Property Summary Office Cont'd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Street Food – 11 Bästa Tipsen

PubliceradPublicerad november januari 20172014 KUALA LUMPUR Street food – 11 bästa tipsen ✔ Takbarer ✔ Petronas ✔ Tempel ✔ Nattliv twin towers ✔ Moskéer ✔ Forsränning ✔ Restauranger ✔ Nattmarknad ✔ Golf ✔ Chinatown ✔ Ekoparken 2 KUALA LUMPUR Här frodas kulturer, nattliv och mat uala Lumpur känns ofta som den ut någon annan plats på jorden med samma otippade vinnaren ingen hade räknat kulinariska variationsrikedom och kvalitet vad Kmed. Många ser staden som en gäller vardagsmat som vanligt folk äter. Det praktisk mellanlandning. För mig är staden andra området är shoppingen. Från den mest snarare ett slutmål, en hel värld i sig, en plats överflödiga lyx till fynd som tillhör Asiens allra som alltid är snäppet intressantare än man billigaste. först trodde. Här finns gott om nyheter av vitt skilda slag. I ingen annan stad lyser de stora asiatiska Ta bara det nya vassa konstmuseet Ilham, kulturerna sida vid sida på samma sätt. Fler än flodpromenaden River of Life eller leden med en överraskad besökare bokar om sitt plan för hängbroar genom KL Forest Eco Park som nu kunna stanna kvar här några extra dagar. möjliggör en djungelvandring mitt i stan. Asien strålar samman i Kuala Lumpur. Staden är Huvudstaden i det muslimska Malaysia har en mosaik plats för alla trosinriktningar och tankesätt. De av så många stora grupperna malajer, kineser och indier möjligheter. samsas med varandra som smakerna och Mat, shopping, kryddorna i den inhemska currygrytan Laksa. wellness, Denna ovanligt mångkulturella stad präglas aktiviteter, av en tolerans som fungerar och tycks leda nattliv och vidare. Stämningen är omisskännligt trivsam. kulturupp levelser. Här På två områden sticker Kuala Lumpur känner man ut. -

Priority Dining (Selected Partners Outlets) Listing

Priority Dining (Selected Partners Outlets) listing No. Brand Outlet Locations Start Date End Date 1. W Hotel Kuala Lumpur, No. 121, Jalan Ampang, 1 January 2019 30 June 2019 WOOBAR Kuala Lumpur, 50450 Malaysia 2. W Hotel Kuala Lumpur, No. 121, Jalan Ampang, 1 January 2019 30 June 2019 WET® Deck Kuala Lumpur, 50450 Malaysia 3. W Hotel Kuala Lumpur, No. 121, Jalan Ampang, 1 January 2019 30 June 2019 Yen Kuala Lumpur, 50450 Malaysia 4. W Hotel Kuala Lumpur, No. 121, Jalan Ampang, 1 January 2019 30 June 2019 Flock Kuala Lumpur, 50450 Malaysia 5. Banyan Tree Hotel, Level 59, No.2, Jalan Conlay, 1 January 2019 30 June 2019 Vertigo 50450 Kuala Lumpur, Wilayah Persekutuan, Malaysia 6. Banyan Tree Hotel, Level 53, No.2, Jalan Conlay, 1 January 2019 30 June 2019 Altitude 50450 Kuala Lumpur, Wilayah Persekutuan, Malaysia 7. Banyan Tree Hotel, Lobby, No.2, Jalan Conlay, 1 January 2019 30 June 2019 Bake By Banyan 50450 Kuala Lumpur, Wilayah Persekutuan, Tree Malaysia 8. Four Seasons Hotel Kuala Lumpur, 145, Jalan 1 January 2019 30 June 2019 Yun House Ampang, 50450 Kuala Lumpur, Malaysia 9. The Lounge at Four Seasons Hotel Kuala Lumpur, 145, Jalan 1 January 2019 30 June 2019 Four Seasons Ampang, 50450 Kuala Lumpur, Malaysia 10. Four Seasons Hotel Kuala Lumpur, 145, Jalan 1 January 2019 30 June 2019 Bar Trigona Ampang, 50450 Kuala Lumpur, Malaysia 11. Pool Bar and Four Seasons Hotel Kuala Lumpur, 145, Jalan 1 January 2019 30 June 2019 Grill Ampang, 50450 Kuala Lumpur, Malaysia 12. 163, Fraser Place Kuala Lumpur, 10, Jalan Perak, 1 January 2019 30 June 2019 Skillet at 163 Kuala Lumpur, 50450 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia Standard Chartered Bank Malaysia Berhad (115793-P) Priority Dining (Selected Partners Outlets) listing May 2019 13. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors. -

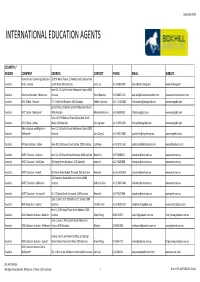

2019.09.26 Agent List (1020 Entry) Website

September 2019 INTERNATIONAL EDUCATION AGENTS COUNTRY / REGION COMPANY ADDRESS CONTACT PHONE EMAIL WEBSITE Academic and Continuing Education 3202 St Martis Tower, 31 Market Street Sydney New Australia (ACE) ‐ Sydney South Wales 2000 Australia Grace Liu +61 2 8066 8958 [email protected] www.liucheng.com Level 18, 101 Collins Street Melbourne Victoria 3000 Australia Adventus Education ‐ Melbourne Australia Victor Rajeevan +61 3 8680 2316 [email protected] www.adventuseducation.com Australia AECC Global ‐ Brisbane 127 Creek Stree Brisbane 4000 Australia Roldan Coronado +61‐7‐3158 2808 [email protected] www.aeccglobal.com Ground Floor, 20 Queens Street Melbourne Victoria Australia AECC Global ‐ Melbourne^ 3000 Australia Meenakshi Sharma +613 9614 5900 [email protected] www.aeccglobal.com Suite 1403, 99 Bathurst Street Sydney New South Australia AECC Global ‐ Sydney Wales 2000 Australia Sonu Agrawal +61 2 9283 5900 [email protected] www.aeccglobal.com Aide Education and Migration ‐ Level 11, 520 Collins Street Melbourne Victoria 3000 Australia Melbourne^ Australia Gary Qiang Li +61 3 9620 4888 [email protected] www.myaide.com.au Australia Alfa Beta Institute ‐ Sydney Suite 402, 368 Sussex Street Sydney 2000 Australia Josh Ryan +61 413 373 369 [email protected] www.alfabetaedu.com Australia AMET Education ‐ Brisbane Level 1A, 243 Edward Street Brisbane 4000 Australia Kristen Du +617 32106033 [email protected] www.amet.com.au Australia AMET Education ‐ Gold Coast 38 Nerang Street Southport -

Download Brochure

FREEHOLD REINVENTING COMMUNITIES Artist’s Impression AN ALL INCLUSIVE COMMUNITY The Suite is the most exciting and Inviting you to be amongst a anticipated co-living and co-working community of like-minded people, space in Kuala Lumpur. In today’s fast one that shares your values in paced digital world, urban dwellers defining the perfect hybrid and knowledge entrepreneurs home-office experience, demand enhanced ways of living, here at The Suite. entertaining, working and interacting. CO-WORKING The latest buzzword in reinventing the concept of traditional offices into one that adds the flexibility and comforts of your space. Whether working as an individual or as a collaboration, The Suite completes COMMUNITY LIFESTYLE your needs in a home and workspace, The Suite sits quietly within an all in one place, complete with all the enclave, just one street off the right trimmings. international offerings of Jalan Ampang. SUITE DREAMS ARE MADE OF THESE The perfect place to live, a definition that evolves through time. Changing based on progress, trends and needs, which come about with modernity. The Suite checks all four boxes that matter now, in order to achieve this new hybrid living concept with success. CO-LIVING SHARED SPACES The Suite gathers like-minded Shared facilities, conveniences urbanites who have a mutual and services allow for much need for convenience, access, more to be offered to the entertainment and rejuvenation. urbanites and entrepreneurs here. Now we are able to cater Satisfy your lifestyle with a to a wider range of lifestyles, host of experiences offered, appetites and interests. or simply retire in the privacy of your living space for some alone time, whenever you need. -

Study on KL Sentral Unique Selling Points (USP)

Study on KL Sentral Unique Selling Points (USP) Final Report Prepared for MRCB 7th March 2018 Revised: 1st June 2018 Contents Introduction 1. An overview of KL Sentral and surrounding developments 1.1 Location Map 1.2 Demand drivers for residential and office markets in Kuala Lumpur 1.3 Leasing activity in KLCC and KL Sentral 1.4 Developments around KL Sentral 2. Advantages and USP of investments in KL Sentral and MRCB’s properties 2.1 Recognition and achievements of MRCB in Malaysia 2.2 Advantages and USP of investments in KL Sentral 2.3 Competitor Analysis – Residential 2.4 Competitor Analysis – Office 2.5 KL Sentral’s future market performance 2.6 TOD Benchmarking 3 Conclusion Appendix © 2018 JLL Property Services (Malaysia) Sdn. Bhd. All rights reserved. Final report Study on KL Sentral Unique Selling Points (USP) 2 Introduction The Brief This report is prepared in accordance with JLL Property Services (Malaysia) Sdn Bhd (herein referred to as “JLLPS”) service proposal dated 17th January 2018 for Malaysian Resource Corporation Berhad (the “Client”) and signed on 17th January 2018 by the Client, to provide a study on the advantage and USPs of KL Sentral’s office and residential developments. The Assignment being instructed for this report is to highlight: . The importance of KL Sentral as a new CBD that rivals KLCC; . KL Sentral as a residential address that rivals Mont Kiara, and Bangsar; . The advantages and unique selling points (USP) of MRCB’s properties in KL Sentral to foreign investors. Scope of Study The Assignment includes the following scope of work: . -

Annual Report Corporate

REIT ANNUAL REPORT CORPORATE 2 Portfolio Overview 12 2015 Achievements – At a Glance 15 Financial Highlights 16 Corporate Information 18 Letter to Unitholders 23 Milestones 2015 25 Corporate Highlights & Events 26 In The News 32 Board of Directors of the Manager 33 Profile of Directors of the Manager CONTENTS 38 The Management Team GOVERNANCE 40 Corporate Governance 53 Statement on Risk Management and Internal Control 56 Statement on Directors’ Responsibility FINANCIALS 57 The Manager’s Report 86 Statement by Manager & Statutory Declaration 87 Trustee’s Report 88 Independent Auditor’s Report 89 Statement of Comprehensive Income 91 Statement of Financial Position 93 Statement of Changes In Net Asset Value 94 Statement of Cash Flows 95 Notes To The Financial Statements OTHER INFORMATION 142 Unitholdings and 30 Largest Unitholders as at 31 December 2015 145 Notice of Fourth Annual General Meeting Proxy Form 2 MRCB-Quill REIT PORTFOLIO OVERVIEW As at 31 December 2015, MQREIT’s portfolio comprised of 10 properties. The details are as follows: QUILL BUILDING 1 – DHL 1 Address/Location : 3509 & 3511, Jalan Teknokrat 5, 63000 Cyberjaya, Selangor Darul Ehsan Property Type : Commercial Building Description : 4-storey office building together with a sub-basement and a basement car park Tenure : Term in Perpetuity Date of Acquisition : 20 November 2006 Net Lettable Area : 92,284 sq ft Purchase Price : RM52,100,000 Market Value : RM126,000,000* Occupancy : 100% * On 14 August 2008, the respective pieces of land on which Quill Building 1 – DHL 1 and Quill Building 4 – DHL 2 are situated have been amalgamated pursuant to the condition imposed by the Securities Commission Malaysia (”SC”) during the initial Public Offering of MQREIT. -

International Golf Privileges

The pair that takes you on a luxurious journey of travel We thank you for choosing Maybank 2 Cards Premier as the best travel pair to accompany your every journey. Rest assured that this convenient pairing will maximise your rewards and benefits be it through global offers, points and VIP treatments, because you simply belong on top of the world. 3 Fastest Way to Earn Air Miles Earn TreatsPoints* whenever you use your Maybank 2 Cards Reserve American Express Card. You can convert your TreatsPoints to Air Miles to redeem free flights, holiday packages or simply exchange them for a host of fabulous gifts from the TreatsPoints rewards programme. Local Spend RM1 = 5 TreatsPoints Overseas Spend RM1 = 5 TreatsPoints Upon Card Activation = 10,000 TreatsPoints Spend TreatsPoints Earned Ultimate Local RM10,000 50,000 Travel Overseas RM10,000 50,000 Upon Activation NA 10,000 Total RM20,000 110,000 Air Miles Conversion 23,060 Air Miles 4,770 TreatsPoints = 1,000 Air Miles *Maybank Credit Card TreatsPoints is valid for 3 years. Kindly be informed that effective 15 April 2016, all transactions for utilities, education, EzyPay and insurance transactions will earn 1x TreatsPoints and no TreatsPoints will be awarded for Government bodies. 5 5 Dining Privileges SPG Hotels and Resorts Malaysia Your Maybank 2 Cards Premier Reserve American Express instantly accords you with exclusive dining privileges at SPG Hotels and Resorts Malaysia. Here, you will enjoy dining benefits* at a number of highly acclaimed restaurants at all participating SPG Hotels and Resorts Malaysia. Simply present your Maybank 2 Cards Premier Reserve American Express to enjoy these privileges. -

The Skyscraper Surge Continues in 2015, the “Year of 100 Supertalls” Report by Jason Gabel, CTBUH; Research by Marty Carver and Marshall Gerometta, CTBUH

CTBUH Year in Review: Tall Trends All building data, images and drawings can be found at end of 2015, and Forecasts for 2016 Click on building names to be taken to the Skyscraper Center The Skyscraper Surge Continues in 2015, The “Year of 100 Supertalls” Report by Jason Gabel, CTBUH; Research by Marty Carver and Marshall Gerometta, CTBUH Note: Please refer to “Tall Buildings in Numbers – 2015: A Tall Building Review” in conjunction with this paper, pages 9–10 The Council on Tall Buildings and Urban the previous record high of 99 completions 2010, the number of supertalls in the world Habitat (CTBUH) has determined that 106 in 2014. This brings the total number of has exactly doubled, from 50 at the end of buildings of 200 meters’ height or greater 200-meter-plus buildings in the world to 2010 to 100 at the end of 2015. were completed around the world in 2015 – 1,040, exceeding 1,000 for the first time in setting a new record for annual tall building history and marking a 392% increase from The tallest building to complete in 2015 completions (see Figure 3). the year 2000, when only 265 existed. was Shanghai Tower, now the tallest building in China and the second-tallest in Further Highlights: A total of 13 supertalls (buildings of 300 the world at 632 meters. This had notable The 106 buildings completed in 2015 beat meters or higher) were completed in 2015, effects on the list of the 10 tallest buildings, every previous year on record, including the highest annual total on record. -

Cover Story Featured Property

Editor Chief Operating Officer’s Foreword Roshan Kaur Sandhu Writer Reena Kaur Bhatt Head of Creatives Angeline Lim Senior Graphic Designers Jason Kwong Wing Wong Junior Graphic Designer Rechean Soong Ad Operations Executive Nur Alia Ahamd Tamezi Chief Operating Officer - International Arthur Charlaftis Group Finance Director Kenneth A Kent General Manager (Agent Sales) Leon Kong Chief Information Officer Changing The Way The World Experiences Harmit Singh Property! The iProperty Group was welcomed into the REA Group family Head of iProperty TV earlier this year and our growing global team have already united a Jonathan Ong common goal - to change the way the world experiences property. International Correspondents Ee Von Ng & Leslie Lin Just how are we changing the way the world experiences property? Well, with our International site, we have more than 4 million property listings from 56 countries. That’s a world of properties right at your fingertips. To help you make an informed decision about your next property move, iPropertyIQ.com offers insights and data into the property iProperty.com Malaysia Sdn Bhd (600850-K) market. The site offers the most comprehensive source of property Suite 11.01, Level 11 Menara IGB Mid Valley City, Lingkaran Syed Putra data and analytics for Malaysia, Singapore, Indonesia and Hong 59200 Kuala Lumpur, Malaysia Kong, delivering incredible value to property agents, investors and Phone: (603) 2264 6888 developers. Fax: (603) 2264 6900 Sales enquiries: [email protected] We want to continue to deliver innovative solutions that meet the Editorial matters: [email protected] General enquiries: [email protected] needs of both our customers and consumers today and well into Subscription: [email protected] the future. -

Senarai Pengagih Elekktrik Tahun 2018 List of Electricity Distributor in 2018 Tempoh Lesen License Duration Pemegang Lesen Alamat Pepasangan Alamat Surat-Menyurat No

Senarai Pengagih Elekktrik tahun 2018 List of Electricity Distributor in 2018 Tempoh Lesen License Duration Pemegang Lesen Alamat Pepasangan Alamat Surat-menyurat No. Telefon No. Faks Dari Hingga Licensee Installation Address Mailing Address Phone No. Fax No. From Until AEON BIG (M) SDN. BHD. AEON BIG BATU PAHAT, 3, JALAN SS 16/1, 03-8022 3600 03-5631 3373 14/01/2013 13/01/2023 LOT PTD 39842 DAN PTD 47500 SUBANG JAYA 39849, SELANGOR MUKIM SIMPANG KANAN, DAERAH BATU PAHAT, 83000 JOHOR. AEON BIG (M) SDN. BHD. AEON BIG MIDVALLEY, 3, JALAN SS 16/1, 03-8022 3600 03-5631 3373 1/10/2013 1/9/2023 SEBAHAGIAN DARIPADA 47500 SUBANG JAYA LOT 80, SEKSYEN 95A, SELANGOR BANDAR KUALA LUMPUR, 58000 WILAYAH PERSEKUTUAN KUALA LUMPUR. AEON BIG (M) SDN. BHD. AEON BIG KEPONG, 3, JALAN SS 16/1, 03-8022 3600 03-5631 3373 1/10/2013 1/9/2023 NO. LOT 63579, MUKIM 47500 SUBANG JAYA BATU, SELANGOR DAERAH KUALA LUMPUR, WILAYAH PERSEKUTUAN KUALA LUMPUR. AEON BIG (M) SDN. BHD. AEON BIG AMPANG, 3, JALAN SS 16/1, 03-8022 3600 03-5631 3373 1/10/2013 1/9/2023 NO. LOT 613, 47638 DAN 47500 SUBANG JAYA 47636, SELANGOR MUKIM BANDAR AMPANG, DAERAH HULU LANGAT, 68000 SELANGOR. AEON BIG (M) SDN. BHD. AEON BIG SUBANG JAYA, 3, JALAN SS 16/1, 03-8022 3600 03-5631 3373 1/10/2013 1/9/2023 LOT PT1, BANDAR 47500 SUBANG JAYA SUBANG JAYA, SELANGOR DAERAH PETALING, SELANGOR. Tempoh Lesen License Duration Pemegang Lesen Alamat Pepasangan Alamat Surat-menyurat No. -

Sunway REIT AR 2015 Part 2.Pdf

96 SUNWAY REIT ANNUAL REPORT 2015 PORTFOLIO AT A GLANCE GEOGRAPHICAL CONTRIBUTION BY PROPERTY VALUE OF RM6.32 BILLION AS AT 30 JUNE 2015 19% KUALA LUMPUR 8% PENANG SUNWAY TOWER SUNWAY PUTRA MALL SUNWAY CARNIVAL SHOPPING MALL SUNWAY PUTRA HOTEL SUNWAY HOTEL SEBERANG JAYA SUNWAY PUTRA TOWER SUNWAY HOTEL GEORGETOWN 1% PERAK 72% SELANGOR SUNCITY IPOH HYPERMARKET SUNWAY PYRAMID SHOPPING MALL SUNWAY RESORT HOTEL & SPA PYRAMID TOWER EAST MENARA SUNWAY SUNWAY MEDICAL CENTRE WISMA SUNWAY SUNWAY REIT ANNUAL REPORT 2015 97 PORTFOLIO AT A GLANCE (CONT’D) Bandar Sunway To Subang Airport Subang Golf Club Freescale (Motorola) Federal Highway Sunway-Setia Jaya Station Railway Line To Kelana Jaya Proposed KTM-BRT integration at ajipan Taylor’s College w Sine Darby SS12 PJS8 Sunway SJ Station Medical Centre PJS 2 Sri KL Toll Plaza an Ke Station Mentari International r School (NPE) Masjid Al-Husna Metropolitan Persia College at Bandar Sunway TO KUALA LUMPUR U-TURN U-TURN CITY CENTRE New Pantai Expressway Link (NPE) TO SUBANG (LDP) JAYA Sunway Sunway Pyramid Sunway Pyramid 3 Shopping Mall Metro Pyramid PROPOSED Tower East NPE LINK PJS9 (Residential Area) Sunway Resort n a Hotel & Spa p Station ) i j P a The Pinnacle D w L Sunway Sunway Lagoon ( e T Line Sunway PJS7 K Sun-U g R Lagoon (Residential Area) n L n Apartment o a PJS11 r Menara h c a Hostel i u s Sunway P r e a Jalan PJS 11/9 P r imur a T s SS13 Sunway n Kompleks BRT Sunway a goon International m a Sunway Lagoon Club a School D a y a Sun - U Sunway Sunway Jalan L Palmville r h Residence Medical Medical