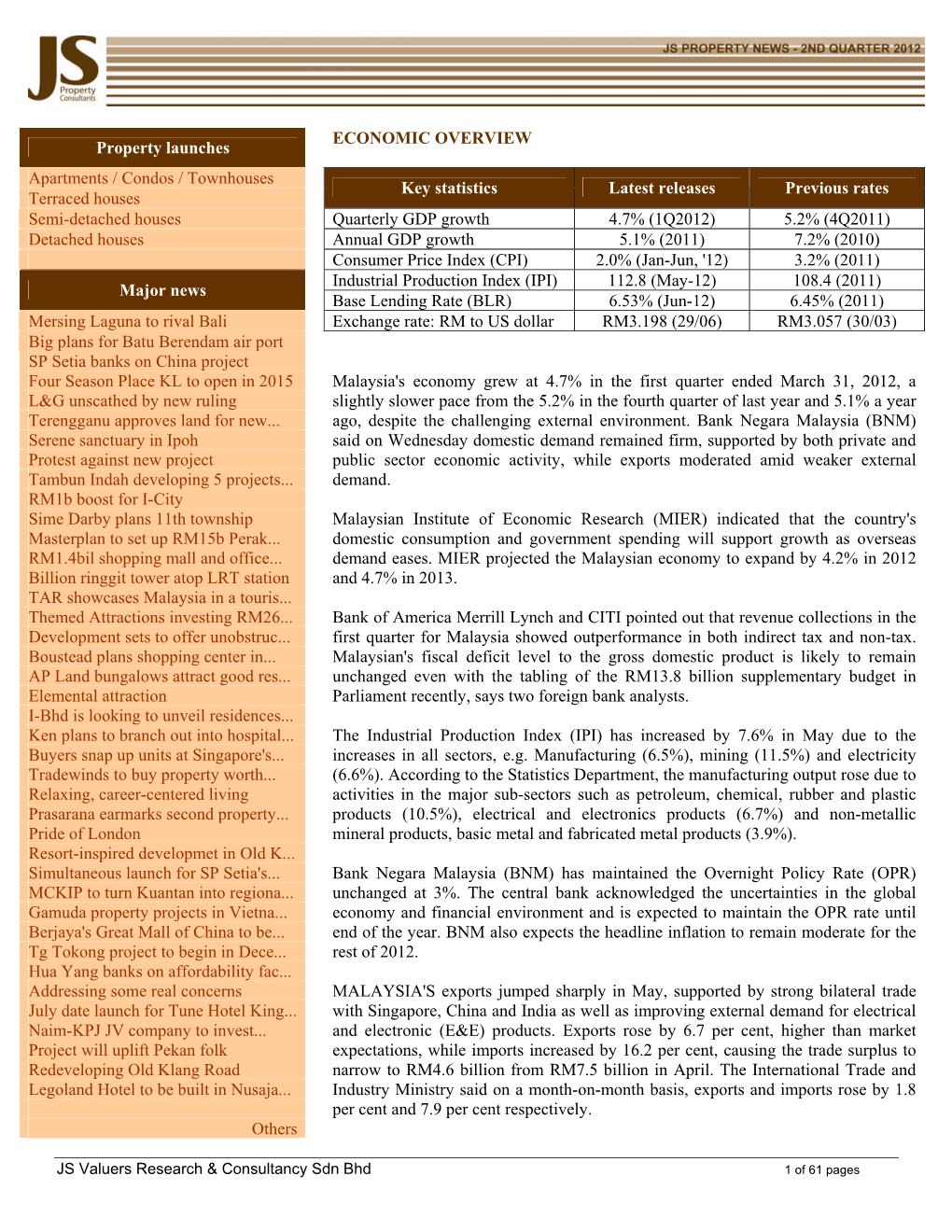

ECONOMIC OVERVIEW Property Launches Apartments / Condos

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SP Setia Berhad

2QFY21 Results Review (Within) | Thursday, 19 August 2021 S P Setia Berhad Maintain BUY (8664 | SPSB MK) Property| Property Steady earnings Unchanged Target Price: RM1.33 KEY INVESTMENT HIGHLIGHTS • 1HFY21 earnings within our expectation RETURN STATISTICS • Earnings recovered from low base in 1HFY20 Price @ 18 Aug 2021 (RM) 1.09 • Strong property sales of RM2.71b in 1HFY21 • Earnings forecast maintained Expected share price return (%) 22.0 • Maintain BUY with an unchanged TP of RM1.33 Expected dividend yield (%) 0.9 Expected total return (%) 22.9 1HFY21 earnings within our expectation. S P Setia 1HFY21 core net SHARE PRICE CHART income of RM179.8m came in within our expectation but above consensus expectation, making up 54% and 61% of our and consensus full year estimates respectively. Note that we have excluded mainly forex loss in our core net income calculations. Earnings recovered from low base in 1HFY20. Sequentially, 2QFY21 core net income was lower at RM73.1m (-31.3%qoq) despite higher topline (+2.8%qoq) as earnings were dragged by higher administrative and general expenses (+34.5%qoq). Meanwhile, 2QFY21 core net income Share price performance (%) Absolute Relative surged by more than ten-fold on yearly basis due to low base in 2QFY20. 1 month 2.8 3.0 Recall that earnings in 2QFY20 were negatively impacted by disruption of 3 months 2.8 8.2 site works as a result of MCO 1.0. This brought cumulative earnings in 12 months 39.7 43.5 1HFY21 to RM179.8m (+522.1%yoy). The earnings growth was mainly KEY STATISTICS underpinned by recovery in construction works at project sites and higher FBM KLCI 1,525.24 sales of completed inventories. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors. -

PENANG REAL ESTATE MARKET Research Report H1 2013 (For Internal Circulation Only)

HENRY BUTCHER MALAYSIA PENANG International Asset Consultants PENANG REAL ESTATE MARKET Research Report H1 2013 (For internal circulation only) Research Report H1 2013 TIME TO BUY, HOLD OR SELL? WHAT’S AHEAD? Real estate is always a crucial link in global capital markets and risk management. While the emerging economies of Malaysia go through its metamorphosis, the real estate industry is also developing rapidly with demand for sustainable developments, social amenities, physical infrastructure as well as the exponential increase of residential and commercial properties. For the past few years, the Penang property market has been unprecedentedly extraordinary, exciting and challenging. This means that there is an inherent need for information and Malaysia, Penang, is pleased to present its current knowledge to improve decision making, whether views on the Penang property market. it is among public institutions, commercial and financial entities, developers and investors. This report is intended for discussion and should not be relied upon as professional advice. This brief report is part of an ongoing effort to facilitate a better understanding of the market. While every reasonable effort has been made to ensure the accuracy of the contents, no warranty is made with Against this backdrop, Henry Butcher regard to that content. Malaysian GDP growth at 4.1% Malaysian economy is still on sturdy track with Residential subsector, hike up to 9.8% , largely GDP growth at 4.1% in Q1 2013 ~ Department attributed by housing development projects in Klang of Statistics. Construction and services sectors Valley and Penang. were the major catalysts that spearheading the country’s economy with 14.7% and 5.9% growth respectively. -

Business Name Business Category Outlet Address State 2020 Motor

Business Name Business Category Outlet Address State 2020 Motor Automotive TB 12186 LOT A 13 TAMAN MEGAH JAYA,JALAN APASTAWAU Sabah 616 Auto Parts Co Automotive Kian yap Industrial lot 113 lorong durians 112 Lorong Durian 5 88450 Kota Kinabalu Sabah Malaysia Sabah 88 Bikers Automotive D-G-5, Ground Floor, Block D, Komersial 88/288 Marketplace, Ph.10A, Jalan Pintas, Kepayan RidgeSabah Sabah Alpha Motor Trading Automotive Alpha Motor Trading Jalan Sapi Nangoh Sabah Malaysia Sabah anna car rental Automotive Sandakan Airport Sabah Apollo service centre Automotive Kudat Sabah Malaysia Sabah AQIQ ENTERPRISE Automotive Lorong Cyber Perdana 3 Penampang Sabah Malaysia 89500 Sabah ar rizqi Automotive Beaufort, Sabah, Malaysia Sabah Armada KK Automobile Sdn Bhd Automotive Ground Floor, Lot No.46, Block E, Asia City, Phase 1B Sabah arsy hany car rental Automotive rumah murah peringkat 1 no 54 Pekan Beaufort Sabah Atlanz Tyres Automotive Kampung Keliangau, Kota Kinabalu, Sabah, Malaysia Sabah Autocycle Motor Sdn Bhd Automotive lot 39, grd polytechnic, 8, Jalan Politeknik, Tuaran, Sabah, Malaysia Sabah Autohaven Superstore Automotive kg sin san peti surat 588 Kudat Sabah Malaysia Sabah Automotive Electrical Tec Automotive No 3, Block H, Hakka Building, Mile 5,5, Tuaran Road, Inanam, Kota Kinabalu, Sabah, Malaysia Sabah Azmi Sparepart Automotive Papar Sabah Malaysia Sabah Bad Monkey Garage Automotive Kg Landong Ayang Jln Landong Ayang 2 Kg Landong Ayang Jalan Landong Ayang II Kudat Sabah Malaysia Sabah BANLEE MOTOR Automotive BANLEE MOTORBATU 1 JLN MERINTAMAN98850 -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Download Brochure

FREEHOLD REINVENTING COMMUNITIES Artist’s Impression AN ALL INCLUSIVE COMMUNITY The Suite is the most exciting and Inviting you to be amongst a anticipated co-living and co-working community of like-minded people, space in Kuala Lumpur. In today’s fast one that shares your values in paced digital world, urban dwellers defining the perfect hybrid and knowledge entrepreneurs home-office experience, demand enhanced ways of living, here at The Suite. entertaining, working and interacting. CO-WORKING The latest buzzword in reinventing the concept of traditional offices into one that adds the flexibility and comforts of your space. Whether working as an individual or as a collaboration, The Suite completes COMMUNITY LIFESTYLE your needs in a home and workspace, The Suite sits quietly within an all in one place, complete with all the enclave, just one street off the right trimmings. international offerings of Jalan Ampang. SUITE DREAMS ARE MADE OF THESE The perfect place to live, a definition that evolves through time. Changing based on progress, trends and needs, which come about with modernity. The Suite checks all four boxes that matter now, in order to achieve this new hybrid living concept with success. CO-LIVING SHARED SPACES The Suite gathers like-minded Shared facilities, conveniences urbanites who have a mutual and services allow for much need for convenience, access, more to be offered to the entertainment and rejuvenation. urbanites and entrepreneurs here. Now we are able to cater Satisfy your lifestyle with a to a wider range of lifestyles, host of experiences offered, appetites and interests. or simply retire in the privacy of your living space for some alone time, whenever you need. -

Financial Results & Group Update

FINANCIAL RESULTS & GROUP UPDATE FOR THE YEAR ENDED 31 DECEMBER 2018 27 February 2019 Strengthened Position as No 1 Property Developer in Malaysia SALES Local 80% International 20% International, 1,001 , 20% Eastern, 9 , <1% Northern, 198 , 4% Total Sales RM5,123 Southern, million 805 , 16% Central, 3,110, 60% Sales for I&P Projects 2017 = RM859mil 2018 = RM1,250mil (46% ) 2 SALES EXCEED TARGET Stronger Contribution led by Central and Southern Regions 6,000 RM 5.123b RM 5.0b RM 4.920b 5,000 1,001 979 1,509 9 4,000 31 198 461 - 805 144 729 3,000 587 2,000 3,110 2,680 2,800 1,000 - Actual FY2017 Target FY2018 Actual FY2018 Central Southern Northern Eastern International 3 RM8.33b SALES FROM BATTERSEA PHASE 2 - COMMERCIAL Setia’s Equity Stake Equals to RM3.33b RM 8.45b 9,000 (with Battersea Ph2) 8,000 7,000 3,332 6,000 RM 5.0b RM 4.920b 5,000 979 1,001 1,509 9 4,000 31 198 461 - 805 144 729 3,000 587 2,000 3,111 2,680 2,800 1,000 - Actual FY2017 Target FY2018 Actual FY2018 Central Southern Northern Eastern International Battersea 4 5 YEARS FINANCIAL HIGHLIGHTS Commendable Revenue Group Revenue (RM'million) 8,000 7,000 6,746 6,000 12 months revenue = RM5,606 million 4,957 5,000 4,520 4,000 3,870 3,594 3,000 2,000 1,000 - FY2014 FY2015 FY2016 FY2017 FY2018 14 months 5 5 YEARS FINANCIAL HIGHLIGHTS Profit Before Tax Profit attributable to shareholders (RM'million) (RM'million) 1,600 1,000 918 933 1,426 900 1,400 1,271 808 1,185 800 12 months = 710 million 1,200 671 12 months = 1,123 million 991 700 1,000 600 800 722 500 406 600 400 400 300 200 -

Property Summary Office Cont'd

134 SUNWAY REIT ANNUAL REPORT 2016 PROPERTY SUMMARY ¶OFFICE· ¶CONT’D· SUNWAY WISMA PUTRA TOWER SUNWAY LOCATION LOCATION KUALA LUMPUR SELANGOR DATE OF ACQUISITION DATE OF ACQUISITION 19 APRIL 2011 23 MARCH 2015 ACQUISITION PRICE (RM MILLION) ACQUISITION PRICE (RM MILLION) 80 60 TITLE, EXPIRY DATE & YEARS REMAINING TITLE, EXPIRY DATE & YEARS REMAINING • Geran 10012, Lot No. 38, Seksyen 51 Strata Title • PN 21876/M1/B1/1 • PN 21876/M1/11/10 Kuala Lumpur, Wilayah Persekutuan • PN 21876/M1/1/3 • PN 21876/M1/12/11 TENURE • PN 21876/M1/N1/4 • PN 21876/M1/13/12 Freehold • PN 21876/M1/N1/5 • PN 21876/M1/14/13 • PN 21876/M1/2/6 • PN 21876/M1/15/14 ENCUMBRANCE • PN 21876/M1/8/7 • PN 21876/M1/16/15 1. Charged to Public Investment Bank Berhad • PN 21876/M1/9/8 • PN 21876/M1/17/16 2. Charged to HSBC Amanah Malaysia Berhad • PN 21876/M1/10/9 3. 30 years lease to Lembaga Letrik Negara Tanah Melayu (Tenaga Nasional Berhad) expiring 4 April 29 August 2094 (78 years remaining) 2017 All situated on Parent Lot No. 517 Bandar Shah Alam 4. Private Caveat by Trustee Daerah Petaling, Selangor Darul Ehsan YEAR OF COMPLETION TENURE 1993 Leasehold - 99 years APPRAISED VALUE RM MILLION ENCUMBRANCE 110 - DATE OF LATEST VALUATION* YEAR OF COMPLETION JUNE 2016 1997; Refurbished in 2013 APPRAISED VALUE RM MILLION 62 DATE OF LATEST VALUATION* JUNE 2016 *NOTE: Valued by C H Williams Talhar & Wong Sdn Bhd SUNWAY REIT ANNUAL REPORT 2016 135 PROPERTY SUMMARY ¶OFFICE· ¶CONT’D· SUNWAY MENARA SUNWAY PUTRA WISMA OFFICE ASSETS SUNWAY TOWER TOWER SUNWAY TOTAL Land Area (sq. -

2018 >> Group Highlights 2018

Stay Together. Stay Integrated Report 2018 >> GROUP HIGHLIGHTS 2018 Earnings Per Share 14.8 sen Shareholders Fund Dividend Per Share RM14.14 8.55 sen billion Ongoing Projects 45 Effective Land Banks 9,516 acres Revenue Strong GDV in the Pipeline Unbilled Sales Total Sales RM3.59 RM149.70 RM12.32 Achieved billion billion billion RM5.12 Profit Before Tax Profit Attributable to Owners Total Strong, Dynamic & billion RM991.0 of the Company Diversified Employees million RM671.0 2,300 million People* * Approximate 1 STAY TOGETHER. STAY SETIA >> Inside this Report Our growth trajectory is anchored in sound fundamentals. Our diligence, integrity and Content persistent focus on sound business practices provide a solid foundation for our continued delivery of value in the long term. Introduction 6 Our Approach to Reporting With decades of experience setting the bar in 8 About This Integrated Report Malaysia’s property market, we know beyond a doubt that it is only together that we can thrive. Our Business Our success is a truly befitting reflection of our 10 Who We Are belief that together, we can weather all challenges 12 Our Presence and achieve even greater heights. 14 Corporate Structure 17 Corporate Information As we continue to expand, we are also now 18 Corporate Calendar celebrating the deeper meaning that our name 25 Accolades stands for. We remain loyal to our stakeholders and steadfast in our commitment to quality and Our Leadership growth – striving to ensure a better life for all. 26 Chairman’s Message 30 Board of Directors Therefore, in staying true to our nature and our 40 Key Management Profile name, we will continue to “STAY TOGETHER. -

2. Soalan Bertulis

PERTANYAAN-PERTANYAAN BERTULIS DARIPADA Y.B. PUAN HANIZA BT. MOHAMED TALHA (TAMAN MEDAN) TAJUK : PELABURAN DAN PELUANG PEKERJAAN DALAM SELANGOR 1. Bertanya kepada Y.A.B. Menteri Besar: a) Nyatakan dengan terperinci mengenai pelaburan baru yang diperoleh bagi 2009-2010. b) Senaraikan bilangan peluang pekerjaan yang ada di seluruh Selangor. c) Apakah usaha kerajaan bagi memastikan pekerjaan tersebut diisi oleh warga Malaysia? JAWAPAN : a) Bagi tempoh Januari hingga Disember 2009 sebanyak 182 projek baru telah diluluskan oleh MIDA di Selangor dengan nilai pelaburan berjumlah RM 3,181,707,948. Daripada jumlah ini, sebanyak RM 1,893,920,504 adalah daripada pelaburan tempatan dan sebanyak RM 1,287,787,444 daripada pelaburan asing. Sebanyak 14,483 potensi peluang pekerjaan telah diwujudkan. b) Bagi tempoh Januari hingga Disember 2009, sebanyak 22,753 potensi peluang pekerjaan telah diwujudkan di Negeri Selangor hasil daripada 278 projek perkilangan yang diluluskan. Daripada jumlah ini sebanyak 14,483 potensi peluang pekerjaan daripada projek baru dan selebihnya sebanyak 8,270 potensi peluang pekerjaan daripada projek pembesaran/pelbagaian. c) Bagi memastikan peluang-peluang pekerjaan ini diisi, Kerajaan Negeri telah mengadakan program “Jom Kerja” yang mana program ini memberi kesempatan kepada pihak syarikat untuk mengadakan “walk in interview” di tempat program ini diadakan. Program ini akan diadakan di setiap daerah bagi membantu pihak syarikat mencari sumber tenaga kerja yang diperlukan di kalangan rakyat tempatan. SSIC Berhad juga turut menganjurkan pertemuan dengan Ketua-Ketua Kampung, Guru- Guru Besar Sekolah dan Pengarah Institut Kemahiran Belia untuk mendapatkan kerjasama mereka bagi menghebahkan kekosongan pekerja bersama-sama kilang- kilang yang memerlukan pekerja dan juga Pejabat Daerah. -

Jumlah 648 Sekolah Rendah Di Negeri Selangor Sepanjang 2012

www.myschoolchildren.com www.myschoolchildren.com BIL NEGERI DAERAH PPD KOD SEKOLAH NAMA SEKOLAH ALAMAT LOKASI BANDAR POSKOD LOKASI NO. TELEFON NO.FAKS L P ENROLMEN 1 SELANGOR PPD GOMBAK BBA7101 SK SELAYANG BARU (2) JALAN 42, SELAYANG BARU BATU CAVES 68100 Bandar 0361386333 0361362333 538 550 1088 2 SELANGOR PPD GOMBAK BBA7102 SK (2) TAMAN SELAYANG JALAN SG. TUA BATU CAVES 68100 Bandar 0361882337 0361850849 588 532 1120 3 SELANGOR PPD GOMBAK BBA7103 SK (2) TAMAN KERAMAT JALAN ENGGANG TIMUR 1 KUALA LUMPUR 54200 Bandar 0342573546 0342573546 255 213 468 4 SELANGOR PPD GOMBAK BBA7201 SK HULU KELANG JALAN HULU KELANG AMPANG 68000 Bandar 0341078662 0341078662 404 384 788 5 SELANGOR PPD GOMBAK BBA7202 SK KLANG GATE JALAN GENTING KLANG KUALA LUMPUR 53100 Bandar 0341084646 0341078125 171 145 316 6 SELANGOR PPD GOMBAK BBA7203 SK GOMBAK SETIA GOMBAK SETIA KUALA LUMPUR 53100 Bandar 0361897851 0361896167 717 692 1409 7 SELANGOR PPD GOMBAK BBA7204 SK GOMBAK UTARA KM11, JALAN GOMBAK KUALA LUMPUR 53100 Bandar 0361893546 0361893546 548 516 1064 8 SELANGOR PPD GOMBAK BBA7205 SK SG TUA BAHARU JALAN MELATI, KG SG TUA BAHARU BATU CAVES 68100 Bandar 0361897052 0361897052 957 892 1849 9 SELANGOR PPD GOMBAK BBA7206 SK KEPONG INSTITUT PENYELIDIKAN PERHUTANAN MALAYSIA(FRIM) KUALA LUMPUR 52100 Bandar 0362756264 0362773045 214 176 390 10 SELANGOR PPD GOMBAK BBA7207 SK RAWANG JALAN KUALA GARING RAWANG 48000 Bandar 0360918453 0360918453 219 206 425 11 SELANGOR PPD GOMBAK BBA7208 SK KUANG KM 28, JALAN KUANG RAWANG 48050 Luar Bandar 0360383780 0360382199 723 715 1438 -

Cover Story Featured Property

Editor Chief Operating Officer’s Foreword Roshan Kaur Sandhu Writer Reena Kaur Bhatt Head of Creatives Angeline Lim Senior Graphic Designers Jason Kwong Wing Wong Junior Graphic Designer Rechean Soong Ad Operations Executive Nur Alia Ahamd Tamezi Chief Operating Officer - International Arthur Charlaftis Group Finance Director Kenneth A Kent General Manager (Agent Sales) Leon Kong Chief Information Officer Changing The Way The World Experiences Harmit Singh Property! The iProperty Group was welcomed into the REA Group family Head of iProperty TV earlier this year and our growing global team have already united a Jonathan Ong common goal - to change the way the world experiences property. International Correspondents Ee Von Ng & Leslie Lin Just how are we changing the way the world experiences property? Well, with our International site, we have more than 4 million property listings from 56 countries. That’s a world of properties right at your fingertips. To help you make an informed decision about your next property move, iPropertyIQ.com offers insights and data into the property iProperty.com Malaysia Sdn Bhd (600850-K) market. The site offers the most comprehensive source of property Suite 11.01, Level 11 Menara IGB Mid Valley City, Lingkaran Syed Putra data and analytics for Malaysia, Singapore, Indonesia and Hong 59200 Kuala Lumpur, Malaysia Kong, delivering incredible value to property agents, investors and Phone: (603) 2264 6888 developers. Fax: (603) 2264 6900 Sales enquiries: [email protected] We want to continue to deliver innovative solutions that meet the Editorial matters: [email protected] General enquiries: [email protected] needs of both our customers and consumers today and well into Subscription: [email protected] the future.