Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NOVEMBER 2015 | 1 Ad -2

Ad -1 NOVEMBER 2015 | 1 Ad -2 2 | NOVEMBER 2015 Ad -2a NOVEMBER 2015 | 3 COMMITTEE MEMBERS & PORTFOLIOS PATRON Lt. General Jagbir Singh SM, VSM, General Officer Commanding, ATNK & K Area PRESIDENT **MR. P.V.S VENCATASUBRAMANIAM [email protected] Golf & Gym Mag VICE PRESIDENT CONTENTS **MR. S.B.P ANAND MOHAN [email protected] Legal & Software from the Secretary’s desk ......................6 VICE PRESIDENT **##BRIG. K.S SELVAN [email protected] from the Treasurer’s desk .......................8 HONORARY SECRETARY **MR. A.P SURESH KUMAR [email protected] Staff & Service Places-A soft and pleasant land ..........10 HONORARY TREASURER **MR. S.M ISPAHANI Happy Married Life .................................12 [email protected] MR. ARVIND C. MEHTA [email protected] Angels Do Exist ......................................14 Chess, Darts, Badminton & Squash MR. A.R. BALAKRISHNAN Bridge ...........................................................16 [email protected] Library MR. M. FAZAL MOHAMMED Events ..........................................................18 [email protected] House & Residential Quarters **DR. T. GUNASAGARAN Personalities ..............................................20 [email protected] Swimming, Snooker, Garden & Environment MR. N. KUMAR The Gymkhana Club Yesteryears ......22 [email protected] Cricket & Gymnasium MR. K. PARTHASARATHY ................................. Food 24 [email protected] Bridge, Tennis & Table Tennis Rs.999 Question? ............................26 #Col. RAJESH SINGH, S.C.,S. M., #COL. R. RAVI KUMAR, S.M., [email protected] .................... Emergency Medical Care 27 MR. SEKHAR ALAGAPPAN [email protected] Catering **MR. C. VENUGOPAL Madras Gymkhana Club [email protected] The Island, Anna Salai, Chennai-2. Bar E-Mail : [email protected], [email protected] Website: madrasgymkhanaclub.com Golf Annexe, Guindy Phone: 22350319, 22300093 MR VIVEK DHANDA [email protected] Deputy General Manager: Mr. -

Machete, Gun Seen As Students Clash DC CORRESPONDENT the Two Groups

c m y k c m y k THE LARGEST CIRCULATED ENGLISH DAILY IN SOUTH INDIA www.facebook.com/deccannews, www.twitter.com/deccanchronicle, www.deccanchronicle.com CHENNAI I WEDNESDAY 5 I FEBRUARY 2020 Vol. 15 No. 310 Established 1938 | 32 PAGES | ` 3.00 SPORT | 14 TABLOID Shaw replaces injured The joy of being Rohit in Test squad a girl-dad WEATHER Thanjavur Big Max: 32OC No public exams for Min: 22OC Temple Rainfall: Nil ASTROGUIDE consecration today classes 5, 8 in TN: Min G. SRINIVASAN | DC Vikari: Thai 22 ● Tithi: Ekadashi THANJAVUR, FEB. 4 G. BABU JAYAKUMAR | DC Several discussions on young students and par- Star: Mrigashirsham CHENNAI, FEB. 4 and seminars were ents to take an examination All roads lead to Big tem- organised to highlight that would run for a week or Rahukalam: ple at Thanjavur with the The Tamil Nadu cabinet so might spell the end for 12 noon to 1.30 pm consecration of the temple, cancelled the public exami- the dark side of the the academic career for Yamagandam: built by King Raja Raja nation announced for Class new examination sys- many children, educational- 7.30 am to 9 am Chola (985 CE to 1014 CE) 5 and 8 students. The deci- tem and numerous ists and social activists felt. and a world heritage mon- sion taken on Tuesday lifts a petitions were shot For not all parents in the PRAYERS ument declared by Unesco, dark veil of apprehension lower rungs of the socio-eco- Fajar: 5.22 am to take place between 9 am that had hung over the col- off to the government nomic ladder, particularly Zohar: 12.28 pm and 10 am on Wednesday, lective conscience of the to do away with it illiterates and daily wage Asar: 3.42 pm February 5. -

Affiliated Clubs the Royal Klang Club Has Reciprocal Arrangements With

AFFILIATED CLUBS THE ROYAL KLANG CLUB HAS RECIPROCAL ARRANGEMENTS WITH THE FOLLOWING CLUBS :- CONTACT NO. SIGNING FACILITIES - WEST MALAYSIA AC 43 KELAB SUNGAI PETANI, KEDAH 04-4224894 AC 3 * KULIM CLUB, KULIM, KEDAH 04-4906054 AC 11 KELANTAN GOLF AND COUNTRY CLUB, KOTA BHARU, KELANTAN 09-7482102 AC 2 KELAB DIRAJA KAMPUNG KUANTAN, BUKIT ROTAN, SELANGOR 03-32891069 AC 4 KELAB KUANTAN, KUANTAN, PAHANG 09-5137377 / 012-9007069 AC34 KELAB GOLF & COUNTRY KUALA KUBU BHARU, SELANGOR 03-60642887 ( G.C. MEMBERS SIGNING FACILITIES / MEMBERS NO SIGNING FACILITIES ) AC 16 SITIAWAN RECREATION CLUB, SITIAWAN, PERAK 05-6918058 AC 41 KELAB IDRIS, KUALA KANGSAR, PERAK 05-7761809 AC 44 IPOH SWIMMING CLUB, IPOH, PERAK 05-2531706 AC 1 * KELAB IPOH DIRAJA, IPOH, PERAK 05-2542212 AC 6 * NEW CLUB, TAIPING, PERAK 05-8073935 AC 29 KELAB GOLF SRI MORIB, BANTING, SELANGOR 018-3119713 AC 28 ROYAL SELANGOR FLYING CLUB, KUALA LUMPUR 21411934 AC 25 * ROYAL PORT DICKSON YACHT CLUB, NEGERI SEMBILAN 06-6471635 AC 15 KELAB BANDAR PENGGARAM, BATU PAHAT, JOHOR 07-4341292 AC 12 JOHOR CULTURAL & SPORTS CLUB, JOHOR BAHRU, JOHOR 07-232 3555 SIGNING FACILITIES - EAST MALAYSIA AC 17 KINABALU CLUB, KOTA KINABALU, SABAH 088-225 075 AC 46 TAWAU RECREATION CLUB, SABAH 089-771 413 AC 45 KELAB GYMKHANA MIRI, SARAWAK 085-434 655 NO SIGNING FACILITIES - MALAYSIA AC 5 MALACCA CLUB, MELAKA (PREPAID CARD / CREDIT CARD) 06-284 2488 AC 7 * PENANG CLUB, PENANG (CASH / CREDIT OR DEBIT CARD) 04-2277366 AC 9 PENANG SPORTS CLUB, PENANG (PREPAID CARD) 04-2297834 AC 10 * ROYAL SUNGEI UJONG CLUB, SEREMBAN, -

The Cosmopolitan Club

1 Sanmar Holdings Limited Sanmar Chemicals Corporation Sanmar Metals Corporation Sanmar Engineering Corporation Chemplast Sanmar Limited Sanmar Foundries Limited Flowserve Sanmar Limited Trubore Piping Systems Sand Foundry BS&B Safety Systems (India) Limited TCI Sanmar Chemicals LLC (Egypt) Investment Foundry Xomox Sanmar Limited Cabot Sanmar Limited Machine Shop Xomox Valves Divn. Sanmar Speciality Chemicals Limited Matrix Metals LLC Pacific Valves Divn. ProCitius Research Keokuk Steel Castings Company (USA) Tyco Sanmar Limited Performance Chemicals Acerlan Foundry (Mexico) Fisher Sanmar Limited NEPCO International (USA) Control Valves Divn. Sanmar Shipping Limited Sanmar Ferrotech Limited Regulators Divn. Eisenwerk Erla GmbH (Germany) Sanmar Engineering Services Limited The Sanmar Group 9, Cathedral Road, Chennai 600 086. Tel.: + 91 44 2812 8500 Fax: + 91 44 2811 1902 2 In this issue... Clubs of Madras: A British Legacy 4 Chemplast Sanmar and BNHS Proud hosts of migratory birds 18 The Sanmar Group Annual Report 2009 7 Madhuram Narayanan Centre for Exceptional Children Sanmar Shipping adds Sonnet to its fleet 10 6th National Workshop on early intervention in State-of-the-art emergency scenario management mental retardation 20 at Chemplast 11 20th anniversary celebrations 21 Employees Union celebrates silver jubilee at Karapakkam 12 Awards galore: Sri Sankara Senior Secondary School 22 Factory Day function at Berigai 13 Free eye camp at Karaikal 23 Long service awards at Eisenwerk Erla 14 The Chennai Season 24 Sanmar welcomes Egyptian Minister 15 Legends from the South: D K Pattammal 26 Matrix can be viewed at www.sanmargroup.com Designed and edited by Kalamkriya Limited, 9, Cathedral Road, Chennai 600 086. Ph: + 91 44 2812 8051/ 52 For Private Circulation Only. -

Best Golf Courses in Chennai"

"Best Golf Courses in Chennai" Created By: Cityseeker 4 Locations Bookmarked Army Palm Grove "River-side Golf Course" Take some time off from your regular schedule and enjoy a game of golf at Army Palm Grove. The spacious golf course is is known for its facilities and its infrastructure. The ground is very well curated and there are plenty of opportunities to enjoy a nice game without much wind. Sometimes, the conditions can get windy, but otherwise it is a great place to practice for by North Charleston beginners. Anna Salai, Park Town, Chennai TNGF Cosmo Club Golf "Beautiful Golf Course" One of the most loved and prestigious golf course in the city is the TNGF Cosmo Club Golf. The club was inaugurated in 1938 by Victor Alexander Hope, who was the Governor General of India back then. The golf course is beautiful, well curated and remains one of the top destinations for people who love this sport. They host many tournaments for sportsmen as by Neville Wootton well as for those who play golf for leisure. +91 44 2435 6098 tngf.in/ [email protected] 334 Anna Salai, Saidapet, Chennai Madras Gymkhana Club Golf Annexe "Challenging Golf Course" Madras Gymkhana Club Golf Annexe is probably one of the toughest golf courses in the city. The club is known for its 18 hole course, with an in line type of field where wind plays a very important role. The course has been defined as the best way to learn golf as it offers a great deal of practice by Fevi in Pictures and precision. -

Educational Qualifications

CURRICULUM VITAE PERSONAL NAME : Dr. Sunita Agarwal I have been fortunate to be born in a family of ophthalmologists. My grandfather Dr. Raghvir S. Agarwal was a noted ophthalmologist of his time in India. My father Dr. Jaivir Agarwal is the founder of Dr. Agarwal ‘s Eye Institute, Chennai, mother Dr. Mrs. Tahira Agarwal is also a renowned ophthalmic surgeon currently practicing as a corneal specialist. My brother Dr. Amar Agarwal and myself both are ophthalmic surgeons, extensively engaged in ophthalmic research, teaching are currently practicing with our parents at Chennai. Dr. Athiya Agarwal, wife of Dr Amar Agarwal is also a part of the team. EDUCATIONAL QUALIFICATIONS 1. COMPLETED MATRICULATION FROM SACRED HEART CHURCH PARK SCHOOL IN 1975 I had a complete childhood with schooling from one of the finest institutions in the country. As is well known convent education brings with it a flare to the child and close proximity with God. In any format the individual gets to think of the less fortunate and realizes the pain and anguish of our school teachers and convent nuns. I was extremely mischievous and was called out to the Principals office very often still in this developed a close camaraderie with my Principal Teacher Sister Clare. So much so that till today she remembers me fondly of tying my unruly hair in her own ribbons or admonishing me for one of my little crimes. I also happened to be the School pupil leader in the my last year occasion came on a day when I had just come back from Delhi after winning the national gold medal for swimming for 1974, and as I entered school the election had taken place in my absence, this was one of few times I saw tears (of joy) in my fathers year. -

IDFC FIRST Wealth Credit Card Offer Details Buy One Ticket and Get up To

Movie Offer – IDFC FIRST Wealth Credit Card Offer Details Buy one ticket and get up to Rs. 500 off on the second ticket on Paytm Mobile App. The offer can be used to avail two free tickets during a month. How to Avail Offer on Paytm Mobile App 1. Go through the regular ticketing flow for selecting the movie, cinema and show of your choice 2. To avail offer, click ‘View All’ offers. Select and click on ‘Apply’ offer on IDFC FIRST Wealth Credit Card or enter Promocode IDFCCCFW1 (for booking up to 3 movie tickets) or enter Promocode IDFCCCFW2 (for booking 4 or more movie tickets). 3. Enter your 16 Digit credit card number and click on ‘Apply Offer’. 4. Instant Discount shall be provided, you will have to pay the remaining transaction amount using the same card on which you have availed the offer. Your card number will auto populate in the box. To make the payment, enter remaining details like name on the card, expiry date and CVV. Offer Terms and Conditions 1. 1+1 On Movie Tickets - Use Promo code IDFCCCFW1 to book 2 or 3 movie tickets using an IDFC FIRST Wealth Credit Card, and get a 100% Instant Discount for one ticket up to Rs.500. Offer is applicable on booking of a minimum of two movie tickets. Offer will only be valid twice per user per card for every calendar month. 2. 2+2 On Movie Tickets - Use Promo code IDFCCCFW2 to book 4 or more movie tickets using an IDFC FIRST Wealth Credit Card, and get a 100% Instant Discount for two tickets up to Rs.1000. -

January 2017, Including in India

www.indiangolfunion.org First Quarter 2017 Vol.1 Issue No.1 THE OFFICIAL JOURNAL OF THE INDIAN GOLF UNION In this issue PRESIDENT’S MESSAGE President’s Message 1 Editorial 2 ere’s wishing the golfing fraternity of the Features - The Gary Phenomenon 3 country, a very Happy Golfing, 2017. The - My Journey 5 year 2016 has gone by and created number - Indian Golf Steeped in History 8 Hof milestones for Indian golf. It was one of the best years - Score Better 11 - The Distractions of Golf 15 in terms of achievements by Indian golfers. The revival - A Remarkable Feat! 17 of golf at Olympics and participation of Indians at this Committee Reports mega event created waves across the golfing fraternity. - Junior Golf - In its Latest Avatar! 4 Snap Shots 9 The performance of Anirban Lahiri and SSP Chaurasia Technical and teenage sensation Aditi Ashok, earned them a - The Rationale Behind Hole Indexing 10 place at the Rio Olympics. Aditi has performed brilliantly during the year and is Know Your Golf Course heading towards becoming Rookie of the year on the LET. SSP won his first - CIAL, Cochin 12 Rules & Regulations tournament abroad and this is followed by five girls who earned cards to play on - R & A Local Rule 6 the LET tour (two will have limited starts) speaks highly of the nursery, that is - Level 1 Rules School at Mauritius 16 the Indian Golf Union, that regularly produces these kind of players. The IGU, has THE IGU COUNCIL over the years, created a robust junior program which is paying dividends in the President - Satish Aparajit form of great professionals at the world stage. -

The Addicts Golfing Society of Southern India

The Addicts Golfing Society of Southern India ENTRY FORM – CHENNAI MEET – 2015 Dates: 10th, 11th, 12th & 13th September 2015 Name: Mr/Miss/Mrs……………………………………………………H/c Index………….Home Club………...…… Permanent Member Invitation Member Addicts Code No. *Dependent Member ………………….……………….. ……… H/c ….(24 max) Date of Birth dd /mm/yyyy *Children (below the age of 21) must be accompanied by the Addict Member. Singles Event at Madras Gymkhana Club - Golf Annex, Guindy JOHNNIE WALKER CHALLENGE CUP: Net Stableford Competition (Singles) Thursday, 10th September 6:30 A.M. (Gents: Full H/C: Max 18 strokes) (Ladies: Full H/C: Max 24 strokes) (Compulsory for Chennai Addicts) Friday, 11th September 6:30 A.M. PALM TREE BOWL for Ladies: Net Stableford Competition (Singles) (Ladies: Full H/C: Max 24 strokes) BUNTY PRATAP TROPHY: Gross Stableford Competition (Singles) (Will be played concurrently with JOHNNIE WALKER CHALLENGE CUP at MGC-Golf Annex) VENKI’S CUP: Net Stableford Competition (Singles) for H’Cap 14 & below: (Will be played concurrently with JOHNNIE WALKER CHALLENGE CUP at MGC-Golf Annex) R. RATHNAM TROPHY: Net Stableford Competition (Singles) For Senior Golfers (Above 65 years as on 10.09.2015. Max. H/c – 24 strokes. Will be played concurrently with JOHNNIE WALKER CHALLENGE CUP. Please fill in your date of birth to be eligible.) DATE OF BIRTH: 2015 SILVER JUBILEE PALM TREE TROPHY: Net Stableford Competition (Singles) (Will be played concurrently with JOHNNIE WALKER CHALLENGE CUP. Those who played at Chennai and Three other Meets during the year.) 2015 GOLDEN JUBILEE PALM TREE TROPHY: Singles Vs Par Competition (Will be played concurrently with JOHNNIE WALKER CHALLENGE CUP. -

Year VI - Semester

DIRECTORATE OF LEGAL STUDIES Chennai - 600 010 5 Year B.A. B.L., Course Semester System III - Year VI - Semester SI. No Subject Subject Code Page No. 1. Constitutional Law - II FRF 3 2. Company Law FRG 33 3. Labour Law - I FRH 49 4. Clinical Course I - Professional Ethics & Professional Accounting System (Internal) FR3 58 COURSE MATERIALS Compiled by: Dr. N. Kayalvizhi M.L., Ph.D., Asst. Professor, Dr. Ambedkar Govt. Law College, Chennai - 600 104 First Compilation : Dec 2012 Second Compilation of Re-edition : Oct 2013 Third Compilation of Re-edition : Oct 2014 Fourth Compilation of Re-edition : Feb 2016 Copyright © Director of Legal Studies, Chennai - 600 010. For Your Information : The Registrar, THE TAMIL NADU Dr. AMBEDKAR LAW UNIVERSITY “Poompozhil”, 5, Dr. D.G.S. Dinakaran Salai, Chennai - 600 028. Telephone : (044) 2464 1212, 2464 1919, Tele - Fax : (044) 2461 7996 Email : [email protected] : [email protected] Website : http://www.tndalu.ac.in DIRECTORATE OF LEGAL STUDIES, Kilpauk, Chennai - 600 010. Telephone : (044) 2532 1394 Email : [email protected] Website : www.tndls.ac.in Dr. AMBEDKAR GOVERNMENT LAW COLLEGE, CHENNAI - 600 104. Telephone : (044) 2534 0907 Email : [email protected] Website : www.draglc.ac.in GOVERNMENT LAW COLLEGE, MADURAI - 625 020. Telephone : (0452) 253 3996 Email : [email protected] Website : www.glcmadurai.ac.in GOVERNMENT LAW COLLEGE, TIRUCHIRAPALLI - 620 023. Telephone : (0431) 242 0324 Email : [email protected] Website : www.glctry.ac.in GOVERNMENT LAW COLLEGE, COIMBATORE - 641 046. Telephone : (0422) 242 2454 Email : [email protected] Website : www.glccbe.ac.in GOVERNMENT LAW COLLEGE, TIRUNELVELI - 627 011. -

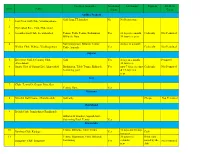

S.No. Name Facilities Available Accommo Dation Limitation

Facilities Available Accommo Limitation Payment Aff.Mem. S.No. Name dation Guest Andhra Pradesh 1 Golf,Gym,TT,Snooker No No Restriction East Point Golf Club, Visakhapatnam 2 Hyderabad Race Club, Hyderabad 3 Secunderabad Club, Secunderabad Tennis, Table Tennis, Badminton, Yes 10 days in a month, Cash only Not Permitted Billiards, Gym 30 days in a year 4 Swimming pool, Billards, Tennis 4 times in a month Waltiar Club, Waltiar, Visakhapatnam Table, Squash Yes Cash only Not Permitted Gujarat 5 Belvedere Golf & Country Club, Golf Yes 4 days in a month, Permitted Ahmedabad 30 days in a 6 Sports Club of Gujarat Ltd, Ahmedabad Badminton, Table Tennis, Billiards, Yes upto 7 days at a time Cash only Not Permitted Seimming pool & 15 days in a year Goa 7 Clube Tennis De Gaspar Dias, Goa Tennis, Gym, Yes Haryana 8 Shivalik Golf Course, Chandimandir Golf only Cheque Not Permitted Jharkhand 9 Beldih Club, Jamshedpur (Jharkhand) Billiards & Snooker, Squash,Golf, Swimming Pool, Tennis Yes Karnataka 10 Tennis, Billiards, Table Tennis 10 days and 30 days Bamboo Club, Kodagu Yes Cash in a year 11 Tennis, Badminton, Gym, Billiards, 30 days in a Debit card Bangalore Club, Bangalore Swimming Yes calendar issued by the Not Permitted year club 12 24 days in a year Bangalore Golf Club, Bangalore Golf Course Yes Not Permitted 13 Belgaum Club, Belgaum (KA) Billiards & Snooker, Lawn Tennis, Yes 4 days in a month, Cash / Credit Not Permitted Squash Court 24 days in a Card year 14 Chikmagalur Golf Club, Chikmagalur Not Permitted Billiards,Golf, Health Club Yes 15 Coorg -

Oct Issue 12

October 2012 O F F I C I A L N E W S L E T T E R O F T H E N O I D A G O L F C L U B CAPTCAPTAIN'SAIN'S PUTTS PUTTS FIRSTFIRST TEE TEE Winds of change, have been Committed to bring change that members want to see, blowing over our Course & have a great start up team of nine sub committees are now brought a whiff of fresh air, New functional .They are operating with a clear sense of President, Vice President and purpose, overcoming bad ideas, taking right decisions Management Board all in a short in a fiscally responsible manner despite them having a span of few months. Quite a level of influence on club management well beyond heady mix! their expertise. Visibly driving force behind all this Departing from yesteryears intense involvement is our self regulating core value of 'parties for votes', campaigning, electioneering this commitment and accountability. Isn't Golf essentially time was a precursor of the impending change in the a self regulating game? style of functioning of this Board. The Management Board & freshly constituted Sub Choice of the end is meaningless without choice of Committees are quietly and steadily bringing means. This idiom seems to be showing up now. On semblance of order. expiry of his contract Mr. Rakesh Sharma Manager Being primarily a Golf Club, our main focus, naturally, (club) has left . Mr Vijay Mohan is appointed on a newly is to provide a quality course to members. created post of Assistant Secretary.