Stk Implementation in Sms Banking in M-Pesa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEURAL COMPUTING 17 Sailee Chitre – T.Y.B.Sc

Our Vision is to establish a leading centre of imparting Quality Education in the field of Science, Commerce and Management with emphasis on: ensuring that students learn the fundamental concepts in various disciplines. motivating students to apply the Scientific & Technological knowledge to develop problem solving capabilities. making students aware of the societal and environmental needs with specific appreciation of the emerging global context. Our mission is to provide : an educational environment where students can reach their full potential in their chosen discipline and become responsible citizens without compromising in ethics a scholarly environment where the talents of both, the faculty members and students are nurtured and used to create knowledge and technology for the benefit of the society. 1 INDEX Sr. No. Topic Page No. 1. 3D PASSWORD FOR MORE SECURE AUTHENTICATION 3 Manisha Patel – T.Y.B.Sc IT 2. ARTIFICIAL INTELLIGENCE IN PROGRAMMING 5 Jay Bhosale – T.Y.B.Sc. IT 3. COMPUTER THAT YOU CAN WEAR 9 Shailendra Mane – T.Y.B.Sc. IT 4. ETHICAL HACKING 12 Manali Darandale – T.Y.B.Sc. IT 5. FOOT PRINTING 14 Bhavesh Naik – S.Y.B.Sc IT 6. NEURAL COMPUTING 17 Sailee Chitre – T.Y.B.Sc. IT 7. ORGANIC LIGHT EMITTING DIODE DISPLAY 20 Angad Anand – T.Y.B.Sc. IT 8. VERIZON 4G LTE NETWORK 23 Dhaval Jain – T.Y.B.Sc. IT 9. MEEGO 25 Nivedita Tikadar – T.Y.B.Sc IT 10. A CHANGE FROM IPv4 TO IPv6 33 Vivek Kapadia – S.Y.B.Sc.I.T 11. BLACKBERRY MESSENGER 36 Rahul Nayak – S.Y.B.Sc.I.T 12. -

Mobile SIM-Based Medical Applications

Mobile for Development mHealth Mobile SIM-based Medical Applications Michael J. Kleeman, Martin Harris and James Erasmus February 2015 Table of Contents Executive summary ............................................................................................................................................................................................................ 4 A SIM-based approach for medical applications ......................................................................................................................................................... 5 The benefits of SIM-based medical applications ........................................................................................................................................................ 6 Other related applications of SIM technology and current mHealth approaches ........................................................................................... 8 Comparison of existing mHealth applications .............................................................................................................................................................. 8 Comparative mobile communication channels ............................................................................................................................................................ 9 Roles of the various actors ...........................................................................................................................................................................................10 -

Assessment of Today's Mobile Banking Applications from the View

Munich Personal RePEc Archive Assessment of Today’s Mobile Banking Applications from the View of Customer Requirements Pousttchi, Key and Schurig, Martin University of Augsburg 2004 Online at https://mpra.ub.uni-muenchen.de/2913/ MPRA Paper No. 2913, posted 25 Apr 2007 UTC Pousttchi, K.; Schurig, M.: Assessment of Today’s Mobile Banking Applications from the View of Customer Requirements. Copyright 2004 IEEE. Published in the Proceedings of the Hawai'i International Conference on System Sciences, January 5 – 8, 2004, Big Island, Hawaii. (Preprint) Assessment of Today’s Mobile Banking Applications from the View of Customer Requirements Key Pousttchi Martin Schurig University of Augsburg, Chair of Business Tecways AG Informatics and Systems Engineering (WI2) e-mail: [email protected] e-mail: [email protected] Abstract restraint affects notebooks and sub notebooks, which are easily transportable, but whose use is typically stationary. The typical connection for these mobile devices up to Mobile banking is a subset of electronic banking which now is realized through mobile communication. Most underlies not only the determinants of the banking busi- relevant is GSM/GPRS, also typical are comparable 2G ness but also the special conditions of mobile commerce. standards (e.g. IS-136, IS-95) and soon will be evolving This paper analyzes customer needs and expectations 3G-technologies (EDGE, CDMA-2000, UMTS). We do from the mobile applications’ view and from the banking not focus on WLAN scenarios. The use of a banking view in order to derive a defined set of requirements. application on a laptop computer with a WLAN connec- Based on these results, existing mobile banking applica- tion underlies the rules of electronic banking, not the tions are assessed. -

Overcoming Channel Bandwidth Constraints in Secure Sim Applications

OVERCOMING CHANNEL BANDWIDTH CONSTRAINTS IN SECURE SIM APPLICATIONS John A. ~ac~onald',William sirett2 and Chris J. itch ell' '~nformationSecurity Croup, Royal Holloway, University of London, Egham, Surrey TW20 OEX, UK; '~rnartCard Centre, Information Security Croup, Royal Holloway, University oj London, Egham, Surrey TW20 OEX, UK. Abstract: In this paper we present an architecture based on a Java (J2SE, J2EE, J2ME and Java Card) platform supporting a secure channel from a Mobile Operator to the SIM card. This channel offers the possibility of end to end security for delivery of large data files to a GSM SIM card. Such a secure channel could be used for delivery of high value content that requires a high bandwidth channel - perhaps either rendered for user infotainment, or processed in the client Mobile Station (device and SIM card) for remote device management. Our methodology overcomes the bandwidth constraints of the SIM Toolkit Security scheme described in GSM standard 03.48. To validate our proposal we have developed code to create DRM and Web Service test scenarios utilising readily available J2ME, Java Card, J2SE and J2EE platforms, Web Services tools from Apache, the KToolBar emulator from Sun, and a Gemplus Java Card. Keywords: J2ME, Java Card, SAT Security, SIM card, Web Service Security, DRM. 1. INTRODUCTION Since its inception in September 1994, the SIM Application Toolkit (SAT) (3GPP TS 3 1.1 11,2004; GSM 11.14, 2001) and SIM Toolkit Security (3GPP TS 03.48, 2001) have been used extensively. They are primarily used to securely transfer device and network management information and simple 540 John A. -

SIM Application Toolkit

SIM Application Toolkit For the Following Multi-Tech Products External Wireless MultiModem® EDGE (MTCBA-E) External Wireless MultiModem® EDGE with USB (MTCBA-E-U) External Wireless MultiModem® EDGE with Bluetooth Interface (MTCBA-E-B) External Wireless MultiModem® EDGE with Ethernet Interface (MTCBA-E-EN) External Wireless MultiModem® EDGE with GPS Functionality (MTCBA-E-GP) Embedded Wireless SocketModem® EDGE (MTSMC-E) AT Commands Reference Guide Copyright and Technical Support SIM Toolkit AT Command Reference Guide For the Following Multi-Tech Products External Wireless MultiModem® EDGE (MTCBA-E) External Wireless MultiModem® EDGE with USB (MTCBA-E-U) External Wireless MultiModem® EDGE with Bluetooth Interface (MTCBA-E-B) External Wireless MultiModem® EDGE with Ethernet Interface (MTCBA-E-EN) External Wireless MultiModem® EDGE with GPS Functionality (MTCBA-E-GP) Embedded Wireless SocketModem® EDGE (MTSMC-E) S000391C, Revision C Copyright This publication may not be reproduced, in whole or in part, without prior expressed written permission from Multi- Tech Systems, Inc. All rights reserved. Copyright © 2005-7 by Multi-Tech Systems, Inc. Multi-Tech Systems, Inc. makes no representations or warranty with respect to the contents hereof and specifically disclaims any implied warranties of merchantability or fitness for any particular purpose. Furthermore, Multi-Tech Systems, Inc. reserves the right to revise this publication and to make changes from time to time in the content hereof without obligation of Multi-Tech Systems, Inc. to notify any person or organization of such revisions or changes. Record of Revisions Revision Date Description A 10/14/05 Initial release. B 01/04/06 Added list of products that use these commands. -

HUAWEI S7 Tablet Product Description 1

HUAWEI S7 Tablet Product Description 1 Product Overview HUAWEI S7 Tablet (hereinafter referred to as the S7) is an information terminal developed by HUAWEI. It integrates the applications and services such as local applications, mobile broadband network services and home network services. With the AndroidTM open source operating system and embedded 3G module, the S7 expands various user applications besides the basic 3G communication services, and supports classification and dragging of the home screen elements. Providing convenient and quality services such as picture, audio, video, network, and information services, the S7 serves as good assistant and partner of your daily life. The S7 has a stylish appearance and a portable design. With a full touchscreen, an ultra-thin design, and a silver metal rim, the S7 presents a stylish and technically appealing appearance. The figures are provided only for reference. For details, see the actual product. Features Seven-inch TFT full touch screen Mobile network technology: GSM/WCDMA/Wi-Fi HUAWEI specific home screen Web Browsing with Chrome Lite High definition video playback GoogleTM Android 2.1 Google Applications 2 Hardware Specifications Dimensions (L × W × H) About 209 mm × 108 mm × 15.5 mm Weight About 500 g (including the battery) Touchscreen Resistive touchscreen by default and customizable capacitive touchscreen, with a gravity sensor Display z Type: TFT z Size: 7 inches z Colors: 262 k z Resolution: WVGA (800 × 480 pixels) SIM/USIM card interface Standard six-pin SIM card interface that -

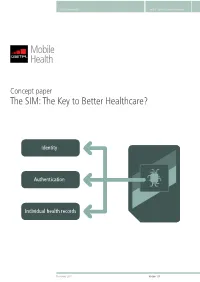

The SIM: the Key to Better Healthcare?

GSMA: Mobile Health The SIM: The Key to Better Healthcare? Concept paper The SIM: The Key to Better Healthcare? Identity Authentication Individual health records November 2011 Version 1.0 GSMA: Mobile Health The SIM: The Key to Better Healthcare? 1 Executive summary More than five billion devices around the world are authenticated on mobile networks using an embedded SIM (an application running on a Universal Integrated Circuit Card or UICC), which stores and presents a unique identifier for each customer to their mobile operator. SIM-style solutions could provide increased security for, and access to, healthcare providers’ information and communications technology (ICT) systems, which can readily harness the strong identity management capabilities of a UICC. In most countries, healthcare ICT systems lack a widely-deployed identity management technology, so there is a clear opportunity to satisfy a critical market need. This paper uses clear examples and case studies to explain how the UICC and other key components of the GSM ecosystem can enable the smooth and cost-effective deployment and enhancement of electronic healthcare solutions. Secure application and transaction enablement – parallels with mobile money Offering a high level of security and flexibility, the UICC underpins a growing number of services that enable people to complete transactions at point of sale or send and receive money using their mobile phone. To enable these services, the UICC is typically partitioned so that an individual’s financial information is stored in a secure domain that can’t be accessed by other applications running on the card. Partitioning can also be used to securely store healthcare information, such as a patient ID or National Insurance number, on a UICC. -

The Hardware End, the Nanopi R1 Packs an Allwinner H3 Soc with a Quad-Core Arm Cortex-A7, up to 1Gb of DDR3 RAM, and Optional 8Gb of Emmc

The , HACKer s HARDWARE TOOLKit 2nd Edition 175 GADGETS 8 CATEGORIES Yago Hansen The HACKer,s HARDWARE TOOLKit 177 GADGETS 8 CATEGORIES Yago Hansen Copyright: Copyright © 2019 Yago Hansen. All rights reserved. Profile: linkedin.com/in/radiusdoc Title: Subtitle: Best gadgets for Red Team hackers E-book download link: https://github.com/yadox666/The-Hackers-Hardware-Toolkit Edition: 2nd English edition August, 2019 Level: Medium Paperback format: 182 pages Paperback editor: Amazon KDP Paperback Paperback ISBN: 9781099209468 Language: English Design: Claudia Hui License: Free for e-book distribution, but not for commercial use Mini computers Boards, palmtops RF SDR, cars, garages, satellite, GSM, LTE Wi-Fi Wi-Fi cards, antennas RFID & NFC Physical access, cards, magnetic stripe, cars HID & Keylog Rubberducky, mouse injection, wireless keyboards Network Routers, modems, VLAN, NAC BUS HW hacking, JTAG, cars, motorbikes Accessories Storage, powerbanks, batteries, chargers, GPS DISCLAIMMER If you like any of the devices shown here DO NOT HESITATE to take a picture of the related page! OCR codes shown here are not malicious! Prices shown here are only estimated Feel free to choose your PREFERRED shop Mini computers Boards, palmtops GPD micro PC 6-inch Handheld Industry Laptop Small handheld computer, ideal for carrying the best hacking software tools, and to handle all the external hardware hacking tools. The previous release supported Kali Linux. This version will probably support it too, since it supports Ubuntu Mate. Specifications Screen -

TOOLKIT #5: CREATE OWN MOBILE BANKING CHANNEL HOW to SUCCEED in YOUR DIGITAL JOURNEY: I a SERIES of TOOLKITS for FINANCIAL SERVICE PROVIDERS

HOW TO SUCCEED IN YOUR DIGITAL JOURNEY: A SERIES OF TOOLKITS FOR FINANCIAL SERVICE PROVIDERS TOOLKIT #5: CREATE OWN MOBILE BANKING CHANNEL HOW TO SUCCEED IN YOUR DIGITAL JOURNEY: i A SERIES OF TOOLKITS FOR FINANCIAL SERVICE PROVIDERS TOOLKIT #5: CREATE OWN MOBILE BANKING CHANNEL PART 1: BUSINESS MODEL DESCRIPTION By PHB ACADEMY and MICROLEAD Mobile banking agent at UOB Rwanda Courtesy of PHB Development MM4P MOBILE MONEY FOR THE POOR HOW TO SUCCEED IN YOUR DIGITAL JOURNEY: A SERIES OF TOOLKITS FOR FINANCIAL SERVICE PROVIDERS TOOLKIT #5: CREATE OWN MOBILE BANKING CHANNEL ii ACKNOWLEDGEMENTS We would like to thank the management and staff of Accion Microfinance Bank in Nigeria, Equity Bank in the United Republic of Tanzania, Fidelity Bank in Ghana, Mwanga Community Bank in the United Republic of Tan- zania and Urwego Opportunity Bank in Rwanda for contributing to this business model and accompanying case studies. We thank them for their time and for sharing their information, lessons learned and recommendations, to enable other financial service providers to succeed on their digital path. We would like to thank in particular the following individuals for their time and effort in preparing this toolkit: • Oladapo Famuyide from Accion Microfinance Bank in Nigeria • Andrew Tushabe from Urwego Opportunity Bank in Rwanda • Joseph Iha, Stephen Mwaniki and Mwita Rhobi from Equity Bank in the United Republic of Tanzania • Hamisi Chimwaga from Mwanga Community Bank in the United Republic of Tanzania • Daniel Amankwah-Aboagye and Merene Botsio from Fidelity Bank in Ghana AUTHORS PHB Development: Chris Statham, Aurélie Wildt Dagneaux and Isabelle Musat United Nations Capital Development Fund – MicroLead: Pamela Eser, Hermann Messan and Ivana Damjanov REVIEW COMMITTEE United Nations Capital Development Fund – MicroLead: Sachin Bansal and Alejandro González Caro PHB Development: Aurélie Wildt Dagneaux Mastercard Foundation: Ruth Dueck-Mbeba and Amos Odero EDITOR Chela Cea October 2017. -

SIM Cards for Cellular Networks an Introduction to SIM Card Application Development

Mid Sweden University The Department of Information Technology and Media (ITM) Author: Peter Edsbäcker E-mail address: [email protected] Study program: B. Sc. in engineering, computer engineering, 180 ECTS Examiner: Åke Malmberg, Mid Sweden University, [email protected] Tutor: Örjan Sterner, Mid Sweden University, [email protected] Scope: 31699 words inclusive of appendices Date: 2010-06-12 B. Sc. Thesis within Computer Engineering C, 15 ECTS SIM cards for cellular networks An introduction to SIM card application development. Peter Edsbäcker SIM cards for cellular networks An introduction to SIM card application development Abstract Peter Edsbäcker 2011-06-12 Abstract A SIM, Subscriber Identity Module, is the removable circuit board found in a modern cellular phone. It carries the network identity information and is a type of smart card which can also be found on payment cards (EMV), ID cards and so on. A smart card is basically a small computer, providing a safe and controlled execution environment. Historically smart card software was very hardware dependent and mostly developed by the manufacturers themselves. With the introduction of the open Java Card standard created by Sun Microsystems (Oracle) this was meant to change. However, information still remains scattered and is hard to obtain. This paper is meant to serve both as an introduction to the field and also as a good foundation for future studies. It begins with a theoretical discussion about smart card hardware and software architectures, network standards in the context of SIM cards, typical applications, coming trends and technologies and ends off with an overview of the Java Card standard. -

ETSI TS 131 111 V3.4.0 (2001-03) Technical Specification

ETSI TS 131 111 V3.4.0 (2001-03) Technical Specification Universal Mobile Telecommunications System (UMTS); USIM Application Toolkit (USAT) (3GPP TS 31.111 version 3.4.0 Release 1999) 3GPP TS 31.111 version 3.4.0 Release 1999 1 ETSI TS 131 111 V3.4.0 (2001-03) Reference RTS/TSGT-0331111UR4 Keywords UMTS ETSI 650 Route des Lucioles F-06921 Sophia Antipolis Cedex - FRANCE Tel.:+33492944200 Fax:+33493654716 Siret N° 348 623 562 00017 - NAF 742 C Association à but non lucratif enregistrée à la Sous-Préfecture de Grasse (06) N° 7803/88 Important notice Individual copies of the present document can be downloaded from: http://www.etsi.org The present document may be made available in more than one electronic version or in print. In any case of existing or perceived difference in contents between such versions, the reference version is the Portable Document Format (PDF). In case of dispute, the reference shall be the printing on ETSI printers of the PDF version kept on a specific network drive within ETSI Secretariat. Users of the present document should be aware that the document may be subject to revision or change of status. Information on the current status of this and other ETSI documents is available at http://www.etsi.org/tb/status/ If you find errors in the present document, send your comment to: [email protected] Copyright Notification No part may be reproduced except as authorized by written permission. The copyright and the foregoing restriction extend to reproduction in all media. © European Telecommunications Standards Institute 2001. -

Mobile Money As an Enabler for Entrepreneurship: Case Eastern Africa

Mobile Money as an Enabler for Entrepreneurship: Case Eastern Africa Entrepreneurship Master's thesis Aarno Jussila 2015 Department of Management Studies Aalto University School of Business Powered by TCPDF (www.tcpdf.org) Mobile Money as an Enabler for Entrepreneurship: Case Eastern Africa Entrepreneurship Master's Thesis Aarno Jussila 2014 Department of Management Studies School of Business Aalto University Author Aarno Jussila Title of thesis Mobile Money as an Enabler for Entrepreneurship: Case Eastern Africa Degree Master’s Degree Degree programme Entrepreneurship Thesis advisor Professor Arto Lahti Year of approval 2015 Number of pages 90 Language English Abstract Over the last 10 years, availability of mobile phones has increased dramatically, especially in the developing markets. At the same time, majority of the population living in developing countries are still lacking the access to official financial services. This gap has enabled an opportunity to mobile network operators and financial service providers to introduce mobile money transfer services that are addressing this need. In developed countries, many attempts have been made to introduce mobile payment into the lives of people, however, the most successful efforts to create sustainable ecosystems operating with mobile money has taken place in few developed countries. This thesis work is studying what is mobile payment, the success factors of the most successful mobile money implementation M-PESA in Kenya and making the comparison to competing systems. In addition, the impact and importance of mobile money services is studied for businesses using the service, as well as what type of customer base is using the mobile money. Finally, a review is conducted over the recent and emerging business opportunities enabled by the mobile money, and innovations around it.