Tata Ethical Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

November 16, 2018 Certificates of Authorisation Issued by the Reserve Bank of India Under the Payment and Settlement Syst

Date : November 16, 2018 Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India A. Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India The Payment and Settlement Systems Act, 2007 along with the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008 have come into effect from 12th August, 2008. The list of 'Payment System Operators’ authorised by the Reserve Bank of India to set up and operate in India under the Payment and Settlement Systems Act, 2007 is as under: Sr. Name of the Address of the Payment System Date of issue of No. Authorised Principal Office Authorised Authorisation Entity & Validity Period (given in brackets) Financial Market Infrastructure 1. The Clearing The Managing i. Securities 11.02.2009 Corporation of Director, segment covering India Ltd. Clearing Corp. of Govt Securities; India, ii. Forex 5th, 6th & 7th floor Settlement Trade World, Segment -do- “C” Wing Kamala comprising of sub- city, SB Marg, segments Lower Parel (West) a. USD-INR Mumbai 400 013 segment, -do- b. CLS segment – Continuous Linked Settlement (Settlement of Cross Currency -do- Deals), c. Forex Forward segment; iii. Rupee Derivatives -do- Segment-Rupee denominated trades in IRS & FRA. Retail Payments Organisation 2. National The Chief Executive i. National Payments Officer, Financial Switch Corporation of National Payments (NFS) 15.10.2009 India Corporation of ii. -

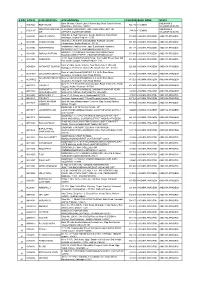

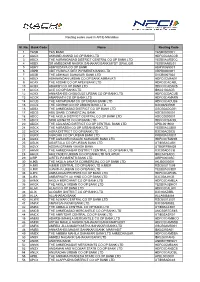

S No Atm Id Atm Location Atm Address Pincode Bank

S NO ATM ID ATM LOCATION ATM ADDRESS PINCODE BANK ZONE STATE Bank Of India, Church Lane, Phoenix Bay, Near Carmel School, ANDAMAN & ACE9022 PORT BLAIR 744 101 CHENNAI 1 Ward No.6, Port Blair - 744101 NICOBAR ISLANDS DOLYGUNJ,PORTBL ATR ROAD, PHARGOAN, DOLYGUNJ POST,OPP TO ANDAMAN & CCE8137 744103 CHENNAI 2 AIR AIRPORT, SOUTH ANDAMAN NICOBAR ISLANDS Shop No :2, Near Sai Xerox, Beside Medinova, Rajiv Road, AAX8001 ANANTHAPURA 515 001 ANDHRA PRADESH ANDHRA PRADESH 3 Anathapur, Andhra Pradesh - 5155 Shop No 2, Ammanna Setty Building, Kothavur Junction, ACV8001 CHODAVARAM 531 036 ANDHRA PRADESH ANDHRA PRADESH 4 Chodavaram, Andhra Pradesh - 53136 kiranashop 5 road junction ,opp. Sudarshana mandiram, ACV8002 NARSIPATNAM 531 116 ANDHRA PRADESH ANDHRA PRADESH 5 Narsipatnam 531116 visakhapatnam (dist)-531116 DO.NO 11-183,GOPALA PATNAM, MAIN ROAD NEAR ACV8003 GOPALA PATNAM 530 047 ANDHRA PRADESH ANDHRA PRADESH 6 NOOKALAMMA TEMPLE, VISAKHAPATNAM-530047 4-493, Near Bharat Petroliam Pump, Koti Reddy Street, Near Old ACY8001 CUDDAPPA 516 001 ANDHRA PRADESH ANDHRA PRADESH 7 Bus stand Cudappa, Andhra Pradesh- 5161 Bank of India, Guntur Branch, Door No.5-25-521, Main Rd, AGN9001 KOTHAPET GUNTUR 522 001 ANDHRA PRADESH ANDHRA PRADESH Kothapeta, P.B.No.66, Guntur (P), Dist.Guntur, AP - 522001. 8 Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW8001 GAJUWAKA BRANCH 530 026 ANDHRA PRADESH ANDHRA PRADESH 9 Gajuwaka, Anakapalle Main Road-530026 GAJUWAKA BRANCH Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW9002 530 026 ANDHRA PRADESH ANDHRA PRADESH -

State Bank of Travancore

DRAFT LETTER OF OFFER May 28, 2011 For circulation to the Equity Shareholders of our Bank only STATE BANK OF TRAVANCORE (Subsidiary of the State Bank of India) Our Bank was constituted under the State Bank of India (Subsidiary Banks) Act, 1959 as a subsidiary of State Bank of India. (For further details please refer to the chapter titled “History of our Bank and Other Corporate Matters” on page 51 of this Draft Letter of Offer.) Head Offi ce: Poojapura, Thiruvananthapuram-695 012 Tel: + 91 0471 2359975/2351903 Fax: +91 0471 2351861 Contact Person: Mr. V.Viswanathan, Compliance Offi cer E-mail: [email protected] Website: www.statebankoftravancore.com FOR PRIVATE CIRCULATION TO THE EQUITY SHAREHOLDERS OF OUR BANK ONLY DRAFT LETTER OF OFFER ISSUE OF [●] EQUITY SHARES WITH A FACE VALUE OF `10/– EACH (“RIGHTS EQUITY SHARES”) FOR CASH AT A PRICE OF `[●]/– INCLUDING A PREMIUM OF `[●]/– AGGREGATING UPTO `500 CRORES TO THE EXISTING EQUITY SHAREHOLDERS OF OUR BANK ON RIGHTS BASIS IN THE RATIO OF [●] RIGHTS EQUITY SHARES FOR EVERY [●] EQUITY SHARES HELD ON THE RECORD DATE I.E. [●] (“RIGHTS ISSUE/ ISSUE”). THE ISSUE PRICE FOR THE RIGHTS EQUITY SHARES IS [●] TIMES THE FACE VALUE OF THE EQUITY SHARES. GENERAL RISKS Investments in equity and equity related securities involve a degree of risk and Investors should not invest any funds in this Issue unless they can afford to take the risk of losing their investment. Investors are advised to read the Risk Factors carefully before taking an investment decision in this Issue. For taking an investment decision, Investors must rely on their own examination of the Issuer and the Issue including the risks involved. -

DIGITAL PAYMENTS BOOK Part1

DIGITAL PAYMENTS Trends, Issues And Opportunities July 2018 FOREWORD A Committee on Digital Payments was growth figures for both volume and value. constituted by Department of Economic Notwithstanding this the analysis finds that Affairs, Ministry of Finance in August 2016 both the data are relevant and equally under my Chairmanship to inter-alia important. They are complementary. In recommend medium term measures of addition to this the underlying growth trends promotion of Digital Payments Ecosystem in Digital Payments over the last seven in the country. The Committee submitted its years are also covered in this booklet. final report to Hon’ble Finance Minister in December 2016. One of the key This booklet has some new chapters which recommendations of the Committee related cover the areas of policy developments, to development of a metric for Digital global trends and opportunities in Digital Payments. As a follow-up on this a group of Payments. In the policy space the important Stakeholders from Different Departments of developments with respect to the Government of India and RBI was amendment of the Payment and Settlement constituted in NITI Aayog under my Act 2007 are covered. chairmanship to facilitate the work relating I am grateful to Governor, RBI, Secretary to development of the metric. This group MeitY and CEO, NPCI for their support in prepared a document on the measurement preparing this booklet. Shri. B.N. Satpathy, issues of Digital Payments. Accordingly, a Senior Consultant, EAC-PM and Shri. booklet titled “Digital Payments: Trends, Suneet Mohan, Young Professional, NITI Issues and Challenges” was prepared in Aayog have played a key role in compiling May 2017 and was released by me in July this booklet. -

Siblink March 16.Pmd

Personnel Department is awarded ISO 9001:2008 Certification: MD & CEO Mr. V G Mathew receiving the ISO 9001:2008 Certificate from Mr. Shashi Nath Mishra, Global Head, IRQS in the presence of Mr. Paul V L, General Manager (Admin). Objectives: To instil in the bank staff a sense of belonging and involvement in the bank’s affairs To appreciate and applaud the individual achievements of our members of staff Corporate Family Magazine of To act as a communication medium between management and the staff South Indian Bank To increase the professional competence of our bank staff Advisory Board: INSIDE Mr. Sivakumar G. Executive Vice President (Credit) Messages Mr. Paul V.L. General Manager (Admin) Articles Mr. John Thomas General Manager (Business Development) Profitability – A leisure time Thought! Sreekumar Chengath BANKING PROFITABILITY An Indian Story Edition Anoop Abraham George Members: Customer Service is the Best Marketing Strategy Linto Abraham Mr. Sibi P.M. Sustainable Profit Planning Strategies Biju E. Punnachalil Dy. General Manager (IRMD) SIB FY 2015- The Era of Digital Innovation Begins Seethalakshmi H. Mr. Krishnadas P.B. The Great Indian Stress Test Bino George Dy. General Manager (Credit) PRADHAN MANTRI YOJANA’s – A WIN – WIN GAME Charan Deep Singh Mr. Roy Dominic P. 69 and still counting..... Christo Paul Asst. General Manager (Personnel) Media Buzz Corporate Communication Team Mr. Bino George Regular Features Manager P&D Layout, Typeset & Printing: Publisher: Editor: Lumiere Printing Works, Thrissur Mr. Thomas Joseph K., Executive Vice President (Admin) Mr. Francy Jos E. 2 VISION To be the most preferred bank in the areas of customer service, stakeholder value and corporate governance. -

Certificates of Authorisation Issued by the Reserve Bank of India Under the Payment and Settlement Systems Act, 2007 For

Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India A. Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India The Payment and Settlement Systems Act, 2007 along with the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008 have come into effect from 12th August, 2008. The list of 'Payment System Operators’ authorised by the Reserve Bank of India to set up and operate in India under the Payment and Settlement Systems Act, 2007 is as under: Sr. Name of the Address of the Payment System Date of issue of No. Authorised Entity Principal Office Authorised Authorisation & Validity Period (given in brackets) Financial Market Infrastructure 1. The Clearing The Managing i. Securities Corporation of India Director, segment covering 11.02.2009 Ltd. Clearing Corp. Govt Securities; of India, ii. Forex 5th, 6th & 7th Settlement floor Trade Segment -do- World, comprising of “C” Wing sub-segments Kamala City, SB a. USD-INR Marg, segment, -do- Lower Parel b. CLS segment – (West) Mumbai Continuous 400 013 Linked Settlement -do- (Settlement of Cross Currency Deals), c. Forex Forward -do- segment; iii. Rupee Derivatives Segment-Rupee denominated trades in IRS & FRA. Retail Payments Organisation 2. National Payments The Chief i. National Corporation of India Executive Financial Switch Officer, (NFS) 15.10.2009 National ii. Immediate Payments Payment System 12.10.2010 Corporation of (IMPS) India, iii. -

Most Admired Bank by All Stakeholders OUR MISSION Devote Balanced Attention to the Interests and Expectations of Stakeholders, and in Particular

Safe Harbour This document contains certain forward-looking statements based on current expectations of The Federal Bank Limited management. Actual results may vary significantly from the forward–looking statements contained in this document due to various risks and political conditions in India and outside India, volatility in interest rates and in the securities market, new regulations and Government policies that may impact the businesses for The Federal Bank Limited as well as its ability to implement the strategy. The Federal Bank Limited does not undertake to update these statements. This documents does not constitute an offer or recommendation to buy or sell any securities of The Federal Bank Limited or any of its subsidiaries and associate companies. This document also does not constitute an offer or recommendation to buy or sell any financial products offered by The Federal Bank Limited. Figures for the previous year have been regrouped wherever necessary to conform to current year’s presentation. Content About our Bank 04 Performance Dashboard 05 Message from Chairman 08 Message from MD & CEO 10 Board of Directors & Management Team 12 Directors' Report 15 Management Discussion and 49 Analysis Corporate Governance 67 Financial Statement of Federal Bank 88 Basel III Disclosures 155 Consolidated Financial Statement 179 From AOC - I 219 Glimpses of events 221 2 THE DELECTABLE FEDERAL PIE The Federal Pie is a metaphor for the diverse strengths and attributes of Federal Bank. It captures the solidity as well as the agility of an organization that has withstood the vicissitudes of time with aplomb. The bank’s Home Market Dominance, robust Capital Structure, evergrowing NR business, State-of-the Art Digital Capabilities, high quality Liability Fran- chise and adaptive Credit Processes are the ingredients that make this pie delectable for investors and customers alike. -

THE STUDY of VARIOUS FINANCIAL PRODUCTS OFFERED by STANDARD CHARTERED BANK Submitted in Partial Fulfilment for the Award Of

THE STUDY OF VARIOUS FINANCIAL PRODUCTS OFFERED BY STANDARD CHARTERED BANK Submitted in Partial Fulfilment for the Award of the Degree of Bachelor in Business Administration 2010-2012 Under the guidance of: Submitted by: Mr. Manoj Verma (senior scale) Maharaja Agrasen Institute of Management Studies Affiliated to Guru Gobind Singh Indraprastha University, Delhi PSP Area, Plot No.1, Sector-22, Rohini-Delhi 110086 STUDENT DECLARATION This is to certify that I have completed the Summer Project titled ―THE STUDY OF STANDARD CHARTERED BANK‖ under the guidance of ―Mr. Manoj Verma‖ in partial fulfilment of the requirement for the award of Degree of Bachelor of Business Administration at Maharaja Agrasen Institute of Management Studies, Delhi. This is an original piece of work and I have not submitted it earlier elsewhere. Date: 21st October, 2010 Signature: Place: Delhi Name: CERTIFICATE FROM THE INSTITUTE GUIDE This is to certify that the summer project titled ―THE STUDY OF STANDARD CHARTERED BANK‖ is an academic work done by ―‖ submitted in the partial fulfilment of the requirement for the award of the degree of Bachelor of Business Administration at Maharaja Agrasen Institute of Management Studies, Delhi, under my guidance and direction. To the best of my knowledge and belief the data and information presented by her in the project has not been submitted earlier. Signature: Name of the Faculty: Mr. Manoj Verma Designation: Assistant professor (senior scale) ACKNOWLEDGEMENT I gratefully acknowledges the valuable contribution of the following persons in completing my project report. They have been a great help and support in making my project. I am very thankful to them. -

A Study on Non Performing Assets of Public Sector Banks in India with Special Reference to State Bank of Travancore”

“A STUDY ON NON PERFORMING ASSETS OF PUBLIC SECTOR BANKS IN INDIA WITH SPECIAL REFERENCE TO STATE BANK OF TRAVANCORE” Thesis submitted to Cochin University of Science and Technology for the award of the Degree of Doctor of Philosophy under the Faculty of Social Sciences by SIRAJ.K.K Reg.No.3355 Under the guidance of Prof.(Dr.) P.SUDARSANAN PILLAI Chairman, Board of Studies in Commerce CUSAT SCHOOL OF MANAGEMENT STUDIES COCHIN UNIVERSITY OF SCIENCE AND TECHNOLOGY COCHIN – 682 022 February 2014 A Study on Non Performing Assets of Public Sector Banks in India with Special Reference to State Bank of Travancore Ph.D. Thesis under the Faculty of Social Sciences Author Siraj K.K Research Scholar School of Management Studies Cochin University of Science and Technology Kochi – 682 022 Email: Supervising Guide Prof (Dr.) P. Sudarsanan Pillai Chairman Board of Studies in Commerce Cochin University of Science and Technology Kochi – 682 022 Email: School of Management Studies Cochin University of Science and Technology Kochi – 682 022 February 2014 Prof. (Dr.) P. SUDARSANAN PILLAI School of Management Studies Chairman Cochin University of Science and Technology Board of Studies in Commerce Kochi – 682 022 Date:……………………… This is to certify that the thesis entitled “A Study on Non Performing Assets of Public Sector Banks in India With Special Reference to State Bank of Travancore” submitted by Mr. Siraj. K. K. to Cochin University of Science and Technology, for the award of the Degree of Doctor of Philosophy under the Faculty of Social Science is a record of bona fide research work carried out under my guidance and supervision and that it has not previously formed the basis for the award of any Degree, Diploma, Associateship, Fellowship or any other similar titles of any University or Institution. -

Banking Industry and the Future: a New Paradigm (Interview with Meera Sanyal) Shashank Shah [email protected]

The Journal of Values-Based Leadership Volume 9 Article 7 Issue 1 Winter/Spring 2016 January 2016 Banking Industry and the Future: A New Paradigm (Interview with Meera Sanyal) Shashank Shah [email protected] Follow this and additional works at: http://scholar.valpo.edu/jvbl Part of the Business Commons Recommended Citation Shah, Shashank (2016) "Banking Industry and the Future: A New Paradigm (Interview with Meera Sanyal)," The Journal of Values- Based Leadership: Vol. 9 : Iss. 1 , Article 7. Available at: http://scholar.valpo.edu/jvbl/vol9/iss1/7 This Interview is brought to you for free and open access by the College of Business at ValpoScholar. It has been accepted for inclusion in The ourJ nal of Values-Based Leadership by an authorized administrator of ValpoScholar. For more information, please contact a ValpoScholar staff member at [email protected]. A Series on Values-Based Business and Stakeholders Management: Case Studies and Interviews Banking Industry and the Future: A New Paradigm DR. SHASHANK SHAH VISITING SCHOLAR, HARVARD BUSINESS SCHOOL, USA Introduction to the Interviewee Prior to her entry into India’s political system, Meera Sanyal directed her time and talent to consumer, commercial, and investment banking space for three decades. She started her career in 1984 with Grindlays Bank PLC (now a part of the Standard Chartered Group). In 1987, she joined Lazard as Head, International Finance and Advisory Services. She joined ABN Amro in 1992 as Head of Structured Finance and was responsible for setting up the Corporate Finance and Project Finance business in India. In 1997, she took over as Head of Corporate Finance Advisory for Asia (based out of Singapore) and was in charge of several restructuring mandates to build profitability post-Asian crisis. -

Secretarial Department

Secretarial Department SD/F24/42/2020-21 June 24, 2020 The Manager The Manager Listing Department Department of Corporate Services The National Stock Exchange of India BSE Limited Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, Bandra-Kurla Complex, Floor 25, Dalal Street, Mumbai – 400 001 Bandra (E), Mumbai – 400 051 Re.: Scrip Symbol: FEDERALBNK/Scrip Code: 500469 Sub: Annual General Meeting (AGM) – Notice of 89th AGM, Annual Report 2019-20, Intimation of Book Closure and e-voting related matters Dear Madam/ Sir, The 89th AGM of the Bank will be held on Thursday, July 16, 2020 at 11 a.m. IST through Video Conferencing / Other Audio Visual Means. In accordance with circulars issued by Ministry of Corporate Affairs (MCA), shareholders will be able to attend and participate in the AGM only through VC / OAVM. Pursuant to Regulation 34(1) of Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Listing Regulations”), we are submitting herewith the Annual Report of the Bank along with the Notice of AGM for the financial year 2019- 20 which is being sent through electronic mode to the Members of the Bank. Pursuant to Regulation 42 of SEBI Listing Regulations, the Register of Members and the Share Transfer Books of the Bank shall remain closed from July 11, 2020 to July 16, 2020 (both days inclusive). Details of the book closure are as follows: Scrip Code/ Stock Type of Book Closure Record Purpose Symbol Exchange Security Date 500469 BSE Limited Equity Saturday, July 11, Nil 89th FEDERALBNK National Stock Shares 2020 to Thursday, AGM Exchange of July 16, 2020 (both India Limited days inclusive) The Bank is providing electronic voting facility to its members to exercise their right to vote by electronic means on any or all the items of business as set out in the Notice, through National Securities Depository Limited, (NSDL) e-voting platform, which will commence on Monday, July 13, 2020 at 9:00 am and ends on Wednesday, July 15, 2020 at 5:00 pm. -

Sl. No. Bank Code Name Routing Code 1 YESB YES BANK

Routing codes used in API E-Mandates Sl. No. Bank Code Name Routing Code 1 YESB YES BANK YESB0000001 2 AACX AKHAND ANAND CO OP BANK LTD HDFC0CAACOB 3 ABCX THE AURANGABAD DISTRICT CENTRAL CO OP BANK LTD YESB0AURDCC 4 ABDX DR AMBEDKAR NAGRIK SAHAKARI BANK MYDT GWALIOR YESB0ANBL01 5 ABHY ABHYUDAYA CO OP BANK ABHY0065001 6 ABPB ADITYA BIRLA IDEA PAYMENTS BANK LTD ABPB0000001 7 ABSB THE ABHINAV SAHAKARI BANK LTD SVCB0007002 8 ABUX ABHINANDAN URBAN CO OP BANK AMRAVATI HDFC0CMAN01 9 ACAX THE ASSAM CO OP APEX BANK LTD HDFC0CACABL 10 ACBX ADARSH CO OP BANK LTD HDFC0CADARS 11 ACCX ACE CO OP BANK LTD IBKL0100ACB 12 ACKX ANNASAHEB CHOUGULE URBAN CO OP BANK LTD HDFC0CDACUB 13 ACOX AMARNATH CO OP BANK LTD HDFC0CAMARN 14 ACUB THE ARYAPURAM CO OP URBAN BANK LTD HDFC0CACUB9 15 ACUX THE ADARSH CO OP URBAN BANK LTD ICIC00ADRSH 16 ADBX THE AHMEDABAD DISTRICT CO OP BANK LTD GSCB0ADC001 17 ADCB ABU DHABI COMMERCIAL BANK ADCB0000001 18 ADCC THE AKOLA DISTRICT CENTRAL CO OP BANK LTD ADCC0000001 19 ADCX SHRI ADINATH CO OP BANK LTD HDFC0CSACBL 20 ADDX THE ADILABAD DISTRICT CO OP CENTRAL BANK LTD APBL0019001 21 AGCX THE AGRASEN CO OP URBAN BANK LTD YESB0ACUB01 22 AGDX AGRA DISTRICT CO OP BANK LTD ICIC00AGDCB 23 AGRX AGROHA CO OP URBAN BANK LTD KKBK0ACUB01 24 AGSX THE AGRASEN NAGARI SAHAKARI BANK LTD HDFC0CTANSB 25 AGUX AGARTALA CO OP URBAN BANK LTD UTIB0SACUB1 26 AGVX ASSAM GRAMIN VIKASH BANK UTBI0RRBAGB 27 AHMX THE AHMEDNAGAR DISTRICT CENTRAL CO OP BANK LTD ICIC00ADCCB 28 AHUX AHILYADEVI URBAN CO OP BANK LTD SOLAPUR IBKL0478ADC 29 AIRP AIRTEL PAYMENTS BANK LTD