93 Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2019

OOTACAMUND GYMKHANA CLUB 123rd ANNUAL REPORT 2018-2019 OOTACAMUND GYMKHANA CLUB 123rd ANNUAL REPORT 2018-2019 Estd 1896 Finger Post, Ootacamund, The Nilgiris - 643 006 South India, Tamil Nadu. Phone : 0423-2442254, 2448497 Fax : 2445967 Mobile : 94887 73351 E-Mail : [email protected] , [email protected] www.ootygymkhana.club 1 OOTACAMUND GYMKHANA CLUB 119th ANNUAL REPORT 2014-2015 2 OOTACAMUND GYMKHANA CLUB 123rd ANNUAL REPORT 2018-2019 OOTACAMUND GYMKHANA CLUB EXECUTIVE COMMITTEE MEMBERS FOR THE YEAR 2018-2019 1 T.GUNDAN PRESIDENT 2. R.SHYAM SUNDER VICE PRESIDENT 3. K.KRISHNAKUMAR HONORARY SECRETARY 4. JUNAID ALI SAIT GOLF CAPTAIN 5. SATHISH BALAGOPAL HONORARY TREASURER 6. M.P.GEORGE COMMITTEE MEMBER 7. MANTHRACHALAM .K COMMITTEE MEMBER 8. MURALI KHEMCHAND COMMITTEE MEMBER 9. RANGASWAMY .P COMMITTEE MEMBER 10. LEELAKRISHNAN.N. COMMITTEE MEMBER 11. KANDAVADIVEL.K COMMITTEE MEMBER 12. S. RAMASUBRAMANIAM COMMITTEE MEMBER 13. KUMARASWAMY .P COMMITTEE MEMBER 14. A. SURENDRAN COMMITTEE MEMBER 14. MRS. INNOCENT DIVYA EX- OFFICIO MEMBER THE COLLECTOR OF NILGIRIS 15. MR.GURUSWAMY DABBALA, I.F.S., EX- OFFICIO MEMBER DFO, NILGIRI FOREST DIVISION 3 OOTACAMUND GYMKHANA CLUB 123rd ANNUAL REPORT 2018-2019 MEETINGS There were Four Meetings of the Executive Committee during the year 2018-2019.Details of attendance of each Committee Member at the meetings of the Executive Committee are as under:- Name No.of Meetings attended 1 T.GUNDAN PRESIDENT 4 2 R.SHYAM SUNDER VICE PRESIDENT 3 3 K.KRISHNAKUMAR HONORARY SECRETARY 4 4 JUNAID ALI SAIT GOLF -

January 2017, Including in India

www.indiangolfunion.org First Quarter 2017 Vol.1 Issue No.1 THE OFFICIAL JOURNAL OF THE INDIAN GOLF UNION In this issue PRESIDENT’S MESSAGE President’s Message 1 Editorial 2 ere’s wishing the golfing fraternity of the Features - The Gary Phenomenon 3 country, a very Happy Golfing, 2017. The - My Journey 5 year 2016 has gone by and created number - Indian Golf Steeped in History 8 Hof milestones for Indian golf. It was one of the best years - Score Better 11 - The Distractions of Golf 15 in terms of achievements by Indian golfers. The revival - A Remarkable Feat! 17 of golf at Olympics and participation of Indians at this Committee Reports mega event created waves across the golfing fraternity. - Junior Golf - In its Latest Avatar! 4 Snap Shots 9 The performance of Anirban Lahiri and SSP Chaurasia Technical and teenage sensation Aditi Ashok, earned them a - The Rationale Behind Hole Indexing 10 place at the Rio Olympics. Aditi has performed brilliantly during the year and is Know Your Golf Course heading towards becoming Rookie of the year on the LET. SSP won his first - CIAL, Cochin 12 Rules & Regulations tournament abroad and this is followed by five girls who earned cards to play on - R & A Local Rule 6 the LET tour (two will have limited starts) speaks highly of the nursery, that is - Level 1 Rules School at Mauritius 16 the Indian Golf Union, that regularly produces these kind of players. The IGU, has THE IGU COUNCIL over the years, created a robust junior program which is paying dividends in the President - Satish Aparajit form of great professionals at the world stage. -

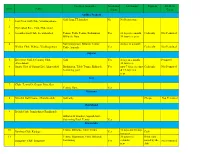

S.No. Name Facilities Available Accommo Dation Limitation

Facilities Available Accommo Limitation Payment Aff.Mem. S.No. Name dation Guest Andhra Pradesh 1 Golf,Gym,TT,Snooker No No Restriction East Point Golf Club, Visakhapatnam 2 Hyderabad Race Club, Hyderabad 3 Secunderabad Club, Secunderabad Tennis, Table Tennis, Badminton, Yes 10 days in a month, Cash only Not Permitted Billiards, Gym 30 days in a year 4 Swimming pool, Billards, Tennis 4 times in a month Waltiar Club, Waltiar, Visakhapatnam Table, Squash Yes Cash only Not Permitted Gujarat 5 Belvedere Golf & Country Club, Golf Yes 4 days in a month, Permitted Ahmedabad 30 days in a 6 Sports Club of Gujarat Ltd, Ahmedabad Badminton, Table Tennis, Billiards, Yes upto 7 days at a time Cash only Not Permitted Seimming pool & 15 days in a year Goa 7 Clube Tennis De Gaspar Dias, Goa Tennis, Gym, Yes Haryana 8 Shivalik Golf Course, Chandimandir Golf only Cheque Not Permitted Jharkhand 9 Beldih Club, Jamshedpur (Jharkhand) Billiards & Snooker, Squash,Golf, Swimming Pool, Tennis Yes Karnataka 10 Tennis, Billiards, Table Tennis 10 days and 30 days Bamboo Club, Kodagu Yes Cash in a year 11 Tennis, Badminton, Gym, Billiards, 30 days in a Debit card Bangalore Club, Bangalore Swimming Yes calendar issued by the Not Permitted year club 12 24 days in a year Bangalore Golf Club, Bangalore Golf Course Yes Not Permitted 13 Belgaum Club, Belgaum (KA) Billiards & Snooker, Lawn Tennis, Yes 4 days in a month, Cash / Credit Not Permitted Squash Court 24 days in a Card year 14 Chikmagalur Golf Club, Chikmagalur Not Permitted Billiards,Golf, Health Club Yes 15 Coorg -

Oct Issue 12

October 2012 O F F I C I A L N E W S L E T T E R O F T H E N O I D A G O L F C L U B CAPTCAPTAIN'SAIN'S PUTTS PUTTS FIRSTFIRST TEE TEE Winds of change, have been Committed to bring change that members want to see, blowing over our Course & have a great start up team of nine sub committees are now brought a whiff of fresh air, New functional .They are operating with a clear sense of President, Vice President and purpose, overcoming bad ideas, taking right decisions Management Board all in a short in a fiscally responsible manner despite them having a span of few months. Quite a level of influence on club management well beyond heady mix! their expertise. Visibly driving force behind all this Departing from yesteryears intense involvement is our self regulating core value of 'parties for votes', campaigning, electioneering this commitment and accountability. Isn't Golf essentially time was a precursor of the impending change in the a self regulating game? style of functioning of this Board. The Management Board & freshly constituted Sub Choice of the end is meaningless without choice of Committees are quietly and steadily bringing means. This idiom seems to be showing up now. On semblance of order. expiry of his contract Mr. Rakesh Sharma Manager Being primarily a Golf Club, our main focus, naturally, (club) has left . Mr Vijay Mohan is appointed on a newly is to provide a quality course to members. created post of Assistant Secretary. -

Annual Report 2019-20 (Single Page)

The Bombay Presidency Golf Club Ltd. (Estd.1927) 94th Annual Report 2019 - 2020 General Committee 2019-20 Brijinder Singh President Kuldeep Singh Sandhu G. Balachandran Atul Laul Captain Hon. Treasurer Convenor - Senior Golf / Morning Golf Hemesh Patel Kiran Korgaonkar Rahul Nigam Shashank Sandu Convenor - Bar (Permit Room)/ Convenor - Gymnasium / Convenor - Tournament / Convenor - Communication / Housekeeping / Swimming Pool & Handicapping HR & Legal Rooms & Banquets Snooker Room Stephen Ambrose Subhash Ramchandran Vikas Arora Col. R. S. Sekhon (Retd) Convenor - Security / Convenor - Events Convenor - Events / Gym / Secretary & CEO Junior Golf / Swimming Pool & Caddies & PRO Snooker Room Annual Report 2019 - 2020 The Bombay Presidency Golf Club Limited (Est. 1927) OFFICE BEARERS AND THE GENERAL COMMITTEE FOR THE YEAR 2019-2020 President - Mr. Brijinder Singh Captain - Mr. Kuldeep Singh Sandhu Hon. Treasurer - Mr. G. Balachandran G.C. Members - Mr. Atul Laul Mr. Hemesh Patel Mr. Kiran Korgaonkar Mr. Rahul Nigam Mr. Shashank Sandu Mr. Stephen Ambrose Mr. Subhash Ramchandran Mr. Vikas Arora Secretary & CEO : Col. R. S. Sekhon (Retd) Auditors : M/s Anand Shenoy & Associates Chartered Accountants Registered Office : Dr. Choithram Gidwani Road, Chembur, Mumbai – 400 074. Tel.Nos. : 022 - 50965000, 022 - 25205874, 022 - 25200875 Email id : [email protected] Website : www.bpgc-golf.com 1 The Bombay Presidency Golf Club Limited (Est.1927) The Bombay Presidency Golf Club Limited CIN : U92410MH1927NPL001307 Registered Office :Dr. Choithram Gidwani Road, Chembur, Mumbai - 400074 Website : www.bpgc-golf.com Tel: (022)-5096 5000 NOTICE NOTICE of the 94th Annual General Meeting of THE BOMBAY PRESIDENCY GOLF CLUB LIMITED will be held on Saturday, 26th December, 2020 at 17.30 hrs through video-conferencing/other audio visual means to transact the following business : ORDINARY BUSINESS : 1. -

List of Affiliated Clubs Bgc

LIST OF AFFILIATED CLUBS BGC 01 Bison Environmental Park & Training 07 Cosmopolitan Golf Annexe Area Golf Club (BEPTA) PB No.371, 63 Anna Salai, General Krishna Rao Road, Chennai-600 002 Near Ayappa Temple, Bollaram, T: +91 2852 5836, 2852 5141, Secunderabad - 503122 2852 5004, 2841 3853-55, T: +91 40 2786 1943 2858 4353-55 [email protected] 02 Bombay Presidency Golf Club Dr.Choitram Gidwani Road, 08 Delhi Gymkhana Club Chembur, Mumbai - 400 074 2, Safdarjung Road, Maharashtra New Delhi - 110 011 T: +91 022 2520 5874 T: +91 2301 5531-35, 2301 2773/ [email protected] 98107 31020 [email protected] 03 Chandigarh Golf Club Sector 6, Near Punjab Governor 09 High Range Golf Club House, Chandigarh - 160 101 High Range Club Munnar T: +91 0172 274 0327 Kerala State - 685612 [email protected] +91 (0091-04865) 230253/ (0091-04865) 230724 [email protected] 04 Chikmagalur Golf Club [email protected] PB No. 154, Chikmagalur, Karadihallikaval - 577101 Karnataka 10 Jayachamaraja Wadiyar Golf Club T: +91 08 2626 56500/ Maharana Pratap Singhji Road, 99803 90371 Nazarbad, Mysore - 570 010 [email protected] Karnataka T: +91 821 2433185/ 97409 99111 [email protected] 05 Coimbatore Golf Club Chettipalayam, Via Podanur, Coimbatore - 641 201, Tamil Nadu 11 Gymkhana Golf Club KGF T: +91 422 3293949, 2655258, Smith Road, 2655363 Kolar Gold Fields - 563 120 [email protected] Karnataka 06 Coorg Golf Links 12 Kodaikanal Golf Club Hatur - Ammati Road, Pillar Rocks Road, Bittangala - 571 218, Karnataka Kodaikanal - 624 -

Annual Report 2020

OOTACAMUND GYMKHANA CLUB 124th ANNUAL REPORT 2019-2020 OOTACAMUND GYMKHANA CLUB 124th ANNUAL REPORT 2019-2020 Estd 1896 Finger Post, Ootacamund, The Nilgiris - 643 006 South India, Tamil Nadu. Phone : 0423-2442254, 2448497 Fax : 2445967 Mobile : 94887 73351 E-Mail : [email protected] , [email protected] www.ootygymkhana.club 1 OOTACAMUND GYMKHANA CLUB 119th ANNUAL REPORT 2014-2015 2 OOTACAMUND GYMKHANA CLUB 124th ANNUAL REPORT 2019-2020 OOTACAMUND GYMKHANA CLUB EXECUTIVE COMMITTEE MEMBERS FOR THE YEAR 2019-2020 1 T.GUNDAN PRESIDENT 2. R.SHYAM SUNDER VICE PRESIDENT 3. K.KRISHNAKUMAR HONORARY SECRETARY 4. JUNAID ALI SAIT GOLF CAPTAIN 5. SATHISH BALAGOPAL HONORARY TREASURER 6. M.P.GEORGE COMMITTEE MEMBER 7. MURALI KHEMCHAND COMMITTEE MEMBER 8. K. KANDAVADIVEL COMMITTEE MEMBER 9. MANTHRACHALAM .K COMMITTEE MEMBER 10. KUMARASWAMY .P COMMITTEE MEMBER 11. RANGASWAMY .P COMMITTEE MEMBER 12. LEELAKRISHNAN.N. COMMITTEE MEMBER 13. S. RAMASUBRAMANIAM COMMITTEE MEMBER 14. A. SURENDRAN COMMITTEE MEMBER 15. MRS. INNOCENT DIVYA EX- OFFICIO MEMBER THE COLLECTOR OF NILGIRIS 16. MR.GURUSWAMY DABBALA, I.F.S., EX- OFFICIO MEMBER DFO, NILGIRI FOREST DIVISION 3 OOTACAMUND GYMKHANA CLUB 124th ANNUAL REPORT 2019-2020 MEETINGS There were Five Meetings of the Executive Committee during the year 2019 -2020. Details of attendance of each Committee Member at the meetings of the Executive Committee are as under :- Name No.of Meetings attended MR.T. GUNDAN PRESIDENT 5 MR. R.SHYAMSUNDER VICE PRESIDENT 2 MR. K. KRISHNAKUMAR HONORARY SECRETARY 5 Mr. JUNAID ALI SAIT GOLF CAPTIAN 4 MR.SATISH BALAGOPAL HONORARY TREASURER 2 MR. M. P. GEORGE COMMITTEE MEMBER 4 MR.MURLI KHEMCHAND COMMITTEE MEMBER 5 MR.K.KANDAVADIVEL COMMITTEE MEMBER 3 MR.MANTHRACHALAM COMMITTEE MEMBER 3 MR.KUMARASWAMY COMMITTEE MEMBER 3 Mr.P.RANGASWAMY COMMITTEE MEMBER 4 Mr.N.LEELAKRISHNAN COMMITTEE MEMBER 2 MR. -

Golfing Destinations in India MAJOR 18-HOLE GOLF COURSES

Golfing Destinations in India MAJOR 18-HOLE GOLF COURSES Ministry of Tourism, Government of India Eicher Goodearth Private Limited India CONTENTS ABOUT THE BOOK Golfing in India goes back to the colonial period when the Royal Calcutta Golf Club (RCGC) was founded in 1829 – the first golf club established outside the British Isles. Golfing Destinations in India, intended for the golf tourist, both international and domestic, catalogues the major 18-hole golf courses in the country, highlighting their key features and giving necessary information, as well as listing the tourist attractions around the courses to project them as ‘total’ holiday destinations. The 42 courses covered here have been listed according to their location – courses in north, south, east and west India. The handy booklet includes a chapter on the History of Golf and the list of Indian Golf Tourism Association (IGTA) tour operators. AN EICHER GOODEARTH PUBLICATION Copyright © 2014 Eicher Goodearth Private Limited, India ISBN 978-93-80262-72-7 Editor and Publisher: Swati Mitra Design: Ayesha Sarkar Design Studio Editorial Team: Nidhi Dhingra, Parvati Sharma, Geetika Sachdev, Trinaa Prasad Photographs: Krishna Roy pp 54-55; Manoj Chhabra p 33A, Sumita Roy pp 5, 52, 53A Special thanks to: IGTA and individual golf clubs for information and images Great care has been taken in the compilation, updation and validation of information, and every effort has been made to ensure that all information is as up-to-date as possible at the time of going to press. However, details like green fees and timings may change. We recommend you check with the Club for latest information before you visit.