Electric Vehicle Charging Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chademo Statement on European Commission Clean Power for Transport Package

January 24, 2013 CHADEMO STATEMENT ON EUROPEAN COMMISSION CLEAN POWER FOR TRANSPORT PACKAGE The European Commission today (January 24, 2013) published the Clean Power for Transport (CPT) package, including a policy paper on an alternative fuels strategy and the recommendation for standardization on recharging infrastructure for electric vehicles. It is encouraging to see clear targets for the deployment of a minimum number of recharging stations at a national level, which signals the momentum to pick up on Zero Emissions mobility. However, the CHAdeMO association would like to ensure that the CHAdeMO standard is not excluded from the DC fast charging specification. The CHAdeMO standard is used by more than 600 chargers across Europe in Norway, Netherlands, UK, France, and Estonia. There are more than 20,000 CHAdeMO-equipped vehicles on the road in Europe, demonstrating that customers and investors have taken a vested interest in the adoption of electric vehicles. They should not be excluded from this initiative. The CHAdeMO quick-charger is expected to be included in the International Electrotechnical Commission (IEC) standard in the second half of 2013 and the process will be expanded to allow for third party certification to increase the availability of CHAdeMO quick chargers. We request the European Commission consider a dual charging system for DC fast charging with CHAdeMO and CCS (combined charging system) that will allow use by the majority of current and future electric vehicles. From a cost point of view, there are significant commonalities between the two devices of more than 80%, with the only difference relating to communication protocol and charging gun. -

Optimal Locations of Us Fast Charging Stations for Long

He, Kockelman, Perrine 1 1 OPTIMAL LOCATIONS OF U.S. FAST CHARGING STATIONS FOR LONG- 2 DISTANCE TRIPS BY BATTERY ELECTRIC VEHICLES 3 4 Yawei He 5 Graduate Research Assistant 6 Department of Management Science and Engineering 7 Beijing Institute of Technology 8 Tel: +86 18611915120; [email protected] 9 10 Kara M. Kockelman, Ph.D., P.E. 11 Corresponding Author 12 Professor, and E.P. Schoch Professor in Engineering 13 Department of Civil, Architectural and Environmental Engineering 14 The University of Texas at Austin 15 Tel: 512-471-0210; Fax: 512-475-8744; [email protected] 16 17 Kenneth A. Perrine 18 Research Associate 19 Center for Transportation Research 20 The University of Texas at Austin 21 [email protected] 22 23 Presented at the 97th Annual Meeting of the Transportation Research Board, Washington, D.C., 24 January 2018 and published in Journal of Cleaner Production 214: 452-461 (2019) 25 26 ABSTRACT 27 Due to environmental and energy challenges, promoting battery electric vehicles (BEVs) is 28 a popular policy for many countries. However, lack of fast recharging infrastructure and 29 limitations on BEV range moderate their purchase and use. It is important to have a well- 30 designed charging station network, so this paper uses U.S. long-distance travel data to place 31 charging stations in order to maximize long-distance trip completions. Each scenario assumes a 32 certain number of charging stations (from 50 to 250, across the U.S.) and vehicle range (from 60 33 mi to 250 mi). 34 The problem is formulated as a mixed integer program, and a modified flow-refueling 35 location model (FRLM) model is solved via a branch-and-bound algorithm. -

Fast Charging: an In-Depth Look at Market Penetration, Charging Characteristics, and Advanced Technologies

EVS27 Barcelona, Spain, November 17-20, 2013 Fast Charging: An In-Depth Look at Market Penetration, Charging Characteristics, and Advanced Technologies Satish Rajagopalan1, Arindam Maitra1, John Halliwell1, Morgan Davis1, Mark Duvall1 1Electric Power Research Institute (EPRI), USA Abstract Plug-in Electric Vehicles (PEVs) are now available in many North American and European markets, with more models expected to become available to consumers in the coming years. These vehicles will present utilities with opportunities as well as challenges as their numbers potentially grow to hundreds of thousands of vehicles connected to the electric grid for charging. In order to support PEV adoption in the market place, it is expected that consumers will demand faster charge rates especially for the all electric vehicles. Faster charge rates require higher power electrical charging systems and the infrastructure to support these fast charging systems. With a view to comprehensively understand the impact of DC fast charging on the customer as well as the electric utility, Electric Power Research Institute (EPRI) has been conducting detailed research into the market potential, technical capabilities, and installation costs. Demand charges and installation costs are currently the most significant barriers widespread adoption of fast charging. Creating a sustainable business case for fast charging will require economics that match utilization. This paper will discuss these findings in depth and will also provide an update on the status of DC fast charging related standards. With a view to address these shortcomings, EPRI has developed a direct medium-voltage fed all solid-state fast charging system, the Utility Direct Medium Voltage Fast Charger (UDFC). -

One Million Electric Vehicles by 2015

One Million Electric Vehicles By 2015 February 2011 Status Report 1 Executive Summary President Obama’s goal of putting one million electric vehicles on the road by 2015 represents a key milestone toward dramatically reducing dependence on oil and ensuring that America leads in the growing electric vehicle manufacturing industry. Although the goal is ambitious, key steps already taken and further steps proposed indicate the goal is achievable. Indeed, leading vehicle manufacturers already have plans for cumulative U.S. production capacity of more than 1.2 million electric vehicles by 2015, according to public announcements and news reports. While it appears that the goal is within reach in terms of production capacity, initial costs and lack of familiarity with the technology could be barriers. For that reason, President Obama has proposed steps to accelerate America’s leadership in electric vehicle deployment, including improvements to existing consumer tax credits, programs to help cities prepare for growing demand for electric vehicles and strong support for research and development. Introduction In his 2011 State of the Union address, President Obama called for putting one million electric vehicles on the road by 2015 – affirming and highlighting a goal aimed at building U.S. leadership in technologies that reduce our dependence on oil.1 Electric vehicles (“EVs”) – a term that includes plug-in hybrids, extended range electric vehicles and all- electric vehicles -- represent a key pathway for reducing petroleum dependence, enhancing environmental stewardship and promoting transportation sustainability, while creating high quality jobs and economic growth. To achieve these benefits and reach the goal, President Obama has proposed a new effort that supports advanced technology vehicle adoption through improvements to tax credits in current law, investments in R&D and competitive “With more research and incentives, programs to encourage communities to invest we can break our dependence on oil in infrastructure supporting these vehicles. -

Renault 10 CV 1928 MOTOR

NEVS-brevet 1 Renault 10 CV 1928 MOTOR – NYTT tisdag 20 augusti Föregående måndag 19 augusti 1. BMW:s knep – kan slippa återkalla brinnande bilar 2. Hårda utsläppskrav på gång: Renaults kassako hotad? 3. Northvolts offensiv: Ska anställa 2 500 personer 4. Viktigaste säkerhetsfunktionen enligt svenskarna 5. Problem för Geely i Kina – försäljningen rasar 6. Premiummodellerna som offras för elbilar och suvar 7. Volkswagen ska skrota hybriderna nu är det eldrift som gäller 8. Volkswagen T-Roc Cabriolet 9. Volkswagen T-Cross på gång som coupé 10. Priset på Skoda Citigo-e avslöjat? 11. Ford kände till strulande växellåda – nu straffar det sig 12. Dubbel effekt och dubbelt vridmoment med nya elmotorn 13. Nu finns Porsche Cayenne med 680 hästar 14. HiPhi 1 – suv med knepigt namn och knepiga dörrar 15. Eldrivna hyperbilar står som spön i backen – här är Karma SC1 16. En McLaren väntas gå för osannolik summa på auktion 17. Mercedes-AMG One försenad till 2021 18. Mercedes laddar för Frankfurt – lovar mängder av nyheter 19. 45 000 har reserverat eldrivna Mini Cooper SE 20. Parkera på laddplats utan att ladda? Då får du skylla dig själv 21. Teslas pickup är på gång – men får tuff konkurrens 22. MG som pickup? Japp, här är Extender! 23. En nedmontering av motorn i nya Toyota Supra 24. Svenska forskare gör biobränsle med solenergi MOTOR ‒ NYTT 20 AUGUSTI 2019 NEVS-brevet 2 25. Här är Lotus nya logga 26. Jaguar XJ220 27. Grattis Chevrolet Bel Air! 28. Columbus Electric 29. Felix Rosenqvist var inblandad i en otäck krasch 30. Föraren anklagas: ”Det är skamligt” 1. -

Bringing the Auto Industry, U.S. Government and Car Consumers

WANADA Bulletin # 4-10 *** 2010 Washington Auto Show Special Issue February 1, 2010 Headlines… 2010 WAS: The Future of the Automobile in Society The Washington Auto Show “is important to Ford because of the constituents here,” says CEO Mulally EPA Administrator Opens Advanced Technology SuperHighway Energy Secretary Chu Announces $1.4 Billion Loan to Nissan Read The Green Car Summit on Capitol Hill Congress Joins WAS Public Policy Day The Daily Bulletin coverage “Sneak Peek” Reception and Preview Draws a “Capitol” Crowd of the Auto Show, Jan. 25-29 WANADA Member Briefing, Chrysler, GM & the Industry Turmoil Student Day at the Auto Show: An Educational Experience here 06/08/2009 Ralph Nader Recognized by Keith Crain/Automotive News EDTA and SAE International Hold Joint Plenary Session at The 2010 Washington Auto Show Thought for the Week… The 2010 Washington Auto Show: Bringing the Auto Industry, U.S. Government and Car Consumers Together on the Future of the Automobile in Society The 2010 Washington Auto Show (WAS) and its organizers achieved what they set out to do on Public Policy Days, Jan 25-26, in bring ing together the key public and private sector players who will decide how the auto industry will evolve in the years ahead. They also successfully assembled a show floor exposition that vividly displayed its direction, particularly within the Advanced Technology SuperHighway, the show’s signature pavilion. Those attending Public Policy Days included leading industry executives, federal officials, congressmen, local elected representatives and affiliated auto industry associations. Together they produced one of the most meaningful public policy forums in the show’s history. -

EV Charging Infrastructure Market Research

Service Abstract – EVSE Charging Points ($6,000) Power Technology Research LLC ©2018 Introduction With the increasing number of Electric Vehicles (EV) on a global scale, EV charging has become an essential aspect of car ownership. To compete with internal combustion engine (ICE) vehicles, the charging time of EVs needs to be at similar levels as refueling conventional vehicles. Historically speaking, charging stations technology dates to the same time as EVs. Charging stations in the early 1900s utilized bulky mercury-arc rectifiers, essentially glass bulbs containing liquid mercury. However, today’s technology has improved exponentially with advancements in power electronics. In the modern era, EV chargers started the technological journey as a device that could recharge a car overnight. This advancement did not come cheap as they were a result of significant investment in research and development . The result has made the recharging experience comparable to a refueling stop for a conventional car. EVSE in Europe - 2017 35000 30000 25000 20000 15000 10000 5000 0 Level 1 Level 2 CHAdeMO CCS Tesla SC Service Description In this service, PTR covers EV charging infrastructure market in five major regions/countries around the globe. Market growth outlook for all charging power capacities will be tracked in this coverage. Forecast Countries Base Year 2014-2018 APAC Cyprus Luxembourg Forecast 2019-2024 China Czech Republic Malta Capacity (kW) India Denmark Norway 0-3 kW Japan Estonia The Netherlands 4-22 kW South Korea Finland Poland 23-60 kW North America France Portugal 61-150 kW United States Germany Romania 151-350 kW Canada Greece Slovakia Standards Mexico Hungary Slovenia Tesla SC Europe Iceland Spain CCS Austria Ireland Sweden CHAdeMO Belgium Italy Switzerland Bulgaria Latvia Turkey Croatia Lithuania United Kingdom Excel Output Tables Customers can download the excel tables at any point in time. -

Electric Vehicles – Country Update from Ireland

Electric Vehicles – Country Update from Ireland Graham Brennan Transport Programme Manager IA-HEV Task 1 Information Exchange 30th April 2015 Gwangju Overview • Progress in Ireland – Introduction to Ireland – Cars – Infrastructure • Technology Perspective Energy Infrastructure of Ireland • 4.7GW peak elect demand 250-500MW DC to Scotland – 2GW of wind Corrib Gas Gas Field – Gas, Coal, Peat £ Connections • Energy Imports 89% to Scotland • RE potential >> 100% AC Inter- • Single Electricity System connectors 500MW DC operator to Wales – Very supportive of EVs € – Faster decisions and consistent approach • (No car industry) Design Study for 700MW DC to France Rep. of Ireland v Rep. of Korea • Republic of Ireland – 4.7GW – 4.5m people – 2m cars – Electrical Energy (2012) • 18.2% Renewables • Republic of Korea – 80.5GW – 51m people – 19m cars – Electrical Energy (2012) • 1.8% Renewables Source: IEA 2012 Country Statistics EV Registrations in Ireland - 850 EVs in Total (Ireland has 2m Passenger Cars) 900 x3? 800 700 600 500 x2? 400 x5 300 200 EV Registrations Per Annum Per EV Registrations 100 0 2011 2012 2013 2014 2015 Cars Registered per Manufacturer 600 500 400 300 200 100 0 Public Charging Infrastructure • Ireland – AC Charge Points (22kW) = 820 – Fast Chargers (Chademo with some Combo) = 69 • Northern Ireland – AC Charge Points (22kW) = 320 – Fast Chargers (Chademo) = 14 • EU TEN-T (First EU Country) – 50% Funding for Chargers on main interurban routes & modal hubs Charge Point Management & Billing System • RFID Card • Roaming – Republic -

A U.S. Consumer's Guide to Electric Vehicles

A U.S. CONSUMER’S GUIDE TO ELECTRIC VEHICLES FEBRUARY 2018 Today’s Choices in Cars Electric cars offer consumers afford- able, efficient, and high-tech trans- portation. More models, including crossovers, minivans, hatchbacks, and sedans, become available every year. Today, new-car buyers can choose from about 40 models. By 2022, about ELECTRIC VEHICLES 90 electric vehicles are projected. Plug-in electric vehicles have batteries that recharge by An expanding nationwide charging plugging into the electricity grid. There are two main network enables more consumers to types. Plug-in hybrids are powered by an electric motor(s) consider electric cars, although most and battery, paired with an internal combustion engine. drivers still prefer to charge at home Battery electric vehicles, also called all-electric vehicles, due to convenience and savings over are powered by an electric motor and battery alone, and time. At the U.S. national average never use gasoline. price of 12.5 cents per kilowatt-hour Plug-in hybrid designs differ. Most drive on electricity alone (kWh), electricity is roughly equivalent using battery energy, and after the battery is discharged, to gasoline at $1 a gallon. Plus, many continue driving using gasoline much like conventional hybrids. (Conventional hybrids have a smaller battery and electricity providers offer special elec- do not plug in.) On average, plug-in hybrids can travel tric vehicle rates. 10 to 50 miles on electricity before they switch to Displacing gasoline with domestic elec- gasoline. Their gas tanks extend total range to between tricity cuts petroleum use and emissions, 300 and 600 miles. -

Page 1 of 32 VEHICLE RECALLS by MANUFACTURER, 2000 Report Prepared 1/16/2008

Page 1 of 32 VEHICLE RECALLS BY MANUFACTURER, 2000 Report Prepared 1/16/2008 MANUFACTURER RECALLS VEHICLES ACCUBUIL T, INC 1 8 AM GENERAL CORPORATION 1 980 AMERICAN EAGLE MOTORCYCLE CO 1 14 AMERICAN HONDA MOTOR CO 8 212,212 AMERICAN SUNDIRO MOTORCYCLE 1 2,183 AMERICAN SUZUKI MOTOR CORP. 4 25,023 AMERICAN TRANSPORTATION CORP. 5 1,441 APRILIA USA INC. 2 409 ASTON MARTIN 2 666 ATHEY PRODUCTS CORP. 3 304 B. FOSTER & COMPANY, INC. 1 422 BAYERISCHE MOTOREN WERKE 11 28,738 BLUE BIRD BODY COMPANY 12 62,692 BUELL MOTORCYCLE CO 4 12,230 CABOT COACH BUILDERS, INC. 1 818 CARPENTER INDUSTRIES, INC. 2 6,838 CLASSIC LIMOUSINE 1 492 CLASSIC MANUFACTURING, INC. 1 8 COACHMEN INDUSTRIES, INC. 8 5,271 COACHMEN RV COMPANY 1 576 COLLINS BUS CORPORATION 1 286 COUNTRY COACH INC 6 519 CRANE CARRIER COMPANY 1 138 DABRYAN COACH BUILDERS 1 723 DAIMLERCHRYSLER CORPORATION 30 6,700,752 DAMON CORPORATION 3 824 DAVINCI COACHWORKS, INC 1 144 D'ELEGANT CONVERSIONS, INC. 1 34 DORSEY TRAILERS, INC. 1 210 DUTCHMEN MANUFACTURING, INC 1 105 ELDORADO NATIONAL 1 173 ELECTRIC TRANSIT, INC. 1 54 ELGIN SWEEPER COMPANY 1 40 E-ONE, INC. 1 3 EUROPA INTERNATIONAL, INC. 2 242 EXECUTIVE COACH BUILDERS 1 702 FEATHERLITE LUXURY COACHES 1 83 FEATHERLITE, INC. 2 3,235 FEDERAL COACH, LLC 1 230 FERRARI NORTH AMERICA 8 1,601 FLEETWOOD ENT., INC. 5 12, 119 FORD MOTOR COMPANY 60 7,485,466 FOREST RIVER, INC. 1 115 FORETRAVEL, INC. 3 478 FOURWINNS 2 2,276 FREIGHTLINER CORPORATION 27 233,032 FREIGHTLINER LLC 1 803 GENERAL MOTORS CORP. -

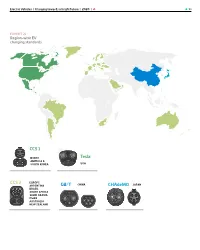

^ GB/T Chademo JAPAN CCS 2 Tesla CCS 1

Electric Vehicles Charging towards a bright future 2020 ^ 51 EXHIBIT 21 Region-wise EV charging standards CCS 1 NORTH Tesla AMERICA & SOUTH KOREA USA CCS 2 EUROPE ARGENTINA GB/T CHINA CHAdeMO JAPAN BRAZIL SOUTH AFRICA SAUDI ARABIA OMAN AUSTRALIA NEW ZEALAND Electric Vehicles Charging towards a bright future 2020 ^ 52 EXHIBIT 22 EV charging standards summary PARAMETER SLOW CHARGERS FAST CHARGERS LEVEL Level 1 Level 2 Level 3 Level 3 AC OR DC AC AC/DC AC DC POWER RANGE <3.7 kW 3.7 – 22 kW 22 – 43.5 kW <400 kW MODE Mode 1 and 2 Mode 3 Mode 3 Mode 4 TYPE Domestic sockets IEC Type 1 IEC Type 2 CCS Combo 1 & 2 IEC Type 2 IEC Type 3 CHAdeMO, GB/T DC and Tesla connector PLACE OF USE Home Home/Public Public Public VEHICLES 2W, 3W, Cars 2W, 3W, Cars Cars and Buses Cars and Buses CUSTOMERS OEM/Retail OEM/Retail, Charging Charging Charging Operators Operators Operators India's stance India has still not formally adopted any specific charging standard. Over the years, the central on EV Charging government has tried to come up with guidelines to assist the charging ecosystem. The government has been flexible around standards and OEMs have been making their choice independently. As the industry picks up and adoption increases, a formal charging standard might be adopted by the country. Electric Vehicles Charging towards a bright future 2020 ^ 53 03 Global EV 54 EV — A common dream across the world Industry 57 Evolution of key markets — China, United States, Europe and Japan 66 Global battery industry Electric Vehicles Charging towards a bright future 2020 ^ 54 Global EV Industry Electric Vehicles — A common dream across the world The first electric cars were developed in the early Tesla has been a game changer for electric vehicles. -

Norway's Efforts to Electrify Transportation

Rolling the snowball: Norway’s efforts to electrify transportation Nathan Lemphers Environmental Governance Lab Working Paper 2019-2 Rolling the snowball: Norway’s efforts to electrify transportation EGL Working Paper 2019-2 September 2019 Nathan Lemphers, Research Associate Environmental Governance Lab Munk School of Global Affairs and Public Policy University of Toronto [email protected] Norway’s policies to encourage electric vehicle (EV) adoption have been highly successful. In 2017, 39 per cent of all new car sales in Norway were all-electric or hybrid, making it the world’s most advanced market for electric vehicles (IEA 2018). This high rate of EV ownership is the result of 30 years of EV policies, Norway’s particular political economy, and significant improvements in EV and battery technology. This paper argues that Norway’s sustained EV policy interventions are not only starting to decarbonize personal transportation but also spurring innovative electrification efforts in other sectors such as maritime transport and short- haul aviation. To explain this pattern of scaling, the paper employs Bernstein and Hoffmann’s (2018) framework on policy pathways towards decarbonization. It finds political causal mechanisms of capacity building and normalization helped create a welcoming domestic environment to realize early uptake and scaling of electric vehicles, and subsequently fostered secondary scaling in other modes of transportation. The initial scaling was facilitated by Norway’s unique political economy. Ironically, Norway’s climate leadership is, in part, because of its desire to sustain oil and gas development. This desire steered the emission mitigation focus towards sectors of the economy that are less contentious and lack opposing incumbents.