Vol. 85 Wednesday, No. 237 December 9, 2020 Pages 79117–79378

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Civil Service Law

Unofficial Translation Final Version of CS Law 06/09/ 005, Zarif Waez CIVIL SERVICE LAW CHAPTER 1 GENERAL PROVISIONS Basis: Article 1 In accordance with Article 50 of the Afghanistan Constitution, this Law has been enacted to establish sound administration, to implement reforms in the administrative system, and to regulate the activities of the Civil Service. Objectives: Article 2 This Law has the following objectives: 1. To establish sound administration through the planning and implementation of reform of the country’s administrative system. 2. To determine the duties of Civil Service. 3. To fill Civil Service posts on merit and competency. 4. To regulate personnel management arrangements and duties of civil servants. Civil Service: Article 3 The Civil Service performs all the executive and administrative activities of the Government based on provisions in law. The Civil Service includes the following activities: 1. Manages, regulates and delivers government services. 2. Develops policies, and provides and offers professional advice. 3. Develops, prepares and implement laws, decrees and relevant regulations Civil Servant: Article 4 1) A civil servant is a person appointed by the Government to perform its executive and administrative duties based on the provisions in law. The ranks and grades of civil servants will be regulated according to the relevant legal document. 2) Any person who is not included in the ranks and grades described in Clause 1 of this Article is not considered to be a civil servant. 1 Chapter 2 Independent Administrative Reform and Civil Service Commission (IARCSC) Leadership of IARCSC: Article 5: 1) The IARCSC is established in order to lead, regulate, reform, formulate and implement structure policies of public administration system. -

The Admission of Government Agency Reports Under Federal Rule of Evidence 803(8)(C) by John D

The Admission of Government Agency Reports under Federal Rule of Evidence 803(8)(c) By John D. Winter and Adam P. Blumenkrantz or (B) matters observed pursuant having hearsay evidence admitted under to duty imposed by law as to which Rule 803(8)(c) follow from the justifica- matters there was a duty to report, tions for adopting the rule in the first excluding, however, in criminal cases place. The hearsay exception is premised matters observed by police officers on several conditions. First, the rule as- and other law enforcement person- sumes that government employees will nel, or (C) in civil actions . factual carry out their official duties in an honest 2 John D. Winter Adam P. Blumenkrantz findings resulting from an investiga- and thorough manner. This assump- tion made pursuant to authority tion results in the rule’s presumption of n product liability and other tort ac- granted by law, unless the sources of reliability. Second, the rule is based on the tions, plaintiffs may seek to introduce information or other circumstances government’s ability to investigate and re- Igovernment records or documents, indicate lack of trustworthiness. port on complex issues raised in many cas- federal and nonfederal alike, to establish es, from product liability claims to section one or more elements of their claims. In This article focuses specifically on 1983 actions against government officials. this regard, plaintiffs attempt to rely on the third prong of the rule: the use of Government agencies generally possess reports or letters written by government agency records in civil actions that result levels of expertise, resources, and experi- agencies responsible for overseeing the from an agency investigation made ence, including access to information that health, safety, and consumer aspects pursuant to authority granted by law. -

India and China

India and China: A Comparative Analysis of Mobile Phones in Agriculture By C2014 Prashanthi Bonthu Submitted to the graduate degree program in Global and International Studies and the Graduate Faculty of the University of Kansas in partial fulfillment of the requirements for the degree of Master of Arts. ________________________________ Chairperson Professor Eric Hanley ________________________________ Committee Member Professor Darlene Budd ________________________________ Committee Member Professor John James Kennedy Date Defended: Feb 3rd , 2014 The Thesis Committee for Prashanthi Bonthu certifies that this is the approved version of the following thesis: India and China: A Comparative Analysis of Mobile Phones in Agriculture ________________________________ Chairperson Professor Eric Hanley Date approved: Feb 3, 2014 ii Abstract In 2010, China and India were named the first and second largest mobile phone markets in the world based on their number of subscribers. India and China have focused on extending their telecommunication services into rural areas for socio-economic benefits. Both countries liberalized and privatized the industry under different political regimes utilizing different strategies. The aim of this thesis is to examine the collaborative efforts of public and private agencies in India and the role they do in disseminating information to farmers through mobile phones when compared to the government agencies in China that have been created to share that information in order to determine which program is more effective. To answer this question, the thesis compares Indian and Chinese policies and programs enacted to encourage sales and use of mobile phones in the agricultural sector to increase efficiency and encourage growth. As free market principles and private for-profit corporations are generally more efficient than government agencies, this thesis hypothesizes that the policies and development initiatives taken by the Indian government are more successful in disseminating information than the government agency approach followed by China. -

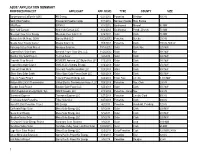

Ab307 Application Summary Proposed Project Applicant App

AB307 APPLICATION SUMMARY PROPOSED PROJECT APPLICANT APP. RCVD. TYPE COUNTY SIZE Bordertown to California 120kV NV Energy 6/27/2012 Powerline Washoe 120 kV North Elko Pipeline Prospector Pipeline Comp. 7/11/2012 Nat Gas Pipeline Elko, Eureka Wild Rose ORNI 47 7/17/2012 Geothermal Mineral 30 MW New York Canyon New York Canyon LLC 8/14/2012 Geothermal Persh., Church. 70 MW Mountain View Solar Energy Mountain View Solar LLC 9/24/2012 Solar Clark 20 MW Mahacek to Mt. Hope 230kV Eureka Moly LLC 10/23/2012 Powerline Eureka 230 kV Moapa Solar Energy Center Moapa Solar LLC 11/5/2012 Powerline Clark 230 kV, 500 kV Pahrump Valley Solar Project Abengoa Solar Inc. 11/14/2012 Solar Clark, Nye 225 MW Copper Rays Solar Farm Element Power Solar Dev. LLC 11/26/2012 Solar Nye 180 MW Boulder City Solar Project Techren Solar 1/2/2013 Solar Clark 300 MW Townsite Solar Project KOWEPO America LLC/Skylar Res. LP 1/15/2013 Solar Clark 180 MW Copper Mountain Solar 3 CMS-3 LLC (Sempra Energy) 1/16/2013 Solar Clark 250 MW Crescent Peak Wind Crescent Peak Renewables LLC 1/23/2013 Wind Clark 500 MW Silver State Solar South Silver State Solar Power South LLC 1/23/2013 Solar Clark 350 MW Toquop Power Project Toquop Power Holdings LLC 1/23/2013 Fossil Fuel Lincoln 1,100 MW Hidden Hills 230kV Transmission Valley Electric Transmission Assoc. LLC 1/28/2013 Powerline Nye, Clark 230 kV Boulder Solar Project Boulder Solar Power LLC 1/25/2013 Solar Clark 350 MW ARES Regulation Energy Mgmt. -

337-19 Biennial Report 2019

337-19 2019 Biennial Report Public Utilities Commission of Nevada BIENNIAL REPORT 2019 PUBLIC UTILITIES COMMISSION OF NEVADA | PAGE 1 Solar PV, Gerlach, NV. Photo: BlackRockSolar Public Utilities Commission of Nevada Steve Sisolak, Governor Ann Wilkinson, Chairman Ann Pongracz, Commissioner C.J. Manthe, Commissioner Stephanie Mullen, Executive Director 1150 E. William Street, Carson City, NV 89701 9075 W. Diablo Drive, Suite 250, Las Vegas, NV 89148 (775) 684-6101 | (702) 486-7210 www.puc.nv.gov A digital copy of this report is available at http://puc.nv.gov/About/Reports/. PAGE 2 Nellis Air Force Base Solar Generating Station. Photo: insideclimatenews.org 2019 Biennial Report PUBLIC UTILITIES COMMISSION OF NEVADA | PAGE 3 2019 Biennial Report TABLE OF CONTENTS LETTER TO GOVERNOR ............................................................................................................................................3 TABLE OF CONTENTS ................................................................................................................................................4 QUICK INFO ..................................................................................................................................................................5 WHO WE ARE & WHAT WE DO ......................................................................................................................5 KEY PERFORMANCE & ACCOMPLISHMENT STATISTICS ......................................................................6 FY17 - FY18 PUCN PROGRAM ACCOMPLISHMENTS -

7: GERMANY Dr

7: GERMANY Dr. Elke Löffler, Public Sector Consultant, Birmingham, UK Overviewi The New Public Management approaches pursued in New Zealand and the UK have evoked little interest in the central or federal governments of some major and successful economies, notably Germany and Japan. Public demand for service improvements in Germany was considerably less than in the UK and other New Public Management countries, arguably at least partly because the baseline of public service quality was perceived by citizens as higher. As a result, there was no real perceived need to engage in radical public sector reforms in Germany. Furthermore, the strong legalistic tradition of the German public administration, when taken together with the strong position of trade unions and staff councils and the decentralized structure of the German federalist system, also encouraged gradual reforms, and gradual reforms based on pilots and employee involvement. In Germany, the public management agenda of the early 1990s was dominated by the Unification process and related public sector transformation policies that imposed the structure and principles of West German public administration on the new Laender, the former East Germany. Only later, with the fiscal crisis that resulted from Unification was there some wider interest in New Public Management approaches within the German public sector. There has since been a degree of bottom-up experimentation with certain elements of New Public Management reforms at local levels in Germany. Subsequently the Laender, as well as some Federal agencies, have shown some interest in pursuing managerial reforms. But given the more equal balance between the legislative, judicial and executive branches in the German system as compared to Westminster-system countries, the pursuit of managerial reforms should not have been expected to – and did not in practice – override the prevailing fundamental legal and political processes in the German system. -

Bills, Budgets Fiscal Notes

A Legislative Guide to Bills, Budgets & Fiscal Notes Office of the Legislative Fiscal Analyst W310 State Capitol Complex Salt Lake City, Utah 84114‐5310 Office (801) 538‐1034 FAX (801) 538‐1692 http://legislature.utah.gov/lfa/index.htm Revised 8‐2008 Table of Contents 1 Introduction 1 The Legislative Fiscal Analyst 3 How a Bill Becomes a Law 6 Bill Types 7 The Legislature Sets the State Budget 7 Consensus Revenue Estimates 8 All Legislators Sit on Budget Subcommittees 8 Budget Subcommittee Hearings 9 Ranking Funding Requests 10 Budget Bills 11 Performance Measures 12 Introduction to Fiscal Notes 13 What do Fiscal Notes Look Like? 14 Fiscal Note Types 14 The Analyst “Owns” the Note 15 Presession Budget Calendar 16 Session Calendar 19 The Fiscal Note Process 21 How to Respond to a Fiscal Note Worksheet 24 Fiscal Note Worksheet Tips 27 Glossary 35 Analysts by Assignment i Introduction This guide includes: • How a bill becomes law • Session rules, and deadlines • Budgets • Fiscal notes • Glossary of terms • Fiscal analysts by assignment The Legislative Fiscal Analyst The Legislative Fiscal Analyst (LFA or the Analyst) advises the Legislature on money matters. The Analyst: • Has a staff of about 20: analysts, economists, secretaries and DP support • Staffs Executive Appropriations Committee • Staffs ten appropriations subcommittees • Makes budget recommendations for state government • Writes fiscal notes • Writes the budget bills 1 How a Bill Becomes a Law A citizen advocate, special interest group, or government agency tells a legislator about a problem and the Legislator decides, “There ought to be a law.” (This example follows a bill that starts in the House of Representatives.) Attorneys Draft a Bill The legislator asks Legislative Research and General Counsel (LRGC) to draft legislation. -

Grant to Provide Volunteer Taxpayer Assistance Services

Changes to Fiscal Year 2022-2023 Request for Proposals: Grant to Provide Volunteer Taxpayer Assistance Services On July 2, 2021, the Minnesota Department of Revenue made two changes to the Request for Proposal originally posted on June 30, 2021. These changes are detailed on pages 6-7, under Part One, Grant Overview and page 11, under Part Three, Proposal Content and Format. 1. “Eligible Organization” was expanded based on the grant appropriation language passed during the Special Session. The new language is: “Eligible organization” means an organization that meets the definition provided in section 7526A(e)(2)(B) of the Internal Revenue Code of 1986” New for FY22-23: Eligible Organization The applicant must be classified as one of these: • A private or public non-profit organization that qualified for and received an IRS determination letter confirming the organization’s tax exemption under section 501 of the Internal Revenue Code, including but not limited to credit unions and faith-based and community organizations • A public, non-profit, or proprietary (privately owned, profit-making) college, university, vocational school, or other postsecondary educational institution • A local government agency including a county or municipal government agency and an Indian tribe including any tribally designated housing entity or other wholly owned tribal entity • A regional, statewide, or local coalition with one lead organization that meets one of the eligibility requirements noted above; the lead organization filing the application must have a substantive role in the coalition • In the case of applicable taxpayers and members of underserved populations as defined in section 7526A, to which no organizations described above are available, a state government agency or Cooperative Extension office as established by a land-grant college or university are also eligible 2. -

U.S. Department of the Interior Bureau of Land Management

U.S. Department of the Interior Bureau of Land Management Final Environmental Assessment DOI-BLM-NV-S010-2010-0091-EA November 2014 Southern Nevada Intertie Project APPLICANT Great Basin Transmission, LLC GENERAL LOCATION Clark County, Nevada BLM CASE FILE SERIAL NUMBER N-086359 PREPARING OFFICE U.S. Department of the Interior Bureau of Land Management Las Vegas Field Office 4701 N. Torrey Pines Drive Las Vegas, Nevada 89130 Phone: (702) 515-5172 Fax: (702) 515-5010 This page intentionally left blank. TABLE OF CONTENTS Chapter 1. Introduction .......................................................................................................... 1-1 1.1. Identifying Information ...................................................................................... 1-2 1.1.1. Title, EA Number, and Type of Project .............................................. 1-2 1.1.2. Location of Proposed Action ............................................................... 1-2 1.1.3. Name and Location of Preparing Office ............................................. 1-2 1.1.4. Identify the Case File Number ............................................................ 1-2 1.1.5. Applicant Name ................................................................................... 1-2 1.2. Purpose and Need for Action ............................................................................. 1-2 1.2.1. Background ......................................................................................... 1-2 1.2.2. BLM Purpose and Need ..................................................................... -

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment Overview: ....................................................................................................................................................... 1 State Energy Landscape (Electric Sector)................................................................................................... 1 A. Electric Utility Providers .................................................................................................................. 2 B. Delivery Systems ................................................................................................................................ 5 C. Generation (in-state, out of state, and imports) ............................................................................ 13 D. Markets ............................................................................................................................................ 25 E. Existing Policies (Laws/Regulations) ............................................................................................. 27 F. Challenges ........................................................................................................................................ 36 G. Trends ............................................................................................................................................... 41 Governor Sandoval’s Energy Policy Goals ............................................................................................... 44 A. Executive Order.............................................................................................................................. -

Internal Revenue Service Appropriated Accounts

Appropriated Accounts Appropriated Internal Revenue Service Program Summary by Appropriations Account associated business processes, (Dollars in Thousands) and technology systems to FY 2004 FY 2005 FY 2006 effectively and efficiently Appropriation Enacted Enacted President’s Increase/ % Budget Decrease change meet service and enforcement Tax Administration & Operations $9,762,024 $9,998,165 $10,460,051 $461,886 4.6% strategic goals. Assistance $1,828,373 $1,829,190 $1,805,965 ($23,225) (1.3%) Outreach $544,146 $500,329 $466,217 ($34,112) (6.8%) Ta x p a y e r s e r v i c e i s Processing $1,337,128 $1,276,459 $1,295,273 $18,814 1.5% improving in key areas. In Subtotal, Taxpayer Service $3,709,647 $3,605,978 $3,567,455 ($38,523) (1.1%) FY 2004, almost 62 million Examination $3,214,410 $3,477,623 $3,711,889 $234,266 6.7% Collection $1,779,233 $1,825,715 $1,990,562 $164,847 9.0% individuals filed their Investigations $656,131 $681,980 $767,418 $85,438 12.5% returns electronically – up Regulatory Compliance $256,248 $252,993 $264,855 $11,862 4.7% 16 percent over last year. Service Revenue Internal Research $146,355 $153,876 $157,872 $3,996 2.6% Electronic filing is faster and Subtotal, Enforcement $6,052,377 $6,392,187 $6,892,596 $500,409 7.8% more reliable, both for the Business Systems Modernization $387,699 $203,360 $199,000 ($4,360) (2.1%) taxpayer and the IRS. -

Top Management Service in Central Government: Introducing a System for the OECD Higher Civil Service in Central and Eastern European Countries

SIGMA Papers No. 1 Top Management Service in Central Government: Introducing a System for the OECD Higher Civil Service in Central and Eastern European Countries https://dx.doi.org/10.1787/5kml6gln4cbq-en GENERAL DISTRIBUTION OCDE/GD(95)45 SUPPORT FOR IMPROVEMENT IN GOVERNANCE AND MANAGEMENT IN CENTRAL AND EASTERN EUROPEAN COUNTRIES (SIGMA) A JOINT INITIATIVE OF THE OECD/CCET AND EC/PHARE FINANCED MAINLY BY EC/PHARE SIGMA PAPERS: NO. 1 TOP MANAGEMENT SERVICE IN CENTRAL GOVERNMENT: INTRODUCING A SYSTEM FOR THE HIGHER CIVIL SERVICE IN CENTRAL AND EASTERN EUROPEAN COUNTRIES ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Paris 1995 COMPLETE DOCUMENT AVAILABLE ON OLIS IN ITS ORIGINAL FORMAT SIGMA -- Support for Improvement in Governance and Management in Central and Eastern European Countries -- is a joint initiative of the OECD Centre for Co-operation with the Economies in Transition (CCET) and the European Union’s Phare Programme. SIGMA assists public administration reform efforts in Central and Eastern Europe. It is 75 per cent funded by Phare; several OECD Member countries also provide resources. The OECD -- Organisation for Economic Co-operation and Development -- is an intergovernmental organisation of 25 democracies with advanced market economies. The CCET channels OECD advice and assistance over a wide range of economic issues to reforming countries in Central and Eastern Europe and the former Soviet Union. The Phare Programme is a European Union initiative which provides know-how and investment support to Central and Eastern Europe to foster the development of market economies and democratic societies. Established in 1992, SIGMA operates within the OECD’s Public Management Service (PUMA).