed to be valid. BlackRock Asset Management Schweiz AG as the fund management company, is responsible for the content of this prospectus and declares that, according to their knowledge, the information contained in this prospectus is accurate and no material facts have been omitted. 1 Information on the Umbrella Fund and the Subfunds 1.1 General Information on the Umbrella Fund and the Subfunds iShares ETF (CH) is an umbrella fund under Swiss law of the “Other funds for traditional investments” type which was established under the Swiss Collective Investment Schemes Act (CISA) of June 23, 2006 and is divided into the following subfunds: Equity Index Exchange Traded Funds a) iShares SLI® ETF (CH) 1 b) iShares SMI® ETF (CH) 1 c) iShares SMIM® ETF (CH) 1 d) iShares Swiss Dividend ETF (CH) 1 e) iShares Core SPI® ETF (CH) 1 Bond Index Exchange Traded Funds f) iShares Swiss Domestic Government Bond 1-3 ETF (CH) 1 g) iShares Swiss Domestic Government Bond 3-7 ETF (CH) 1 h) iShares Swiss Domestic Government Bond 7-15 ETF (CH) 1 i) iShares Core CHF Corporate Bond ETF (CH) 1 The fund contract was originally drawn up by Credit Suisse Funds AG, Zurich, as fund management company and with the agreement of Credit Suisse AG, Zurich, as custodian bank, and submitted to the Swiss Financial Market Supervisory Authority (“FINMA”). -

Annual Report 2012 13 2012 Report Annual

ANNUAL REPORT 2012 13 2012 REPORT ANNUAL ANNUAL REPORT 2012 13 WorldReginfo - 9631d156-9290-4b9f-b21c-1bc93918fa13 LEADERSHIP DRIVEN BY INNOVATION Sonova aims to be recognized as the innovation leader in the global hearing care market, so we constantly challenge the limits of technology. We base our leadership on a full pipeline of new technologies, products, and features – and prove it every day in close, productive relationships with hearing care professionals, who appreciate how our technological innovation creates tangible benefit for their clients. WorldReginfo - 9631d156-9290-4b9f-b21c-1bc93918fa13 HIGHLIGHTS – Sonova reached record sales in financial year 2012 /13 : Sales, at CHF 1,795 million, rose 10.8 % in Swiss francs and 7.4 % in local currencies. Both the hearing instruments and cochlear implants segment and all major regions contributed to the increase. – Consolidating our market leading position in hearing instruments: Despite a challenging market environment, sales in the hearing instrument segment grew by 4.9 % in local currencies, driven by continuing strong innovation and a global sales presence. EBITA margin rose by 100 basis points to 23.3 %, thanks to strict cost control and favorable currency development. – Break-even target reached in cochlear implants: Supported by an strong sales increase of 47.1 % in local currencies, the cochlear implant segment reached a key milestone, breaking even for the first time on a normalized basis. – Significant operational improvements, increased margins and strong cash flow: Normalized for one-off costs, EBITA was CHF 386 million, up 22.6 % in Swiss francs and 15.4 % in local currencies. Operating margin improved by 200 basis points to 21.5 %.