Promote Iceland Audit V3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Arctic As a Food Producing Region

FINAL REPORT -- THE ARCTIC AS A FOOD PRODUCING REGION The Arctic as a Food Producing Region Final Project Report Prepared for the Arctic Council’s Sustainable Development Working Group February 2019 Contributors to this Report: David Natcher, Yang Yang, Jill Hobbs (University of Saskatchewan), Kristin Hansen, Florent Govaerts, Silje Elde, Ingrid Kvalvik, Bjørg Helen Nøstvold, Rune Rødbotten (Nofima), Sigridur Dalmannsdottir, Hilde Halland, Eivind Uleberg (Nibio), Ólafur Reykdal, Jón Árnason, Páll Gunnar Pálsson, Rakel Halldórsdóttir, Óli Þór Hilmarsson, Gunnar Þórðarson, Þóra Valsdóttir (Matis). Iceland • Marine bioresources play a key role in the bioeconomy of Iceland. Import of food, feed and fertilizers to the region indicates opportunities to increase self-sufficiency, especially with cross sectoral utilisation of side products. • Export of fish and fish products are by far the most important food export items from Iceland. In 2016 about 596 thousand tons fish products were exported for revenue of about 246,000 million ISK. • There are about 3,000 small family-owned sheep farms in Iceland. The challenges for sheep farmers are low income and the need for off-farm employment. Innovation, product development and added value products are very much needed in the sheep value chain. • Geothermal energy makes the production of various vegetables possible in Iceland. This sector can be developed considerably. • The production of the old Icelandic dairy product skyr has increased greatly in Iceland and abroad. A total volume of about 1,300 tons are exported annually for a value of about 500 million ISK. Norway • There is a potential for increased value adding of food produced in the Norwegian Arctic, in both local and national markets. -

View Travel Planning Guide

YOUR O.A.T. ADVENTURE TRAVEL PLANNING GUIDE® New! Arctic Expedition: Untamed Norway & Svalbard 2021 Small Groups: 20-25 travelers—guaranteed! (average of 22) Overseas Adventure Travel ® The Leader in Personalized Small Group Adventures on the Road Less Traveled 1 Dear Traveler, At last, the world is opening up again for curious travel lovers like you and me. And the O.A.T. New! Arctic Expedition: Untamed Norway & Svalbard itinerary you’ve expressed interest in will be a wonderful way to resume the discoveries that bring us so much joy. You might soon be enjoying standout moments like these: Throughout your cruise, you’ll gain in-depth insights into the mysteries of the Arctic alongside an experienced Expedition Team who will share their expertise with you. They’ll provide vital information about your voyage, lead insightful discussions about the Arctic, and join you on every Zodiac excursion. You’ll also meet with two local experts at the Bellona Foundation—an independent non-profit organization working to identify and implement sustainable environmental solutions—to discuss whether the country is acting heroically, or hypocritically, when it comes to the issue of climate change. Although the country boasts some of the most progressive environmentally-friendly practices around the globe, Norway dredges up more oil per capita than most other countries in the world. Some experts say the country is making a grave misstep on the fight to protect the climate, while others believe there are many benefits to Norway’s oil production. We’ll get a firsthand account from both sides of this controversy with a representative of the Bellona Foundation and a local offshore oil worker. -

ITINERARY Icelandic Getaway November 4—10, 2021

icelandic GETAWAY A Nordic Adventure November 4—10, 2021 Icelandic Getaway November 4—10, 2021 THE STUNNING HARPA CONCERT HALL IN REYKJAVÍK’S HARBOR When it comes to Iceland, the scenery is just the tip of the iceberg... Iceland is one of Onward Travel’s favorite places on the planet and we have been there many times to explore this dynamic and exciting destination Imagine yourself… with our travel groups. Over the years we’ve established a robust network of travel partners and friends and an understanding of and appreciation for Soaking away your Icelandic culture. jetlag in the Blue Lagoon Iceland is like nowhere else on earth and during this tour we’ll immerse ourselves in Reykjavík and its surrounds. Our small group will learn about the history of the country from the vikings through the present day; taste Looking up in delight classic dishes, modern Icelandic cuisine, and greenhouse grown tomatoes; as the Northern Lights gain an understanding of geothermal energy and how it enables Icelandic dance above you society to flourish; soak in multiple geothermal pools (the best!); and so (fingers crossed!) much more. Reykjavík is a tiny capital city, perfect for strolling and full of great Eating hot lobster soup restaurants and fabulous shopping. Our fun group of travelers is sure to in Reykjavík’s harbor have a real blast laughing, learning and experiencing Iceland together! OnwardTravel.co Based in Philadelphia, Pennsylvania and the Hudson Valley, New York DAILY ITINERARY Icelandic Getaway November 4—10, 2021 Welcome to Iceland! Reykjavík -

“Art Is in Our Heart”

“ART IS IN OUR HEART”: TRANSNATIONAL COMPLEXITIES OF ART PROJECTS AND NEOLIBERAL GOVERNMENTALITY _____________________________________________ A Dissertation Submitted to the Temple University Graduate Board _____________________________________________ in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy _____________________________________________ By G.I Tinna Grétarsdóttir January, 2010 Examining Committee Members: Dr. Jay Ruby, Advisory Chair, Anthropology Dr. Raquel Romberg, Anthropology Dr. Paul Garrett, Anthropology Dr. Roderick Coover, External Member, Film and Media Arts, Temple University. i © Copyright 2010 by G.I Tinna Grétarsdóttir All Rights Reserved ii ABSTRACT “ART IS IN OUR HEART”: TRANSNATIONAL COMPLEXITIES OF ART PROJECTS AND NEOLIBERAL GOVERNMENTALITY By G.I Tinna Grétarsdóttir Doctor of Philosophy Temple University, January 2010 Doctoral Advisory Committee Chair: Dr. Jay Ruby In this dissertation I argue that art projects are sites of interconnected social spaces where the work of transnational practices, neoliberal politics and identity construction take place. At the same time, art projects are “nodal points” that provide entry and linkages between communities across the Atlantic. In this study, based on multi-sited ethnographic fieldwork in Canada and Iceland, I explore this argument by examining ethnic networking between Icelandic-Canadians and the Icelandic state, which adopted neoliberal economic policies between 1991 and 2008. The neoliberal restructuring in Iceland was manifested in the implementation of programs of privatization and deregulation. The tidal wave of free trade, market rationality and expansions across national borders required re-imagined, nationalized accounts of Icelandic identity and society and reconfigurations of the margins of the Icelandic state. Through programs and a range of technologies, discourses, and practices, the Icelandic state worked to create enterprising, empowered, and creative subjects appropriate to the neoliberal project. -

The Fish Dock: 27 O C T O B

THE FISH DOCK: 27 O C T O B Fresh from the waters of Iceland E R lafur and Maria Baldursson come from families of fishermen, set halibut; salmon, which is farm-raised 5 , on the north-west coast, just under 2 were born and grew up in out to open a store in Bergen County 0 1 Akranes, Iceland, a west that specialized in selling Icelandic the Arctic circle; Arctic char, cod fil- 5 coast port town not far from the cap- fish, helping introduce area residents lets, cod loins and cod cheeks; had- • F Oital city of Reykjavik. Throughout to the cuisine of their homeland. dock; blue ling; ling; tusk; A L their youth they dined on haddock, a Olafurʼs son, Bo Olafsson, wolffish/seawolf; European plaice; L D moved with his family from Iceland and lemon sole. I staple of Icelandic cuisine, and other N Wild Icelandic shrimp (cleaned, I fish from the pristine waters of the this year to open The Fish Dock in N North Atlantic and the Arctic oceans. Closter on June 13. peeled and cooked) and delicious G When the Baldurssons found “We are a family company first European Langoustine Scampi are G U and foremost,” Olafsson said. “We also available. The Fish Dock also I each other again later in life and got D married, they were looking to bring have a passion for bringing some of offers locally sourced wild gulf E something from their homeland to the purest and freshest seafood prod- shrimp (jumbo), dry sea scallops and mussels. the their new home in the Northern ucts from our native country, Ice- This picture is bound to make you hungry. -

Iceland: Land of Fire &

WISE & Healthy Aging presents Iceland: Land of Fire & Ice Featuring Reykjavík, Golden Circle and Thingvellir & Vatnajökull National Parks August 11, 2021 (9 Days) Tour Highlights • Reykjavík • Golden Circle • Gullfoss Waterfall • Geysir • Snæfellsnes Peninsula • Skógafoss • Breidafjördur Bay Cruise • Vik • Seljalandsfoss • Skógar Museum • Vatnajökull National Park & Glacier • Lava Exhibition Center • Learn about the 400-year-old tradition of catching and preserving the Greenland shark • Glide past icebergs on a cruise of the Jökulsárlón Glacial Lagoon • Savor Icelandic cuisine • Relish Iceland’s local cheeses during a visit to a family-owned dairy farm. Inclusions • 13 Meals (7 breakfasts, 6 dinners) • Choices of experiential tours • Sightseeing with local experts Book by Feb. 12 & Save $200 Per Person! Double $4.349 Double $4,149* Single $4,949 Single $4,749 Triple $4,299 Triple $4,099 (For bookings made after Feb. 12, 2021, call for rates) Contact Information Included in Price: Round Trip Air from LAX, Air Taxes and Fees/Surcharges, Hotel Transfers WISE & Healthy Aging • Attn: Grace Cheng Braun Not included in Price: Cancellation Waiver and 1527 4th Street, 2nd Floor, Santa Monica, CA 90401 Insurance of $315 per person * All rates are per person and subject to change, (310) 394-9871 • Fax: (310) 394-7152 based on air inclusive package from LAX [email protected] www.wiseandhealthyaging.org/travel-programs Day 1 ~ Overnight Flight (Wednesday, August 11, 2021) relationship with this trade. Before you go, taste the Icelandic Set out on a journey full of dramatic contrasts. Come to know delicacy “hákarl” cured shark meat. Your day concludes with a Iceland, a place where steaming lava fields reflect a volcanic nature private nature cruise of Breidafjördur Bay with Seatours. -

Icelands-Magical-Northern-Lights

https://gateway.gocollette.com/link/908740 Day-by-Day Itinerary DAY 1 Oct 09, 2019: Overnight Flight You’re on your way to Iceland, a land and culture forged by fire and ice. Where steaming lava fields and massive glaciers sculpt mountains and valleys, leaving thundering waterfalls and plunging fjords. In this land of many natural wonders, enjoy the rare opportunity to see the aurora borealis — one of nature’s most dazzling light displays, also known as the northern lights.* DAY 2 Oct 10, 2019: Reykjavík, Iceland - Tour Begins Your tour opens in Reykjavík, Iceland’s capital city. Get ! Included Meals acquainted with old town Reykjavík on a walking tour featuring Hallgrimskirkja church, city hall, the harbor, and Dinner Reykjavík’s oldest building, now home to the Kraum Icelandic design center. Tonight, gather with your fellow travelers at a popular restaurant for dinner featuring Icelandic cuisine. Then, take an exhilarating northern lights cruise.** Leave behind the bright city lights and sail into the darkness of Faxaflói Bay in search of the aurora borealis – or northern lights – one of nature’s wonders. When revealed, you’ll be dazzled by the flickering light display of bursting color that unfolds before your eyes.* DAY 3 Oct 11, 2019: Reykjavik - Golden Circle - Lava Exhibition Center - Vik Travel the incredible Golden Circle, a route that ! Included Meals encompasses many of Iceland's most renowned natural wonders. Journey to Thingvellir National Park, the Breakfast nation’s most historic area, where Icelanders gathered in Dinner A.D. 930 and established what is considered one of the world’s first parliaments. -

Reykjavík & National Parks

ICELAND Reykjavík & National Parks A Guided Walking Adventure Table of Contents Daily Itinerary ........................................................................... 4 Tour Itinerary Overview .......................................................... 15 Tour Facts at a Glance ........................................................... 18 Traveling To and From Your Tour .......................................... 20 Information & Policies ............................................................ 24 Iceland at a Glance ................................................................ 24 Packing List ........................................................................... 30 800.464.9255 / countrywalkers.com 2 © 2016 Otago, LLC dba Country Walkers Travel Style This small-group Guided Walking Adventure offers an authentic travel experience, one that takes you away from the crowds and deep in to the fabric of local life. On it, you’ll enjoy 24/7 expert guides, premium accommodations, delicious meals, effortless transportation, and local wine or beer with dinner. Rest assured that every trip detail has been anticipated so you’re free to enjoy an adventure that exceeds your expectations. And, with our optional Flight + Tour Combo to complement this destination, we take care of all the travel to simplify the journey. Refer to the attached itinerary for more details (if applicable). Overview Iceland is a country defined by active volcanoes, glaciers, waterfalls, and hot springs; traveling from one place to another means seeing multiple -

Grandeur of Iceland

LAND JO URNEY DAY-BY-DAY ITINERARY Grandeur Day 1 | In Transit Depart for Reykjavik, Iceland. of Icela nd Day 2 | Reykjavik Arrive in Iceland and transfer to the Radisson Blu 1919 Hotel, Reykjavik. ALUMNI CAMPUS Discovery: Reykjavik City Tour. Witness Iceland’s ABROAD ® vibrant capital, including the Hallgrímskirkja Church, House of Parliament, the Harpa Concert Hall and Inspiring Moments the open-air Árbæjarsafn folk museum. Also, admire Reykjavik’s street art scene adorning the buildings. > Thrill to the stirring beauty of the Golden Later tonight, gather for a Welcome Reception. Circle, where bubbling mud pools, geysers and waterfalls dot the landscape. Day 3 | Reykjavik | Eyrarbakki > Encounter Reykjavik, Iceland’s cultural Discovery: Renewable Energy. Iceland’s unique capital, home to culinary ingenuity and geography of volcanoes, hot springs, geysers and colorful streetscapes. mountains is not only stunning but also features a wealth of hydroelectric and geothermal resources. > Discover how Iceland harnesses its vast Take an informative tour of one of the world’s biggest at a state-of- geothermal resources Breeching whale the-art geothermal plant. geothermal power plants and learn how Iceland Behold the mystic and magic of Iceland during this sustainably uses geothermal energy. > Enjoy Saga Music, witnessing Icelandic Enrichment: An expert sagas brought to life by a well-known unforgettable adventure. From our base in Reykjavik, Geothermal Energy. shares facts about Iceland’s green energy industry. musician and lyricist. we’ll journey through wild landscapes of unspeakable beauty, witnessing fantastical land formations, water - > Watch for magnificent breaching whales AHI Connects: Icelandic Saga Songs. Celebrated musicians share a dynamic music and darling puffins during a whale falls, hot springs and charming villages. -

Diversity Spectrum Areas

MMII • DIVERSITY SPECTRUM AREAS GENDER NATIONAL REGION MENTAL AND EMOTIONAL HEALTH/ILLNESS • Underrepresentation of Women in the Male-Dominated Job Sector • Clean Water and International Cooperation • Overcoming Depression and Thoughts of Suicide • Miss Representation: Film Viewing • 313: Life in the Motor City: Book Discussion • Mental Health Awareness Exhibit • Celebrating Women’s History Month • The Abolitionists: Film Viewing • Identifying Mental Health Needs on Campus: Presentation • Media Objectification of Girls and Women • Smyrna: The Destruction of a Cosmopolitan City: Film Viewing • Mathematics Film Series: Proof • Women Who Brew: Breaking the Glass Ceiling: Film Viewing • Quinn Road and the Underground Railroad in Macomb County • Mathematics Film Series: A Beautiful Mind • Half the Sky: Turning Oppression into Opportunity for Women Worldwide: Film Viewing • Paula Tutman, Local Author: Celebrating Black History Month • Macomb STITCHES Doll Project • The Invention of Wings: Book Discussion • The Forum Committee Presents Faye Nelson • Suicide Remembrance Wall • Dangerous Experiment: Changes in Women’s Education in the 19th Century • The Adventures of Huckleberry Finn: Book and Film • Suicide: Student-Created Exhibit • The Re-enactment of the Underground Railroad • The Abolitionists: Film Viewing • Stomp Out Suicide: Shoe Exhibit • Women in Math: Breaking the Barrier • Slavery by Another Name: Film Viewing • Suicide Awareness: Coloring Event • Unmatched: Film Viewing • 2015 Library Fair: Detroit • A Smile as Big as the Moon: Book -

Untamed Iceland 2023

YOUR O.A.T. ADVENTURE TRAVEL PLANNING GUIDE® Untamed Iceland 2023 Small Groups: 8-16 travelers—guaranteed! (average of 13) Overseas Adventure Travel ® The Leader in Personalized Small Group Adventures on the Road Less Traveled 1 Dear Traveler, For me, one of the joys of traveling is the careful planning that goes into an adventure—from the first spark of inspiration to hours spent poring over travel books about my dream destinations—and I can’t wait to see where my next journey will take me. I know you’re eager to explore the world, too, and our Untamed Iceland itinerary described inside is an excellent way to start. Exactly how your adventure unfolds is up to you, because you have many choices to customize it. You can arrive early and stay later—perhaps by adding a pre- or post-trip extension, spending time in a Stopover city, or combining 2 or more trips. Plus, your itinerary is laced with free time, so you’ll have opportunities to do your own thing. More than 80% of the travelers who reserve this trip choose to tailor their adventure. In fact, O.A.T. is the only travel company to offer such flexibility and choice for an experience that is truly personalized. As for Untamed Iceland, thanks to your small group of 8-16 travelers (average 13) you can expect some unforgettable experiences. Here are a few that stood out for me: While I stood in awe of Iceland’s dramatic landscapes and raw natural beauty, I was most impressed by its people and their dedication to protecting the environment and to each other. -

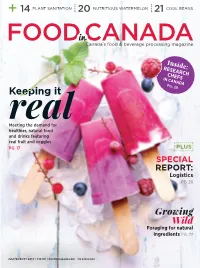

Keeping It G

14 Plant sanitation 20 nutritious watermelon 21 Cool beans Inside: RE SEarc H CHEfs IAN C NADA P Keeping it G. 29 real Meeting the demand for healthier, natural food and drinks featuring real fruit and veggies PG. 17 PLUS SPeciaL RePoRt: Logistics PG. 26 Growing Wild Foraging for natural ingredients PG. 22 JULY/AUGUST 2017 | $15.00 | FoodInCanada.com PM #40069240 001_Cover-7.indd 1 17-07-27 5:58 PM Our focus on premium service means every shipment arrives on time and worry free, backed by an on-time For transborder shipments, OD offers: record and claims ratio that rank among the best in the industry. When shipping to or from the U.S., choose Old Dominion. • A single point of contact with a local OD shipping expert • In-house customs clearance and brokerage services available 24/7 • 100% visibility with door-to-door track and trace • Complete coverage of the U.S. with direct loading to major markets • PARS and PAPS pre-clearance that reduces paperwork issues and delays at the border Old Dominion Freight Line, the Old Dominion logo, OD Household Services and Helping The World Keep Promises are service marks or registered service marks of Old Dominion Freight Line, Inc. All other trademarks and service marks identifi ed herein are the intellectual property of their respective owners. © 2017 Old Dominion Freight Line, Inc., For more information, visit odfl .ca or call 1-800-432-6335. Thomasville, N.C. All rights reserved. 17-1812-04908_Canada_Custom_Content_Barndoor_MagCover_AD_R02A_Final.inddFULLAD-Dominion-BarnDoor.inddBarnDoor.indd 2 1 1 17-07-31 5:05 PM 17-07-315/16/17 4:075:00 PMPM Our focus on premium service means every shipment arrives on time and worry free, backed by an on-time For transborder shipments, OD offers: record and claims ratio that rank among the best in the industry.