Cabcharge a Nnual Report 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Macquarie Park Bus Network Map Mona Vale to Newcastle 197 Hornsby 575 Hospital Ingleside N 575 Terrey Hills

Macquarie Park bus network map Mona Vale To Newcastle 197 Hornsby 575 Hospital Ingleside N 575 Terrey Hills East Wahroonga St Ives 575 Cherrybrook Castle Hill 619 621 Turramurra 651 Gordon 651 619 621 West Beecroft Baulkham Hills Pennant Hills 295 North Epping South Turramurra To 740 565 Lindfield Plumpton 630 M2 Motorway Stations 575 Yanko Rd West Lindfield 651 740 UTS Kuring-gai 611 619 621 651 611 M54 140 290 292 North Rocks 611 630 Chatswood Marsfield 288 West Killara 545 565 630 619 740 M54 Epping To Blacktown Macquarie 545 611 630 Carlingford Park Macquarie North Ryde Centre/University Fullers Bridge M41 Riverside 292 294 Corporate Park 459 140 Eastwood 506 290 Oatlands 621 651 M41 518 288 Dundas 459 545 289 507 506 M54 Valley North Ryde Denistone M41 288 550 544 East 459 289 North Parramatta Denistone Lane Cove West East Ryde Dundas Ermington 506 Ryde 507 Gore Hill 288 292 Boronia Park 140 Meadowbank 294 Parramatta 289 M54 545 550 507 290 621 To Richmond 651 & Emu Plains 518 Hunters Hill St Leonards Silverwater 140 To Manly Putney Crows Nest M41 Gladesville 459 507 North Sydney Rhodes City - Circular Quay Concord M41 506 507 518 Hospital Drummoyne Concord West City - Wynyard Rozelle North Strathfield Concord Auburn M41 White Bay City - QVB 544 288 290 292 Strathfield 459 Burwood 294 621 651 To Hurstville M41 Legend Busways routes Rail line Forest Coach Lines routes Railway station Hillsbus routes Bus route/suburb Sydney Buses routes Bus/Rail interchange TransdevTSL Shorelink Buses routes Diagrammatic Map - Not to Scale Service -

Operations Review

OPERATIONS REVIEW SINGAPORE PUBLIC TRANSPORT SERVICES (BUS & RAIL) • TAXI AUTOMOTIVE ENGINEERING SERVICES • INSPECTION & TESTING SERVICES DRIVING CENTRE • CAR RENTAL & LEASING • INSURANCE BROKING SERVICES OUTDOOR ADVERTISING Public Transport Services The inaugural On-Demand Public Bus ComfortDelGro Corporation Limited is Services trial, where SBS Transit operated a leading provider of land transport and five bus routes – three in the Joo Koon area related services in Singapore. and two in the Marina-Downtown area – for 2.26 the LTA ended in June 2019. Conducted REVENUE Scheduled Bus during off-peak hours on weekdays, (S$BILLION) SBS Transit Ltd entered into its fourth year commuters could book a ride with an app of operating under the Bus Contracting and request to be picked up and dropped Model (BCM) in 2019, where the provision off at any bus stop within the defined areas. of bus services and the corresponding It was concluded by the LTA that such bus standards are all determined by the Land services were not cost-effective due to Transport Authority (LTA). Under this model, the high technology costs required in the Government retains the fare revenue scaling up. and owns all infrastructure and operating assets such as depots and buses. A major highlight in 2019 was SBS Transit’s active involvement in the three-month long 17,358 Bus routes in Singapore are bundled into public trial of driverless buses on Sentosa TOTAL OPERATING 14 bus packages. Of these, SBS Transit Island with ST Engineering. Operated as an FLEET SIZE operated nine. During the year, it continued on-demand service, visitors on the island to be the biggest public bus operator with could book a shuttle ride on any of the a market share of 61.1%. -

Comfortdelgro Corporation CFA Global Investment Research Challenge Crystal Research (Asia Pacific Region ‐ Singapore) April 2009

ComfortDelGro Corporation CFA Global Investment Research Challenge Crystal Research (Asia Pacific Region ‐ Singapore) April 2009 1 DOMESTIC INTERNATIONAL RISK REWARD INTRODUCTION VALUATION OUTLOOK STRATEGY ANALYSIS Corporate Profile ComfortDelGro Corporation World’s 2nd largest land transport Multiple company in fleet acquisitions in size 7 countries Merger of Comfort Group & DelGro Corp in 2003 2 Conclusion Domestic Earnings Depression Ahead Momentum for • Three different valuation International Growth Impeded approaches suggest further downside of 18‐25% from current levels Expensive Valuation: • SELL reiterated Premium Unjustified • TtTarget price set at $1.10 based on DCF –FCFF approach 3 DOMESTIC INTERNATIONAL RISK REWARD INTRODUCTION VALUATION OUTLOOK STRATEGY ANALYSIS Others Australia 04%0.4% $2.30 Domestic:7% Earnings China Depression8% Ahead Singapore $2.00 57% $1.70 $1.40 ComfortDelgro $1.10 ? UK/Ireland 27% $0.80 International: Impetus Expensive Valuation: for Growth Hindered Premium Unjustified 4 DOMESTIC INTERNATIONAL RISK REWARD INTRODUCTION VALUATION OUTLOOK STRATEGY ANALYSIS Singapore Market Analysis Bus Revenue Facing Significant Headwinds Significant Headwinds in Bus Market Erosion of Taxi Rental Margins IntroduceSingapore BusCompetitive & Rail Ridership tendering % Growth Disintegration of Land Transport 15% new ppylayers of bus routes duoppyoly structure Immaterial Rail Au thority Contribution Master Plan GreaterEast rail‐ Westpenetration Rail Substitution effectNorth of new‐East rail Rail 10% cannibalisingLine extension -

![GC Cabbie Nov 9 for PDF[1]](https://docslib.b-cdn.net/cover/0253/gc-cabbie-nov-9-for-pdf-1-1200253.webp)

GC Cabbie Nov 9 for PDF[1]

I S S U E MONTHLY 9 N O V E M B E R 2 0 0 9 GC Cabbie this issue From the CEO CEO News P.1 Operational News P.2 Once again the Gold Coast has shown it’s resiliency in the face of global pressures; the media has essentially reported that we are now in the Marketing / Ombudsman Survey P.3 middle of a boom, the restaurants are busy, there are people out and Accounts P.4 about and the public are travelling again. Our figures have shown the same trend: bookings have increased over the last three months and Technical Services P .5 our hope is that the trend continues. Our Contact Centre Staff have Human Resources / Dreamworld Rank P.6 been under pressure as the calls have increased faster than antici- pated, thus, we have hired additional staff to assist with the Christmas Customer Feedback P.7 period. I would like to congratulate all of the Customer Service Reps Customer Feedback P.8 and Radio Operators for their efforts. Following on from a disappointing SuperGP we are heading into our traditionally busy period. Everyone within the Gold Coast Cabs group needs to ensure that we continue to provide exceptional customer service even when it is busy: • Smile • Be courteous • Be helpful (put the luggage / shopping into the car, open the door for the passenger etc) • Take pride in your work, car and appearance • Drive safely • Offer to change the radio station or to turn it off • Ask if they are comfortable, adjust / turn on the air-conditioning • Don’t speak on your mobile phone (even hands free) with passengers in the car • Be positive Do every job: every customer is to be treated equally, regardless of whether they are travelling around the cor- ner or going further. -

Government Pension Fund – Global Holding of Equities at 31 December 2007

NORGES BA N K IN VESTME N T MA N AGEME N T ANNU A L REPO R T 2007 1 Government Pension Fund – Global Holding of equities at 31 December 2007 Europe Market value (NOK 1000) Ownership stake (per cent) Voting (per cent) Market value (NOK 1000) Ownership stake (per cent) Voting (per cent) AUSTRIA CROATIA Agrana Beteiligungs AG 7 370 0,092 0,092 Hrvatski Telekom dd 9 366 0,031 0,031 Andritz AG 44 606 0,261 0,261 A-TEC Industries AG 8 731 0,183 0,183 CYPRUS Austriamicrosystems AG 14 733 0,545 0,544 Bank of Cyprus Public Co Ltd 258 088 0,462 0,462 Austrian Airlines AG 4 904 0,115 0,115 Marfin Popular Bank Public Co Ltd 112 322 0,195 0,195 Boehler-Uddeholm AG 21 637 0,077 0,077 bwin Interactive Entertainment AG 23 914 0,346 0,346 CZECH REPUBLIC BWT AG 7 777 0,151 0,151 Philip Morris CR AS 23 736 0,364 0,364 CA Immo International AG 6 034 0,151 0,151 CA Immobilien Anlagen AG 34 729 0,328 0,328 DENMARK CAT Oil AG 4 798 0,082 0,082 A P Moller - Maersk A/S 921 847 0,363 0,433 Conwert Immobilien Invest SE 26 735 0,328 0,328 ALK-Abello A/S 13 504 0,209 0,230 Erste Bank der Oesterreichischen Sparkassen AG 729 685 0,599 0,599 Alm Brand A/S 7 943 0,125 0,125 EVN AG 62 871 0,219 0,219 Amagerbanken A/S 5 234 0,176 0,176 Flughafen Wien AG 19 884 0,151 0,151 Auriga Industries 3 080 0,123 0,175 Immoeast AG 173 045 0,355 0,355 Bang & Olufsen A/S 21 199 0,342 0,377 IMMOFINANZ AG 179 658 0,709 0,709 Bavarian Nordic A/S 3 610 0,148 0,148 Intercell AG 15 019 0,157 0,157 Biomar Holding A/S 2 573 0,112 0,112 Lenzing AG 3 475 0,033 0,033 Carlsberg A/S 97 282 0,199 -

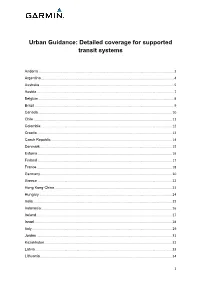

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia ................................................................................................................................................. -

Spotto Cash Card Product Disclosure Statement

SPOTTO CASH CARD PRODUCT DISCLOSURE STATEMENT In this Product Disclosure Statement for the Spotto Cash Card you will find: Part A – General Information and Part B – Terms and Conditions including Fees and Charges Dated 5 June 2019 Page 1 of 24 CONTENTS Part A General Information ........................................................................................................................................ 4 1. About this Product Disclosure Statement ................................................................................................ 4 2. Electronic Statements ................................................................................................................................. 4 3. Changes to this PDS .................................................................................................................................... 4 4. General Product Description ...................................................................................................................... 4 5. Parties involved in the distribution of the Card........................................................................................ 5 6. Card Issuer .................................................................................................................................................... 5 7. Roles of the card Distributors and Issuer ................................................................................................. 5 8. Who is eligible for the Card? ...................................................................................................................... -

Perspectives on Payments Regulation – It Depends Which Way You Look At

Perspectives on Payments Regulation – It depends which way you look at it… March 2020 Lance Blockley David Ojerholm Mitchell Hu The Japanese remain welded to the use of cash, whilst Australians are heavy users of payment cards - there are clearly lots of differences between the two countries, but one is certainly the cost for merchants to accept a card payment, which has been regulated down to a low level in Australia. Whether or not regulation is good or bad often depends which side of the fence you sit. Sometimes society demands it to solve a problem. Sometimes legislators impose it to solve a problem that is over the horizon or we don’t yet know we have. But with regulation, there are almost always unintended consequences, winners and losers, storm clouds and silver linings. The RBA introduces payments regulation to Australia With respect to credit cards, the RBA first introduced interchange regulation in January 2003 that allowed merchants to recover the costs of accepting card payments – the right to surcharge. The second part of the reform was introduced in October 2003 to limit the level of interchange being paid by acquirers to issuers on credit cards to a weighted average of 0.55%. Data supporting the achievement of the average was to be reviewed every 3 years, with a re-set of Scheme interchange rates if necessary. Debit cards and 3-party Scheme cards, such as American Express and Diners Club, were not regulated. The 0.55% rate1 was determined following separate credit card cost studies undertaken by Visa and Mastercard, as mandated by the RBA, which also defined what the Schemes and their credit card issuing banks were permitted to include in their cost calculations. -

Comfortdelgro Acquires Third Largest Taxi And

COMFORTDELGRO ACQUIRES THIRD LARGEST TAXI AND PRIVATE HIRE OPERATOR IN LIVERPOOL CITY REGION 10 March 2020 – ComfortDelGro Corporation is expanding its foothold in the United Kingdom (UK) through a £7 million (S$12.5 million) acquisition of the third largest taxi and private hire operator in the Liverpool City Region. The acquisition of Argyle Satellite Ltd and Argyle Satellite Contract Services Ltd (collectively known as AST) will be conducted through the Group’s wholly-owned subsidiary, CityFleet Networks Limited. AST, which manages more than 700 self-employed drivers on its circuit and handles about 200 active corporate accounts, will complement CityFleet’s existing 400-strong taxi operation in Liverpool. ComfortDelGro Managing Director/Group CEO, Mr Yang Ban Seng, explained: “This acquisition is line with our intention to grow our operations in the UK outside of London. It will expand, synergise and consolidate our position as the leading point-to-point passenger transport operator in Liverpool through an expansion of the customer base and driver pool.” AST currently operates across three licensing areas in Liverpool City Region – The Wirral, Liverpool and Cheshire West, as well as Chester. In addition to those existing licensing areas, AST also recently acquired a licence in the Sefton area which will facilitate growth in that borough and add to the overall fleet strength. In each of these areas, AST hold private hire licences and drivers can operate in any of the areas covered. Besides taxi and private hire operations in Liverpool, the Group operates a fleet of about 3,000 radio taxis in London and Aberdeen. -

Revenue Result Following 5 Year Commitment to Strengthening Revenue Mix

1H20 highlights ▪ Record 1H revenue result following 5 year commitment to strengthening revenue mix ▪ Mobile Technologies International and Gold Coast Cabs performing above post acquisition expectations ▪ Fully digitised Cabcharge Payment offering gaining traction ▪ Launch of new Network/Bureau services in Mackay, Gold Coast, Tweed Heads, Perth and Albury Wodonga extending national footprint ▪ Strong organic growth in new Champ Network established in Perth during 1H20 from 0 to 223 cars ▪ Accelerating growth in handheld payments with Spotto growth up 22% ▪ Preferred Driver program launched giving Passengers more choice and control ▪ Installation of next generation in-car equipment ▪ App bookings up 19% 2 1H20 Overview A2B grew revenue, improved its services and enhanced the value propositions of its core products. 13cabs expanded its national personal transport footprint and MTI extended its global technology reach with new clients. Additional investment in marketing came at a short term cost but contributed to a strengthened 13cabs brand and growing use of digital booking channels (13cabs app up 19% and 13cabs mobile web up 66%). Competition with rideshare continued in 1H20 although there are now signs that Taxi patronage has stabilised. Our determination to raise the bar with higher qualifying standards for Driver professionalism and for 13cabs and Silver Service vehicles coincided with a temporary impact of short term tactics amongst smaller Taxi network and payment providers who are less invested in market changes. Meanwhile A2B was impacted by an aggregate $1.1m from adverse changes in Taxi licence markets, particularly in NSW. Government policy changes in NSW have deferred the full benefits of our investment in Safety cameras for up to 12 months while 88 Wheelchair Accessible Taxis were excluded from the fleet in Sydney. -

Multipurpose Fare Media: Developments and Issues

Transit Cooperative Research Program Sponsored by the Federal Transit Administration RESEARCH RESULTS DIGEST June 1997--Number 16 Subject Area: VI Public Transit Responsible Senior Program Officer: Stephen J Andrle Multipurpose Fare Media: Developments and Issues This TCRP digest presents the interim findings of TCRP Project A-14, "Potential of Multipurpose Fare Media," conducted by Multisystems, Inc., in collaboration with Dove Associates, Inc., and Mundle & Associates, Inc. Included in the digest are (1) a summary of the emerging developments, (2)a discussion of key issues and concerns, and (3) a technicalappendix presenting the results of a survey of transit operators fare collection practices and plans. CHAPTER 1--INTRODUCTION These may overlap, and in particular, the latter two approaches are often pursued together. This digest contains examples of multipurpose TCRP Project A-14, Potential of Multipurpose transit fare payment programs and discusses Fare Media, is intended to identify issues and institutional, technological, and financial issues that concerns on the part of transit agencies and financial must be addressed to implement such programs. This institutions, assess customer and financial will be of interest to transit managers, transit implications associated with various approaches, planners, transit financial officers, and other financial monitor emerging developments, and assess the professionals. The desire on the part of both transit potential of increasing the role of the banking agencies and financial institutions to reduce the use industry in transit fare payment and collection. This of cash for payments and improve customer research is intended to provide both transit and convenience has dovetailed with advancements in the financial services professionals (1) an understanding payment technology area to facilitate various types of of the nature of the costs and potential benefits of "multipurpose" media. -

Transport for a Connected City

STRATEGIC DIRECTION C TRANSPORT FOR A CONNECTED CITY METROPOLITAN PLAN FOR SYDNEY 2036 | PAGE 81 Introduction SYDneY IN 2010 The metropolitan heavy rail network is the The rail backbone of Sydney’s public transport system and network Sydney’s transport needs are met by several modes has helped shaped the city’s extensive suburban including rail, road, ferries and buses. This complex development around rail corridors. The city rail caters for system has expanded over time to meet Sydney’s network caters for almost one million passengers almost growth and changing travel demands. a day on a network of some 2,110 km of track from Dungog in the north to Nowra in the south and one million The road network is critical to Sydney’s economy out to Goulburn and Lithgow. The metropolitan passenger and to the daily lives of Sydneysiders. Of the 16.3 component of the network (bounded by Berowra, million trips undertaken on an average weekday, Emu Plains, Macarthur and Waterfall) comprises trips a day 92 per cent are by road for a variety of purposes 830 km of track. The majority of passenger including commuting to work and education, movements on the rail network are between shopping, recreation and the distribution of Sydney’s suburbs, the CBD, and the Global goods via light commercial and heavy vehicles. Economic Corridor (from Macquarie Park through Motorways are the workhorse of the network, Chatswood and the CBD to Sydney Airport and with several sections moving more than 100,000 Port Botany in the south). vehicles a day. While car travel offers flexibility and is effective for multi–purpose trips, the benefits of public transport for particular destinations and at particular times of day are well recognised.