THE STUDY of VARIOUS FINANCIAL PRODUCTS OFFERED by STANDARD CHARTERED BANK Submitted in Partial Fulfilment for the Award Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation

5/7/2019 [ Press Release ] Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Ratings-London-07 May 2019: Fitch Ratings has placed 31 Short-Term (ST) Issuer Default Ratings (IDR) and related ST debt level ratings of EMEA-based banks Under Criteria Observation (UCO) following the publication of its cross-sector criteria for Short-Term Ratings on 2 May 2019. A full list of rating actions is below. Fitch intends to conclude full implementation of the criteria, and resolution of all UCO designations within six months of the designation. KEY RATING DRIVERS The ST ratings of the affected banks are determined primarily by correspondence tables linking short-term to long-term ratings. The new ST rating criteria introduced changes to our correspondence table between long-term and ST ratings. Two new cusp points at 'A' and 'BBB+' have been added to the existing three cusp points ('A+', 'A-' and 'BBB'), where baseline or higher ST ratings can be assigned. For banks with Long-Term IDRs driven by their standalone profile, as reflected by their Viability Ratings (VR), Fitch uses the funding and liquidity factor score as the principal determinant of whether the 'baseline' or 'higher' ST IDR is assigned at each cusp point. The ST IDRs and, where relevant, associated ST debt/deposit ratings of the following issuers have been placed UCO because the ratings could be upgraded by one notch under the new criteria. This is because the latest funding and liquidity scores that feed into their VRs are at least in line with the minimum levels required for a higher ST rating under the new criteria: - Banco Cooperativo Espanol, S.A. -

November 16, 2018 Certificates of Authorisation Issued by the Reserve Bank of India Under the Payment and Settlement Syst

Date : November 16, 2018 Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India A. Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India The Payment and Settlement Systems Act, 2007 along with the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008 have come into effect from 12th August, 2008. The list of 'Payment System Operators’ authorised by the Reserve Bank of India to set up and operate in India under the Payment and Settlement Systems Act, 2007 is as under: Sr. Name of the Address of the Payment System Date of issue of No. Authorised Principal Office Authorised Authorisation Entity & Validity Period (given in brackets) Financial Market Infrastructure 1. The Clearing The Managing i. Securities 11.02.2009 Corporation of Director, segment covering India Ltd. Clearing Corp. of Govt Securities; India, ii. Forex 5th, 6th & 7th floor Settlement Trade World, Segment -do- “C” Wing Kamala comprising of sub- city, SB Marg, segments Lower Parel (West) a. USD-INR Mumbai 400 013 segment, -do- b. CLS segment – Continuous Linked Settlement (Settlement of Cross Currency -do- Deals), c. Forex Forward segment; iii. Rupee Derivatives -do- Segment-Rupee denominated trades in IRS & FRA. Retail Payments Organisation 2. National The Chief Executive i. National Payments Officer, Financial Switch Corporation of National Payments (NFS) 15.10.2009 India Corporation of ii. -

(Winner)MCB Bank Limited Best Bank of the Year 2017 – Mid Size Banks

Banking: Best Bank of the year 2017 – Large Size Banks (Winner)MCB Bank Limited Best Bank of the year 2017 – Mid Size Banks (Winner) Bank Al Habib Limited Best Bank of the year 2017 – Small Size Banks Industrial and Commercial Bank of China (Winner) Limited Best Islamic Window of the year 2017 (Winner) Habib Bank Limited Best Islamic Bank of the year 2017 (Winner) Meezan Bank Limited Corporate Finance: Transaction of the year 2017 (Winner) Habib Bank Limited for Dasu Hydropower Project Best Corporate Finance House of the year (Fixed Income) 2017 United Bank Limited (Winner) Best Corporate Finance House of the year (Fixed Income) 2017Habib Bank Limited (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) - Banks Bank Alfalah Limited 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) - Banks United Bank Limited 2017 (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) – Arif Habib Limited Security Firms 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) – AKD Securities Limited Security Firms 2017 (Runner-up) Investor Relations: Best Investor Relations – Listed Companies 2017 (Winner) Bank Alfalah Limited Best Investor Relations – Listed Companies 2017 (Runner-up) Engro Fertilizers Limited Women in Finance Initiative: Gender Diversity at Workplace Award 2017 (Winner) Unilever Pakistan Limited Recognizing Gender Diversity Award – Special Recognition: Local National Foods Limited Industry 2017 (Winner) Recognizing Gender Diversity Award – Special Recognition: -

Global Finance Names the World's Best Investment Banks 2020

Global Finance Names The World’s Best Investment Banks 2020 NEW YORK, February 10, 2020 – Global Finance magazine has named the 21st annual World’s Best Investment Banks in an exclusive survey to be published in the April 2020 issue. Winning organizations will be honored at an awards ceremony on the evening of March 26 at Sea Containers London. J.P. Morgan was honored as the Best Investment Bank in the world for 2020. About Global Finance “Investment banking is a critical factor driving global growth. Global Finance’s Best Global Finance, founded in Investment Bank awards identify the financial institutions that deliver innovative and 1987, has a circulation of practical solutions for their clients in all kinds of markets,” said Joseph D. Giarraputo, 50,000 and readers in 188 publisher and editorial director of Global Finance. countries. Global Finance’s audience includes senior Global Finance editors, with input from industry experts, used a series of criteria— corporate and financial including entries from banks, market share, number and size of deals, service and officers responsible for making investment and strategic advice, structuring capabilities, distribution network, efforts to address market decisions at multinational conditions, innovation, pricing, after-market performance of underwritings and companies and financial market reputation—to score and select winners, based on a proprietary algorithm. institutions. Its website — Deals announced or completed in 2019 were considered. GFMag.com — offers analysis and articles that are the legacy For editorial information please contact Andrea Fiano, editor: [email protected] of 33 years of experience in international financial markets. Global Finance is headquartered in New York, with offices around the world. -

Competition Commission Addresses Exclusionary Conveyancing Practices in the Banking Industry

Media Statement For Immediate Release 17 July 2020 COMPETITION COMMISSION ADDRESSES EXCLUSIONARY CONVEYANCING PRACTICES IN THE BANKING INDUSTRY The Competition Commission (Commission) is pleased to announce commitments made by Standard Bank, Investec, FNB and Nedbank, to reform their conveyancing practices, following advocacy engagements over the past two years. The banks’ renewed commitment is in response to concerns raised by the Commission on the relationship between banks and conveyancers, which is governed through Service Level Agreements (SLAs) and structured in an exclusionary and anti-competitive manner. In February 2018, the Commission conducted the advocacy engagements following a complaint that was filed by Mr Michael Monthe (Mr Monthe) against Standard Bank. In the complaint, Mr Monthe alleged that he had approached about several law firms in the area where he resides for assistance to institute legal action against Standard Bank. Mr Monthe alleged all the law firms that he had approached refused to take on his matter on the basis that they are part of the SBSA’s panel of attorneys and that they are conflicted in terms of their Service Level Agreements (“SLA’s”) with Standard Bank. Further, the Commission established that the practice of restrictive SLAs for conveyancing services extended to other major banks, namely, Investec, FNB and Nedbank. Following the engagements between the Commission, Standard Bank, Investec, FNB and Nedbank, it was agreed that contractual clauses that prevented law firms appointed to provide conveyancing services from acting against the banks on any matter should be removed. These exclusionary clauses created barriers for small and particularly firms owned by historically disadvantaged persons to expand in the market. -

The Standard Bank of South Africa

The Standard Bank of South Africa Annual report 2013 About Standard Bank Contents About this report 3 Established in 1862, the Standard Bank of South Africa (SBSA or Standard Bank) is one of South Africa’s oldest Our business companies. The bank’s original vision was to understand its How we make money 4 customers better, have people with strong knowledge of local How we create socioeconomic value 6 business conditions and to connect borrowers with lenders. This vision created the platform for the kind of bank it has Our performance become and the qualities on which its customers and clients Chief executive’s review 8 rely. Over its history, Standard Bank has grown and extended Executive committee 12 its roots deep into the fabric of South African society. Finance review 14 We have evolved and adapted along with our customers and Seven-year review 24 clients, growing a rich heritage while nurturing and protecting Sustainability report 28 our reputation. We uphold high standards of corporate Risk and capital management report 46 governance, are committed to advancing the principles and practices of sustainable development, and are inspired to Governance and transparency advance national development objectives. Our success and Corporate governance report 101 growth over the long term is built on making a difference in Our board of directors 103 the communities in which we operate. Annual financial statements Directors’ responsibility for financial reporting 122 Group secretary’s certification 122 Report of the audit committee 123 Salient -

Standard Settlement Instructions

STANDARD SETTLEMENT INSTRUCTIONS For Account of: Bank Leumi (UK) PLC SWIFT: LUMIGB22WES Further Credit to: Your beneficiary account name & number in full AUD - AUSTRALIAN DOLLAR Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: Australia and New Zealand Banking Group SWIFT: ANZBAU3MXXX CAD – CANADIAN DOLLAR Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: Royal Bank of Canada, Toronto SWIFT: ROYCCAT2XXX CHF – SWISS FRANC Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: UBS Switzerland AG, Zurich SWIFT: UBSWCHZH80A CNY - CHINESE YUAN RENMINBI Pay to Bank: Hongkong & Shanghai Banking, Hong Kong SWIFT: HSBCHKHHHKH CZK – CZECH KORUNA Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: Ceskoslovenska Obchodni Banka AS, Prague SWIFT: CEKOCZPPXXX DKK – DANISH KRONE Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX EUR – EURO Pay to Bank: J.P. Morgan AG. Frankfurt SWIFT: CHASDEFXXXX EUR – EURO Pay to Bank: J.P. Morgan AG. Frankfurt SWIFT: CHASDEFXXXX 1 STANDARD SETTLEMENT INSTRUCTIONS For Account of: Bank Leumi (UK) PLC SWIFT: LUMIGB22WES Further Credit to: Your beneficiary account name & number in full GBP – STERLING (CHAPS / UK SETTLEMENTS) Sort Code: 30-14-95 GBP – STERLING (INTERNATIONAL) Pay to Bank: HSBC, London SWIFT: MIDLGB22XXX HKD – HONG KONG DOLLAR Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: JPMorgan Chase Bank, Hong Kong Branch SWIFT: CHASHKHHXXX HUF – HUNGARIAN FORINT Pay to Bank: JPMorgan Chase Bank, N.A. London SWIFT: CHASGB2LXXX Cover Through: UniCredit Bank Hungary SWIFT: BACXHUHBXXX ILS – ISRAELI SHEKEL Pay to Bank: Bank Leumi Le-Israel BM, Tel Aviv SWIFT: LUMIILITXXX JPY – JAPANESE YEN Pay to Bank: JPMorgan Chase Bank, N.A. -

Brown Brothers Harriman Global Custody Network Listing

BROWN BROTHERS HARRIMAN GLOBAL CUSTODY NETWORK LISTING Brown Brothers Harriman (Luxembourg) S.C.A. has delegated safekeeping duties to each of the entities listed below in the specified markets by appointing them as local correspondents. The below list includes multiple subcustodians/correspondents in certain markets. Confirmation of which subcustodian/correspondent is holding assets in each of those markets with respect to a client is available upon request. The list does not include prime brokers, third party collateral agents or other third parties who may be appointed from time to time as a delegate pursuant to the request of one or more clients (subject to BBH's approval). Confirmations of such appointments are also available upon request. COUNTRY SUBCUSTODIAN ARGENTINA CITIBANK, N.A. BUENOS AIRES BRANCH AUSTRALIA CITIGROUP PTY LIMITED FOR CITIBANK, N.A AUSTRALIA HSBC BANK AUSTRALIA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) AUSTRIA DEUTSCHE BANK AG AUSTRIA UNICREDIT BANK AUSTRIA AG BAHRAIN* HSBC BANK MIDDLE EAST LIMITED, BAHRAIN BRANCH FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BANGLADESH* STANDARD CHARTERED BANK, BANGLADESH BRANCH BELGIUM BNP PARIBAS SECURITIES SERVICES BELGIUM DEUTSCHE BANK AG, AMSTERDAM BRANCH BERMUDA* HSBC BANK BERMUDA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BOSNIA* UNICREDIT BANK D.D. FOR UNICREDIT BANK AUSTRIA AG BOTSWANA* STANDARD CHARTERED BANK BOTSWANA LIMITED FOR STANDARD CHARTERED BANK BRAZIL* CITIBANK, N.A. SÃO PAULO BRAZIL* ITAÚ UNIBANCO S.A. BULGARIA* CITIBANK EUROPE PLC, BULGARIA BRANCH FOR CITIBANK N.A. CANADA CIBC MELLON TRUST COMPANY FOR CIBC MELLON TRUST COMPANY, CANADIAN IMPERIAL BANK OF COMMERCE AND BANK OF NEW YORK MELLON CANADA RBC INVESTOR SERVICES TRUST FOR ROYAL BANK OF CANADA (RBC) CHILE* BANCO DE CHILE FOR CITIBANK, N.A. -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

COMPARATIVE ANALYSIS of FINANCIAL PERFORMANCE and GROWTH of CONVENTIONAL and ISLAMIC BANKS of PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar

COMPARATIVE ANALYSIS OF FINANCIAL PERFORMANCE AND GROWTH OF CONVENTIONAL AND ISLAMIC BANKS OF PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar. Email: [email protected] Wali Rahman, Associate Professor, Sarhad University of Science & IT, Peshawar. Email: [email protected] Saeedullah Jan, Khushal Khan Khattak University, Karak. Email: [email protected] Mustaq Khan, Abasyn University of Science & IT, Peshawar Email: [email protected] Abstract. Various types of the banking system are operating in the world. The most commons are conventional and Islamic. Customers evaluate these systems before they decide in invest. The prime aim of this study is to assess and compare the financial performance and growth of conventional and Islamic banks operating in Pakistan. Banks offer different types of products and services for the satisfaction of customers for their financial needs. Conventional banking is based on interest while Islamic banking offers interest-free banking. To compare their respective performance financial ratios are applied. In Pakistan, Habib Bank Limited and Allied Bank Limited are typical examples of the conventional banking whereas Dubai Islamic Bank Limited and Meezan Bank Limited are operating as Islamic banking. Three (03) years data were obtained from the “Financial Statement Analysis of Financial Sector of Pakistan 2009-2011” State Bank of Pakistan publication. The analyses reflect that the liquidity ratio of Islamic banks appeared higher as compared to conventional banks, whereas the profitability and solvency ratios of conventional banks were comparatively higher than Islamic banks. Debt to asset ratio of Islamic banks seemed better than conventional banks due to low debt financing. Also, with regard to expansion, the growth rate of Islamic banks in Pakistan is comparatively higher than conventional banks. -

Standard Chartered Bank Zambia Annual Report 2017

New valued behaviours REPORT STRATEGIC 1. Do the right thing 2. Never settle 3. Better together Directors’ report Contents 02 Chairman’s statement 04 Chief Executive Officer’s statement 06 Retail banking 08 Commercial banking 10 Corporate and Institutional banking statements Financials 12 Wealth management 14 Board of Directors 16 Executive Management Team 18 Directors’ report 22 Corporate governance 26 Sustainability 29 Directors’ responsibilities in respect of the preparation of consolidated and separate financial statements 30 Independent auditor’s report 34 Consolidated and separate statement of profit or loss Supplementary information and other comprehensive income 35 Consolidated and separate statement of financial position 36 Consolidated and separate statement of changes in equity 39 Consolidated and separate statement of cash flows 40 Notes to the consolidated and separate financial statements 100 Appendix – Five year summary 101 Principal Addresses 102 Branch Network 103 Dividend 104 Notice of 47th Annual General Meeting Agenda 105 Form of Proxy 1 STRATEGIC REPORT Chairman’s statement Chairman’s statement Annual Report 2018 Earnings per share stemming over 110 years. The potential Risk and Governance to grow the business remains huge, positioning the Bank to grow its strategic Risk continues to be at the forefront Z M W 0.171 footprint across different client profiles. It of every aspect of our business. It 2016: 0.208 is clear from the interaction I have had so is imperative that we continue to be far with both clients and employees that vigilant so that we stay ahead and they appreciate the value of our brand. It mitigate possible economic and social is therefore, our responsibility to ensure headwinds. -

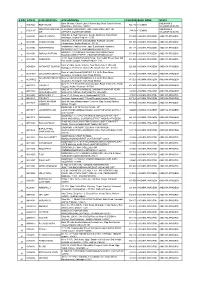

S No Atm Id Atm Location Atm Address Pincode Bank

S NO ATM ID ATM LOCATION ATM ADDRESS PINCODE BANK ZONE STATE Bank Of India, Church Lane, Phoenix Bay, Near Carmel School, ANDAMAN & ACE9022 PORT BLAIR 744 101 CHENNAI 1 Ward No.6, Port Blair - 744101 NICOBAR ISLANDS DOLYGUNJ,PORTBL ATR ROAD, PHARGOAN, DOLYGUNJ POST,OPP TO ANDAMAN & CCE8137 744103 CHENNAI 2 AIR AIRPORT, SOUTH ANDAMAN NICOBAR ISLANDS Shop No :2, Near Sai Xerox, Beside Medinova, Rajiv Road, AAX8001 ANANTHAPURA 515 001 ANDHRA PRADESH ANDHRA PRADESH 3 Anathapur, Andhra Pradesh - 5155 Shop No 2, Ammanna Setty Building, Kothavur Junction, ACV8001 CHODAVARAM 531 036 ANDHRA PRADESH ANDHRA PRADESH 4 Chodavaram, Andhra Pradesh - 53136 kiranashop 5 road junction ,opp. Sudarshana mandiram, ACV8002 NARSIPATNAM 531 116 ANDHRA PRADESH ANDHRA PRADESH 5 Narsipatnam 531116 visakhapatnam (dist)-531116 DO.NO 11-183,GOPALA PATNAM, MAIN ROAD NEAR ACV8003 GOPALA PATNAM 530 047 ANDHRA PRADESH ANDHRA PRADESH 6 NOOKALAMMA TEMPLE, VISAKHAPATNAM-530047 4-493, Near Bharat Petroliam Pump, Koti Reddy Street, Near Old ACY8001 CUDDAPPA 516 001 ANDHRA PRADESH ANDHRA PRADESH 7 Bus stand Cudappa, Andhra Pradesh- 5161 Bank of India, Guntur Branch, Door No.5-25-521, Main Rd, AGN9001 KOTHAPET GUNTUR 522 001 ANDHRA PRADESH ANDHRA PRADESH Kothapeta, P.B.No.66, Guntur (P), Dist.Guntur, AP - 522001. 8 Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW8001 GAJUWAKA BRANCH 530 026 ANDHRA PRADESH ANDHRA PRADESH 9 Gajuwaka, Anakapalle Main Road-530026 GAJUWAKA BRANCH Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW9002 530 026 ANDHRA PRADESH ANDHRA PRADESH