FREMF 2019-K736 Mortgage Trust and Freddie Mac Structured Pass- Through Certificates, Series K-736 Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

451 E GRAND AVENUE 4201 STREETERVILLE Welcome to Luxury

451 E GRAND AVENUE 4201 STREETERVILLE Welcome to luxury. Located in the esteemed One Bennett Park by renowned ROOM DIMENSIONS LIVING ROOM : 27' × 23' architect, Robert A. M. Stern, this gorgeous 3 Bed 3.5 bath, home highlights North, FAMILY ROOM : 16' × 13' South, and West views of the lake, river and the conic Chicago sky-line. Home KITCHEN : 19' × 11' features include a phenomenal layout, light-filled throughout, combo living and PRIMARY BEDROOM : 17' × 14' dining room with separate family room off the chef's kitchen with custom cabinetry SECOND BEDROOM : 11' × 12' and state of the art appliances. All bedrooms feature their own en-suite with THIRD BEDROOM : 11' × 11' custom closets. Hardwood flooring throughout, plenty of storage space, and separate laundry/utility room/Full luxury amenity building featuring 24/7 concierge service, fitness center, indoor & outdoor pools, salon & massage rooms, pet retreat, valet, and much more! 2 Parking spaces included. 3 BEDROOM 3.1 BATH 4 451 E GRAND AVENUE 4201 451 E GRAND AVENUE 4201 5 6 451 E GRAND AVENUE 4201 451 E GRAND AVENUE 4201 7 8 451 E GRAND AVENUE 4201 451 E GRAND AVENUE 4201 9 10 451 E GRAND AVENUE 4201 451 E GRAND AVENUE 4201 11 MAJOR DEVELOPMENT IN RECENT YEARS HAS PUT STREETERVILLE ON THE MAP. In the past two decades alone, dozens of new buildings, high-rises, hotels, stores and institutions have sprung up, bringing with them a flock of residents to the high-energy community. A wide range of housing is available, the majority in high-rise buildings. -

High Rise Agreement by and Between Apartment

FOR ABOMA MEMBER USE ONLY Apartment Building Owners and Managers Association of Illinois HIGH RISE AGREEMENT BY AND BETWEEN APARTMENT BUILDING OWNERS AND MANAGERS ASSOCIATION OF ILLINOIS and SERVICE EMPLOYEES INTERNATIONAL UNION LOCAL 1 Residential Division for the period DECEMBER 1, 2014 THROUGH NOVEMBER 30, 2017 Covering Head Janitors and Other Employees as specified in Article II, Section 1(g) who are employed in ABOMA Member High Rise (Fireproof) Buildings who have authorized ABOMA to include them in this agreement. ABOMA Presidential Towers 625 West Madison Street Suite 1403 Chicago, Illinois 60661 Phone: (312) 902-2266 FAX: (312) 284-4577 E-mail: [email protected] Web site: aboma.com Apartment Building Owners and Managers Association of Illinois ABOMA SEIU LOCAL 1 JANITORIAL COLLECTIVE BARGAINING AGREEMENT OVERVIEW OF CHANGES EFFECTIVE DECEMBER 1, 2014 JANITORIAL EMPLOYEES—HIGH RISE BUILDINGS Pages I through III is an Overview of the changes in the terms, wages and benefits which become effective December 1, 2014 in the High Rise Agreement by and between ABOMA and Building Services Division of SEIU Local 1 for the period beginning December 1, 2014 through November 30, 2017 Covering Head Janitors and Other Employees as specified in Article II, Section 1(g) who are employed in ABOMA Member High Rise (Fireproof) Buildings who have authorized ABOMA to include them in this agreement. Please reference the full CBA to fully understand the language changes highlighted in the Overview-pages I through III This agreement does not cover non-member buildings or Member Buildings who have not authorized ABOMA to include them in the negotiations or the resulting contract. -

Analysis of Technical Problems in Modern Super-Slim High-Rise Residential Buildings

Budownictwo i Architektura 20(1) 2021, 83-116 DOI: 10.35784/bud-arch.2141 Received: 09.07.2020; Revised: 19.11.2020; Accepted: 15.12.2020; Avaliable online: 09.02.2020 © 2020 Budownictwo i Architektura Orginal Article This is an open-access article distributed under the terms of the CC-BY-SA 4.0 Analysis of technical problems in modern super-slim high-rise residential buildings Jerzy Szołomicki1, Hanna Golasz-Szołomicka2 1 Faculty of Civil Engineering; Wrocław University of Science and Technology; 27 Wybrzeże Wyspiańskiego st., 50-370 Wrocław; Poland, [email protected] 0000-0002-1339-4470 2 Faculty of Architecture; Wrocław University of Science and Technology; 27 Wybrzeże Wyspiańskiego St., 50-370 Wrocław; Poland [email protected] 0000-0002-1125-6162 Abstract: The purpose of this paper is to present a new skyscraper typology which has developed over the recent years – super-tall and slender, needle-like residential towers. This trend appeared on the construction market along with the progress of advanced struc- tural solutions and the high demand for luxury apartments with spectacular views. Two types of constructions can be distinguished within this typology: ultra-luxury super-slim towers with the exclusivity of one or two apartments per floor (e.g. located in Manhattan, New York) and other slender high-rise towers, built in Dubai, Abu Dhabi, Hong Kong, Bangkok, and Melbourne, among others, which have multiple apartments on each floor. This paper presents a survey of selected slender high-rise buildings, where structural improvements in tall buildings developed over the recent decade are considered from the architectural and structural view. -

Chicago No 16

CLASSICIST chicago No 16 CLASSICIST NO 16 chicago Institute of Classical Architecture & Art 20 West 44th Street, Suite 310, New York, NY 10036 4 Telephone: (212) 730-9646 Facsimile: (212) 730-9649 Foreword www.classicist.org THOMAS H. BEEBY 6 Russell Windham, Chairman Letter from the Editors Peter Lyden, President STUART COHEN AND JULIE HACKER Classicist Committee of the ICAA Board of Directors: Anne Kriken Mann and Gary Brewer, Co-Chairs; ESSAYS Michael Mesko, David Rau, David Rinehart, William Rutledge, Suzanne Santry 8 Charles Atwood, Daniel Burnham, and the Chicago World’s Fair Guest Editors: Stuart Cohen and Julie Hacker ANN LORENZ VAN ZANTEN Managing Editor: Stephanie Salomon 16 Design: Suzanne Ketchoyian The “Beaux-Arts Boys” of Chicago: An Architectural Genealogy, 1890–1930 J E A N N E SY LV EST ER ©2019 Institute of Classical Architecture & Art 26 All rights reserved. Teaching Classicism in Chicago, 1890–1930 ISBN: 978-1-7330309-0-8 ROLF ACHILLES ISSN: 1077-2922 34 ACKNOWLEDGMENTS Frank Lloyd Wright and Beaux-Arts Design The ICAA, the Classicist Committee, and the Guest Editors would like to thank James Caulfield for his extraordinary and exceedingly DAVID VAN ZANTEN generous contribution to Classicist No. 16, including photography for the front and back covers and numerous photographs located throughout 43 this issue. We are grateful to all the essay writers, and thank in particular David Van Zanten. Mr. Van Zanten both contributed his own essay Frank Lloyd Wright and the Classical Plan and made available a manuscript on Charles Atwood on which his late wife was working at the time of her death, allowing it to be excerpted STUART COHEN and edited for this issue of the Classicist. -

540 N Lake Shore Dr-2019.Indd

540 N LAKE SHORE DRIVE, CHICAGO CONFIDENTIALY & CONDITIONS Jameson Real Estate (the “Agent”) has been engaged as the the right, at their sole and absolute discretion, to reject any and all exclusive agent for the sale of the 540 Lakeshore Dr, Chicago, IL (the expressions of interest or offers regarding the Properties and/or to “Properties”), by the Owner (the “Seller”). terminate discussions with any entity at any time, with or without notice. This Offering Memorandum is made subject to omissions, The Properties are being offered for sale in an “as-is, where-is” corrections or errors, change of price or other terms and prior sale or condition and the Seller and the Agent make no representations withdrawal from market without notice. The Agent is not authorized to or warranties as to the accuracy of the information contained in make any representations or agreements on behalf of the Seller. The this information package. The enclosed materials include highly Seller shall have no legal commitment or obligation to any interested confidential information and are being furnished solely interest party reviewing the enclosed materials, performing additional described herein. Neither the enclosed materials, nor any information investigation and/or making an offer to purchase the Properties contained herein, are to be used for any other purpose, or made unless and until a binding written agreement for the purchase of the available to any other person without the express written consent of Properties have been fully executed, delivered and approved by the the Seller. Each recipient, as a prerequisite to receiving the enclosed Seller and any conditions to Seller’s Obligations there under have been information, should be registered with Jameson Real Estate as a satisfied or waived. -

Most Influential Commercial Real Estate Brokers in Chicago, a Lease in the Loop, and Blue Star Deerfield

CRAIN’S CUSTOM CONTENT BEN AZULAY JEFFREY BRAMSON Principal Senior Managing Director MOST INFLUENTIAL Bradford Allen HFF Since joining Earlier this Bradford year, Jeffrey Allen in 2004, Bramson was Ben Azulay recognized by COMMERCIAL has been a NAIOP Chicago significant for his role in contributor the team that to the success and growth of sold Chicago’s Old Main Post the company, supporting the Office. It’s among the highest- REAL ESTATE firm’s research and recruiting profile of the 88 deals valued efforts and mentoring new at more than $7 billion that he’s brokers—all while overseeing been involved with over the last the firm’s tenant representation three years. Other highlights BROKERS department. Over the last include the $467.5 million sale of three years he’s represented AMA Plaza in Chicago, the $185 GrubHub, MedSpeed, and million sale of 500 W. Adams Foley & Mansfield in Chicago- in Chicago, the sale of the IN CHICAGO area headquarters expansions. Riverway campus in Rosemont, He also represented Walton and the sale of the four-building Isaacson in securing a new Corporate 500 office park in Welcome to the inaugural edition of The Most Influential Commercial Real Estate Brokers in Chicago, a lease in the Loop, and Blue Star Deerfield. Notable clients include special custom content section from Crain’s Custom Media. Properties in the purchase of Intercontinental Real Estate a 26,000-square-foot office Corp., John Hancock Real Estate, The 60 entries featured alphabetically in these pages (with teams grouped together on the last three) building in the South Loop—also CBRE Global Investors, Cabor represent an impressive cross-section of the Chicago-area commercial real estate sales community, arranging for Baderbrau Brewing Properties, Lincoln Property many of whom have practiced with distinction for decades. -

Distribution That Works Chicago

CHICAGO Fall/Winter 2013 the great restaurants of chicago sweet Brunch at innovations PUBLIC page 46 HOUSE DISTRIBUTION THAT WORKS CHICAGO TASTES AND TRENDS TO FEED YOUR INNER FOODIE Say cheese! Cheese plates for every occasion 22 :: Our favorite high-powered lunch spots 26 :: Scratch-made delights all over town 36 :: Private dining at its finest 42 :: Raise your rocks glass—to bourbon! 60 :: Holiday traditions we love 194 106 WEST GERMANIA PLACE, STE. 209 | CHICAGO, IL 60610 | PH. 773.319.4457 FAX. 312.595.0349 HOTEL DISTRIBUTION POINTS Allegro Hotel Hard Rock Hotel Mile North The James Hotel SUBURBAN HOTELS Hyatt Regency Hotel Allerton Hotel Hotel 71 Millenium Knickerbocker The Langham Chicago Marriott O’Hare Aloft Chicago City Center Hotel Blake Omni Michigan Ave The Majestic Hotel Suites O’Hare Hyatt Regency Woodfield Avenue Hotel Hotel Burnham (In Room) The Raffaello Hotel Crowne Plaza Chicago Intercontinental Chicago O’Hare Hotel & O’Hare Hotel Belden-Stratford Hotel Hotel Felix Palmer House Hilton The Renaissance Hotel Conference Center Lincolnshire Marriott (In Room) Hotel Intercontinental Park Hyatt The Talbot Doubletree Hotel Resort Blackstone Hotel Hotel Lincoln Peninsula Hotel Trump Schaumburg Marriott Schaumburg Courtyard Marriot- Hotel Monaco Public Chicago W-Lakeshore Embassy Suites O’Hare Michigan Ave (Abassador East) optima tower Hotel Palomar W-City Center Rosemont Crowne Plaza Metro Radison Blu Renaissance Schaumburg Hotel Sax Waldorf Astoria Embassy Suites Hotel and Convention Dana Hotel & Spa Ritz-Carlton Schaumburg -

EVENT GUIDE SPECIAL ADVERTISING SECTION: This Section Was Edited and Produced by the Chicago Architecture Foundation

ARCHITECTUREFREE FESTIVAL This weekend, get FREE, behind-the-scenes access to 200+ buildings across Chicago. openhousechicago.org EVENT GUIDE SPECIAL ADVERTISING SECTION: This section was edited and produced by the Chicago Architecture Foundation. 2 PRESENTED BY ABOUT THE CHICAGO ARCHITECTURE FOUNDATION Six years ago, the Chicago Architecture Foundation (CAF) launched the first Open House Chicago. This free, citywide festival drew 23,000 people in its first year. By 2016, it grew to 100,000 attendees, making it one of the largest architecture events in the world. This year is our biggest yet, with more than 200 sites. OHC is just one of many CAF programs that inspire people to discover why design matters. Today, when you visit CAF at 224 S. Michigan Ave., you’ll find visitors embarking on tours, FIRST CHURCH OF DELIVERANCE, BRONZEVILLE (p. 15) camps for children, lectures for adults and field trip groups gathered around our 3D model of Chicago. TEN THINGS TO KNOW ABOUT In summer 2018, CAF will open the Chicago Architecture Center at CHICAGO ARCHITECTURE CENTER — OPEN HOUSE CHICAGO (OHC) COMING IN SUMMER 2018 111 E. Wacker Dr. This new location is situated above the dock for the 1. OHC is a FREE public festival with behind-the-scenes access Chicago Architecture Foundation River CAF’s 450 expert volunteer docents to 200+ buildings across Chicago—no tickets required. Cruise aboard Chicago’s First Lady will lead 85+ tours from the Center, Cruises—the city’s top-ranked tour. by boat, bus, L train and on foot for SPECIAL CHICAGO ARCHITECTURE FOUNDATION ADVERTISING SECTION | THURSDAY, OCTOBER 12, 2017 ADVERTISING SECTION | THURSDAY, SPECIAL CHICAGO ARCHITECTURE FOUNDATION 2. -

1187 W Wilson St Green Meadows Apartments 150 Unit Apartment Building Batavia, Illinois - Fox River Valley Neighborhood

Underwriting Report 1187 W Wilson St Green Meadows Apartments 150 Unit Apartment Building Batavia, Illinois - Fox River Valley Neighborhood PREPARED BY Robert Petrich 1187 W Wilson St - Green Meadows Apartments SUBJECT PROPERTY Property Details 2 RENT COMPS Map & List 7 Photo Comparison 9 Rent Comps Details 11 Unit Mix Summary 30 Ranking Chart By Bedroom 31 Changes in Rent Comps 34 Rent Trend Charts 37 Rent Trend Data 43 CONSTRUCTION Overall Construction Map & Summary 45 Under Construction Map & List 46 Under Construction Details 48 Deliveries Past 12 Months Map & List 49 Delivered Property Details 51 Construction Summary 54 SALE COMPS Map & List 60 Sale Comp Details 62 Sales Volume 66 Sales Pricing 67 Cap Rates 69 Top Buyers & Sellers 70 DEMOGRAPHICS Overview 73 Age & Education 74 Ethnicity 75 SUBMARKET OVERVIEW Fox River Valley Overview 76 MARKET OVERVIEW 5/25/2017 Bob Petrich Boardwalk Commercial Real Estate 708-917-3333 1187 W Wilson St - Green Meadows Apartments Chicago Overview 95 5/25/2017 Bob Petrich Boardwalk Commercial Real Estate 708-917-3333 Subject Property 1187 W Wilson St - Green Meadows Apartments Batavia, Illinois - Fox River Valley Neighborhood PROPERTY PROPERTY MANAGER No. of Units: 150 Napro Management LTD - Green Meadows A… Stories: 2 (630) 879-8300 Avg. Unit Size: 849 SF Type: Apartments - All Rent Type: Market OWNER Year Built: 1978 Nancy Protter Parking: 225 Spaces; 1.5 per Unit Purchased Feb 2004 Distance to Transit: - $11,800,000 ($78,667/Unit) ASKING RENTS PER UNIT/SF VACANCY 12 MONTH NET ABSORPTION Current: -

Download the Fall/Winter 2018 PDF

Fall/Winter 2018 Upon Reflection “We will not promise you happiness. We will not wish you security. For we remember that ‘security is mortal’s chiefest enemy.’ And we know that you can be secure only when you can stand everything that can happen to you. If your school has prepared you for this, it has been a good school.” – Sister M. Madeleva Wolff, CSC This quote from Sister Madeleva comes to mind when it seems like there is so much darkness in our world. Natural disasters on the coasts have cost people of everything, their homes and their belongings. Fires and hurricanes have destroyed towns and taken lives. The Catholic Church is facing a crisis of its own with the release of the Pennsylvania Grand Jury report in August and reports of clergy sexual abuse surfacing. With the allegations, questions of what it means to be Catholic pervades media and our own interior lives. These crises have me wondering, what is next? Facing the unknown is never easy. We’ve seen this firsthand on our campus with Former President Jan Cervelli’s resignation and our leadership transition in October. It caused concern and fear among those who know and love Saint Mary’s. But in the months since Nancy Nekvasil has assumed the interim presidency, our community has come together in ways unforeseen. Students have organized town hall sessions with administration to discuss their concerns. Faculty and administrators have re-envisioned and implemented a new academic services structure to better serve our students. True to our mission, we are responding to the needs of the time. -

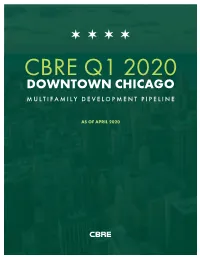

Downtown Chicago Multifamily Development Pipeline

CBRE Q1 2020 DOWNTOWN CHICAGO MULTIFAMILY DEVELOPMENT PIPELINE AS OF APRIL 2020 Q1 2020 DOWNTOWN CHICAGO MULTIFAMILY DEVELOPMENT PIPELINE # Project Name Submarket Developer/Equity Status Delivery Date Units 2021 RENTAL DELIVERIES 1 One Chicago Square River North JDL / Wanxiang U/C 20 21 795 2 AMLI 808 Old Town AMLI U/C 20 21 297 3 3300 N Clark* Lakeview Blitzlake Partners U/C 20 21 140 4 Pilsen Gateway Pilsen Cedar Street / Origin U/C 20 21 202 5 Parkline Loop Moceri / Rozak U/C 20 21 190 6 300 N Michigan Loop Magellan / Sterling Bay U/C 20 21 289 7 Cascade Lakeshore East Magellan / Lend Lease U/C 20 21 503 8 Old Town Park III (1100 N Wells St) Near North Onni U/C 20 21 456 9 Triangle Square* Bucktown Belgravia / Lennar U/C 20 21 300 Subtotal 2021 3,172 2020 RENTAL DELIVERIES 10 740 N Aberdeen River West Fifield U/C 2020 188 11 The Grand River North Onni U/C 2020 356 12 Aspire* South Loop Draper & Kramer Inc. U/C 2020 275 13 1900 West Lawrence* Ravenswood Springbank U/C 2020 59 14 Oak and Larrabee Near North Brinshore Development U/C 2020 104 15 2405 W Hutchinson* Lincoln Square KR Developments U/C 2020 48 16 Motif on Belden* Logan Square Inland U/C 2020 100 17 128 S Laflin West Loop Michigan Avenue RE Group U/C 2020 52 18 2701 W Armitage* Logan Square Eco Development U/C 2020 59 19 Edge on Broadway* Edgewater City Pads Leasing Q2 2020 105 20 Porte West Loop The John Buck Company / Lend Lease Leasing Q2 2020 586 21 Logan Apartments* (2500 N Milwaukee) Logan Square Fifield / Terraco Inc Leasing Q2 2020 220 22 Imprint South Loop CMK Leasing -

Typologies and Evaluation of Outdoor Public Spaces at Street Level of Tall Buildings in Chicago

TYPOLOGIES AND EVALUATION OF OUTDOOR PUBLIC SPACES AT STREET LEVEL OF TALL BUILDINGS IN CHICAGO Abstract Authors Zahida Khan and Peng Du Outdoor public spaces are key to human interactions, promoting Illinois Institute of Technology public life in cities. The constant increase in world population has led Keywords to increased tall urban conditions making the study of outdoor public Public spaces, tall buildings, urban forms, rating system spaces around tall buildings very popular. This paper outlines typol- ogies for outdoor public spaces occurring at street level of tall build- ings in downtown Chicago, the birthplace of skyscrapers and an ideal case study for an American city. The study uses online data archives, Google Maps, and on-site surveys as research techniques for the analysis. The result depicts around 50% of all the tall buildings in Chicago foster public life at its street level through public spaces. The other key finding is the outline of seven typologies based on their position around the tall building. Further, a comparative analysis is conducted using one example of each typology based on three crite- ria adopted from ‘Project for Public Spaces,’ namely (1) Accessibility; (2) Design and Comfort, and (3) Users and Activities. Prometheus 04 Buildings, Cities, and Performance, II Introduction outdoor public spaces, including: (A) Accessibility, (B) Design & Comfort, (C) Users & Activities, (D) Environ- Outdoor public spaces at street level of tall buildings play mental Sustainability, and (E) Sociable. The scope of this a significant role in sustainable city development. The research is limited to the first three design criteria since rapid increase in world population and constant growth of the last two require a bigger timeframe and is addressed urbanization has led many scholars to support Koolhaas’ for future research.