WGAW Comments MB Docket No 14-16 3.21.14

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spring 2011 Vancouver Prime Time TV Schedules 7 P.M

Spring 2011 Vancouver Prime Time TV Schedules 7 p.m. - 11 p.m. February 20 - March 12 2011 Monday Tuesday Wednesday Thursday Friday Saturday Sunday 7 Wheel of Fortune Heartland Jeopardy! 8 Little Mosque Rick Mercer Report Marketplace NHL Hockey Dragon's Den The Nature of Things 18 to Life InSecurity The Rick Mercer Report Movie 9 Village on a Diet The Pillars of the Earth Republic of Doyle Documentary the fifth estate HNIC After Hours 10 The National The National CBUT CBC News Make the Politician Work 7 Entertainment Tonight 16:9 The Bigger Picture Simpsons Entertainment Tonight Canada Family Restaurant American Dad 8 Survivor: Redemption Simpsons House Glee Wipeout Kitchen Nightmares Island Bob's Burgers Movie 9 The Office Family Guy The Chicago Code NCIS: Los Angeles NCIS 90210 The Office Cleveland Show 10 The Office Hawaii Five-0 The Good Wife Off the Map Haven The Guard Brothers & Sisters CHAN Outsourced 7 How I Met Your Mother what's cooking America's Funniest Home The Office The Most Amazing Videos 8 Community Who do you think you Glenn Martin, DDS Extreme Makeover: Home Minute to Win It Rules of Engagement are? Out There Edition The Bachelor The Biggest Loser 9 Modern Family How I Met Your Mother Fringe The Cape Cougar Town Parks & Recreation 10 30 Rock Movie Harry's Law Parenthood The Murdoch Mysteries Mantracker The Murdoch Mysteries CKVU Perfect Couples 7 eTalk eTalk eTalk eTalk CSI W-Five Undercover Boss The Big Bang Theory The Big Bang Theory The Big Bang Theory The Big Bang Theory 8 Mr. -

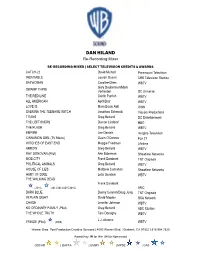

DAN HILAND Re-Recording Mixer

DAN HILAND Re-Recording Mixer RE-RECORDING MIXER | SELECT TELEVISION CREDITS & AWARDS CATCH-22 David Michod Paramount Television INSATIABLE Lauren Gussis CBS Television Studios BATWOMAN Caroline Dries WBTV Gary Dauberman/Mark SWAMP THING Verheiden DC Universe THE RED LINE Cairlin Parrish WBTV ALL AMERICAN April Blair WBTV LOVE IS Mara Brock Akil OWN SABRINA THE TEENAGE WITCH Jonathan Schmock Viacom Productions TITANS Greg Berlanti DC Entertainment THE LEFTOVERS Damon Lindelof HBO THE FLASH Greg Berlanti WBTV EMPIRE Lee Daniels Imagine Television CINNAMON GIRL (TV Movie) Gavin O'Connor Fox 21 WITCHES OF EAST END Maggie Friedman Lifetime ARROW Greg Berlanti WBTV RAY DONOVAN (Pilot) Ann Biderman Showtime Networks MOB CITY Frank Darabont TNT Originals POLITICAL ANIMALS Greg Berlanti WBTV HOUSE OF LIES Matthew Carnahan Showtime Networks HART OF DIXIE Leila Gerstein WBTV THE WALKING DEAD Frank Darabont (2010) (2012/2014/2015/2016) AMC DARK BLUE Danny Cannon/Doug Jung TNT Originals IN PLAIN SIGHT David Maples USA Network CHASE Jennifer Johnson WBTV NO ORDINARY FAMILY (Pilot) Greg Berlanti ABC Studios THE WHOLE TRUTH Tom Donaghy WBTV J.J. Abrams FRINGE (Pilot) (2009) WBTV Warner Bros. Post Production Creative Services | 4000 Warner Blvd. | Burbank, CA 91522 | 818.954.7825 Award Key: W for Win | N for Nominated OSCAR | BAFTA | EMMY | MPSE | CAS LIMELIGHT (Pilot) David Semel, WBTV HUMAN TARGET Jonathan E. Steinberg WBTV EASTWICK Maggie Friedman WBTV V (Pilot) Kenneth Johnson WBTV TERMINATOR: THE SARAH CONNER Josh Friedman CHRONICLES WBTV CAPTAIN -

Pg TV Guide 2.Indd

SUNDAY EVENING A-DirecTV;B-Dish;C-Brandenburg MAY 6, 2012 A B C 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 TV Guide Listings 3/WAVE 3 3 3Dateline NBC (N) Harry’s Law (N) The Celebrity Apprentice (N) Å WAVE 3 News Extra (N) 7/WTVW News Home Offi ce Theory Theory News House (S) Å McCarv 9/WNIN Jubilee (S) Å Finding-Roots Masterpiece Mystery! (S) Great Performances at the Met Å 11/WHAS 11 11 11 Funny Videos Upon a Time Desp.-Wives (:01) GCB Å News Criminal Minds (S) May 2 - May 8 23/WKZT 4Manor Summer Time/By Served? Masterpiece Mystery! (S) Land Globe Trekker (S) Religion 32/WLKY 32 32 560 Minutes Å The Amazing Race (S) Å NYC 22 (N) Å News News Access 34/WBKI 34 34 17 Fturama Fturama ››› “Chicago” (2002, Musical) News Insider (:05) TMZ (N) (S) Electric SATURDAY MORNING A-DirecTV;B-Dish;C-Brandenburg MAY 5, 2012 41/WDRB 41 41 12 Simpson Cleve Simpson Burgers Family Amer. News Sports Theory Two 30 Rock A B C 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 A&E 265 118 79 Storage Storage Storage Storage Storage Storage Duck D. Duck D. Duck D. Duck D. Storage Frozen Planet (S) River Monsters Swamp Wars (N) River Monsters (S) Swamp Wars (S) Monster 3/WAVE 3 3 3Today (N) (S) Å Wave 3’s Derby Day ANPLAN 282 184 78 CNN 202 200 24 CNN Newsroom CNN Presents Piers Morgan CNN Newsroom CNN Presents Piers 7/WTVW Paid Paid Garden Wild Busi Home. -

WORST COOKS in AMERICA: CELEBRITY EDITION Contestant Bios

Press Contact: Lauren Sklar Phone: 646-336-3745; Email: [email protected] WORST COOKS IN AMERICA: CELEBRITY EDITION Contestant Bios MINDY COHN Mindy Cohn made her acting debut as the witty, precious Eastland Academy student Natalie Green in the hit comedy series The Facts of Life. She was discovered while attending Westlake School for Girls in Bel Air, California, when actress Charlotte Rae and producer Norman Lear came to the school to authenticate scripts for their new show. Ms. Rae was so taken with the vivacious eighth grader she convinced producers to create a role for her. Mindy remained on the show for all nine seasons, also traveling to Paris and Australia with her co-stars to produce two successful television movies based on the series. Concurrently, with her role in Facts, Mindy played “Rose Jenko” in Fox’s 21 Jump Street. Other notable television appearances included Diff’rent Strokes, Double Trouble, Charles in Charge, Dream On and Suddenly Susan. In 1983, Mindy appeared in her first professional stage performance in Table Settings, written and directed by James Lapine and filmed for HBO Television. The illustrious cast included Eileen Heckart, Stockard Channing, Robert Klein, Peter Riegart, and Dinah Manoff. She went on to make her feature film debut in The Boy Who Could Fly, which co-starred Colleen Dewhurst, Fred Gwynne and Fred Savage. Mindy took a hiatus from her career to attend university, where she earned a Bachelor’s degree in Cultural Anthropology and a Masters in Education. During this time, she studied improvisation and scene work with Gary Austin and Larry Moss. -

Monday Morning, July 9

MONDAY MORNING, JULY 9 FRO 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 COM 4:30 KATU News This Morning (N) Good Morning America (N) (cc) AM Northwest (cc) The View Dr. Oz and Terry Wrong; Live! With Kelly Kyra Sedgwick; 2/KATU 2 2 (cc) (Cont’d) Aaron Paul. (N) (TV14) Eric McCormack. (N) (TVPG) KOIN Local 6 at 6am (N) (cc) CBS This Morning (N) (cc) Let’s Make a Deal (cc) (TVPG) The Price Is Right (N) (cc) (TVG) The Young and the Restless (N) (cc) 6/KOIN 6 6 (TV14) NewsChannel 8 at Sunrise at 6:00 Today Ray Romano; Piper Perabo. (N) (cc) Anderson Tom Bergeron; Bethen- 8/KGW 8 8 AM (N) (cc) ny Frankel. (cc) (TVG) Power Yoga: Mind Wild Kratts (cc) Curious George Cat in the Hat Super Why! (cc) Dinosaur Train Sesame Street Big Bird wants to Sid the Science Clifford the Big Martha Speaks WordWorld (TVY) 10/KOPB 10 10 and Body (TVY) (TVY) Knows a Lot (TVY) (TVY) change his appearance. (TVY) Kid (cc) (TVY) Red Dog (TVY) (TVY) Good Day Oregon-6 (N) Good Day Oregon (N) MORE Good Day Oregon The 700 Club (cc) (TVPG) Law & Order: Criminal Intent Miss- 12/KPTV 12 12 ing bookkeeper. (cc) (TV14) Paid Paid Paid Paid Paid Paid Through the Bible Feed the Children Paid Paid Paid 22/KPXG 5 5 (TVG) Creflo Dollar (cc) John Hagee Breakthrough This Is Your Day Believer’s Voice Northwest Focus Always Good Manna From Behind the Jewish Voice (cc) Life Today With Today: Marilyn & 24/KNMT 20 20 (TVG) Today (cc) (TVG) W/Rod Parsley (cc) (TVG) of Victory (cc) News (cc) Heaven (cc) Scenes (cc) James Robison Sarah Eye Opener (N) (cc) My Name Is Earl My Name Is Earl Swift Justice: Swift Justice: Maury (cc) (TV14) The Steve Wilkos Show (N) (cc) 32/KRCW 3 3 (TVPG) (TV14) Jackie Glass Jackie Glass (TV14) Andrew Wom- Paid The Jeremy Kyle Show (cc) (TVPG) America Now (cc) Paid Cheaters (cc) Divorce Court The People’s Court (cc) (TVPG) America’s Court Judge Alex (cc) 49/KPDX 13 13 mack (TVG) (TV14) (cc) (TVPG) (TVPG) Paid Paid Dog the Bounty Dog the Bounty Dog the Bounty Dog the Bounty Criminal Minds Soul Mates. -

Current, October 31, 2011

University of Missouri, St. Louis IRL @ UMSL Current (2010s) Student Newspapers 10-31-2011 Current, October 31, 2011 University of Missouri-St. Louis Follow this and additional works at: https://irl.umsl.edu/current2010s Recommended Citation University of Missouri-St. Louis, "Current, October 31, 2011" (2011). Current (2010s). 93. https://irl.umsl.edu/current2010s/93 This Newspaper is brought to you for free and open access by the Student Newspapers at IRL @ UMSL. It has been accepted for inclusion in Current (2010s) by an authorized administrator of IRL @ UMSL. For more information, please contact [email protected]. OCTOBER 31, 2011 VOL. 45; TheWWW.T H ECURRECurrentN T-ONL INE . C OM ISSUE 1359 Cardinals win World Series, St. Louis parties! By Owen Shroyer, page 2 SARAH LOWE / THE CURRENT ALSO INSIDE RumMan DiariesEating review Sandwich Harry Potter celebration Men’s soccer ends strong 77 WorthyNew art adaptation installation of feeds Hunter one S . manThompson1312 UPB provides showing of final film 14 UMSL takes game 5-2 2 | The Current | OCTOBER 31, 2011 | WWW.THECURRENT-ONLINE.COM | | NEWS TheCurrent VOL. 45, ISSUE 1359 News WWW.THECURRENT-ONLINE.COM EDITORIAL Cardinals craze sweeps over the Editor-in-Chief....................................................Matthew B. Poposky Managing Editor.........................................................Janaca Scherer News Editor..................................................................Minho Jung University of Missouri and St. Louis Features Editor............................................................Ashley -

Western Outlaws and Angels

‘SAND DOLLAR COVE’ Cast Bios CHAD MICHAEL MURRAY (Brody) – Chad Michael Murray first rose to prominence with fan favorite roles on the Warner Bros. dramas “Dawson’s Creek” and “Gilmore Girls.” He became a household name with his leading role as Lucas Scott in the massive Warner Bros. television hit “One Tree Hill” from 2003-2012, during which he won three Teen Choice Awards. He showcased his talents as a leading actor playing the outcast-turned-cool-kid throughout his near-decade run. He took position behind the camera as well, both writing and directing an episode of the series. Murray is currently in production on the action-thriller Killing Field, starring as Eric, a man whose life on his serene farm is interrupted when a cop and a pair of dangerous criminals shows up. Bruce Willis, Kate Katzman, Donna D’errico, Swen Temmel, and Zack Ward also star. Murray most recently wrapped production on Ted Bundy: American Boogeyman, starring as America’s most infamous serial killer. The film is slated for theatrical release in August 2021 through Fathom Events. He will also be seen in the upcoming “The Fortress” and “The Fortress 2,” also starring Bruce Willis as well as Jesse Metcalfe. Recently, he starred in the television movies “Colors of Love” and “Too Close for Christmas,” both opposite Jessica Lowndes. Murray has also starred in Lionsgate’s 2020 action film “Survive the Night” alongside Bruce Willis; the Hallmark Channel original movie “Write Before Christmas,” alongside Torrey DeVitto; seasons three and four of the hit teen drama “Riverdale,” in which he played an enigmatic cult leader; and as Atticus Virtue in the family sci-fi thriller Max Winslow and the House of Secrets, which told the story of five teenagers who competed to win a mansion owned by entrepreneur and scientist, Virtue. -

Getting to “The Pointe”

Running head: GETTING TO “THE POINTE” GETTING TO “THE POINTE”: ASSESSING THE LIGHT AND DARK DIMENSIONS OF LEADERSHIP ATTRIBUTES IN BALLET CULTURE Ashley Lauren Whitely B.A., Western Kentucky University, 2003 M.A., Western Kentucky University, 2006 Submitted to the Graduate Faculty under the supervision of Gail F. Latta, Ph.D. in partial fulfillment of the requirements for the degree of Doctor of Education in Leadership Studies Xavier University Cincinnati, OH May 2017 Running head: GETTING TO “THE POINTE” Running head: GETTING TO “THE POINTE” GETTING TO “THE POINTE”: ASSESSING THE LIGHT AND DARK DIMENSIONS OF LEADESHIP ATTRIBUTES IN BALLET CULTURE Ashley Lauren Whitely Dissertation Advisor: Gail F. Latta, Ph.D. Abstract The focus of this ethnographic study is to examine the industry-wide culture of the American ballet. Two additional research questions guided the investigation: what attributes, and their light and dark dimensions, are valued among individuals selected for leadership roles within the culture, and how does the ballet industry nurture these attributes? An understanding of the culture was garnered through observations and interviews conducted in three classically-based professional ballet companies in the United States: one located in the Rocky Mountain region, one in the Midwestern region, and one in the Pacific Northwest region. Data analysis brought forth cultural and leadership themes revealing an industry consumed by “the ideal” to the point that members are willing to make sacrifices, both at the individual and organizational levels, for the pursuit of beauty. The ballet culture was found to expect its leaders to manifest the light dimensions of attributes valued by the culture, because these individuals are elevated to the extent that they “become the culture,” but they also allow these individuals to simultaneously exemplify the dark dimensions of these attributes. -

Gossip Girl-Season1 Episode3 (The Letter)

www.SSEcoach.com Gossip Girl-Season1 Episode3 – Blair reads her letter to Serena Title: Gossip Girl – The letter Time – 2:31 Part 1 - Script 1. Blair: Whenever something’s bothering you, I can always find you here. 2. Serena: You here for another catfight? 3. Serena: What’s that? 4. Blair: A letter; I wrote it to you when you were away at boarding school. 5. Blair: I never sent it. 6. Blair: Dear Serena, my world is falling apart and you’re the only one who would understand. My father left my mother for a 31 year old model; a male model. I feel like screaming because I don’t have anyone to talk to. 7. Blair: You’re gone. My dad’s gone. Nate’s acting weird. Where are you? Why don’t you call? Why did you leave without saying goodbye? 8. Blair: You’re supposed to be my best friend. I miss you so much. Love Blair. 9. Serena: Why didn’t you send it? I would’ve- 10. Blair: You would’ve what! 11. Blair: You knew Serena and you didn’t even call. 12. Serena: I didn’t know what to say to you. I didn’t know how to be your friend after what I did. I’m so sorry. 13. Blair: Erik told me what happened; I guess your family’s been going through a hard time too. 14. Gossip Girl: Spotted in Central Park: Two white flags waving. Could an Upper East Side peace accord be far off? 15. Gossip Girl: So what will it be? Truce or consequences? We all know one nation can’t have two queens. -

Berry Fest Starts Friday Hurricane Prep Underway for Local Officials

1 THURSDAY, MAY 31, 2012 | YOUR COMMUNITY NEWSPAPER SINCE 1874 | 75¢ Lake City Reporter LAKECITYREPORTER.COM Storm season Special treat for ‘berry fest starts Friday Hurricane prep underway for local officials. By TONY BRITT [email protected] Less than two days after Tropical Storm Beryl brought more than six inches of much-needed rain to Columbia County, local officials held a meeting to discuss the 2012 Atlantic Hurricane Season, which begins tomorrow. A hurricane preparedness meet- ing with local constitutional officers and elected officials took place 9 a.m. Wednesday at the Columbia County Emergency Operation Center. Shayne Morgan, Columbia County Emergency Management director, said the meeting was one of three sched- uled for the day to bring local JASON MATTHEW WALKER/Lake City Reporter officials, county Wellborn artist Douglas Fisher is seen with some of his acrylic paintings inspired by the works of the Highwaymen artists. ‘They incorporate their own d e p a r t m e n t style into their art,’ said Fisher, who was nicknamed ‘The Painter’ by some of the Highwaymen. ‘I consider myself the new generation of Highwaymen. heads and emer- I’m carrying on the tradition of their style of art.’ Morgan gency support function staff members up to date on details on the county’s preparation of coming Annual Wellborn event Atlantic hurricane season, which runs from June 1 - Nov. 30. In their preliminary weather reports, fore- to include appearance casters have predicted there will be 10 named storms, four hurricanes. Two of the storms could be major by Highwaymen artist (at least a category 3 hurricane). -

The Intertwining of Multimedia in Emma, Clueless, and Gossip Girl Nichole Decker Honors Scholar Project May 6, 2019

Masthead Logo Scholar Works Honors Theses Honors 2019 Bricolage on the Upper East Side: The nI tertwining of Multimedia in Emma, Clueless, and Gossip Girl Nichole Decker University of Maine at Farmington Follow this and additional works at: https://scholarworks.umf.maine.edu/honors_theses Part of the Comparative Literature Commons Recommended Citation Decker, Nichole, "Bricolage on the Upper East Side: The nI tertwining of Multimedia in Emma, Clueless, and Gossip Girl" (2019). Honors Theses. 5. https://scholarworks.umf.maine.edu/honors_theses/5 This Research Project is brought to you for free and open access by the Honors at Scholar Works. It has been accepted for inclusion in Honors Theses by an authorized administrator of Scholar Works. For more information, please contact [email protected]. 2 Bricolage on the Upper East Side: The Intertwining of Multimedia in Emma, Clueless, and Gossip Girl Nichole Decker Honors Scholar Project May 6, 2019 “Okay, so you’re probably going, is this like a Noxzema commercial or what?” - Cher In this paper I will analyze the classic novel Emma, and the 1995 film Clueless, as an adaptive pair, but I will also be analyzing the TV series, Gossip Girl, as a derivative text. I bring this series into the discussion because of the ways in which it echos, parallels, and alludes to both Emma and Clueless individually, and the two as a source pair. I do not argue that the series is an actual adaptation, but rather, a sort of collage, recombining motifs from both source texts to create something new, exciting, and completely absurd. -

FALL 2016 NEWSLETTER Dean’S Message Welcome to the College of Applied Sciences and Arts (CASA) Fall Newsletter

SHAPING THE WAY WE LIVE, WORK AND PLAY FALL 2016 NEWSLETTER Dean’s Message Welcome to the College of Applied Sciences and Arts (CASA) Fall Newsletter. In this issue you will learn about a INSIDE THIS ISSUE sampling of the many interesting and innovative learning opportunities for all our students within CASA. I want to personally invite you to take the time to read about the accomplishments in the Department of Justice Studies that includes the Fifth Annual CSI Camp as well as a program we are very proud of, the Records Clearance Project. CSI Camp 4 The School of Journalism and Mass Communications offered the first ever Data Journalism Workshop with many experts in the journalism field. Another first, is that CASA coordinated hosting a portion of the annual Alzheimer’s Association Walk on SJSU’s campus. Records Clearance Project 5 We had a chance to meet with many of our emeritus and retired faculty at our annual luncheon. Many are vitally contributing to our community in so many ways as are all our alums, take a look at what they are doing. Data Journalism Workshop 6 We are proud of our CASA alums who are teaching in many of our departments and schools as well as volunteering as guest speakers, and hiring our graduates whenever possible. As I begin my second year as dean of CASA, I am very proud of the accomplishments that the staff, faculty, administrators and students Emeritus and Retired Faculty Luncheon 7 have achieved in the past year. CASA has grown to 352 faculty members, 4454 undergraduates as well as 2397 graduate students in 11 departments and schools.