Annual and Sustainability Report 2018 Essity Aktiebolag (Publ)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Governance Report 2018

Corporate Governance Report – Corporate governance Corporate governance The task of corporate governance is to ensure the company’s commitments to all of its stakeholders: shareholders, custom- ers, suppliers, creditors, society and employees. It must be structured in a way that supports the company’s long-term strat- egy, market presence and competitiveness. Corporate governance shall be reliable, clear, simple and business-oriented. This Corporate Governance Report forms part of the Board of Directors’ Report for Essity’s 2018 Annual Report. The report has been reviewed by the company’s auditors. Corporate governance, including Swedish Code of Corporate Governance Sustainability remuneration, pages 46–55. without any deviations Essity’s sustainability work is an integral This section describes applicable (www.corporategovernanceboard.se). part of the company’s business model. regulatory rules and regulations for the The company’s sustainability report Group’s corporate governance and the Risk management, pages 33–38 forms part of the Board of Directors’ company’s management structure and Essity’s processes to identify and man- Report. The sustainability work helps organization. It also details the Board of age risks are part of the Group’s strategy reduce risks and costs, strengthen Directors’ responsibilities and its work work and are pursued at a local and competitiveness, attract new employees during the year. Information regard- Group-wide level. The section dealing and investors, and contributes toward a ing remuneration and remuneration with risk management describes the more sustainable world. issues and Essity’s internal control are most significant risks and procedures also included here. Essity applies the used to eliminate or limit these risks. -

Press Release

Press Release Stockholm October 7, 2014 SCA’s Hygiene Matters 2014 consumer survey; Continued global need for increased access to hygiene products and knowledge Hygiene Matters 2014 is the fourth global consumer survey commissioned by leading global hygiene and forest products company SCA. The aim is to raise awareness among decision makers, experts and the general public globally, of the connection between hygiene, health and wellbeing. SCA also aims to contribute to a more knowledge-based public dialogue that strengthens the possibility of improved hygiene for women, men and children everywhere. The theme of Hygiene Matters 2014 has been “Women and Hygiene”. SCA aims to make a difference to people’s everyday life by providing sustainable personal care, tissue and forest products under many strong brands such as TENA, Tork, Libero, Libresse, Lotus, Nosotras, Saba, Tempo and Vinda. The 2014 Hygiene Matters survey results reinforce SCA’s determination to work even harder to meet women’s needs and desires when it comes to personal and intimate hygiene for themselves and their families. The Hygiene Matters 2014 consumer survey clearly shows that there are still unmet needs among women globally both when it comes to hygiene products and solutions, as well as raising knowledge about personal hygiene that could help combat taboos. “This year’s Hygiene Matters survey results show that SCA’s work is relevant and there is still a lot to do for women’s access to hygiene products and solutions, and explaining the close link between hygiene and health. About 80 percent of SCA’s consumers are women. -

The Palgrave Handbook of Critical Menstruation Studies Chris Bobel · Inga T

The Palgrave Handbook of Critical Menstruation Studies Chris Bobel · Inga T. Winkler · Breanne Fahs · Katie Ann Hasson · Elizabeth Arveda Kissling · Tomi-Ann Roberts Editors The Palgrave Handbook of Critical Menstruation Studies Editors Chris Bobel Inga T. Winkler Department of Women’s, Gender, and Institute for the Study of Human Rights Sexuality Studies Columbia University University of Massachusetts Boston New York, NY, USA Boston, MA, USA Katie Ann Hasson Breanne Fahs Center for Genetics and Society Women and Gender Studies & Social Berkeley, CA, USA and Cultural Analysis Arizona State University Tomi-Ann Roberts Glendale, AZ, USA Department of Psychology Colorado College Elizabeth Arveda Kissling Colorado Springs, CO, USA Women’s & Gender Studies Eastern Washington University Cheney, WA, USA ISBN 978-981-15-0613-0 ISBN 978-981-15-0614-7 (eBook) https://doi.org/10.1007/978-981-15-0614-7 © The Editor(s) (if applicable) and The Author(s) 2020. This book is an open access publication. Open Access This book is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made. The images or other third party material in this book are included in the book’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the book’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. -

Interim Report 6M:2021

Interim Report 6M:2021 January 1–June 30, 2021 Net asset value on June 30, 2021, was SEK 135.4 billion, or SEK 311 per share, an in- crease during the first half of the year of SEK 32 per share. Including reinvested divi- dend, net asset value increased by 14%. The total return for the first six months 2021 was 24% for the Class A shares and 21% for the Class C shares, compared with 22% for the Stockholm Stock Exchange’s total return index (SIXRX). Earnings per share for the period were SEK 40.58. During the first half of 2021, shares were purchased in Sandvik for SEK 1.5 billion, in Essity for 0.5 billion and in Handelsbanken for 0.3 billion. The debt-equities ratio as per June 30, 2021, was 3%. The shareholding in SSAB was divested in May for SEK 2.0 billion. Value performance Average annual change as per June 30, 2021 Total return Net asset value* Industrivärden C Index (SIXRX) 6M:2021 14% 21% 22% 1 year 30% 52% 47% 3 years 14% 24% 20% 5 years 16% 21% 18% 7 years 13% 16% 14% 10 years 12% 15% 14% *Including reinvested dividend. AB Industrivärden (publ) Reg. no. 556043-4200 www.industrivarden.net CEO’s message The ongoing pandemic continues to affect society to a high Essity has strengthened its positions in several partly owned degree. Vaccinations for Covid-19 continues, and with a businesses in key growth areas. During the second quarter steadily higher level of immunity, parts of the world are now the company increased its ownership in the Colombian hy- successively opening up their societies. -

Semiannual Report (Pdf)

Semiannual report Mutual funds 2021 3 Pareto Aksje Norge Contents 9 Pareto Investment Fund 16 Pareto Global 23 Pareto Nordic Return 32 Fixed income funds 42 Ethical framework, returns and risk Pareto Aksje Norge Pareto Aksje Norge 4 Portfolio manager commentary The portfolio had a strong performance in the first supply growth, according to Kontali, indicate a tight and the gas price have almost doubled from the same half of the year. The upturn is broadly founded across market and high salmon prices. time last year. Equinor, like other companies in the oil sectors. A sharp improvement in the business conditions industry, has implemented sharp cost cuts since the for several of our companies and solid operational In February, we became co-owners of Sonans Holding downturn in 2015. It is expected that the company this performance contributed to improved earnings, which in in connection with the IPO. Our ownership period is year will generate approximately NOK 180 billion in cash turn contributed to the good returns in the first half of the relatively short, but the start has been good and we are flow from operations. This is the highest in the company’s year. We note that analysts have gradually begun to raise optimistic about the prospects for education in the post- history. In comparison, cash flow from operations in their estimates for the current year and next. COVID world. 2011 to 2013, with an average oil price of 110 dollars per barrel, was between 101 and 119 billion. All our bank investments could show improved return Our industrial companies account for just over a third of on equity in the first quarter of the year, driven by lower this year’s return. -

Download Shortlist

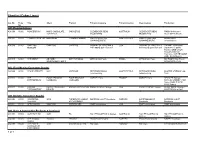

Title Brand Product/Service Entrant Company Location Production Company Location A03 Durable Consumer Goods including Automotive WANDA PRODUCTIONS, Paris / MIKROS THE OTHERS VOLKSWAGEN IQ.DRIVE DDB PARIS * FRANCE FRANCE IMAGE, Paris CHRISTMAS GIFTS ICONOCLAST, Paris / MATHEMATIC, KEEP CHRISTMAS WONDERFUL ORANGE PUBLICIS CONSEIL, Paris * FRANCE FRANCE COLLECTION Paris A04 Travel, Leisure, Retail, Restaurants & Fast Food Chains GENERAL POP, Pantin / GREEN UNITED THE LITTLE DUCK DISNEYLAND PARIS DISNEYLAND PARIS BETC, Paris * FRANCE FRANCE MUSIC, Paris SWITCH TO BAZARCHIC BAZARCHIC INTERNET SHOPPING CHANGE, Paris FRANCE SOVAGE, Paris FRANCE HJALTELIN STAHL PART OF ACCENTURE GOTH LIFE COPENHAGEN METRO COPENHAGEN METRO DENMARK PEGASUS PRODUCTION, Copenhagen DENMARK INTERACTIVE, Copenhagen * BUY SECOND-HAND. OR NOTHING AT FINN.NO ONLINE MARKETPLACE MORGENSTERN, Oslo * NORWAY BACON OSLO, Oslo NORWAY ALL. THIS IS HOW IT FEELS KOMPLETT KOMPLETT ANORAK, Oslo * NORWAY BACON OSLO, Oslo NORWAY C'EST MAGNIFIQUE INTERMARCHÉ INTERMARCHÉ ROMANCE, Paris * FRANCE GRAND BAZAR, PARIS / THE, Paris FRANCE A05 Media / Entertainment MISSION REALLY IMPOSSIBLE CANAL+ CANAL+ BETC, Paris * FRANCE LA PAC, Paris / SCHMOOZE, Paris FRANCE INSURRECTION, Paris / PRODIGIOUS, CONTENT BATTLE ORANGE ORANGE TV PUBLICIS CONSEIL, Paris * FRANCE FRANCE Paris A06 Consumer Services/Business to Business ARBETSFÖRMEDLINGEN - THE SWEDISH COLONY, Stockholm / BACON FILM, TAKING CARE OF BUSINESS EMPLOYMENT SERVICE LE BUREAU, Stockholm * SWEDEN SWEDEN PUBLIC EMPLOYMENT SERVICE Stockholm -

ESSITY AKTIEBOLAG (PUBL) (Incorporated with Limited Liability in Sweden with the Registered Number 556325-5511) ESSITY CAPITAL B.V

BASE PROSPECTUS ESSITY AKTIEBOLAG (PUBL) (incorporated with limited liability in Sweden with the registered number 556325-5511) ESSITY CAPITAL B.V. (incorporated with limited liability in the Netherlands and registered with the commercial register number 82525897) Euro 6,000,000,000 Euro Medium Term Note Programme Unconditionally and irrevocably guaranteed by (in respect of Notes issued by Essity Capital B.V. only) ESSITY AKTIEBOLAG (PUBL) This document constitutes a base prospectus for the purposes of Article 8 of Regulation (EU) 2017/1129 (the "Prospectus Regulation") for the purposes of giving information with regard to the issue of notes (the "Notes") by Essity Aktiebolag (publ) ("Essity") or Essity Capital B.V. ("Essity Capital") (each an "Issuer" and, together, the "Issuers") under the Euro Medium Term Note Programme (the "Programme") described herein (the "Base Prospectus"). Notes under the Programme may be issued by either Issuer. Notes issued by Essity Capital will be unconditionally and irrevocably guaranteed by Essity (in such capacity, the "Guarantor") pursuant to a deed of guarantee dated 7 May 2021 (the "Deed of Guarantee"). Any Notes issued under the Programme on or after the date of this Base Prospectus are issued subject to the provisions described herein. This does not affect any Notes already in issue. Pursuant to the Programme, an Issuer may from time to time issue Notes denominated in any currency agreed between such Issuer and the relevant Dealer(s) (as defined below). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed Euro 6,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. -

Admission to Trading of the Shares in Essity Aktiebolag (Publ) on Nasdaq Stockholm Important Information

Admission to trading of the shares in Essity Aktiebolag (publ) on Nasdaq Stockholm Important information For certain definitions used in this prospectus, see Certain“ definitions” on the next page. This prospectus has been prepared following a resolution at the 2017 Annual General Meeting of Svenska Cellulosa Aktiebolaget SCA (publ) (“SCA”) to distribute to SCA’s shareholders the shares in Essity Aktiebolag (publ) (“Essity” or the “Company”) and the Board of Directors of Essity’s application for listing of those shares on Nasdaq Stockholm. A Swedish version of this prospectus has been approved and registered by the Swedish Financial Supervisory Authority (the “SFSA”) in accordance with Chapter 2, Sections 25 and 26 of the Swedish Financial Instruments Trading Act (lagen (1991:980) om handel med finansiella instrument). Approval and registration does not imply that the SFSA guarantees that the information in the prospectus is accurate or complete. The prospectus is governed by Swedish law. Disputes arising in connection with this prospectus and related legal matters shall be settled exclusively by Swedish courts. The prospectus has been prepared in both Swedish and English language versions. The English version contains certain sections specifically directed to holders outside of Sweden, which are not included in the Swedish version. In the event of any conflict between the versions, the Swedish version shall prevail. This prospectus has been prepared for the purpose of Essity’s application of admission to trading of the shares in Essity on Nasdaq Stockholm and does not contain any offer to subscribe for, or in any other way acquire shares or other financial instruments in the Company, neither in Sweden nor in any other jurisdiction. -

Corporate Governance Report

Corporate governance report Corporate governance report Good corporate governance ensures that Skanska is managed sustainably, responsibly and efficiently on behalf of all share- holders. The overall goal is to increase value for shareholders, and in doing so meet their expectations for invested capital. The purpose of corporate governance is also to ensure oversight by the Board of Directors (the “Board”) and management. By having a clearly defined governance structure as well as proper rules and processes, the Board can ensure that manage- ment and employees are focused on developing the business and thereby generating value for shareholders. This corporate governance report for 2019 has been reviewed by Skanska’s external auditors in accordance with Chapter 9, Section 31 of the Swedish Companies Act. The report contains information as required by Chapter 6, Section 6 of the Annual Accounts Act. Corporate governance principles Key external governing documents Skanska is one of the world’s leading construction and project development companies, focused on selected home markets in the • Swedish Companies Act Nordic region, Europe and the USA. Supported by global trends • Nasdaq Stockholm Rule Book for Issuers in urbanization and demographics, and by being at the forefront • Swedish Corporate Governance Code of sustainability, Skanska offers competitive solutions for both • Annual Accounts Act simple and the most complex assignments. Driven by the Skanska • Securities Market Act values, Skanska helps create sustainable futures for customers and • International Financial Reporting Standards (IFRS) communities. The parent company of the Group is Skanska AB and other accounting rules (the “Company”), with a registered office in Stockholm, Sweden. -

Essity Annual and Sustainability Report 2019

Corporate Governance Report – Corporate governance Corporate governance The task of corporate governance is to ensure the company’s commitments to all of its stakeholders: shareholders, customers, suppliers, creditors, society and employees. It must be structured in a way that supports the company’s long-term strategy, market presence and competitiveness. Corporate governance shall be reliable, clear, simple and business-oriented. This Corporate Governance Report forms part of the Board of Directors’ Report for Essity’s 2019 Annual Report. The report has been reviewed by the company’s auditors. Corporate governance, including Swedish Code of Corporate Sustainability remuneration, pages 46–55. Governance without any deviations Essity’s sustainability work is an integral This section describes applicable (www.corporategovernanceboard.se). part of the company’s business model. regulatory rules and regulations for The company’s sustainability report the Group’s corporate governance and Risk management, pages 34–39 forms part of the Board of Directors’ the company’s management structure Essity’s processes to identify and man- Report. The sustainability work helps and organization. It details the Board of age risks are part of the Group’s strategy reduce risks and costs, strengthen Directors’ responsibilities and its work work and are pursued at a local and competitiveness, attract new employees during the year. Information regarding Group-wide level. The section dealing and investors, and contributes toward a remuneration and remuneration issues with risk management describes the more sustainable world. and Essity’s internal control are also most significant risks and procedures included here. Essity applies the used to eliminate or limit these risks. -

Cyber Shortlist

Shortlist (Cyber Lions) Cat. No Entry Title Client Product Entrant Company Entrant Country Idea Creation Production No A01 (Food & Drinks ) A01/009 00992 HUNGERITHM MARS CHOCOLATE SNICKERS® CLEMENGER BBDO AUSTRALIA CLEMENGER BBDO FINCH Melbourne / AUSTRALIA MELBOURNE MELBOURNE FLUTTER Melbourne A01/011 01553 CADBURY PRE-JOY MONDELEZ CADBURY BUBBLY OGILVY & MATHER SOUTH AFRICA OGILVY & MATHER BOMB FILMS JOHANNESBURG JOHANNESBURG Johannesburg A01/016 01402 CHEETOS CHEETOS CHEETOS GOODBY SILVERSTEIN & USA GOODBY SILVERSTEIN & CAVIAR Los Angeles / MUSEUM PARTNERS San Francisco PARTNERS San Francisco COMPANY 3 Santa Monica / ONE UNION RECORDING San Francisco / WHITEHOUSE POST Santa Monica A01/049 02964 THE DEBUT AB INBEV INSTITUTIONAL AFRICA São Paulo BRAZIL AFRICA São Paulo BIG FOOTE São Paulo / (BUDWEISER) / ESPN SAIGON São Paulo A02 (Fast Moving Consumer Goods) A02/004 00110 VAGINA VARSITY SCA LIBRESSE NET#WORK BBDO SOUTH AFRICA NET#WORK BBDO ZOOTEE STUDIOS Cape Johannesburg Johannesburg Town A02/018 02456 THE FOUR SEASONS FOUR SEASONS MARCEL Paris FRANCE MARCEL Paris HECKLER Sydney / EXTENDABLES CONDOMS CONDOMS MARCEL SYDNEY / NKI Paris / WORLD WIDE MIND Sydney A02/027 01399 ASPIRIN BAYER CONSUMER ASPIRIN MEDICATION ENERGY BBDO Chicago USA ENERGY BBDO Chicago FLARE BBDO Chicago / "HEROSMITHS" HEALTH MAVERICK New York A03 (Durable Consumer Goods) A03/004 01108 IKEA RETAIL IKEA FURNITURE & HOME ÅKESTAM HOLST Stockholm SWEDEN ÅKESTAM HOLST ÅKESTAM HOLST THERAPY ACCESSORIES Stockholm Stockholm A03/011 01412 SPECTACLES SNAP, INC. SPECTACLES -

25,716 3,235 13 % 29 % Institutions in More Than 100 Countries

Net sales and operating margin SEKm % 25,000 15 20,000 12 15,000 9 10,000 6 5,000 3 0 0 05 06 07 08 09 Net sales Margin Operating cash flow SEKm 5,000 4,000 3,000 2,000 1,000 0 05 06 07 08 09 Operating profit and ROCE SEKm % 3,000 30 2,400 24 1,800 18 1,200 12 600 6 0 0 05 06 07 08 09 Operating profit ROCE SCA offers incontinence care prod- Share of Group ucts, baby diapers and feminine care products for the markets’ quality seg- ments. All three segments have a high development rate and new products are launched continuously. The com- Net sales, 23% Operating profit, 32% Capital employed, 11% Av. no. of employees, 15% pany’s products are sold under SCA’s own brands and retailers’ brands and are distributed via retailers and care 25,716 3,235 13 % 29 % institutions in more than 100 countries. Sales, SEKm EBIT, SEKm EBIT margin ROCE1) 1) Return on capital employed. Board of Directors’ Report Personal Care Personal Care Market position and brands Innovation and product development Strategic priorities: SCA is one of the world’s largest players in per- SCA invests considerable resources in its • Develop SCA’s world-leading position in sonal care products and the global market efforts to gain deep insight into consumer and incontinence care using the Tena brand. leader in incontinence care products. SCA has customer needs. This insight forms the basis • Continue the programmes involved in the a portfolio of global, regional and local brands.