Table 5. Refiners' Total Operable Atmospheric Crude Oil Distillation Capacity As of January 1, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAMREF Refinery Embraces Wireless Applications, Sets Foundation for Site-Wide Onewireless Network Infrastructure

Case Study SAMREF Refinery Embraces Wireless Applications, Sets Foundation for Site-wide OneWireless Network Infrastructure “Wireless seemed like the natural answer to our immediate need for mobile video monitoring and Honeywell was the right partner because of its broad range of products and solutions and its field- proven track record in the areas of security, reliability and professional support." Mr. Azam L. Al-Hakeem, Information Technology Superintendent, SAMREF Background Benefits SAMREF is a joint venture between Saudi Arabian Oil Company The Wireless solution allows SAMREF to enhance their incident (Saudi Aramco) and Mobil Yanbu Refining Company Inc., a management procedures and rescue operations resulting in wholly owned subsidiary of Exxon Mobil Corporation. Saudi improved employee safety. Deployment of industrial video Aramco is the world’s largest oil producing and exporting cameras over the wireless network enables remote coverage of company with a history dating back more than 80 years. Exxon the refinery site from roaming vehicles. This allows SAMREF to Mobil Corporation is a global energy company which conducts record safety and security incidents, compare them with previous business in 140 countries on every continent throughout the incidents and keep a video record of near misses. By providing world. The SAMREF refinery complex in Yanbu, Saudi Arabia the refinery Incident Commander with a direct view of real-time produces approximately 400,000 barrels of product daily streaming video from the vehicle he is able to make faster including gasoline, heating oil, LPG, jet fuel and other energy decisions during crisis situations while reducing his dependency products. The Yanbu operation is said to be the most on the control room. -

Perspectives on Climate-Related Scenarios Risks and Opportunities Table of Contents

October 2019 Perspectives on Climate-Related Scenarios Risks and Opportunities Table of Contents 3 Letter from the Chairman and CEO 36 Metrics and Performance Data 4 About MPC 37 Managing Physical Risks to Our Facilities 6 Introduction 41 Conclusions 7 Governance and Risk Management 43 Endnotes 10 Climate Scenario Planning 43 Forward-looking Statements 30 Energy Strategy and Performance GLOSSARY OF TERMS barrel: 42 U.S. gallons — a common volume ERM: Enterprise Risk Management measure for crude oil and petroleum products GHGs: Greenhouse gases, such as carbon dioxide barrel of oil equivalent or boe: is a unit of energy and methane based on the energy released by burning one barrel IEA: International Energy Agency of crude oil or 5.8 million British thermal units. IEA’s CPS: Current Policies Scenario bpcd: barrels per calendar day — the average of how much crude oil or other feedstock a refinery IEA’s NPS: New Policies Scenario processes over a period of time, divided by the IEA’s SDS: Sustainable Development Scenario number of days in that period, typically 365 days (a LNG: Liquefied natural gas common rate measure for petroleum refineries) LPG: Liquefied petroleum gases bpd: barrels per day — a common rate measure for crude oil and petroleum products Tonne or metric ton: 2,205 pounds Carbon dioxide equivalent is a common unit MPC: Marathon Petroleum Corporation CO2e: of measurement converting all greenhouse gases NGL: Natural gas liquid — a light hydrocarbon to carbon dioxide. MPC calculates CO2e emissions liquid often produced with natural gas using the EPA factors identified in Equation A-1 in Scope 1 Emissions: All direct GHG emissions by 40 CFR Part 98. -

2019 Annual Report Are Commission-Free

Table of Contents 1 Letter to Our Shareholders 4 Financial Highlights 6 Our Businesses Midstream Chemicals Refining Marketing and Specialties 7 Our Value Chain 8 Our Strategy Operating Excellence Growth Returns Distributions High-Performing Organization 28 Board of Directors 30 Executive Leadership Team 31 Non-GAAP Reconciliations 32 Form 10-K | ON THE COVER AND TABLE OF CONTENTS Lake Charles Refinery WESTLAKE, LA In 2019, Lake Charles Manufacturing Complex achieved a sustained safety record of more than 55 months, equivalent to 7.5 million safe work hours. 2019 PHILLIPS 66 ANNUAL REPORT 1 To Our Shareholders We have the right strategy in place to create shareholder value, and our employees are executing it well. Phillips 66 achieved 34% total shareholder return during 2019, which exceeded our peer group average and the S&P 100. In 2019, we delivered earnings of $3.1 billion and earnings per share of $6.77. Adjusted earnings were $3.7 billion or $8.05 per share. During the year, we generated $4.8 billion of operating cash flow. We reinvested $3.9 billionback into the business and returned $3.2 billion of capital to shareholders through dividends and share repurchases. We increased our quarterly dividend 12.5% and announced a $3 billion increase to our share repurchase program. Since our formation, we have returned $26 billion to shareholders through dividends, share repurchases and exchanges, reducing our initial shares outstanding by 33%. Operating excellence is our No. 1 priority and core to everything we do. Our goal is zero incidents, zero accidents and zero injuries. We believe this is attainable, and we strive for it daily. -

2015 Annual Report Mission

2015 annual report Mission Our mission is to facilitate innovation, collaborative research and technology development, demonstration and deployment for a responsible Canadian hydrocarbon energy industry. 2 Vision Our vision is to help Canada become a global hydrocarbon energy technology leader. PTAC Technology Areas Manage Environmental Impacts • Air Quality • Alternative Energy Improve Oil and Gas Recovery • Ecological • CO2 Enhanced Hydrocarbon Recovery • Emission Reduction / Eco-Efficiency • Coalbed Methane, Shale Gas, Tight Gas, Gas Hydrates, • Energy Efficiency and other Unconventional Gas • Resource Access • Conventional Heavy Oil, Cold Heavy Oil Production with • Soil and Groundwater Sands • Water • Conventional Oil and Gas Recovery • Wellsite Abandonment • Development of Arctic Resources • Development of Remote Resources Additional PTAC Technical Areas • Enhanced Heavy Oil Recovery • e-Business • Enhanced Oil and Gas Recovery • Genomics • Enhanced Oil Sands Recovery • Geomatics • Emerging Technologies to Recover Oil Sands from Deposits • Geosciences with Existing Zero Recovery • Health and Safety • Tight Oil, Shale Oil, and other Unconventional Oil • Instrumentation/Measurement • Nano Technology Reduce Capital, Operating, and G&A Costs • Operations • Automation • Photonics • Capital Cost Optimization • Production Engineering • Cost Reduction Using Emerging Drilling and Completion • Remote Sensing Technologies • Reservoir Engineering • Cost Reduction Using Surface Facilities • Security • Eco-Efficiency and Energy Efficiencyechnologies -

Report Document

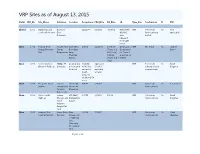

VRP Sites as of August 13, 2015 Status VRP_No. Site_Name Volunteer Location Acceptance DatePRA_Date RA_Date LA Type_Site Contaminant IC PM Closed 1001 Rail siding and Big Horn 12/11/00 3/26/02 3/26/02 NFA Letter VRP Petroleum No Not coal load out area Coal 4/26/02; hydrocarbons, applicable Company area metals released from LQD bond Open 1002 Powder River Powder River 1095 West 1/8/01 10/17/01 10/01/07 Certificate of VRP Oil, diesel No Jaymee Energy Sheridan Energy Brundage (Tracts 8, 9, Completion Binion Site Corporation Lane, & 10 only), for Tracts 8, Sheridan, 5/18/09 9, and 10 on 82801 (Tracts 6 & 7 5/8/09 only) Open 1003 Former Conoco Phillips 66 Located 1/2 3/19/01; Approved VRP Petroleum No Sarah Glenrock Refinery Company mile west of 6/28/2011 5/13/02; refinery related Bargsten Glenrock amended amended contaminants South 9/19/02 property additional 54 acres Open 1004 Cheyenne Crude Suncor 199 South 4/4/01 5/30/06 VRP Petroleum No Ben Luckey Station Energy USA, Morrie Av, hydrocarbons formerly Cheyenne Conoco Inc. Open 1005 Union Pacific Former 543 West 4/4/01 7/31/03 1/3/05 VRP Petroleum No Sarah Railroad Chicago and Midwest Av, Hydrocarbons Bargsten North Casper Western Casper Rail Yard Open 1006 Laramie Yard Union Pacific Near 4/4/01 7/09/04 VRP Petroleum No Cindi Fueling Platform Railroad intersection Hydrocarbons Martinez of Railroad and University St., Laramie Yard Page 1 of 29 Status VRP_No. Site_Name Volunteer Location Acceptance DatePRA_Date RA_Date LA Type_Site Contaminant IC PM Closed 1007 Gulley Enterprises Cheyenne 411 E. -

23Rd WPC Announces Innovation Zone Special Feature Invites Innovators to Share Their Transformative Ideas That Will Impact the Future of Energy

FOR IMMEDIATE RELEASE 23rd WPC Announces Innovation Zone Special feature invites innovators to share their transformative ideas that will impact the future of energy HOUSTON, TX (August 4, 2021) — The 23rd World Petroleum Congress Organizing Committee has announced the launch of the Innovation Zone, a captivating new feature on the exhibition floor of the Congress, which will take place in-person in Houston from December 5-9, 2021 at the George R. Brown Convention Center. The Innovation Zone, presented by ConocoPhillips, will provide startup companies an international platform to showcase cutting-edge practices and solutions to combat the current challenges of the energy industry and bring awareness to progressive energy solutions available on the market today. “For more than a century, innovation has enabled our industry to keep pace with the growing demand for safe and reliable energy,” said W. L. (Bill) Bullock, Jr., EVP and CFO, ConocoPhillips. “ConocoPhillips is pleased to be the Innovation Zone presenting sponsor, where companies will showcase innovations that can propel our industry’s purposeful journey through the energy transition and into the future.” Thirty-two selected startup companies and individuals will have the opportunity to pitch their innovative energy tools, technologies and practices on stage to Congress delegates and participants, who will then pick one to receive the Energy Innovator Award. The Innovation Zone is open to all for-profit energy companies, private entities and individuals operating as independent -

Q3 2020 Husky-MDA

MANAGEMENT’S DISCUSSION AND ANALYSIS October 29, 2020 Table of Contents 1.0 Summary of Quarterly Results 2.0 Business Overview 3.0 Business Environment 4.0 Results of Operations 5.0 Risk Management and Financial Risks 6.0 Liquidity and Capital Resources 7.0 Critical Accounting Estimates and Key Judgments 8.0 Recent Accounting Standards and Changes in Accounting Policies 9.0 Outstanding Share Data 10.0 Reader Advisories 1.0 Summary of Quarterly Results Three months ended Quarterly Summary Sep. 30 Jun. 30 Mar. 31 Dec. 31 Sept. 30 Jun. 30 Mar. 31 Dec. 31 ($ millions, except where indicated) 2020 2020 2020 2019 2019 2019 2019 2018(1) Production (mboe/day) 258.4 246.5 298.9 311.3 294.8 268.4 285.2 304.3 Throughput (mbbls/day) 300.1 281.3 307.8 203.4 356.4 340.3 333.6 286.9 Gross revenues and Marketing and other(1) 3,379 2,408 4,113 4,921 5,373 5,321 4,610 5,042 Net earnings (loss) (7,081) (304) (1,705) (2,341) 273 370 328 216 Per share – Basic (7.05) (0.31) (1.71) (2.34) 0.26 0.36 0.32 0.21 Per share – Diluted (7.06) (0.31) (1.71) (2.34) 0.25 0.36 0.31 0.16 Cash flow – operating activities 79 (10) 355 866 800 760 545 1,313 Funds from operations(2) 148 18 25 469 1,021 802 959 583 Per share – Basic 0.15 0.02 0.02 0.47 1.02 0.80 0.95 0.58 Per share – Diluted 0.15 0.02 0.02 0.47 1.02 0.80 0.95 0.58 (1) Gross revenues and Marketing and other results reported for 2019 have been recast to reflect a change in reclassification of intersegment sales eliminations and a change in presentation of the Integrated Corridor and Offshore business units. -

Oil Refining in Mexico and Prospects for the Energy Reform

Articles Oil refining in Mexico and prospects for the Energy Reform Daniel Romo1 1National Polytechnic Institute, Mexico. E-mail address: [email protected] Abstract: This paper analyzes the conditions facing the oil refining industry in Mexico and the factors that shaped its overhaul in the context of the 2013 Energy Reform. To do so, the paper examines the main challenges that refining companies must tackle to stay in the market, evaluating the specific cases of the United States and Canada. Similarly, it offers a diagnosis of refining in Mexico, identifying its principal determinants in order to, finally, analyze its prospects, considering the role of private initiatives in the open market, as well as Petróleos Mexicanos (Pemex), as a placeholder in those areas where private enterprises do not participate. Key Words: Oil, refining, Energy Reform, global market, energy consumption, investment Date received: February 26, 2016 Date accepted: July 11, 2016 INTRODUCTION At the end of 2013, the refining market was one of stark contrasts. On the one hand, the supply of heavy products in the domestic market proved adequate, with excessive volumes of fuel oil. On the other, the gas and diesel oil demand could not be met with production by Petróleos Mexicanos (Pemex). The possibility to expand the infrastructure was jeopardized, as the new refinery project in Tula, Hidalgo was put on hold and the plan was made to retrofit the units in Tula, Salamanca, and Salina Cruz. This situation constrained Pemex's supply capacity in subsequent years and made the country reliant on imports to supply the domestic market. -

Initial Project Description Summary

SUNCOR ENERGY INC. Base Mine Extension INITIAL PROJECT DESCRIPTION SUMMARY February 2020 SUNCOR ENERGY INC. Base Mine Extension - Initial Project Description Summary February 2020 This Page Intentionally Left Blank SUNCOR ENERGY INC. Base Mine Extension - Initial Project Description Summary February 2020 EXECUTIVE SUMMARY Suncor Energy Inc. (Suncor) is submitting a proposal to develop the Base Mine Extension Project (the Project). All plausible pathways to address global emissions need energy from fossil fuels and Suncor views Canada’s world class, strategic oil sands resource as a key part of the energy future for decades to come. Commensurate with Canada’s ambitions, Suncor is committed to a long-term strategy of reducing absolute emissions. With the innovation we are known for, Suncor can provide the world with trusted low carbon energy. Suncor has invested billions of dollars in infrastructure that produces value added products to meet the energy needs of Albertans and Canadians. This Project is necessary to continue to add value with this infrastructure. The bitumen from this project will be used to supply the existing upgraders at Suncor’s Oil Sands Base Plant operations (Base Plant), when the existing mines are depleted. The Project is adjacent to Base Plant and includes an open pit mining operation and extraction facilities. Production is expected to be nominally 225 thousand barrels per day of replacement bitumen during its estimated 25-year operational life. The Project application will be based on best-available technology. In parallel, Suncor is developing new technologies, such as non-aqueous extraction. These new technologies have the potential to significantly reduce the overall footprint, reclamation timeline, and GHG emissions of mining and will be incorporated as appropriate. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Marathon Agreement

UNITED STATES OF AMERICA BEFORE THE FEDERAL TRADE COMMISSION __________________________________________ ) In the Matter of ) ) Marathon Petroleum Corporation, ) a corporation, ) ) Express Mart Franchising Corp., ) File. No. 181-0152 a corporation, ) ) Petr-All Petroleum Consulting Corporation, ) a corporation, and ) ) REROB, LLC, ) a limited liability company. ) __________________________________________) AGREEMENT CONTAINING CONSENT ORDERS The Federal Trade Commission (“Commission”) has initiated an investigation of the proposed acquisition by Respondent Marathon Petroleum Corporation, through its wholly owned subsidiary, Speedway LLC (collectively “Marathon”), of retail fuel outlets from Respondents REROB, LLC, Petr-All Petroleum Consulting Corporation, and Express Mart Franchising Corp. (collectively “Proposed Respondents”). The Commission’s Bureau of Competition has prepared a draft administrative complaint (“Draft Complaint”). The Bureau of Competition, Proposed Respondents, and Sunoco LP (“Sunoco”) enter into this Agreement Containing Consent Orders (“Consent Agreement”) to divest certain assets and providing for other relief to resolve the allegations in the Draft Complaint through a proposed Decision and Order and Order to Maintain Assets, all of which are attached, to present to the Commission. IT IS HEREBY AGREED by and between Proposed Respondents and Sunoco, by their duly authorized officers and attorneys, and counsel for the Commission that: 1. Proposed Respondent Marathon Petroleum Corporation is a corporation organized, existing, and doing business under, and by virtue of, the laws of the State of Delaware, with its office and principal place of business located at 539 South Main Street, Findlay, Ohio 45840. 2. Proposed Respondent Express Mart Franchising Corp. is a corporation organized, existing, and doing business under, and by virtue of, the laws of the State of New York, with its office and principal place of business located at 7401 Round Pond Road, Syracuse, New York 13212. -

Concept Papers for Changes to Rule 9-1 -- Refinery Fuel Gas Sulfur

Draft: 05‐14‐15 Appendix C: Concept Paper for Changes to Rule 9‐1: Refinery Fuel Gas Sulfur Limits Rules to Be Amended or Drafted Regulation of refinery fuel gas (RFG) requires amendments to Air District Regulation 9, Rule 1, Sulfur Dioxide. Goals The goal of this rulemaking is to achieve technically feasible and cost‐effective sulfur dioxide (SO2) emission reductions from RFG systems at Bay Area refineries. Background The lightest components of crude oil separated by a refinery’s atmospheric fractionator are methane and ethane, which are also the primary components of natural gas. At petroleum refineries, these products are not produced in marketable quantities, but are used as fuel in the numerous onsite steam generators and process heaters. When produced at a refinery, this product is called refinery fuel gas (RFG). Pipeline natural gas may be used as a supplemental fuel when needed to enhance the quality of RFG or when there is not enough RFG available. Unlike, pipeline natural gas, refinery fuel gas often contains significant quantities of sulfur that occur naturally in crude oil. When burned, these sulfur compounds are converted to SO2. Process and Source Description RFG can contain between a few hundred and a few thousand parts per million‐volume (ppmv) sulfur in the form of hydrogen sulfide (H2S), carbonyl sulfide (COS), and organic sulfur compounds, such as mercaptans. During combustion, the sulfur in all of these compounds will oxidize to form SO2, which is a criteria air pollutant and a precursor to particulate matter. Scrubbing with an amine or caustic solution can be effective at removing H2S and some acidic sulfur containing compounds, but is generally ineffective at removing nonacidic sulfur compounds.