Finance Bill Explanatory Notes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

Parliamentary Debates (Hansard)

Wednesday Volume 528 18 May 2011 No. 160 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Wednesday 18 May 2011 £5·00 © Parliamentary Copyright House of Commons 2011 This publication may be reproduced under the terms of the Parliamentary Click-Use Licence, available online through The National Archives website at www.nationalarchives.gov.uk/information-management/our-services/parliamentary-licence-information.htm Enquiries to The National Archives, Kew, Richmond, Surrey TW9 4DU; e-mail: [email protected] 323 18 MAY 2011 324 I am sure the Secretary of State will join me in House of Commons congratulating the Police Service of Northern Ireland and the Garda on the recent Northern Ireland weapons Wednesday 18 May 2011 finds in East Tyrone and South Armagh. Will he give an assurance that the amnesty previously offered under the decommissioning legislation to those handing in, The House met at half-past Eleven o’clock and in possession of, such weapons will no longer apply, and that anyone caught in possession of weapons will be brought before the courts and any evidence arising PRAYERS from examination of the weapons will be used in prosecutions? [MR SPEAKER in the Chair] Mr Paterson: I am grateful to the right hon. Gentleman for his question, and I entirely endorse his comments on the co-operation between the PSNI and the Garda and Oral Answers to Questions the recent arms finds in Tyrone. The amnesty to which he refers expired in February 2010, and we have no plans to reintroduce it. There is no place for arms in NORTHERN IRELAND today’s Northern Ireland. -

Public Bodies Act 2011

Public Bodies Act 2011 CHAPTER 24 Explanatory Notes have been produced to assist in the understanding of this Act and are available separately Public Bodies Act 2011 CHAPTER 24 CONTENTS PART 1 GENERAL ORDER-MAKING POWERS Powers of Ministers 1Power to abolish 2Power to merge 3Power to modify constitutional arrangements 4 Power to modify funding arrangements 5 Power to modify or transfer functions 6 Consequential provision etc Powers of Ministers: supplementary 7 Restrictions on Ministerial powers 8 Purpose and conditions 9Devolution 10 Consultation 11 Procedure 12 Time limits Powers of Welsh Ministers 13 Powers relating to environmental bodies 14 Powers relating to other bodies 15 Powers of Welsh Ministers: consequential provision etc Powers of Welsh Ministers: supplementary 16 Purpose and conditions for orders made by Welsh Ministers 17 Consent of UK Ministers 18 Consultation by Welsh Ministers ii Public Bodies Act 2011 (c. 24) 19 Procedure for orders by Welsh Ministers etc Restrictions on powers of Ministers and Welsh Ministers 20 Restriction on creation of functions 21 Restriction on transfer and delegation of functions 22 Restriction on creation of criminal offences Transfer of property, rights and liabilities 23 Transfer schemes 24 Transfer schemes: procedure 25 Transfer schemes: taxation PART 2 OTHER PROVISIONS RELATING TO PUBLIC BODIES Delegation and shared services 26 Delegation of functions by Environment Agency 27 Delegation of Welsh environmental functions 28 Shared services 29 Shared services: Forestry Commissioners Specific -

Corporation Tax Act 2010

Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Corporation Tax Act 2010. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes Corporation Tax Act 2010 CHAPTER 4 CORPORATION TAX ACT 2010 PART 1 INTRODUCTION 1 Overview of Act PART 2 CALCULATION OF LIABILITY IN RESPECT OF PROFITS CHAPTER 1 INTRODUCTION 2 Overview of Part CHAPTER 2 RATES AT WHICH CORPORATION TAX ON PROFITS CHARGED 3 Corporation tax rates CHAPTER 3 CALCULATION OF AMOUNT TO WHICH RATES APPLIED 4 Amount of profits to which corporation tax rates applied ii Corporation Tax Act 2010 (c. 4) Document Generated: 2021-09-28 Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Corporation Tax Act 2010. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes CHAPTER 4 CURRENCY The currency to be used in tax calculations 5 Basic rule: sterling to be used 6 UK resident company operating in sterling and preparing accounts in another currency 7 UK resident company operating in currency other than sterling and preparing accounts in another currency 8 UK resident company preparing accounts in currency other than sterling 9 Non-UK resident company preparing return of accounts in currency other than sterling 9A Designated currency of a UK resident -

Budget 2020: Overview of Tax Legislation and Rates

Overview of Tax Legislation and Rates 11 March 2020 1 Contents 1. Finance Bill 2020 Personal Tax 4 Capital Allowances 6 Corporate Tax 6 Indirect Tax 7 Avoidance and Evasion 10 Tax Administration 11 2. Measures not in Finance Bill 2020 Personal Tax 13 Capital Allowances 14 Corporate Tax 15 Indirect Tax 16 Property Tax 19 Avoidance and Evasion 19 Tax Administration 21 Table 1: Unchanged measures 22 Table 2: Measures in this document without a corresponding 23 announcement in the Budget report 24 Annex A: Rates and Allowances 62 Annex B: Consultations 63 Annex C: Guide to impact assessments in Tax Information and 67 Impact Notes (TIINs) and full text of TIINs 2 Introduction This document sets out the detail of each tax policy measure announced at Budget 2020. It is intended for tax practitioners and others with an interest in tax policy changes, especially those who will be involved in consultations both on the policy and on draft legislation. Finance Bill 2020 will be published on 19 March 2020. The information in the document is set out as follows: Chapter 1 contains details of measures that are included in Finance Bill 2020. Chapter 2 contains details of measures which are part of Budget 2020 but are not in Finance Bill 2020. Table 1 lists measures where draft legislation was published on 11 July 2019, for consultation, and which remain unchanged. Table 2 lists measures in this document without a corresponding announcement in the Budget report. Annex A provides tables of tax rates and allowances for the tax year 2020 to 2021 and the tax year 2021 to 2022. -

Explanatory Notes to Finance Bill 2020

Finance Bill Explanatory Notes 19 March 2020 Introduction ............................................................................................................................................ 5 Part 1: Income Tax, Corporation Tax and Capital Gains Tax .......................................................... 6 Clause 1: Income tax charge for tax year 2020 - 21 ............................................................................ 7 Clause 2: Main rates of income tax for tax year 2020- 21 ................................................................. 8 Clause 3: Default and savings rates of income tax for tax year 2020- 21 ........................................ 9 Clause 4: Starting rate limit for savings for tax year 2020-21 ........................................................ 10 Clause 5: Main rate of corporation tax for financial year 2020 ...................................................... 11 Clause 6: Corporation tax: charge and main rate for financial year 2021 .................................... 12 Clause 7: Determining the appropriate percentage for a car: tax year 2020-21 onwards .......... 13 Clause 8: Determining the appropriate percentage for a car: tax year 2020-21 only .................. 15 Clause 9: Determining the appropriate percentage for a car: tax year 2021-22 only .................. 17 Clause 10: Apprenticeship bursaries paid to persons leaving local authority care .................... 19 Clause 11: Tax treatment of certain Scottish social security benefits ........................................... -

Finance (No. 3) Bill Explanatory Notes

Finance (No. 3) Bill Explanatory Notes 7 November 2018 Introduction ............................................................................................................................. 5 Part 1: Direct taxes .................................................................................................................. 6 Clause 1: Income tax charge for tax year 2019-20 .............................................................. 7 Clause 2: Corporation tax charge for financial year 2020 ................................................. 8 Clause 3: Main rates of income tax for tax year 2019-20 ................................................... 9 Clause 4: Default and savings rates of income tax for tax year 2019-20 ....................... 10 Clause 5: Basic rate limit and personal allowance ........................................................... 11 Clause 6: Starting rate limit for savings for tax year 2019-20 ......................................... 13 Clause 7: Optional remuneration arrangements: arrangements for cars and vans .... 14 Clause 8: Exemption for benefit in form of vehicle-battery charging at workplace ... 17 Clause 9: Exemptions relating to emergency vehicles .................................................... 19 Clause 10: Exemption for expenses related to travel ....................................................... 22 Clause 11: Beneficiaries of tax-exempt employer-provided pension benefits ............. 24 Clause 12: Tax treatment of social security income ........................................................ -

Form and Accessibility of the Law Applicable in Wales

Law Commission Consultation Paper No 223 FORM AND ACCESSIBILITY OF THE LAW APPLICABLE IN WALES A Consultation Paper ii THE LAW COMMISSION – HOW WE CONSULT About the Commission: The Law Commission is the statutory independent body created by the Law Commissions Act 1965 to keep the law under review and to recommend reform where it is needed. The Law Commissioners are: The Rt Hon Lord Justice Lloyd Jones (Chairman), Stephen Lewis, Professor David Ormerod QC and Nicholas Paines QC. The Chief Executive is Elaine Lorimer. Topic of this consultation paper: The form and accessibility of the law applicable in Wales. Availability of materials: This consultation paper is available on our website in English and in Welsh at http://www.lawcom.gov.uk. Duration of the consultation: 9 July 2015 to 9 October 2015. How to respond Please send your responses either: By email to: [email protected] or By post to: Sarah Young, Law Commission, 1st Floor, Tower, Post Point 1.54, 52 Queen Anne’s Gate, London SW1H 9AG Tel: 020 3334 3953 If you send your comments by post, it would be helpful if, where possible, you also send them to us electronically. After the consultation: In the light of the responses we receive, we will decide our final recommendations and we will present them to the Welsh Government. Consultation Principles: The Law Commission follows the Consultation Principles set out by the Cabinet Office, which provide guidance on type and scale of consultation, duration, timing, accessibility and transparency. The Principles are available on the Cabinet Office website at https://www.gov.uk/government/publications/consultation-principles-guidance. -

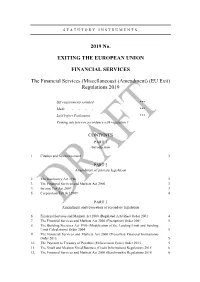

EU Exit) Regulations 2019

STATUTORY INSTRUMENT S 2019 No. EXITING THE EUROPEAN UNION FINANCIAL SERVICES The Financial Services (Miscellaneous) (Amendment) (EU Exit) Regulations 2019 Sift requirements satisfied *** Made - - - - *** Laid before Parliament *** Coming into force in accordance with regulation 1 CONTENTS PART 1 Introduction 1. Citation and commencement 3 PART 2 Amendment of primary legislation 2. The Insolvency Act 1986 3 3. The Financial Services and Markets Act 2000 3 4. Income Tax Act 2007 3 5. Corporation Tax Act 2009 4 PART 3 Amendment and revocation of secondary legislation 6. Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 4 7. The Financial Services and Markets Act 2000 (Exemption) Order 2001 5 8. The Building Societies Act 1986 (Modification of the Lending Limit and Funding Limit Calculations) Order 2004 5 9. The Financial Services and Markets Act 2000 (Prescribed Financial Institutions) Order 2013 5 10. The Payment to Treasury of Penalties (Enforcement Costs) Order 2013 5 11. The Small and Medium Sized Business (Credit Information) Regulations 2015 6 12. The Financial Services and Markets Act 2000 (Benchmarks) Regulations 2018 6 13. The Alternative Investment Fund Managers (Amendment etc.) (EU Exit) Regulations 2019 7 14. The Bank of England (Amendment) (EU Exit) Regulations 2018 7 15. The Central Securities Depositories (Amendment) (EU Exit) Regulations 2018 7 16. The Markets in Financial Instruments (Amendment) (EU Exit) Regulations 2018 7 17. The Bank Recovery and Resolution and Miscellaneous Provisions (Amendment) (EU Exit) Regulations 2018 10 18. The Credit Institutions and Insurance Undertakings Reorganisation and Winding Up (Amendment) (EU Exit) Regulations 2019 10 19. The Financial Services and Markets Act 2000 (Amendment) (EU Exit) Regulations 2019 10 20. -

Corporation Tax Bill and Taxation (International and Other Provisions) Bill

House of Lords House of Commons Joint Committee on Tax Law Rewrite Bills Corporation Tax Bill and Taxation (International and Other Provisions) Bill First Report of Session 2009-10 Report, together with formal minutes and written evidence Ordered by the House of Lords to be printed 11 January 2010 Ordered by the House of Commons to be printed 11 January 2010 HL Paper 31 HC 232 Published on 27 January 2010 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Joint Committee on Tax Law Rewrite Bills The Joint Committee on Tax Law Rewrite Bills is appointed to consider tax law rewrite bills, and in particular to consider whether each bill committed to it preserves the effect of the existing law, subject to any minor changes which may be desirable. Current membership Mr Andrew Tyrie MP (Conservative, Chichester) (elected Chairman, 11 January 2010) Mr William Bain MP (Labour, Glasgow North East) Mr Colin Breed MP (Liberal Democrats, South East Cornwall) Ms Kali Mountford MP (Labour, Colne Valley) Mr Andy Reed MP (Labour, Loughborough) Mr Stephen Timms MP (Labour, East Ham) Mr Peter Viggers MP (Conservative, Gosport) Lord Blackwell (Conservative) Lord Goodhart (Liberal Democrat) Baroness Goudie (Labour) Lord Haskel (Labour) Rt Hon Lord Millett (Cross Bench) Lord Newton of Braintree (Conservative) Powers The Joint Committee is appointed under Standing order No. 152C of the House of Commons and pursuant to the motion of 9 December 2004 of the House of Lords. It has the power to require the submission of written evidence and documents, to examine witnesses, to meet at any time (except when Parliament is prorogued or dissolved), to appoint specialist advisers, and to make Reports to the House. -

M2389 - MCGREGOR PRINT.Indd Xvi 23/9/10 14:03:00 Table of Statutes Xvii

Table of statutes AUSTRALIA BARBADOS Commonwealth Charities Act 1989 170, 183, 184, 185, 254, 257 Australian Human Rights Commission Act 1986 (Cth) 195 CANADA Export Expansion Grants Act 1978 (Cth) 260 Income Tax Act (1985) 26, 28, Extension of Charitable Purpose 30, 31, 259 Act 2004 (Cth) 2, 9, 38, 80, 126, 183–4, 185, 191, 192, 204, 254, 257 CHINA Family Law Act 1974 (Cth) 256 Enterprise Income Tax Law Fringe Benefi ts Tax Assessment 135 Act 1986 (Cth) 187 Public Welfare Donations Income Tax Assessment Act 1997 Law 130–31 (Cth) 41, 187, 191, 259 Trust Law of the People’s Tax Laws Amendment (2005 Republic of China 130, Measures No. 3) Act 135 2005 38 Trade Practices Act 1974 Subordinate legislation (Cth) 256 Provisional Regulations on State Non-enterprise Institutions 1998 131 Legal Profession Act 2007 Regulations on Foundations (Qld) 259 2004 131 Succession Act 1981 (Qld) Regulations on Social 256 Organisations 1998 131 xvi Myles McGregor-Lowndes and Kerry O’Halloran - 9781849807975 Downloaded from Elgar Online at 09/24/2021 10:50:33AM via free access M2389 - MCGREGOR PRINT.indd xvi 23/9/10 14:03:00 Table of statutes xvii IRELAND Income Tax Act 2004 35, 46, 259 Income Tax Act 2007 35, 46 Charities Act 2009 75, 76–94, 95, Maori Land Act 1993 33 96, 97, 98, 100, 119, 126, 138, 140, 159, 184, 185, 186, 197 s. 2 90, 91, 98 UNITED KINGDOM s. 3 76–7, 93, 95 s.3(1) 77–81 Act for the Relief of the Poor s.3(10) 80 1601 184 s.3(11) 80–85 Charitable Trusts Act 1853 13 Charities Acts 1961–73 76, 79, Charitable Uses Act 1601 see 96 Statute of Charitable Uses Finance Act 1998 160 1601 Finance Act 2001 160, 161 Charities Act (Northern Ireland) Freedom of Information Act 1964 14 1997 81, 92, 100 Charities Act (Northern Ireland) Gaming and Lotteries Act 2008 16, 43, 44, 83, 95, 96, 1956 99 118, 121, 126, 183, 184, 185, Irish Nationality and Citizenship 186, 192, 254, 257 Act 2004 97 Charities Act 1960 13, 48, 121 Radio and Television Act Charities Act 2006 (Eng&W) 16, 1988 90 17, 19, 21, 24–5, 31, 43, 44, 48, Statute of Pious Uses 1634 (10 52, 53, 54, 71, 81, 95, 96, 97, Car. -

Finance (No.2) Bill

Finance (No.2) Bill EXPLANATORY NOTES Explanatory notes to the Bill, prepared by HM Revenue & Customs and HM Treasury, are published separately as Bill 270–EN. EUROPEAN CONVENTION ON HUMAN RIGHTS The Chancellor of the Exchequer has made the following statement under section 19(1)(a) of the Human Rights Act 1998: In my view the provisions of the Finance (No.2) Bill are compatible with the Conven- tion rights. Bill 270 58/1 Finance (No.2) Bill CONTENTS PART 1 INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX Income tax charge, rates etc 1 Income tax charge for tax year 2021-22 2 Main rates of income tax for tax year 2021-22 3 Default and savings rates of income tax for tax year 2021-22 4 Starting rate limit for savings for tax year 2021-22 5 Basic rate limit and personal allowance for future tax years Corporation tax charge and rates 6 Charge and main rate for financial years 2022 and 2023 7 Small profits rate chargeable on companies from 1 April 2023 Rate of diverted profits tax 8 Increase in the rate of diverted profits tax Capital allowances: super-deductions etc 9 Super-deductions and other temporary first-year allowances 10 Further provision about super-deductions etc 11 Reduced super-deduction 12 Disposal of assets where super-deduction made 13 Disposal of assets where SR allowance made 14 Counteraction where arrangements are contrived etc Capital allowances: other measures 15 Extension of temporary increase in annual investment allowance 16 Meaning of “general decommissioning expenditure” 17 Extensions of plant or machinery leases