HMRC's Management of the U.K. Tax System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

Taxation of Crypto Assets

Taxation of Crypto Assets Edited by Niklas Schmidt Jack Bernstein Stefan Richter Lisa Zarlenga Published by: Kluwer Law International B.V. PO Box 316 2400 AH Alphen aan den Rijn The Netherlands E-mail: [email protected] Website: lrus.wolterskluwer.com Sold and distributed by: Wolters Kluwer Legal & Regulatory U.S. 7201 McKinney Circle Frederick, MD 21704 United States of America Email: [email protected] Printed on acid-free paper. ISBN 978-94-035-2350-7 e-Book: ISBN 978-94-035-2351-4 web-PDF: ISBN 978-94-035-2352-1 © 2021 Niklas Schmidt, Jack Bernstein, Stefan Richter & Lisa Zarlenga All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the publisher. Permission to use this content must be obtained from the copyright owner. More information can be found at: lrus.wolterskluwer.com/policies/permissions-reprints-and-licensing Printed in the United Kingdom. Editors Jack Bernstein is the Senior Tax Partner at Aird & Berlis LLP in Toronto and Chair of the firm’s International Tax practice. Jack is well known in international tax planning, mergers and acquisitions, corporate restructuring, reorganizations and financing. He is experienced in dealing with public and private corporations and has advised hedge funds, venture capital funds and real estate funds. He also has extensive experience in advising high-net-worth private clients on international, cross-border and domestic estate and tax planning. An authority on multijurisdictional matters and a prolific writer and speaker, Jack regularly contributes to leading tax publications globally, including Tax Notes International. -

———————— Number 9 of 2012 ———————— FINANCE ACT 2012 ———————— ARRANGEMENT of SECT

———————— Number 9 of 2012 ———————— FINANCE ACT 2012 ———————— ARRANGEMENT OF SECTIONS PART 1 Income Levy, Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax Chapter 1 Interpretation Section 1. Interpretation (Part 1). Chapter 2 Universal Social Charge 2. Universal social charge: miscellaneous amendments. 3. Universal social charge: surcharge on use of property incentives. Chapter 3 Income Levy and Income Tax 4. Share-based remuneration. 5. Amendment of Schedule 23A (specified occupations and professions) to Principal Act. 6. Amendment of section 470B (age-related relief for health insurance premiums) of Principal Act, etc. 7. Amendment of section 126 (tax treatment of certain benefits payable under Social Welfare Acts) of Principal Act. 8. Relief for key employees engaged in research and develop- ment activities. 9. Amendment of section 244 (relief for interest paid on certain home loans) of Principal Act. 1 [No. 9.]Finance Act 2012. [2012.] 10. Amendment of section 472A (relief for the long term unemployed) of Principal Act. 11. Amendment of section 473A (relief for fees paid for third level education, etc.) of Principal Act. 12. Deduction for income earned in certain foreign states. 13. Amendment of section 825B (repayment of tax where earn- ings not remitted) of Principal Act. 14. Special assignee relief programme. 15. Provisions relating to PAYE. 16. Changes relating to tax relief for lessors, carried forward losses and balancing charges. 17. Provisions in relation to property incentives and capital allowances. 18. Retirement benefits. Chapter 4 Income Tax, Corporation Tax and Capital Gains Tax 19. Amendment of section 176 (purchase of unquoted shares by issuing company or its subsidiary) of Principal Act. -

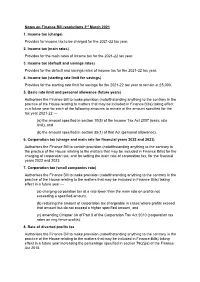

Notes on Finance Bill Resolutions 3Rd March 2021 1

Notes on Finance Bill resolutions 3rd March 2021 1. Income tax (charge) Provides for income tax to be charged for the 2021-22 tax year. 2. Income tax (main rates) Provides for the main rates of income tax for the 2021-22 tax year. 3. Income tax (default and savings rates) Provides for the default and savings rates of income tax for the 2021-22 tax year. 4. Income tax (starting rate limit for savings) Provides for the starting rate limit for savings for the 2021-22 tax year to remain at £5,000. 5. Basic rate limit and personal allowance (future years) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to matters that may be included in Finance Bills) taking effect in a future year for each of the following amounts to remain at the amount specified for the tax year 2021-22 — (a) the amount specified in section 10(5) of the Income Tax Act 2007 (basic rate limit), and (b) the amount specified in section 35(1) of that Act (personal allowance). 6. Corporation tax (charge and main rate for financial years 2022 and 2023) Authorises the Finance Bill to contain provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) for the charging of corporation tax, and for setting the main rate of corporation tax, for the financial years 2022 and 2023. 7. Corporation tax (small companies rate) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) taking effect in a future year — (a) charging corporation tax at a rate lower than the main rate on profits not exceeding a specified amount, (b) reducing the amount of corporation tax chargeable in cases where profits exceed that amount but do not exceed a higher specified amount, and (c) amending Chapter 3A of Part 8 of the Corporation Tax Act 2010 (corporation tax rates on ring fence profits). -

Parliamentary Debates (Hansard)

Wednesday Volume 528 18 May 2011 No. 160 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Wednesday 18 May 2011 £5·00 © Parliamentary Copyright House of Commons 2011 This publication may be reproduced under the terms of the Parliamentary Click-Use Licence, available online through The National Archives website at www.nationalarchives.gov.uk/information-management/our-services/parliamentary-licence-information.htm Enquiries to The National Archives, Kew, Richmond, Surrey TW9 4DU; e-mail: [email protected] 323 18 MAY 2011 324 I am sure the Secretary of State will join me in House of Commons congratulating the Police Service of Northern Ireland and the Garda on the recent Northern Ireland weapons Wednesday 18 May 2011 finds in East Tyrone and South Armagh. Will he give an assurance that the amnesty previously offered under the decommissioning legislation to those handing in, The House met at half-past Eleven o’clock and in possession of, such weapons will no longer apply, and that anyone caught in possession of weapons will be brought before the courts and any evidence arising PRAYERS from examination of the weapons will be used in prosecutions? [MR SPEAKER in the Chair] Mr Paterson: I am grateful to the right hon. Gentleman for his question, and I entirely endorse his comments on the co-operation between the PSNI and the Garda and Oral Answers to Questions the recent arms finds in Tyrone. The amnesty to which he refers expired in February 2010, and we have no plans to reintroduce it. There is no place for arms in NORTHERN IRELAND today’s Northern Ireland. -

Public Bodies Act 2011

Public Bodies Act 2011 CHAPTER 24 Explanatory Notes have been produced to assist in the understanding of this Act and are available separately Public Bodies Act 2011 CHAPTER 24 CONTENTS PART 1 GENERAL ORDER-MAKING POWERS Powers of Ministers 1Power to abolish 2Power to merge 3Power to modify constitutional arrangements 4 Power to modify funding arrangements 5 Power to modify or transfer functions 6 Consequential provision etc Powers of Ministers: supplementary 7 Restrictions on Ministerial powers 8 Purpose and conditions 9Devolution 10 Consultation 11 Procedure 12 Time limits Powers of Welsh Ministers 13 Powers relating to environmental bodies 14 Powers relating to other bodies 15 Powers of Welsh Ministers: consequential provision etc Powers of Welsh Ministers: supplementary 16 Purpose and conditions for orders made by Welsh Ministers 17 Consent of UK Ministers 18 Consultation by Welsh Ministers ii Public Bodies Act 2011 (c. 24) 19 Procedure for orders by Welsh Ministers etc Restrictions on powers of Ministers and Welsh Ministers 20 Restriction on creation of functions 21 Restriction on transfer and delegation of functions 22 Restriction on creation of criminal offences Transfer of property, rights and liabilities 23 Transfer schemes 24 Transfer schemes: procedure 25 Transfer schemes: taxation PART 2 OTHER PROVISIONS RELATING TO PUBLIC BODIES Delegation and shared services 26 Delegation of functions by Environment Agency 27 Delegation of Welsh environmental functions 28 Shared services 29 Shared services: Forestry Commissioners Specific -

Finance Act 2009 (C.10) Which Received Royal Assent on 21 July 2009

These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 FINANCE ACT 2009 —————————— EXPLANATORY NOTES INTRODUCTION 1. These notes relate to the Finance Act 2009 that received Royal Assent on 21st July 2009. They have been prepared by HM Revenue and Customs in partnership with HM Treasury in order to assist the reader in understanding the Act. They do not form part of the Act and have not been endorsed by Parliament. 2. The notes need to be read in conjunction with the Act. They are not, and are not meant to be, a comprehensive description of the Act. So, where a section or part of a section does not seem to require any explanation or comment, none is given. 3. The Act is divided into nine parts: (1) Charges, rates, allowances, etc (2) Income tax, corporation tax and capital gains tax (3) Pensions (4) Value Added Tax (5) Stamp taxes (6) Oil (7) Administration (8) Miscellaneous (9) Final Provisions The Schedules follow the sections on the Act. 4. Terms used in the Act are explained in these notes where they first appear. Hansard references are provided at the end of the notes. 1 These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 SECTION 1: INCOME TAX: CHARGE AND MAIN RATES FOR 2009-10 SUMMARY 1. Section 1 imposes the income tax charge for 2009-10 and sets the basic rate of income tax at 20 per cent and the higher rate at 40 per cent. -

Customs and Excise Acts (Application) (Amendment) Order 2019 Index

Customs and Excise Acts (Application) (Amendment) Order 2019 Index c CUSTOMS AND EXCISE ACTS (APPLICATION) (AMENDMENT) ORDER 2019 Index Article Page 1 Title ................................................................................................................................... 3 2 Commencement .............................................................................................................. 3 3 Interpretation ................................................................................................................... 3 4 Application ...................................................................................................................... 3 5 Amendment of the principal Order ............................................................................. 4 6 Amendment of Customs and Excise Acts (Application) Order 2011 .................... 13 SCHEDULE 15 EXCEPTIONS, ADAPTATIONS AND MODIFICATIONS SUBJECT TO WHICH PART 3 OF SCHEDULE 7, PART 2 OF SCHEDULE 8 AND PARAGRAPH 9 OF SCHEDULE 9 TO THE TAXATION (CROSS-BORDER TRADE) ACT 2018 (C.22 OF PARLIAMENT) SHALL HAVE EFFECT IN THE ISLAND 15 GENERAL MODIFICATION 15 SCHEDULE 7 – IMPORT DUTY: CONSEQUENTIAL AMENDMENTS 15 PART 3 – AMENDMENTS OF OTHER ENACTMENTS 15 SCHEDULE 8 – VAT AMENDMENTS CONNECTED WITH WITHDRAWAL FROM THE EU 17 PART 2 – AMENDMENTS TO OTHER ENACTMENTS 17 SCHEDLE 9 – EXCISE DUTY AMENDMENTS CONNECTED WITH WITHDRAWAL FROM EU 18 PARAGRAPH 9 18 ANNEX 19 ENDNOTES 24 TABLE OF ENDNOTE REFERENCES 24 c SD No.2019/0083 Page 1 Customs and Excise Acts (Application) -

Corporation Tax Act 2010

Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Corporation Tax Act 2010. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes Corporation Tax Act 2010 CHAPTER 4 CORPORATION TAX ACT 2010 PART 1 INTRODUCTION 1 Overview of Act PART 2 CALCULATION OF LIABILITY IN RESPECT OF PROFITS CHAPTER 1 INTRODUCTION 2 Overview of Part CHAPTER 2 RATES AT WHICH CORPORATION TAX ON PROFITS CHARGED 3 Corporation tax rates CHAPTER 3 CALCULATION OF AMOUNT TO WHICH RATES APPLIED 4 Amount of profits to which corporation tax rates applied ii Corporation Tax Act 2010 (c. 4) Document Generated: 2021-09-28 Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Corporation Tax Act 2010. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes CHAPTER 4 CURRENCY The currency to be used in tax calculations 5 Basic rule: sterling to be used 6 UK resident company operating in sterling and preparing accounts in another currency 7 UK resident company operating in currency other than sterling and preparing accounts in another currency 8 UK resident company preparing accounts in currency other than sterling 9 Non-UK resident company preparing return of accounts in currency other than sterling 9A Designated currency of a UK resident -

Legislative Drafting and the Rule of Law Ronan Cormacain Institute Of

Legislative Drafting and the Rule of Law Ronan Cormacain Institute of Advanced Legal Studies, School of Advanced Study, University of London PhD Thesis 2017 1 Declaration The work presented in this thesis is my own. Dedication I dedicate this thesis to my long-suffering family who have endured many years of a father and husband too busy with work to spend time with his family. 2 Abstract The rule of law is a cornerstone of the UK legal order, it states that we are all subject to, and ruled in accordance with, the law. Under Bingham’s analysis, the rule of law is made up of eight separate elements. Element one has four aspects, these are that legislation ought to be accessible, intelligible, clear and predictable. Legislative drafting means turning policy ideas into legislation fit for the statute book – it is literally writing the law. It is best described as phronesis, the subjective application of wisdom. The hypothesis of this thesis is that legislative drafting principles can be derived from element one of Bingham’s definition of the rule of law, and that these drafting principles facilitate the drafting of legislation in accordance with the rule of law. The methodology is deductive reasoning, meaning that each aspect of element one is examined, and from each aspect, drafting principles are derived. The principles therefore flow directly from the rule of law. In Chapter 2 the rule of law requirement of accessibility is dissected. Accessibility means that citizens have access to the law. This leads to the conclusions that legislation ought to be drafted so as to be available (citizens can physically read it), navigable (citizens can find their way around it, particularly to the portion which directly affects them) and inclusive (containing all the relevant legal information). -

Finance Bill Explanatory Notes

Finance Bill Explanatory Notes 19 March 2020 Introduction ....................................................... 11 Part 1: Income Tax, Corporation Tax and Capital Gains Tax .............................................. 12 Clause 1: Income tax charge for tax year 2020 - 21 .......................................................................... 13 Clause 2: Main rates of income tax for tax year 2020- 21 ............................................................... 14 Clause 3: Default and savings rates of income tax for tax year 2020- 21 .................................... 16 Clause 4: Starting rate limit for savings for tax year 2020-21 ........................................................ 18 Clause 5: Main rate of corporation tax for financial year 2020 ............................................. 21 Clause 6: Corporation tax: charge and main rate for financial year 2021 ............................... 22 Clause 7: Determining the appropriate percentage for a car: tax year 2020-21 onwards .............................................................................. 23 Clause 8: Determining the appropriate percentage for a car: tax year 2020-21 only .... 30 1 Clause 9: Determining the appropriate percentage for a car: tax year 2021-22 only .... 35 Clause 10: Apprenticeship bursaries paid to persons leaving local authority care ............... 40 Clause 11: Tax treatment of certain Scottish social security benefits ...................................... 46 Clause 12: Power to exempt social security benefits from income tax -

Civil Service Quarterly Issue 03 January 2014

7 Issue 3 » January 2014 Civil Service Quarterly Legislation.gov.uk and Good Law » Clear laws are essential to the economy and society, but people often find them difficult to understand. Recent research has been exploring how to make legislation better and present it in more effective ways, says John Sheridan, Head of Legislation at The National Archives. It’s not news that people want legislation that is simple, Good Law ...We want... accessible and easy to comply The Good Law initiative to create with. It isn’t always possible: is an appeal to everyone legislation needs to be confidence among users interested in the making precise to have the intended that the law is for them… and publishing of law legal effect, and precision – www.gov.uk/ to come together with can be complicated. But a good-law a shared objective of lot can be done to improve making legislation work the accessibility of the law. well for the users of today That’s the aim of the Good and tomorrow. Law initiative, being led by the any UK statute. Around two Office of the Parliamentary million people do so every Good law is law that is: Counsel (OPC), a partnership month. They are the users • necessary involving everyone with a of Legislation.gov.uk. The • clear role in making, shaping and challenge now is to ensure the • coherent presenting legislation. needs of this new audience • effective The National Archives are properly understood and • accessible manages Legislation.gov. addressed, so they have a fair uk, the official home of UK chance of comprehending the legislation.