1. the Directors' Report On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Read H. C. Hirschboeck Autobiography

AUTOBIOGRAPHY HERBERT C. HIRSCHBOECK Copr. 1981 H.C. Hirschboeck TO MERT AUTOBIOGRAPHY HERBERT C. HIRSCHBOECK Page No. 1. Early Years .......................................... 2 2. After High School .................................... 6 3. Amateur Theater ...................................... 11 4. After Law School ..................................... 13 5. Beginning Law Practice ............................... 17 6. Europe ............................................... 20 7. Dunn & Hirschboeck ................................... 25 8. Early Supreme Court Appeals .......................... 26 9. The Depression ....................................... 34 10. City Attorney's Office .............................. 36 11. Baby Bonds .......................................... 49 12. Miller, Mack & Fairchild ............................ 56 13. Marriage ............................................ 60 14. Return to Individual Practice ....................... 68 15. Cancer .............................................. 74 16. Hirschboeck & McKinnon .............................. 77 17. Thorp Finance Corporation ........................... 79 18. John Smith .......................................... 83 19. World War II ........................................ 86 20. Whyte & Hirschboeck ................................. 90 21. New Associates and Partners ......................... 95 22. Michael and John Cudahy ............................. 97 23. Milwaukee Bar Association ........................... 100 24. Miller Brewing Company ............................. -

Wkład Kompanii Piwowarskiej W Polską Gospodarkę

WKŁAD KOMPANII PIWOWARSKIEJ W POLSKĄ GOSPODARKĘ KOMPANIA PIWOWARSKA LIDER BRANŻY PIWOWARSKIEJ W POLSCE Kompania Piwowarska SA jest największym przedsiębiorstwem piwowarskim w Polsce. Kilkusetletnie doświadczenia w warzeniu piwa, nowoczesne technologie i rygorystyczne przestrzeganie zasad produkcji na światowym poziomie gwarantują najwyższą jakość naszych produktów. Do portfela marek Kompanii Piwowarskiej należą Kompania Piwowarska powstała najpopularniejsze polskie piwa - m.in. Tyskie, w 1999 roku i posiada trzy browary: Żubr, Lech, Dębowe Mocne, Redd’s, w TYCHACH, POZNANIU I BIAŁYMSTOKU a także międzynarodowe marki premium: oraz 14 oddziałów handlowych na Pilsner Urquell, Grolsch terenie całego kraju. oraz Peroni Nastro Azzurro. KOMPANIA PIWOWARSKA JEST CZĘŚCIĄ AMERYKA PÓŁNOCNA JEDNEGO Z NAJWIĘKSZYCH NA ŚWIECIE STANY ZJEDNOCZONE AMERYKI PRODUCENTÓW PIWA - SABMILLER PLC. Grupa produkuje lub dystrybuuje piwo na sześciu kontynentach, a jej ogólnoświatowy portfel obejmuje międzynarodowe piwa premium, takie jak Grolsch, Miller Genuine Draft, Peroni Nastro Azzurro czy Pilsner Urquell oraz czołowe marki lokalne, takie jak Aquila, Castle, Miller Lite, Snow czy Tyskie. SABMiller jest jedną AMERYKA POŁUDNIOWA I CENTRALNA KOLUMBIA / EKWADOR / SALWADOR / z największych na świecie (poza USA) firm rozlewających HONDURAS / PANAMA / PERU / ARGENTYNA produkty Coca-Coli. W roku finansowym zakończonym 31 marca 2011 r. SABMiller osiągnął przychody w wysokości 28,3 mld USD oraz wypracował zysk brutto (EBITA) w wysokości 5 mld USD. SABMiller plc jest notowany na giełdach papierów wartościowych w Londynie i Johannesburgu. KOMPANIA PIWOWARSKA/SABMILLER JEST CZŁONKIEM NASTĘPUJĄCYCH ORGANIZACJI: Związek Pracodawców Przemysłu Piwowarskiego – Browary Polskie - organizacja, która skupia największych producentów piwa w Polsce i reprezentuje ok. 90 % rynku. Związek służy firmom zrzeszonym wiedzą i doradztwem w zakresie regulacji rynku i powinności uczestniczących w nim podmiotów. -

We Rank the Top 20 Beer Wholesalers in the United States. 20 Ranked by Case Volume

Beverage Executive’s Distribution We rank the top 20 beer wholesalers in the United States. 20 Ranked by case volume Reyes Beverage Group Leading Suppliers/Brands: Boston Beer, growth throughout 2011 with the 1 (RBG) Crown Imports, Diageo-Guinness acquisition of The Schenck Co. in 6250 N. River Road, Rosemont, IL 60018 USA, Dogfish Head, Heineken USA, Orlando, Fla., early in the year. Tel: 847.227.6500, reyesbeveragegroup.com MillerCoors, Mike’s Hard Lemonade Co., New Belgium, Sierra Nevada, Silver Eagle CV 93.0 MIL DS $1.9 BIL Yuengling 2 Distributors, L.P. Number of Employees: 2,000 The Details: The beer division of Reyes 7777 Washington Ave., Houston, TX Principals: Chris Reyes, co-chairman, Holdings collected more accolades 77007 Tel: 713.869.4361, silvereagle.com, Reyes Holdings, LLC; Jude Reyes, wideworldofbud.com, craftbrewers.com co-chairman, Reyes Holdings, LLC; Duke Reyes, CEO, Reyes Beverage CV 45.6 MIL DS $821.0 MIL Group; Ray Guerin, COO, Reyes Number of Employees: 1,200+ Beverage Group; Jimmy Reyes, director, Principals: John Nau III, majority Reyes Holdings, LLC; Tom Reyes, owner, president & CEO; Robert president, Harbor Distributing, LLC Boblitt Jr., minority owner, executive and Gate City Beverage; Jim Doney, vice president, COO, CFO; John president, Chicago Beverage Systems; Johnson, minority owner, executive John Zeltner, president, Premium vice president, corporate sales and Distributors of Virginia, Maryland marketing and Washington, D.C.; Bob Johnston, Other Locations: Conroe, Cypress, president, Florida Distributing Rosenberg and San Antonio, Texas Co.; Patrick Collins, president, Lee Leading Suppliers/Brands: ABInBev, Distributors; Steve Sourapas, president, Crown Imports, Green Mountain Bev, Crest Beverage Inc., North American Breweries, Phusion Other Locations: Anaheim, Calif., and acquisitions over the past year. -

Blue Moon Belgian White Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Anheuser-Busch Bud Light Lager

BEER DRAFT Blue Moon Belgian White Pint 6 Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Pitcher 22 Blue Moon Belgian White, Belgian-style wheat ale, is a refreshing, medium-bodied, unfiltered Belgian-style wheat ale spiced with fresh coriander and orange peel for a uniquely complex taste and an uncommonly... Anheuser-Busch Bud Light Pint 6 Lager - American Light / 4.2% ABV / 6 IBU / 110 CAL / St. Louis, Pitcher 22 MO Bud Light is brewed using a blend of premium aroma hop varieties, both American-grown and imported, and a combination of barley malts and rice. Its superior drinkability and refreshing flavor... Coors Coors Light Pint 5 Lager - American Light / 4.2% ABV / 10 IBU / 100 CAL / Pitcher 18 Golden, CO Coors Light is Coors Brewing Company's largest-selling brand and the fourth best-selling beer in the U.S. Introduced in 1978, Coors Light has been a favorite in delivering the ultimate in... Deschutes Fresh Squeezed IPA Pint 7 IPA - American / 6.4% ABV / 60 IBU / 192 CAL / Bend, OR Pitcher 26 Bond Street Series- this mouthwatering lay delicious IPA gets its flavor from a heavy helping of citra and mosaic hops. Don't worry, no fruit was harmed in the making of... 7/2/2019 DRAFT Ballast Point Grapefruit Sculpin Pint 7 IPA - American / 7% ABV / 70 IBU / 210 CAL / San Diego, CA Pitcher 26 Our Grapefruit Sculpin is the latest take on our signature IPA. Some may say there are few ways to improve Sculpin’s unique flavor, but the tart freshness of grapefruit perfectly.. -

Big Beer Duopoly a Primer for Policymakers and Regulators

Big Beer Duopoly A Primer for Policymakers and Regulators Marin Institute Report October 2009 Marin Institute Big Beer Duopoly A Primer for Policymakers and Regulators Executive Summary While the U.S. beer industry has been consolidating at a rapid pace for years, 2008 saw the most dramatic changes in industry history to date. With the creation of two new global corporate entities, Anheuser-Busch InBev (ABI) and MillerCoors, how beer is marketed and sold in this country will never be the same. Anheuser-Busch InBev is based in Belgium and largely supported and managed by Brazilian leadership, while MillerCoors is majority-controlled by SABMiller out of London. It is critical for federal and state policymakers, as well as alcohol regulators and control advocates to understand these changes and anticipate forthcoming challenges from this new duopoly. This report describes the two industry players who now control 80 percent of the U.S. beer market, and offers responses to new policy challenges that are likely to negatively impact public health and safety. The new beer duopoly brings tremendous power to ABI and MillerCoors: power that impacts Congress, the Office of the President, federal agencies, and state lawmakers and regulators. Summary of Findings • Beer industry consolidation has resulted in the concentration of corporate power and beer market control in the hands of two beer giants, Anheuser-Busch InBev (ABI) and MillerCoors LLC. • The American beer industry is no longer American. Eighty percent of the U.S. beer industry is controlled by one corporation based in Belgium, and another based in England. • The mergers of ABI and MillerCoors occurred within months of each other, and both were approved much quicker than the usual merger process. -

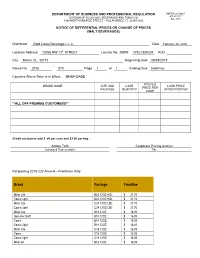

DEPARTMENT of BUSINESS and PROFESSIONAL REGULATION DBPR Form AB&T DIVISION of ALCOHOLIC BEVERAGES and TOBACCO 4000A-032E Rev

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION DBPR Form AB&T DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO 4000A-032E Rev. 5/04 1940 NORTH MONROE STREET • TALLAHASSEE, FL 32399-1022 NOTICE OF DIFFERENTIAL PRICES OR CHANGE OF PRICES (MALT BEVERAGES) Distributor Gold Coast Beverage L.L.C. Date February 26, 2016 Location Address 10055 NW 12th STREET License No. JDBW WSL2300224 KLD City Miami, FL 33172 Beginning Date 09/28/2015 - Notice No. 2016 074 Page 1 of 1 Ending Date Indefinite Counties Where Price is in Effect: MIAMI-DADE POSTED BRAND NAME SIZE AND CASE CASH PRICE PRICE PER PACKAGE QUANTITY AFTER POSTING CASE **ALL OFF PREMISE CUSTOMERS** Credit customers add $ .40 per case and $2.00 per keg. Amber Toth Corporate Pricing Analyst Authorized Representative Title Ref posting 2015-222 Amend – Frontlines Only Brand Package Frontline Miller Lite B24 12OZ HGL $ 21.70 Coors Light B24 12OZ HGL $ 21.70 Miller Lite C24 12OZ LSE $ 21.70 Coors Light C24 12OZ LSE $ 21.70 Miller Lite B18 12OZ $ 16.05 Genuine Draft B18 12OZ $ 16.05 Coors B18 12OZ $ 16.05 Coors Light B18 12OZ $ 16.05 Miller Lite C18 12OZ $ 16.05 Coors C18 12OZ $ 16.05 Coors Light C18 12OZ $ 16.05 Miller 64 B18 12OZ $ 16.05 Miller 64 C18 12OZ $ 16.05 Lite B24 12OZ 12P $ 21.80 Genuine Draft B24 12OZ 12P $ 21.80 Coors Light B24 12OZ 12P $ 21.80 Miller Lite C24 12OZ 12P $ 21.80 Coors Light C24 12OZ 12P $ 21.80 Coors Banquet C24 12OZ 12P $ 21.80 Coors Banquet Stubby B24 12OZ 12STB $ 21.80 Coors LT Citrus Radler C24 12OZ 12P $ 21.80 Miller Lite B24 12OZ 6P $ 22.40 Coors Light B24 12OZ -

AB Inbev-Sabmiller Merger Bash: Who Will Have the Most Fun by HELEN THOMAS and SPENCER JAKAB, WSJ, Sept

AB InBev-SABMiller Merger Bash: Who Will Have the Most Fun By HELEN THOMAS And SPENCER JAKAB, WSJ, Sept. 16, 2015 12:53 p.m. ET Anheuser-Busch InBev has finally opted to down its pint, but everyone else in the bar may end up having more fun. The world’s largest brewer by sales said Wednesday that it planned to make an offer to buy SABMiller, a long-awaited deal that would bring together companies controlling 30% of global beer volumes. The timing, at least from AB InBev’s standpoint, makes sense. SABMiller has underperformed other beer companies this year, thanks to its huge emerging-markets exposure. Nearly 70% of its sales are made in China or markets reliant on commodities like Nigeria, Australia or sub-Sahran Africa, notes Barclays, the highest in the European staples sector. Longer-term this should translate into higher growth. Indeed, increasing its exposure to markets like Colombia, Peru and in Africa may be part of the appeal for AB InBev. But given current anxieties, SABMiller’s valuation had dropped to about 18 times forecast earnings, a slight discount to the sector. Over the past year, the stock has underperformed AB InBev by about 30 percentage points. SABMiller still won’t come cheap. Even before the deal announcement, its valuation was at a slight premium to its five- year average of about 18.3 times. Its substantial shareholders, Altria and Colombia’s Santo Domingo family, from whom SAB bought Bavaria in 2005, together control more than 40% of the company. But AB InBev’s formidable reputation in slashing costs means a deal helps to offset concerns about its own slowing growth. -

SAB 201406240040A Annual Financial Report Sabmiller Plc

SAB 201406240040A Annual Financial Report SABMiller plc JSEALPHA CODE: SAB ISIN CODE: SOSAB ISIN CODE: GB0004835483 Annual Financial Report SABMiller plc has today submitted a copy of the 2014 Annual Report and Accounts, Notice of the 2014 Annual General Meeting and Shareholder Proxy Form (UK) to the National Storage Mechanism and they will shortly be available for inspection at www.hemscott.com/nsm.do. The Annual Report and Notice of Annual General Meeting are also available on the Company’s website www.sabmiller.com SABMiller plc’s Annual General Meeting will be held on Thursday, 24 July 2014 at the InterContinental London Park Lane, One Hamilton Place, Park Lane, London W1J 7QY. A condensed set of SABMiller’s financial statements and information on important events that have occurred during the financial year and their impact on the financial statements were included in SABMiller’s preliminary results announcement released on 22 May 2014. That information, together with the information set out below, which is extracted from the 2014 Annual Report, constitutes the material required by Disclosure and Transparency Rule 6.3.5 to be communicated to the media in unedited full text through a Regulatory Information Service. This announcement is not a substitute for reading the full 2014 Annual Report. Page numbers and cross- references in the extracted information below refer to page numbers and sections in the 2014 Annual Report. PRINCIPAL RISKS AND UNCERTAINTIES (page 18 & 19) Principal risks Focused on managing our risks The principal risks facing the group and considered by the board are detailed below. The group’s well-developed risk management process is described in the corporate governance section while financial risks are discussed in the Chief Financial Officer’s review on page 39 and in note 21 to the consolidated financial statements. -

Meet China's Corporates: a Primer

Meet China’s Corporates: A Primer An At-A-Glance Guide to China’s Non-Financial Sectors July 9, 2020 S&P Global (China) Ratings www.spgchinaratings.cn July 9, 2020 Meet China’s Corporates: A Primer July 9, 2020 Contents Beer ..................................................................................................... 3 Car Makers ........................................................................................... 6 Cement ................................................................................................ 9 Chemical Manufacturers .................................................................... 11 Coal ................................................................................................... 13 Commercial Real Estate ..................................................................... 16 Engineering and Construction ............................................................ 18 Flat Panel Display Technology ............................................................ 21 Household Appliances ....................................................................... 23 Liquor ................................................................................................ 25 Online and Mobile Gaming.................................................................. 28 Power Generation ............................................................................... 31 Real Estate Development ................................................................... 34 Semiconductors ................................................................................ -

Benefity Dla Pracowników KP

Świadczenia dodatkowe dla pracowników KP Piwo za darmo, pakiet sportowy, dofinansowanie do wypoczynku dzieci, pożyczki remontowe na preferencyjnych warunkach, a także unikalny pakiet medyczny z możliwością wyboru jednego z trzech operatorów. To tylko niektóre z korzyści wynikających z pracy w Kompanii Piwowarskiej. „Nasza filozofia wynagrodzeń zakłada, że wynagradzamy w zależności od rozmiaru stanowiska, jego rynkowej wartości oraz osiąganych wyników.” – mówi Piotr Soroka koordynator ds. rozwoju wynagrodzeń w KP – „Dodatkowo chcemy zmotywować pracowników, aby wspierali realizację strategii KP poprzez osiąganie celów działowych lub firmowych. Temu służą premie.” Wynagrodzenia w Kompanii Piwowarskiej są konkurencyjne na rynku firm dóbr szybkozbywalnych (FMCG). Z kolei premie roczne zależą od rodzaju piastowanego stanowiska. Przeciętny pracownik może liczyć na premię w wysokości od 50% do 150% średniego wynagrodzenia z ostatnich trzech miesięcy i zależy ona od udziałów rynkowych firmy oraz osiągniętego przez KP zysku. Inny system premiowy stosuje się do pracowników sprzedaży oraz wyższego szczebla. Jednak wynagrodzenia to nie wszystko… Zobacz film na temat benefit ów dla pracowników KP Piwo za darmo Każdy pracownik Kompanii Piwowarskiej raz w miesiącu ma możliwość odebrania zgrzewki swojego ulubionego piwa. Tym samym można spróbować każdej produkowanej marki piwa. Ponadto, pracownicy mają możliwość korzystania z darmowych degustacji w pubie w Poznaniu i Tychach. „Firma dzieli się z nami tym co robi najlepiej, czyli piwem”– mówi Natalia Simenka specjalista ds. trade marketingu w KP, i dodaje – „Nasz pub pracowniczy to miejsc imprez i spotkań, takich jak np. imprezy integracyjne czy spotkania wigilijne.” Stawimy na sport Sport to nie tylko zdrowie, ale także sposób na rozładowanie stresu i codziennego napięcia oraz polepszenie samopoczucia. Zaangażowanie w sportowy tryb życia ułatwi pracownikom Kompanii karta Multisport. -

View Presentation

WORLD BREWING CONGRESS 2016 World Brewing Congress August 13-17, 2016 Prospective demand for malting barley and malt quality for the global brewing industry Sheraton Downtown Denver 159 Peter Watts1, Dr. Yueshu Li1 and Dr. Jessica Yu2 Denver, CO 80202, U.S.A. 1. Canadian Malting Barley Technical Centre, Winnipeg, Manitoba, Canada R3C 3G7 2. Tsingtao Brewery Co. Ltd, Qingdao, China 266100 Introduction China Beer Market Evolving Quality Requirements Rapid changes in the world brewing industry including the boom in craft brewing, diversification in In addition to international brewing groups such as Carlsberg and AB-InBev, China Resource Snow Brewery, Tsingtao Brewery, and Beijing Yangjing Beer are dominant Rising beer production in China and the rapid development of craft brewing in the US beer brand/style as well as changing ownership present both challenges and opportunities for the players in China accounting for 71% of beer output. Increasingly Chinese beer manufacturers are strengthening their brand positioning. In 2014 China Resources Snow are driving increased demand for malting barley and malt, and are also shifting quality malting barley industry. In this presentation, trends in global malting and brewing sectors, Breweries produced 107 million hectolitres of Snow beer making it the world’s largest beer brand at 5.4% of the global market. Its total volume is higher than the requirements. In China, brewers are demanding barley with higher grain protein and specifically in China and the United States, and changing quality requirements for malting barley combined volume of Budweiser (4.6 billion liters) and Budlight (5.0 billion liters). Together with Tsingtao Brewery and Beijing Yangjing Beer, these three Chinese brewers very high enzyme potential to compensate for large adjunct incorporation. -

Millercoors V. Anheuser-Busch Cos., LLC

No Shepard’s Signal™ As of: May 28, 2019 12:50 PM Z Millercoors v. Anheuser-Busch Cos., LLC United States District Court for the Western District of Wisconsin May 24, 2019, Decided; May 24, 2019, Filed 19-cv-218-wmc Reporter 2019 U.S. Dist. LEXIS 88259 * comments during oral argument on that motion on May 16, 2019, and for the reasons more fully explained MILLERCOORS, LLC, Plaintiff, v. ANHEUSER-BUSCH below, the court will grant plaintiff a preliminary COMPANIES, LLC, Defendant. injunction, [*2] though more narrow in scope than that sought by plaintiff, enjoining defendant's use of the Counsel: [*1] For Millercoors, LLC, Plaintiff: Anita following statements: (1) Bud Light contains "100% less Marie Boor, Donald Karl Schott, LEAD ATTORNEYS, corn syrup"; (2) Bud Light in direct reference to "no corn Quarles & Brady, Madison, WI; Christopher A Cole, syrup" without any reference to "brewed with," "made Crowell & Moring LLP, Washington, DC; Raija Janelle with" or "uses"; (3) Miller Lite and/or Coors Light and Horstman, Crowell & Moring LLP, Los Angeles, CA. "corn syrup" without including any reference to "brewed For Anheuser-Busch Companies, LLC, Defendant: with," "made with" or "uses"; and (4) describing "corn 2 James Forrest Bennett, Megan Susan Heinsz, LEAD syrup" as an ingredient "in" the finished product. ATTORNEYS, Adam Joseph Simon, Dowd Bennett LLP, St. Louis, MO; Jennifer Lynn Gregor, Kendall W. Harrison, Godfrey & Kahn S.C., Madison, WI. Judges: WILLIAM M. CONLEY, United States District Judge. Opinion by: WILLIAM M. CONLEY Opinion OPINION AND ORDER During Super Bowl LIII, defendant Anheuser-Busch Companies, LLC, launched an advertising campaign highlighting plaintiff MillerCoors, LLC's use of corn syrup in brewing Miller Lite and Coors Light, as compared to Anheuser-Busch's use of rice in its flagship light beer, preliminary injunction based on the likelihood of plaintiff Bud Light.