Annual Report and Accounts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

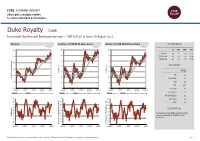

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Stoxx® Europe Total Market Financial Services Index

STOXX® EUROPE TOTAL MARKET FINANCIAL SERVICES INDEX Components1 Company Supersector Country Weight (%) LONDON STOCK EXCHANGE Financial Services GB 10.21 DEUTSCHE BOERSE Financial Services DE 9.72 INVESTOR B Financial Services SE 8.23 PARTNERS GRP HLDG Financial Services CH 5.46 3I GROUP PLC. Financial Services GB 4.58 STANDARD LIFE ABERDEEN Financial Services GB 3.39 EXOR NV Financial Services IT 2.91 INVESTOR A Financial Services SE 2.82 GRP BRUXELLES LAMBERT Financial Services BE 2.74 M&G Financial Services GB 2.63 HARGREAVES LANSDOWN Financial Services GB 2.32 INTERMEDIATE CAPITAL GRP Financial Services GB 2.01 KINNEVIK B Financial Services SE 1.93 SCHRODERS Financial Services GB 1.68 AMUNDI Financial Services FR 1.54 EURONEXT Financial Services FR 1.41 INDUSTRIVARDEN A Financial Services SE 1.37 INDUSTRIVARDEN C Financial Services SE 1.32 INVESTEC Financial Services GB 1.24 WENDEL Financial Services FR 1.20 QUILTER Financial Services GB 1.17 ACKERMANS & VAN HAAREN Financial Services BE 1.14 SOFINA Financial Services BE 1.09 IG GRP HLDG Financial Services GB 1.08 MAN GRP Financial Services GB 1.04 PARGESA Financial Services CH 1.01 TP ICAP Financial Services GB 0.98 EURAZEO Financial Services FR 0.98 ASHMORE GRP Financial Services GB 0.97 BOLSAS Y MERCADOS ESPANOLES Financial Services ES 0.93 GRENKE N Financial Services DE 0.92 AZIMUT HLDG Financial Services IT 0.84 ONESAVINGS BANK Financial Services GB 0.80 JUPITER FUND MANAGEMENT Financial Services GB 0.79 JOHN LAING GROUP Financial Services GB 0.78 LATOUR INVESTMENT B Financial -

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021 FTF - FTF Franklin UK Rising August 31, 2021 Dividends Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 0673123 ASSOCIATED BRITISH FOODS PLC 155,000 £3,069,000 2.01% N/A N/A 0989529 ASTRAZENECA PLC 84,000 £7,151,760 4.68% N/A N/A 0263494 BAE SYSTEMS PLC 575,000 £3,268,300 2.14% N/A N/A BYQ0JC6 BEAZLEY PLC 680,000 £2,662,200 1.74% N/A N/A 3314775 BLOOMSBURY PUBLISHING PLC 660,000 £2,329,800 1.52% N/A N/A B3FLWH9 BODYCOTE PLC 275,000 £2,652,375 1.74% N/A N/A 0176581 BREWIN DOLPHIN HOLDINGS -

Diversified International All Cap Fund Portfolio Holdings

PORTFOLIO HOLDINGS Harbor Diversified International All Cap Fund As of 06/30/2021 Subadviser: Marathon Asset Management LLP - Since 11/02/2015 Portfolio Managers: Neil M. Ostrer, Charles Carter, Nick Longhurst, William J. Arah, Simon Somerville, Michael Nickson, CFA, Robert Anstey, CFA, Justin Hill, Alex Duffy Shares/Par/ Current Base Base Market Value % of Total Net SEDOL Asset Description Contracts Price $ $ Assets Taiwan Semiconductor Manufacturing Co., Ltd. 1,151,000 21.35 24,579,453 2.06 Samsung Electronics Co., Ltd. 274,384 71.66 19,662,379 1.65 Roche Holding Ltd 34,928 377.08 13,170,501 1.11 Hitachi,Ltd. 218,200 57.31 12,505,364 1.05 BP p.l.c. 2,805,151 4.35 12,206,804 1.03 Eurobank Ergasias Services & Holdings SA 11,388,327 1.01 11,479,607 0.96 Brookfield Asset Management Inc. Class A 215,169 51.07 10,988,685 0.92 Vestas Wind Systems A/S 273,185 39.04 10,665,045 0.90 Baidu Inc Sponsored ADR Class A 50,779 203.90 10,353,838 0.87 Novo Nordisk A/S Class B 119,403 83.79 10,004,599 0.84 HelloFresh SE 95,973 97.22 9,330,504 0.78 Porto Seguro S.A. 875,941 10.66 9,333,991 0.78 Barclays PLC 3,565,858 2.36 8,429,465 0.71 Fairfax Financial Holdings Limited 19,049 438.99 8,362,300 0.70 Grupo Financiero Inbursa SAB de CV Class O 8,463,619 0.99 8,382,641 0.70 Toyota Motor Corp. -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St. -

Financial Reporting by Investment Managers

Financial reporting by investment managers The need for clarity December 2015 kpmg.co.uk © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent Financial reporting by Investment Managers member firms affiliated with KPMG International (“KPMG International”), a Swiss entity. All rights reserved. 02 Executive summary Contents 04 Benchmarking 12 Survey 18 Narrative reporting 24 Corporate Governance 26 Remuneration 29 Accounting update 34 Conclusion © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International (“KPMG International”), a Swiss entity. All rights reserved. Financial reporting by Investment Managers 01 01Executive summary Welcome to the 2015 A complex task more information in reports – without fully considering how that information edition of Financial Factors such as increased regulation is selected, presented and structured Reporting by Investment and market volatility are impacting – preparers will deliver documents that upon performance. In this respect, are opaque rather than enlightening. Managers. there is a real challenge inherent in As new risks emerge, arguably one of The investment industry is working in preparing reports that take account of these factors, while also providing the greatest challenges is to quantify an ever-more complex environment. the threats in a way that is meaningful. Businesses in the sector are not only a true and accurate picture of the performance of individual businesses This year’s reports suggest that cyber faced with tighter regulation, at a time risk, in particular, has been under when investor pressure to deliver that can be compared to reports published by other firms in the sector. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Rathbone Managed Portfolio Service (MPS) Strategy Information and Performance

Rathbone Managed Portfolio Service (MPS) Strategy information and performance This document shows the performance of the Rathbone Managed Portfolio Service strategies provided by Rathbone Investment Management Data as at 31 May 2019 Managed Portfolio Service Rathbone Investment Management Managed Portfolio Service (MPS) strategy information 31 May 2019 Cautious Invested in the Rathbone Multi-Asset Total Return Portfolio Strategy facts Date launched March 2017 Objective Historical distribution yield Inc: 1.44%/Acc: 1.46% (est) The strategy’s objective is investing for growth with a target total return in excess of MiFID II charges 2% above sterling six month LIBOR over a minimum three years, and a target risk Ongoing Charges Figure (OCF) as at 31.03.2019 level of one third of the volatility of global equities as measured by the MSCI World Inc: 0.92%/Acc: 0.92% Equity index. Transaction costs Inc: 0.08%/Acc: 0.08% Total MiFID II charges Inc: 1.00%/Acc: 1.00% Simulated performance and volatility The MiFID II charges include the Ongoing Charges Figure (OCF) and transaction costs. PRIIPs compliant^ The performance data shown is a simulated illustration of historic performance using the charging Rathbone risk profle (1-6) level used by the Managed Portfolio Service to 31.08.2017 and the performance of the M class unit Cautious: 2 thereafter. Data as at 31.05.19 1 year 3 years 5 years Rathbone MPS Cautious Strategy 2.91% 12.01% 20.90% LIBOR GBP 6 month +2% 2.95% 8.31% 14.32% Volatility as % of MSCI World Equity Index* 25.14% 28.12% 28.86% Discrete -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

START HERE Strategic Focus Our Performance Divisional Review Environmental, Social and Governance (ESG) Directors’ Remuneration Report

START HERE Strategic focus Our performance Divisional review Environmental, social and governance (ESG) Directors’ remuneration report VOL. 1 THE 2020 INTEGRATED Strategic report ANNUAL REPORT COVERS incorporating THE PERIOD 1 APRIL 2019 TO environmental, social 31 MARCH 2020 AND PROVIDES and governance (ESG) and the AN OVERVIEW OF remuneration report THE INVESTEC GROUP VOL. 2 Risk disclosures VOL. 3 Annual financial MAIN MENU statements Feedback For queries regarding information in this We value feedback and invite questions and comments on document our reporting. To give feedback please contact our Investor Investor Relations Relations division. Telephone: (27) 11 286 7070 (44) 20 7597 5546 E-mail: [email protected] www.investec.com/en_za/welcome-to-investec/about-us/investor- relations.html Investec integrated annual report 2020 1 Strategic focus Our performance Divisional review Environmental, social and governance (ESG) Directors’ remuneration report CONTENTS Cross reference tools Alternative performance measures We supplement our IFRS figures with alternative performance measures used Our reporting suite 4 by management internally and which provide valuable, relevant information. These measures are highlighted with Strategic report the symbol The description of alternative performance measures and their 01 Strategic focus calculation is provided in the alternative Who we are 6 performance measures section. Our strategic direction 7 Strategic objectives 8 AUDITED INFORMATION Our business model 9 Denotes information in