SP Setia Berhad

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PENANG REAL ESTATE MARKET Research Report H1 2013 (For Internal Circulation Only)

HENRY BUTCHER MALAYSIA PENANG International Asset Consultants PENANG REAL ESTATE MARKET Research Report H1 2013 (For internal circulation only) Research Report H1 2013 TIME TO BUY, HOLD OR SELL? WHAT’S AHEAD? Real estate is always a crucial link in global capital markets and risk management. While the emerging economies of Malaysia go through its metamorphosis, the real estate industry is also developing rapidly with demand for sustainable developments, social amenities, physical infrastructure as well as the exponential increase of residential and commercial properties. For the past few years, the Penang property market has been unprecedentedly extraordinary, exciting and challenging. This means that there is an inherent need for information and Malaysia, Penang, is pleased to present its current knowledge to improve decision making, whether views on the Penang property market. it is among public institutions, commercial and financial entities, developers and investors. This report is intended for discussion and should not be relied upon as professional advice. This brief report is part of an ongoing effort to facilitate a better understanding of the market. While every reasonable effort has been made to ensure the accuracy of the contents, no warranty is made with Against this backdrop, Henry Butcher regard to that content. Malaysian GDP growth at 4.1% Malaysian economy is still on sturdy track with Residential subsector, hike up to 9.8% , largely GDP growth at 4.1% in Q1 2013 ~ Department attributed by housing development projects in Klang of Statistics. Construction and services sectors Valley and Penang. were the major catalysts that spearheading the country’s economy with 14.7% and 5.9% growth respectively. -

Business Name Business Category Outlet Address State 2020 Motor

Business Name Business Category Outlet Address State 2020 Motor Automotive TB 12186 LOT A 13 TAMAN MEGAH JAYA,JALAN APASTAWAU Sabah 616 Auto Parts Co Automotive Kian yap Industrial lot 113 lorong durians 112 Lorong Durian 5 88450 Kota Kinabalu Sabah Malaysia Sabah 88 Bikers Automotive D-G-5, Ground Floor, Block D, Komersial 88/288 Marketplace, Ph.10A, Jalan Pintas, Kepayan RidgeSabah Sabah Alpha Motor Trading Automotive Alpha Motor Trading Jalan Sapi Nangoh Sabah Malaysia Sabah anna car rental Automotive Sandakan Airport Sabah Apollo service centre Automotive Kudat Sabah Malaysia Sabah AQIQ ENTERPRISE Automotive Lorong Cyber Perdana 3 Penampang Sabah Malaysia 89500 Sabah ar rizqi Automotive Beaufort, Sabah, Malaysia Sabah Armada KK Automobile Sdn Bhd Automotive Ground Floor, Lot No.46, Block E, Asia City, Phase 1B Sabah arsy hany car rental Automotive rumah murah peringkat 1 no 54 Pekan Beaufort Sabah Atlanz Tyres Automotive Kampung Keliangau, Kota Kinabalu, Sabah, Malaysia Sabah Autocycle Motor Sdn Bhd Automotive lot 39, grd polytechnic, 8, Jalan Politeknik, Tuaran, Sabah, Malaysia Sabah Autohaven Superstore Automotive kg sin san peti surat 588 Kudat Sabah Malaysia Sabah Automotive Electrical Tec Automotive No 3, Block H, Hakka Building, Mile 5,5, Tuaran Road, Inanam, Kota Kinabalu, Sabah, Malaysia Sabah Azmi Sparepart Automotive Papar Sabah Malaysia Sabah Bad Monkey Garage Automotive Kg Landong Ayang Jln Landong Ayang 2 Kg Landong Ayang Jalan Landong Ayang II Kudat Sabah Malaysia Sabah BANLEE MOTOR Automotive BANLEE MOTORBATU 1 JLN MERINTAMAN98850 -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

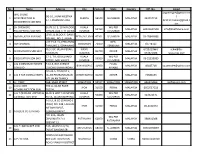

Financial Results & Group Update

FINANCIAL RESULTS & GROUP UPDATE FOR THE YEAR ENDED 31 DECEMBER 2018 27 February 2019 Strengthened Position as No 1 Property Developer in Malaysia SALES Local 80% International 20% International, 1,001 , 20% Eastern, 9 , <1% Northern, 198 , 4% Total Sales RM5,123 Southern, million 805 , 16% Central, 3,110, 60% Sales for I&P Projects 2017 = RM859mil 2018 = RM1,250mil (46% ) 2 SALES EXCEED TARGET Stronger Contribution led by Central and Southern Regions 6,000 RM 5.123b RM 5.0b RM 4.920b 5,000 1,001 979 1,509 9 4,000 31 198 461 - 805 144 729 3,000 587 2,000 3,110 2,680 2,800 1,000 - Actual FY2017 Target FY2018 Actual FY2018 Central Southern Northern Eastern International 3 RM8.33b SALES FROM BATTERSEA PHASE 2 - COMMERCIAL Setia’s Equity Stake Equals to RM3.33b RM 8.45b 9,000 (with Battersea Ph2) 8,000 7,000 3,332 6,000 RM 5.0b RM 4.920b 5,000 979 1,001 1,509 9 4,000 31 198 461 - 805 144 729 3,000 587 2,000 3,111 2,680 2,800 1,000 - Actual FY2017 Target FY2018 Actual FY2018 Central Southern Northern Eastern International Battersea 4 5 YEARS FINANCIAL HIGHLIGHTS Commendable Revenue Group Revenue (RM'million) 8,000 7,000 6,746 6,000 12 months revenue = RM5,606 million 4,957 5,000 4,520 4,000 3,870 3,594 3,000 2,000 1,000 - FY2014 FY2015 FY2016 FY2017 FY2018 14 months 5 5 YEARS FINANCIAL HIGHLIGHTS Profit Before Tax Profit attributable to shareholders (RM'million) (RM'million) 1,600 1,000 918 933 1,426 900 1,400 1,271 808 1,185 800 12 months = 710 million 1,200 671 12 months = 1,123 million 991 700 1,000 600 800 722 500 406 600 400 400 300 200 -

2018 >> Group Highlights 2018

Stay Together. Stay Integrated Report 2018 >> GROUP HIGHLIGHTS 2018 Earnings Per Share 14.8 sen Shareholders Fund Dividend Per Share RM14.14 8.55 sen billion Ongoing Projects 45 Effective Land Banks 9,516 acres Revenue Strong GDV in the Pipeline Unbilled Sales Total Sales RM3.59 RM149.70 RM12.32 Achieved billion billion billion RM5.12 Profit Before Tax Profit Attributable to Owners Total Strong, Dynamic & billion RM991.0 of the Company Diversified Employees million RM671.0 2,300 million People* * Approximate 1 STAY TOGETHER. STAY SETIA >> Inside this Report Our growth trajectory is anchored in sound fundamentals. Our diligence, integrity and Content persistent focus on sound business practices provide a solid foundation for our continued delivery of value in the long term. Introduction 6 Our Approach to Reporting With decades of experience setting the bar in 8 About This Integrated Report Malaysia’s property market, we know beyond a doubt that it is only together that we can thrive. Our Business Our success is a truly befitting reflection of our 10 Who We Are belief that together, we can weather all challenges 12 Our Presence and achieve even greater heights. 14 Corporate Structure 17 Corporate Information As we continue to expand, we are also now 18 Corporate Calendar celebrating the deeper meaning that our name 25 Accolades stands for. We remain loyal to our stakeholders and steadfast in our commitment to quality and Our Leadership growth – striving to ensure a better life for all. 26 Chairman’s Message 30 Board of Directors Therefore, in staying true to our nature and our 40 Key Management Profile name, we will continue to “STAY TOGETHER. -

WTW Property Market 2012 C H Williams Talhar & Wong

C H Williams Talhar & Wong WTW Property Market 2012 C H WILLIAMS TALHAR & WONG Established in 1960, C H Williams Talhar & Wong (WTW) is a leading real estate services company in Malaysia and Brunei (headquartered in Kuala Lumpur) operating with 25 branches and associated offices. WTW provides Valuation & Advisory Services, Agency & Transactional Services and Management Services. HISTORY Colin Harold Williams established “C H Williams & Co, Valuer & Estate Agent” when he set up office in Kuala Lumpur in 1960. Messrs C H Williams Talhar & Wong was formed in 1973 following the merger with Johor based Talhar & Co (Valuer & Estate Agent) and the inclusion of Dato Wong Choon Kee. PRESENT MANAGEMENT The Group is headed by Chairman, Mohd Talhar Abdul Rahman who guides the group on policy developments and identifies key marketing strategies which have been instrumental in maintaining the strong competitive edge of WTW. The current Managing Directors of the WTW Group operations are: ► C H Williams Talhar & Wong Sdn Bhd Foo Gee Jen ► C H Williams Talhar & Wong (Sabah) Sdn Bhd Chong Choon Kim ► C H Williams Talhar & Wong & Yeo Sdn Bhd (operating in Sarawak) Robert Ting ► WTW Bovis Sdn Bhd Dinesh Nambiar CONTENTS C H Williams Talhar & Wong State of the Property Market............... 4 Klang Valley . .10 Johor Bahru . .21 Penang ...............................27 East Coast . .35 Kota Kinabalu ..........................40 Kuching...............................49 Review of Malaysian REITs 2010 / 2011 . .56 Review of the Plantations Sector . .60 2 Chairman’s Foreword We hope to convey to our readers a broad sweep of the property scene in the different parts of our nation as viewed on the ground, in situ and in real time, so to speak. -

Rahim & Co Research Property Market Review 2016 / 2017

Property Market Review 2016/2017 1 FOREWORD Standard & Poor’s affirmed Malaysia’s A- sovereign rating with strong external position & monetary policy flexibility 2016 was a year of unpredictability I would say. First is the Growth – Inclusive Prudent Spending – Wellbeing of The Rakyat”, a Brexit Referendum results which surprised many, then Portugal pragmatic and Rakyat-Centric budget has emphasized such priority defeated the home favourites’ France and won their first European to enhance the living standards of the rakyat with a special focus on Championship, followed by the election of the Republican candidate the lower and middle-income groups through various programmes Donald Trump as the 45th president of the United States of America and provisions. These include special “step-up” financing for outnumbering the pollster’s pre-election favourite Hillary Clinton PR1MA programme, a “house for rent” programme, stamp-duty just before the end of the year. exemption on instruments of transfer and loan agreement for first home ownership. All these initiatives are aimed to encourage more On the Malaysian property scene, 2016 saw another challenging home ownership and to benefit first-time home buyers. This will year under a tough environment from both the economic and also indirectly boost the property sector especially in the affordable property fronts. Numbers reported in the Property Market Report housing segment. by the Valuation & Property Services Department (JPPH) showed the prolonging of the downward trend in property market activity The World Bank’s “Economic Monitor Report” released in June that started since 2013 though it momentarily improved in 2014 by 2016 had estimated the Malaysian economy to grow at a slower 0.8%. -

Hansard 16 Nov 2015

LAPORAN PERSIDANGAN MESYUARAT KEDUA PENGGAL KETIGA DEWAN UNDANGAN NEGERI PULAU PINANG YANG KETIGA BELAS Tarikh : 16 NOVEMBER 2015 (ISNIN) Masa : 9.30 Pagi Tempat : Dewan Undangan Negeri Lebuh Light, George Town Pulau Pinang. HADIR Bil. Nama Jawatan/Ahli Kawasan 1 Y.A.B. Lim Guan Eng Ketua Menteri / Air Putih 2 YB. Dato' Law Choo Kiang Yang di-Pertua Dewan Undangan Negeri 3 YB. Dato' Haji Mohd Rashid Bin Hasnon Timbalan Ketua Menteri I/ Pantai Jerejak 4 YB. Prof. Dr. P. Ramasamy A/L Palanisamy Timbalan Ketua Menteri II/Perai 5 YB. Chow Kon Yeow Padang Kota 6 YB. Dato' Haji Abdul Malik Bin Abul Kassim Batu Maung 7 YB. Chong Eng Padang Lalang 8 YB. Lim Hock Seng Bagan Jermal 9 YB. Law Heng Kiang Batu Lancang 10 YB. Phee Boon Poh Sungai Puyu 11 YB. Jagdeep Singh Deo A/L Karpal Singh Datok Keramat 12 YB. Dr. Afif Bin Bahardin Seberang Jaya 13 YB. Dato' Haji Maktar Bin Haji Shapee Timbalan Yang di-Pertua Dewan Undangan Negeri/Sungai Bakap 14 YB. Wong Hon Wai Air Itam 15 YB. Ong Kok Fooi Berapit 16 YB. Dr. Hajah Norlela Binti Ariffin Penanti 17 YB. Dato' Haji Mohd. Salleh Bin Man Permatang Pasir 18 YB. Tanasekharan A/L Autherapady Bagan Dalam 1 Bil. Nama Jawatan/Ahli Kawasan 19 YB. Yeoh Soon Hin Paya Terubong 20 YB. Teh Yee Cheu Tanjong Bunga 21 YB. Sanisvara Nethaji Rayer A/L Rajaji Seri Delima 22 YB. Ong Chin Wen Bukit Tengah 23 YB. Lau Keng Ee Pengkalan Kota 24 YB. Cheah Kah Peng Kebun Bunga 25 YB. -

Malaysia Sime Darby, SP Setia

PP16832/01/2013 (031128) PP16832/01/2012 (029059) Malaysia Company Update 11 September 2012 17 October 2011 Sime Darby Sime Darby, SP Setia This Time, Its For Real Buy (unchanged) Share price: MYR9.79 Half the battle won. The Mayor of London, also chairman of Transport for London, publicly gave his commitment and support to the Battersea Target price: MYR11.00 (unchanged) Power Station (BPS) redevelopment and timely construction of Northern Line Extension (NLE) at last Wednesday’s completion event. We are optimistic that this GBP8b GDV project will proceed as planned, Ong Chee Ting, CA as the crucial outline planning permission is in hand. The soft launch of [email protected] (603) 2297 8678 the GBP1b GDV Phase 1 may take place as early as Dec 2012/Jan 2013. Maintain BUY on Sime, HOLD on SP Setia. Critical success factors in place. Where the past owners have failed to redevelop BPS into a theme park, shopping mall, housing development or home to a circus troupe, the formula for a successful redevelopment of BPS is now in place. We list them below: (i) Shareholders’ financial strength. The previous owner, Real SP Setia Estate Opportunities Plc (REO), was affected by the 2008/09 global financial crisis and did not have the financial means to (unchanged) Hold carry out the development. New shareholders SPSB-Sime-EPF Share price: MYR3.54 (40:40:20) have the financial muscle to see through the GBP8b Target price: MYR4.00 (from MYR4.10) GDV project over the 15-year development period. (ii) Feasible planning consent in hand. -

TA Securities Thursday, 18 Sept 2014 a Member of the TA Group FBMKLCI: 1,843.78

RESULTS UPDATE TA Securities Thursday, 18 Sept 2014 A Member of the TA Group FBMKLCI: 1,843.78 MENARA TA ONE, 22 JALAN P. RAMLEE, 50250 KUALA LUMPUR, MALAYSIA TEL: +603 -20721277 / FAX: +603 -20325048 Sector: Property SP Setia Berhad TP: RM 3. 08 (-7.0%) RM5.0bn sales target to be dependent on Battersea Last Traded: RM3.31 THIS REPORT IS STRICTLY FOR INTERNAL CIRCULATION ONLY* Sell Thiam Chiann Wen Tel: +603-2167 9615 [email protected] www.taonline.com.my Review Share Information SP Setia’s 9MFY14 net profit of RM274.4mn came in below expectations, Bloomberg Code SPSB MK Stock Code 8664 making up 67% of ours and 59% of street’s FY14 estimates. The variance Listing Main Market was largely due to slower-than-expected progress billing and inclusion of Share Cap (mn) 2538.1 GST impact on construction costs for on-going projects, which span over the Market Cap (RMmn) 8401.1 Apr-15 implementation date. Par Value 0.75 52-wk Hi/Lo (RM) 3.65/2.70 12-mth Avg Daily Vol ('000 shrs) 1203.1 The group’s 9MFY14 revenue and PBT grew 12% YoY and 14% YoY Estimated Free Float (%) 20.1 respectively to RM2.6bn and RM500mn, mainly driven by higher revenue Beta 0.65 recognition from property development as a results of higher overall group Major Shareholders (%) sales achieved since FY12 – see Figure 1 . However, YTD net profit dipped PNB (64.0) KWAP (8.7) 5% YoY to RM274mn, mainly due to higher taxes and profit distribution to EPF (6.1) the holders of perpetual bonds and non-controlling interests, as well as the recognition of GST impact and long term incentive plan (LTIP) expenses. -

ECONOMIC OVERVIEW Property Launches Apartments / Condos

ECONOMIC OVERVIEW Property launches Apartments / Condos / Townhouses Key statistics Latest releases Previous rates Terraced houses Semi-detached houses Quarterly GDP growth 4.7% (1Q2012) 5.2% (4Q2011) Detached houses Annual GDP growth 5.1% (2011) 7.2% (2010) Consumer Price Index (CPI) 2.0% (Jan-Jun, '12) 3.2% (2011) Industrial Production Index (IPI) 112.8 (May-12) 108.4 (2011) Major news Base Lending Rate (BLR) 6.53% (Jun-12) 6.45% (2011) Mersing Laguna to rival Bali Exchange rate: RM to US dollar RM3.198 (29/06) RM3.057 (30/03) Big plans for Batu Berendam air port SP Setia banks on China project Four Season Place KL to open in 2015 Malaysia's economy grew at 4.7% in the first quarter ended March 31, 2012, a L&G unscathed by new ruling slightly slower pace from the 5.2% in the fourth quarter of last year and 5.1% a year Terengganu approves land for new... ago, despite the challenging external environment. Bank Negara Malaysia (BNM) Serene sanctuary in Ipoh said on Wednesday domestic demand remained firm, supported by both private and Protest against new project public sector economic activity, while exports moderated amid weaker external Tambun Indah developing 5 projects... demand. RM1b boost for I-City Sime Darby plans 11th township Malaysian Institute of Economic Research (MIER) indicated that the country's Masterplan to set up RM15b Perak... domestic consumption and government spending will support growth as overseas RM1.4bil shopping mall and office... demand eases. MIER projected the Malaysian economy to expand by 4.2% in 2012 Billion ringgit tower atop LRT station and 4.7% in 2013. -

SP Setia (SPSB MK) BUY Share Price MYR 3.05 Sales May Fall Short Company Description S12mp Setia Pricebhd Targetis Involved Myrin the 3.63Real (+19%)Estate Businesses

August 1, 2016 SP Setia (SPSB MK) BUY Share Price MYR 3.05 Sales may fall short Company Description S12mP Setia PriceBhd Targetis involved MYRin the 3.63real (+19%)estate businesses. ItsPreviousreputable Price Targetprojects includingMYR 3.86Setia Alam and Setia Eco Park. A defensive offering; maintain BUY Statistics Shariah status Yes Based on launches in the pipeline and weak buying sentiment in both 52w high/low (MYR) 3.40/2.80 Malaysia and UK, the latter post-Brexit, SPSB’s internal sales target of 3m avg turnover (USDm) 0.5 MYR4b for FY16 seems challenging. We adjust our FY16/17/18 earnings Free float (%) 22.0 forecasts by -1% to +7% and our TP to MYR3.63 (-6%; on unchanged 30% Issued shares (m) 2,628 discount to RNAV). Despite a lower TP, the implied capital upside is >10%. Market capitalisation MYR8.0B The stock also offers a 12M forward net yield of 6.3%. Maintain BUY. USD2.0B Major shareholders: More new launches in 2H Bumiputra Investment Foundation 51.0% Kumpulan Wang Persaraan 9.4% Management is keeping its MYR4b sales target for 2016 despite weak Employees Provident Fund 6.0% Real Estate sales in 4M16 (MYR696m) on the lack of new launches. It intends to Price Performance intensify its property launches in 2H16 and has lined up MYR3b worth of new launches. In view of the weak buying sentiment and tight lending 3.70 135 requirements in Malaysia and potentially slower sales in Battersea Power 3.60 130 Station (BPS) phase 3A post-Brexit, we think SPSB’s sales target for 2016 3.50 125 is a big challenge.