EABL 2018 Half Year Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BAR BITES Meat

BAR BITES COCKTAIL SAMOSAS 850 Choose from chicken, beef, lamb feta & dhania Meat TAMARIND MEAT PLATTER Beef ribs, pork ribs, chicken, lamb, sausages & chips 300g 500g 1 Kg 2,500 3,000 4,900 CHICKEN WINGS 950 Spicy chicken wings, garlic, paprika and chilli powder, sriracha mayonnaise Deep Sea lovers 1,000 CALAMARI ‘FRITTO MISTO’ Crispy fried calamari, lime, tartar, chilli soy sauce COCKTAIL OF THE MONTH 750 Southside Martini Gordons Pink Gin, Southern Comfort, Lime Juice, Orange Juice and Ginger Syrup SOUTHSIDE MARTINI 750 Gordons Pink Gin, Southern Comfort, Lime Juice, Orange Juice and Ginger Syrup WHISKEY DAWA 1,000 Johnnie Walker (Green Label), sugar, quartered lime, ice and honey. WHISKEY MOJITO 1,000 Johnnie Walker (Green Label), lime juice, soda water, sugar and fresh mint. PINK GIN & TONIC 850 Gordons Pink Gin, Strawberry, Tonic, Ice TANQUERAY 10 GIN & TONIC 950 Tanqueray Ten Gin, Slice of Grape Fruit Tonic, Ice BREAKFAST MARTINI 1100 Tanqueray No. TEN Gin, Pernod, grenadine, orange juice and ice. DUTCH MULE 1000 Ketel Citroen Vodka, Fresh Lime, Ginger Beer(Stoney), dashes bitters. THE AMERICAN SOUR BULLET 1100 Bulleit Bourbon Whiskey, aqua faba, sugar syrup, lemon juice, bitters. SINGLETON OLD FASHIONED 1400 Singleton Tailfire,Sugar syrup, Orange zest and ice DAWA 750 Smirnoff Vodka, sugar, quartered lime, ice and honey. MOJITO 850 White rum, lime juice, soda water, sugar and fresh mint. COSMOPOLITAN 750 Smirnoff Vodka, triple sec, fresh lime juice and cranberry juice. STRAWBERRY DAIQUIRI 750 Rum, fresh strawberries, lime juice, sugar syrup and ice. LONG ISLAND 1,200 Gin, Vodka, White Rum, Tequila, triple sec , lime juice and ice MARGARITA 750 Tequila, orange liqueur, lime Juice, crushed ice, salt. -

Verandah Beverage Menu

Beers Local per glass per bottle Tusker Premium 700 VT 750 VT Tusker Lemon 750 VT Vanuatu Bitter 750 VT International Victoria Bitter (AU) 850 VT XXXX Gold (AU) 850 VT Heineken (ND) 950 VT Corona (MX) 950 VT Sparkling Wine Sparkling Wine per glass per bottle Jean Pierre brut (Hunter Valley – AU) 900 VT 4,100 VT Francois Montand Brut (Jura – FR) 1,000 VT 4,200 VT Champagne Louis Roederer Brut (Reims – FR) 14,900 VT Moet et Chandon (Reims – FR) 16,500 VT White Wine Sauvignon Blanc per glass per bottle Markview Sauvignon Blanc (Hunter Valley – AU) 800 VT 3,600 VT Domaine du Tariquet Sauvignon Blanc (Armagnac – FR) 1,250 VT 4,500 VT Oyster Bay Sauvignon Blanc (Marlborough – NZ) 1,450 VT 4,900 VT Shaw + Smith Sauvignon Blanc (Adelaide Hills – AU) 6,400 VT Chardonnay Deakin Estate Chardonnay (Sunraysia – AU) 1,100 VT 4,200 VT Como Estate Chardonnay (Margaret River – AU) 1,400 VT 6,700 VT Brookland Valley Verse 1 Chardonnay (Margaret River – AU) 6,200 VT Other White Wine Varietals Domain du Tariquet Ugni Blanc Colombard (Armagnac – FR) 1,350 VT 4,900 VT Chateau Rousseau Semillon (Bordeaux – FR) 1,450 VT 5,200 VT Villa Maria Riesling (Marlborough – NZ) 5,200 VT Red Wine Cabernet Sauvignon per glass per bottle Rawsons Retreat Cabernet Sauvignon (Barossa Valley – AU) 1,150 VT 4,600 VT Como Estate Cabernet Sauvignon (Margaret River – AU) 1,400 VT 6,700 VT Houghton cabernet sauvignon (Swan Valley – AU) 1,550 VT 6,000 VT Merlot Deakin Estate Merlot (Sunraysia – AU) 1,100 VT 4,200 VT Wyndham Estate Bin 999 Merlot (Margaret River – AU ) 1,200 VT 4,900 -

EABL Annual Report 2019

DELIVERING VALUE TOGETHER 2019 Integrated Report and Financial Statements DELIVERING VALUE TOGETHER EABL in 2019 ast African Breweries Limited (EABL) is a regional leader in beverage alcohol with an exceptional collection of brands across beer and spirits. Although our business is concentrated in three core markets of Kenya, Uganda and Tanzania, our products are sold in more than 10 countries across Africa and beyond. Our Ebrands are an outstanding combination of local beers and international premium spirits. These include: Tusker, Guinness, Bell Lager, Serengeti Lager, Kenya Cane, Uganda Waragi, Smirnoff and Johnnie Walker among others. Our performance ambition is to be among the best performing, most trusted and respected consumer products company in Africa. We are proud of the brands we make and the positive impact they have on society. We are passionate about alcohol playing a positive role in society as part of a balanced lifestyle. Contents Our Business Model 4 Driving EABL’s Sustainability 5 Our Strategy 6 Financial Highlights 8 Executive Summary 10 Chairman’s Statement 14 Group Managing Director’s Statement 18 Sustainability 22 Brands 36 Consumer Focus 59 People and Culture 62 Compliance and Ethics 68 Board of Directors 72 EABL Senior Management 76 Notice of Annual General Meeting 77 Corporate Governance Statement 80 Governance Auditor’s Report 86 Statement of Directors’ Responsibilities - Governance 87 Annual Report and Financial Statements 88 Corporate Information 90 Directors’ Report 92 Directors’ Remuneration Report 100 Statement of Directors’ Responsibilities 106 Report of the Independent Auditor 107 Financial Statements 110 Principal Shareholders and Share Distribution 172 Information to Shareholders 173 Our Business Model Our Business Model ast African Breweries Limited (EABL) is a regional and geographic reach enable us to deliver sustainable leader in beverage alcohol with iconic brands performance and create value for our shareholders. -

Beverage List

BEVERAGE LIST Soft Drinks Coke/ Fanta/ Sprite / Tonic 2 00 Coke Zero/Zero Sugar 200 Red Bull 500 Fitch & Leedes Indian Tonic 500 Fresh Juices Orange 40 0 Passion 400 Lime 400 Packed Juice Orange/ Apple 30 0 Pinneaple/ Passion 300 Water Aquamist Still 750ml 30 0 Aquamist Sparkling 750ml 350 Non – Alcoholic Beers Barbican Malt Flavour/ Apple 400 Local and Imported Beers & Ciders Tusker Lager/ Tusker Lite/ Pilsner 40 0 Tusker Malt / Guinness 40 0 White Cap/ Tusker Cider 450 Smirnoff Ice 45 0 Sikera Apple Cider 450 Hunter’s Dry Cider 450 Heineken 550 Bateleur Dire Straits Pilsen 550 Tusker Premium Ale 550 Hop House 13 550 Aperitifs Campari 300 Martini Bianco 300 Martini Rosso 300 Pernod 300 Pimm's No. 1 300 Fernet Branca 400 Sherry & Port Bristol 300 Tio Pepe Very Dry 350 Cockburn Port 350 All our prices are inclusive of VAT, Catering Levy and Service Charge BEVERAGE LIST Gin Gilbey’s / Beefeater/ Gordon’s 300 Bombay Sapphire 400 Tanqueray 400 Tanqueray 10 650 Hendricks 700 Monkey 47 700 Vodka Smirnoff Red 300 Absolute Blue 350 Ketel One 400 Cîroc 600 Grey Goose 650 Belvedere Pure Naked 650 Rum Malibu 300 Bacardi Carta Blanca 300 Captain Morgan Spiced Rum 300 Captain Morgan Black Label 300 Lambs Navy 350 Scotch Whisky Johnnie Walker Red Label 300 J&B Rare 300 Famous Grouse Finest 300 Grants 300 American & Canadian Jim Beam 300 Canadian Club 300 Jack Daniel’s 450 Bulleit 500 Gentleman Jack 700 Deluxe Scotch Johnnie Walker Black Label 500 Chivas Regal 550 Johnnie Walker Double Black 600 Johnnie Walker Green Label 750 Johnnie Walker Gold Reserve -

Beer Vodka Gin Brandy Rum Port Vermouth Whisky & Bourbon Sherry Tequila Liqueurs Cocktails

BEER Johnny Walker Red - 350/- Tusker, Pilsner, White Cap, Tusker Malt, Tusker J&B Rare - 350/- Light, Tusker Cider, White Cap Light, Guinness Famous Grouse - 350/- 350/- Jameson - 350/- Heineken Marshall’s Bourbon - 350/- 450/- Jack Daniel’s No 7 - 400/- Jim Beam Bourbon - 400/- VODKA Johnny Walker Black - 450/- Jack Daniel’s Tennessee Honey - 500/- Smirnoff Red Label - 300/- Glenfiddich 12 yrs - 550/- Absolut - 350/- Chivas Regal 12 yrs - 550/- Grey Goose - 450/- Ballantine’s Finest - 550/- GIN Glenmorangie The Original 10 yrs - 650/- Gilbey’s - 300/- Glenfiddich 18yrs - 800/- Gordon’s - 375/- Bombay Sapphire - 375/- SHERRY Hendrick’s - 400/- Harveys Bristol Cream - 350/- BRANDY Viceroy - 300/- TEQUILA Martell (VS) - 500/- Camino - 300/- Courvoisier (VS) - 550/- Jose Cuervo Gold - 400/- Remy Martin (VSOP) - 950/- Jose Cuervo Silver - 400/- RUM LIQUEURS Malibu - 300/- Angostura Bitters (dash) - 100/- Bacardi - 300/- Crème De Cassis - 300/- Myers’s - 350/- Apple Sour - 300/- Captain Morgan Spiced Gold - 400/- Amarula - 350/- Baileys - 350/- Tia Maria - 350/- PORT Benedictine - 350/- KWV Tawny - 400/- Kahlua - 350/- KWV Ruby - 400/- Jägermeister - 350/- Amaretto - 350/- Grappa - 350/- VERMOUTH Limoncello - 350/- Martini Extra Dry - 300/- Sambuca - 350/- Martini Rosso - 300/- Drambuie - 400/- Martini Bianco - 300/- Southern Comfort - 400/- Cinzano Rosso - 300/- Fernet Branca - 400/- Cinzano Bianco - 300/- Frangelico - 400/- Cinzano Bitter - 300/- Cointreau - 500/- Campari - 300/- Grand Marnière - 500/- Pimms - 300/- WHISKY & BOURBON COCKTAILS Wine . Brandy . Lemonade . Fresh Fruit STRAWBERRY SMASH *Red or White Wine Sangria Available Gin . Campari . Triple Sec . Grenadine Syrup Glass : 900/- Pitcher : 2,500/- Fresh Strawberries . Basil Leaves . Lime Juice Sugar Syrup PROSECCO COCKTAILS 700/- MIMOSA THYME OUT Prosecco Brut . -

Brand Calories Per Serving Pure Ethanol Not a Real Drink, For

ABV Brand Alcohol % Calories by Volume Per Serving Pure Ethanol 100% 238 calories per 1.5 oz Not a real drink, for comparison only Everclear 95% 226 calories per 1.5 oz Jose Cuervo Especial (Gold) 40% 96 calories per 1.5 oz Jose Cuervo Especial (Silver) 40% 96 calories per 1.5 oz Crown Royal - Special Reserve 40% 96 calories per 1.5 oz Knob Creek Bourbon 50% 120 calories per 1.5 oz Don Julio Blanco Tequila 40% 96 calories per 1.5 oz Ketel One Vodka 40% 96 calories per 1.5 oz Myers Original Dark Rum 40% 96 calories per 1.5 oz Pendleton Whisky 40% 96 calories per 1.5 oz Monarch Citron Vodka 35% 84 calories per 1.5 oz Smirnoff Vodka Blue Label 100 Proof 50% 121 calories per 1.5 oz Bulleit Rye 45% 109 calories per 1.5 oz Bulleit Bourbon 45% 109 calories per 1.5 oz Makers Mark 45.5% 110 calories per 1.5 oz Bacardi 151 Rum 75.5% 183 calories per 1.5 oz Vodka and Diet Coke 13.3% 258 calories per 12 oz Smirnoff Vodka Red Label 80 Proof 40% 97 calories per 1.5 oz Vodka - Royal Gate (generic) 80 proof 40% 97 calories per 1.5 oz Grey Goose Vodka 40% 97 calories per 1.5 oz 1910 Rye Whisky 40% 97 calories per 1.5 oz Bombay Sapphire Gin 47% 114 calories per 1.5 oz E&J Brandy 40% 97 calories per 1.5 oz Smirnoff Vodka Silver Label 90 Proof 45.2% 110 calories per 1.5 oz Bacardi Gold Rum 40% 98 calories per 1.5 oz Jack Daniels Whiskey 40% 98 calories per 1.5 oz Jack and Diet Coke 10% 195 calories per 12 oz Dalwhinnie Scotch Whisky 57.8% 141 calories per 1.5 oz Patron Anejo Tequila 40% 98 calories per 1.5 oz Patron Gran Patron Burdeos Anejo 40% 98 calories -

EWHC 2140 (Comm) Case No: 2009 FOLIO 992 in the HIGH COURT of JUSTICE QUEEN's BENCH DIVISION

Neutral Citation Number: [2009] EWHC 2140 (Comm) Case No: 2009 FOLIO 992 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 18/08/2009 Before: MR JUSTICE CHRISTOPHER CLARKE - - - - - - - - - - - - - - - - - - - - - Between: SABMILLER AFRICA B.V. - and - TANZANIA BREWERIES LIMITED Applicants - and - EAST AFRICAN BREWERIES LIMITED Respondents - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Alain Choo-Choy QC & Nicholas Sloboda (instructed by Lovells) for the Applicants David Oliver QC & Alec Haydon (instructed by Addleshaw Goddard) for the Respondents Hearing dates: 4th, 5th & 6th August 2009 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that pursuant to CPR PD 39A para 6.1 no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. MR JUSTICE CHRISTOPHER CLARKE MR JUSTICE CHRISTOPHER CLARKE SABMILLER AFRICA V EAST AFRICAN BREWERIES Approved Judgment MR JUSTICE CHRISTOPHER CLARKE: 1. This is an application for injunctive relief pending further order of the Court or of the arbitration tribunal, which at the time of the hearing was yet to be appointed in order to determine the disputes between the parties. 2. The case concerns the production and distribution of beer in Tanzania. The battle is between very sizeable players. The applicants are Sabmiller Africa BV (“Sabma”) and its subsidiary Tanzania Breweries Ltd (“TBL”). Sabma, previously named South African Breweries International (Africa) B.V., is a subsidiary of SABMiller Plc. In 2002, as now, TBL was the market leader in the brewing market in Tanzania. It currently holds an 80-85% market share. Another major player in that market was and is Serengeti Breweries Ltd (“SBL”), TBL’s most significant competitor. -

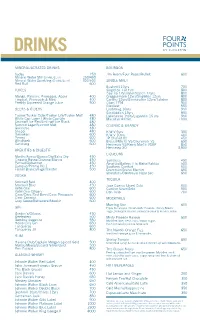

Four Points by Sheraton Pablos Menu 4Pager

DRINKS MINERAL/AERATED DRINKS BOURBON Sodas 250 Jim Beam/Four Roses/Bulleit 600 Mineral Water Still (0.5ML/1LTR) 250/450 Mineral Water Sparkling (0.5ML/1LTR) 300/500 SINGLE MALT Red Bull 600 Bushmill 10yrs 700 JUICES Singleton Tail Fire 800 Caol Ila 12yrs/Glenfiddich 12yrs 800 Mango, Passion, Pineapple, Apple 400 Cragganmore 12yrs/Singleton 12yrs 800 Tropical, Pineapple & Mint 400 Cardhu 12yrs/Glenkinchie 12yrs/Talisker 800 Freshly Squeezed Orange Juice 500 Oban 1794 900 Glenlivet 950 BEERS & CIDERS Laphroaig 10yrs 950 Glenfiddich 15yrs 950 Tusker/Tusker Cider/Tusker Lite/Tusker Malt 480 Dalwhinnie 15yrs/Lagavulin 16 yrs 950 White Cap Lager / White Cap Lite 480 Macallan Amber 1000 Smirnoff Ice Red/Smirnoff Ice Black 480 Summit Lager/Summit Malt 480 COGNAC & BRANDY Guinness 480 Snapp 480 K.W.V 5yrs 350 Heineken 600 K.W.V 10yrs 400 Peroni 600 JP Chenet XO 450 Windhoek 600 Biscuit/Martel VS/Courvosier VS 650 Carlsberg 600 Hennessy VS/Remy Martin VSOP 850 Hennessy XO 3,900 APERITIFS & DIGESTIF LIQUEURS Martini Rosso/Bianco/Dry/Extra Dry 450 Cinzano Rosso/Cinzano Bianco 450 Sambuca 450 Pernod/Dubonnet 450 Amarula/Baileys /Tia Maria/Kahlua 500 Campari/Pimms No.1 450 Southern Comfort 500 Fernet Branca/Jagermeister 500 Drambuie/Grand Marnier 650 Sheridans/Cointreau/Triple Sec 650 VODKA TEQUILA Smirnoff Red 400 Smirnoff Blue 450 Jose Cuervo Silver/ Gold 500 Ketel One 600 Camino Silver/Gold 500 Ketel One Citroen 600 Don Julio 700 Ciroc/Ciroc Red Berry/Ciroc Pineapple 600 Ciroc Coconut 600 MOCKTAILS Grey Goose/Belvedere/Absolut 600 Morning Star 600 GIN Enjoy the unique mix of exotic flavours: Honey,Brown sugar,pineapple chunks,pineapple juice & mineral water. -

Scotch Whisky in Thailand. Strategic Implications of International Alliances and Product Adaptation

Munich Personal RePEc Archive Scotch Whisky in Thailand. Strategic implications of international alliances and product adaptation. A secondary data research case study. Mongay, Jorge and Johnson, Ashia and Head, Margaret and Guenard, Camille and Kincaid, Brian 10 September 2012 Online at https://mpra.ub.uni-muenchen.de/42735/ MPRA Paper No. 42735, posted 22 Nov 2012 12:41 UTC Scotch Wisky in Thailand. Strategic implications of international alliances and product adaptation. A secondary data research case study. Jorge Mongay. SBS Swiss Business School (Switzerland)) Ashia Johnson. Arizona State University (USA) Margaret Head. Butler University. (USA) Camille Guenard. Arizona State University (USA) Brian Kincaid Arizona State University (USA) ABSTRACT According to an article in 2008 issue of The Globe titled “Newly Introduced Alcohol Marketing Strategies: Thai Experience” provided by the Global Alcohol Policy Alliance, Thailand is classified as an "emerging market" in regards to the growth and development of the alcohol industry. The industry growth and expansion is caused by the international entrepreneurs that have invaded and populated the thai scene. International labels are now becoming more widespread; however, the domestic producers and operators are still powerful in the industry with the low price point being a contributor to its domestic labels steady market and industry success. The appeal of international labels and brands is mostly due to the "created image of life success and friendship" (Newly Introduced Alcohol Marketing Strategies: Thai Experience). Consumers of international labels are fascinated by the elegance of associating with such products. It seems as if only the well-off and well-rounded of business people consume international alcoholic beverages. -

View Annual Report

Annual Report 2020 Annual Report 2020 Contents Diageo is a global leader in beverage Strategic report alcohol with an outstanding collection Our brands ....................................................................... 2 of brands across spirits and beer. Our global reach .......................................................... 3 Chairman’s statement ............................................ 4 Our Performance Ambition is to be one of the Our purpose and ambition ................................ 6 best performing, most trusted and respected Chief Executive’s statement ............................... 8 Our business model ................................................. 10 consumer products companies in the world. Stakeholder engagement ................................... 12 Our market dynamics ............................................. 14 Our products are sold in more Our strategic priorities ............................................ 17 than 180 countries and our brands include Key performance indicators ............................... 30 Johnnie Walker, Crown Royal, JεB, Buchanan’s Sustainability performance ................................. 32 Our principal risks and and Windsor whiskies, Smirnoff, Cîroc risk management ....................................................... 38 and Ketel One vodkas, Captain Morgan, Climate-related risks ................................................. 42 Baileys, Don Julio, Tanqueray and Guinness. Group financial review ........................................... 44 Business review ........................................................... -

Drinks Menu Black

Beers At Seven's, we take beer seriously. Looking to savor the ultimate taste of barley, enquire from your waiter for the best from Kenya! White Cap Lager @ Ksh. 350 White Cap Lite @ Ksh. 350 Tusker Lager @ Ksh. 350 Tusker Malt @ Ksh. 350 Tusker Lite @ Ksh. 350 Guinness @ Ksh. 350 Pilsner Lager @ Ksh. 400 Heineken @ Ksh. 450 Dire Strits @ Ksh. 500 Tandala @ Ksh. 500 Dirthy Hairy @ Ksh. 550 Bila Shaka @ Ksh. 550 Soft Drinks Juices Small @ Ksh. 300 Large @ Ksh. 500 Sodas Coke @ Ksh. 150 Fanta Orange @ Ksh. 150 Fanta Black Current @ Ksh. 150 Stoney @ Ksh. 150 Bitter Lemon @ Ksh. 150 Sprite @ Ksh. 150 Soda Water @ Ksh. 150 Tonic Water @ Ksh. 150 Diet Coke @ Ksh. 200 Coke Zero @ Ksh. 200 Red Bull @ Ksh. 300 Water Still 500ml @ Ksh. 200 Sparkling 500ml @ Ksh. 250 Still 750ml @ Ksh. 300 Sparkling 750ml @ Ksh. 350 San Pellegrino 750ml @ Ksh. 450 Seven Seafood & Grill @experienceseven @experienceseven DRINKS LIST Small Bites Spirits (30ml) Seared Chicken Taco Gin Gilbey’s @ Ksh. 250 Paprika grilled Chicken, roasted Garlic Crispy Leeks Gordons @ Ksh. 350 @ Ksh. 950/- Tanqueray @ Ksh. 350 Bombay Sapphire @ Ksh. 400 Tanqueray 10yrs @ Ksh. 450 Calamari A La Plancha Taco Hendricks @ Ksh. 500 Delicately Seared with a rich Lemon Garlic Butter @ Ksh. 995/- Rum Bacardi @ Ksh. 300 Malibu @ Ksh. 300 Top Sirloin Taco Captain Morgan Dark @ Ksh. 300 Seared Sirloin with Jalapeno & Crispy Shallots with Captain Morgan Spiced @ Ksh. 300 Bacardi Gold @ Ksh. 350 roasted Garlic Aioli Myers @ Ksh. 350 @ Ksh. 950/- Cachaca @ Ksh. 350 Havana Club @ Ksh. 350 Tempura Octopus Tequila Tender, crispy & served with a Wasabi Mayo Olmeca Silver @ Ksh. -

Dawa Lounge & Bar Menu Deep Sea Lovers

Dawa Lounge & bar Menu COCKTAIL SAMOSAS 850 Choose from chicken, beef, lamb or vegetable CHICKEN WINGS 950 Spicy chicken wings with garlic, paprika and chilli powder served sriracha mayonnaise sauce OVEN BAKED CHICKEN WINGS 950 Tossed in onions, Chilli and Coriander SPICY SAUSAGES Sliced sausages, onions, Maasai Chilli Sauce and Coriander SPICY CHICKEN GIZZARDS 950 Tossed in chilli, onions, garlic and coriander BASKET OF CHIPS 850 Masala or Plain Deep Sea lovers CALAMARI ‘FRITTO MISTO’ 1,000 Crispy fried Calamari with lime, tartar and chilli soy sauce TEMPURA PRAWNS 1,700 Served with sweet chilli sauce and limes Meat TAMARIND MEAT PLATTER Beef ribs, pork ribs, chicken, lamb, sausages served with French fries 300g 2,500 500g 3,000 1 Kg 4,900 PORK SPARE RIBS Sauteed belly ribs in garlic, ginger, lime, soy & honey 300g 2,000 600g 3,500 1 Kg 4,900 BEEF RIBS Slow cooked beef ribs served with BBQ Sauce 600g 3,200 1 Kg 4,700 Gin Mojito 850 Gin, lime juice, soda water, sugar and fresh mint. Tamarind Fizzle 850 Gilbeys Gin fused with Passion Fruit, Soda Water and Cinnamon Twisted Hurricane 950 Captain Black, captain spice, Bacardi, orange juice, passion juice, grenadine WEEKDAY HAPPY HOUR ON COCKTAILS FROM 5 PM TO 7 PM SOUTHSIDE MARTINI 750 Gordons Pink Gin, Southern Comfort, Lime Juice, Orange Juice and Ginger Syrup WHISKEY DAWA 1,000 Johnnie Walker (Green Label), sugar, quartered lime, ice and honey. WHISKEY MOJITO 1,000 Johnnie Walker (Green Label), lime juice, soda water, sugar and fresh mint. PINK GIN & TONIC 850 Gordons Pink Gin, Strawberry, Tonic, Ice TANQUERAY 10 GIN & TONIC 950 Tanqueray Ten Gin, Slice of Grape Fruit Tonic, Ice BREAKFAST MARTINI 1100 Tanqueray No.