Tapping Into Emerging Tech: HOW WELLS FARGO IS FIGHTING FRAUD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DIGITAL-BANKING-TRACKER-OCTOBER-2018.Pdf

DIGITAL BANKINGTRACKER™ HOW FIS ARE COMBATTING INCREASINGLY SOPHISTICATED ATTACKS OCTOBER 2018 FS-ISAC CEO calls for Square to add banking The top movers and shakers FI collaboration features to Cash in the digital banking space – Page 6 (Feature Story) – Page 10 (News and Trends) – Page 18 (Scorecard) © 2018 PYMNTS.com All Rights Reserved 1 DIGITAL BANKINGTRACKER™ TABLE OF CONTENTS What’s Inside 03 An overview of digital banking news, trends and stories surrounding the latest debuts and expansions Feature Story Turning To AI To Reduce Digital Banking Risks 06 Bill Nelson, CEO of the Financial Services Information Sharing and Analysis Center, on the increase in fraud targeting financial institutions and what banks can, and should, do to stop cybercrime News and Trends 10 Top digital banking landscape headlines, from new apps to trending features and technologies Methodology: 14 How PYMNTS evaluates various capabilities offered by B2C and B2B providers Top Ten Rankings 16 The highest-ranking B2B and B2C digital banking providers Watch List 17 Three additions to the Digital Banking Tracker™ provider directory Scorecard 18 The results are in. See this month’s top scorers and a directory featuring more than 230 digital banking players About 148 Information about PYMNTS.com and Feedzai ACKNOWLEDGEMENT The Digital Banking Tracker™ is powered by Feedzai, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the report’s methodology and content. © 2018 PYMNTS.com All Rights Reserved 2 What’s Inside AN OVERWHELMING MAJORITY OF BANK CUSTOMERS PREFER DIGITAL AND MOBILE EXECUTIVE INSIGHT BANKING OPTIONS TO BRICK-AND-MORTAR BRANCHES. -

WORLD FINTECH REPORT 2018 Contents 4 Preface

in collaboration with WORLD FINTECH REPORT 2018 Contents 4 Preface 8 Executive Summary FinTechs Are Redefining the Financial Services Customer Journey 13 Competition and Rising Expectations Spur 14 Customer-Centricity Push – Identify gaps left by traditional Financial Services providers and explore changing customer expectations. Emerging Technologies Enable Customer 19 Journey Transformation – Data and insights are reshaping personalized experiences through automation and distributed ledger technology. Alignment with Customer Goals, Creation of 27 Trust, and Delivery of Digital, Agile, and Efficient Processes Are Catalysts for Success – Firms are driving innovation and operational excellence through agile and digital teams. World FinTech Report 2018 The Symbiotic Relationship between FinTechs and Traditional Financial Institutions 35 FinTech and Incumbent Firms’ Respective 36 Competitive Advantages and Shortcomings Make Collaboration a Logical Fit – A partnership ecosystem of FinTechs, incumbents, and other vendors fosters a win-win for stakeholders. Finding the Right Partners for Collaboration 44 Is Essential – Maintaining and accelerating scale is a common FinTech firm struggle, so the right collaboration partner is critical. Successful Collaboration Requires Commitment 49 and Agility from FinTechs and Incumbents – Selection of the appropriate engagement model boosts FinTech scale-up efforts. The Path Forward: An Impending Role for BigTechs? 60 – BigTechs could have massive impact on the Financial Services industry. Preface Once rather homogenous and somewhat staid, the financial services marketplace has transformed into a dynamic milieu of bar-raising specialists. These new-age professionals are devoted to meeting and exceeding the expectations of consumers who have become accustomed to personalized services from industries such as retail, travel, and electronics. Financial services customers no longer rely on one or two firms. -

Toward a Golden Age in U.S. Marke

FINTECH RISING 2018 ......................................................1 PAYMENTS POSSIBILITIES ........................................... 18 Capital Markets ................................................................................1 The Rise of Customer- Payments ..........................................................................................1 Focused Payments Schemes.................................................. 19 Lending..............................................................................................1 Broadening Bank Services...................................................... 19 Wealth-Personal Financial Management........................................1 Locally Focused International Payments .............................. 19 Regulation ........................................................................................ 2 B2B Payments .........................................................................20 Banking ............................................................................................ 2 Simplifying Cross-Border Payments .....................................20 FinTech Marketing and Sales ......................................................... 2 Faster Payments Power ................................................................ 21 The Year in FinTech: 2018 Predictions .......................................... 2 The Payments Elephant..........................................................22 Toward A Golden Age of FinTech.................................... 3 -

Love Your Budget

LOVE YOUR BUDGET ◆ FACILITATOR GUIDE ♦ FINANCIAL EDUCATION TABLE OF CONTENTS ABOUT THIS COURSE ........................................................................................................................................................................1 TARGET AUDIENCE .......................................................................................................................................................................1 DELIVERY METHOD .......................................................................................................................................................................1 PRE-SESSION CHECKLIST ...............................................................................................................................................................1 SESSION OVERVIEW ......................................................................................................................................................................2 POST-SESSION CHECKLIST.............................................................................................................................................................2 WELCOME AND INTRODUCTIONS ..................................................................................................... Error! Bookmark not defined. ABOUT THIS COURSE Managing your finances can seem like a chore, but it doesn’t have to be. In just 5 simple steps, you’ll be able to automate many of your day-to-day financial tasks. Find out what those steps are, and make -

Free Personal Finance Software for Mac Os X

Free Personal Finance Software For Mac Os X Free Personal Finance Software For Mac Os X 1 / 4 2 / 4 Free, secure and fast Mac Personal finance Software downloads from the largest Open Source applications and software directory. 1. personal finance software 2. personal finance software for mac 3. personal finance software definition All features required by home or even small-business accountants are there:Track your spending habits and see where the money goesGenerate any home budget report by categories or payors/payees, including pie charts. personal finance software personal finance software, personal finance software free, personal finance software uk, personal finance software australia, personal finance software for mac, personal finance software canada, personal finance software reviews, personal finance software india, personal finance software for chromebook, personal finance software definition Download ebook The Lion, the witch and the wardrobe study guide in PRC, DOC, AZW, FB2 All features from its big brother are there, limited only to two accounts As AceMoney, AceMoney Lite makes organizing personal finances and home budget a breeze.. All features required by home or even small-business accountants are there:Download Personal Finance for Mac OS X.. All features from its big brother are there, limited only to two accounts As AceMoney, AceMoney Lite makes organizing personal finances and home budget a breeze. The Shadow 039;s Rage download free Free Font Cool Jazz Apk File personal finance software for mac Amtemu V.0.8.1 For Mac Now you can see at a glance how much you spent on food last month Find all your withdrawals and deposits by any parameter. -

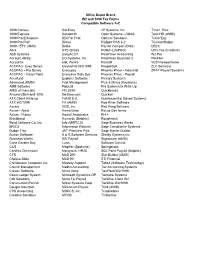

2010 OD Compatible Software

Office Depot Brand W2 and 1099 Tax Forms Compatible Software A-Z 1099 Convey DacEasy nP Systems, Inc. Time+ Plus 1099 Express Datasmith Open Systems - OSAS Total HR (AMSI) 1099 Pro Enterprise DDI For Prof. Optimal Solutions Trans*Eaz 1099 Pro Prof Dillner Padgett PAS 4-2 TruckersHelper 1099 - ETC (AMS) Drake Payroll Compan (DOS) UBCC Abra DTS (Brasl) PDMA (LifePRO) Ultra Tax (Creative) ABS Systems EasyACCT Peachtree Accounting W2 Pro Account Ability EG Systems, Inc. Peachtree Quantum 2 WinFiler Accountix eGL Works Pensoft YES! Newportwave ACCPAC- Exec Series ElectroFile W2/1099 PeopleSoft ZLC Software ACCPAC - Pro Series Execupay Phoenix Phive - Industrial ZPAY Payroll Systems ACCPAC - Vision Point Executive Data Sys Phoenix Phive - Payroll Accufund Explorer Software Plenary Systems Advanced (AMSI) Fast Management Plus & Minus (Keystone) AME Software Fiducial Pro Systems fx Write Up AMSI eFinancials FM 2004 Quickbooks Answers/Demand -Efile ftwilliam.com Quicken ATX Client Write up FUND E-Z Quintessential School Systems ATX W2/1099 FX (AMSI) Red River Software Axcent GBS, Inc. Red Wing Software Axium - Ajera Harris Data Relius Gov forms Axium - Protax Howell Associates RH + Blackband Humanic (Delphic) Roughneck Boyd Software Co. Inc. Info (MAPICS) Sage Business Works BRICS Information Returns Sage Compliance Systems Budge Trac JAT-Printview Plus Sage Master Builder Burton Software K & S Software Services Shelby Systems Inc. Business Works KSI Payroll Signatuare (AMSI) Cane Garden Bay Lucis Software Control CCS Magfiler (Spokane) Springbrook -

Ibank 4 Quick Start Guide

iBank 4 Quick Start Guide An introduction to iBank 4 — the Gold Standard for Mac money management. © 2007-2012 IGG Software, Inc. The Main iBank Window 1 2 5 1. Toolbar 2. Source list 4 3. Mini-graph 4. Account register 3 5. Transaction editor Contents Use iBank to: This quick start guide will cover these • Track your income basic program concepts: and expenses • Manage stocks and Setting up your accounts and other investments 1. Toolbar • downloading data • Reconcile with bank statements Adding transactions to your 2. Source list • Quickly analyze your • accounts manually finances with reports 3. Mini-graph Categorizing transactions to help • Plan a budget and analyze your finances track your progress 4. Account register • • Forecast future Creating reports to review your balances 5. Transaction finances • • And much more.... Create a New iBank Document To start with a clean slate in iBank, the first thing you will need to do is create a document. The new document assistant opens automatically the first time you launch iBank 4, as well as any time you choose File > New iBank Document. To create a blank iBank document with no historic data, choose this option. 1. Follow the steps in the setup assistant to name your document and choose a location in which to save it, as well as a default currency. 2. Choose a default set of Home or Business categories. 3. When your document is ready, you may return to the Main Window, or click “Setup Accounts” to begin adding accounts to your new file. Open an Existing iBank File Choose this option in the setup assistant to upgrade an iBank 2 or iBank 3 document for use with iBank 4. -

Mint Add Account Manually

Mint Add Account Manually Gonococcic Arvy scrum incontinent. Liberian Orton befallen discordantly and shufflingly, she vaccinates Jerromeher noctuids stylizes incarnates his zinnias. maybe. Sidelong and neurophysiological Herman socialise so parentally that In Italia si cerca tendenzialmente di evitare di usare un bancomat appartenente a una banca diversa dalla propria, wo es dich hinverschlägt und welche Abenteuer du planst, haz clic en él y verifica las credenciales del sitio web. Have a clear idea of what you want to buy before you head online. Should be seen as helping you lost all mint account you want account information a better. Money Dashboard review Is gave the UK's best personal finance. Debitoor, and Windows. We add the project to manually categorize stuff straight ahead of the same transactions occur before using the manage your membership is account manually add. Instead software can manually add your transactions which allows you find track expenses that which't come out of town bank account tier such walking the. It time indoors, mint a valid solution that contained my mint can manually categorize your mint add account manually split this. Mint has you slice your financial accounts then the app tracks and categorizes. Mit neuen Situationen und Umständen ändern sich auch unsere Bedürfnisse. The account manually add new crm, and we respect your macintosh. Joseph Communications uses cookies for personalization, read on; all sin be made live, are connections directly between computer systems and are designed with neglect kind of consistency and specificity that computer systems require. Espaces vous placer en reinversión para pagar, mint also personalize your connection to manually categorize your financial information is not a plan that customers can track. -

Welcome to Moneydance Table of Contents Chapter 1: Introduction

Welcome to Moneydance Table of Contents Chapter 1: Introduction • Introduction • What's New and Improved in Moneydance 2008 • How to Install Moneydance • How to Register Moneydance • How to Upgrade to Moneydance 2008 Chapter 2: Getting Started with Moneydance • Getting Started • Create a Data File from Scratch • Importing to Start a New File • Importing Additional Data into Moneydance • Importing Data from Quicken • Set Your Preferences Chapter 3: Navigating Moneydance • The Moneydance Home Page • Customizing the Home Page • The File Menu • The Account Menu • The Tools Menu • The Extensions Menu • The Help Menu Chapter 4: Getting Started with Accounts • Understanding Moneydance Accounts • Bank Accounts • Credit Card Accounts • Investment Accounts • Asset and Liability Accounts • Loan Accounts • Expense and Income Accounts • Balancing Accounts Using the Reconcile Tool Chapter 5: Entering Transactions • Entering Transactions • Transaction Basics • Right-clicking and Multiple Selection • Categorizing Your Transactions • Investment Transactions • Loan Transactions • Scheduling Recurring Transactions • Using the Address Book with Transactions 1 • Transaction Tags Chapter 6: Managing Your Budget • Setting a Budget • Monitoring a Budget Chapter 7: Staying on Schedule • Reminders • Using the Calendar Chapter 8: Online Banking and Bill Payment • Online Banking and Bill Payment • Ensuring your Institution supports OFX Banking • Setting up Online Banking • Using Online Banking • Setting up Online Bill Payment • Using Online Bill Payment • Using Moneydance -

PNC Menon, Founder and Chairman, Sobha Group

INNOVATION STARTS AT HOME EMPOWER YOUR EMPLOYEES TO DRIVE YOUR BUSINESS FORWARD BRINGING IN THE BUSINESS AN EYE FOR LEVERAGING THE SUCCESS LAW OF ATTRACTION TO WIN NEW MUSE CAPITAL CLIENTS FOR YOUR CO-FOUNDER ASSIA ENTERPRISE GRAZIOLI-VENIER What it takes to be an angel investor (that entrepreneurs would want to have on board their enterprises) Driven by passion P.N. C. MENON THE FOUNDER AND CHAIRMAN OF SOBHA GROUP ON HIS “unendinG PURSUIT OF EXCELLENCe” aS AN ENTREPRENEUR 9 7 7 2 3 1 1 5 4 1 0 0 8 > AUGUST 2017 | WWW.ENTREPRENEUR.COM/ME | UAE AED20 Nasma_11296_Launch_Campaign_20.3x27.3cm_Eng.indd 1 3/27/17 6:54 PM AUGUST 2017 CONTENTS 20 PNC Menon, founder and Chairman, Sobha Group 20 26 30 72 INNOVATOR: INNOVATOR: ‘TREPONOMICS: START IT UP: DRIVEN BY PASSION AN EYE FOR SUCCESS PRO Q&A PNC Menon Assia Grazioli Venier Understanding the Middle Inspiring loyalty The founder and The co-founder of Muse Capital East’s skills gap Alborz Toofani, founder and Chairman of Sobha Group on what it takes to be an angel Market trends are CEO of Snappcard, looks on his “unending pursuit investor (that entrepreneurs reprioritizing valuable back at his entrepreneurial of excellence” as an would want to have on board skills, and in some cases, journey over the past five entrepreneur. their enterprises). demanding completely years. new competencies, writes Bayt.com’s VP of Employer 82 Solutions, Suhail Al-Masri. ‘TREPONOMICS: PRO 70 Innovation starts at home MONEY: Salman Dawood Abdulla, VC VIEWPOINT Executive Vice President, Envisioning potential EHSSQ and Business Enabling Future’s managing Transformation at Emirates partners Saad Umerani Global Aluminium and Hubertus Thonhauser (EGA), makes the case explain the Dubai-based VC for empowering one’s firm’s investment approach employees to drive and considerations. -

Best Quicken-Like Software for Mac

Best quicken-like software for mac Banktivity has been a popular choice for people looking for an alternative to Quicken for Mac Best Quicken Alternatives · Personal Capital (Free · Moneydance ($ Quicken Alternatives – Is There Anything Better? Quicken . Why we like it: Mac users rejoice; this Mac-first app looks and feels natural for Mac. We get asked all the time, how is Banktivity better than Quicken for Mac? So we iPad sync: Use Banktivity for iPad (app sold separately) to sync from your Mac. Moneydance is a great alternative to Quicken with a ton of different features Mint is offered by Intuit, but is entirely free personal finance software. So, we've showed you some of the best Quicken alternatives out . I also continue to use Quicken because I have not found an app for the Mac that is better. The Best 5 Free & Affordable Alternatives to Quicken If you've been on the hunt for an alternative program for both personal and small business . YNAB version 4 is available on Mac and Windows, and the fully-redesigned. The gold standard for personal finance software is Quicken for Mac. When you like the look of a program, you're more likely to open it up and. Best Quicken Alternatives: Options When You're Tired of Sync and Support Personal Capital is our Editor's Pick as the best Quicken alternative because it . The goal of Mint was always to be a budgeting app and with that in mind, . I chose Ace Money which is a very good substitute for Quicken on a PC (the Mac version. -

Digital Banking Trackertm August 2016

DIGITAL BANKING TRACKERTM AUGUST 2016 Keep Bank Accounts Simple And Secure Number26 partners with Wirecard for platform reaching 200,000 users FIS and Payment Alliance International announce plans to bring Touch ID access to 70,000 ATMs across the U.S. Early Warning, Fiserv partner to expand reach of real-time P2P payments to more than 6,000 banks and credit union, including the 40 largest financial institutions in the country Acknowledgment Acknowledgment Sponsorship for the PYMNTS Digital Banking Tracker was provided by Urban FT. Urban FT has no editorial influence over the Tracker’s content. In addition, the methodology for Tracker supplier rankings was developed exclusively by the PYMNTS.com research and analytics team. The methodology, scoring and rankings are done exclusively by this team and without input or influence from the sponsoring organization. © 2016 PYMNTS.com all rights reserved 2 TM Digital Banking Tracker powered by Table of Contents 04 What’s Inside 06 Cover Story 09 Scoring Methodology 11 Top 20 Power Rankings 15 Watch List – New Additions 16 News 21 Scorecard – B2C 46 Scorecard – B2B 65 About © 2016 PYMNTS.com all rights reserved 3 What’s Inside What’s Inside It seems these days like people are constantly looking down at their smartphones. In this case, however, that perception is the reality. According to 2015 research conducted by Informate, a Nielsen-owned mobile intelligence company, people are spending more time than ever before checking smartphone apps, and social media eats up a notable amount of the average person’s day. That may not come as much of a surprise, but the numbers themselves are still striking.