WBADLCRPT 010620.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Developing a Business Performance Management Model for Paltel Group - Palestine

An-Najah National University Faculty of Graduate Studies Developing A Business Performance Management Model For Paltel Group - Palestine By Ahmad Hasan Maharma Supervisor Dr. Yahya Saleh This Thesis is Submitted in Partial Fulfillment of the Requirements for the Degree of Master in Engineering Management, Faculty of Graduate Studies, An-Najah National University, Nablus-Palestine 2014 iii Acknowledgement First and foremost I offer my sincere gratitude to my supervisor, Dr. Yahya Saleh, who has supported me throughout my thesis with his patience and knowledge. I attribute the level of my Master degree to his encouragement and without him this thesis would not have been completed or written. I would like to thank the thesis examiner committee members: Dr. Yahya Saleh, Dr. Abdelbaset Rabaiah, and Dr. Sameh Atout, for their time, insightful comments, and valuable questions which highly contribute thesis quality. Also, I would like to thank the faculty at An-Najah National University in general and department of Engineering Management in specific for the full support and facilities I have needed to produce and complete my thesis. My greatest appreciation goes to Paltel Group for the outstanding support and amenities to accomplish this research. The success of this study required the help of various individuals. Without them, the researcher might not be able to meet their objectives in this study. The researcher want to give gratitude to the following people for their invaluable help and support, my father and mother, brothers Mohammad, Khaled, Belal, my sisters, and my friends. I gratefully acknowledge Mais as she inspires me and bright my world. -

Palestine's Occupied Fourth Estate

Arab Media and Society (Issue 17, Winter 2013) Palestine’s Occupied Fourth Estate: An inside look at the work lives of Palestinian print journalists Miriam Berger Abstract While for decades local Palestinian media remained a marginalized and often purely politicized subject, in recent years a series of studies has more critically analyzed the causes and consequences of its seeming diversity but structural underdevelopment.1 However, despite these advances, the specific conditions facing Palestinian journalists in local print media have largely remained underreported. In this study, I address this research gap from a unique perspective: as viewed from the newsroom itself. I present the untold stories of the everyday work life of Palestinian journalists working at the three local Jerusalem- and Ramallah-based newspapers— al-Quds, al-Ayyam, and al-Hayat al-Jadida—from 1994 until January 2012. I discuss the difficult working conditions journalists face within these news organizations, and situate these experiences within the context of Israeli and Palestinian Authority policies and practices that have obstructed the political, economic, and social autonomy of the local press. I first provide a brief background on Palestinian print media, and then I focus on several key areas of concern for the journalists: Israeli and Palestinian violence, the economics of printing in Palestine, the phenomenon of self-censorship, the Palestinian Journalists Syndicate, and internal newspaper organization. This study covers the nearly two decades since the signing of the Oslo Peace Accords between Israel and the Palestinian Liberation Organization (PLO) which put in place the now stalled process of ending the Israeli military occupation of Palestine (used here to refer to the West Bank, East Jerusalem, and Gaza Strip). -

Benchmarking West Bank & Gaza

42987 World Bank Public Disclosure Authorized WEST BANK AND GAZA TELECOMMUNICATIONS SECTOR NOTE Public Disclosure Authorized INTRODUCING COMPETITION IN THE PALESTINIAN TELECOMMUNICATIONS SECTOR January 2008 Public Disclosure Authorized Policy Division Global Information Communications Technology Department Public Disclosure Authorized - CONTENTS ACKNOWLEDGMENTS ............................................................................. ii ABBREVIATIONS AND ACRONYMS.......................................................... iii EXECUTIVE SUMMARY .......................................................................... iv INTRODUCTION ....................................................................................... 1 SECTOR OVERVIEW ................................................................................ 1 Overall Context of the Sector................................................................................. 1 Sector Structure ..................................................................................................... 2 Market Dominance ................................................................................................ 5 Unauthorized Competition .................................................................................... 6 TELECOMMUNICATIONS SECTOR IN COMPARATIVE PERSPECTIVE .......... 8 POLICY RECOMMENDATIONS ................................................................ 11 Issue: Market Dominance ................................................................................... -

E-Commerce in Palestine

ممنوع Access الوصول Denied E-Commerce in Palestine 1 “Access Denied - E-Commerce in Palestine” 7amleh - The Arab Center for the Advancement of Social Media Researchers: Zayne Abudaka, Sari Taha Editorial Team: Alison Carmel, Lina Hegazi, Alissa Fischer Arabic Translation: Khaled Sayed Graphic Design: Amal Shoufany This research was done with the support of Association for Progressive communications This work is licensed under the Creative Commons Attribution - NonCommercial No Derivatives 4.0 International License. To view a copy of this license, visit: http://creativecommons.org/licenses/by-nc-nd/4.0/ Contact Us: Email: [email protected] Website: www.7amleh.org Tel: +972 (0)774020670 Find us on Social Media: 7amleh Table of Contents 04 List of Acronyms 06 Executive Summary 09 Digital Economy in Palestine 10 The Rise of e-Commerce Globally 13 Palestinian Experiences in the Digital Economy 13 Buying Online: A Snapshot of User Journeys 15 Selling Online: A Snapshot of Vendor Journeys 19 Online Marketplaces 25 Palestiniane Readiness 25 Purchasing Power 27 Digital Readiness 29 Financial Readiness 33 Logistics Readiness 37 Legal and Policy Environment 39 Conclusion & Recommendations 39 Digital Access 40 Financial Access 40 Integrated Logistics 41 Policy 42 About 7amleh Center Access Denied - E-Commerce in Palestine List of Acronyms $PPP Gross Domestic Product per Capita APIs Application Programming Interfaces ARIJ Applied Research Institute – Jerusalem B2B Business to business B2C Business to consumer C2B Consumer to business C2C Consumer to -

Nablus Salfit Tubas Tulkarem

Iktaba Al 'Attara Siris Jaba' (Jenin) Tulkarem Kafr Rumman Silat adh DhahrAl Fandaqumiya Tubas Kashda 'Izbat Abu Khameis 'Anabta Bizzariya Khirbet Yarza 'Izbat al Khilal Burqa (Nablus) Kafr al Labad Yasid Kafa El Far'a Camp Al Hafasa Beit Imrin Ramin Ras al Far'a 'Izbat Shufa Al Mas'udiya Nisf Jubeil Wadi al Far'a Tammun Sabastiya Shufa Ijnisinya Talluza Khirbet 'Atuf An Naqura Saffarin Beit Lid Al Badhan Deir Sharaf Al 'Aqrabaniya Ar Ras 'Asira ash Shamaliya Kafr Sur Qusin Zawata Khirbet Tall al Ghar An Nassariya Beit Iba Shida wa Hamlan Kur 'Ein Beit el Ma Camp Beit Hasan Beit Wazan Ein Shibli Kafr ZibadKafr 'Abbush Al Juneid 'Azmut Kafr Qaddum Nablus 'Askar Camp Deir al Hatab Jit Sarra Salim Furush Beit Dajan Baqat al HatabHajja Tell 'Iraq Burin Balata Camp 'Izbat Abu Hamada Kafr Qallil Beit Dajan Al Funduq ImmatinFar'ata Rujeib Madama Burin Kafr Laqif Jinsafut Beit Furik 'Azzun 'Asira al Qibliya 'Awarta Yanun Wadi Qana 'Urif Khirbet Tana Kafr Thulth Huwwara Odala 'Einabus Ar Rajman Beita Zeita Jamma'in Ad Dawa Jafa an Nan Deir Istiya Jamma'in Sanniriya Qarawat Bani Hassan Aqraba Za'tara (Nablus) Osarin Kifl Haris Qira Biddya Haris Marda Tall al Khashaba Mas-ha Yasuf Yatma Sarta Dar Abu Basal Iskaka Qabalan Jurish 'Izbat Abu Adam Talfit Qusra Salfit As Sawiya Majdal Bani Fadil Rafat (Salfit) Khirbet Susa Al Lubban ash Sharqiya Bruqin Farkha Qaryut Jalud Kafr ad Dik Khirbet Qeis 'Ammuriya Khirbet Sarra Qarawat Bani Zeid (Bani Zeid al Gharb Duma Kafr 'Ein (Bani Zeid al Gharbi)Mazari' an Nubani (Bani Zeid qsh Shar Khirbet al Marajim 'Arura (Bani Zeid qsh Sharqiya) Bani Zeid 'Abwein (Bani Zeid ash Sharqiya) Sinjil Turmus'ayya. -

UMTS: Alive and Well

TABLE OF CONTENTS PREFACE…………………………………………………………………...……………………………… 5 1 INTRODUCTION......................................................................................................................... 10 2 PROGRESS OF RELEASE 99, RELEASE 5, RELEASE 6, RELEASE 7 UMTS-HSPA .......... 12 2.1 PROGRESS TIMELINE .................................................................................................................. 12 3 PROGRESS AND PLANS FOR RELEASE 8: EVOLVED EDGE, HSPA EVOLVED/HSPA+ AND LTE/EPC ............................................................................................................................ 19 4 THE GROWING DEMANDS FOR WIRELESS DATA APPLICATIONS ................................... 26 4.1 WIRELESS DATA TRENDS AND FORECASTS ................................................................................. 28 4.2 WIRELESS DATA REVENUE ......................................................................................................... 29 4.3 3G DEVICES............................................................................................................................... 31 4.4 3G APPLICATIONS ...................................................................................................................... 34 4.5 FEMTOCELLS ............................................................................................................................. 41 4.6 SUMMARY ................................................................................................................................. -

Community Resilience Development

Annexes Annex 1: Evaluation Terms of Reference Annex 2: The Concept of Resilience Annex 3: Bibliography Annex 4: List of Documents Reviewed Annex 5: List of people met: interviewees, focus groups, field visits Annex 6: List of field visits Annex 7: Sample of Projects for Document Review Annex 8: Maps, Vulnerability and Resilience Data Annex 9: Analysis of CRDP Project Portfolio Profile Annex 10: Vulnerability Analysis Annex 11: Universal Lessons on Gender-Sensitive Resilience-Based programming Annex 12: Field Work Calendar Annex 13: Achievements of Programme (Rounds 1-3) 1 Annex 1: Evaluation Terms of Reference 1. BACKGROUND AND CONTEXT About the CRDP The Community Resilience Development Programme (CRDP) is the result of a fruitful cooperation between the Palestinian Government through the Ministry of Finance and Planning (MOFAP, the United Nations Development Programme/Programme of Assistance to the Palestinian People (UNDP/PAPP), and the Government of Sweden. In 2012, an agreement was signed between the Government of Sweden and UNDP/PAPP so as to support a three-year programme (from 2012 to 2016), with a total amount of SEK 90,000,000, equivalent to approximately USD 12,716,858. During the same year, the UK’s Foreign and Commonwealth Office (FCO) joined the program and provided funds for the first year with an amount of £300,000, equivalent to USD 453,172. In 2013, the government of Austria joined the programme and deposited USD 4,202,585, (a final amount of approximately $557,414 remains to be deposited) to support the programme for two years. Finally, in 2014, the Government of Norway joined the programme with a contribution of USD 1,801,298 to support the programme for two years. -

Annual Report 2017

ANNUAL REPORT PADICO HOLDING ANNUAL Palestine Development and Investment, Ltd. REPORT Foreign, limited, public shareholding limited Liability Company, registered in the Republic of Liberia Under the Liberian Business Law of 1977 Years of success Contents About PADICO HOLDING 6 FUTURE VISION 40 42 PADICO HOLDING: 8 Social Responsibility Twenty-three years of investment in Palestine Financial Performance in 2017 48 Board of Directors 10 Key Financial Indicators 54 Shareholder 15 Performance of PADICO HOLDING share 56 The Chairman Message 18 Auditors’ Report and Consolidated 58 Performance Summary of Investment 20 Financial Statements About PADICO HOLDING Our Values and Mission Our Strategy PADICO HOLDING believes in the importance of PADICO HOLDING is committed to developing its role and contribution in building the Palestinian the Palestinian economy through a group of PADICO HOLDING Company was established in 1993 as a foreign limited liability economy. It has several leading companies that subsidiaries and affiliates that invest in key sectors holding company registered in Liberia at the initiative of prominent Palestinian and contribute to the economic development of Palestine constant with the company’s overall strategy, Arab businesspersons with the aim of contributing to the building and development by implementing investment projects in various including real estate, communications, tourism, of the Palestinian economy by establishing development projects in vital economic economic sectors, creating jobs and launching industry, agriculture, the environment and financial creative economic initiatives in partnership with services. PADICO HOLDING’s ability to generate sectors. public sector institutions. Moreover, attracting local profits depends mainly on the performance of its and international investors and encouraging them subsidiaries and affiliates. -

Study on Small-Scale Agriculture in the Palestinian Territories Final

Study on Small-scale Agriculture in the Palestinian Territories Final Report Jacques Marzin. Cirad ART-Dév Ahmad Uwaidat. MARKAZ-Co Jean Michel Sourrisseau. CIRAD ART-Dév Submitted to: The Food and Agriculture Organization of the United Nations (FAO) June 2019 ACRONYMS ACAD Arab Center for Agricultural Development CIRAD Centre International de Recherche Agronomique pour le Développement FAO Food and Agriculture Organization of the United Nations GDP Gross National Product LSS Livestock Sector Strategy MoA Palestinian Ministry of Agriculture NASS National Agricultural Sector Strategy NGO Non-governmental organization PACI Palestinian Agricultural Credit Institution PCBS Palestinian Central Bureau of Statistics PNAES Palestinian National Agricultural Extension Strategy PARPIF Palestinian Agricultural Risk Prevention and Insurance Fund SDGs Sustainable Development Goals (UN) SSFF Small-scale family farming UNHRC United Nations human rights council WFP World Food Programme 1 CONTENTS General introduction ....................................................................................................................................... 5 Scope and objectives of the study ...................................................................................................................... 5 Empirical material for this study ........................................................................................................................ 5 Acknowledgement and disclaimer .................................................................................................................... -

SAMENA TRENDS-(Nov 2015).Indd

Volume 06 _ Issue 11 _ Nov 2015 SAMENA TRENDS EXCLUSIVELY FOR SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS BUILDING DIGITAL ECONOMIES A SAMENA Telecommunications Council Newsletter Articles Cloud Computing Provides Foundation to Fight Mobile Fraud in MEA Page 47 Pay-TV providers in MEA and middle-income Asia can learn from Apple... Exclusive Interview Page 55 Dr. Khaled H. Biyari Cloud gaming is gaining Group CEO traction in 2015: operators need to plan their market STC entry carefully Page 04 Page 57 Raising demand for mobile content and cloud services and the way forward for the telecom industry stakeholders www.samenacouncil.org SAMENA CONTENTS VOLUME _ 06 _ISSUE _ 11_NOV 2015 TRENDS The SAMENA TRENDS newsletter is wholly REGIONAL & MEMBERS owned and operated by The SAMENA UPDATES Telecommunications Council FZ, LLC 09. Members news (SAMENA Council). Information in the newsletter is not intended as professional services advice, and SAMENA Council 16. Regional news disclaims any liability for use of specific information or results thereof. Articles REGULATORY & POLICY and information contained in this publication are the copyright of SAMENA UPDATES 19. Regulatory news Telecommunications Council, (unless otherwise noted, described or stated) and cannot be reproduced, copied or 25. A snapshot of regulatory activities in printed in any form without the express SAMENA region written permission of the publisher. 32. Regulatory activities beyond the The SAMENA Council does not necessar- SAMENA region ily endorse, support, sanction, encour- age, verify or agree with the content, comments, opinions or statements made in The SAMENA TRENDS by any entity WHOLESALE UPDATES or entities. Information, products and 44. -

Dr. Neuhaus Telekommunikation Mobile Network Code

Dr. Neuhaus Telekommunikation Mobile Network Code The Mobile Country Code (MCC) is the fixed country identification. The Mobile Network Code (MNC) defines a GSM‐, UMTS‐, or Tetra radio network provider. This numbers will be allocates June 2011 autonomus from each country. Only in the alliance of bothscodes (MCC + MNC) the mobile radio network can be identified. All informations without guarantee Country MCC MNC Provider Operator APN User Name Password Abkhazia (Georgia) 289 67 Aquafon Aquafon Abkhazia (Georgia) 289 88 A-Mobile A-Mobile Afghanistan 412 01 AWCC Afghan Afghanistan 412 20 Roshan Telecom Afghanistan 412 40 Areeba MTN Afghanistan 412 50 Etisalat Etisalat Albania 276 01 AMC Albanian Albania 276 02 Vodafone Vodafone Twa guest guest Albania 276 03 Eagle Mobile Albania 276 04 Plus Communication Algeria 603 01 Mobilis ATM Algeria 603 02 Djezzy Orascom Algeria 603 03 Nedjma Wataniya Andorra 213 03 Mobiland Servei Angola 631 02 UNITEL UNITEL Anguilla (United Kingdom) 365 10 Weblinks Limited Anguilla (United Kingdom) 365 840 Cable & Antigua and Barbuda 344 30 APUA Antigua Antigua and Barbuda 344 920 Lime Cable Antigua and Barbuda 338 50 Digicel Antigua Argentina 722 10 Movistar Telefonica internet.gprs.unifon.com. wap wap ar internet.unifon Dr. Neuhaus Telekommunikation Mobile Network Code The Mobile Country Code (MCC) is the fixed country identification. The Mobile Network Code (MNC) defines a GSM‐, UMTS‐, or Tetra radio network provider. This numbers will be allocates June 2011 autonomus from each country. Only in the alliance of bothscodes (MCC + MNC) the mobile radio network can be identified. All informations without guarantee Country MCC MNC Provider Operator APN User Name Password Argentina 722 70 Movistar Telefonica internet.gprs.unifon.com. -

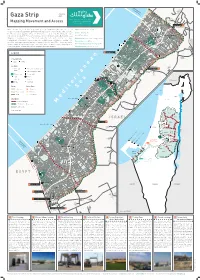

Gaza Strip 2020 As-Siafa Mapping Movement and Access Netiv Ha'asara Temporary

Zikim Karmiya No Fishing Zone 1.5 nautical miles Yad Mordekhai January Gaza Strip 2020 As-Siafa Mapping Movement and Access Netiv Ha'asara Temporary Ar-Rasheed Wastewater Treatment Lagoons Sources: OCHA, Palestinian Central Bureau of Statistics of Statistics Bureau Central OCHA, Palestinian Sources: Erez Crossing 1 Al-Qarya Beit Hanoun Al-Badawiya (Umm An-Naser) Erez What is known today as the Gaza Strip, originally a region in Mandatory Palestine, was created Width 5.7-12.5 km / 3.5 – 7.7 mi through the armistice agreements between Israel and Egypt in 1949. From that time until 1967, North Gaza Length ~40 km / 24.8 mi Al- Karama As-Sekka the Strip was under Egyptian control, cut off from Israel as well as the West Bank, which was Izbat Beit Hanoun al-Jaker Road Area 365 km2 / 141 m2 Beit Hanoun under Jordanian rule. In 1967, the connection was renewed when both the West Bank and the Gaza Madinat Beit Lahia Al-'Awda Strip were occupied by Israel. The 1993 Oslo Accords define Gaza and the West Bank as a single Sheikh Zayed Beit Hanoun Population 1,943,398 • 48% Under age 17 July 2019 Industrial Zone Ash-Shati Housing Project Jabalia Sderot territorial unit within which freedom of movement would be permitted. However, starting in the camp al-Wazeer Unemployment rate 47% 2019 Q2 Jabalia Camp Khalil early 90s, Israel began a gradual process of closing off the Strip; since 2007, it has enforced a full Ash-Sheikh closure, forbidding exit and entry except in rare cases. Israel continues to control many aspects of Percentage of population receiving aid 80% An-Naser Radwan Salah Ad-Deen 2 life in Gaza, most of its land crossings, its territorial waters and airspace.