A Nnual Report 2017 Scomi Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SCOMI GROUP BHD ANNUAL REPORT 2019 Contents

SCOMI GROUP BHD ANNUAL REPORT 2019 Contents 002 Key Financial Indicators 003 Key Financial Highlights 004 Corporate Structure 006 Corporate Statement 007 Corporate Information 008 Board of Directors 012 Key Senior Management 014 Management Discussion & Analysis 020 Sustainability Statement 022 Corporate Governance Overview Statement 037 Statement on Risk Management & Internal Control 040 Audit & Risk Management Committee Report 044 Additional Information 046 Statement of Directors’ Responsibility 047 Financial Statements 224 Analysis of Shareholdings 228 Analysis of Warrant Holdings 230 List of Properties 231 Corporate Directory 233 Notice of Annual General Meeting 237 Form of Proxy Key Financial Indicators 20191,2 20182 20173 20163 20153 RM’000 RM’000 RM’000 RM’000 RM’000 (Restated) Continuing operations Turnover 643,502 613,957 826,892 1,383,332 1,798,572 EBITDA (142,270) (114,613) 17,666 199,531 257,911 Depreciation and amortization 78,021 80,839 104,962 110,032 97,524 Finance costs 23,165 23,943 61,107 63,706 56,480 Share of profit in associates (2,299) - - 495 (124) Share of profit from joint ventures (3,866) (36,663) (24,208) (10,628) 1,117 (Loss)/Profit before tax (243,453) (219,395) (148,403) 25,793 103,907 Taxation (20,883) (13,058) (17,248) (13,889) (37,535) (Loss)/Profit from continuing operations (264,336) (232,453) (165,651) 11,904 66,372 Loss from discontinued operations (161,633) (99,629) - - (71) (Loss)/Profit for the year (425,969) (332,082)) (165,651) 11,904 66,301 Non-controlling interest 29,798 82,108 58,246 10,632 -

CONSIDERAÇÕES a RESPEITO DO SISTEMA DE MONOTRILHO: Características Técnicas, Vantagens & Desvantagens E Projetos Em Andamento

1 CONSIDERAÇÕES A RESPEITO DO SISTEMA DE MONOTRILHO: Características técnicas, vantagens & desvantagens e projetos em andamento Moacir de Freitas Junior FATEC Zona Sul [email protected] Alex Macedo de Araujo FATEC Zona Sul [email protected] Resumo – Este artigo visa apresentar o sistema de Monotrilho como alternativa aos sistemas de transporte de passageiros convencionais, quer por Ônibus, BRT (Bus Rapid Transit), VLT, Trem ou Metrô. Considera as características técnicas distintivas deste sistema de transporte de massa. As vantagens e desvantagens no que tange os custos, aspectos operacionais e implantação da infra-estrutura necessária ao seu funcionamento. Apresenta os três principais fornecedores do mercado comparando os produtos oferecidos por eles e considerada alguns projetos de monotrilho em andamento em grandes cidades brasileiras. Palavras-chaves: (Monotrilho, Tráfego e Trânsito, Transporte de Passageiros) Abstract - This paper aims to introduce the system of monorail systems as an alternative to conventional passenger transport, whether by bus, BRT (Bus Rapid Transit), VLT, Train or Subway. Consider the distinctive technical features of this system of mass transit. The advantages and disadvantages regarding the cost, deployment and operational aspects of the infrastructure needed for its operation. Presents the three main suppliers in the market by comparing products offered by them and considered some of monorail projects underway in major cities brazilians. Keywords: (Monorail, Traffic and Transit, Passenger Transport) Temática: Tráfego e Trânsito: Transporte Público de Passageiros 2 Introdução A cidade de São Paulo enfrenta o desafio de implementar soluções e políticas públicas de transporte eficazes a curto e médio prazos com o fim de diminuir os congestionamentos, melhorar o transporte público de passageiros e, por conseguinte aumentar a velocidade média dos veículos durante os horários de pico. -

SEB COVER Front&Back

Scomi Engineering Bhd (111633-M) Level 17, 1 First Avenue Bandar Utama 47800 Petaling Jaya Selangor Darul Ehsan Malaysia Telephone +603 7717 3000 Facsimile +603 7728 5258 www.scomiengineering.com.my CONTENTS 002 041 Key Financial Highlights Audit and Risk Management Committee Report 003 Corporate Structure 044 Additional Information 004 Corporate Statement 045 Statement of Directors’ 005 Responsibility Corporate Information 048 008 Financial Statements Board of Directors 126 014 Analysis of Shareholdings Chairman’s Statement 129 018 List of Property Management Review of Operations 130 Corporate Directory 024 Corporate Social 131 Responsibility Notice of Annual General Meeting 028 Form of Proxy Statement on Corporate Governance 036 Statement on Risk Management and Internal Control Annual Report 2015 001 KEY FINANCIAL HIGHLIGHTS Revenue Total Assets (RM Million) (RM Million) 2015 2015 996.3 12 months 238.3 2014 2014 956.6 12 months 236.9 2013 15 months 450.3 2011 Earnings/(Loss) per share (Basic)(sen) 12 months 246.8 2015 2010 0.11 12 months 400.8 2014 (11.04) Net Prot/(Loss) (RM Million) Net Tangible Assets (RM Million) 2015 12 months 0.4 2015 110.7 2014 12 months (37.8) 2014 113.4 2013 15 months (21.1) 2011 12 months (81.6) Shareholders' fund (RM Million) 2010 12 months (11.2) 2015 269.7 2014 270.3 Prot/(Loss) Before Tax (RM Million) Net Assets per share (Attributable to owners of the Company)(sen) 2015 12 months (2.0) 2015 78.8 2014 12 months (34.6) 2014 79.0 2013 15 months (33.0) 2011 12 months (74.4) 2010 12 months (21.2) 002 Scomi -

Realising Solutions

POTENTIAL in TRANSPORT REALISING SOLUTIONS Transport Solutions We want to become a trusted global player in providing Transport Solutions through technology prowess, innovation and performance. Realising Potential in In an ever-changing global landscape, technology and innovation are prerequisites in enhancing Transport Solutions productivity and competitiveness. At Scomi Engineering, our strategy is to continually acquire the most pertinent knowledge and technologies that can further enhance our skills and capabilities. And provide the crucial solutions to help you realise your full business development and growth potential. At Scomi Engineering, we are wholly committed to providing service that is second-to-none. Our state-of- the-art equipment and facilities, advanced technology and proven processes are all backed by skilled and experienced industry professionals with in-depth local knowledge and an international understanding of your industry needs and business goals. With our parent company, Scomi Group Bhd, providing a solid foundation of global infrastructure, network and complementary skills, we are primed to set new industry standards in providing total Transport Solutions. Setting the Highest Standards At Scomi Engineering, ensuring your success is at the heart of what we do. Each and every one of our business partners are assured of: • Commitment to quality – we have been awarded the esteemed ISO 9002 and ISO 9001:2000 certification • Dedication to perfection – through our Group’s unique and innovative Process Technology, our -

SCOMI-Cover to Page 30 (2.5MB).Pdf

CONTENTS 2 Key Financial Indicators and 31 Corporate Social Responsibility 140 Analysis of Shareholdings Key Financial Highlights 34 Statement on Corporate Governance 143 List of Properties 4 Corporate Legal Structure 44 Statement of Internal Control 146 Corporate Directory 6 Our Corporate Statement 48 Audit and Risk Management 148 Notice of Annual General Meeting 8 Corporate Information Committee Report 150 Statement Accompanying the Notice of 9 Profile of Directors 54 Additional Information Annual General Meeting 14 Key Management Team 55 Statement on Directors’Responsibility 16 Chairman’s Statement 56 Financial Statements • Form of Proxy 20 Management’s Review of Operations Ambitious 7th Annual General Meeting Ballroom 3, First Floor Sime Darby Convention Centre 1A, Jalan Bukit Kiara 1 60000 Kuala Lumpur 15 June 2009, Monday, 2 p.m. 2 SCOMI GROUP BHD ANNUAL REPORT 2008 KEY FINANCIAL INDICATORS AND KEY FINANCIAL HIGHLIGHTS In RM’000 2008 2007 2006 2005 2004 Turnover 2,106,140 1,995,530 1,577,495 1,067,972 590,457 EBITDA 291,364 441,277 253,129 271,031 103,146 Depreciation 74,524 65,987 53,984 (41,848) (17,640) Finance costs 75,168 87,946 78,207 (42,181) (12,017) Share of profit in associated companies 28,040 23,570 30,084 6,429 114 Share of profit from jointly controlled entities – – – 19 1,000 PBT 140,213 286,416 120,722 186,812 74,603 Taxation (3,928) (4,261) (12,982) (13,937) 5,571 PAT 136,285 282,155 107,740 172,875 69,032 Minority interests 19,732 25,026 15,326 21,184 (7,538) PAT after minority interests 116,553 257,129 92,414 151,691 -

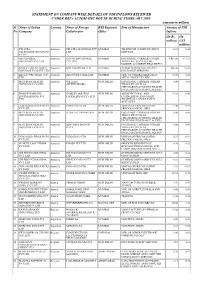

STATEMENT on COMPANY-WISE DETAILS of FDI INFLOWS RECEIVED UNDER RBI’S AUTOMATIC ROUTE DURING FEBRUARY 2010 (Amount in Million) Sl

STATEMENT ON COMPANY-WISE DETAILS OF FDI INFLOWS RECEIVED UNDER RBI’s AUTOMATIC ROUTE DURING FEBRUARY 2010 (Amount in million) Sl. Name of Indian Country Name of Foreign RBI Regional Item of Manufacture Amount of FDI No Company Collaborator Office Inflows (In Rs (In million) US$ million) 1 TELSTRA Australia TELSTRA HOLDINGS PTY MUMBAI TELEPHONE COMMUNICATION 0.10 0.00 TELECOMMUNICATIONS LTD. SERVICES P. LTD 2 SBI GENERAL Australia IAG INTERNATIONAL MUMBAI INSURANCE, CARRIERS OTHER 5,421.00 117.01 INSURANCE CO. LTD. PTY LTD. THAN LIFE, SUCH AS FIRE, MARINE, ACCIDENT, HEALTH ETC. 3 RAHEJA QBE GENERAL Australia QBE HOLDINGS LTD MUMBAI DEPOSIT/CREDIT GUARANTY 468.00 10.10 INSURANCE CO.PVT LTD INSURANCE SERVICES 4 BLUESCOPE STEEL (I) P. Australia BLUSCOPE STEEL LTD. MUMBAI MFR. OF OTHER FABRICATED 10.00 0.22 LTD. METAL PRODUCTS NEC. 5 MAX BUPA HEALTH Australia WILLIAM NEW DELHI INSURANCE CARRIERS OTHEER 0.00 0.00 INSURANCE CO LTD STEPHENWORD THAN LIFE SUCH AS FIRE,MARINE,ACCIDENT,HEALTH INCLUDING INSURANCE AGENTS 6 WORLEYPARSONS Australia WORLEY [ARSPMS NEW DELHI ARCHITECTURAL AND 19.28 0.42 ENGINEERING(I) PVT ENGINEERING PTY LTD ENGINEERING AND OTHER LTD TECHNICAL CONSULTANCY ACTIVITIES 7 INDO GOLD RESOURCES Australia INDO GOLD LTD NEW DELHI MINING OF PRECIOUS/SEMI 1.30 0.03 PVT LTD PRECIOUS METAL ORES 8 MAX BUPA HEALTH Australia DEAN ALLAN HOLDEN NEW DELHI INSURANCE CARRIERS OTHEER 0.00 0.00 INSURANCE CO LTD THAN LIFE SUCH AS FIRE,MARINE,ACCIDENT,HEALTH INCLUDING INSURANCE AGENTS 9 MAX BUPA HEALTH Australia BENJAMIN DAVIND NEW DELHI INSURANCE CARRIERS OTHEER 0.00 0.00 INSURANCE CO LTD KENT THAN LIFE SUCH AS FIRE,MARINE,ACCIDENT,HEALTH INCLUDING INSURANCE AGENTS 10 INDO GOLD RESOURCES Australia INDO GOLD LTD NEW DELHI MINING OF PRECIOUS/SEMI 0.27 0.01 PVT LTD PRECIOUS METAL ORES 11 SP SKILLS SOLUTIONS Australia EMOBS PTY LTD NEW DELHI SERVICES RENDERED BY 0.90 0.02 PVT LTD BUSINESS,PROFESSIONAL AND LABOR ORGANISATIONS NEC 12 IDP EDUCATION INDIA Australia IDP EDUCATION PTY NEW DELHI OTHER BUSINESS SERVICES N.E.C. -

Of Scomi Engineering

Scomi Engineering Bhd ANNUAL REPORT 2007 Energy & Logistics Engineering realisingpotential contents 2 Key Financial Highlights 3Corporate Legal Structure 4 Chairman’s Statement 10 Interview with the Group Chief Executive Officer 20 Corporate Social Responsibility 22 Corporate Information 24 Profile of Directors 28 Management Team 29 Statement of Corporate Governance 35 Statement of Internal Control 37 Audit and Risk Management Committee Report 41 Additional Information 41 Statement of Directors’ Responsibility 42 Financial Statements 113 Analysis of Shareholdings 116 List of Properties 117 Corporate Directory 118 Notice of Annual General Meeting 120 Statement Accompanying Notice of 24th Annual General Meeting Form of Proxy www.scomiengineering.com.my 1 Annual Report 2007 omi Engineering Bhd Sc 24th Annual General Meeting Ballroom 1, 1st Floor 23 June 2008, Monday Sime Darby Convention Centre 3.00 p.m 1A Jalan Bukit Kiara 1 60000 Kuala Lumpur .scomiengineering.com.my www 2 key financial highlights for the year ended 31 december 2007 Annual Report 2007 Sc omi Engineering Bhd Total Assets Shareholders’ Funds 2007 2007 rm601.8m rm395.2m Net Assets Per Share Net Tangible Assets 2007 2007 rm1.44 rm151.5m 136.3 208.7 323.9 368.8 16.0 25.1 28.3 42.4 nue (rm million) ve re net profit (rm million) net profit 20 20 20 20 20 20 20 20 04 05 06 07 04 05 06 07 NOTE www 2004 & : Unaudited pro forma financial results of the existing Scomi Engineering Bhd group of companies .scomiengineering.com.my 2005 (excluding that of Scomi Transportation Systems Sdn Bhd and its subsidiary companies) 2006 & : Audited financial results of the Scomi Engineering Bhd group of companies. -

Malaysian Rail Supporting Industry Roadmap 2030

MALAYSIAN RAIL SUPPORTING INDUSTRY ROADMAP 2030 MALAYSIAN RAIL SUPPORTING INDUSTRY ROADMAP 2030 Malaysian RAIL Supporting Industry Roadmap 2030 2 Published by Malaysian Industry-Government Group for High Technology (MIGHT) (320059-P) MIGHT Building, 3517 Jalan Teknokrat 5 63000 Cyberjaya Selangor Darul Ehsan MALAYSIA Tel : +603 8315 7888 (GL) Fax : +603 8312 0300 Website : www.might.org.my ©MALAYSIAN INDUSTRY-GOVERNMENT GROUP FOR HIGH TECHNOLOGY ISBN 978-967-11818-1-2 MIGHT, 2014 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronics, mechanical, photocopying, recording or otherwise, without prior permission from the publisher. The information in this publication has been updated as accurately as possible until the date of print. MALAYSIAN RAIL SUPPORTING INDUSTRY ROADMAP 2030 3 Acknowledgment We wish to acknowledge the contribution of Future Rail 2030 Committee for their work, commitment and support by providing the necessary inputs and subsequently validating the work with regards to the development of this roadmap. Chairman Lt. Col. (R) Sarbini Tijan Committee Members S.M Sabri Ismail Mansor Tahir Ahmad Nizam Mohd Amin Omar Jaafar Jasbinder Singh Wee Chong Kwang C. Sreejith Azreen Mohamed Yusup Tan Sri Ravindran Menon Malaysian RAIL Supporting Industry Roadmap 2030 4 We would also like to acknowledge Land Public Transport Ministry of Transport Ministry of Finance Ministry of Ministry of Science, Ministry of Malaysian Investment Commision (MOT) (MOF) International Technology and Higher Education Development Authority the contribution (SPAD) Trade and Industry Innovation (MoHE) (MIDA) of all participating (MITI) (MOSTI) stakeholders involved in the focus group and working group Department of Skills Majlis Amanah Unit Peneraju Economic SIRIM Berhad Keretapi Tanah Syarikat Prasarana Development Rakyat Agenda Bumiputera Planning Unit Melayu Berhad Negara Berhad throughout the (DSD) (MARA) (TERAJU) (EPU) (KTM) (Prasarana) formulation of the roadmap. -

Index to Volume 82: 2019

INDEX TO VOLUME 82: 2019 FEATURE ARTICLES AZERBAIJAN 2019 ISSUE DATES AND PAGES Stockholm Light Rail Day 2018 – Geoff Butler.... 10 Baku ................................................................ 149, 486 Crossing boundaries in Alsace – Reg Harman ....12 January (973) 1 – 40 UK barriers to progress – Tim Kendell .................16 February (974) 41 – 80 BANGLADESH Nagasaki: Risen from ruin – Neil Pulling .............20 March (975) 81 – 120 Dhaka .......................................................................486 Revitalising Milwaukee – Vic Simons (m) ............50 April (976) 121 – 160 Innovation in urban integration – Thomas Lorent .. 55 May (977) 161 – 200 Belarus UK Tram-Train: Learning lessons – June (978) 201-240 Minsk ...................................................................... 190 Tim Kendell & Ian Ambrose ..................................61 July (979) 241-280 Industry ...................................................................110 New tramways for 2019 – Mike Taplin .................89 August (980) 281-320 El Paso’s streetcar – Vic Simons (m) ..................... 96 September (981) 321 – 360 BELGIUM Tel Aviv’s LRT dream – Simon Johnston (m) .... 100 October (982) 361 – 400 Antwerpen ...... 29, 110, 190, 207, 350, 390, 430, 486 LRT rolling stock review 2019 – Michael Taplin .. 131 November (983) 401 – 440 Brussels ............ 29, 44, 149, 190, 207, 247, 269, 310, A tramway for the Potteries? – Reg Harman (m) . 135 December (984) 441-496 ........................................................ -

SCOMIEN-Annualreport2011

Scomi Engineering Bhd Scomi Engineering Bhd (111633-M) Scomi Engineering Bhd (111633-M) Level 17, 1 First Avenue, Bandar Utama 47800 Petaling Jaya, Selangor Darul Ehsan, Malaysia Tel: +603 7717 3000 Fax: +603 7727 7935 www.scomiengineering.com.my Annual Report NEW OPPORTUNITIES. MOVING AHEAD. Annual Report 2011 2011 CONTENTS 2 Key Financial Highlights 38 Statement on Corporate 144 Analysis of Shareholdings Governance 3 Corporate Structure 147 Analysis of Irredeemable 44 Statement on Internal Control Convertible Unsecured Loan 4 Corporate Statement of Stocks (“ICULS”) Holdings Scomi Group 46 Audit and Risk Management Committee Report 149 List of Property 5 Corporate Information 50 Additional Information 150 Corporate Directory 8 Profile of Directors 51 Information in Relation to 151 Notice of Annual General 12 Management Team Employees’ Share Option Meeting 14 Chairman’s Statement Scheme 154 Statement Accompanying 22 Chief Executive Officer’s 52 Statement on Directors’ Notice of the Twenty Eighth Review of Operations Responsibility Annual General Meeting 30 Corporate Social 55 Financial Statements • Form of Proxy Responsibility New Opportunities. Moving Ahead. With a presence in 27 countries, Scomi Group is an accomplished global technology enterprise. Entrusted with numerous high-profile projects, Scomi’s achievements have reinforced its position as a world-class service provider and technology owner in oilfield services, transport solutions and energy logistics. By consolidating operations and building on its strengths, Scomi will continue to seek out new opportunities in both the domestic and global market. Moving ahead, Scomi will keep delivering value to its stakeholders and making a difference in the communities it helps shape. Ballroom 3 th 1st Floor, Sime Darby Convention Centre 28 1A Jalan Bukit Kiara 1 ANNUAL 60000 Kuala Lumpur GENERAL on 26 June 2012 at 10.00 a.m. -

ANNUAL REPORT 2019 Contents

SCOMI GROUP BHD ANNUAL REPORT 2019 Contents 002 Key Financial Indicators 003 Key Financial Highlights 004 Corporate Structure 006 Corporate Statement 007 Corporate Information 008 Board of Directors 012 Key Senior Management 014 Management Discussion & Analysis 020 Sustainability Statement 022 Corporate Governance Overview Statement 037 Statement on Risk Management & Internal Control 040 Audit & Risk Management Committee Report 044 Additional Information 046 Statement of Directors’ Responsibility 047 Financial Statements 225 Analysis of Shareholdings 229 Analysis of Warrant Holdings 231 List of Properties 232 Corporate Directory 234 Notice of Annual General Meeting 239 Form of Proxy Key Financial Indicators 20191,2 20182 20173 20163 20153 RM’000 RM’000 RM’000 RM’000 RM’000 (Restated) Continuing operations Turnover 643,502 613,957 826,892 1,383,332 1,798,572 EBITDA (142,270) (114,613) 17,666 199,531 257,911 Depreciation and amortization 78,021 80,839 104,962 110,032 97,524 Finance costs 23,165 23,943 61,107 63,706 56,480 Share of (loss)/profit in associates (2,299) - - 495 (124) Share of (loss)/profit from joint ventures (3,866) (36,663) (24,208) (10,628) 1,117 (Loss)/Profit before tax (243,453) (219,395) (148,403) 25,793 103,907 Taxation (20,883) (13,058) (17,248) (13,889) (37,535) (Loss)/Profit from continuing operations (264,336) (232,453) (165,651) 11,904 66,372 Loss from discontinued operations (161,633) (99,629) - - (71) (Loss)/Profit for the year (425,969) (332,082)) (165,651) 11,904 66,301 Non-controlling interest 29,798 82,108 -

Analysis of WBV on Standing and Seated Passengers During Off-Peak Operation in KL Monorail

ICMEMSCE IOP Publishing IOP Conf. Series: Materials Science and Engineering1234567890 324 (2018)‘’“” 012003 doi:10.1088/1757-899X/324/1/012003 Analysis of WBV on standing and seated passengers during off-peak operation in KL monorail K Hasnan1, Q Bakhsh1, A Ahmed1, D Ali1, A R Jamali1 1Universiti Tun Hussein Onn Malaysia, 86400 Batu Pahat, Johor-Malaysia Email: [email protected] Abstract. In this study, the Whole-Body Vibration (WBV) was analyzed on the standing and seated passenger during off-peak operating hours when train was on the track. The experiments were conducted on two car train at one constant location (bogie-1, which is near to driver’s cabin) during downward direction from KL sentral station towards Titiwangsa station. The aim of this study was to analyze that, in which posture of passenger’s exposures the maximum level of WBV. Since, one passenger was performed the whole journey in standing posture whereas, the other passenger was in seated posture. The result obtained from experiments for the RMS accelerations (Arms), maximum acceleration (Amax) and minimum acceleration (Amin) during the trip. As per standard ISO 2631-1, the daily vibration exposure (A8), Vibration Dose value (VDV) and Crest Factor (CF) of this trip for both standing and sitting orientations were calculated. Results shows that the seated passenger was exposed to longer periods of continuous vibration as compared to the standing passenger. Whereas, the Vibration Dose value (VDV) value was greater than the action value as per ISO 2631-1 and within the limit values. The study concluded that whole body vibration transmitted towards both passengers either standing or seated during their journey.