Vote Summary Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mondrian 2020 Proxy Voting Report

Year ending June 30, 2020 This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors. This report contains the votes cast by Mondrian during the period for clients who have delegated full voting discretion The information was obtained from sources we believe to be reliable, but there is no guarantee that all votes cast have been accepted Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate. Mondrian Investment Partners Limited is authorised and regulated by the Financial Conduct Authority. Mondrian Investment Partners Limited Fifth Floor, 10 Gresham Street, London EC2V 7JD - Telephone: 020 7477 7000 Mondrian Investment Partners (U.S.), Inc. 201 King of Prussia Road, Suite 620, Radnor PA 19087 - Telphone: (215) 825-4500 www.mondrian.com Mondrian Annual Proxy Voting J Sainsbury Plc Meeting Date: 4 Jul 2019 Country: United Kingdom Meeting Type: Annual ISIN: GB00B019KW72 Proposal Proposal Text Proponent Mgmt Rec Vote Instructed 1 Accept Financial Statements and Statutory Reports Management For For 2 Approve Remuneration Report Management For For 3 Approve Final Dividend Management For For 4 Elect Martin Scicluna as Director Management For For 5 Re-elect Matt Brittin as Director Management -

BEIS Issues Its Final Notice for the Forthcoming Second Cfd Auction

Tom C risp Editor 01603 604421 t.crisp@cornwall -insight.com Monday 13/03 – BEIS issues its Final Notice for the forthcoming ENERGY PERSPECTIVE 02 second CfD auction, confirming the timetable and the administered Ofgem takes aim for Targeted strike prices. Ofgem opens a consultation on its proposals for a Charging Review Targeted Charging Review of electricity networks. The Association for Decentralised Energy launches a new task force to deliver a subsidy- POLICY 04 free heat network market with strong protections for consumers. SSE “Time is up” for Big Six, says announces that it will increase its standard electricity prices by 14.9%. Clark CCC finds energy efficiency Tuesday 14/03 – Business and Energy Secretary Greg Clark labels gains offsetting green policies recent price rises by the Big Six as unacceptable. Cornwall research BEIS sets terms of second CfD finds the costs facing household electricity suppliers fell in February. auction Contingency balancing Google’s DeepMind confirms it is in talks with National Grid over the measures went unused, think possibility of using artificial intelligence to help balance the supply and tank finds demand of energy in Britain. Eurostat figures reveal that, among the Suppliers told to help vulnerable customers during smart roll-out EU member states, the UK is one of the furthest away from its 2020 Parliamentary Update – Week 11 target for deploying renewables. 2017 Wednesday 15/03 – BEIS research shows a reduction in the UK’s REGULATION 13 projected shortfall for the Fourth Carbon Budget. Co-op Energy sets Interim SO incentives signal out plans to expand its support for community energy in the UK. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Marketing Particulars

On the Instruction of Lloyds Banking Group TO LET – NEW LEASE AVAILABLE CHESTER, 4 Foregate Street CH1 1HA Location Chester is an historic city located approximately 36 miles south west of Manchester, and approximately 25 miles south of Liverpool. It is located at the western end of the M56 motorway, which links with the M6 and M60 motorways. The property is situated on Foregate Street, the prime retail pitch within Chester city centre. Nearby occupiers include Lloyds Bank, HSBC Bank, WHSmith, Clarks and JD Sports. Description The ground floor comprises a shell unit with open plan floor space. The basement floor consists of ancillary storage and toilets. Accommodation • Prime Retail Location • Heavy Footfall Ground Floor 34.90 sq m 376 sq ft • New lease terms available Basement Floor 78.78 sq m 794 sq ft EPC An EPC can be made available upon Tenure request. The property is available on an FRI Leasehold basis. Viewing Length of term to be negotiated. By appointment via this office: Rent Ross Jackson £40,000 pax. t: + 44 161 233 5492 e: [email protected] Rates CBRE Limited We are informed by the Local Rating Authority that the current rateable Henrietta House, Henrietta Place value of the property is £34,500 and the rates payable are £17,008.50. London W1G 0NB The UBR for 2018/2019 is 49.3 p. Interested parties are advised to make www.cbre.co.uk/retail their own enquiries with the Local Authority for verification purposes. Date of Issue 13 th June 2018 On the Instruction of Lloyds Banking Group TO LET – NEW LEASE AVAILABLE CHESTER, 4 Foregate Street CH1 1HA DISCLAIMER: CBRE Limited CBRE Limited on its behalf and for the Vendors or Lessors of this property whose Agents they are, give notice that: 1. -

N5925 Cover 99

WHITBREAD PLC ANNUAL REPORT AND ACCOUNTS 1998/9 ANNUAL REPORT OUR BUSINESSES ARE POSITIONED IN MARKETS WHERE GROWTH IS DRIVEN BY WELL-ESTABLISHED CONSUMER TRENDS. IN ADDITION, MANAGEMENT HAS TAKEN FURTHER ACTION TO STRENGTHEN THE CONSUMER APPEAL OF OUR BRANDS, PARTICULARLY THROUGH ENHANCED CUSTOMER SERVICE, AND REMAINS FOCUSED ON IMPROVING RETURNS THROUGH INCREASED EFFICIENCY. CONTENTS 2 FINANCIAL HIGHLIGHTS 4CHAIRMAN’S STATEMENT 5 COMPANY OVERVIEW 6 OPERATING AND FINANCE REVIEW 14BOARD OF DIRECTORS 16 DIRECTORS’ REPORT 18 – CORPORATE GOVERNANCE 20 – REMUNERATION REPORT This document contains detailed financial and statutory information and constitutes Whitbread PLC’s annual report and accounts for 1998/9. The company also publishes a shorter document, the Whitbread annual review, which aims to give private shareholders a good overview of the company’s results and activities. 26 STATEMENT OF DIRECTORS’ 32 BALANCE SHEETS RESPONSIBILITIES 33 CASH FLOW STATEMENT 27 REPORT OF THE AUDITORS 34 NOTES TO THE ACCOUNTS 28 ACCOUNTING POLICIES 56 FIVE YEAR SUMMARY 30 GROUP PROFIT AND LOSS ACCOUNT 58 GLOSSARY 31 STATEMENT OF TOTAL RECOGNISED GAINS 60 SHAREHOLDER SERVICES AND LOSSES 31 HISTORICAL COST PROFITS AND LOSSES 2 FINANCIAL HIGHLIGHTS SEGMENTAL TURNOVER ANALYSIS 1998/9 Beer Pub Partnerships Inns Restaurants Hotels Sports, health and fitness Other drinks TURNOVER INCLUDING JOINT VENTURES (£m) PROFIT BEFORE EXCEPTIONAL ITEMS AND TAX (£m) 3,313 3,410 3,131 354.8 365.3 2,840 316.5 2,556 283.1 255.1 1994/5 1995/6 1996/7 1997/8 1998/9 1994/5 1995/6 1996/7 1997/8 1998/9 WHITBREAD PLC ANNUAL REPORT AND ACCOUNTS 3 FINANCIAL HIGHLIGHTS SEGMENTAL PROFIT ANALYSIS 1998/9 Beer Pub Partnerships Inns Restaurants Hotels Sports, health and fitness Other drinks TO HAVE ACHIEVED A 4.6% INCREASE IN ADJUSTED EARNINGS PER SHARE IN DIFFICULT MARKET CONDITIONS WAS A CREDITABLE PERFORMANCE. -

Annual Report and Accounts 2017 Accounts and Report Annual the Future of Learning

Pearson Annual report and accounts 2017 The future of learning Pearson Annual report and accounts 2017 In this report Strategic report 01 Overview 22 Efficacy 02 Our KPIs 24 Sustainability 04 About Pearson 06 Chairman’s introduction 34 Our performance 08 CEO’s strategic overview 34 Financial review 42 Operating performance 12 Our strategy in action 48 Risk management 12 Market trends 50 Principal risks and uncertainties 13 Our strategy Governance Financial statements 62 Governance overview 112 Independent auditor’s report to the members 64 Leadership and effectiveness of Pearson plc 76 Accountability 118 Group accounts 86 Engagement 178 Parent company accounts 90 Remuneration 190 Five-year summary 106 Additional disclosures 192 Financial key performance indicators 110 Statement of Directors’ responsibilities 196 Shareholder information BC Principal offices worldwide Helping create the future of learning In this report we have included employee interviews from around our business to showcase how Pearson’s people are helping create the future of learning. CC Cedrick Collomb 19 IS Indika Senadhira 33 Senior Vice President for Senior Manager, Software Global Product Technology Engineering, Pearson Technology Delivery Centre KE Kate Edwards 23 AC Alvaro Castro 41 Senior Vice President Product Management Analyst, Efficacy & Research Pearson Test of English Strategy and performance reporting The was approved for issue by the Board on strategic report up to and including p60 is 14 March 2018 and signed on its behalf by: formed of three sections: ‘Overview’, ‘Our strategy in action’ and ‘Our performance’, and Coram Williams Chief Financial Officer Section 1 Overview 01 At Pearson we have a clear mission: to help people make progress in their lives through learning. -

Resilience of Your Supply Chain… About Us

WE INVITE YOU TO INCREASE THE RESILIENCE OF YOUR SUPPLY CHAIN… ABOUT US The Transported Asset Protection Association (TAPA) was formed 23 years ago by leading global Manufacturers & Logistics Service Providers to make their supply chains more resilient. Transported Asset Protection Association Today, TAPA is the world’s leading Security Expert Network for everyone in the supply chain … and we invite you to join our family. Joining our Association will give you access to supply chain resilience insight, trends and tools as well as industry-leading security standards, training and CARGO CRIME IN EMEA unique networking opportunities with like-minded supply chain professionals. With today’s unprecedented focus on supply chain resilience, TAPA’s presence • Thefts from supply chains cost businesses in Europe alone more than in the Europe, Middle East & Africa (EMEA) region is greater than at any time in €8.2 billion a year* our history … and we are growing at a record pace. I kindly ask you to spend a • All types of products are now a target for cargo thieves** moment reading this invitation to find out more about us. • Cargo thefts recorded in 48 countries in EMEA in 12 months** I would also welcome a conversation with you to answer any further questions you may have. You can reach me at [email protected] • Average annual loss for major cargo crimes = €536,889** I hope we will be speaking soon. • Annual increase in recorded cargo thefts = 114.7%** • Supply chain theft incidents reported to TAPA in EMEA in 12 months** = 8,548 • -

INVITATION BERENBERG Is Delighted to Invite You to Its

INVITATION BERENBERG is delighted to invite you to its USA CONFERENCE 2021 on Tuesday, May 18th – Thursday, May 20th 2021 Virtual Conference Conference calls will be scheduled throughout the day. Our Events Team will be providing technical support and facilitating all calls. LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Aerospace & Defence and Automotives Capital Goods & Industrial Engineering Construction, Metals & Mining and Utilities BAE Systems plc Alfen NV Breedon Group plc CONTINENTAL AG Alstom SA CRH plc RHEINMETALL AG Aluflexpack AG RWE AG Rolls-Royce Holdings plc Ceres Power Holdings plc Travis Perkins plc Schaeffler AG Diploma plc Victoria plc Vitesco Technologies GmbH Exponent Inc. Volution Group plc FASTNED B.V. Wienerberger AG Jungheinrich AG Knorr-Bremse AG Business Services, Leisure and Transport Marel hf Consumer Accor SA McGrath RentCorp AB InBev Applus Services SA Rational AG ASOS Plc Basic-Fit Schindler Holding AG Boozt AB Befesa SA Stabilus S.A Carlsberg A/S Borussia Dortmund GmbH & Co. KGaA Trex Company, Inc. Chr. Hansen A/S Brenntag AG va-Q-tec AG Essity Compass Group PLC VARTA AG Fevertree Drinks plc CTS Eventim AG & Co KGaA XP Power Ltd FIELMANN AG Dalata Hotel Group plc Zebra Technologies Glanbia plc Deutsche Post AG Global Fashion Group Henkel AG & Co KGaA doValue SpA Chemicals Entain PLC home24 SE Air Liquide SA Fluidra S.A. JD Sports Plc Ambercycle Hapag-Lloyd AG J Sainsbury Akzo Nobel NV IMCD N.V. Kerry Group plc BASF SE JTC plc Marley Spoon Bayer AG National Express Nestlé SA Evonik Industries AG Rubis SCA Reckitt Benckiser Group plc Fuchs Petrolub SE RWS Holdings plc Shop Apotheke Europe NV Kemira Oyj SGS SA Westwing Group AG LANXESS AG SIXT SE Linde plc Solutions 30 SE Novozymes A/S LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Financials Healthcare Healthcare Barclays plc AbCellera Biologics Inc Novo Nordisk A/S Brewin Dolphin Holdings plc Align Technology, Inc. -

BEIS Consults on Potential Actions in the 2020S to Phase out the Use of High-Carbon Fossil Fuel Heating in Buildings ENERGY PERSPECTIVE 02 Located Off the Gas Grid

Tom Crisp Editor 01603 604421 [email protected] Monday 19/03 – BEIS consults on potential actions in the 2020s to phase out the use of high-carbon fossil fuel heating in buildings ENERGY PERSPECTIVE 02 located off the gas grid. Media reports indicate BEIS has rejected calls for an inquiry into the UK’s gas storage capacity following recent price Cliff-hanger: supplier new entry in volatile markets – Gareth spikes. Oil and Gas UK predicts that production from the UK Miller Continental Shelf will increase by 5% in 2018. POLICY 05 Tuesday 20/03 – Energy and Clean Growth Minister Claire Perry confirms the government will be undertaking a formal review of the Low-carbon levies to breach £12bn per annum in 2026 Capacity Market this year. The Offshore Wind Industry Council details BEIS consults on standards for the industry’s vision for 2030, including 30GW of new capacity and smart appliances £48bn of investment in UK infrastructure. The government loses two BEIS considers novel options to votes in the House of Lords over its plans for successor arrangements decarbonise off-grid heat Parliamentary update – Week 12 for Euratom post-Brexit. The former CEO of E.ON UK Tony Cocker is 2018 appointed as the new Chairman of the Energy Innovation Centre. REGULATION 11 Wednesday 21/03 – Appearing before a Lords select committee, Claire Perry indicates the UK will look to remain in the EU Emissions Ofgem considers default tariff cap options Trading System, at least until the end of the current phase in 2020. Ofgem’s annual report on the Renewables Obligation shows it issued INDUSTRY STRUCTURE 14 86.2mn ROCs in 2016-17 – lower than the total UK supplier obligation Triad demand falls to record of 100.7mn ROCs. -

DATABANK INSIDE the CITY SABAH MEDDINGS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times November 11, 2018 BUSINESS Andrew Lynch LETTERS “The fee reflects the cleaning out the Royal Mail Send your letters, including food sales at M&S and the big concessions will be made for Delia’s fingers burnt by online ads outplacement amount boardroom. Don’t count on it SIGNALS full name and address, supermarkets — self-service small businesses operating charged by a major company happening soon. AND NOISE . to: The Sunday Times, tills. These are hated by most retail-type operations, but no Delia Smith’s website has administration last month for executives at this level,” 1 London Bridge Street, shoppers. Prices are lower at such concessions would been left with a sour taste owing hundreds of says Royal Mail, defending London SE1 9GF. Or email Lidl and other discounters, appear to be available for after the collapse of Switch thousands of pounds to its the Spanish practice. BBC friends [email protected] but also you can be served at businesses occupying small Concepts, a digital ad agency clients. Delia, 77 — no You can find such advice Letters may be edited a checkout quickly and with a industrial workshop or that styled itself as a tiny stranger to a competitive for senior directors on offer reunited smile. The big supermarkets warehouse units. challenger to Google. game thanks to her joint for just £10,000 if you try. Eyebrows were raised Labour didn’t work in the have forgotten they need Trevalyn Estates owns, Delia Online, a hub for ownership of Norwich FC — Quite why the former recently when it emerged 1970s, and it won’t again customers. -

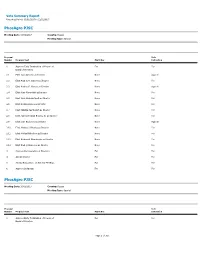

Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017

Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017 PhosAgro PJSC Meeting Date: 10/02/2017 Country: Russia Meeting Type: Special Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Approve Early Termination of Powers of For For Board of Directors 2.1 Elect Igor Antoshin as Director None Against 2.2 Elect Andrey A. Guryev as Director None For 2.3 Elect Andrey G. Guryev as Director None Against 2.4 Elect Yury Krugovykh as Director None For 2.5 Elect Sven Ombudstvedt as Director None For 2.6 Elect Roman Osipov as Director None For 2.7 Elect Natalya Pashkevich as Director None For 2.8 Elect James Beeland Rogers, Jr. as Director None For 2.9 Elect Ivan Rodionov as Director None Against 2.10 Elect Marcus J. Rhodes as Director None For 2.11 Elect Mikhail Rybnikov as Director None For 2.12 Elect Aleksandr Sharabayko as Director None For 2.13 Elect Andrey Sharonov as Director None For 3 Approve Remuneration of Directors For For 4 Amend Charter For For 5 Amend Regulations on General Meetings For For 6 Approve Dividends For For PhosAgro PJSC Meeting Date: 10/02/2017 Country: Russia Meeting Type: Special Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Approve Early Termination of Powers of For For Board of Directors Page 1 of 767 Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017 PhosAgro PJSC Proposal Vote Number Proposal Text Mgmt Rec Instruction 2.1 Elect Igor Antoshin as Director None Against 2.2 Elect Andrey A. -

Working at Heights

COMMUNICATION HUB FOR THE WIND ENERGY INDUSTRY SPECIALIST SURVEYING WORKING AT HEIGHTS LAW SPOTLIGHT ON TYNE & TEES APRIL/MAY 2013 | £5.25 INTRODUCTION ‘SPOTLIGHT’ ON THE TYNE & THE TEES CONTINUING OUR SUCCESSFUL REGULAR FEATURES company/organisation micropage held ‘Spotlight On’ featureS WE We can boast no fewer than 9 separate within our website, so that you can learn AGAIN VISIT THE TYNE & TEES features within this edition. Some much more in all sorts of formats. AS ‘an area of excellence are planned and can be found in our IN THE WIND ENERGY INDUSTRY ‘Forthcoming Features’ tab on our These have already become very popular THROUGHOUT EUROPE AND website – we do however react to editorial as it links the printed magazine in a very beyond’ received, which we believe is important interactive way – a great marketing tool to the industry and create new features to for our decision making readership to The area is becoming more and more suit. find out about products and services important to the wind energy industry. immediately following the reading of an As you will see the depth and breadth Therefore please do not hesitate to let us interesting article. Contact the commercial of the companies and organisations know about any subject area which you department to find out how to get one for who have contributed to this feature do feel is important to the continued progress your company. not disappoint. of the industry and we will endeavour to bring it to the fore. The feature boasts the largest page Click to view more info count so far which stretches over 40 WIND ENERGY INDUSTRY SKILLS GAP pages! – initiative update = Click to view video I year ago we reported that there were 4 COLLABORATION AND THE VESSEL main areas to focus on if we are to satisfy CO-OPERATIVE that need and would include a focused Our industry lead article in this edition approach in the following areas.