Green Government Fleet Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2 0 Annual Report 1 8 年度報告

Annual Report 2018 年度報告 2238 股份代號: (於中華人民共和國註冊成立的股份有限公司) Important Notice 1. The Board, supervisory committee and the directors, supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. 2. All directors of the Company have attended meeting of the Board. 3. PricewaterhouseCoopers issued an unqualified auditors’ report for the Company. 4. Zeng Qinghong, the person in charge of the Company, Feng Xingya, the general manager, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Accounting Chief), represent that they warrant the truthfulness and completeness of the financial statements contained in this annual report. 5. The proposal for profit distribution or conversion of capital reserve into shares for the reporting period as considered by the Board The Board proposed payment of final cash dividend of RMB2.8 per 10 shares (tax inclusive). Together with the cash dividend of RMB1.0 per 10 shares (including tax) paid during the interim period, the ratio of total cash dividend payment for the year to net profit attributable to the shareholders’ equity of listed company for the year would be approximately 35.66%. 6. Risks relating to forward-looking statements The forward-looking statements contained in this annual report regarding the Company’s future plans and development strategies do not constitute any substantive commitment to investors and investors are reminded of investment risks. -

How Urban Delivery Vehicles Can Boost Electric Mobility Decarbonising Transport How Urban Delivery Vehicles Can Boost Electric Mobility Decarbonising Transport

CPB Corporate Partnership Board How Urban Delivery Vehicles can Boost Electric Mobility Decarbonising Transport How Urban Delivery Vehicles can Boost Electric Mobility Decarbonising Transport The International Transport Forum The International Transport Forum is an intergovernmental organisation with 62 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre- negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. The Members of the Forum are: Albania, Armenia, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Chile, China (People’s Republic of), Croatia, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Republic of Moldova, Mongolia, Montenegro, Morocco, the Netherlands, New Zealand, North Macedonia, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Tunisia, Turkey, Ukraine, the United Arab Emirates, the United Kingdom, the United States and Uzbekistan. -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

Magazine 2018 Eco The— Dürr Group Magazine2018

ECO THE DÜRR GROUP MAGAZINE 2018 ECO THE— DÜRR GROUP MAGAZINE2018 FUTURE TRENDS – PIONEERING SOLUTIONS New horizons The future factory Driverless safety Page 10 Page 18 Page 26 60 CLEVER MINDS, ONE GOAL Ready, get set, go! In August 2018, it was all systems go for the second ADAMOS Hackathon. Around 60 developers took part in the program- ming competition. Divided into agile teams, they developed prototypes for new software products and apps, all based on the ADAMOS IIoT platform. In the top positions were a solution for online orders of spare parts and an app for controlling data traffic in the cloud. You can find out more about software development, our Digital Facto- ries and the Hackathon by reading pages 18 ff. www.adamos.com EDITORIAL Dear Readers, The world is moving at an ever-increasing pace, not only politically, but also in economic and technological terms. This is why a globally active company such as the Dürr Group must do more than just monitor global trends. It must seize its opportunity when the moment is right. Over the past decades, we have proved time and again that we take advantage of opportunities and trends, for instance by developing efficient paint shops, using painting robots, enter- ing into equipment provision for the woodworking industry, and developing digitally networked production processes. We naturally see ourselves as pioneers, always working to create ground-breaking products and services for our customers. The trend toward digitization is currently far ahead of any other. In our Digital Factories, we are developing smart applications for machines and systems. -

Guangzhou Brace Autoparts2014

GUANGZHOU BRACE AUTO PARTS CO., LTD. 广州步锐汽车配件有限公司 Contact: Johnny Zhang Mobile:0086 18964917717 Tel:0086 20 87484990 Fax:0086 20 26099160 Email:[email protected] MSN:[email protected] Skype:cnartex QQ:8899618 ADD:B1-8 Sanyuanli Auto Parts Market, NO.715 Sanyuanli Road,Guangzhou,China 地址:中国广州三元里大道715号三元里汽配城B1-8档 Company Brief We are the professional auto parts supplier in Guangzhou, China. We have been specialized in wholesales and exporting of auto parts for more than 10 years. We mainly export auto spare parts for DFM, SOKON, HAFEI, CHANA, GONOW, WULING, CHANGHE,GEELY and SUZUKI MARUTI and Japanese/Korean cars. Our products have been exported by containers to Africa, Middle East, SouthEast Asia, South America,East Europe, Australia and other areas. Our Advantaged Parts DFM, SOKON, HAFEI, CHANGHE, CHANA, FAW, JAC, WULING, GONOW We supply entire vehicle auto parts: auto drivetrain, auto electrical system, auto engine system, body parts, steering system, universal parts and other parts. We can supply both genuine and copy parts with competitive price as the customers' requirements, even they are difficult to find in market. Other Services We Offer 1. Shipping Service: we can offer our customer the whole shipping solution by sea and by air, and door to door service is available. No matter the goods is in one container or one box, we can suggest the most reasonable shipping way. 2. Inspection & Warehouse Services: we can help our customer to inspect and collect all goods from different suppliers, and repack or stock the goods in our warehouse. 3. Payment Service: We can accept the payment by LC, PAYPAL,WU and TT. -

Trade Mark Journal No

Trade Mark Journal No. 001/2021 31 January, 2021 FEBRUARY 2021 Issue No. 002/2021 1 Trade Mark Journal No. 001/2021 31 January, 2021 CONTENTS General Information 3 Operating Hours 3 Submission of Application 3 Enquiries 3 Trademarks Legislation 4 Forms and Fees 4 INID Codes 5 First Schedule – Fees 7 Second Schedule – Forms 12 Third Schedule – Classification of Goods and Services 14 New Trade Mark Applications Filed 17 Change of Proprietor’s Name 79 Change of Proprietor’s Address 80 Change of Address for Service 83 Subsequent Proprietor Registered 84 Subsequent Proprietor and Address for Service Registered 85 Trade Mark Registered 86 Trade Mark Pending for Renewal (6 months before expiration date) 89 Trade Mark Unpaid Renewal Fee (6 months grace period after expiration date) 108 Trade Mark Renewed 144 Trade Mark Renewed and Change of Agent 145 Trade Mark Renewed and Restored 183 Trade Mark Removed Through Non-Payment of Renewal Fee 184 New Trade Mark Applications Filed Under The Madrid Protocol 185 Trade Mark Registered Filed Under the Madrid Protocol 298 Trade Mark Registered Filed Under the Madrid Protocol due to 18 Months Lapsed 304 Trade Mark Pending for Renewal Filed Under the Madrid Protocol 306 ******* 2 Trade Mark Journal No. 001/2021 31 January, 2021 General Information The Brunei Darussalam Intellectual Property Office (BruIPO) is an Office under the Attorney General’s Chamber and its premises with effect from the 1 April, 2019 and is situated at the following address: Brunei Darussalam Intellectual Property Office (BruIPO) Attorney General’s Chamber Knowledge Hub, Level 2, Anggerek Desa Technology Park Jalan Berakas BB3713, Brunei Darussalam Tel: +673 2380966 Opening Hours With effect from 1 January, 2020, the Brunei Intellectual Property Office (BruIPO) counter will operate as follows: Monday to Thursday : 8.00am to 12.00am 2.00pm to 3.00pm Saturday : 8.00am to 11.00am Friday and Sunday : CLOSED Submission of Applications 1. -

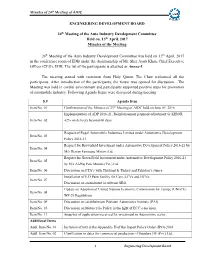

ENGINEERING DEVELOPMENT BOARD 24Th Meeting of the Auto

th Minutes of 24 Meeting of AIDC ENGINEERING DEVELOPMENT BOARD 24th Meeting of the Auto Industry Development Committee Held on, 13th April, 2017 Minutes of the Meeting 24th Meeting of the Auto Industry Development Committee was held on 13th April, 2017 in the conference room of EDB under the chairmanship of Mr. Sher Ayub Khan, Chief Executive Officer (CEO), EDB. The list of the participants is attached as Annex-I. The meeting started with recitation from Holy Quran. The Chair welcomed all the participants. After introduction of the participants, the forum was opened for discussion. The Meeting was held in cordial environment and participants supported positive steps for promotion of automobile industry. Following Agenda Items were discussed during meeting. S.# Agenda Item Item No. 01 Confirmation of the Minutes of 23rd Meeting of AIDC held on June 09, 2016 Implementation of ADP 2016-21, Reimbursement payment adjustment @ KIBOR Item No. 02 +2% on delivery beyond 60 days Request of Regal Automobile Industries Limited under Automotive Development Item No. 03 Policy 2016-21 Request for Brownfield Investment under Automotive Development Policy 2016-21 by Item No. 04 M/s Dewan Farooque Motors Ltd. Request for Green Field Investment under Automotive Development Policy 2016-21 Item No. 05 by M/s Al-Haj Faw Motors (Pvt.) Ltd Item No. 06 Discussion on FTA’s with Thailand & Turkey and Pakistan’s stance. Installation of E.D Paint facility for Cars, LCVs and HCVs: Item No. 07 Discussion on amendment in relevant SRO. Update on Adoption of United Nations Economic Commission for Europe (UNECE) Item No. -

HIGH PERFORMANCE with CLEAN ENERGY CORPORATE PROFILE

ANNUAL REPORT 五菱汽車集團控股有限公司 (Incorporated in Bermuda with limited liability) Entering the Era of HIGH PERFORMANCE with CLEAN ENERGY CORPORATE PROFILE Wuling Motors Holdings Limited (“Wuling Motors Holdings” or the “Company”) and its subsidiaries (collectively referred to as the “Group”) are principally engaged in the businesses of trading and manufacturing of automotive components, engines and specialized vehicles. Our Group’s corporate goal is to grasp the tremendous business opportunities arising from the rapidly growing automobile industry in China and Asia. We supply engines and automotive components to commercial-type mini-vehicles and passenger vehicles. We also manufacture and supply different types of specialized vehicles, including electric vehicles in China. The Group’s main production facilities are located in Liuzhou, Qingdao, Chongqing and Indonesia. Since 2018, we have been ranked as one of the Global Top 100 Enterprises of Automotive Components Suppliers. GROUP STRUCTURE WULING MOTORS GUANGXI DRAGON HILL HOLDINGS AUTOMOBILE HKEx:305 11.6% 60.6% 60.9% 39.1% WULING INDUSTRIAL ENGINES AND AUTOMOTIVE SPECIALIZED RELATED PARTS COMPONENTS VEHICLES AND (INCLUDING NEW OTHER INDUSTRIAL ENERGY VEHICLES) SERVICES WULING MOTORS HOLDINGS LIMITED ANNUAL REPORT 2019 CONTENTS CORPORATE PROFILE GROUP STRUCTURE 2 CHAIRMAN’S STATEMENT 8 REPORT OF THE CEO 16 OPERATION REVIEW MAIN BUSINESS SEGMENTS ENGINES AUTOMOTIVE SPECIALIZED AND RELATED COMPONENTS VEHICLES PARTS AND OTHER (including New Energy Vehicles) INDUSTRIAL SERVICES 31 FINANCIAL REVIEW 38 DIRECTORS’ AND SENIOR MANAGEMENT’S BIOGRAPHIES 46 CORPORATE GOVERNANCE REPORT 65 REPORT OF THE DIRECTORS 85 INDEPENDENT AUDITOR’S REPORT 91 CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 92 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 94 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 95 CONSOLIDATED STATEMENT OF CASH FLOWS 97 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS CORPORATE INFORMATION CHAIRMAN’S STATEMENT In Pursuit of a and for thee Group and Shareholders Mr. -

T1 212015249 Full Text.Pdf

PENDAHULUAN Latar Belakang Perkembangan ekonomi saat ini mengarah pada persaingan ketat. Perusahaan dituntut untuk memiliki keunikan tersendiri yang dapat menarik minat konsumen dalam merebut pangsa pasar yang ada atau mempertahankan dari para pesaingnya. Konsumen saat ini sangat kritis dalam memilih suatu produk yang akan dibelinya. Tawaran produk saat ini sangatlah beragam tidak terkecuali untuk produk mobil, dengan berbagai merek, tipe, warna, dan spesifikasi yang ditawarkan oleh para produsen membuat konsumen lebih bebas dalam memilih mobil mana yang akan dibeli. Banyak aspek yang dipertimbangkan oleh konsumen sebelum melakukan pembelian sebuah mobil, antara lain country of origin atau negara asal produk. Country of origin merupakan identitas dalam atribut sebuah produk yang berpengaruh dalam benak konsumen tentang dari mana asal negara suatu produk (Moradi dan Azim, 2011) dalam (Dewa, 2015). Banyak negara-negara di dunia yang memasarkan produk otomotifnya di Indonesia. Semakin meningkatnya pasar otomotif di Indonesia diperlukan penelitian tentang pengaruh dari negara asal (Country Of Origin. Perusahaan perlu mengetahui persepsi konsumen tentang pengaruh Country Of Origin supaya dapat diketahui posisi produk dalam benak konsumen, sehingga dapat ditentukan strategi pemasaran dan promosi yang tepat untuk bersaing di pasar. Produk mobil dipilih karena perkembangan dan pertumbuhan industri otomotif yang pesat ditandai dengan meningkatnya nilai penjualan dari tahun ke tahun. Selain itu banyak negara-negara penghasil produk otomotif yang memasarkan produknya di Indonesia. Banyak- banyak jenis mobil yang dipasarkan di Indonesia antara lain SUV(Sport Utility Vehicle), MPV(Multi Purpose Vehicle), Sedan, Hatchback, City Car, LCGC(Low Cost Green Car) dan sebagainya. Untuk kendaraan terlaris di Indonesia sendiri adalah jenis MPV dan LCGC, mobil jenis ini diproduksi hampir semua produsen otomotif di Indonesia. -

Analyst Day Presentation March 2021 Disclaimer

Analyst Day Presentation March 2021 Disclaimer Important Disclosures This investor presentation (the “presentation”) is for information purposes only to assist interested parties in making their own evaluation with respect to the possible transaction (the “Transaction”) between Forum Merger III Corporation (“Forum”) and Electric Last Mile, Inc. (“ELMS”). The information contained herein does not purport to be all-inclusive and none of Forum, ELMS or their respective directors, officers, stockholders, affiliates or advisers or any other person makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation or any other written or oral communication to the recipient in the course of the recipient's evaluation of Forum or ELMS. The information contained herein is preliminary and is subject to change and such changes may be material. The information in this presentation assumes that the Transaction is consummated on the terms contemplated by the Agreement and Plan of Merger (“Merger Agreement”) entered into by Forum and ELMS. This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transaction or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Forum, ELMS, or any of their respective affiliates (and there shall not be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction). You should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation. -

Report on Emerging Automakers in China in 2018 (Corporate Reach & Connectivity Functions)

Report on Emerging Automakers in China in 2018 (Corporate Reach & Connectivity Functions) November 2018 STUDY GOAL AND OBJECTIVES METHODOLOGY This report provides the industry executives with strategically signifisignificantcant Both primary and secondary research methodologies were used competitor information, analysis, insight and projection on the in preparing this study. Initially, a comprehensive and exhaustive competitive pattern and key companies in the industry, crucial to the search of the literature on this industry was conducted. These development and implementation of effective business, marketing and sources included related books and journals, trade literature, R&D programs. marketing literature, other product/promotional literature, annual reports, security analyst reports, and other publications. REPORT OBJECTIVES Subsequently, telephone interviews or email correspondence TtblihTo establish a compre hiftlhensive, factual, annua lldtddtlly updated and cost- was conducted with marketing executives etc. Other sources effective information base on market size, competition patterns, included related magazines, academics, and consulting market segments, goals and strategies of the leading players in the companies. market, reviews and forecasts. To assist potential market entrants in evaluating prospective INFORMATION SOURCES acquisition and joint venture candidates. The primary information sources include Company Reports, To complement the organizations’ internal competitor information and National Bureau of Statistics of -

Does Ownership Determine Business Model?

sustainability Article Does Ownership Determine Business Model? Li Zhang 1, Yingqi Liu 1,* and Ari Kokko 2 1 College of Economics and Management, Beijing Jiaotong University, Beijing 100044, China; [email protected] 2 Department of International Economics, Government, and Business, Copenhagen Business School, 2000 Copenhagen, Denmark; [email protected] * Correspondence: [email protected]; Tel.: +86-1350-112-5524 Received: 27 April 2019; Accepted: 30 May 2019; Published: 4 June 2019 Abstract: The development of a new energy vehicle industry is considered a sustainable approach to solving the global energy crisis and the problem of environmental pollution. The sales of new energy vehicles in China are the highest in the world, and China’s new energy vehicle enterprises have played an important role in this. The business model, as a method for enterprises to achieve their strategic goals, utilizes resource advantages to deliver value to consumers, and is affected by enterprises’ ownership, competitive strategy, and resources. Based on the resource-based view (RBV) theory, the article uses a mixed quantitative and qualitative methodology, selects 30 vehicle enterprises from the mainstream market, and takes product value, suppliers, dealers and external relations, research capabilities, shareholders, and profitability as potential explanatory elements to analyze business model differentiation between different ownership categories. The article explores the reasons for the differences in business models between different ownership classes through case studies and data comparisons. It examines the characteristics and types of business model based on resources and competitive strategy. This study suggests that the ownership of enterprises plays a decisive role in strategic choices and resource acquisition and has a differential impact on the business model in resources and revenue dimensions.