Securities and Exchange Commission Form 11-K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Communications Commission DA 10-1348

Federal Communications Commission DA 10-1348 Availability of Additional Share of Retail Monthly Monthly Charge in Broadband Service Broadband Service Installation Charges Broadband Bundled Length of Broadband Service Competition Fixed Type of Broadband Speed Foreign Charge (in USD, PPP Modem Rental Promot-ional Country Offerings Name / Offerings (Connection) including Line part of Double Play/ Service Usage limit Broadband Provider's URL Provider Status Broadband Technology (download/ upload) Currency Foreign (Purchasing Power Charge Price Description (Community or Charge Rental/ Triple Play ? Contract Access Market* Currency) Parity) National Level) Leasing Charge Bigpond Cable Standard Double play/ full service Australia Telstra Bigpond Incumbent 48% Cable 8Mbps/128kbps Aus Dollar $29.95 $20.40 Self installation $15.75 12 months No 200 MB 200 MB phone http://www.bigpond.com/home Bigpond Cable Standard Double play/ full service Telstra Bigpond Incumbent Cable 8Mbps/128kbps Aus Dollar $39.95 $27.21 Self installation $15.75 12 months No 400 MB 400 MB phone Double play/ full service Telstra Bigpond Incumbent Bigpond Liberty 12 GB Cable 8Mbps/128kbps Aus Dollar $59.95 $40.84 Self installation $15.75 12 months No 12 GB phone Double play/ full service Telstra Bigpond Incumbent Bigpond Liberty 25 GB Cable 8Mbps/128kbps Aus Dollar $79.95 $54.46 Self installation $15.75 12 months No 25 GB phone Up to 30 Mbps in Bigpond Cable Extreme Sydney and Melbourne Double play/ full service Telstra Bigpond Incumbent Cable Aus Dollar $39.95 $27.21 Self installation -

Ready for Upload GCD Wls Networks

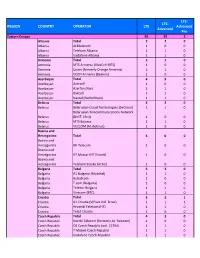

LTE‐ Region Country Operator LTE 5G Advanced Eastern Europe 93 60 18 Albania Total 320 Albania ALBtelecom 100 ONE Telecommunications (formerly Albania Telekom Albania) 110 Albania Vodafone Albania 110 Armenia Total 330 Armenia MTS Armenia (Viva‐MTS) 110 Armenia Ucom 110 Armenia VEON Armenia (Beeline) 110 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 431 Belarus A1 Belarus 101 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 110 Belarus MTS Belarus 110 Bosnia‐Herzegovina Total 310 Bosnia‐Herzegovina BH Telecom 110 Bosnia‐Herzegovina HT Mostar (HT Eronet) 100 Bosnia‐Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 331 Croatia A1 Hrvatska (formerly VIPnet/B.net) 110 Croatia Hrvatski Telekom (HT) 111 Croatia Tele2 Croatia 110 Czech Republic Total 433 Czech Republic Nordic Telecom 100 Czech Republic O2 Czech Republic (incl. CETIN) 111 Czech Republic T‐Mobile Czech Republic 111 Czech Republic Vodafone Czech Republic 111 Estonia Total 331 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 111 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom 110 Georgia Ostelecom (MegaFon) (South Ossetia) 100 Georgia -

277 Table 7.1. Pricing Structures for Residential Users in the OECD, 2009-2010

7. MAIN TRENDS IN PRICING Table 7.1. Pricing structures for residential users in the OECD, 2009-2010 Telephony National DSL pricing Cable Internet Local telephony, fixed lines Bitcaps from cable flat-rate structure pricing structure operators fixed calling Australia Unmetered (flat rate) Data controlled Data controlled Yes Yes Yes Metered (options for unmetered Austria Flat rate Flat rate No Yes No weekends and evenings) Flat rate, data Flat rate, data Belgium Metered, unmetered Yes Yes Yes controlled controlled Canada Unmetered Data controlled Data controlled Yes Yes Yes Chile Metered Flat rate Flat rate No Yes No Metered (options for unmetered Czech Republic Flat rate Flat rate No Yes No weekends and offpeak) Flat rate, data Denmark Metered Flat rate Yes Yes Yes controlled Estonia Metered Flat rate Flat rate No Yes No Finland Metered Flat rate Flat rate No Yes Yes France Metered/Unmetered Flat rate Flat rate No Yes Yes Germany Metered/Unmetered Flat rate Flat rate No Yes Yes Greece Metered Flat rate NA No NA No Flat rate, data Flat rate, data Hungary Metered Yes Yes No controlled controlled Iceland Metered Data controlled NA Yes NA No Flat rate, data Flat rate, data Ireland Metered Yes Yes Yes controlled controlled Israel Metered Flat rate Flat rate No Yes No Italy Metered Flat rate, timed NA No NA Yes Japan Metered Flat rate Flat rate No Yes No Korea Metered Flat rate Flat rate No No No Flat rate, data Flat rate, data Luxembourg Metered Yes Yes Yes controlled controlled Unmetered (first 100 calls free, Mexico Flat rate Flat rate No -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Regulatory Framework Distribution of High Definition Television Channels in the Western Balkan Countries

technics technologies education management Regulatory framework distribution of high definition television channels in the western Balkan countries Zaklina Spalevic1, Zoran Trajcevski2, Zeljko Bjelajac3, Milan Pocuca3, Dusko Dimitrijevic4 1 Faculty of Entrepreneurial Business,, University Union Nikola Tesla, Belgrade, Serbia, 2 Broadcasting Council of The Republic Macedonia, Skoplje, Republic of Macedonia, 3 Faculty of Law for Economy end Justice, University Business Academy, Novi Sad, Serbia, 4 Institute of International Politics and Economics, Belgrade, Serbia. Abstract 1080 represent the “height” of the image, and the width is 1280, or 1920 pixels). The paper includes an analysis of the distri- Table 1. Primary DTV standards bution of HDTV channels in the countries of the former Yugoslavia: Serbia, Montenegro, Croatia, Resolution Aspect ratio Frames per second Slovenia, Bosnia and Herzegovina and Mace- DTV donia. An overview of the number of channels is 1920 x 1080 16:9 24p, 30p, 60i made based on the different types of distribution: DVB-T, DVB-S, DVB-C and IPTV. Furthermore, HDTV 1280 x 720 16:9 24p, 30p, 60i the presence of the HDTV channels of national 704 x 480 16:9 24p, 30p, 60i, 60p and foreign production is presented, as well as the 704 x 480 4:3 24p, 30p, 60i, 60p SDTV presence of channels by genres. Comparison is 640 x 480 4:3 24p, 30p, 60i, 60p made between the presence of the HDTV chan- nels and the SDTV channels in different types of The number of frames by second (FPS) is in- the distribution. dicated next to the code, for ex. 720p60, which Key words: Law Framework, Abuse, Digitali- shows the resolution 1280×720, a progressive zation, SDTV channels, HDTV channels, DVB-T, way of image scanning and 60 frames per second. -

Trust Funds Presentation

IFC MOBILE MONEY SCOPING COUNTRY REPORT: TANZANIA Margarete Biallas (with assistance from Alana Fook) TANZANIA SUMMARY - PAGE 1 CURRENT MOBILE MONEY SOLUTION Currently 5 mobile money solutions offered. POPULATION 51 million MOBILE PENETRATION 55% (high) BANKED POPULATION 19% through financial institutions, 40% overall [Source: World Bank FINDEX] PERCENT UNDER POVERTY LINE 28.2% (2012) [Source: World Bank] ECONOMICALLY ACTIVE POPULATION Workforce: 26.11 million (2015) [Source: CIA] ADULT LITERACY 70.6% of Tanzanians, age 15 and over, can read and write (2015) [Source: CIA] MOBILE NETWORK OPERATORS Vodacom (12.4 million subscribers) Tigo (11.4 million subscribers) Airtel (10.7 million subscribers) Zantel (1.2 million subscribers) There are smaller MNO’s eg Halotel (4%), Smart (3%) and TTCL (1%) but they are marginal and do not currently Market Readiness offer mobile money at this time. OVERALL READINESS RANKING The telcom sector has dramatically improved access Regulation 3 through mobile money. Over 40% of mobile money Financial Sector 3 subscribers are active on a 90-day basis. The financial Telecom Sector 4 sector has begun to incorporate agency banking into their channel strategies. Scope for improvements in Distribution 3 strategy formulation and execution exists. Distribution Market Demand 4 in rural areas is difficult as population density is low and infrastructure is poor. 4 (Moderate) Macro-economic Overview Regulations Financial Sector Telecom Sector Other Sectors Digital Financial Services Landscape MOBILE BANKING MARKET POTENTIAL -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

NASDAQ Stock Market LLC (“Nasdaq Exchange”), a Subsidiary of the Nasdaq Stock Market, Inc

July 31, 2006 Nancy M. Morris, Esq. Secretary US Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 RE: Request for Relief from § 12 of the Securities Exchange Act of 1934 Dear Ms. Morris: On January 13, 2006, the Securities and Exchange Commission (“SEC” or “Commission”) approved the application of The NASDAQ Stock Market LLC (“Nasdaq Exchange”), a subsidiary of The Nasdaq Stock Market, Inc. (“Nasdaq”), to register under Section 6 of the Securities Exchange Act of 1934 (“Act” or “Exchange Act”) as a national securities exchange.1 Nasdaq’s transition of its listing and trading activities to the Nasdaq Exchange will further Congress’s instruction to promote “fair competition . between exchange markets.”2 Absent the relief requested herein, however, Nasdaq’s transition to a national securities exchange would require approximately 3,200 Nasdaq Global Market3 and Capital Market issuers with securities registered pursuant to the Act, or exempt from registration under Section 12(g) of the Act,4 to file registration statements5 to register those securities under Section 12(b) of the Act.6 1 Securities Exchange Act Release No. 53128 (January 13, 2006), 71 FR 3550 (January 23, 2006) (the “Exchange Approval Order”). 2 Exchange Act Section 11A(a)(1)(C)(ii). 3 Effective July 1, 2006, Nasdaq renamed the Nasdaq National Market as the Nasdaq Global Market and created a new segment within the Global Market called the Global Select Market. References to the Nasdaq Global Market include those securities listed on the Nasdaq Global Market and the Nasdaq Global Select Market. See Securities Exchange Act Release No. -

Annual Report 2017 Simply Better

Annual Report 2017 Simply better April 2018 TABLE OF CONTENTS 1. MANAGEMENT REPORT 6 1.1. Corporate Principles 7 1.2. About the Company 8 1.2.1. Company info 8 1.2.2. Ownership 8 1.2.3. Management 8 1.2.4. Directors 8 1.2.5. Supervisory board 8 1.2.6. Changes in the Management in 2017 8 1.3. Employees 9 1.4. Social Responsibility 9 1.5. Selected Performance Indicators 10 1.5.1. Analysis of the Profit and Loss Statement 10 1.5.2. Analysis of the Balance Sheet 11 1.6. Transactions with Related Parties 12 1.7. Risk Exposure 12 1.7.1. Regulatory Risks 12 1.7.2. Credit Risk 13 1.7.3. Interest Rate Risk 14 1.7.4. Currency Risk 14 1.7.5. Liquidity Risk 14 1.8. Plans for the Future 15 1.9. Governance Statement 16 1.9.1. Governance Code 16 1.9.2. Work of the General Meeting 16 1.9.3. Management and Supervisory Board 16 Description of the Main Characteristics of the Company’s Internal Control and Risk Management 1.9.4. 16 Systems Relevant for the Financial Reporting Procedure 2. FINANCIAL REPORT 17 2.1. GENERAL DISCLOSURES 18 2.1.1. About A1 Slovenia 18 2.1.1.1. Company's registered seat, legal form, and country of registration 18 2.1.1.2. Nature of operations and core activities 18 2.1.1.3. Information about the controlling company 18 2.1.1.4. Data on Employees 19 2.1.2. -

Abonnement Netflix Free

ABONNEMENT NETFLIX FREE Netflix et des tiers utilisent des cookies et des technologies similaires sur ce site Web afin de collecter certaines données sur vos activités en ligne que nous utilisons pour analyser votre utilisation du site... Netflix est un service de streaming qui propose une vaste sélection de séries TV, films, animes, documentaires et autres programmes primés sur des milliers d'appareils connectés à Internet. Get Free Netflix Accounts: Netflix Free Trial, Netflix Cookies, Netflix Mod Apk, Daily Telegram... Netflix Free Account with Password 7 Ways To Get Netflix Accounts Free of Cost netflix,netflix,méthode netflix,netflix 2021,mot de passe netflix,compte netflix gratuit,netflix,netflix gratuit,compte netflix,netflix C'est pas du FAKE !! Free netflix sans abonnement !!! Netflix propose trois types d'abonnements à des tarifs de 7,99, 11,99 et 15,99 euros par mois. L'abonnement à Netflix est sans engagement, vous pouvez donc vous désinscrire à tout moment. Je vous fournirai un compte Netflix Free. Dans cet article. 4 1. Abonnement gratuit Netflix Premium pour 1 mois. 5 2. Partagez votre compte Netflix (facilement avec votre famille et vos amis). Do you want to watch NetFlix for Free. Yes, this is possible, even for lifetime. 1. Use the Free Trial Offer. This is another excellent way to enjoy watching your favourite shows on Netflix at no cost. Since Netflix has recently bumped up the cost of membership in many of the countries, today we are going to see how you can How to Get Free Netflix 2021. -

Phase 3 Dissemination Additions

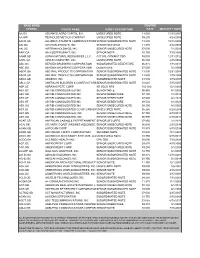

NASD BOND COUPON SYMBOL ISSUER NAME SHORT DESCRIPTION RATE MATURITY DATE AA.GA ADVANCE AGRO CAPITAL B.V. UNSECURED NOTE 13.000 11/15/2007 AA.GW REYNOLDS METALS COMPANY UNSECURED NOTE 09.200 4/24/2006 AACB.GA ALLIANCE ATLANTIS COMMUNICATIONSSENIOR SUBORDINATED NOTE 13.000 12/15/2009 AAI.GA AIRTRAN AIRWAYS, INC. SENIOR SECURED 11.270 4/12/2008 AAI.GC AIRTRAN HOLDINGS, INC. SENIOR UNSECURED NOTE 07.000 7/1/2023 AAIF.GA AAI.FOSTERGRANT, INC. SENIOR NOTE 10.750 7/15/2006 AANR.GB ALPHA NATURAL RESOURCES L.L.C. ACTUAL CPN/MAT TBD 00.000 12/31/2012 AAPL.GA APPLE COMPUTER, INC. UNSECURED NOTE 06.500 2/15/2004 ABC.GC BERGEN BRUNSWIG CORPORATION SUBORDINATED DEBENTURE 06.875 7/15/2011 ABC.GD BERGEN BRUNSWIG CORPORATION DEBENTURE 07.000 3/1/2006 ABCR.GA ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 12/31/2004 ABCR.GB ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 1/15/2004 ABGX.GB ABGENIX, INC SUBORDINATED NOTE 03.500 3/15/2007 ABLC.GA AMERICAN BUILDERS & CONTRACTORSSENIOR SUBORDINATED NOTE 10.625 5/15/2007 ABP.GE ABRAXAS PETE CORP. SR SECD NTS 100.000 12/1/2009 ABY.GC ABITIBI-CONSOLIDATED INC. SENIOR NOTE 06.950 4/1/2008 ABY.GD ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.400 4/1/2018 ABY.GE ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.500 4/1/2028 ABY.GF ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 08.500 8/1/2029 ABY.GG ABITIBI-CONSOLIDATED INC SENIOR UNSECURED NOTE 08.300 8/1/2005 ABY.GJ ABITIBI-CONSOLIDATED CO OF CANADAUNSECURED NOTE 05.250 6/20/2008 ABY.GN ABITIBI-CONSOLIDATED, INC.