The Role of Saving and Credit Cooperatives in Improving Rural Micro Financing: the Case of Bench Maji, Kaffa, Shaka Zones

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

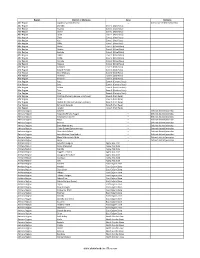

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

Fissha Asmare.Pdf

SCHOOL OF GRADUATE STUDIES SCHOOL OF ECONOMICS THE EFFECT OF CLIMATE CHANGE ADAPTATION STRATEGY ON FARM HOUSEHOLD’S WELFARE IN NILE BASIN OF ETHIOPIA: IS THERE SYNERGY OR TRADEOFF? BY FISSHA ASMARE MARYE ADDIS ABABA, ETHIOPIA JUNE, 2016 ADDIS ABABA UNIVERSITY SCHOOL OF GRADUATE STUDIES SCHOOL OF ECONOMICS The Effect of Climate Change Adaptation Strategy on Farm Household’s Welfare in Nile Basin of Ethiopia: Is There Synergy or Tradeoff? A Thesis Submitted To the School Of Graduate Studies of Addis Ababa University in Partial Fulfillment of the Requirements for the Degree Of Master of Science in Economics (Resource and Environmental Economics Stream) By Fissha Asmare Marye Addis Ababa, Ethiopia June, 2016 Addis Ababa University School of Graduate Studies This is to certify that the thesis prepared by Fissha Asmare, entitled: the effect of climate change adaptation strategy on farm household’s welfare in Nile basin of Ethiopia: is there synergy or trade off?; and submitted in partial fulfillment of the requirement for the degree of Masters of Science in Economics (Resource and Environmental Economics) complies with the regulations of the university and meets the accepted standards with respect to originality and quality. Signed by the examining committee: Chairman: Kebede Bekele signature_______________ Date: ____________________________ External Examiner: Abebe Damte (PhD) signature_____________ Date: ____________________________ Internal Examiner: Adane Tuffa (PhD) signature______________ Date: ____________________________ Advisor: Hailemariam Teklewold (PhD) signature______________ Date: ____________________________ Graduate programs coordinator, Department of Economics Kebede Bekele: signature ____ Date: ____________________________ i ACKNOWLEDGEMENTS First I would like to thank God Almighty; it is not exaggeration to say that without insisting the Almighty God would not have been in a place to complete successfully this thesis paper. -

Resettlement and Sustainable Livelihoods in Ethiopia: a Comparative Analysis of Amhara And

RESETTLEMENT AND SUSTAINABLE LIVELIHOODS IN ETHIOPIA: A COMPARATIVE ANALYSIS OF AMHARA AND SOUTHERN REGIONS BY KASSA TESHAGER ALEMU Submitted in accordance with the requirements For the degree of DOCTOR OF LITERATURE AND PHILOSOPHY In the subject DEVELOPMENT STUDIES At the UNIVERSITY OF SOUTH AFRICA SUPERVISOR: DR SEVENIA VICTOR PETER MADZIAKAPITA February 2015 i DECLARATION I, KASSA TESHAGER ALEMU, do hereby declare that this doctoral thesis titled “RESETTLEMENT AND SUSTAINABLE LIVELIHOODS IN ETHIOPIA: A Comparative Analysis of Amhara and Southern Regions” is my own work and that all the sources that I have used or quoted have been indicated and acknowledged by means of complete references. In addition, I also declare that this work has not been submitted elsewhere for a similar or any other educational or non-educational award. Candidate: Kassa Teshager Alemu Signature: __________________ Date: __________________ ii ACKNOWLEDGEMENT I express my gratitude to the University of South Africa (UNISA), Department of Development Studies, for giving me the chance to do my PhD in Development Studies. I appreciate the UNISA- Ethiopia Branch staff members and UNISA-SANTRUST PhD proposal development programme coordinators and trainers for the hard work and support they provided in this study. I sincerely thank the School of Graduate Studies, Ethiopian Civil Service University, for the funding and study leave provided. I thank the Institute of Public Management and Development Studies (IPMDS), Department of Development Management, for providing multi-dimensional support and giving me a pleasant working environment. I am also grateful to the Nordic Africa Institute (NAI) in Sweden for providing me the African Guest Researchers Scholarship of 2014. -

Demography and Health

SNNPR Southern Nations Nationalities and Peoples Demography and Health Aynalem Adugna, July 2014 www.EthioDemographyAndHealth.Org 2 SNNPR is one of the largest regions in Ethiopia, accounting for more than 10 percent of the country’s land area [1]. The mid-2008 population is estimated at nearly 16,000,000; almost a fifth of the country’s population. With less than one in tenth of its population (8.9%) living in urban areas in 2008 the region is overwhelmingly rural. "The region is divided into 13 administrative zones, 133 Woredas and 3512 Kebeles, and its capital is Awassa." [1] "The SNNPR is an extremely ethnically diverse region of Ethiopia, inhabited by more than 80 ethnic groups, of which over 45 (or 56 percent) are indigenous to the region (CSA 1996). These ethnic groups are distinguished by different languages, cultures, and socioeconomic organizations. Although none of the indigenous ethnic groups dominates the ethnic makeup of the national population, there is a considerable ethnic imbalance within the region. The largest ethnic groups in the SNNPR are the Sidama (17.6 percent), Wolayta (11.7 percent), Gurage (8.8 percent), Hadiya (8.4 percent), Selite (7.1 percent), Gamo (6.7 percent), Keffa (5.3 percent), Gedeo (4.4 percent), and Kembata (4.3 percent) …. While the Sidama are the largest ethnic group in the region, each ethnic group is numerically dominant in its respective administrative zone, and there are large minority ethnic groups in each zone. The languages spoken in the SNNPR can be classified into four linguistic families: Cushitic, Nilotic, Omotic, and Semitic. -

D.Table 9.5-1 Number of PCO Planned 1

D.Table 9.5-1 Number of PCO Planned 1. Tigrey No. Woredas Phase 1 Phase 2 Phase 3 Expected Connecting Point 1 Adwa 13 Per Filed Survey by ETC 2(*) Hawzen 12 3(*) Wukro 7 Per Feasibility Study 4(*) Samre 13 Per Filed Survey by ETC 5 Alamata 10 Total 55 1 Tahtay Adiyabo 8 2 Medebay Zana 10 3 Laelay Mayechew 10 4 Kola Temben 11 5 Abergele 7 Per Filed Survey by ETC 6 Ganta Afeshum 15 7 Atsbi Wenberta 9 8 Enderta 14 9(*) Hintalo Wajirat 16 10 Ofla 15 Total 115 1 Kafta Humer 5 2 Laelay Adiyabo 8 3 Tahtay Koraro 8 4 Asegede Tsimbela 10 5 Tselemti 7 6(**) Welkait 7 7(**) Tsegede 6 8 Mereb Lehe 10 9(*) Enticho 21 10(**) Werie Lehe 16 Per Filed Survey by ETC 11 Tahtay Maychew 8 12(*)(**) Naeder Adet 9 13 Degua temben 9 14 Gulomahda 11 15 Erob 10 16 Saesi Tsaedaemba 14 17 Alage 13 18 Endmehoni 9 19(**) Rayaazebo 12 20 Ahferom 15 Total 208 1/14 Tigrey D.Table 9.5-1 Number of PCO Planned 2. Affar No. Woredas Phase 1 Phase 2 Phase 3 Expected Connecting Point 1 Ayisaita 3 2 Dubti 5 Per Filed Survey by ETC 3 Chifra 2 Total 10 1(*) Mile 1 2(*) Elidar 1 3 Koneba 4 4 Berahle 4 Per Filed Survey by ETC 5 Amibara 5 6 Gewane 1 7 Ewa 1 8 Dewele 1 Total 18 1 Ere Bti 1 2 Abala 2 3 Megale 1 4 Dalul 4 5 Afdera 1 6 Awash Fentale 3 7 Dulecha 1 8 Bure Mudaytu 1 Per Filed Survey by ETC 9 Arboba Special Woreda 1 10 Aura 1 11 Teru 1 12 Yalo 1 13 Gulina 1 14 Telalak 1 15 Simurobi 1 Total 21 2/14 Affar D.Table 9.5-1 Number of PCO Planned 3. -

Download E-Book (PDF)

OPEN ACCESS African Journal of Biotechnology 12 September 2018 ISSN 1684-5315 DOI: 10.5897/AJB www.academicjournals.org About AJB The African Journal of Biotechnology (AJB) is a peer reviewed journal which commenced publication in 2002. AJB publishes articles from all areas of biotechnology including medical and pharmaceutical biotechnology, molecular diagnostics, applied biochemistry, industrial microbiology, molecular biology, bioinformatics, genomics and proteomics, transcriptomics and genome editing, food and agricultural technologies, and metabolic engineering. Manuscripts on economic and ethical issues relating to biotechnology research are also considered. Indexing CAB Abstracts, CABI’s Global Health Database, Chemical Abstracts (CAS Source Index) Dimensions Database, Google Scholar, Matrix of Information for The Analysis of Journals (MIAR), Microsoft Academic, Research Gate Open Access Policy Open Access is a publication model that enables the dissemination of research articles to the global community without restriction through the internet. All articles published under open access can be accessed by anyone with internet connection. The African Journals of Biotechnology is an Open Access journal. Abstracts and full texts of all articles published in this journal are freely accessible to everyone immediately after publication without any form of restriction. Article License All articles published by African Journal of Biotechnology are licensed under the Creative Commons Attribution 4.0 International License. This permits anyone -

Epidemiological Study of Ticks and Their Distribution in Decha Woreda of Kafa Zone, SNNPRS

International Journal of Research in Agriculture and Forestry Volume 3, Issue 6, June 2016, PP 7-19 ISSN 2394-5907 (Print) & ISSN 2394-5915 (Online) Epidemiological Study of Ticks and their Distribution in Decha Woreda of Kafa zone, SNNPRS Yismashewa Wogayehu1, Abebe Wossene2, Senait Getachew3, Tigist Kabtyimer4 1,4 Mizan Regional Veterinary Laboratory, SNNPRS 2 Faculty of Veterinary Medicine of Addis Ababa University 3 South Omo Agricultural Research Center of SNNP ABSTRACT An epidemiological investigation of tick parasites was undertaken from September 2004 to March 2005 in Decha woreda of Kaffa zone, Southern Nations and Nationalities of People’s Regional States (SNNPRS). The study was conducted with the aim to determine the distribution, prevalence and seasonal variation of cattle tick species through cross sectional and longitudinal epidemiological study methods. A combination of sampling techniques was used to identify sampling units. A total of 480 cattle equally distributed to each stratum (160 cattle from highland, midland and lowland) were subjected for sampling. Furthermore, out of 160 cattle, 40 were randomly selected for longitudinal study from each agro-ecological zone. The result found shows that all examined cattle from lowland were positive for tick infestation followed by animals from midland and highland areas with 100%, 92.5% and 68.12% prevalence, respectively. Though the difference is not statistically significant between animals with different body conditions, the proportion of infested animals appear to be higher in animals of poor body condition (90.91%) than those in good body condition (85.16%). A significant variation (p<0.05) in prevalence of tick infestation was noted between different age groups, the highest being in animals with 3 and half years as well as of 4 years old. -

Ethiopian Journal of Economics

Ethiopian Journal of Economics Volume XXVII Number 2 October 2018 Does the Export Competitiveness of Coffee Improving So far? 1 Cherkos Meaza and Yetsedaw Emagne Residential Pricing in Addis Ababa: Do Urban Green Amenities Influence Residents’ Preferences for a House? ................................ 29 Dawit Woubishet Mulatu, and Tsegaye Ginbo Agricultural and Rural Transformation in Ethiopia: Obstacles, Triggers and Reform Considerations................................................ 51 Getachew Diriba The Impact of Micro-Credit Intervention on Female Labor Force Participation in Income-Generating Activities in Rural Households of North Wollo, Ethiopia ............................................. 111 Haimanot Eshetu, Belaineh Legesse, Seid Nuru and Fekadu Beyene Technical Inefficiency of Smallholder Wheat Production System: Empirical Study from Northern Ethiopia ...................................... 151 Tekleyohannes Hailekiros, Berhanu Gebremedhin and Tewodros Tadesse A Publication of THE ETHIOPIAN ECONOMICS ASSOCIATION (EEA) ©Ethiopian Economics Association VOLUME XXVII NUMBER 2 OCTOBER 2018 Published: April 2020 Does the Export Competitiveness of Coffee Improving So far? Cherkos Meaza1 and Yetsedaw Emagne2 Abstract The general objective of the study is to examine the export competitiveness and determinants of export performance of the Ethiopian coffee sector. In analyzing competitiveness of the country in its coffee exports, data from UNCTAD-ITC is used for the periods 1991-2016. The Revealed Comparative Advantage (RCA) and Revealed Symmetric Comparative Advantage (RSCA) measures of competitiveness were used for the analysis. Furthermore, a multiple regression (OLS model) has also been employed to investigate the determinants of coffee export competitiveness and performance as well. Results for the RCA and RSCA showed that Ethiopia has comparative advantage in exports of coffee. The regression analysis revealed domestic consumption level of coffee affects export competitiveness adversely and this relationship is statistically significant. -

Val Imp C Lue Chain Plication Certified N and Co on Hous Organic St Benefi Sehold Fo C and Con Sout Fit Analys Ood Secu Nvention

ADDIS ABABA UNIVERSITY COLLEGE OF DEVELOPMENT STUDIES, FOOD SECURITY STUDIES PROGRAM Value chain and cost benefit analyssis of honey production and its implication on household food security: a comparative analyl sis of certified organic and conventional honey in Ginbo Wereda, southern Ethiopia By: Amanuel Tadesse June 2011 Addis Ababa ADDIS ABABA UNIVERSITY COLLEGE OF DEVELOPMENT STUDIES, FOOD SECURITY STUDIES PROGRAM Value chain and cost benefit analysis of honey production and its implication on household food security: a comparative analysis of certified and conventional honey in Ginbo Wereda, southern Ethiopia By Amanuel Tadesse A Thesis Submitted to the Food Security Studies Program of the College of Development Studies in Partial Fulfillment of the Requirements for the Degree of Master of Science in Food Security Studies APPROVED BY THE EXAMINING BOARD: CHAIRPERSON, DEPARTMENT GRADUATE COMMITTEE _____________________________________ _______________ ADVISOR Dr. Aseffa Seyoum _______________ EXAMINER Dr. Beyene Tadesse _______________ Table of Contents Table of Contents ............................................................................................................................. i List of Tables ................................................................................................................................. iv List of Figures ................................................................................................................................. v List of Appendices ......................................................................................................................... -

Literature Survey on Biological Data and Research Carried out in Bonga Area, Kafa, Ethiopia

Literature Survey on biological data and research carried out in Bonga area, Kafa, Ethiopia for PPP-Project Introduction of sustainable coffee production and marketing complying with international quality standards using the natural resources of Ethiopia by Dennis Riechmann November 2007 Literature survey for Biosphere Reserve in Kafa, Ethiopia Contents 1 Introduction 3 2 State of available data for Bonga area in Kafa Zone 3 2.1 Abiotic and biotic issues 5 a Geology, topography and soils 5 b Climate and weather 6 c Flora (Bonga and Boginda) 8 d Fauna (Bonga and Boginda) 10 e Biodiversity 11 3 Population 12 4 Land use 14 5 Land tenure 15 5.1 Historical situation 16 5.2 Recent situation 16 5.3 Role of the Ethiopian government 17 6 Legal regulation of forests 19 7 Forest products 19 8 Threats and disturbance of the forest 21 8.1 Social and Environmental impacts due to upgrading the Jima-Mizan Road 22 8.2 Deforestation 23 8.3 Deforestation in Boginda 23 9 Conservation Activities 24 9.1 Conservation efforts 25 10 GIS data and Maps 28 11 Used literature and further readings 31 Appendix 39 A Conceptions 39 B Coffee 39 B.1 Introduction 39 B.2 Ecological requirements of Coffea arabica 39 B.3 Traditional management and processing practices 40 B.4 Characterisation of wild coffee management systems 41 C Definition of category II National Park 42 D UNESCO Biosphere reserve 43 E Maps & Tabs 44 1 Literature survey for Biosphere Reserve in Kafa, Ethiopia Index of Figures Fig 1 Centre of Boginda Village 4 Fig 2 Land tenure and land distribution during the three regimes 16 Fig 3 Hierarchy in the process of resolving tenure disputes 18 Fig 4 Initial stage of land degradation in settlement areas in 24 Bonga Index of Maps Map 1 Topography of Southwest Ethiopia 5 Map 2 Average temperature/year in Bonga and Ethiopia 7 Map 3 Annual Precipitation in Bonga and Ethiopia 8 Map 4 National Forest Priority Area in Bonga 24 Map 5 Conceptional reserve design for C. -

Assessment of Weed Flora Composition in Arable Fields of Bench Maji, Keffa and Sheka Zones, South West Ethiopia

Research Article Agri Res & Tech: Open Access J Volume 14 Issue 1 - February 2018 Copyright © All rights are reserved by Getachew Mekonnen DOI: 10.19080/ARTOAJ.2018.14.555906 Assessment of Weed Flora Composition in Arable Fields of Bench Maji, Keffa and Sheka Zones, South West Ethiopia Getachew Mekonnen*, Mitiku Woldesenbet, Gtahun Kassa College of Agriculture and Natural Resources, Mizan Tepi University, Ethiopia Submission: December 11, 2017; Published: February 12, 2018 *Corresponding author: Getachew Mekonnen, College of Agriculture and Natural Resources, Mizan Tepi University, Ethiopia, Email: Abstract Assessment of Weed Flora Composition on of weeds in arable fields were conducted in Bench Maji, Keffa and Sheka Zones, South West 35Ethiopia, families. during Poaceae 2017 (20), main Asteraceae and sub cropping (21), Fabaceae seasons. (12) The studyand Polygonaceae was initiated (7) to determinewere by far the the weed richest flora, taxa prevalence and accounted and distribution together (44.5of weeds %) in the major crop fields. The result showed a total of one hundred thirty five weed species that were collectedAmaranthus and graecizansrecorded in L. 135 Mimosa genera invisa, and Amaranthus hybridus L. and Cynodon dactylon L. 7-87%of the entire and 0.04 flora to of2.4%, the respectively.study area. The Similarity most frequent, indices of abundant weed communities and dominant in different weed species locations were were also determined to be >60% across all locations sampled. The average values for frequency and dominance of weed species in arable fields ranged between Keywords: Flora composition; Qualitative; Quantitative; Similarity index; Weed communities Introduction measures to be adopted. To design effective weed control Weeds compete with cultivated food crops for limited resources such as water, nutrients and light [1-3]. -

Analysis of Tax Compliance and Its De and Sheka Zones Category B Tax

DOI: 10.32602/jafas.2019 .2 Analysis of Tax Compliance and Its Determinants: Evidence from Kaffa, Bench Maji and Sheka Zones Category B Tax Payers, SNNPR, Ethiopia Abdu Mohammed Assfaw a Wondimu Sebhat b a Coressponding Author, Lecturers in Department of Accounting and Finance, Mizan Tepi University, Ethiopia, [email protected] b Lecturers in Department of Accounting and Finance, Mizan Tepi University, Ethiopia Keywords Abstract Tax, Tax Compliance, Despite the fact that tax is an important stream of revenue for Ordered Logistic government of any country, there is tax avoidance and tax evasion which are constraints serving as a bottlenecks for efficient tax Regression, Tax payers, collection performance. Therefore, this study examines tax Ethiopia. compliance and its determinants in Kaffa, Bench Maji and Sheka Zones category ‘B’ business income tax payers, Ethiopia. To do this, data was collected with the aid of structured questionnaires, administered to 311 respondents using proportionate simple Jel Classification random sampling procedure. The data was examined with the use of H25, H26. descriptive statistics and econometr ic model particularly ordered logit model. The result of ordered logistic regression showed that, among different variables tested, tax compliance was positively affected by education level of tax payers, tax knowledge and awareness of tax payers, simplici ty of the tax system, attitude of tax payers towards tax, perceived role of government expenditure, and rewarding scheme for loyal tax payers. It is therefore recommended that the tax authority ought to conduct effective and sustainable awareness creation programmes and tax education to the general public in general and to tax payers in particular through printed and electronic medias and face-to-face cessions.