Embracer Group Acquires Aspyr Media

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

Embracer Group Acquires Easy Trigger

Press release Karlstad, Sweden, 5 August 2021 Embracer Group acquires Easy Trigger Embracer Group AB (“Embracer”) through its wholly owned subsidiary Coffee Stain Studios AB ("Coffee Stain"), have entered into an agreement to acquire 100 percent of the shares in Easy Trigger AB ("Easy Trigger"), the studio behind the critically acclaimed title Huntdown. “We have worked with Easy Trigger for a couple of years already on the Huntdown game and are impressed with talent within the studio. We will continue to work closely with the team and are excited welcome them into the Embracer family”, says Anton Westbergh, Co-founder and CEO Coffee Stain. Background and rationale Easy Trigger is a development studio founded in 2016, with headquarters located in Trollhättan, Sweden. The studio consists of 5 employees that have collaborated with Coffee Stain on the development and release of the critically acclaimed indie title Huntdown. Easy Trigger is led by co-founder and CEO Tommy Gustafsson, and co- founder and lead programmer Andreas Renberg. The company was wholly owned by the two co-founders who will remain in their current roles post-transaction. Through the acquisition, Coffee Stain onboards a talented team that will boost the development of 1st party IP within the group. Going forward, Easy Trigger will collaborate with Coffee Stain to continue working on the Huntdown IP as well as creating new original indie titles. “We look forward to continuing our partnership with Coffee Stain and further leverage the knowledge and experience within the entire Embracer Group, to accelerate growth within Easy Trigger and continue to make great games” says Tommy Gustafsson, Co-founder and CEO Easy Trigger. -

Read Full Report (PDF)

Equity Research - 09 August 2021 21:00 CET Embracer Group Reason: Preview of results Plenty to like despite negative sentiment Company sponsored research ABGSC Q1e adj. EBIT SEK 1,137m, -9% vs. consensus Not rated Raising adj. EPS by 1-5% ’21/22e-’23/24e on M&A Raising fair value to SEK 225-350 (225-345) per share Estimate changes (%) 2021e 2022e 2023e Q1’21/22e sales of SEK 3,249m, +57% y-o-y (~19% organic) Sales 7.3% 12.7% 13.9% For Q1’21/22e, we factor in sales of SEK 3,249m (-2.3% vs. FactSet EBIT (rep) -62.5% nm nm consensus), for total y-o-y growth of 57.1%, but organic growth of 19.5% EPS (rep) -49.1% nm nm when adjusting for M&A and FX. We consider this a strong performance Source: ABG Sundal Collier in the 2021 quarter facing the toughest COVID-19-boosted comparables. 09/08/2021 The largest revenue driver in the quarter is Biomutant by our estimate, Share price (SEK) 188.0 where we factor in ~1.4mn copies sold across all platforms. Given the Fair value range (per share) 225-350 economics of the game (internally developed & published on an own IP) this yields net sales of ~SEK 314m with a gross margin of 90.2%. Other IT, Sweden notable drivers include Metro Exodus Enhanced edition on PC and next- EMBRACB.ST/EMBRACB ST gen consoles, and SnowRunner on Steam/Switch. Overall, we estimate that Games will generate 80.9% of sales, driving a strong gross margin MCap (SEKm) 92,344 of 59.8% in the quarter. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

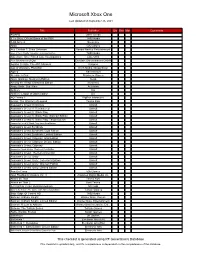

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

Inside the Video Game Industry

Inside the Video Game Industry GameDevelopersTalkAbout theBusinessofPlay Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman Downloaded by [Pennsylvania State University] at 11:09 14 September 2017 First published by Routledge Th ird Avenue, New York, NY and by Routledge Park Square, Milton Park, Abingdon, Oxon OX RN Routledge is an imprint of the Taylor & Francis Group, an Informa business © Taylor & Francis Th e right of Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman to be identifi ed as authors of this work has been asserted by them in accordance with sections and of the Copyright, Designs and Patents Act . All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. Trademark notice : Product or corporate names may be trademarks or registered trademarks, and are used only for identifi cation and explanation without intent to infringe. Library of Congress Cataloging in Publication Data Names: Ruggill, Judd Ethan, editor. | McAllister, Ken S., – editor. | Nichols, Randall K., editor. | Kaufman, Ryan, editor. Title: Inside the video game industry : game developers talk about the business of play / edited by Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman. Description: New York : Routledge is an imprint of the Taylor & Francis Group, an Informa Business, [] | Includes index. Identifi ers: LCCN | ISBN (hardback) | ISBN (pbk.) | ISBN (ebk) Subjects: LCSH: Video games industry. -

THQ Nordic (THQNO.ST)

COMPANY ANALYSIS 1 March 2018 Summary THQ Nordic (THQNO.ST) List: Power-up! Market Cap: 11,190 MSEK The company had an immense release schedule with loads of Industry: Gaming new content during the quarter. The reported numbers beat CEO: Lars Wingefors Chairman: Kicki Wallje-Lund our estimates. Even though that THQ Nordic produced a record quarter, the thing stole the spotlight was the announcement of the acquisition of Koch Media; we get into OMXS 30 THQ Nordic detail about the acquired company in this research update. 160 The acquisition is a prime example of THQ Nordic’s 140 acquisition strategy. We believe that the market is yet to fully 120 100 grasp the underlying value and cash flow generating 80 capabilities of THQ Nordic’s growing IP portfolio, which was 60 enhanced significantly by the acquirement. 40 20 We raised our Base-case valuation to 140 SEK per share 0 28-Feb 29-May 27-Aug 25-Nov 23-Feb based on a Back-Of-The-Envelope assessment on the same day as the acquisition. Following a more in-depth analysis, we increase our fair value estimate further to 168 SEK per share. We argue that the new addition to the Group was acquired at a low price and that the long-term possibilities following the purchase are vast. Redeye Rating (0 – 10 points) Management Ownership Profit outlook Profitability Financial strength 8.0 points 9.0 points 7.0 points 6.0 points 8.0 points Key Financials 2016 2017 2018E 2019E 2020E Share information Revenue, MSEK 302 508 3,666 3,909 4,300 Share price (SEK) 141.0 Growth 42% 68% 622% 7% 10% Number of shares (m) 79.4 EBITDA 132 273 929 1,009 1,212 Market Cap (MSEK) 11,190 EBITDA margin 44% 54% 25% 26% 28% Net cash (MSEK) 255 EBIT 95 188 616 696 849 Free float (%) 50 % EBIT margin 31% 37% 17% 18% 20% Daily turnover (’000) 60 Pre-tax earnings 93 182 616 696 849 Net earnings 72 139 480 543 662 Net margin 24% 27% 13% 14% 15% Analysts: Kristoffer Lindstrom 2016 2017 2018E 2019E 2020E [email protected] Dividend/Share 0.00 0.00 0.00 0.00 2.50 2016 2017 2018E 2019E 2020E EPS adj. -

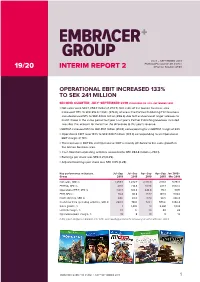

19/20 Interim Report 2 Reg No

JULY – SEPTEMBER 2019 EMBRACER GROUP AB (PUBL) 19/20 INTERIM REPORT 2 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 133% TO SEK 241 MILLION SECOND QUARTER, JULY–SEPTEMBER 2019 (COMPARED TO JULY–SEPTEMBER 2018) > Net sales were SEK 1,259.7 million (1,272.7). Net sales of the Games business area increased 117% to SEK 816.0 million (376.0), whereas the Partner Publishing/Film business area decreased 51% to SEK 443.6 million (896.6) due to the absence of larger releases to match those in the same period last year. Last year’s Partner Publishing revenues included two titles that account for more than the difference to this year’s revenue. > EBITDA increased 95% to SEK 418.1 million (214.8), corresponding to an EBITDA margin of 33%. > Operational EBIT rose 133% to SEK 240.7 million (103.4) corresponding to an Operational EBIT margin of 19%. > The increase in EBITDA and Operational EBIT is mainly attributed to the sales growth in the Games business area. > Cash flow from operating activities amounted to SEK 284.8 million (–740.1). > Earnings per share was SEK 0.21 (0.25). > Adjusted earnings per share was SEK 0.65 (0.28). Key performance indicators, Jul–Sep Jul–Sep Apr–Sep Apr–Sep Jan 2018– Group 2019 2018 2019 2018 Mar 2019 Net sales, SEK m 1,259.7 1,272.7 2,401.8 2,110.1 5,754.1 EBITDA, SEK m 418.1 214.8 807.6 421.7 1,592.6 Operational EBIT, SEK m 240.7 103.4 444.8 173.1 897.1 EBIT, SEK m 76.4 90.8 157.7 143.3 574.6 Profit after tax, SEK m 64.6 65.0 117.4 98.5 396.8 Cash flow from operating activities, SEK m 284.8 –740.1 723.1 –575.6 1,356.4 Sales growth, % –1 1,403 14 2,281 1,034 EBITDA margin, % 33 17 34 20 28 Operational EBIT margin, % 19 8 19 8 16 In this report, all figures in brackets refer to the corresponding period of the previous year, unless otherwise stated. -

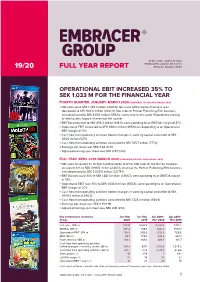

19/20 Full Year Report Reg No

APRIL 2019 – MARCH 2020 EMBRACER GROUP AB (PUBL) 19/20 FULL YEAR REPORT REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 35% TO SEK 1,033 M FOR THE FINANCIAL YEAR FOURTH QUARTER, JANUARY–MARCH 2020 (COMPARED TO JANUARY–MARCH 2019) > Net sales were SEK 1,339.1 million (1,630.5). Net sales of the Games business area decreased to SEK 903.5 million (1,034.9). Net sales of Partner Publishing/Film business area decreased to SEK 435.6 million (595.6), mainly due to the covid-19 pandemic closing of retail outlets towards the end of the quarter. > EBITDA amounted to SEK 495.2 million (618.6), corresponding to an EBITDA margin of 37%. > Operational EBIT amounted to SEK 286.0 million (395.9) corresponding to an Operational EBIT margin of 21%. > Cash flow from operating activities before changes in working capital amounted to SEK 384.6 million (527.1). > Cash flow from operating activities amounted to SEK 765.7 million (777.2). > Earnings per share was SEK 0.42 (0.37). > Adjusted earnings per share was SEK 0.97 (1.00). FULL YEAR, APRIL 2019–MARCH 2020 (COMPARED TO APRIL 2018–MARCH 2019) > Net sales increased 3% to SEK 5,249.4 million (5,121.2). Net sales of the Games business area grew 31% to SEK 3,196.5 million (2,447.1), whereas the Partner Publishing/Film business area decreased to SEK 2,052.9 million (2,674,1). > EBITDA increased 33% to SEK 1,821.3 million (1,366.7), corresponding to an EBITDA margin of 35%. -

Stubbs the Zombie: Rebel Without 21 Starship Troopers PC Continues to Set the Standard for Both Technology and Advancements in Gameplay

Issue 07 THE WAY It’s Meant To Be Played Peter Jackson’s King Kong Age Of Empires III Serious Sam 2 Blockbusters Enjoy the season’s hottest games on the hottest gaming platform Chronicles Of Narnia: The Lion, The Witch City Of Villains F.E.A.R And The Wardrobe NNVM07.p01usVM07.p01us 1 119/9/059/9/05 33:57:57:57:57 ppmm The way it’s meant to be played 3 6 7 8 Welcome Welcome to Issue 7 of The Way It’s Meant 12 13 to be Played, the magazine that showcases the very best of the latest PC games. All the 30 titles featured in this issue are participants in NVIDIA’s The Way It’s Meant To Be Played program, a campaign designed to deliver the best interactive entertainment experience. Development teams taking part in 14 19 the program are given access to NVIDIA’s hardware, with NVIDIA’s developer technology engineers on hand to help them get the very best graphics and effects into their new games. The games are then rigorously tested by NVIDIA for compatibility, stability and reliability to ensure that customers can buy any game with the TWIMTBP logo on the box and feel confident that the game will deliver the ultimate install- and-play experience when played with an Contents NVIDIA GeForce-based graphics card. Game developers today like to use 3 NVIDIA news 14 Chronicles Of Narnia: The Lion, Shader Model 3.0 technology for stunning, The Witch And The Wardrobe complex cinematic effects – a technology TWIMTBP games 15 Peter Jackson’s King Kong fully supported by all the latest NVIDIA 4 Vietcong 2 16 F.E.A.R. -

As a New Crop of Baby Animals

Expert Guidance on Children’s Interactive Media May 2009 Volume 17, No. 5, Issue 110 Bugsby Reading System Cate West: The Vanishing Files Circus Games Crayola Colorful Journey Curious George’s Dictionary DanceDanceRevolution Disney Grooves Donkey Kong Jungle Beat Elizabeth Find, MD: Diagnosis Mystery Emergency! Disaster Rescue Squad Excitebots: Trick Racing Faceland Free Realms Grand Slam Tennis Harry Potter and the Half-Blood Prince Hell’s Kitchen Intel ClassMate Convertible PC Jewel Master: Cradle of Rome Kids Collection DVDs LEGO Education: WeDo Robotics LEGO Rock Band M&M’s Beach Party Madden NFL 10 Mortimer Beckitt and the Secrets of Spooky Manor NCAA Football 10 Nitro Jr. Notebook Nitro Tunes Desktop PuttingPutting thethe OMG! High School Triple Play Pack Paper Show PebbleGo APTOP PeeWee Pivot Tablet Laptop ““LL”” Penguin Cold Cash Professor Heinz Wolff’s Gravity Ride & Learn Giraffe Bike Rosetta Stone Version 3, Level 1: inin OLPCONE LAPTOP PER CHILD Italian OLPC SCRABBLE The Atom Powered Intel ClassMate Convertable PC Secret Saturdays Sims 3, The Step & Count Kangaroo DDR Disney Grooves, Help for Baby Animals, Curious George on an iPhone, Talking Pens and more.... Super Secret (www.supersecret.com) Tiger Woods PGA Tour 10 TouchMaster 2 Up! V.Smile Smartridges for 2009 One Laptop Per Doctor “Mr. Buckleitner?” My doctor peered into the waiting room, juggling a battered HP Laptop TM in one arm. The computer was clearly both a nuisance and a necessity that had earned a May 2009 proper place in the medical routine. Volume 17, No. 5, Issue 110 As the blood pressure monitor tightened EDITOR Warren Buckleitner, Ph.D., around my arm, I asked about the laptop.