Scheme of Arrangement (Scheme) and Interconditional Capital Return (Capital Return) (Together, the Transaction)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Treasury Wine Estates Limited – Information Memorandum

Treasury Wine Estates Limited – Information Memorandum In relation to the application for admission of Treasury Wine Estates Limited to the official list of ASX For personal use only Ref:BJ/SM FOST2205-9069112 © Corrs Chambers Westgarth 1 Purpose of Information Memorandum This Information Memorandum has been prepared by Treasury Wine Estates Limited ABN 24 004 373 862 (Treasury Wine Estates) in connection with its application for: (a) admission to the official list of ASX; and (b) Treasury Wine Estates Shares to be granted official quotation on the stock market conducted by ASX. The Information Memorandum will only apply if the Demerger is approved and implemented. This Information Memorandum: • is not a prospectus or disclosure document lodged with ASIC under the Corporations Act; and • does not constitute or contain any offer of Treasury Wine Estates Shares for subscription or purchase or any invitation to subscribe for or buy Treasury Wine Estates Shares. 2 Incorporation of Demerger Scheme Booklet (a) Capitalised terms defined in the Booklet prepared by Foster’s Group Limited ABN 49 007 620 886 (Foster’s) dated 17 March 2011 (a copy of which is included as Appendix 1 to this Information Memorandum) have the same meaning where used in this Information Memorandum (unless the context requires otherwise). (b) The following parts of the Booklet, and any supplementary booklets issued in connection with the Demerger Scheme, are taken to be included in this Information Memorandum: • Important notices and disclaimers, to the extent that it -

Hotel Website Specialists

The on & off Premise Published Bi-annually march 2011 Information about availability of liquor products, CPi eDiTion names of producers and/or distributors, suggested retail prices etc. Hotel Website Specialists • Web Design • Content Management Systems • e-Commerce • Search Engine Optimisation Boylen Media (aha|sa sponsor) Call Tim Boylen on 8233 9433 or email [email protected] LNA0186 0186 LNA TED Liquor Guide 17.3_FA.indd 1 22/02/11 10:00 AM Date: 21/02/2011 Designer: Mike C M Job#/Client: LNA 0186 Trim Size: 210(H) x 297(W)mm Y K Job Name/Ver: TED Liquor Guide 17.03_FA Bleed: 5 mm Index bEER, sTOuT, CiDER, RTD & sOFT DRinK, KEg & glAss PRiCEs .............................................................. 5 bEER – PACKAgED AusTRAliAn from bREWERs ...................................................................................... 6 bEER – PACKAgED inTERnATiOnAl from bREWERs ................................................................................. 7 bEER – PACKAgED AusTRAliAn from MERChAnTs ................................................................................. 7 bEER – PACKAgED inTERnATiOnAl from MERChAnTs ............................................................................ 7 BITTERS........................................................................................................................................................ 10 BOURBON ..................................................................................................................................................... 10 BRANDY -

F.I.T.T. for Investors the Rising Star of Africa

Deutsche Bank Markets Research Industry Date 4 February 2015 Beer Sub-Saharan Africa Consumer Staples Beverage Wynand Van Zyl Research Analyst (+27) 11 775-7185 [email protected] Tristan Van Strien Research Analyst (+44) 20 754-77654 [email protected] Gerry Gallagher Research Analyst (+44) 20 754-50251 [email protected] F.I.T.T. for investors The rising star of Africa Driving the next decade of beer growth Over the next decade, Africa should account for 40% of global volume and profit growth. In our view, population dynamics will drive structural growth; realistic pricing will accelerate per capita growth, taking share from illicit alcohol in a continent where only 15% can currently afford a beer. Structurally protective "moats" and strong positions for established players help ensure sustainable profits. Any corporate activity would likely be limited to the last independent brewer, Castel, and consolidation in ancillary businesses including soft drinks. Heineken (Buy) and SABMiller (Hold) appear best positioned to capture the growth. ________________________________________________________________________________________________________________ Deutsche Securities (Pty) Ltd Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 148/04/2014. Deutsche Bank Markets Research Sub-Saharan Africa Industry Date 4 February 2015 Consumer Staples Beer Beverage FITT Research Wynand Van Zyl Research Analyst The rising star of Africa (+27) 11 775-7185 [email protected] Driving the next decade of beer growth Tristan Van Strien Over the next decade, Africa should account for 40% of global volume and Research Analyst profit growth. -

US V. Anheuser-Busch Inbev SA/NV and Sabmiller

Case 1:16-cv-01483 Document 2-2 Filed 07/20/16 Page 1 of 38 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA UNITED STATES OF AMERICA, Plaintiff, Civil Action No. v. ANHEUSER-BUSCH InBEV SA/NV, and SABMILLER plc, Defendants. PROPOSED FINAL JUDGMENT WHEREAS, Plaintiff, United States of America (“United States”) filed its Complaint on July 20, 2016, the United States and Defendants, by their respective attorneys, have consented to entry of this Final Judgment without trial or adjudication of any issue of fact or law, and without this Final Judgment constituting any evidence against or admission by any party regarding any issue of fact or law; AND WHEREAS, Defendants agree to be bound by the provisions of the Final Judgment pending its approval by the Court; AND WHEREAS, the essence of this Final Judgment is the prompt divestiture of certain rights and assets to assure that competition is not substantially lessened; AND WHEREAS, this Final Judgment requires Defendant ABI to make certain divestitures for the purpose of remedying the loss of competition alleged in the Complaint; Case 1:16-cv-01483 Document 2-2 Filed 07/20/16 Page 2 of 38 AND WHEREAS, Plaintiff requires Defendants to agree to undertake certain actions and refrain from certain conduct for the purposes of remedying the loss of competition alleged in the Complaint; AND WHEREAS, Defendants have represented to the United States that the divestitures required below can (after the Completion of the Transaction) and will be made, and that the actions and conduct restrictions can and will be undertaken, and that Defendants will later raise no claim of hardship or difficulty as grounds for asking the Court to modify any of the provisions contained below; NOW THEREFORE, before any testimony is taken, without trial or adjudication of any issue of fact or law, and upon consent of the parties, it is ORDERED, ADJUDGED, AND DECREED: I. -

Coca-Cola and Sabmiller to Join Their Forces in the African Market

Coca-Cola and SABMiller to join their forces in the African market The Coca-Cola Company; market cap (as of 28/11/2014): $194.0bn SABMiller plc; market cap (as of 27/11/2014) £57.17bn Introduction SABMiller, the world's second biggest brewer by revenue has agreed to a merge with one of Coca-Cola’s bottler, Coca-Cola Sabco, to combine bottling operations in Southern and east Africa and form a new company, Coca-Cola Beverages Africa, which, based in Port Elizabeth (South Africa), will become the biggest bottler of the soft drink in Africa and the 10th largest in the world, with annual revenue of $2.9bn and 14,000 employees in more than 30 plants. About Coca-Cola The Coca-Cola Company is the world's largest beverage company delivering its products in over 200 different countries worldwide employing more than 130,000 people. Founded in 1892 and based in Atlanta, the Company owns or licenses and markets more than 500 non-alcoholic brands, for a total value of $64.7bn (Eurobrand). Despite $46.25bn revenues and a worldwide 4% five years CAGR, Coca-Cola is in the middle of a cost-cutting operation aimed at countering falling soda sales in many of its key markets, especially North America. In order to diversify its revenues base the Company is seeking a bottling partner to strengthen its position in another key market, namely Africa. Going in this direction, the merge of the firm’s subsidiary Coca-Cola Sabco, owned for 80% by Gutsche Family, with the world’s second biggest brewer, SABMiller, will create a new business, Coca-Cola Beverages Africa. -

Financial Services Guide and Independent Expert's Report In

Financial Services Guide and Independent Expert’s Report in relation to the Proposed Demerger of Treasury Wine Estates Limited by Foster’s Group Limited Grant Samuel & Associates Pty Limited (ABN 28 050 036 372) 17 March 2011 GRANT SAMUEL & ASSOCIATES LEVEL 6 1 COLLINS STREET MELBOURNE VIC 3000 T: +61 3 9949 8800 / F: +61 3 99949 8838 www.grantsamuel.com.au Financial Services Guide Grant Samuel & Associates Pty Limited (“Grant Samuel”) holds Australian Financial Services Licence No. 240985 authorising it to provide financial product advice on securities and interests in managed investments schemes to wholesale and retail clients. The Corporations Act, 2001 requires Grant Samuel to provide this Financial Services Guide (“FSG”) in connection with its provision of an independent expert’s report (“Report”) which is included in a document (“Disclosure Document”) provided to members by the company or other entity (“Entity”) for which Grant Samuel prepares the Report. Grant Samuel does not accept instructions from retail clients. Grant Samuel provides no financial services directly to retail clients and receives no remuneration from retail clients for financial services. Grant Samuel does not provide any personal retail financial product advice to retail investors nor does it provide market-related advice to retail investors. When providing Reports, Grant Samuel’s client is the Entity to which it provides the Report. Grant Samuel receives its remuneration from the Entity. In respect of the Report in relation to the proposed demerger of Treasury Wine Estates Limited by Foster’s Group Limited (“Foster’s”) (“the Foster’s Report”), Grant Samuel will receive a fixed fee of $700,000 plus reimbursement of out-of-pocket expenses for the preparation of the Report (as stated in Section 8.3 of the Foster’s Report). -

Sabmiller and Molson Coors to Combine U.S. Operations in Joint Venture

SABMILLER AND MOLSON COORS TO COMBINE U.S. OPERATIONS IN JOINT VENTURE • Combination of complementary assets will create a stronger, more competitive U.S. brewer with an enhanced brand portfolio • Greater scale and resources will allow additional investment in brands, product innovation and sales execution • Consumers and retailers will benefit from greater choice and access to brands • Distributors will benefit from a superior core brand portfolio, simplified systems, lower operating costs and improved chain account programs • $500 million of annual cost synergies will enhance financial performance • SABMiller and Molson Coors with 50%/50% voting interest and 58%/42% economic interest 9 October 2007 (London and Denver) -- SABMiller plc (SAB.L) and Molson Coors Brewing Company (NYSE: TAP; TSX) today announced that they have signed a letter of intent to combine the U.S. and Puerto Rico operations of their respective subsidiaries, Miller and Coors, in a joint venture to create a stronger, brand-led U.S. brewer with the scale, resources and distribution platform to compete more effectively in the increasingly competitive U.S. marketplace. The new company, which will be called MillerCoors, will have annual pro forma combined beer sales of 69 million U.S. barrels (81 million hectoliters) and net revenues of approximately $6.6 billion. Pro forma combined EBITDA will be approximately $842 million1. SABMiller and Molson Coors expect the transaction to generate approximately $500 million in annual cost synergies to be delivered in full by the third full financial year of combined operations. The transaction is expected to be earnings accretive to both companies in the second full financial year of combined operations. -

Molson Coors Brewing Company

424B5http://www.oblible.com 1 a2229065z424b5.htm 424B5 Use these links to rapidly review the document TABLE OF CONTENTS TABLE OF CONTENTS Table of Contents Filed Pursuant to Rule 424(b)(5) Registration No. 333-209123 CALCULATION OF REGISTRATION FEE Proposed Maximum Proposed Maximum Title of Each Class of Amount to be Offering Price Aggregate Amount of Securities to be Registered Registered per Note Offering Price Registration Fee(1) 1.450% Senior Notes due 2019 $500,000,000 99.950% $499,750,000 $50,324.83 2.100% Senior Notes due 2021 $1,000,000,000 99.962% $999,620,000 $100,661.74 3.000% Senior Notes due 2026 $2,000,000,000 99.845% $1,996,900,000 $201,087.83 4.200% Senior Notes due 2046 $1,800,000,000 99.357% $1,788,426,000 $180,094.50 Guarantees related to the Senior Notes N/A N/A N/A N/A (1) Calculated in accordance with Rule 457(r) of the Securities Act of 1933, as amended. Table of Contents PROSPECTUS SUPPLEMENT (To Prospectus dated January 26, 2016) $5,300,000,000 Molson Coors Brewing Company $500,000,000 1.450% Senior Notes due 2019 $1,000,000,000 2.100% Senior Notes due 2021 $2,000,000,000 3.000% Senior Notes due 2026 $1,800,000,000 4.200% Senior Notes due 2046 Molson Coors Brewing Company is offering $500,000,000 aggregate principal amount of 1.450% Senior Notes due 2019, $1,000,000,000 aggregate principal amount of 2.100% Senior Notes due 2021, $2,000,000,000 aggregate principal amount of 3.000% Senior Notes due 2026 and $1,800,000,000 aggregate principal amount of 4.200% Senior Notes due 2046, which we refer to together as the "notes." Interest on the notes is payable on January 15 and July 15 of each year, commencing on January 15, 2017. -

Sabmiller Plc Annual Report 2011 Welcome To

SABMiller plc Annual Report 2011 Welcome to the SABMiller plc Annual Report 2011. Overview This interactive PDF allows you to access information easily, search for a specific item or go directly to another page, section or website. Guide to buttons Business review Go to main Go to Search Print contents page Definitions this PDF options Return to Go to Go to last page preceding next page Governance visited page Links in this PDF Words and numbers that are underlined are dynamic links – clicking on them will take you to further information within the document or to a web page (opens in a new window). Financial statements Tabs Clicking on one of the tabs at the side of the page takes you to the start of that section. Shareholder information SABMiller plc Annual Report 2011 Building locally, winning globally SABMiller plc Annual Report 2011 Contents What’s inside Overview 1 Performance highlights Overview 2 Five minute read 4 Group at a glance Financial and operational highlights of the year, an overview of the group and a description of our business activities Business review 6 Chairman’s statement 22 Operations review Business review 10 Global beer market trends 22 Latin America 11 SABMiller’s market positions 24 Europe Statements from our Chairman 13 Chief Executive’s review 26 North America and executive directors, an 18 Strategic priorities 28 Africa overview of our markets, 19 Key performance indicators 30 Asia strategy, our business model, 20 Principal risks 32 South Africa: Beverages the way we manage risk, how 34 South Africa: Hotels -

Sabmiller Plc U.S.$5,000,000,000

Proof3:8.7.09 PROSPECTUS DATED 9 July 2009 SABMiller plc (incorporated with limited liability in England and Wales) (Registered Number 3258416) U.S.$5,000,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Prospectus (the ‘‘Programme’’), SABMiller plc (the ‘‘Issuer’’ or ‘‘SABMiller’’), subject to compliance with all relevant laws, regulations and directives, may from time to time issue Euro Medium Term Notes (the ‘‘Notes’’). The aggregate nominal amount of Notes outstanding will not at any time exceed U.S.$5,000,000,000 (or the equivalent in other currencies). Application has been made to the Financial Services Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 (‘‘FSMA’’) (the ‘‘UK Listing Authority’’) for Notes issued under the Programme for the period of 12 months from the date of this Prospectus to be admitted to the official list of the UK Listing Authority (the ‘‘Official List’’) and to the London Stock Exchange plc (the ‘‘London Stock Exchange’’) for such Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the ‘‘Market’’). References in this Prospectus to Notes being ‘‘listed’’ (and all related references) shall mean that such Notes have been admitted to the Official List and have been admitted to trading on the Market. The Market is a regulated market for the purposes of the Directive 2004/39/EC of the European Parliament and of the Council on markets in financial instruments. However, unlisted Notes may be issued pursuant to the Programme. -

Sabmiller Plc Anheuser-Busch Inbev SA/NV

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. PART II OF THIS DOCUMENT COMPRISES AN EXPLANATORY STATEMENT IN COMPLIANCE WITH SECTION 897 OF THE COMPANIES ACT 2006. THIS DOCUMENT RELATES TO A TRANSACTION WHICH, IF IMPLEMENTED, WILL RESULT IN THE CANCELLATION OF THE LISTINGS OF SABMILLER SHARES ON THE OFFICIAL LIST OF THE LONDON STOCK EXCHANGE AND THE MAIN BOARD OF THE JOHANNESBURG STOCK EXCHANGE, AND OF TRADING OF SABMILLER SHARES ON THE LONDON STOCK EXCHANGE’S MAIN MARKET FOR LISTED SECURITIES AND ON THE MAIN BOARD OF THE JOHANNESBURG STOCK EXCHANGE. THE SECURITIES PROPOSED TO BE ISSUED PURSUANT TO THE UK SCHEME WILL NOT BE REGISTERED WITH THE SEC UNDER THE US SECURITIES ACT OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES. THE APPROVAL OF THE HIGH COURT OF JUSTICE IN ENGLAND AND WALES PROVIDES THE BASIS FOR THE SECURITIES TO BE ISSUED WITHOUT REGISTRATION UNDER THE US SECURITIES ACT, IN RELIANCE ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE US SECURITIES ACT PROVIDED BY SECTION 3(a)(10). If you are in any doubt as to the action you should take, you are recommended to seek your own independent advice as soon as possible from your stockbroker, bank, solicitor, accountant, fund manager or other appropriate independent professional adviser who, if you are taking advice in the United Kingdom, is appropriately authorised to provide such advice under the United Kingdom Financial Services and Markets Act 2000 (as amended), or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. -

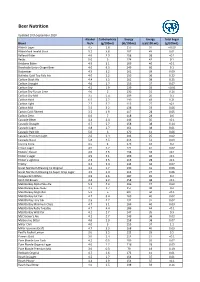

Nutritional Information

Beer Nutrition Updated 10th September 2020 Alcohol Carbohydrate Energy Energy Total Sugar Brand %v/v (g/100mL) (kJ/100mL) (cal/100 mL) (g/100mL) Abbots Lager 4.5 2.8 155 37 <0.20 Abbotsford Invalid Stout 5.2 3.8 187 45 0.01 Ballarat Bitter 4.6 2.9 158 38 <0.1 Becks 5.0 3 174 42 0.1 Brisbane Bitter 4.9 3.1 169 40 <0.1 Brookvale Union Ginger Beer 4.0 9.3 249 60 9.1 Budweiser 4.5 3.2 161 39 0.09 Bulimba Gold Top Pale Ale 4.0 3.2 150 36 0.22 Carlton Black Ale 4.4 3.3 161 38 0.25 Carlton Draught 4.6 2.7 155 37 0.07 Carlton Dry 4.5 1.9 139 33 <0.01 Carlton Dry Fusion Lime 4.0 2 130 31 0.16 Carlton Dry Mid 3.5 1.4 109 26 0.1 Carlton Hard 6.5 2.7 199 48 0.21 Carlton Light 2.7 2.7 113 27 <0.1 Carlton Mid 3.5 3.2 138 33 0.06 Carton Cold Filtered 3.5 1.9 117 28 0.05 Carlton Zero 0.0 7 118 28 0.6 Cascade Bitter 4.4 2.4 146 35 <0.1 Cascade Draught 4.7 2.7 158 38 0.14 Cascade Lager 4.8 2.7 161 38 0.01 Cascade Pale Ale 5.0 3 170 41 0.06 Cascade Premium Light 2.6 2.4 103 25 0.02 Cascade Stout 5.8 4.5 213 51 0.03 Corona Extra 4.5 4 176 42 0.2 Crown Lager 4.9 3.2 171 41 0.02 Fosters' Classic 4.0 2.5 138 33 <0.1 Foster's Lager 4.9 3.1 169 40 <0.1 Foster's Light Ice 2.3 3.5 116 28 <0.1 Frothy 4.2 2.4 143 34 0.07 Great Northern Brewing Co Original 4.2 1.7 130 31 0.06 Great Northern Brewing Co Super Crisp Lager 3.5 1.4 112 27 0.06 Hoegaarden White 4.9 3.6 187 45 0.2 Kent Old Brown 4.4 3.2 158 38 <0.1 Matilda Bay Alpha Pale Ale 5.2 4.3 196 47 0.03 Matilda Bay Beez Neez 4.7 2.7 157 38 0.2 Matilda Bay Dogbolter 5.2 5 207 50 <0.1 Matilda Bay Fat Yak 4.7 3.4 169