2007-2008 Comptroller and Auditor General of India 2008

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

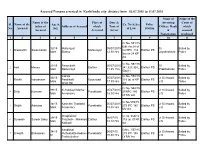

Accused Persons Arrested in Kozhikodu City District from 05.07.2015 to 11.07.2015

Accused Persons arrested in Kozhikodu city district from 05.07.2015 to 11.07.2015 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, Rank which No. Accused Sex of Law Station Accused Arrested Arrest & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 Cr.No. 551/15 6(b) r/w 24 of 32/15 Malluvayal 05/07/2015 Si Bailed by 1 Sreekanth Sreenivasan Mattuvayal COTPA ,118 Elathur PS Male Elathur 12.30 Hrs Jayakrishnan Police (b) r/w 24 KP Act Cr.No. 552/15 21/15 Parambath 05/07/2015 SI Bailed by 2 Asik Moosa Elathur 341,323,324,, Elathur PS Male Naduvilayil 11.45 Hrs Prabhakaran Police 506(1) Indraja Cr.No. 553/15 33/15 05/07/2015 Jr Si Aswani. Bailed by 3 Rohith Indrasenan Parakkatil Koya road 118 (a) of KP Elathur PS Male 17.50 Hrs J.S Police West Hill Act Cr.No. 554/15 39/15 Kizhakkayil Methal 05/07/2015 Jr Si Aswani. Bailed by 4 Shiju Kanaran Purakkattiri 279IPC 185 Elathur PS Male Annassery 18.30 Hrs J.S Police Of MV Act Cr.No 555/15 34/15 Karimbin Thottathil 05/07/2015 Jr Si Aswani. Bailed by 5 Shijith Ashokan Purakkattiri 279 IPC 185 Elathur PS Male Annassery 18.35 Hrs J.S Police MV Act Ottapilakkal Cr.no. 556/15 29/15 06/07/15 Jr Si Aswani. -

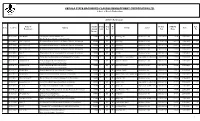

2015-16 Term Loan

KERALA STATE BACKWARD CLASSES DEVELOPMENT CORPORATION LTD. A Govt. of Kerala Undertaking KSBCDC 2015-16 Term Loan Name of Family Comm Gen R/ Project NMDFC Inst . Sl No. LoanNo Address Activity Sector Date Beneficiary Annual unity der U Cost Share No Income 010113918 Anil Kumar Chathiyodu Thadatharikathu Jose 24000 C M R Tailoring Unit Business Sector $84,210.53 71579 22/05/2015 2 Bhavan,Kattacode,Kattacode,Trivandrum 010114620 Sinu Stephen S Kuruviodu Roadarikathu Veedu,Punalal,Punalal,Trivandrum 48000 C M R Marketing Business Sector $52,631.58 44737 18/06/2015 6 010114620 Sinu Stephen S Kuruviodu Roadarikathu Veedu,Punalal,Punalal,Trivandrum 48000 C M R Marketing Business Sector $157,894.74 134211 22/08/2015 7 010114620 Sinu Stephen S Kuruviodu Roadarikathu Veedu,Punalal,Punalal,Trivandrum 48000 C M R Marketing Business Sector $109,473.68 93053 22/08/2015 8 010114661 Biju P Thottumkara Veedu,Valamoozhi,Panayamuttom,Trivandrum 36000 C M R Welding Business Sector $105,263.16 89474 13/05/2015 2 010114682 Reji L Nithin Bhavan,Karimkunnam,Paruthupally,Trivandrum 24000 C F R Bee Culture (Api Culture) Agriculture & Allied Sector $52,631.58 44737 07/05/2015 2 010114735 Bijukumar D Sankaramugath Mekkumkara Puthen 36000 C M R Wooden Furniture Business Sector $105,263.16 89474 22/05/2015 2 Veedu,Valiyara,Vellanad,Trivandrum 010114735 Bijukumar D Sankaramugath Mekkumkara Puthen 36000 C M R Wooden Furniture Business Sector $105,263.16 89474 25/08/2015 3 Veedu,Valiyara,Vellanad,Trivandrum 010114747 Pushpa Bhai Ranjith Bhavan,Irinchal,Aryanad,Trivandrum -

GENERAL ELECTION to LOK SABHA 2019 - Appointment of Polling Personnel

Collectorate, KOZHIKODE Ref. No : DC KKD/2591/19/E1 Dtd. 26-03-2019 From District Election Officer & District Collector, KOZHIKODE To The Head of the Office KSFE, Cheruvannur(0290040450226) null KOZHIKODE, Village : 004045 - CHERVANNUR Sir, Sub:- GENERAL ELECTION TO LOK SABHA 2019 - Appointment of Polling Personnel - The appointment orders in respect of the staff members in your office, who have been posted for election duty in connection with the GENERAL ELECTION TO LOK SABHA 2019 is enclosed herewith in duplicate. The Appointment Orders shall be served on the officers concerned and obtain the acknowledgement of each officer on the other copy of the covering letter and return to Tahsildar forthwith. Encl: Covering Letter & Posting Orders in duplicate. Yours faithfully District Election Officer & District Collector, KOZHIKODE NB:- Breach of official duty in connection with election is cognizable offence under Sec. 134 of the RP. Act 1951 and is punishable. Sl. No Name Designation Category Signature 1 BIJU P SPECIAL GRADE ASST Polling Officer 1 2 RASHEED K P JUNIOR ASSISTANT Polling Officer 1 NAZEER AHAMMED 3 JUNIOR ASSISTANT Polling Officer 1 C K SIBI KUMARA 4 ASSISTANT MANAGER Presiding Officer MENON ORDER OF THE APPOINTMENT OF PRESIDING AND POLLING OFFICERS In pursuance of sub-section (1) and sub-section (3) of section 26 of the Representation of People Act, 1951 (43 of 1951), I hereby appoint the officers specified in column 1 or 2 of the Table below as the Presiding Officer / Polling Officer respectively for the GENERAL ELECTION TO LOK SABHA 2019 Name of the Presiding Officer Name of the Polling Officer (1) (2) P01 BIJU P SPECIAL GRADE ASST KSFE, Cheruvannur(0290040450226) null KOZHIKODE Mobile : 9947303936 The poll will be held on 23-04-2019 during the hours 07.00 AM to 06.00 PM. -

Voters List for Ipc General Executive Election 2019-2022

VOTERS LIST FOR IPC GENERAL EXECUTIVE ELECTION 2019-2022 Church Serial Pastor Constituency Centre Name Church Name Title Name ID No. ID ALAPPUZHA Alappuzha EAST 11919 IPC Bethel Eramathoor Chennithala 1001 Pr. C V Chacko 101477 ALAPPUZHA Alappuzha EAST 11919 IPC Bethel Eramathoor Chennithala 1002 Evg. Thankachan M K 103556 ALAPPUZHA Alappuzha EAST 11919 IPC Bethel Eramathoor Chennithala 1003 K V Abraham ALAPPUZHA Alappuzha EAST 11919 IPC Bethel Eramathoor Chennithala 1004 Dr. Thomas Varghese ALAPPUZHA Alappuzha EAST 11919 IPC Bethel Eramathoor Chennithala 1005 Joseph George ALAPPUZHA Alappuzha EAST 11913 IPC Bethel pallipad 1006 Pr. Varghese John 105016 ALAPPUZHA Alappuzha EAST 11913 IPC Bethel pallipad 1007 Pr. George Daniel 103965 ALAPPUZHA Alappuzha EAST 11913 IPC Bethel pallipad 1008 S Thomas ALAPPUZHA Alappuzha EAST 11913 IPC Bethel pallipad 1009 Varghese Abraham ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1010 Pr. Biju Panamthoppu 101341 ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1011 Pr. M V Varghese 104298 ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1012 Pr. Monsy M Varghese 102431 ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1013 Varghese Chacko ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1014 M V Philip ALAPPUZHA Alappuzha EAST 11779 IPC Bethel Veeyapuram Payipad 1015 G Thomas ALAPPUZHA Alappuzha EAST 11930 IPC Ebenezer Vazhakuttam 1016 Pr. Jose Lukose 101896 ALAPPUZHA Alappuzha EAST 11930 IPC Ebenezer Vazhakuttam 1017 John P M ALAPPUZHA Alappuzha EAST 11933 IPC Elim Ennakkad 1018 Pr. Sabu Varghese 103330 ALAPPUZHA Alappuzha EAST 11933 IPC Elim Ennakkad 1019 Pr. Mathew Joseph 102385 ALAPPUZHA Alappuzha EAST 11933 IPC Elim Ennakkad 1020 Rejimon B ALAPPUZHA Alappuzha EAST 11918 IPC Elim Kayamkulam 1021 Pr. -

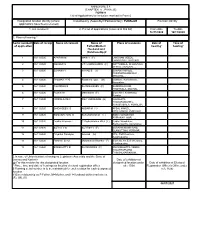

(CHAPTER V , PARA 25) FORM 9 List of Applications for Inclusion

ANNEXURE 5.8 (CHAPTER V , PARA 25) FORM 9 List of Applications for inclusion received in Form 6 Designated location identity (where Constituency (Assembly/£Parliamentary): PUNALUR Revision identity applications have been received) 1. List number@ 2. Period of applications (covered in this list) From date To date 16/11/2020 16/11/2020 3. Place of hearing * Serial number$ Date of receipt Name of claimant Name of Place of residence Date of Time of of application Father/Mother/ hearing* hearing* Husband and (Relationship)# 1 16/11/2020 APARNA M MANI V (F) LAKSHAM VEEDU, THADICADU, ARACKAL, , 2 16/11/2020 YOUSUF U UTHUMAN KANNU (F) KOTTUMALA, CHARUVILA VEEDU, ARACKAL, , 3 16/11/2020 SUHANA V VAHAB S (F) SUHANA MANZIL, PARANKIMAMMUKAL , ARACKAL, , 4 16/11/2020 THOMAS IYPE Saramma Iype (M) Vaithara , Kuthirachira , Karavaloor , , 5 16/11/2020 CHANDHU S SURESH BABU (F) SANDRALAYAM, THOITHALA, ANCHAL, , 6 16/11/2020 Roshini M Mahendran (F) Block No1, Kelankavu, Punalur, , 7 16/11/2020 NIRMALA REJI REJI VARGHESE (H) KAVALAYIL THAKARAMANNIL, KANJIRAMALA, PUNALUR, , 8 16/11/2020 SAIDA BEEVI S AKBAR M (H) AFSAL MANZIL, CHALAKODU, PUNALUR, , 9 16/11/2020 SOMANATHAN S SUKUMARAN D (F) SOMA MANDIRAM, AYIRANALLOOR, , , 10 16/11/2020 Devika Krishnan L C Radhakrishna Pillai (F) Radha Mandhiram, Eachemkuzhy, Ayiranaloor, , 11 16/11/2020 SURYA V S SURESH V (F) SURABHI MANDIRAM, ELAMUTTAM, YEROOR, , 12 16/11/2020 Priyanka Pandiyan Aravind (H) RPL, Staff Quarters, Kulathupuzha, , 13 16/11/2020 Fathima Beevi Muhammed Rawther (F) Block No 69, E S M Colony, Kulathupuzha, -

Accused Persons Arrested in Kollam Rural District from 07.06.2020To13.06.2020

Accused Persons arrested in Kollam Rural district from 07.06.2020to13.06.2020 Name of Name of Name of the Place at Date & Arresting the Court Sl. Name of the Age & Cr. No & Police father of Address of Accused which Time of Officer, at which No. Accused Sex Sec of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 1953/2020 U/s 269 IPC & 118(e) of GEETHA KP Act & VILASOM, 13-06-2020 ANCHAL G.PUSHPAK 20, RO JN Sec. 5 of BAILED BY 1 ABHIJITH SURESH KURUVIKKONAM, at 21:05 (Kollam UMAR ,SI OF Male ANCHAL Kerala POLICE ANCHAL Hrs Rural) POLICE Epidemic VILLAGE Diseases Ordinance 2020 1952/2020 U/s 188, 269 KOCHU VEEDU, IPC & Sec. 5 13-06-2020 ANCHAL G.PUSHPAK MADHAVA 33, NEAR ANCHAL RO JN of Kerala BAILED BY 2 ANOOP at 20:15 (Kollam UMAR ,SI OF N NAIR Male CHC, ANCHAL ANCHAL Epidemic POLICE Hrs Rural) POLICE VILLAGE Diseases Ordinance 2020 1952/2020 U/s 188, 269 IPC & Sec. 5 KAILASOM, 13-06-2020 ANCHAL G.PUSHPAK AJAYA 25, RO JN of Kerala BAILED BY 3 ANANDU ANCHAL at 20:15 (Kollam UMAR ,SI OF KUMAR Male ANCHAL Epidemic POLICE VILLAGE Hrs Rural) POLICE Diseases Ordinance 2020 1951/2020 U/s 188, 269 IPC & Sec. 5 THIRUVATHIRA 13-06-2020 ANCHAL G.PUSHPAK 25, RO JN of Kerala BAILED BY 4 AROMAL SASIDARAN VAKKAMMUK at 20:25 (Kollam UMAR ,SI OF Male ANCHAL Epidemic POLICE THAZHAMEL Hrs Rural) POLICE Diseases Ordinance 2020 1951/2020 U/s 188, 269 IPC & Sec. -

Post-Tsunami Rehabilitation of Fishing Communities and Fisheries Livelihoods in Tamil Nadu, Kerala and Andhra Pradesh

POST-TSUNAMI REHABILITATION OF FISHING COMMUNITIES AND FISHERIES LIVELIHOODS IN TAMIL NADU, KERALA AND ANDHRA PRADESH BY VENKATESH SALAGRAMA REVISED 12 JANUARY 2006 ICM INTEGRATED COASTAL MANAGEMENT 64-16-3A, PRATAP NAGAR, KAKINADA 533 004 ANDHRA PRADESH INDIA TELE: +91 884 236 4851 EMAIL: [email protected]; [email protected] Post-Tsunami Rehabilitation of Fisheries Livelihoods in India CONTENTS 1. INTRODUCTION....................................................................................................................................2 2. IMPACTS OF TSUNAMI ON COASTAL FISHING COMMUNITIES.............................................................5 Extent of damages..................................................................................................................5 Impacts on craft, gear and infrastructure ...............................................................................5 Impacts of tsunami on different livelihood groups................................................................9 Impact of tsunami on natural resources ...............................................................................10 Impact of tsunami on the psyche of the fishers....................................................................13 Impact of tsunami on social networks .................................................................................13 3. REHABILITATION OF FISHERIES-RELATED LIVELIHOODS.................................................................15 Packages for supporting fisheries-livelihoods -

Dr. S Sreekumar

LONG TERM MITIGATION STRATEGIES FOR LANDSLIDE HAZARDS IN HILL RANGES OF KOZHIKODE DISTRICT, KERALA. UGC File No. F. 42-70/2013 (SR) MAJOR RESEARCH PROJECT Submitted to UNIVERSITY GRANTS COMMISSION NEW DELHI Submitted by Dr. S Sreekumar Associate professor (Retd.) PG & Research Department of Geology and Environmental Science, Christ college (Autonomous), Irinjalakuda, Calicut University 2018 i LONG TERM MITIGATION STRATEGIES FOR LANDSLIDE HAZARDS IN HILL RANGES OF KOZHIKODE DISTRICT, KERALA. UGC File No. F. 42-70/2013 (SR) MAJOR RESEARCH PROJECT Submitted to UNIVERSITY GRANTS COMMISSION NEW DELHI Submitted by Dr. S Sreekumar Associate professor (Retd.) PG & Research Department of Geology and Environmental Science, Christ college (Autonomous), Irinjalakuda, Calicut University Research Fellow Arish Aslam 2018 ii ACKNOWLEDGEMENT The Principal Investigator wishes to place on record his sincere thanks and in debtedness to the UGC, New Delhi for their financial support. The engineering properties of soil was determined in the geotechnical laboratory of Government Engineering College, Thrissur. The author wishes to thanks Mr. Anilkumar P S, Associate Professor, Department of Civil Engineering, Government Engineering College, Thrissur for the guidance rendered during the course of work. I express my sincere gratitude to Rev Fr. Dr. Jose Thekkan, Principal, Christ College, Irinjalakuda, for his valuable supports and for providing the infrastructure facilities of the college. I also wish to express gratitude to Dr. R V Rajan, Head, Department of Geology and Environmental science. We acknowledged the assistance provided by Sial Tech Surveys, Kozhikode, for carrying out the total station survey. I am thankful to Mr. Alex Jose for the consultancy with regard to GIS analysis. -

Unclaimed September 2018

SL NO ACCOUNT HOLDER NAME ADDRESS LINE 1 ADDRESS LINE 2 CITY NAME 1 RAMACHANDRAN NAIR C S/O VAYYOKKIL KAKKUR KAKKUR KAKKUR 2 THE LIQUIDATOR S/O KOYILANDY AUTORIKSHA DRIVERS CO-OP SOCIE KOLLAM KOYILANDY KOYILANDY 3 ACHAYI P K D/OGEORGE P K PADANNA ARAYIDATH PALAM PUTHIYARA CALICUT 4 THAMU K S/O G.R.S.MAVOOR MAVOOR MAVOOR KOZHIKODE 5 PRAMOD O K S/OBALAKRISHNAN NAIR OZHAKKARI KANDY HOUSE THIRUVALLUR THIRUVALLUR KOZHIKODE 6 VANITHA PRABHA E S/O EDAKKOTH HOUSE PANTHEERANKAVU PANTHEERANKAVU PANTHEERAN 7 PRADEEPAN K K S/O KOTTAKKUNNUMMAL HOUSE MEPPAYUR MEPPAYUR KOZHIKODE 8 SHAMEER P S/O KALTHUKANDI CHELEMBRA PULLIPARAMBA MALAPPURAM 9 MOHAMMED KOYA K V S/O KATTILAVALAPPIL KEERADATHU PARAMBU KEERADATHU PARAMBU OTHERS 10 SALU AUGUSTINE S/O KULATHNGAL KOODATHAI BAZAR THAMARASSERY THAMARASSE 11 GIRIJA NAIR W/OKUNHIRAMAN NAIR KRISHADARSAN PONMERI PARAMBIL PONMERI PARAMBIL PONMERI PA 12 ANTSON MATHEW K S/O KANGIRATHINKAV HOUSE PERAMBRA PERUVANNAMUZHI PERUVANNAM 13 PRIYA S MANON S/O PUNNAMKANDY KOLLAM KOLLAM KOZHIKODE 14 SAJEESH K S/ORAJAN 9 9 KOTTAMPARA KURUVATTOOR KONOTT KURUVATTUR 15 GIRIJA NAIR W/OKUNHIRAMAN NAIR KRISHADARSAN PONMERI PARAMBIL PONMERI PARAMBIL PONMERI PA 16 RAJEEVAN M K S/OKANNAN MEETHALE KIZHEKKAYIL PERODE THUNERI PERODE 17 VINODKUMAR P K S/O SATHYABHAVAN CHEVAYOOR MARRIKKUNNU CHEVAYUR 18 CHANDRAN M K S/O KATHALLUR PUNNASSERY PUNNASSERY OTHERS 19 BALAKRISHNAN NAIR K S/O M.C.C.BANK LTD KALLAI ROAD KALLAI ROAD KALLAI ROA 20 NAJEEB P S/O ZUHARA MANZIL ERANHIPALAM ERANHIPALAM ERANHIPALA 21 PADMANABHAN T S/O KALLIKOODAM PARAMBA PERUMUGHAM -

Chapter I Tsunami

Executive summary In the morning hours of 26 December, 2004, huge seismic sea waves triggered by massive undersea earthquake in the Indian Ocean caused the death of many thousands of people, leaving tens of thousands homeless in India, Sri Lanka, Indonesia, Malaysia, Thailand and Maldives. Fishermen, tourists and people living on the coast were unprepared for the waves that rose upto 6 meters high throughout the Indian Ocean, Andaman Sea and Arabian Sea. The earthquake, had its epicenter 257 km south southwest of Banda Aceh in Sumatra, Indonesia. This was the most powerful earthquake experienced in the region during the last 40 years. 176 persons were killed in Kerala as tsunami waves rising over the Arabian Sea invaded the land, wreaking havoc and destruction in the coastal fishing hamlets in the southern districts of the state. This report presents the impact of tsunami on natural eco systems. The marine environment in the southwest coast between Thottapally and Muttam has been successfully affected as a result of the impact of Tsunami , as reflected by the following findings : The concentration of nutrients has been reduced at all transects just after tsunami. However, values gradually picked up in the period from January to May 2005. Primary productivity had been drastically reduced in the wake of tsunami, especially near Vizhinjam and Kolachel. This also has improved considerably evident from the samples collected in May 2005. There was a lowering of plankton species diversity just after tsunami period, in January 2005. The fish catch has been reduced subsequent to tsunami. This has shown considerable improvement now, as reported by the fishermen from that area. -

Accused Persons Arrested in Kozhikodu Rural District from 13.03.2016 to 19.03.2016

Accused Persons arrested in Kozhikodu Rural district from 13.03.2016 to 19.03.2016 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Address of Cr. No & Sec Police father of which Time of Officer, Rank which No. Accused Sex Accused of Law Station Accused Arrested Arrest & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 Cheruvalath (House), Kurunhaliyode 1 (PO), Vatakara, Kozhikode Rural Cr. No. 99/16 District, Mob: u/s 118(a) of Radhakrishnan. Released on Prasanth Balan Nambiar Male 8243021844 Kurunhaliyode 13/03/16 KP Act Edacheri T, SI Bail by Police Vellayvelli (House), Kotanchery (PO), Cr. No. 97/16 2 Purameri, u/s 341, 323, 44/16 Kozhikode Rural 15/03/16 at 324, 294(b) r/w Radhakrishnan. Released on Murali Kunhekkan Male District, Edachery 11:30 hrs 34 IPC Edacheri T, SI Bail by Police Illath Thazhakkuni (House), 3 Kotenchery (PO), Cr. No. 97/16 Purameri, u/s 341, 323, 44/16 Kozhikode Rural 15/03/16 at 324, 294(b) r/w Radhakrishnan. Released on Chandran Kunhikkannan Male District, Edachery 11:30 hrs 34 IPC Edacheri T, SI Bail by Police Illath Thazhakkuni (House), 4 Kotanchery (PO), Cr. No. 97/16 Purameri, u/s 341, 323, 37/16 Kozhikode Rural 15/03/16 at 324, 294(b) r/w Radhakrishnan. Released on Rajeesh Kunhikkannan Male District, Edachery 11:30 hrs 34 IPC Edacheri T, SI Bail by Police Thazhe Kunnath Cr. No. 97/16 5 (House), Kachery u/s 341, 323, 60/16 (PO), Kozhikode 15/03/16 at 324, 294(b) r/w Radhakrishnan. -

Accused Persons Arrested in Kozhikodu Rural District from 12.02.2017 to 18.02.2017

Accused Persons arrested in Kozhikodu Rural district from 12.02.2017 to 18.02.2017 Name of the Name of Name of the Place at Date & Court at Sl. Name of the Age & Cr. No & Sec Police Arresting father of Address of Accused which Time of which No. Accused Sex of Law Station Officer, Rank Accused Arrested Arrest accused & Designation produced 1 2 3 4 5 6 7 8 9 10 11 Kalayamkulath (House), Kacheri (PO), Vadakara, 1 Kozhikode Rural Cr. No. 67/17 32/17 District, Mob: u/s 118 a of KP Sasidharan P K, Released on Sajeesh Rajan Male 9048000064 Kallunira 12-02-2017 Act Valayam SI SN Bail by Police Chambangattu Cr. No. 66/17 (House), Kallunira, u/s 279 IPC 2 Valayam (PO), 132(i) r/w 179 , 22/17 Kozhikode Rural 129 r/w 177 of Sasidharan P K, Released on Ashwanth Ashokan Male District, Valayam 13-02-2017 MV Act Valayam SI SN Bail by Police Cr. No. 69/17 Thaivecha parambath u/s 279 IPC 3 (House), Kodiyoora 132(i) r/w 179, 28/17 (PO), Kozhikode 129 r/w 177 of Sasidharan P K, Released on Asharudheen Kunhali Male Rural District, Valayam 13-02-2017 MV Act Valayam SI SN Bail by Police Cr. No. 68/17 Valiyakandi (House), u/s 279 IPC 4 Valayam (PO), 132(i) r/w 179, 49/17 Kozhikode Rural 129 r/w 177 of Sasidharan P K, Released on Balan Kannan Male District, Manjappally 14-02-2017 MV Act Valayam SI SN Bail by Police Kollantavide (House), Cr.