Resilience of Your Supply Chain… About Us

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Marketing Particulars

On the Instruction of Lloyds Banking Group TO LET – NEW LEASE AVAILABLE CHESTER, 4 Foregate Street CH1 1HA Location Chester is an historic city located approximately 36 miles south west of Manchester, and approximately 25 miles south of Liverpool. It is located at the western end of the M56 motorway, which links with the M6 and M60 motorways. The property is situated on Foregate Street, the prime retail pitch within Chester city centre. Nearby occupiers include Lloyds Bank, HSBC Bank, WHSmith, Clarks and JD Sports. Description The ground floor comprises a shell unit with open plan floor space. The basement floor consists of ancillary storage and toilets. Accommodation • Prime Retail Location • Heavy Footfall Ground Floor 34.90 sq m 376 sq ft • New lease terms available Basement Floor 78.78 sq m 794 sq ft EPC An EPC can be made available upon Tenure request. The property is available on an FRI Leasehold basis. Viewing Length of term to be negotiated. By appointment via this office: Rent Ross Jackson £40,000 pax. t: + 44 161 233 5492 e: [email protected] Rates CBRE Limited We are informed by the Local Rating Authority that the current rateable Henrietta House, Henrietta Place value of the property is £34,500 and the rates payable are £17,008.50. London W1G 0NB The UBR for 2018/2019 is 49.3 p. Interested parties are advised to make www.cbre.co.uk/retail their own enquiries with the Local Authority for verification purposes. Date of Issue 13 th June 2018 On the Instruction of Lloyds Banking Group TO LET – NEW LEASE AVAILABLE CHESTER, 4 Foregate Street CH1 1HA DISCLAIMER: CBRE Limited CBRE Limited on its behalf and for the Vendors or Lessors of this property whose Agents they are, give notice that: 1. -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Company Outline Numerical Facts About Nippon Express

Numerical Facts about Nippon Express Company Outline (As of March 31, 2021) (As of March 31, 2021) Company Nippon Express Company, Limited Employees Scale Warehousing Revenues and Segment Income (billions of yen) Name: Number of employees Subsidiaries …………………………………… 278 Commercial warehouses ……………… 1,100 Head Office: Higashi-shimbashi 1-9-3, Minato-ku, Tokyo 105-8322 Consolidated total ……………… 72,366 Locations TEL 03-6251-1111 Affiliates …………………………………………… Established: October 1, 1937 Non-consolidated total …………………… 63 34,766 3,400,000 Paid-in 70,175 million yen Japan Americas Europe East Asia m² Overseas employees …………………… Capital: 21,520 Overseas Network ………………………………… 47 Domestic distribution facilities ………… 55.9 Cumulative total of Revenues: 2,079,195 million yen (fiscal year ended March 2021) 51.9 …………… Countries 2,300 8.4 employees assigned overseas 4,498 Locations 42.8 Operating 78,100 million yen (fiscal year ended March 2021) 4.2 3.4 3.0 2.7 2.2 1.7 2.9 143.6 Income: 1,256.8 0.4 314 1,213.5 1,212.8 Number of employees by segment 122.7 Cities 7,000,000 Principal road freight transportation; air freight transportation; 119.3 117.1 m² 114.8 112.0 Japan …………………………………… Lines of ocean freight transportation; marine and harbor 42,554 Overseas 98.6 Business: transportation; railway freight transportation; 91.0 Americas …………………………………… 733 warehousing space ……… 2,866 Locations 3,600,000 warehousing; security; haulage, construction and 78.1 m² installation of heavy equipment and related businesses; Europe ……………………………………… 3,394 construction; -

INVITATION BERENBERG Is Delighted to Invite You to Its

INVITATION BERENBERG is delighted to invite you to its USA CONFERENCE 2021 on Tuesday, May 18th – Thursday, May 20th 2021 Virtual Conference Conference calls will be scheduled throughout the day. Our Events Team will be providing technical support and facilitating all calls. LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Aerospace & Defence and Automotives Capital Goods & Industrial Engineering Construction, Metals & Mining and Utilities BAE Systems plc Alfen NV Breedon Group plc CONTINENTAL AG Alstom SA CRH plc RHEINMETALL AG Aluflexpack AG RWE AG Rolls-Royce Holdings plc Ceres Power Holdings plc Travis Perkins plc Schaeffler AG Diploma plc Victoria plc Vitesco Technologies GmbH Exponent Inc. Volution Group plc FASTNED B.V. Wienerberger AG Jungheinrich AG Knorr-Bremse AG Business Services, Leisure and Transport Marel hf Consumer Accor SA McGrath RentCorp AB InBev Applus Services SA Rational AG ASOS Plc Basic-Fit Schindler Holding AG Boozt AB Befesa SA Stabilus S.A Carlsberg A/S Borussia Dortmund GmbH & Co. KGaA Trex Company, Inc. Chr. Hansen A/S Brenntag AG va-Q-tec AG Essity Compass Group PLC VARTA AG Fevertree Drinks plc CTS Eventim AG & Co KGaA XP Power Ltd FIELMANN AG Dalata Hotel Group plc Zebra Technologies Glanbia plc Deutsche Post AG Global Fashion Group Henkel AG & Co KGaA doValue SpA Chemicals Entain PLC home24 SE Air Liquide SA Fluidra S.A. JD Sports Plc Ambercycle Hapag-Lloyd AG J Sainsbury Akzo Nobel NV IMCD N.V. Kerry Group plc BASF SE JTC plc Marley Spoon Bayer AG National Express Nestlé SA Evonik Industries AG Rubis SCA Reckitt Benckiser Group plc Fuchs Petrolub SE RWS Holdings plc Shop Apotheke Europe NV Kemira Oyj SGS SA Westwing Group AG LANXESS AG SIXT SE Linde plc Solutions 30 SE Novozymes A/S LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Financials Healthcare Healthcare Barclays plc AbCellera Biologics Inc Novo Nordisk A/S Brewin Dolphin Holdings plc Align Technology, Inc. -

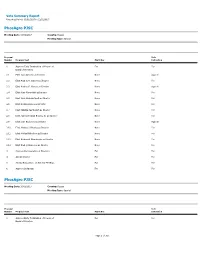

Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017

Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017 PhosAgro PJSC Meeting Date: 10/02/2017 Country: Russia Meeting Type: Special Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Approve Early Termination of Powers of For For Board of Directors 2.1 Elect Igor Antoshin as Director None Against 2.2 Elect Andrey A. Guryev as Director None For 2.3 Elect Andrey G. Guryev as Director None Against 2.4 Elect Yury Krugovykh as Director None For 2.5 Elect Sven Ombudstvedt as Director None For 2.6 Elect Roman Osipov as Director None For 2.7 Elect Natalya Pashkevich as Director None For 2.8 Elect James Beeland Rogers, Jr. as Director None For 2.9 Elect Ivan Rodionov as Director None Against 2.10 Elect Marcus J. Rhodes as Director None For 2.11 Elect Mikhail Rybnikov as Director None For 2.12 Elect Aleksandr Sharabayko as Director None For 2.13 Elect Andrey Sharonov as Director None For 3 Approve Remuneration of Directors For For 4 Amend Charter For For 5 Amend Regulations on General Meetings For For 6 Approve Dividends For For PhosAgro PJSC Meeting Date: 10/02/2017 Country: Russia Meeting Type: Special Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Approve Early Termination of Powers of For For Board of Directors Page 1 of 767 Vote Summary Report Reporting Period: 10/01/2017 to 12/31/2017 PhosAgro PJSC Proposal Vote Number Proposal Text Mgmt Rec Instruction 2.1 Elect Igor Antoshin as Director None Against 2.2 Elect Andrey A. -

Artemis Institutional UK Special Situations Fund

Artemis Institutional UK Special Situations Fund Half-Yearly Report (unaudited) for the six months ended 30 June 2021 General information Objective and investment policy Company profile Objective The investment objective of the Fund is to provide long- and term capital growth by exploiting special situations. The Artemis is a leading UK-based fund manager, offering a range investment Fund invests principally in UK equities and in companies of funds which invest in the UK, Europe, the US and around policy which are headquartered or have a significant part of their activities in the UK which are quoted on a regulated the world. market outside the UK. The securities of companies listed, quoted and/or traded in the UK but domiciled elsewhere As a dedicated, active investment house, we specialise in and the securities of companies traded on PLUS may be investment management for both retail and institutional included in the portfolio. Income within the portfolio is accumulated and reinvested. The Fund aims to provide investors across Europe. investors with a total return in excess of that of the FTSE ALL-Share Index. Independent and owner-managed, Artemis opened The Manager actively manages the portfolio in order to for business in 1997. Its aim was, and still is, exemplary achieve this objective. Exposure to large, medium and small companies varies over time, reflecting the Manager’s investment performance and client service. All Artemis’ views on where the greatest performance potential exists. staff share these two precepts – and the same flair and The Fund may also invest the property in transferable enthusiasm for fund management. -

Factsheet: DWS European Opportunities

Marketing Material Factsheet: DWS European Opportunities Equity Funds - Europe August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class LD (in %) Selected European companies with medium market capitalizations (mid caps) as well as some with small market capitalizations (small caps). Fund Benchmark (since 22/04/2002)* *Benchmark: 70% STOXX Europe Mid 200, 30% STOXX Europe Small 200 ab 30.6.00 (RI) Fund Management's Comment Calculation of performance is based on the time-weighted return and excludes front-end fees. Individual costs such as fees, commissions and other charges have not been included in this presentation and would have an adverse impact on returns if they were included. Past performance is not a reliable indicator of future returns. In August, the European equity market was stronger on balance. The continued high bond purchases by the ECB and the Fed, the stabilization of long-term bond yields in the Cumulative performance (in %) - share class LD Eurozone and in the US, continued moderate 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 investor positioning and emerging speculation about details of the Fed’s plan to reduce its bond purchases supported the equity markets EUR 2.4 39.8 55.7 97.2 3,128.0 18.6 15.9 14.5 19.0 -19.4 42.4 16.4 in August. The continued spread of the delta BM IN EUR 2.1 37.0 32.6 69.3 2,206.3 20.1 9.9 11.1 16.8 -12.2 28.2 2.1 variant, the further strengthening of regulatory dynamics in China, falling commodity prices and mixed global economic data were negative trends in August. -

CSR Report 2012

CSR Report 2012 Nippon Express CSR Report 2012 1 Delivering your passion across the globe. Editorial Policy s4HISREPORTCOVERSTHE.IPPON%XPRESS'ROUPSCORPORATESOCIALRESPONSIBILITY#32 INITIATIVESDURINGFISCAL ANDCOMPRISESSUCHFEATURESASANEXPLANATIONOFOUR#32 MANAGEMENTSTRUCTURE REPORTSONOURACTIVITIESANDPERFORMANCEDATA s7EHAVEATTEMPTEDTOPROVIDEANUNDERSTANDINGOFTHELOGISTICSINDUSTRYS#32EFFORTS BYDESCRIBINGINDUSTRYCONDITIONS ENVIRONMENTALCHALLENGES RECENTPOLICYMEASURESAND OTHERFACTORSBEHINDOURINITIATIVES s)NADDITIONTOTHEUSEOFILLUSTRATIONSANDPHOTOGRAPHS WEHAVEENDEAVOUREDTOKEEP THETEXTEASYTOUNDERSTAND s)NWRITINGTHISREPORTWEHAVEREFERREDTOTHE%NVIRONMENTAL2EPORTING'UIDELINES 6ERSION PUBLISHEDIN*UNEBY*APANESE-INISTRYOFTHE%NVIRONMENT ANDTHE'2) 3USTAINABILITY2EPORTING'UIDELINES s4HISREPORTALSOINCLUDESINFORMATIONABOUTONGOINGINITIATIVESLAUNCHEDINORPRIORTO FISCAL4HISISTOPROVIDEANOVERALLUNDERSTANDINGOF#32INOURBUSINESS 3COPEOF4HIS2EPORT 4HISREPORTCOVERS#32 RELATEDINITIATIVESANDMANAGEMENTSTRUCTUREOFTHE.IPPON %XPRESS'ROUPINCLUDING'ROUPAFFILIATESIN*APANANDOVERSEAS 3OMEMATERIALREPORTED HEREAPPLIESONLYTO.IPPON%XPRESS#O ,TD !PPLICABLE0ERIOD !PRIL TO-ARCH )NCERTAINPLACESWEHAVEUSEDDATACOVERINGUPTO*UNEFORMATTERSDESERVING SPECIALMENTION CSR Report 2012 Contents 4–5 Message from the President 6–7 Corporate Philosophy 8–9 CSR Activities of the Nippon Express Group 10–11 Targets and Achievements 12–13 Business Outline 14–15 Global Network 16–17 Nippon Express Group Initiatives in Overseas Regions 18–21 Feature: Striving to realize sustainable logistics 22–36 Environmental -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47