Russian Cinema Exhibition Market Overviwe 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information Translation JSC Inter RAO 2014 Annual Report

1 Information translation JSC Inter RAO 2014 Annual Report Preliminarily approved by the Board of Directors of JSC Inter RAO on April 07, 2015 (Minutes No. 138 of the meeting of the Board of Directors dated April 09, 2015). Management Board Boris Kovalchuk Chairman Chief Accountant Alla Vaynilavichute 2 Table of content 1 Report overview ........................................................................................................................ 4 2 General information on Inter RAO Group .................................................................................. 8 2.1 About Inter RAO Group ..................................................................................................... 8 2.2 Group's key performance indicators ................................................................................. 14 2.3 Inter RAO Group on the energy market ........................................................................... 15 2.4 Associations and partnerships ......................................................................................... 15 3 Statement for JSC Inter RAO shareholders and other stakeholders ........................................ 18 4 Development strategy of Inter RAO Group and its implementation ......................................... 21 4.1 Strategy of the Company ................................................................................................. 21 4.2 Business model .............................................................................................................. -

Moscow, Russia

Moscow, Russia INGKA Centres The bridge 370 STORES 38,6 MLN to millions of customers VISITORS ANNUALLY From families to fashionistas, there’s something for everyone meeting place where people connect, socialise, get inspired, at MEGA Belaya Dacha that connects people with inspirational experience new things, shop, eat and naturally feel attracted lifestyle experiences. Supported by IKEA, with more than to spend time. 370 stores, family entertainment and on-trend leisure and dining Our meeting places will meet people's needs & desires, build clusters — it’s no wonder millions of visitors keep coming back. trust and make a positive difference for local communities, Together with our partners and guests we are creating a great the planet and the many people. y w h e Mytischi o k v s la Khimki s o r a Y e oss e sh sko kov hel D RING RO c IR AD h ov Hwy TH S ziast ntu MOSCOW E Reutov The Kremlin Ryazansky Avenue Zheleznodorozhny Volgogradskiy Prospect Lyubertsy Kuzminki y Lyublino Kotelniki w H e o Malakhovka k s v a Dzerzhinsky h s r Zhukovskiy a Teply Stan V Catchment Areas People Distance Kashirskoe Hwy Lytkarino Novoryazanskoe Hwy ● Primary 1,600,000 < 20 km ● Secondary 1,600,000 20–35 km ● Tertiary 3,800,000 35–47 km Gorki Total area: <47 km: 7,000,000 Leninskiye Volodarskogo 55% 25 3 METRO 34 MIN CUSTOMERS BUS ROUTES STATIONS AVERAGE COME BY CAR NEAR BY COMMUTE TIME A region with Loyal customers MEGA Belaya Dacha is located at the heart of the very dynamic population development in strong potential the South-East of Moscow and attracts shoppers from all over Moscow and surrounding areas. -

MEGA Belaya Dacha Le N in G R Y a D W S H V K Olo O E K E O O Mytischi Lam H K Sk W S O Y Av E

MEGA Belaya Dacha Le n in g r y a d w s h V k olo o e k e o o Mytischi lam h k sk w s o y av e . sl o h r w a y Y M K Tver A Market overview D region Balashikha Dmitrov Krasnogorsk y Welcome v hw Sergiev-Posad hw uziasto oe y nt Klin Catchment Peoplesk Distance E Vladimir region izh or Reutov ov to MEGA N Mytischi Pushkin areas Schelkovo Belaya Dacha Moscow Zheleznodorozhny Primary 1,589,000 < 20 km Smolensk region Odintsovo N Naro-Fominsk o Podolsk v o ry a Klimovsk wy z Secondary 1,558,800 h 20–35 km a oe n k sk ins o Obninsk Kolomna M e y h hw w oe y Serpukhov Tertiary 3,787,300 35–47vsk km ALONG WITH LONDON’S WESTFIELD Kaluga region Kie AND ISTANBUL’S FORUM, MEGA BELAYA y y w Tula region h w h DACHA IS ONE OF EUROPE’S LARGEST e ko e Total area: 6,965,200 s o z h k RETAIL COMPLEXES. s lu Troitsk a v K a h s r a Domodedovo V It has more than 350 tenants and the centre Moscow has the highest density of retailers façade runs for four km. Major brands such of all Russian cities with tenants occupying as Auchan, Inditex brands, TopShop, H&M, 4.5 million square metres, according to fig- Uniqlo, T.G.I. Fridays, Debenhams, MAC, ures for 2013. Many world-famous retailers IKEA, OBI, MediaMarkt, Kinostar, Cosmic, have outlets here and the city is the first M.Video, Detsky Mir, Deti and Decathlon to show new trends. -

JTI Invests in Innovations in Yelets

JTI Invests in Innovations in Yelets Yelets, Lipetsk Region, February 1, 2016 – The JTI Yelets factory (part of JTI Group) has invested over 300 million rubles in a sustainable cogeneration plant producing heat and power from natural gas. The company’s own heat and power plant will help improve the environment in Yelets, reduce the burden on the city’s grid and ensure uninterruptible power supply. The cogeneration plant has no equal in Lipetsk Region by efficiency, which reaches 88 percent. The CHP has an electrical output of 3,638 MW and heat output of 3,089 Gcal/h. Unlike a regular power plant, where all the produced heat is lost to the environment, the cogeneration station uses heat for production and heating purposes, which helps reduce carbon dioxide and other air pollutants by a factor of 2 to 3 and make the air in the city cleaner. “The JTI Yelets factory continues to develop rapidly and implement innovations. The company has invested over 75 million US dollars in the factory over the past eight years and the new project is yet another evidence of our commitment to continuous improvement. The launch of the cogeneration plant will improve not only the plant’s power efficiency and environmental safety, but the city’s energy infrastructure as well,” said Timur Mutaev, General Director of JTI Yelets. In addition to the stand-alone power plant, the factory also constructed a new cable line to supply power to several neighboring socially significant buildings, including the fire department. When disconnecting from the city power grid, the factory will present this cable line to Yelets municipal services. -

Demographic, Economic, Geospatial Data for Municipalities of the Central Federal District in Russia (Excluding the City of Moscow and the Moscow Oblast) in 2010-2016

Population and Economics 3(4): 121–134 DOI 10.3897/popecon.3.e39152 DATA PAPER Demographic, economic, geospatial data for municipalities of the Central Federal District in Russia (excluding the city of Moscow and the Moscow oblast) in 2010-2016 Irina E. Kalabikhina1, Denis N. Mokrensky2, Aleksandr N. Panin3 1 Faculty of Economics, Lomonosov Moscow State University, Moscow, 119991, Russia 2 Independent researcher 3 Faculty of Geography, Lomonosov Moscow State University, Moscow, 119991, Russia Received 10 December 2019 ♦ Accepted 28 December 2019 ♦ Published 30 December 2019 Citation: Kalabikhina IE, Mokrensky DN, Panin AN (2019) Demographic, economic, geospatial data for munic- ipalities of the Central Federal District in Russia (excluding the city of Moscow and the Moscow oblast) in 2010- 2016. Population and Economics 3(4): 121–134. https://doi.org/10.3897/popecon.3.e39152 Keywords Data base, demographic, economic, geospatial data JEL Codes: J1, J3, R23, Y10, Y91 I. Brief description The database contains demographic, economic, geospatial data for 452 municipalities of the 16 administrative units of the Central Federal District (excluding the city of Moscow and the Moscow oblast) for 2010–2016 (Appendix, Table 1; Fig. 1). The sources of data are the municipal-level statistics of Rosstat, Google Maps data and calculated indicators. II. Data resources Data package title: Demographic, economic, geospatial data for municipalities of the Cen- tral Federal District in Russia (excluding the city of Moscow and the Moscow oblast) in 2010–2016. Copyright I.E. Kalabikhina, D.N.Mokrensky, A.N.Panin The article is publicly available and in accordance with the Creative Commons Attribution license (CC-BY 4.0) can be used without limits, distributed and reproduced on any medium, pro- vided that the authors and the source are indicated. -

Russian NGO Shadow Report on the Observance of the Convention

Russian NGO Shadow Report on the Observance of the Convention against Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment by the Russian Federation for the period from 2001 to 2005 Moscow, May 2006 CONTENT Introduction .......................................................................................................................................4 Summary...........................................................................................................................................5 Article 2 ..........................................................................................................................................14 Measures taken to improve the conditions in detention facilities .............................................14 Measures to improve the situation in penal institutions and protection of prisoners’ human rights ..........................................................................................................................................15 Measures taken to improve the situation in temporary isolation wards of the Russian Ministry for Internal Affairs and other custodial places ..........................................................................16 Measures taken to prevent torture and cruel and depredating treatment in work of police and other law-enforcement institutions ............................................................................................16 Measures taken to prevent cruel treatment in the armed forces ................................................17 -

Retail Banking, Servicing Over Approx

IFRS Results for the Three-Month Period Ended March 31, 2014 Webcast and Conference call June 16, 2014 Disclaimer This presentation is based on the reviewed IFRS results for 1Q2014, 1Q2013 and 1Q2012 as well as audited IFRS results for FY2013, FY2012 and FY2011. However, it includes certain information that is not presented in accordance with the relevant accounting principles and has not been verified by an independent auditor. CBM has taken all reasonable care to ensure that in all instances the information included in the presentation is full and correct and is taken from reliable sources. At the same time the presentation should not be seen as providing any guarantees, express or implied, to its accuracy or completeness. Furthermore, CREDIT BANK OF MOSCOW undertakes no guarantees that its future operations will be consistent with the information included in the presentation and accepts no liability whatsoever for any expenses or loss connected with the use of the presentation. Please note that due to rounding, the numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. This presentation contains statements related to our future business and financial performance and future events or developments involving CREDIT BANK OF MOSCOW. Such forward-looking statements are based on the current expectations and certain assumptions of CREDIT BANK OF MOSCOW’s management, and, therefore, should be evaluated with consideration taken to risks and uncertainties inherent in our business. A variety of factors, many of which are beyond CREDIT BANK OF MOSCOW’s control, can materially affect the actual results in comparison to such statements. -

Midweek Football Results Weekend Football

Issued Date Page WEEKENDMIDWEEK FOOTBALLFOOTBALL RESULTSRESULTS 18/10/2020 08:49 1 / 7 INFORMATION INFORMATION INFORMATION RESULTS RESULTS RESULTS GAME CODE HOME TEAM AWAY TEAM GAME CODE HOME TEAM AWAY TEAM GAME CODE HOME TEAM AWAY TEAM No CAT TIME HT FT No CAT TIME HT FT No CAT TIME HT FT Friday, 16 October, 2020 Saturday, 17 October, 2020 Saturday, 17 October, 2020 60012 ROM3 15:00 0:1 2:1 UNIREA BASCOV CS VEDITA COLONESTI .. 6032 ROM2 11:00 0:1 0:1 FK CSIKSZEREDA MIER.. FC UNIREA 2004 SLOBO.. 6957 RUS4 12:00 : : OKA-M STUPINO LEGION-KHOROSHOVO 6584 NIR 21:45 0:1 0:1 COLERAINE FC BALLYMENA UNITED FC 6033 ROM2 11:00 0:1 0:2 RIPENSIA TIMISOARA METALOGLOBUS BUCU.. 6958 RUS4 12:00 : : SH N2 VO ZVEZDA NOR.. NEVA LEGIRUS 6034 UKR19 11:00 : : FC MINAJ U19 ILLICHIVEC M U19 6959 RUS4 12:00 : : TSARSKOYE SELO PARUS Saturday, 17 October, 2020 6036 UKR19 11:00 : : FC RUKH LVIV U19 DYNAMO KIEV U19 60142 KAZ 12:00 2:0 2:2 FC TARAZ FC KAISAR KYZYLORDA 6001 AUST 06:00 : 5:0 SOUTH HOBART FC CLARENCE ZEBRAS FC 6039 UKR19 11:00 : : SHAKHTAR D. U19 FC LVIV U19 60143 NORW 12:00 : 0:6 IF FLOEYA ASANE FOTBALL DAMER 6002 AUST 06:15 : 1:0 DEVONPORT CITY SC LAUNCESTON CITY FC 6862 HUN19 11:00 0:1 1:2 BUDAPEST HONVED MTK HUNGARIA 60229 ITAW 12:00 : 5:1 CROTONE SPEZIA 6003 AUST 06:15 : 3:0 RIVERSIDE OLYMPIC FC KINGBOROUGH LIONS U.. 6946 RUSUW 11:00 : : CHELYABINSK YOUTH METALLURG MAGNITOG. -

Aron Levin Interviewer: Simon Rekhson Date of Interview: December 20, 2013 Location of Interview: 1221 Drury Court, Apt

Soviet Jewish Oral History Project Western Reserve Historical Society Interviewee: Aron Levin Interviewer: Simon Rekhson Date of interview: December 20, 2013 Location of interview: 1221 Drury Court, Apt. 442, Mayfield Heights File WS310064 Simon Rekhson: Okay, today is December 20th, 2013. We are in Aron Levin’s apartment to conduct an interview for the Western Reserve Historical Society. About your life, Aron. Welcome! It’s a big honor and joy for me to interview you, but first we need to go over a few standard questions just for the record. So, could you please introduce yourself: what’s your name? Aron Levin: Aron Levin. I was born on January 1st in 1917. What else? SR: Where? AL: I was born in the village of Bervenovka, in the Gomel Region. This used to be Russia, and in about 1924, it became Belarus. We had to flee there from the thugs that ran this part of Gomel. And according to my passport, I was born in [the city of] Gomel. There was an external investigation there, because all of the documents had been lost along the way, and in my passport, it says that I was born January 1st, 1917, in the city of Gomel. SR: January 1st, 1917. The year of the revolution. AL: Yes. Well, at that time, our family was made up of nine people. Earlier, it used to be eleven, but two of them had already died—before the revolution, I think. So, in our family, we had five girls and two boys, including me. That is, five sisters and me. -

Avant-Garde Museology E-Flux Classics

Avant-Garde Museology e-flux Classics Avant-Garde Museology Arseny Zhilyaev, Editor Distributed by the University Published in collaboration with of Minnesota Press V-A-C Foundation CONTENTS Acknowledgments . 13 Arseny Zhilyaev Preface . 15 Julieta Aranda, Brian Kuan Wood, Anton Vidokle Introduction Avant-GARDE MuseoLogY: Toward a History of a Pilot Experiment . 21 Arseny Zhilyaev I Museum as Common Task The Museum, its Meaning and Mission (c. 1880s) . 59 Nikolai Fedorov The ART of ResembLance (of False Artistic Regeneration) and the ART of ReaLitY (Real Resurrection): Ptolemaic and Copernican Art (c. 1890s) . 143 Nikolai Fedorov The VORonezh Museum in 1998 (1898) . 149 Nikolai Fedorov Contents Contents the CATHERINE THE GREAT EXHIBITION II at the VORonezh RegionaL Museum The Museum of Avant-Gardism (1896) . 165 Nikolai Fedorov and Nikolai Peterson ON THE CathedRAL OF THE RESURRECTING THE MUSEUM OF ART, an EXceRpt FRom MUSEUM (1921) . 171 the noveL RED STAR (1908) . 255 Vasiliy Chekrygin Aleksandr Bogdanov THE CHURCH RITUAL AS A SYNTHESIS OF ON THE MUSEUM (1919) . 267 THE ARTS (1918) . 197 Kazimir Malevich Pavel Florensky THE MUSEUM NewspapeR: Suggestions for ON THE CReation OF A PANTHEON IN THE Regional Museums and Community Centers USSR: A Proposal (1927) . 215 (1931) . 275 Vladimir Bekhterev V. Karpov MateRIALS ON THE INSTITUTE OF BiogRAPHY AvaLANCHE EXHIBITIONS: The Experience (1920) . 223 of the Leningrad Organization of Worker-Artists Nikolai Rybnikov (1933) . 279 Leonid Chetyrkin THE REVOLUTION MEMORIAL RESERvation, AN EXCERPT FROM THE NOVEL CHEVENGUR ON THE QUESTION OF MUSEUMS: Record of (1926 –28) . 233 the Discussion of Problems and Objectives of Andrey Platonov Fine Art Museums at the Art and Industry Board (1919) . -

Appendix 2: Q4 (Oct-Dec) 2020 Cities in Russia Top Mobile Internet Providers Based on Average Download and Top 10% Speeds of Speedtest Intelligence Data

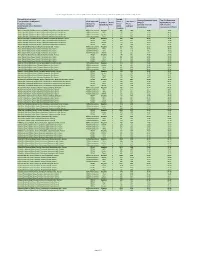

Appendix 2: Q4 (Oct-Dec) 2020 Cities in Russia Top Mobile Internet Providers based on average download and top 10% speeds of Speedtest Intelligence data City and Location Name Sample Average Download Speed Top 10% Download from Speedtest Intelligence / Claim Approved CoUnt / Test CoUnt / Provider / Rank / (Mbps) / Speed (Mbps) / Топ Название города, /Заявление Число Число Провайдер Ранг Средняя скорость 10% скорость местоположения из Speedtest одобрено точек замеров скачивания скачивания (Мбит/с) Intelligence замеров Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии MegaFon 1 468 1369 34.89 79.85 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии MTS 2 227 612 23.35 48.91 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии Beeline 3 125 516 18.92 34.17 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии Tele2 4 204 571 18.60 41.73 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G MegaFon 1 439 1257 35.61 79.35 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G MTS 2 205 491 24.35 49.98 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G Beeline 3 113 430 20.07 34.29 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G Tele2 4 192 527 19.17 43.24 AksaY, Rostov Oblast, Russia / Аксай, Ростовская обл., Россия All/Все технологии MegaFon 1 207 417 28.17 -

Invest in Moscow Region

INVEST IN MOSCOW REGION LOCATION GENERAL INFORMATION Dubna Sergiev Posad Mytishchy Population - 7.1 million Korolev Khimki Balashiha Urban population - 80% Odintsovo Lyubertsy More than 100 000 people live Zhukovsky in 20 cities of Moscow Region Podolsk Shatura Zaraysk DEVELOPED TRANSPORT INFRASTRUCTURE Road density km/1000 km2 3 international airports 232 Total passengers - 60 million people/year The total volume of cargo transportation in Russia (%) Moscow Central Federal Region District of Russia Density of railways 40 km/1000 km2 60 26 - Volume of cargo transportation in Moscow and Central Federal Moscow Region Moscow District of Russia Region QUALIFIED WORK FORCE Key Facts: 4.5 million people are 18-60 years old Salaries are 30% lower than in Moscow 71% of population has a higher education or vocational training CITIES OF MOSCOW REGION HAVE HISTORICALLY HIGH PERSONNEL POTENTIAL INNOVATIVE, HIGH-TECH HI-TECH BIOTECHNOLOGY DEVELOPMENT and SPACE ENGINEERING PHARMACEUTICALS Korolev, Podolsk, Dubna Podolsk, Kolomna, Klimovsk Pushchino, Chernogolovka, Obolensky Population Population Population 464 793 people 404 583 people 47 615 people THE LARGEST CONSUMER MARKET IN RUSSIA Tver region 30 million people live in the Moscow agglomeration or 20% of Russia's Smolensk region 300 km population Yaroslavl 1/3 of consumer spending in Russia Kaluga region region Tula region Ivanovo region Vladimir region Ryazan region ECONOMIC AND INVESTMENT INDICATORS Gross regional product of Regions of the Russian Federation (2012, billion USD) 352.57