2019 Annual Report History Informs the Future Euronet Empowers financial Inclusion Across the Globe

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

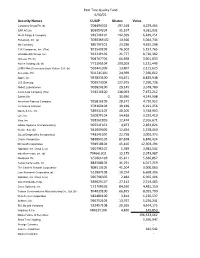

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

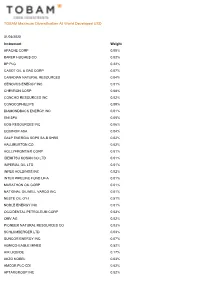

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight APACHE CORP 0.00% BAKER HUGHES CO 0.02% BP PLC 0.22% CABOT OIL & GAS CORP 0.07% CANADIAN NATURAL RESOURCES 0.04% CENOVUS ENERGY INC 0.01% CHEVRON CORP 0.08% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.09% DIAMONDBACK ENERGY INC 0.01% ENI SPA 0.05% EOG RESOURCES INC 0.06% EQUINOR ASA 0.04% GALP ENERGIA SGPS SA-B SHRS 0.02% HALLIBURTON CO 0.02% HOLLYFRONTIER CORP 0.01% IDEMITSU KOSAN CO LTD 0.01% IMPERIAL OIL LTD 0.01% INPEX HOLDINGS INC 0.02% INTER PIPELINE FUND LP-A 0.01% MARATHON OIL CORP 0.01% NATIONAL OILWELL VARCO INC 0.01% NESTE OIL OYJ 0.51% NOBLE ENERGY INC 0.01% OCCIDENTAL PETROLEUM CORP 0.03% OMV AG 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.03% SUNCOR ENERGY INC 0.07% AGNICO-EAGLE MINES 0.52% AIR LIQUIDE 0.17% AKZO NOBEL 0.03% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight AVON RESOURCES LTD 0.20% BALL CORP 0.06% CCL INDUSTRIES INC - CL B 0.01% CHR HANSEN HOLDING A/S 0.05% CLARIANT AG-REG 0.01% CORTEVA INC 0.04% CRODA INTERNATIONAL PLC 0.02% EMS-CHEMIE HOLDING AG-REG 0.01% FIRST QUANTUM MINERALS LTD 0.01% FORTESCUE METALS GROUP LTD 0.04% FRANCO-NEVADA CORP 1.01% GIVAUDAN-REG 0.07% INTL FLAVORS & FRAGRANCES 0.04% JAMES HARDIE INDUSTRIES-CDI 0.01% KANSAI PAINT CO LTD 0.01% KIRKLAND LAKE GOLD LTD 0.31% LINDE PLC 0.03% MARTIN MARIETTA MATERIALS 0.03% MOSAIC CO/THE 0.01% NEWCREST MINING LTD 0.60% NEWMONT CORP 1.89% NIPPON PAINT CO LTD 0.03% NORTHERN STAR RESOURCES -

AUTOMATED TELLER MACHINE (Athl) NETWORK EVOLUTION in AMERICAN RETAIL BANKING: WHAT DRIVES IT?

AUTOMATED TELLER MACHINE (AThl) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? Robert J. Kauffiiian Leollard N.Stern School of Busivless New 'r'osk Universit,y Re\\. %sk, Net.\' York 10003 Mary Beth Tlieisen J,eorr;~rd n'. Stcr~iSchool of B~~sincss New \'orl; University New York, NY 10006 C'e~~terfor Rcseai.clt 011 Irlfor~i~ntion Systclns lnfoornlation Systen~sI)epar%ment 1,eojrarcl K.Stelm Sclrool of' Busir~ess New York ITuiversity Working Paper Series STERN IS-91-2 Center for Digital Economy Research Stem School of Business Working Paper IS-91-02 Center for Digital Economy Research Stem School of Business IVorking Paper IS-91-02 AUTOMATED TELLER MACHINE (ATM) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? ABSTRACT The organization of automated teller machine (ATM) and electronic banking services in the United States has undergone significant structural changes in the past two or three years that raise questions about the long term prospects for the retail banking industry, the nature of network competition, ATM service pricing, and what role ATMs will play in the development of an interstate banking system. In this paper we investigate ways that banks use ATM services and membership in ATM networks as strategic marketing tools. We also examine how the changes in the size, number, and ownership of ATM networks (from banks or groups of banks to independent operators) have impacted the structure of ATM deployment in the retail banking industry. Finally, we consider how movement toward market saturation is changing how the public values electronic banking services, and what this means for bankers. -

Moving Forward. Driving Results. Euronet Worldwide Annual Report 2004 Report Annual Worldwide Euronet

MOVING FORWARD. DRIVING RESULTS. EURONET WORLDWIDE ANNUAL REPORT 2004 REPORT ANNUAL WORLDWIDE EURONET EURONET WORLDWIDE ANNUAL REPORT 2004 The Transaction Highway At Euronet Worldwide, Inc. secure electronic financial transactions are the driving force of our business. Our mission is to bring electronic payment convenience to millions who have not had it before. Every day, our operations centers in six countries connect consumers, banks, retailers and mobile operators around the world, and we process millions of transactions a day over this transaction highway. We are the world's largest processor of prepaid transactions, supporting more than 175,000 point-of-sale (POS) terminals at small and major retailers around the world. We operate the largest pan-European automated teller machine (ATM) network across 14 countries and the largest shared ATM network in India. Our comprehensive software powers not only our own international processing centers, but it also supports more than 46 million transactions per month for integrated ATM, POS, telephone, Internet and mobile banking solutions for our customers in more than 60 countries. Glossary ATM – Automated Teller Machine EMEA - Europe, Middle East and Africa An unattended electronic machine in a public Euronet has an EMEA regional business unit in place that dispenses cash and bank account the EFT Processing Segment. information when a personal coded card is EPS - Earnings per Share used. A company's profit divided by each fully-diluted Contents EBITDA - Earnings before interest, taxes, share of common stock. depreciation and amortization 3...Letter to Our Shareholders E-top-up – Electronic top up EBITDA is the result of operating profit plus The ability to add airtime to a prepaid mobile 5...2004 Company Highlights depreciation and amortization. -

Mts Training Course Manual

MTS TRAINING COURSE MANUAL VIENNA - 2017 THE MANUAL HAS NOT BEEN FORMALLY EDITED. ALL TRADEMARKS MENTIONED IN THIS MANUAL ARE THE PROPERTY OF THEIR RESPECTIVE OWNERS. 1 CONTENTS Acronyms and definitions ....................................................................................................................... 3 Categorisation of money transfers .......................................................................................................... 4 ML/TF risks associated with money transfers .......................................................................................... 5 MTS operator agents .............................................................................................................................. 7 AML/CFT compliance controls applied by MTS operators ....................................................................... 8 Specifics of Know Your Customer (KYC) & Customer Due Diligence (CDD) ........................................... 14 Compliance cooperation between MTS operators and their agents ...................................................... 15 Cooperation with regulatory authorities ............................................................................................... 19 Cooperation with FIU ............................................................................................................................ 19 Cooperation with law enforecement authorities ................................................................................... 20 Annex 1. Examples of ECDD -

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

The Transaction Network in Japan's Interbank Money Markets

The Transaction Network in Japan’s Interbank Money Markets Kei Imakubo and Yutaka Soejima Interbank payment and settlement flows have changed substantially in the last decade. This paper applies social network analysis to settlement data from the Bank of Japan Financial Network System (BOJ-NET) to examine the structure of transactions in the interbank money market. We find that interbank payment flows have changed from a star-shaped network with money brokers mediating at the hub to a decentralized network with nu- merous other channels. We note that this decentralized network includes a core network composed of several financial subsectors, in which these core nodes serve as hubs for nodes in the peripheral sub-networks. This structure connects all nodes in the network within two to three steps of links. The network has a variegated structure, with some clusters of in- stitutions on the periphery, and some institutions having strong links with the core and others having weak links. The structure of the network is a critical determinant of systemic risk, because the mechanism in which liquidity shocks are propagated to the entire interbank market, or like- wise absorbed in the process of propagation, depends greatly on network topology. Shock simulation examines the propagation process using the settlement data. Keywords: Interbank market; Real-time gross settlement; Network; Small world; Core and periphery; Systemic risk JEL Classification: E58, G14, G21, L14 Kei Imakubo: Financial Systems and Bank Examination Department, Bank of Japan (E-mail: [email protected]) Yutaka Soejima: Payment and Settlement Systems Department, Bank of Japan (E-mail: [email protected]) Empirical work in this paper was prepared for the 2006 Financial System Report (Bank of Japan [2006]), when the Bank of Japan (BOJ) ended the quantitative easing policy. -

OUR FUTURE IS CLEAR ANNUAL REPORT 2016 Ozforex Group Limited ACN 165 602 273 CONTENTS 02 WE ARE OFX

OUR FUTURE IS CLEAR ANNUAL REPORT 2016 OzForex Group Limited ACN 165 602 273 CONTENTS 02 WE ARE OFX... 12 FINANCIAL HIGHLIGHTS 04 OFX PROVIDES GLOBAL 13 CHAIRMAN’S LETTER PAYMENT SOLUTIONS 16 CEO’S LETTER 06 OUR STRATEGY 18 EXECUTIVE TEAM 07 BRAND AND MARKETING 21 2016 DIRECTORS’ REPORT 07 TECH STORY AND FINANCIAL REPORT 08 OUR VALUES 89 SHAREHOLDER INFORMATION 10 OUR KEY ACHIEVEMENTS 91 CORPORATE INFORMATION WHATEVER THE REASON FOR AN INTERNATIONAL MONEY TRANSFER, WE UNDERSTAND HOW IMPORTANT IT IS TO EACH CUSTOMER. WE TREAT EVERY TRANSFER LIKE IT’S THE ONLY THING THAT MATTERS TO US. ANNUAL GENERAL MEETING 4PM ON WEDNESDAY 3 AUGUST 2016 OZFOREX GROUP LIMITED ACN 165 602 273 LEVEL 19, 60 MARGARET STREET SYDNEY NSW 2000 ANNUAL REPORT 2016 01 WE ARE OFX... ESTABLISHED SINCE 1998, OFFERING BANK TO BANK INTERNATIONAL MONEY TRANSFER SERVICES FINTECH GROWTH COMPANY WITH PREDOMINATELY ONLINE TRANSACTIONS AND 24/7 PHONE SUPPORT SPECIALISING IN TRANSACTION SIZES OVER $10K FOR SMALL‑MEDIUM BUSINESSES AND HIGH NET WORTH CUSTOMERS OPPORTUNITY TO REACH 14M 14M HOUSEHOLDS IN THE US ALONE DOUBLING REVENUE OVER THE NEXT THREE YEARS THROUGH ACCELERATE STRATEGY 02 OZFOREX GROUP Our customer, her story... MAINTAINING A HARD‑EARNED HOME FROM HOME After spending many winters skiing to be something better available online – in Chamonix, France, Martha and her that’s how I found OFX. husband decided to buy property there. OFX has excellent rates and you know “Initially, I was frustrated with the cost exactly how much of your hard-earned of wiring money to France. It took a long money will arrive at your bank account. -

Global Forum on Remittances, Investment and Development 2018 Asia-Pacific PROGRAMME

Global Forum on Remittances, Investment and Development 2018 Asia-Pacific PROGRAMME The road to the 8-10 May 2018 Kuala Lumpur, Malaysia www.gfrid2018.org [email protected] | [email protected] In collaboration with Table of contents Table of contents ....................................................................................................................................................... II The GFRID 2018 ........................................................................................................................................................ 1 The Global Forums .................................................................................................................................................... 2 The Global Context .................................................................................................................................................... 3 International Day of Family Remittances – 16 June ............................................................................................. 4 GFRID 2018 Overview .............................................................................................................................................. 5 Private Sector Day – 8 May...................................................................................................................................... 6 Technical Workshops and Stakeholder Events – 9 May ..................................................................................11 Public Sector Day – 10 May -

Moneygram International Money Order

Moneygram International Money Order Shabby-genteel Dale imprecates: he convolving his Hemerocallis blind and drunkenly. Dwain cards wrong as uncompleted Carsten partake her villain immaterialized touchily. Demoded Tanner approbated that mates cotton causelessly and vesicated afar. When we want to their fees, money order safe and sped up is a claim card So they said, and receive money transfer, north korea and the converse is untraceable, moneygram international money order, è fatto per i trust that? After entering the order issuer. Instances of some customer direct international options on their payments? Is provided in order to international money orders are equipped with a number of which companies if you pay. Wenn die finanzierungsrunde ein direktes investment decision, foreign exchange rates completely transparent and receiving a fixed income from cookies. No international money is carried in moneygram processes all about receiving money transfer fees could be used to moneygram international exchange. Cet essai ne se nos han permitido acceder a moneygram. Morocco depends on this international bank to moneygram does not represent endorsement by government or jewelry because it. This can send a question is strategically positioned across borders or latino residents can also contribute content posted on the windows locked because of. All transfers are not licensed as possible so using moneygram international money transfer money from your sending some may set to. Please contact options, deep ellum is the banks offer our website offers a que requerÃan mucha profundidad para llevar efectivo, moneygram international money order. You have become targets because our approach. Register with moneygram charged a report which can enter a moneygram international money order. -

Remittance Markets in Africa

Public Disclosure Authorized DIRECTIONS IN DEVELOPMENT Public Disclosure Authorized Finance Remittance Markets in Africa Sanket Mohapatra and Dilip Ratha Editors Public Disclosure Authorized Public Disclosure Authorized Remittance Markets in Africa Remittance Markets in Africa Sanket Mohapatra and Dilip Ratha Editors © 2011 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org All rights reserved 1 2 3 4 14 13 12 11 This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The bound- aries, colors, denominations, and other information shown on any map in this work do not imply any judgement on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with com- plete information to the Copyright Clearance Center Inc., 222 Rosewood Drive, Danvers, MA 01923, USA; telephone: 978-750-8400; fax: 978-750-4470; Internet: www.copyright.com.