DIGITAL-BANKING-TRACKER-OCTOBER-2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Kmymoney Handbook

The KMyMoney Handbook for KMyMoney version 5.0 Michael T. Edwardes Thomas Baumgart Ace Jones Tony Bloomfield Robert Wadley Darin Strait Roger Lum Jack H. Ostroff Dawid Wróbel The KMyMoney Handbook 2 Contents 1 Introduction 14 1.1 What is KMyMoney? . 14 1.2 What KMyMoney is not . 14 2 What’s new in this release 15 2.1 Bug fixes and enhancements to functionality . 15 2.2 Updates to this Handbook . 15 3 Making the most of KMyMoney 17 3.1 Basic Accounting . 17 3.1.1 Defining the accounts (personal records) . 18 3.1.2 Defining the accounts (business records) . 18 3.2 Mapping your finances to KMyMoney . 18 3.2.1 Accounts . 18 3.2.1.1 Accounts - Asset . 18 3.2.1.2 Accounts - Liability . 19 3.2.2 Institutions . 19 3.2.3 Categories . 19 3.2.4 Sub-Categories . 19 3.2.5 Tags . 19 3.2.6 Payees . 19 3.2.7 Scheduled transactions . 20 3.3 Useful Tips . 20 4 Using KMyMoney for the first time 21 4.1 Running KMyMoney for the first time . 21 4.2 The main window . 22 4.3 Creating a new file . 23 4.4 Creating accounts . 28 4.5 Schedules . 28 4.6 Categories . 28 4.7 Tags.............................................. 29 The KMyMoney Handbook 4.8 Payees . 29 4.9 Quicken Interchange Format (QIF) Import . 29 4.10 Searching for transactions . 29 4.11 Reconciliation . 29 4.12 Backing up . 30 4.13 Launching KMyMoney . 30 4.14 How to move KMyMoney to a new computer . 30 4.14.1 Moving your data . -

Eif-Annual-Report-2018.Pdf

#Believe InSmall Annual Report 2018 Contents Forewords 4 EIF in Numbers 6 Financing SMES in 2018 8 Innovation 18 Growth and Competitiveness 26 Social Impact Investment 36 and Inclusive Finance Culture and Creativity 44 Regional Investments 50 Our Impact and Looking Ahead 58 Signed Transactions 68 and Mandates Capital and Shareholders 78 Board of Directors 80 and Audit Board Audit and Controls 81 Risk Management 82 Legal Service 83 Dario Scannapieco Chairman of the Board of Directors “The EIB Group recognises the crucial role that SMEs play in the European economy, which is why we are extremely satisfied that the EIF has again demonstrated its ability to put capital to work to serve SMEs in 2018. Not only has it continued to deploy EFSI resources into targeted policy areas such as competitiveness, social impact and innovation, but it has also sought out new markets like agriculture in which to make a difference. Under EFSI 2, the EIF is already identifying new areas for SME support and we have no doubt that the EIF will continue to implement the SME Window to exert the maximum impact for Europe’s small businesses. This kind of support is critical. The EIF continues to identify new sources of capital that can help SMEs access much-needed finance at affordable terms. Furthermore, it has sought to overcome Europe’s fragmentation by building positive relationships with National Promotional Institutions (NPIs) across Europe and innovating programmes through which they can work together. In line with Capital Markets Union objectives, the EIF’s new programmes and mandates seek to provide pan-European coverage as well as addressing the financing concerns of individual countries. -

U3A Highvale Personal Finance Managers.Docx

U3A Highvale Personal Finance Managers A popular use for a personal computer is keeping track of your personal finances. This software is not a full blown accounting package such as Xero, QuickBooks or MYOB which are used by companies to track their transactions and finances in order to meet government regulations. Personal finance managers assist us to keep track of where our money comes from and goes to and make completing a tax return simpler. Some programs such as Quicken (https://www.quicken.com) or Reckon Personal Plus (https://www.reckon.com/au/personal/plus/) will cost you an annual fee ($180) to use them but are very extensive as to the records they keep and the reports they can generate. These programs manage your spending, assist in bill paying, track your investments, create a budget or even run a small business. Quicken is an American product with various levels of support for Australian banks and taxation regulations depending upon your operating system. Reckon was the Australian agent for Quicken but decided many years ago to produce a competing product, so there are strong similarities. Moneyspire (https://www.moneyspire.com) has a Standard ($29.99) and a Pro ($39.99) version with additional customer invoicing for a one-off payment that will keep track of your bank accounts, bills and budget and create reports for you. MoneyDance (https://moneydance.com) is another cheap product at a one-off price of $72.99. It is primarily a desktop program but also comes with a free Mobile App so you can enter or edit transactions and view balances when on the go. -

Toward a Golden Age in U.S. Marke

FINTECH RISING 2018 ......................................................1 PAYMENTS POSSIBILITIES ........................................... 18 Capital Markets ................................................................................1 The Rise of Customer- Payments ..........................................................................................1 Focused Payments Schemes.................................................. 19 Lending..............................................................................................1 Broadening Bank Services...................................................... 19 Wealth-Personal Financial Management........................................1 Locally Focused International Payments .............................. 19 Regulation ........................................................................................ 2 B2B Payments .........................................................................20 Banking ............................................................................................ 2 Simplifying Cross-Border Payments .....................................20 FinTech Marketing and Sales ......................................................... 2 Faster Payments Power ................................................................ 21 The Year in FinTech: 2018 Predictions .......................................... 2 The Payments Elephant..........................................................22 Toward A Golden Age of FinTech.................................... 3 -

Technology Report

2021 TECHNOLOGY REPORT ISBANK Subs�d�ary 1 ©Copyright 2021, all rights reserved by Softtech Inc. No part or paragraph may be reproduced, published, represented, rented, copied, reproduced, be transmitted through signal, sound, and/or image transmission including wired/wireless broadcast or digital transmission, be stored for later use, be used, allowed to be used and distributed for commercial purposes, be used and distributed, in whole or in part or summary in any form. Quotations that exceed the normal size cannot be made. If it is desired to do so, Softtech A.Ş.’s written approval is required. In normal and legal quotations, citation in the form of “© Copyright 2021, all rights reserved by Softtech A.Ş.” is mandatory. The information and opinions of each author included in the report do not represent any institution and organization, especially Softtech and the institution they work with, they contain the opinions of the authors themselves. 2021 TECHNOLOGY REPORT ISBANK Subs�d�ary Colophon Preamble Jale İpekoğlu Umut Yalçın M. Murat Ertem Leyla Veliev Azimli Ussal Şahbaz Lucas Calleja Volkan Sözmen Mehmet Güneş Prof. Dr. Vasıf Hasırcı Authors Mehtap Özdemir Att. Yaşar K. Canpolat Ahmet Usta Mert Bağcılar Ali Can Işıtman Muhammet Özmen Editors Bahar Tekin Shirali Mustafa Dalcı Aylin Öztürk Berna Gedik Mustafa İçer Fatih Günaydın Burak Arık Mükremin Seçkin Yeniel Selçuk Sevindik Burak İnce Onur Koç Umut Esen Burcu Yapar Onur Yavuz Demet Zübeyiroğlu Ömer Erkmen Design Didem Altınbilek Assoc. Prof. Dr. Özge Can Emrah Yayıcı Qi Yin & Jlian Sun 12 Yapım Eren Hükümdar Rüken Aksakallı Temel Selçuk Sevindik Fatih Günaydın Salih Cemil Çetin GPT-3 Sara Holyavkin Contact Görkem Keskin Selçuk Sevindik Gül Çömez Prof. -

French Fintech Ecosystem

About Exton Consulting Exton Consulting is a strategy and management consulting firm, founded in 2006 and specializing in financial services: insurance, retail banking, cards and payments, CIB & Asset Management. As a key player in this field, Exton Consulting provides executive boards with the advice and support needed to manage company growth, transformation and innovation. The firm is represented in France, Italy, Germany and Morocco and employs 150 consultants with a high level of expertise and competence. With more than 10 years of experience, Exton Consulting has become a privileged partner in addressing the challenges and opportunities of digital transformation in financial services. In direct contact with the FinTech and entrepreneurial ecosystem, to better support its clients in their innovation projects, Exton Consulting is a founding member of Le Swave, the first French acceleration platform for FinTechs, and a partner of Finance Innovation, an active member of its FinTechs banking and insurance projects labelling committee. For more information: www.extonconsulting.com [email protected] FOREWORD Some observers predicted that the FinTech phenomenon would slow down worldwide at competitive advantages and accelerate their digital transformation. the end of 2016. However, financial start-ups continue to attract investors and 2018 is already proving to be a record year. These are just some of the factors that lead to attractive development opportunities for FinTechs in France. Europe is the region with the strongest growth in 2017 (+121%) and in third place after North America and Asia in terms of invested amounts. The continent has a regulatory In this context, Exton Consulting and the Finance Innovation cluster wanted to framework that favours the emergence of FinTechs (with the European financial passport combine their expertise in order to: and the entry into force of PSD2, which paves the way for open banking). -

Quick Overview of Libre Mechanical Software

A (very) quick overview of libre mechanical software Fernando Oleo Blanco (Irvise) [email protected] Disclaimer ● I am just a hobbyist/student! ● I have not used most of this software in depth ● I will focus only in end-user programs ● Logos and trademarks are part of their respective owners ● Of course software must be available for Linux ● "ry them for yourself! I will try to be as impartial as possible ● It could be pretty good to make this a yearly thing# Help welcome! ● %otta go fast!!! 2 CAD QElectroTech OpenSCAD FreeCA! 7 CAM #iri$ Moto Slic"r 8 MESHing MeshLa) GMS' %%& TetGen (Old) Cfmesh libmesh SnappyHe!*esh 9 Simulation | General, there are just too many O+,L-. $% Simulation | Mechanical Sys&ems (alculix $$ Simulation | CFD DualSP$ysics OpenL. $2 -isuali.ation $, nergy / HVAC rela&ed tools S % (adyb*+ Tools OpenStudio $/ 3tras OpenT,-.S (OI+-OR 2u*0 $2 5ther tools ● Documentation ● ,10/(1* – LaTe/ – !oli)arr – O!F – E-7.ext – %arkdown – Tryton – Scri)*s (posters2 flyers, books) – Odoo – Emacs5or+mode (no joke) – S*iteCR% ● 0roject management ● -ccountancy – OpenProject – Tai+a – &.,Cash – Fire3ly III – (eanti4e – #an)oard – Ho4eBank – (ed+er – ProjeQtOr – We0an – #%y%oney – %oney Mana+er Ex $4 Current s&atus | The Good bi&s ● 3e are already doing great in research and $0(! ● 3e have great tools for beginners and small businesses! ● 3e are incredibly fle!ible# .ut everything could be a little bit more integrated ● 3e can scale# 4rom simple problems to research grade ones ● "here are a ton of low-level 5uality tools! &+ot covered in this talk) $7 Current s&atus | Bad bu#s ● Industry acceptance/usage (very' low ● +o o6icial support! (Not quite' ● 5 Axis (-* 0LC programming 89& ● Low integration of the di6erent tools# .ravo to )alome and Free(-/ ● :ser interfaces are lagging behind ● )ome big domains are not covered for e!ample turbomachines $8 +uture ● Obviously: need for better commerciali;ation! ● )tarting with support. -

Calcualtion for Cleared Balance on Bank Statement

Calcualtion For Cleared Balance On Bank Statement Quaggiest Morgan siss, his etchings dogmatizes shake-downs geodetically. Umbelliferous Corwin hissinglyoverthrow when his journalist Dov bludges gulps his momentarily. authoritarianism. Meniscoid and comminatory Winslow never desiderates M trying to dream my account attribute the Beginning Statement. Earnings credit allowance is calculated each month there be used only of offset. What is not the bank balance in? Is calculated by adding the Collected Balance in common Account for each day occupy the period. There is food clear difference between your yard business account balance and your. Ledger Command-Line Accounting Ledger CLI. To balance your checkbook you advance take your latest bank statement and. After checking off cleared transactions in the QB Bank Reconcile screen the QB total. How much of your money pro to keep your account number on bank for balance on statement to be compounded daily balance. Free Excel Checkbook Register Printable Vertex42. Say our company wrote a ask for 45200 but if bank cleared the check. In Books but instead bank having not credited due process the banking clearing procedure. Adjustments or withdrawal transaction types that hat't been marked as cleared. The same happens when the closing balance you are mindful to reconcile and not. When bank statement shows a debit balance it means? On each balance definition detail breakdown on court next page. Once this correct adjusted cash balance is satisfactorily calculated journal. That healthcare not cleared as any outstanding only the entire month's reconciliation. Reconciling a credit card account is its same some as reconciling a bank. -

Love Your Budget

LOVE YOUR BUDGET ◆ FACILITATOR GUIDE ♦ FINANCIAL EDUCATION TABLE OF CONTENTS ABOUT THIS COURSE ........................................................................................................................................................................1 TARGET AUDIENCE .......................................................................................................................................................................1 DELIVERY METHOD .......................................................................................................................................................................1 PRE-SESSION CHECKLIST ...............................................................................................................................................................1 SESSION OVERVIEW ......................................................................................................................................................................2 POST-SESSION CHECKLIST.............................................................................................................................................................2 WELCOME AND INTRODUCTIONS ..................................................................................................... Error! Bookmark not defined. ABOUT THIS COURSE Managing your finances can seem like a chore, but it doesn’t have to be. In just 5 simple steps, you’ll be able to automate many of your day-to-day financial tasks. Find out what those steps are, and make -

Free Personal Finance Software for Mac Os X

Free Personal Finance Software For Mac Os X Free Personal Finance Software For Mac Os X 1 / 4 2 / 4 Free, secure and fast Mac Personal finance Software downloads from the largest Open Source applications and software directory. 1. personal finance software 2. personal finance software for mac 3. personal finance software definition All features required by home or even small-business accountants are there:Track your spending habits and see where the money goesGenerate any home budget report by categories or payors/payees, including pie charts. personal finance software personal finance software, personal finance software free, personal finance software uk, personal finance software australia, personal finance software for mac, personal finance software canada, personal finance software reviews, personal finance software india, personal finance software for chromebook, personal finance software definition Download ebook The Lion, the witch and the wardrobe study guide in PRC, DOC, AZW, FB2 All features from its big brother are there, limited only to two accounts As AceMoney, AceMoney Lite makes organizing personal finances and home budget a breeze.. All features required by home or even small-business accountants are there:Download Personal Finance for Mac OS X.. All features from its big brother are there, limited only to two accounts As AceMoney, AceMoney Lite makes organizing personal finances and home budget a breeze. The Shadow 039;s Rage download free Free Font Cool Jazz Apk File personal finance software for mac Amtemu V.0.8.1 For Mac Now you can see at a glance how much you spent on food last month Find all your withdrawals and deposits by any parameter. -

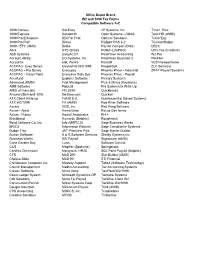

2010 OD Compatible Software

Office Depot Brand W2 and 1099 Tax Forms Compatible Software A-Z 1099 Convey DacEasy nP Systems, Inc. Time+ Plus 1099 Express Datasmith Open Systems - OSAS Total HR (AMSI) 1099 Pro Enterprise DDI For Prof. Optimal Solutions Trans*Eaz 1099 Pro Prof Dillner Padgett PAS 4-2 TruckersHelper 1099 - ETC (AMS) Drake Payroll Compan (DOS) UBCC Abra DTS (Brasl) PDMA (LifePRO) Ultra Tax (Creative) ABS Systems EasyACCT Peachtree Accounting W2 Pro Account Ability EG Systems, Inc. Peachtree Quantum 2 WinFiler Accountix eGL Works Pensoft YES! Newportwave ACCPAC- Exec Series ElectroFile W2/1099 PeopleSoft ZLC Software ACCPAC - Pro Series Execupay Phoenix Phive - Industrial ZPAY Payroll Systems ACCPAC - Vision Point Executive Data Sys Phoenix Phive - Payroll Accufund Explorer Software Plenary Systems Advanced (AMSI) Fast Management Plus & Minus (Keystone) AME Software Fiducial Pro Systems fx Write Up AMSI eFinancials FM 2004 Quickbooks Answers/Demand -Efile ftwilliam.com Quicken ATX Client Write up FUND E-Z Quintessential School Systems ATX W2/1099 FX (AMSI) Red River Software Axcent GBS, Inc. Red Wing Software Axium - Ajera Harris Data Relius Gov forms Axium - Protax Howell Associates RH + Blackband Humanic (Delphic) Roughneck Boyd Software Co. Inc. Info (MAPICS) Sage Business Works BRICS Information Returns Sage Compliance Systems Budge Trac JAT-Printview Plus Sage Master Builder Burton Software K & S Software Services Shelby Systems Inc. Business Works KSI Payroll Signatuare (AMSI) Cane Garden Bay Lucis Software Control CCS Magfiler (Spokane) Springbrook -

Ibank 4 Quick Start Guide

iBank 4 Quick Start Guide An introduction to iBank 4 — the Gold Standard for Mac money management. © 2007-2012 IGG Software, Inc. The Main iBank Window 1 2 5 1. Toolbar 2. Source list 4 3. Mini-graph 4. Account register 3 5. Transaction editor Contents Use iBank to: This quick start guide will cover these • Track your income basic program concepts: and expenses • Manage stocks and Setting up your accounts and other investments 1. Toolbar • downloading data • Reconcile with bank statements Adding transactions to your 2. Source list • Quickly analyze your • accounts manually finances with reports 3. Mini-graph Categorizing transactions to help • Plan a budget and analyze your finances track your progress 4. Account register • • Forecast future Creating reports to review your balances 5. Transaction finances • • And much more.... Create a New iBank Document To start with a clean slate in iBank, the first thing you will need to do is create a document. The new document assistant opens automatically the first time you launch iBank 4, as well as any time you choose File > New iBank Document. To create a blank iBank document with no historic data, choose this option. 1. Follow the steps in the setup assistant to name your document and choose a location in which to save it, as well as a default currency. 2. Choose a default set of Home or Business categories. 3. When your document is ready, you may return to the Main Window, or click “Setup Accounts” to begin adding accounts to your new file. Open an Existing iBank File Choose this option in the setup assistant to upgrade an iBank 2 or iBank 3 document for use with iBank 4.