2020 Annual Report of C&D International Investment Group Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

工程业绩 RECORD of PROJECT 4006-501-510 泰宁项目 1 这 是 泰 宁 This Is TIDELION 北京 | 深圳 | 上海 | 长春 | 天津 | 济南 | 长沙 | 贵阳 | 昆明

2003—2015 工程业绩 RECORD OF PROJECT www.tidelion.com 4006-501-510 泰宁项目 1 这 是 泰 宁 This is TIDELION 北京 | 深圳 | 上海 | 长春 | 天津 | 济南 | 长沙 | 贵阳 | 昆明... Tidelion Project 2 泰宁助力海绵城市建设 TIDELION Projects Covers Many Fields 3 泰宁工程覆盖多领域 TIDELION Support Sponge City Construction 目录 4 重点工程 Contents Major Projects 沙特阿拉伯 Saudi Arabia 越南 Vietnam 菲律宾 Philippines 新加坡 Singapore 刚果 Congo 印度尼西亚 Indonesia 南非 South Africa 京泰宁科创雨水利用技术股份有限公司于2003年4月在北京中关村科技 园区昌平园成立。公司自成立以来,坚持走自主创新之路,目前公司已 北形成以雨水综合利用系统为主、同层排水系统为辅的业务格局。 公司以泰宁虹吸式雨水斗、渗排一体化技术等具有自主知识产权的高新技术 为基础,在雨水综合利用技术和同层排水技术方面取得了突破性的研究成果, 并全面实现了科研成果的产品化。相关技术已申报专利100余项,获批专利90 余项。同时,凭借多年的技术积累和业务创新,公司已成为国内多项国家标 准及行业规范的编制或起草者之一,主编了中华人民共和国城镇建设行业标准 《虹吸雨水斗》CJ/T245-2007,参与编制了国家标准《建筑与小区雨水利用工 程技术规范》GB50400-2006、国家建筑设计标准图集《雨水斗选用及安装》 09S302、中国工程建设标准化协会标准《虹吸式屋面雨水排水系统技术规程》 这是泰宁 CECS183:2005、北京市地方标准《建筑卫生间同层排水系统》09BSZ1-1、北京 市地方标准《雨水控制与利用工程设计规范》DB11/685-2013、国家建筑设计 This is Tidelion >>> 标准图集《雨水综合利用》10SS705以及国家行业标准《建筑屋面雨水排水系统 技术规程》CJJ 142-2014、2014住建部《海绵城市建设技术指南》等。目前, 公司拥有建筑业企业机电设备安装工程专业承包资质,并已通过GB/T19001- 2008/ISO9001:2008标准质量管理体系认证。 公司已累计完成包括国家、省、市级重点工程在内的3000余个项目的设计、 施工。先后完成了多项奥运及奥运配套工程,其中包括国家游泳中心、北京奥 林匹克中心区、北京首都机场改扩建、五棵松体育馆、国家会议中心等项目。此 外,公司还完成包括上海虹桥机场改扩建工程,上海世博会美国馆、澳大利亚 馆、西班牙馆,以及深圳大运会主体育场、广州亚运会主体育场、北京未来科技 城、昌平新城滨河森林公园、南京青奥会议中心、上海虹桥商务区中国博览会会 展综合体等一批重点工程。公司正积极开拓国外市场,已经在新加坡、刚果、印 尼、南非等国家签约经销商或承建项目。 公司自2009年起已连续三次被评为中关村科技园区的“瞪羚企业”,2006年 公司承建的奥运工程项目,被北京市工业促进局立项为北京市重点工程项目,同 年被建设部科学技术委员会评为节水技术“中国建设科技自主创新优势企业”, 在2007年获得了“节水与雨水利用项目”住宅产业化金奖;在2008年获得“中 关村园区参与奥运建设重点企业”;中关村科技园区“创新试点企业”;被中国 建筑学会建筑给水排水研究分会授予“雨水综合利用实验示范基地”称号,被北 京市科委评为“科技奥运先进集体”;“第十一届北京技术市场金桥奖”等多项 -

China Media Bulletin

Issue No. 154: May 2021 CHINA MEDIA BULLETIN Headlines ANALYSIS The Gutting of Hong Kong’s Public Broadcaster P2 IN THE NEWS • Regulators “clean up” internet ahead of CCP anniversary alongside censorship of Oscars, Bible apps, and Weibo P5 • Surveillance updates: Personal data-protection law advances, Apple compromises on user data, citizen backlash P6 • Criminal charges for COVID commentary, Uyghur religious expression, Tibetan WeChat use P7 • Hong Kong: Website blocks, netizen arrests, journalist beating, and Phoenix TV ownership change P9 • Beyond China: Beijing’s COVID-19 media strategy, waning propaganda impact in Europe, new US regulations to enhance transparency P10 FEATURED PUSHBACK Netizens demand transparency on Chengdu student’s death P12 WHAT TO WATCH FOR P13 TAKE ACTION P14 IMAGE OF THE MONTH Is RTHK History? This cartoon published on April 5 by a Hong Kong visual arts teacher is part of a series called “Hong Kong Today.” It depicts a fictional Hong Kong Museum of History, which includes among its exhibits two institutions that have been critical to the city’s freedom, but are being undermined by Chinese and Hong Kong government actions. The first is the Basic Law, the mini-constitution guaranteeing freedom of expression and other fundamental rights; the other is Radio Television Hong Kong (RTHK), the once-respected public broadcaster now facing a government takeover. The teacher who posted the cartoon is facing disciplinary action from the Education Department. Credit: @vawongsir Instagram Visit http://freedomhou.se/cmb_signup or email [email protected] to subscribe or submit items. CHINA MEDIA BULLETIN: MAY 2021 ANALYSIS The Gutting of Hong Kong’s Public Broadcaster By Sarah Cook A government takeover of Radio Television Hong Kong has far-reaching Sarah Cook is the implications. -

Annual Report for Year 2014(English)

Table of Contents Corperate Profile .................................................................................................... 2 Chairman’s Statement ............................................................................................ 3 President’s Report................................................................................................... 5 Definition ................................................................................................................ 7 Important Notice ..................................................................................................... 8 Major Risk Notice ................................................................................................... 9 Chapter I Corporate Information ......................................................................... 10 Chapter II Accounting and Business Figure Highlights ........................................ 12 Chapter III Changes in Share Capital and Shareholders ...................................... 17 Chapter IV Overview of Directors, Supervisors, Senior Management, Employees and Organization .................................................................................................. 23 Chapter V Corporate Governance Structure ........................................................ 47 Chapter VI Report of the Board of Directors ........................................................ 72 Chapter VII Social Responsibilities ..................................................................... 112 Chapter -

Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. Huangjindui

产品总称 委托方名称(英) 申请地址(英) Huangjindui Industrial Park, Shanggao County, Yichun City, Jiangxi Province, Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. China Folic acid/D-calcium Pantothenate/Thiamine Mononitrate/Thiamine East of Huangdian Village (West of Tongxingfengan), Kenli Town, Kenli County, Hydrochloride/Riboflavin/Beta Alanine/Pyridoxine Xinfa Pharmaceutical Co., Ltd. Dongying City, Shandong Province, 257500, China Hydrochloride/Sucralose/Dexpanthenol LMZ Herbal Toothpaste Liuzhou LMZ Co.,Ltd. No.282 Donghuan Road,Liuzhou City,Guangxi,China Flavor/Seasoning Hubei Handyware Food Biotech Co.,Ltd. 6 Dongdi Road, Xiantao City, Hubei Province, China SODIUM CARBOXYMETHYL CELLULOSE(CMC) ANQIU EAGLE CELLULOSE CO., LTD Xinbingmaying Village, Linghe Town, Anqiu City, Weifang City, Shandong Province No. 569, Yingerle Road, Economic Development Zone, Qingyun County, Dezhou, biscuit Shandong Yingerle Hwa Tai Food Industry Co., Ltd Shandong, China (Mainland) Maltose, Malt Extract, Dry Malt Extract, Barley Extract Guangzhou Heliyuan Foodstuff Co.,LTD Mache Village, Shitan Town, Zengcheng, Guangzhou,Guangdong,China No.3, Xinxing Road, Wuqing Development Area, Tianjin Hi-tech Industrial Park, Non-Dairy Whip Topping\PREMIX Rich Bakery Products(Tianjin)Co.,Ltd. Tianjin, China. Edible oils and fats / Filling of foods/Milk Beverages TIANJIN YOSHIYOSHI FOOD CO., LTD. No. 52 Bohai Road, TEDA, Tianjin, China Solid beverage/Milk tea mate(Non dairy creamer)/Flavored 2nd phase of Diqiuhuanpo, Economic Development Zone, Deqing County, Huzhou Zhejiang Qiyiniao Biological Technology Co., Ltd. concentrated beverage/ Fruit jam/Bubble jam City, Zhejiang Province, P.R. China Solid beverage/Flavored concentrated beverage/Concentrated juice/ Hangzhou Jiahe Food Co.,Ltd No.5 Yaojia Road Gouzhuang Liangzhu Street Yuhang District Hangzhou Fruit Jam Production of Hydrolyzed Vegetable Protein Powder/Caramel Color/Red Fermented Rice Powder/Monascus Red Color/Monascus Yellow Shandong Zhonghui Biotechnology Co., Ltd. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

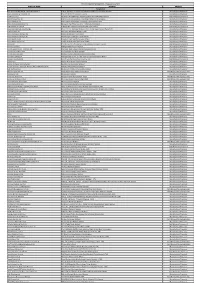

TIER2 SITE NAME ADDRESS PROCESS M Ns Garments Printing & Embroidery

TIER 2 MANUFACTURING SITES - Produced July 2021 TIER2 SITE NAME ADDRESS PROCESS Bangladesh Mns Garments Printing & Embroidery (Unit 2) House 305 Road 34 Hazirpukur Choydana National University Gazipur Manufacturer/Processor (A&E) American & Efird (Bd) Ltd Plot 659 & 660 93 Islampur Gazipur Manufacturer/Processor A G Dresses Ltd Ag Tower Plot 09 Block C Tongi Industrial Area Himardighi Gazipur Next Branded Component Abanti Colour Tex Ltd Plot S A 646 Shashongaon Enayetnagar Fatullah Narayanganj Manufacturer/Processor Aboni Knitwear Ltd Plot 169 171 Tetulzhora Hemayetpur Savar Dhaka 1340 Manufacturer/Processor Afrah Washing Industries Ltd Maizpara Taxi Track Area Pan - 4 Patenga Chottogram Manufacturer/Processor AKM Knit Wear Limited Holding No 14 Gedda Cornopara Ulail Savar Dhaka Next Branded Component Aleya Embroidery & Aleya Design Hose 40 Plot 808 Iqbal Bhaban Dhour Nishat Nagar Turag Dhaka 1230 Manufacturer/Processor Alim Knit (Bd) Ltd Nayapara Kashimpur Gazipur 1750 Manufacturer/Processor Aman Fashions & Designs Ltd Nalam Mirzanagar Asulia Savar Manufacturer/Processor Aman Graphics & Design Ltd Nazimnagar Hemayetpur Savar Dhaka Manufacturer/Processor Aman Sweaters Ltd Rajaghat Road Rajfulbaria Savar Dhaka Manufacturer/Processor Aman Winter Wears Ltd Singair Road Hemayetpur Savar Dhaka Manufacturer/Processor Amann Bd Plot No Rs 2497-98 Tapirbari Tengra Mawna Shreepur Gazipur Next Branded Component Amantex Limited Boiragirchala Sreepur Gazipur Manufacturer/Processor Ananta Apparels Ltd - Adamjee Epz Plot 246 - 249 Adamjee Epz Narayanganj -

PDF Full Report

Heightening Sense of Crises over Press Freedom in Hong Kong: Advancing “Shrinkage” 20 Years after Returning to China April 2018 YAMADA Ken-ichi NHK Broadcasting Culture Research Institute Media Research & Studies _____________________________ *This article is based on the same authors’ article Hong Kong no “Hodo no Jiyu” ni Takamaru Kikikan ~Chugoku Henkan kara 20nen de Susumu “Ishuku”~, originally published in the December 2017 issue of “Hoso Kenkyu to Chosa [The NHK Monthly Report on Broadcast Research]”. Full text in Japanese may be accessed at http://www.nhk.or.jp/bunken/research/oversea/pdf/20171201_7.pdf 1 Introduction Twenty years have passed since Hong Kong was returned to China from British rule. At the time of the 1997 reversion, there were concerns that Hong Kong, which has a laissez-faire market economy, would lose its economic vigor once the territory is put under the Chinese Communist Party’s one-party rule. But the Hong Kong economy has achieved generally steady growth while forming closer ties with the mainland. However, new concerns are rising that the “One Country, Two Systems” principle that guarantees Hong Kong a different social system from that of China is wavering and press freedom, which does not exist in the mainland and has been one of the attractions of Hong Kong, is shrinking. On the rankings of press freedom compiled by the international journalists’ group Reporters Without Borders, Hong Kong fell to 73rd place in 2017 from 18th in 2002.1 This article looks at how press freedom has been affected by a series of cases in the Hong Kong media that occurred during these two decades, in line with findings from the author’s weeklong field trip in mid-September 2017. -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

Public Space Analysis on Spontaneously Formed University

International Conference on Humanities and Social Science (HSS 2016) Public Space Analysis on Spontaneously Formed University Towns on the Basis of Students’ Behaviors to Attend and Dismiss the Class —A Case Study of Shigulu Block in Jimei District, Xiamen City Min-feng YAO1, 2, Sha LIU2 and Run-shen LIU2 1School of Transportation Engineering, TongJi University, Shanghai, China 2School of Architecture, Huaqiao University, Xiamen, Fujian, China Keywords: Behaviors, University town, Jimei School Village, Shigulu Block. Abstract. Jimei School Village is a university town with a history of nearly one hundred years. Its “spontaneous” formation is distinctly different from that of the prevailing “planning-construction” university towns. Under the turning point of public space optimization in Jimei District, this paper took the behaviors of students in the university town to attend and dismiss the class as the breakthrough point to analyze characteristics in the block, so as to understand the demands of students in this special university town for public space. The paper summarized possible shortcomings in Jimei School Village and regarded this as the basis for optimization and reconstruction of the school village. It provided a case for researches on “spontaneous” university towns. History and Current Status of Jimei School Village and Shegulu Blocks Jimei School Village Jimei School Village is located in Jimei District, Xiamen City. It is the general term for all types of schools and cultural institutions in Jimei. The name of Jimei School Village originated in the 1920s. In order to avoid adverse impacts of warlords on students, schools in Jimei made a petition to the State Department to admit Jimei schools as “school villages with permanent peace”, so as to ensure a peaceful learning environment. -

2.18 Fujian Province Fujian Jinghong Group Co., Ltd., Affiliated to The

2.18 Fujian Province Fujian Jinghong Group Co., Ltd., affiliated to the Fujian Provincial Prison Administration Bureau1, has 20 prison entreprises Legal representative of the prison company: Chen Youshun, Chairman of Fujian Jinghong Group Co., Ltd. His official positions in the prison system: Communist Party Committee Deputy Secretary and Political Commissar of Fujian Provincial Prison Administration Bureau2 The Fujian Provincial Prison Administration Bureau has 17 prisons, one juvenile correctional institution, Fujian Jianxin Hospital and the Fujian Provincial Judicial Police Training Corps under its jurisdiction. Business areas: operation and management of state-owned assets of provincial prison enterprises according to the law and under the authorization of the provincial government; production of industrial products, such as mechanical equipment, mold, building materials and cement; processing of clothing, electronic products, footwear and bags; and property management No. Company Name of the Prison, Legal Person Legal representative / Registered Business Scope Company Notes on the Prison Name to which the and Title Capital Address Company Belongs Shareholder(s) 1 Fujian Jinghong Fujian Provincial Prison Fujian Provincial Chen Youshun 833.33 million Operation and 146 Yangqiao The Fujian Provincial Prison Group Co., Ltd. Administration Bureau Prison Chairman of Fujian yuan management of state- Middle Road, Administration Bureau4 is the province’s Administration Jinghong Group Co., Ltd.; owned assets of 10th Floor, penal enforcement -

C&D International Investment Group

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. C&D INTERNATIONAL INVESTMENT GROUP LIMITED 建發國際投資集團有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 1908) CONTINUING CONNECTED TRANSACTION AND MAJOR TRANSACTION IN RELATION TO PROVISION OF ENTRUSTED MANAGEMENT SERVICES PROPERTY PROJECT ENTRUSTED MANAGEMENT SERVICE AGREEMENT The Board is pleased to announce that on 1 August 2017 (after trading hours), Zhaocheng Construction, a wholly-owned subsidiary of the Company, entered into the Entrusted Management Service Agreement in relation to the Jianyang Western District Ecological City (建陽西區生態城) project with Jiaying Real Estate, pursuant to which Zhaocheng Construction shall provide entrusted management services to Jiaying Real Estate in respect of the Jianyang Western District Ecological City (建陽西區生態城) project. Under the Entrusted Management Service Agreement, the entrusted management services commenced on 1 August 2017 and will end on 31 July 2020. The entrusted management service fee shall be 8% of total sales of the Jianyang Western District Ecological City (建陽西區生態城) project payable on a lump sum basis, which is expected to be no more than RMB70,000,000. LISTING RULES IMPLICATIONS Zhaocheng Construction is a wholly-owned subsidiary of the Company. Jiaying Real Estate, which is 50% owned by C&D Real Estate, is a subsidiary of C&D Real Estate, which is in turn a controlling shareholder of the Company. -

Printmgr File

HISTORY AND REORGANIZATION OUR HISTORY Our Company was incorporated in the Cayman Islands on November 24, 2010 and, as part of the Reorganization, became the holding company of our various subsidiaries. Prior to the incorporation of our Company and the completion of the Reorganization, our business was conducted by our subsidiaries in the PRC, namely, Fujian Rongchang, Fujian Rongping and Fuzhou Yihua. Our history can be traced to 1958 when Fuzhou Yihua Chemical Factory ( ), a state- owned enterprise and the predecessor of Fuzhou Yihua, was established in the PRC. Fuzhou Yihua Chemical Factory was one of the earliest chemical plants to produce chlorate salt in China. Since our establishment, we have set up chemical plants to produce a range of chemicals including chlorate salt in China. In 1970, we established Fujian Fuwen, the predecessor of Fujian Rongchang, for producing hydrogen peroxide, liquid caustic soda and biurea. In 1992, we established Fujian Pingnan, the predecessor of Fujian Rongping, for producing sodium chlorate and potassium chlorate. Significant Milestones The following highlights our significant development milestones: 1958 Fuzhou Yihua Chemical Factory, the predecessor of Fuzhou Yihua, was established, being one of the earliest chemical plants to produce chlorate salt in China. 1970 Fujian Fuwen Chemical Factory ( ), the predecessor of Fujian Rongchang, was established for producing hydrogen peroxide, liquid caustic soda and biurea. 1992 Fujian Pingnan, the predecessor of Fujian Rongping, was established for producing sodium chlorate and potassium chlorate. 2000 We began to export sodium chlorate to Japan. 2002 Fuzhou Yihua established its branch office in Yongtai, Fuzhou. 2005 Through a number of entrustment arrangements, Mr.