Automotive Logistics Update Table of Content

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Auto Sales Rev up in June As States Unlock Inventory Build-Up in Anticipation of Big July Offtake

Auto sales rev up in June as States unlock Inventory build-up in anticipation of big July offtake OUR BUREAU New Delhi, July 1 With States steadily unlock- ing, automobile companies are seeing a significant risein enquiries and bookings and stepped up dispatches to deal- ers in June. The country’s largest car- maker, Maruti Suzuki India (MSIL), on Thursday reported domestic sales soaring more than three and half times to units in May. So, did ‘City’ 1,59,561 units in the previous 1,24,280 units in June com- maker Honda Cars India dis- month. pared to 32,903 units in May. patching 4,767 units. Bajaj Auto also reported Similarly, Hyundai Motor In- factory-gate sales jumping dia (HMIL) reported sales MG, Kia retail sales up two-and-half times to 1,55,640 jumping 62 per cent to 40,496 MG Motor India said it retail units from 60,342 units in May. units in June compared with sales trebled to 3,558 units in 25,001 in May. June from 1,016 units in May. CVs, tractors too Tata Motors reported a Similarly, Kia India registered In the commercial vehicle and growth of 59 per cent to 24,110 retail sales of 15,015 units tractor segments, also, com- units from 15,181 in May. against 11,050 units in May. panies reported multi-fold Shailesh Chandra, President, “The last few weeks have jump in their sales on Passenger Vehicles Business shown signs of improved cus- monthly basis. Unit, Tata Motors, said, “The PV tomer sentiment, and we con- According to Mitul Shah, industry’s sequential growth tinue to be optimistic about Head of Research at Reliance momentum got adversely im- the future. -

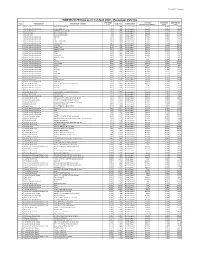

4W FE Declaration 2019-20.Xlsx

BS-VI 4W FE Declaration SIAM BS VI FE Data as on 1st April 2020 – Passenger Vehicles Kerb Weight Fuel Type Declared FE Declared CO2 S.no. Manufacturer Vehicle Model / Variant Engine cc Emission Stage (Kgs) (Gasoline/Diesel/CNG etc.) (Kmpl) (g/km) 1 Renualt India Renault KWID 0.8L MT 737 799 Bharat Stage VI Gasoline 20.710 114.50 2 Maruti Suzuki India Limited S-Presso [Std, LXI] 740 998 Bharat Stage VI Gasoline 21.400 110.81 3 Nissan Motor India DATSUN redi GO 0.8L MT 740 799 Bharat Stage VI Gasoline 20.710 114.50 4 Renualt India Renault KWID 1L MT 751 999 Bharat Stage VI Gasoline 21.700 109.30 5 Renualt India Renault KWID 1L AMT 756 999 Bharat Stage VI Gasoline 22.000 107.80 6 Maruti Suzuki India Limited TOUR H1 757 796 Bharat Stage VI Gasoline 22.050 107.54 7 Maruti Suzuki India Limited Alto 762 796 Bharat Stage VI Gasoline 22.050 107.54 8 Maruti Suzuki India Limited S-Presso [VXI, VXI+] 763 998 Bharat Stage VI Gasoline 21.700 109.28 9 Maruti Suzuki India Limited S-Presso AGS 767 998 Bharat Stage VI Gasoline 21.700 109.28 10 Maruti Suzuki India Limited TOUR H2 815 998 Bharat Stage VI Gasoline 21.620 109.63 11 Maruti Suzuki India Limited WagonR 1.0 820 998 Bharat Stage VI Gasoline 21.790 108.78 12 Maruti Suzuki India Limited WagonR 1.0 AGS 825 998 Bharat Stage VI Gasoline 21.790 108.78 13 Maruti Suzuki India Limited WagonR 1.2 835 1,197 Bharat Stage VI Gasoline 20.520 115.51 14 Maruti Suzuki India Limited Celerio 840 998 Bharat Stage VI Gasoline 21.620 109.63 15 Maruti Suzuki India Limited Celerio AGS 840 998 Bharat Stage VI Gasoline -

FADA Releases July'21 Vehicle Retail Data

FEDERATION OF AUTOMOBILE DEALERS ASSOCIATIONS 804-805-806, Surya Kiran, 19, K G Marg New Delhi - 110 001 (INDIA) T +91 11 6630 4852, 2332 0095, 4153 1495 E [email protected] CIN U74140DL2004PNL130324 FOR IMMEDIATE RELEASE FADA Releases July’21 Vehicle Retail Data • Total vehicle retails for the month of July’21 rise by 34.12% on YoY basis. When compared to July’19 (a regular pre-covid month), recovery is visible as the deficit reduces to low double digits of -13.22%. • On YoY basis, all categories were in green with 2W up by 28%, 3W up by 83%, PV up by 63%, Tractor up by 7% and CV up by 166%. • After Tractors, PV for the first time shows strong numbers by clocking 24% growth when compared to pre-covid month of July’19. • FADA has been raising red flag about semi-conductor shortage since quite some time. The situation is now becoming grave with ever-increasing supply-side constraints. • rd The delta variant and a possibility of 3 wave continues to remain a threat for stable Auto Retails. 9th August’21, New Delhi: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for July’21. July’21 Retails Commenting on how July’21 performed, FADA President, Mr. Vinkesh Gulati said, “With entire country now open, July continues to see robust recovery in Auto Retails as demand across all categories remain high. The low base effect also continues to play its part. With all categories in green, CV’s continue to see increase in demand specially in M&HCV segment with the Government rolling out infrastructure projects in many parts of the country. -

White Paper – Automotive Industry

White Paper – Automotive Industry Technology Cluster Manager (TCM) Technology Centre System Program (TCSP) Office of DC MSME, Ministry of MSME October, 2020 TCSP: Technology Cluster Manager White Paper: Automotive Industry Table of Contents 1 INTRODUCTION ......................................................................................................................................... 7 1.1 BACKGROUND .................................................................................................................................................. 7 1.2 OBJECTIVE OF WHITE PAPER ................................................................................................................................ 7 2 SECTOR OVERVIEW .................................................................................................................................... 8 2.1 GLOBAL SCENARIO ............................................................................................................................................. 8 Structure of Automotive Industry ............................................................................................................ 9 Global Business Trends .......................................................................................................................... 10 Product and Demand ............................................................................................................................. 12 Production and Supply Chain ................................................................................................................ -

Bengaluru Boy Bags Rs 60 Lakh Job at Google

JULY 2019 PAGE 1 Globally Recognized Editor-in-Chief: Azeem A. Quadeer, M.S., P.E. JULY 2019 Vol 10, Issue 7 Bengaluru boy bags Rs 60 lakh job at Google INSIDE Google, Apple, Amazon and Facebook are some of biggest tech com- panies in the world. And working in one of these companies is like a dream come true for most people. But landing up a job in these com- panies isn’t easy. Individuals need to pass several rounds of interviews to get a nod from the recruiters at these tech giant. Naturally, few make the cut. But now, a Bengaluru-based boy has broken that glass ceiling bagged a coveted spot at Google. Women have heads shaved by mob His salary? Rs 60 lakh. of men because they resisted rape The 22-year-old student of International Institute of Information Tech- nology Bangalore (IIIT-B) has landed a job at Google with a package of Rs 60 lakh. KB Shyam recently completed his five-year dual degree ATTN: INVESTORS course at IIIT_B and he will fly to Warsaw, Poland in October this year to join Google. But bagging his dream job at one of the biggest tech companies wasn’t easy. Shyam, who hails from Chennai, had to clear an online interview, Invest in an on-site interview at Munich, Germany and a team matching process to decide his team - all in a span of five months. It was only after he Dallas - Fort Worth Area completed each level that he was able to get a position at Google. -

Safety Fast July 2020

SINCE 1959 NOW IN INDIA VOLUME 1 | JULY 2020 www.mgmotor.co.in WELCOME TO SAFETYFAST! INDIA. WELCOME TO THE WORLD OF MG. Hello and welcome to the first This new chapter also is a leaf of the MG issue of SafetyFast! India. Car Club India just like its UK counterpart. We at MG are excited to extend the It will be an organisation led by passionate world of MG to you via ‘SafetyFast!’, a MG owners for MG owners in India. magazine that has been around for 60 years, Because no matter how good the cars may and has been sought by MG family and get, how much innovation or new features motor enthusiasts the world over. It has we may bring in, what makes MG special excited and captured is you – the owners, every little nudge, poke, drivers, and fans of MG. push and leap MG has I want to reiterate taken towards innovating that we are committed the world of auto-tech. to disruption and The magazine is digital differentiation and the only edition subscription last couple of month for a convenient confirm our beliefs that customer experience. we are on the right path. Available at your Thanks to you all for the fingertips and most support, love for the importantly, contactless brand and great reviews in today’s environment. of our two products We brought this Hector & ZS EV. We are magazine to India as it is devoted to innovation in an iconic part of the MG autotech and hope you as a brand. With the magazine, we plan to will be able to see the same in our bring to you ‘the world of MG’, inform upcoming launch of Gloster. -

The MG Car Club Geelong Inc

The MG Car Club Geelong Inc. Selected Indexes of articles in MG Enthusiast magazine. Many of these magazines are missing from our Library, please return if you have them. The Index is not complete but is a 'work in progress' and will be updated regularly. Only articles of on-going historical or technical interest are indexed. I have included any articles about the history of the MG Company, MG cars, or the people who were involved in either. I have not listed articles about Club Runs, Competition Events, or non-technical reports of Club Members' MGs as many of these are only relevant to Members in the UK. To find keywords from articles use <Ctrl><f> to open the pdf search box and insert the appropriate text. To go to latest indexed edition of the magazine, use <Ctrl><f> to open the pdf search box, insert text "latestmge" in the search box Librarian - The MGCC Geelong Inc. MG Enthusiast Magazine Edition Article Title Pages Articles relating to MGCC Geelong highlighted Volume One, Number One, published bi-monthly April / May 1983 MG in a Model World - review of model MGs available 5-7 MG mini-profile: MGB GT V8, Gran Turismo 16-20 Maestro? MG if you please - new Maestro 1600 22 Abingdon Archaeology 23-25 The Specialists - Naylor - made to measure 26-29 Terrific Turbo Road Test - Metro Turbo 30-31 June 1983 MISSING July 1983 August 1983 MISSING September 1983 October 1983 MGCC November 1983 December 1983 MISSING January 1984 February/March 1984 MISSING April /May 1984 Naylor Cars Launch 'All New' TF 5 Spring Fever - Midget 1500 10-12 MG -

Forbesindia.Com

SOCIOECONOMIC FALLOUT OF A PANDEMIC PRICE ` 250 RNI REG. NO. MAH RNI REG. NO. APRIL 10, 2020 E N G /2009/28102 Auto Special BUCKING Auto Special Auto THE TREND How MG Motor and Kia Motors are seeking to capitalise on their brisk beginning in India. New emission norms, weak demand and Covid-19-triggered supply FORBESINDIA.COM chain disruptions, however, present fresh challenges / VOLUME 12 ISSUE 8 APRIL 10, 2020 8 APRIL 10, 12 ISSUE / VOLUME (From left) Rajeev Chaba, president & MD, MG Motor India Kookhyun Shim, MD & CEO, KIA Motors India BS VI AND THE BIG SHIFT THE ELECTRIC IMPERATIVE CHINESE AUTO AND THE INDIA OPPORTUNITY TATA MOTORS’ SUV GAMBIT www.forbesindia.com A crisis is a good time to look at the Letter From The Editor opportunities for the Indian auto sector Long and Winding Road uhan in China, the centre of the outbreak worst. The exception may well be China, which bore the of the coronovirus, is also the “motor brunt in the March-ended quarter. As growth in new city” of China, the world’s biggest car infections slows down and employees get back to work, W market. From General Motors and Honda economic indicators will slowly pick up. For the rest of to Nissan and Renault, a clutch of car makers has their the world, a recovery may be some time away, but the factories there. The World Economic Forum says Wuhan planning—and the resolve—to come back is evident. accounts for half of Honda’s production in China and, in As Oliver Zipse, chairman of BMW AG, put it 2019, the Hubei Province, of which Wuhan is the capital, in a mid-March press conference in Munich to was the fourth-largest car producer in China. -

![S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD](https://docslib.b-cdn.net/cover/0659/s-no-aeo-registration-no-name-iec-code-1-inaaacv5657k1f186-gimatex-industries-pvt-ltd-0397062826-2-inaabct1122c1f181-tide-water-oil-co-india-ltd-4100659.webp)

S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD

S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD. 0296013633 3 INAABCV2801N1F180 VEER-O-METALS PRIVATE LIMITED 0799011029 4 INAABCE5852A1F187 EVERFLOW PETROFILS LTD. 0306015714 5 INAAACJ7650E1F184 JINDAL POLY FILMS LTD. 0588065781 6 INAACCB5512F1F180 BANOX EXIM PRIVATE LIMITED 0504086031 7 INAAACJ0474G1F189 JINDAL EXPORTS & IMPORTS PVT.LTD. 0588058173 8 INAAACS2679A1F182 SARITA HANDA EXPORTS PVT LTD 0501036636 9 INAABCS3931J1F183 SPIROTECH HEAT EXCHANGERS PVT. LTD. 0594045754 10 INAACCG7788C1F185 GRAND SLAM FITNESS PRIVATE LIMITED 0507001796 11 INAAACS3317D1F181 SUNRISE SPORTS (INDIA) PVT LTD 0594054451 12 INAABCV6922E1F185 VARDEEP PETRO CHEMICAL PRIVATE LIMITED 0403016827 13 INAAAFJ4032F1F181 JAIN METAL ROLLING MILLS 0488048397 14 INAADCP6204B1F185 P.A.R.K. FELTS (P) LTD 3306002801 15 INAAFCG2966D1F184 GREENLAM INDUSTRIES LIMITED. 1414002017 16 INAACCG6027C1F188 SIEMENS GAMESA RENEWABLE POWER PRIVATE LIMITED 0508033608 17 INAADCS5009B1F181 SUBRAMANY & CO (EXPORTS) PRIVATE LIMITED 3596001021 18 INAABCJ5937F1F180 JSK INDUSTRIES PVT. LTD., 0307076555 19 INAABCM9522F1F180 MAURIA UDYOG LTD 0588077186 20 INAAACS8793F1F189 SECO TOOLS INDIA PVT. LTD. 0389062375 21 INAAACT6305N1F185 J. K. PAPER LTD 3496003154 22 INAABCN0010F1F187 NELCAST LIMITED 0493027173 23 INAJCPM7016K1F186 FLOAT GLASS CENTRE 0404004075 24 INAAECT2086J1F184 TIRUBALA INTERNATIONAL PVT.LTD., 0605009058 25 INAAACW4857C1F184 WALTER TOOLS INDIA PVT.LTD 3103005946 26 INAASCS7221E1F187 -

November 2018

C M C M PREPS PREPS Y K Y K DIALogueg C M C M Y K Y K SAIF REBORN DIWALI DAZZLERS MARRAKECH MAGIC AUTUMN SONATA Pioneer_Dialogue_Inner_945 Single page.job 1 WxT chaapa Pioneer_Dialogue_Inner_945 Single page.job 1 WxT chaapa 11/02/2018 10:38:19 Process CyanMagentaYellowBlack C M C M PREPS PREPS Y K Y K C M C M Y K Y K Pioneer_Dialogue_Inner_945 Single page.job 2 WxT chaapa Pioneer_Dialogue_Inner_945 Single page.job 2 WxT chaapa 11/02/2018 10:38:19 Process CyanMagentaYellowBlack C M C M PREPS PREPS Y K Y K C M C M Y K Y K Pioneer_Dialogue_Inner_945 Single page.job 3 WxT chaapa Pioneer_Dialogue_Inner_945 Single page.job 3 WxT chaapa 11/02/2018 10:38:19 Process CyanMagentaYellowBlack 04_CM_MESSAGE(1).qxd 2/13/1950 7:25 PM Page 4 C M C M PREPS PREPS Y K Y K EDITOR’S LETTER POLLUTER POLLUTES, WE PAY! ust as temperatures start falling and the muggy summer heat abates, another weather-related adversity engulfs large parts of North India, especially the National Capital Region of Delhi. Pollution spikes to incredible heights making living conditions, including the air we breathe, seriously contaminated. Delhi residents are advised not to go out for morning walks or undertake exercises during the day as the Air Quality Index routinely hovers between Very Poor and Severe. Usually, matters improve after Diwali if it rains on occasion but there is no guarantee of that. In other words, the early winters in North India bring untold atmospheric misery. That is a pity for the winter months are traditionally regarded as the most pleasant and enjoyable period of the year. -

Automobile Manufacturers ANNUAL REPORT 2019-20

SIAM Society of Indian Automobile Manufacturers ANNUAL REPORT 2019-20 Re-Building the Nation, Responsibly 1 SIAM Society of Indian Automobile Manufacturers ANNUAL REPORT 2019-20 CONTENTS President’s Message 6 About SIAM 13 Performance of the Automobile Industry in 2019-20 14 Global Auto Industry Performance in 2019 17 Re-Building the Nation, Responsibly 19 SIAM Annual Activities & Milestones 20 SIAM 59th Annual Convention 2019 22 Auto Expo – The Motor Show 2020 24 Economic & Commercial Affairs 27 Technical Affairs 53 Initiatives of SIAM – SAFE 85 SIAM Councils & Groups 2019-20 88 SIAM Executive Committee 2019-20 95 Past Presidents 96 SIAM Members 97 Linkage with other Institutions in India 99 Overseas Linkage 100 PRESIDENT’S MESSAGE Dear Colleagues, It has been a tough ride for the Indian Automobile industry, with sales sharply declining by about 18% in 2019-20 over 2018-19. The Commercial vehicle sector was the worst hit with about 29% drop in sales in 2019-20. The lower performance of 2019-20 can be attributed to poor customer sentiments, liquidity crisis, higher cost of acquisition due to new safety and environment regulations, including BS IV to BS VI transition, higher upfront insurance premium, lower demand of CVs due to change in Axle weight norms, amongst others. However, the impact of COVID-19 and consequent lockdown since March 2020, has resulted in further plummeting of sales very sharply, in the last four months. Passenger Vehicles and Two-Wheelers have seen more than 60% drop in sales during April to July 2020, compared to the previous years. However, sales of Three-Wheelers have dwindled by more than 87%. -

BEV Industry in India

Assessment of Industry Readiness for Manufacturing of BEVs in India Haritha Saranga IIM Bangalore INDIA Overview • Evolution of Battery Electric Vehicles (BEVs) in India • Various schemes introduced by Indian government for adoption of BEVs • Current developments in various segments of auto industry • Battery charging infrastructure • Investments into BEV supply chain • Q&A Evolution of BEVs in India First Market introduction Why such slow progress? • First BEV in PV segment was • Customers’ reluctance to shift introduced in India in 2001 to EVs • However, the number of BEVs sold in PV segment were a • Manufacturers’ reluctance to mere 3,400 in 2019-20 introduce new products • Similarly, the first Electric • two-wheeler was introduced Lack of Infrastructure, such as in India in 2006 charging stations or battery • And the EV sales in two- swapping facilities wheeler segment stood at • Lack of incentives and push 152,000 in 2019-20 by government for adoption • A total of 600 electric buses were sold in 2020. • High cost of Battery Falling Prices of Lithium-ion Battery • Battery price was close to $1200/kWh in 2010; but dropped to $200/kWh in 2018. • By 2025 batteries are likely to cost less than $100/kWh, as cathode chemistries that are less dependent on cobalt or advanced NCA batteries become more popular Government push for BEVs in India ➢ India’s huge dependence on imported crude oil ➢ India imported nearly 85% of its crude oil needs in the year 2019-20 and spent $102 billion dollars on oil imports ➢ Greenhouse gas (GHG) emissions from ICE based vehicles ➢ 22 out of the 30 most polluted cities in the world belong to India ➢ The Indian government began pushing for BEVs in earnest from 2015 with FAME (Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India) policy ➢ Phase I of FAME - started in 2015 with an outlay of Rs.