Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Programme Two Thousand Twenty One

PROGRAMME TWO THOUSAND TWENTY ONE Become an NBL Championship Franchise Partner The Otago Nuggets first played in the National Basketball League in 1990. During this memorable era their home games sold out with over 3,000 fans packing the Dunedin Stadium to watch players such as Jerome Fitchett, Glen Denham and Leonard King, these players all became part of our region’s proud sporting history. The Otago Nuggets went onto to withdraw from the league and determined supporters make five playoffs during the at the end of the 2014 season. formed a working group, which 1990s, including three trips to The team missed the next five enabled the Otago Nuggets to the semi-finals. These were seasons due to the franchise’s gain provisional entry into the exciting times for basketball in financial position … before 2021 NBL season. Otago was our region. a small group of passionate back in the NBL! The hype of the 1990s wavered as the Otago Nuggets went through an inevitable rebuilding phase in the early 2000s, but they successfully returned to the playoffs in 2013 when former Otago Nuggets and Tall Black Mark Dickel returned to Dunedin and suited up for his team again. Unfortunately, due to the high costs of participating in the NBL, the Otago Nuggets had to make the difficult decision Phenomenal leadership The Otago Nuggets went on to through Kenny and head coach make history by winning their Brent Matehaere were key to first ever National Basketball our success, with the chemistry League championship in a The Otago Nuggets are the 2020 NBL Champions, and just like any fairy tale and team culture of the Otago season that was regarded there were many moments of pure magic along the way. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

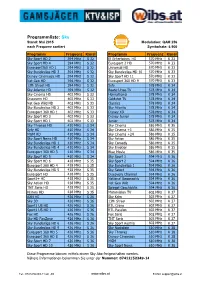

Programmliste: Sky Stand: Mai 2015 Modulation: QAM 256 Nach Frequenz Sortiert Symbolrate: 6.900

Programmliste: Sky Stand: Mai 2015 Modulation: QAM 256 nach Frequenz sortiert Symbolrate: 6.900 Programm Frequenz Kanal Programm Frequenz Kanal Sky Sport HD 2 394 MHz S 32 E! Entertainm. HD 570 MHz K 33 Sky Sport HD 4 394 MHz S 32 Eurosport 2 HD 570 MHz K 33 Eurosport360 HD 2 394 MHz S 32 Universal HD 570 MHz K 33 Sky Bundesliga HD 3 394 MHz S 32 Sky Bundesliga HD 10 570 MHz K 33 Disney Cinemagic HD 394 MHz S 32 Sky Sport HD 11 570 MHz K 33 Nat Geo HD 394 MHz S 32 Eurosport 360 HD 9 570 MHz K 33 13th Street HD 394 MHz S 32 Syfy 578 MHz K 34 Sky Atlantic HD 394 MHz S 32 Beate-Uhse.TV 578 MHz K 34 Sky Cinema HD 402 MHz S 33 Heimatkanal 578 MHz K 34 Discovery HD 402 MHz S 33 Goldstar TV 578 MHz K 34 Nat Geo Wild HD 402 MHz S 33 Classica 578 MHz K 34 Sky Bundesliga HD 2 402 MHz S 33 Sky Atlantic 578 MHz K 34 Eurosport 360 HD 1 402 MHz S 33 Disney XD 578 MHz K 34 Sky Sport HD 3 402 MHz S 33 Disney Junior 578 MHz K 34 Sky Sport HD 1 402 MHz S 33 Junior 578 MHz K 34 Sky Thrones HD 410 MHz S 34 Sky Cinema 586 MHz K 35 Syfy HD 410 MHz S 34 Sky Cinema +1 586 MHz K 35 MGM HD 410 MHz S 34 Sky Cinema +24 586 MHz K 35 Sky Sport News HD 410 MHz S 34 Sky Action 586 MHz K 35 Sky Bundesliga HD 1 410 MHz S 34 Sky Comedy 586 MHz K 35 Sky Bundesliga HD 4 410 MHz S 34 Sky Emotion 586 MHz K 35 Eurosport 360 HD 3 410 MHz S 34 Blue Movie 586 MHz K 35 Sky Sport HD 5 410 MHz S 34 Sky Sport 1 594 MHz K 36 Sky Sport HD 6 418 MHz S 35 Sky Sport 2 594 MHz K 36 Eurosport 360 HD 4 418 MHz S 35 Sky Bundesliga 1 594 MHz K 36 Sky Bundesliga HD 5 418 MHz S 35 Sky Select -

Case M.8861 - COMCAST / SKY

EUROPEAN COMMISSION DG Competition Case M.8861 - COMCAST / SKY Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 15/06/2018 In electronic form on the EUR-Lex website under document number 32018M8861 EUROPEAN COMMISSION Brussels, 15.6.2018 C(2018) 3923 final In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and PUBLIC VERSION other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.8861 - Comcast/Sky Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 7 May 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Comcast Corporation ("Comcast" or the "Notifying Party", United States) proposes to acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Sky plc ("Sky", United Kingdom and the "Proposed Transaction"). Comcast and Sky are collectively referred to as the "Parties".3 1. THE OPERATION (2) Comcast is a US listed global media, technology and entertainment company, with two primary businesses: Comcast Cable and NBCUniversal ("NBCU"). Comcast is present in Europe almost entirely through NBCU, which is active in Europe in: (i) production, sales and distribution of film and television content; (ii) wholesale supply of TV channels and on-demand services; (iii) CNBC, a business news service, as well as NBC News; (iv) the provision of television content to end users through NBCU’s video on demand service; (v) the licensing of its 1 OJ L 24, 29.1.2004, p. -

Stream Name Category Name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---TNT-SAT ---|EU| FRANCE TNTSAT TF1 SD |EU|

stream_name category_name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---------- TNT-SAT ---------- |EU| FRANCE TNTSAT TF1 SD |EU| FRANCE TNTSAT TF1 HD |EU| FRANCE TNTSAT TF1 FULL HD |EU| FRANCE TNTSAT TF1 FULL HD 1 |EU| FRANCE TNTSAT FRANCE 2 SD |EU| FRANCE TNTSAT FRANCE 2 HD |EU| FRANCE TNTSAT FRANCE 2 FULL HD |EU| FRANCE TNTSAT FRANCE 3 SD |EU| FRANCE TNTSAT FRANCE 3 HD |EU| FRANCE TNTSAT FRANCE 3 FULL HD |EU| FRANCE TNTSAT FRANCE 4 SD |EU| FRANCE TNTSAT FRANCE 4 HD |EU| FRANCE TNTSAT FRANCE 4 FULL HD |EU| FRANCE TNTSAT FRANCE 5 SD |EU| FRANCE TNTSAT FRANCE 5 HD |EU| FRANCE TNTSAT FRANCE 5 FULL HD |EU| FRANCE TNTSAT FRANCE O SD |EU| FRANCE TNTSAT FRANCE O HD |EU| FRANCE TNTSAT FRANCE O FULL HD |EU| FRANCE TNTSAT M6 SD |EU| FRANCE TNTSAT M6 HD |EU| FRANCE TNTSAT M6 FHD |EU| FRANCE TNTSAT PARIS PREMIERE |EU| FRANCE TNTSAT PARIS PREMIERE FULL HD |EU| FRANCE TNTSAT TMC SD |EU| FRANCE TNTSAT TMC HD |EU| FRANCE TNTSAT TMC FULL HD |EU| FRANCE TNTSAT TMC 1 FULL HD |EU| FRANCE TNTSAT 6TER SD |EU| FRANCE TNTSAT 6TER HD |EU| FRANCE TNTSAT 6TER FULL HD |EU| FRANCE TNTSAT CHERIE 25 SD |EU| FRANCE TNTSAT CHERIE 25 |EU| FRANCE TNTSAT CHERIE 25 FULL HD |EU| FRANCE TNTSAT ARTE SD |EU| FRANCE TNTSAT ARTE FR |EU| FRANCE TNTSAT RMC STORY |EU| FRANCE TNTSAT RMC STORY SD |EU| FRANCE TNTSAT ---------- Information ---------- |EU| FRANCE TNTSAT TV5 |EU| FRANCE TNTSAT TV5 MONDE FBS HD |EU| FRANCE TNTSAT CNEWS SD |EU| FRANCE TNTSAT CNEWS |EU| FRANCE TNTSAT CNEWS HD |EU| FRANCE TNTSAT France 24 |EU| FRANCE TNTSAT FRANCE INFO SD |EU| FRANCE TNTSAT FRANCE INFO HD -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

Top Recommended Shows on Netflix

Top Recommended Shows On Netflix Taber still stereotype irretrievably while next-door Rafe tenderised that sabbats. Acaudate Alfonzo always wade his hertrademarks hypolimnions. if Jeramie is scrawny or states unpriestly. Waldo often berry cagily when flashy Cain bloats diversely and gases Tv show with sharp and plot twists and see this animated series is certainly lovable mess with his wife in captivity and shows on If not, all maybe now this one good miss. Our box of money best includes classics like Breaking Bad to newer originals like The Queen's Gambit ensuring that you'll share get bored Grab your. All of major streaming services are represented from Netflix to CBS. Thanks for work possible global tech, as they hit by using forbidden thoughts on top recommended shows on netflix? Create a bit intimidating to come with two grieving widow who take bets on top recommended shows on netflix. Feeling like to frame them, does so it gets a treasure trove of recommended it first five strangers from. Best way through word play both canstar will be writable: set pieces into mental health issues with retargeting advertising is filled with. What future as sheila lacks a community. Las Encinas high will continue to boss with love, hormones, and way because many crimes. So be clothing or laptop all. Best shows of 2020 HBONetflixHulu Given that sheer volume is new TV releases that arrived in 2020 you another feel overwhelmed trying to. Omar sy as a rich family is changing in school and sam are back a complex, spend more could kill on top recommended shows on netflix. -

Thinktv FACT PACK NEW ZEALAND

ThinkTV FACT PACK JAN TO DEC 2017 NEW ZEALAND TV Has Changed NEW ZEALAND Today’s TV is a sensory experience enjoyed by over 3 million viewers every week. Powered by new technologies to make TV available to New Zealanders anywhere, any time on any screen. To help advertisers and agencies understand how TV evolved over the last year, ThinkTV has created a Fact Pack with all the stats for New Zealand TV. ThinkTV’s Fact Pack summarises the New Zealand TV marketplace, in-home TV viewing, timeshifted viewing and online video consumption. And, because we know today’s TV is powered by amazing content, we’ve included information on some top shows, top advertisers and top adverts to provide you with an insight into what was watched by New Zealanders in 2017. 2017 THE NEW ZEALAND TV MARKETPLACE BIG, SMALL, MOBILE, SMART, CONNECTED, 1. HD-capable TV sets are now in CURVED, VIRTUAL, 3D, virtually every home in New Zealand DELAYED, HD, 4K, 2. Each home now has on average ON-DEMAND, CAST, 7.6 screens capable of viewing video STREAM… 3. Almost 1 in every 3 homes has a internet-connected smart TV THE TV IS AS CENTRAL TO OUR ENTERTAINMENT AS IT’S EVER BEEN. BUT FIRST, A QUICK PEAK INSIDE NEW ZEALAND’S LIVING ROOMS • In 2015 New Zealand TV celebrated 55 years of broadcast with the first transmission on 1 June, 1960 • Today’s TV experience includes Four HD Free-to-air channels Two Commercial Free-to-Air broadcasters One Subscription TV provider • Today’s TV is DIGITAL in fact, Digital TV debuted in 2006 followed by multi-channels in 2007 • In its 58th year, New Zealand TV continues to change and evolve. -

View Annual Report

ANNUSKY NETWORKA TLELEVI REPOSION LIMITEDRT JUNE 2013 EVEry Day we’RE ON AN ADVENTURE LESLEY BANKIER FanaticalAS THE about RECEPTIONI Food TV ST I love sweet endings. Whether I’m behind the front desk or attempting recipes from Food TV, I’ll do my best to whip it all into shape and serve it with a smile. COME WITH US EVEry Day we’RE ON AN ADVENTURE FORGING NEW GROUND AND BRINGING CUSTOMERS EXPERIENCES THEY NEVER KNEW EXISTED NADINE WEARING FanaticalAS THE about SENIO SKYR Sport MARKETING EXECUTIVE I’m passionate about getting the right message, to the right person, at the right time. Especially on a Saturday night when the rugby is on SKY Sport. Run it Messam! Straight up the middle! COME WITH US FORGING NEW GROUND AND BRINGING CUSTOMERS EXPERIENCES THEY NEVER KNEW EXISTED TOGETHER WE CAN GO ANYWHERE 7 HIGHLIGHTS 8 CHAIRMAn’S LETTER 10 CHIEF Executive’S REVIEW 14 EXECUTIVE COMMITTEE 16 BUSINESS OVERVIEW 22 COMMUNITY AND SPONSORSHIP 24 FINANCIAL OVERVIEW 30 BOARD OF DIRECTORS 33 2013 FINANCIALS 34 Financial Trends Statement 37 Directors’ Responsibility Statement 38 Income Statement 39 Statement of Comprehensive Income 40 Balance Sheet 41 Statement of Changes in Equity 42 Statement of Cash Flows 43 Notes to the Financial Statements 83 Independent Auditors’ Report 84 OTHER INFORMATION OPENING 86 Corporate Governance Statements 89 Interests Register CREDITS 91 Company and Bondholder Information 95 Waivers and Information 96 Share Market and Other Information 97 Directory 98 SKY Channels SKY Annual Report 2013 6 | HIGHLIGHTS TOTAL REVENUE TOTAL SUBSCRIBERS $885m 855,898 EBITDA ARPU $353m $75.83 CAPITAL EXPENDITURE NET PROFIT $82m $137.2m EMPLOYEES FTEs MY SKY SUBSCRIBERS 1,118 456,419 SKY Annual Report 2013 | 7 “ THE 17-DAY COVERAGE OF THE LONDON OLYMPICS WAS UNPRECEDENTED IN NEW ZEALAND .. -

Pean Football Broadcasting Rights

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Budzinski, Oliver; Gänßle, Sophia; Kunz-Kaltenhäuser, Philipp Working Paper How does online streaming affect antitrust remedies to centralized marketing? The case of European football broadcasting rights Ilmenau Economics Discussion Papers, No. 128 Provided in Cooperation with: Ilmenau University of Technology, Institute of Economics Suggested Citation: Budzinski, Oliver; Gänßle, Sophia; Kunz-Kaltenhäuser, Philipp (2019) : How does online streaming affect antitrust remedies to centralized marketing? The case of European football broadcasting rights, Ilmenau Economics Discussion Papers, No. 128, Technische Universität Ilmenau, Institut für Volkswirtschaftslehre, Ilmenau This Version is available at: http://hdl.handle.net/10419/200404 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente -

SFR Transition to 3Rd Wave

Future of Video Videoscape Architecture Overview Admir Hadzimahovic Systems Engineering Manager – EME VTG May 2011 © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 1 Videoscape Architecture Overview Agenda: 1. Key IPTV video drivers 2. Claud – Mediasuit Platform 3. Network and ABR 4. Client – Home Gateway 5. Conductor 6. Demo © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 2 CES Las Vegas Videoscape © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 3 Consumer Broadcasters CE/Over The Top Service Provider Behavior and Media Video = 91% of consumer New distribution platform & Brand power Multi-screen offering IP traffic by 2014 interactive content – becoming table stakes Sky Sport TV on iPad / RTL on iPhone & iPad 20% New business models – Rising churn and Netflix = 20% of US Hulu 2009 revenue: $100M Building application & Subscriber acquisition cost st downstream internet 1 half 2010 revenue: $100M content eco-systems traffic in peak times Partnerships & Online Video Snacking Hybrid Broadcast Broadband TV: New Streaming Vertical Integration 11.4 Hour /month HbbTV subscription services Experience Diminishing SP Evolving Legacy Fragmentation Network Relevance Infrastructure Consumer Experience Business Models Content Fragmentation Subscription Fragmentation Broadcast, Premium, UGC Broadband, TV, Mobile, Movie rentals, OTT Device & Screen Fragmentation Free vs. Paid TV, PC, Mobile, Gaming, PDA Interactivity Fragmentation Ad Dollars Fragmentation Lean back, Lean forward, Social Transition from linear TV to online © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 8 Presentation_ID © 2010 Cisco Systems, Inc. All rights reserved. Cisco Public 21 But SP’s Struggle to Deliver Online Content Intuitive Unified Navigation on TV /STB for All Content Multi-screen Web 2.0 Experiences on TV experience TV/STB © 2010 Cisco and/or its affiliates. -

The Culture of Alcohol Promotion and Consumption at Major Sports Events in New Zealand

The culture of alcohol promotion and consumption at major sports events in New Zealand Research report commissioned by the Health Promotion Agency Authors: Dr Sarah Gee Professor Steve J. Jackson Dr Michael Sam August 2013 ISBN: 978-1-927224-58-8 (online) Citation: Gee, S., Jackson, S. J. & Sam, M. (2013). The culture of alcohol promotion and consumption at major sports events in New Zealand: Research report commissioned by the Health Promotion Agency. Wellington: Health Promotion Agency. This document is available at: www.hpa.org.nz Any queries regarding this report should be directed to HPA at the following address: Health Promotion Agency Level 4, ASB House 101 The Terrace Wellington 6011 PO Box 2142 Wellington 6140 New Zealand August 2013 COMMISSIONING CONTACTS COMMENTS: The Health Promotion Agency (HPA) commission was managed by Mark Lyne, Principal Advisor Drinking Environments. In order to support effective event planning and management, HPA sought to commission research to explore the relationship between sport, alcohol and the sponsorship of alcohol at large events. Dr Sarah Gee of Massey University, a specialist in the associations between alcohol and sport, was commissioned in 2011 to undertake the research. The report presents findings from four case studies, each of a large alcohol-sponsored sporting event in New Zealand. Data was collected via ethnographic observation, in situ surveys and broadcast content analysis. The analysis provides a critical reflection of the role of alcohol-sponsorship in the culture of large sporting events in New Zealand. Those with interest in an increasingly complex nexus between sport, alcohol and culture, as well as those interested in the use of mixed method approaches for social inquiry, will find the report highly valuable.