2.2 Corporate Governance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Annual Report 2012

Annual Report 2012 Groupe Bruxelles Lambert Online additional information www.gbl.be Investors information Additional information can be found on Online registration in order to receive the website, among which: investors information (notices, • Historical information of GBL press releases, ...) through the • The yearly and half-yearly reports and Company website. also quarterly press releases • Adjusted net assets on a weekly basis • The press releases • The portfolio Investor relations Axelle Henry [email protected] Tel.: +32 (0)2 289 17 17 Annual Report 2012 Overview of GBL 2 THE ESSENTIAL Message from the Chairman of the Board of Directors 4 Message from the CEO and the Managing Directors 6 Value creation 8 Highlights 10 Key fi gures 12 Risk management 14 Corporate and Social Responsibility 16 Evolution of the share in 2012 18 SHAREHOLDERS Distribution policy and proposed dividend 19 INFORMATION AND Investor relations 19 MARKET DATA Financial calendar 19 Market data and indicators 20 Resolutions proposed to Shareholders 22 Portfolio and adjusted net assets 24 ACTIVITY REPORT Consolidated fi gures IFRS (economic analysis) 28 Strategic investments 34 Total 34 GDF SUEZ 36 Lafarge 38 Pernod Ricard 40 Imerys 42 Suez Environnement 44 Breakdown of turnover by geographical area 46 Financial Pillar 47 Ergon Capital Partners 48 Sagard 49 Consolidated fi nancial statements 52 ACCOUNTS Condensed statutory balance sheet and income statement 100 AT 31 DECEMBER 2012 Dividend policy 102 Historical data 103 Corporate governance statement 106 CORPORATE Board of -

Building Leading Companies Through Long-Term Engaged and Responsible Ownership

Building leading companies through long-term engaged and responsible ownership Groupe Bruxelles Lambert Half-yearly report July 30, 2020 Privileged information - Regulated information as of June 30, 2020 2 GBL Half-yearly report as of June 30, 2020 Groupe Bruxelles Lambert (“GBL”) is an established investment holding company, with over sixty years of stock exchange listing, a net asset value of EUR 18 billion and a market capitalization of EUR 12 billion as of end of June 2020. GBL is a leading investor in Europe, focused on long-term and sustainable value creation and relying on a stable and supportive family shareholder base. GBL strives to maintain a diversified high-quality portfolio composed of global companies, leaders in their sector, in which it can contribute to value creation by being an engaged professional investor. GBL seeks to provide attractive returns to its shareholders through a combination of a sustainable dividend and growth in its net asset value. GBL is listed on Euronext Brussels (Ticker: GBLB BB; ISIN code: BE0003797140) and is part of the BEL20 index. 3 GBL Half-yearly report as of June 30, 2020 Half-yearly report as of June 30, 2020 Key information for shareholders 4 Message from Ian Gallienne, CEO of GBL Financial calendar • November 4, 2020: Results as of September 30, 2020 5 Key financial data • March 2021: Annual Results 2020 6 Highlights • April 27, 2021: Ordinary General Meeting 2021 8 Organisation chart and net asset value • Early May 2021: First quarter 2021 results 8 Organisation chart as of June 30, 2020 • End July 2021: Half-year 2021 results 8 Net asset value Note: the above-mentioned dates depend on the agenda of the Board of Directors meetings and are thus subject to change. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

31 March 2020 and Effective on Wednesday, 01 April 2020

STANDARD ETHICS BELGIAN INDEX REVIEW – APRIL 2020 Standard Ethics has approved the following changes that will become effective after the close of business on Tuesday, 31 March 2020 and effective on Wednesday, 01 April 2020. Rating Changes (January 2020 – March 2020) 26/03/2020 – Solvay (ISIN: BE0003470755): upgraded from E+ to EE- (Outlook: Positive) Inclusion None Exclusion None Index Constituents and Weights from 01 April 2020: Rating Outlook Company ISIN Weights Rating Outlook Company ISIN Weights EE+ Cofinimmo BE0003593044 15,07% E+ KBC Group BE0003565737 2,82% EE+ Proximus BE0003810273 15,07% E+ UCB BE0003739530 2,82% EE+ Umicore BE0974320526 15,07% E+ Warehouses de Pauw (WDP) BE0003763779 2,82% EE Ontex Group BE0974276082 11,30% E Ageas BE0974264930 0,47% EE- pos. Solvay BE0003470755 8,47% E Colruyt BE0974256852 0,47% EE- argenx NL0010832176 7,53% E Galapagos BE0003818359 0,47% EE- Engie FR0010208488 7,53% E Groupe Bruxelles Lambert BE0003797140 0,47% E+ Ackermans V.Haaren BE0003764785 2,82% E Sofina BE0003717312 0,47% E+ Aperam LU0569974404 2,82% E Telenet Group BE0003826436 0,47% E+ ING Groep NL0011821202 2,82% E- AB Inbev BE0974293251 0,19% For inquiries or comments please contact the front office of Standard Ethics at the following e- mail address: [email protected] Important Legal Disclaimer. All rights reserved. Ratings, analyses and statements are statements of opinion as of the date they are expressed and not statements of fact. Standard Ethics' opinions, analyses and ratings are not recommen- dations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. -

28 June 2019 and Effective on Monday, 01 July 2019

STANDARD ETHICS BELGIAN INDEX REVIEW – JULY 2019 Standard Ethics has approved the following changes that will become effective after the close of business on Friday, 28 June 2019 and effective on Monday, 01 July 2019. Rating Changes (April 2019 – June 2019) None Inclusion None Exclusion None Index Constituents and Weights from 01 July 2019 Rating Outlook Company ISIN Weights Rating Outlook Company ISIN Weights EE+ Cofinimmo BE0003593044 14,61% E+ KBC Group BE0003565737 2,74% EE+ Proximus BE0003810273 14,61% E+ Solvay BE0003470755 2,74% EE+ Umicore BE0974320526 14,61% E+ UCB BE0003739530 2,74% EE Bpost BE0974268972 10,96% E AB Inbev BE0974293251 0,46% EE Ontex Group BE0974276082 10,96% E Ageas BE0974264930 0,46% EE- argenx NL0010832176 7,31% E Colruyt BE0974256852 0,46% EE- Engie FR0010208488 7,31% E Galapagos BE0003818359 0,46% E+ Ackermans V.Haaren BE0003764785 2,74% E Groupe Bruxelles Lambert BE0003797140 0,46% E+ Aperam LU0569974404 2,74% E Sofina BE0003717312 0,46% E+ ING Groep NL0011821202 2,74% E Telenet Group BE0003826436 0,46% For inquiries or comments please contact the front office of Standard Ethics at the following e- mail address: [email protected] Important Legal Disclaimer. All rights reserved. Ratings, analyses and statements are statements of opinion as of the date they are expressed and not statements of fact. Standard Ethics' opinions, analyses and ratings are not recommen- dations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. Standard Ethics Ltd does not act as a fiduciary or an investment advisor except where registered as such. -

FACTSHEET - AS of 24-Sep-2021 Solactive GBS Belgium Large & Mid Cap Index TR

FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Belgium Large & Mid Cap Index TR DESCRIPTION The Solactive GBS Belgium Large & Mid Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Belgian market. It is calculated as a total return indexinEUR and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,000 900 800 700 600 500 400 300 200 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Belgium Large & Mid Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4DC5 / SLA4DC Base Value / Base Date 725.02 Points / 08.05.2006 Bloomberg / Reuters / .SBELMCT Last Price 831.43 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency EUR History Available daily back to 08.05.2006 Index Members 16 FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Belgium Large & Mid Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.37% -5.85% 5.20% 20.82% 6.01% 14.68% Performance (p.a.) - - - - - 0.89% Volatility (p.a.) 11.25% 13.27% 12.79% 17.52% 14.21% 22.53% High 863.93 878.49 901.39 901.39 901.39 1007.16 Low 813.25 813.25 797.43 650.18 749.91 203.19 Sharpe Ratio -2.98 -1.59 0.89 1.24 0.62 0.06 Max. -

List of Running Issuance Programs (03/09/2021)

Financial Markets Department Payments and securities Securities Settlement Unit boulevard de Berlaimont 14 – BE-1000 Brussels Phone : +32 2 221 22 17 – Fax : +32 2 221 31 20 VAT BE 0203.201.340 – RLP Brussels Account number : BE36 0016 2658 1781 [email protected] Ref: Issuanceprograms List of Running Issuance Programs (28/09/2021) Type of issuance program: 1. Treasury bills IP Issuer Paying Agent Term STEP Id Start End Amount to be issued Outstanding 2155.LEASINVEST REAL ESTATE NV/SA BBRUBEBB010.ING 136 - 11/10/1999 31/12/9999 110 000 000 EUR Program name: TB LEASINVEST REAL ESTATE BELGIUM S.A. 2253.SANOMA CORPORATION BBRUBEBB010.ING 268 Short 29/12/2003 31/12/9999 300 000 000 EUR Program name: TB SANOMA BELGIUM S.A. 2265.SANDVIK AB BBRUBEBB010.ING 387 - 04/03/2005 31/12/9999 500 000 000 EUR Program name: TB SANDVIK AB BELGIUM S.A. 2266.SANDVIK TREASURY AB BBRUBEBB010.ING 388 - 04/03/2005 31/12/9999 500 000 000 EUR Program name: TB SANDVIK TREASURY AB BELGIUM S.A. 2305.STAD AALST BBRUBEBB010.ING 450 Short 18/01/2007 31/12/9999 50 000 000 EUR 18 250 000,00 EUR Program name: TB STAD AALST BELGIUM S.A. 2327.COMMUNE DE CHAUDFONTAINE BBRUBEBB010.ING 493 - 22/01/2008 31/12/9999 75 000 000 EUR Program name: TB COMMUNE DE CHAUDFONTAINE BELGIUM S.A. 2357.STAD ZOTTEGEM BBRUBEBB010.ING 558 Short 12/06/2009 31/12/9999 30 000 000 EUR Program name: TB STAD ZOTTEGEM BELGIUM S.A. 2358.PROVINCIE VLAAMS-BRABANT BBRUBEBB010.ING 559 Short 29/06/2009 31/12/9999 25 000 000 EUR Program name: TB PROVINCIE VLAAMS-BRABANT BELGIUM S.A. -

CDP Climate Change Report 2016 France and Benelux Edition

CDP Climate Change Report 2016 France and Benelux edition On behalf of 827 investors with US$100 trillion in assets CDP Report 2016 | October 2016 Report writer Scoring Partners Key Messages 21 companies achieved the top score entering the CDP A List. 151 companies responded Their emissions represent 28% of the total reported emissions, and a decrease of 6 Mt of CO2e. to CDP in Benelux and Schneider Electrics, Royal Philips, L’Oréal, Atos, France, accounting for 81% Proximus ING Group and Royal BAM Group were also leaders in 2016. Bic scored A also in 2013, of the market capitalization KPN was graded A in 2011, 2012 and 2013 and in the region. Renault was part of the leaders in 2014. AkzoNobel, Bouygues, DSM, EDF, ENGIE, Group PSA, ICADE, Klépierre, Michelin, SUEZ and VEOLIA , are joining the list for the first time this year. Integrating climate change into business strategy is becoming main stream but targets lack ambition. 131 out of 141 companies have included climate change into their business strategy. 114 of them set specific targets and initiatives to reduce their climate impact. 2020 is the most common target year, while leaders distinguish themselves by setting long term targets, as far as 2050 and beyond. 53% of the companies managed to decrease their emissions in 2016. For 115 companies that responded also last year the emissions decreased from 723 Mt CO2e to 712 Mt CO2e meaning a 2% decrease of total emissions. From these 115 15% of the companies companies, 61 decreased their emissions by average of 14%. achieved A. -

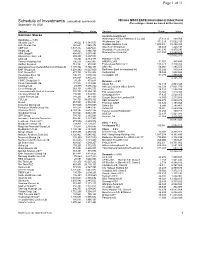

Schedule of Investments (Unaudited) (Continued) Ishares MSCI EAFE International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Page 1 of 11 Schedule of Investments (unaudited) (continued) iShares MSCI EAFE International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Security Shares Value Security Shares Value Common Stocks Australia (continued) Australia — 7.4% Washington H Soul Pattinson & Co. Ltd. 47,613 $ 808,764 Afterpay Ltd. (a) 90,622 $ 5,341,675 Wesfarmers Ltd. 471,219 15,062,155 AGL Energy Ltd. 260,681 2,545,374 Westpac Banking Corp 1,509,831 18,358,483 AMP Ltd. 1,537,332 1,447,660 WiseTech Global Ltd. 65,468 1,226,197 Ampol Ltd. 109,323 1,886,766 Woodside Petroleum Ltd. 391,630 4,970,593 APA Group (b) 494,431 3,675,441 Woolworths Group Ltd. 521,955 13,648,424 Aristocrat Leisure Ltd. 238,800 5,207,879 427,542,370 ASX Ltd. 82,342 4,814,175 Austria — 0.1% Aurizon Holdings Ltd. 796,526 2,450,407 ANDRITZ AG 31,927 985,449 AusNet Services 719,189 970,857 Erste Group Bank AG (a) 113,573 2,378,263 Australia & New Zealand Banking Group Ltd. 1,178,702 14,705,477 OMV AG 54,660 1,495,555 BHP Group Ltd. 1,224,282 31,627,603 Raiffeisen Bank International AG 55,226 845,288 BHP Group PLC 877,767 18,726,404 Verbund AG 30,844 1,684,460 BlueScope Steel Ltd. 196,372 1,809,334 voestalpine AG 51,476 1,356,694 Brambles Ltd. 636,805 4,835,282 8,745,709 CIMIC Group Ltd. (a) 35,358 473,611 Belgium — 0.9% Coca -Cola Amatil Ltd. -

Annual Report 2015

Annual Report 2015 Experience. Our greatest asset. Groupe Bruxelles Lambert Online additional information www.gbl.be Additional information can be found on our website, among which: • Historical information on GBL • Our annual and half-year reports as well as press releases in relation to quarterly results • Adjusted net assets on a weekly basis • Our press releases • Our investments • A market consensus Investor information Online registration in order to receive investor information (notifications of publication, press releases, etc.) is available through our website. Investor relations Céline Donnet [email protected] Tel.: +32 (0)2 289 17 77 Overview GBL 2015 GBL is the second largest listed holding company in Europe with adjusted net assets of EUR 15.2 billion and a market capitalisation of EUR 12.7 billion at the end of 2015. As a holding company focused on long-term value creation, GBL relies on a stable, family shareholder base. Its portfolio is composed of global industrial and services companies, leaders in their market and in which GBL plays its role of professional shareholder. Groupe Bruxelles Lambert GBL Annual Report 2015 Overview GBL’s primary objective is to create value for its shareholders. Key information 2nd largest Founded in 1902 holding and listed since company in Europe 1956 Focused on global industrial and services Controlled by the Frère (Belgium) Target leaders and Power Corporation of Canada (Canada) groups Resilient track record with above market average Progressive diversification of the portfolio in terms of sectors, geographies, as well as type and number of assets Executive Management: Gérard Lamarche and Ian Gallienne Policy of limited Significant Competitive net debt financial cost over time liquidity structure GBL Annual Report 2015 Overview GBL strives to develop a quality portfolio focused on a targeted number of companies that are leaders in their market and in which it can play an active role as a professional shareholder over the long term. -

Corporate Governance

Corporate Governance CORPORATE GOVERNANCE STATEMENT Groupe Bruxelles Lambert (“GBL” or the “Company”) complies with all corporate governance regulations. In this context, it complies in particular with the provisions of the 2020 Belgian Corporate Governance Code (the “2020 Code”). The standards of conduct for members of GBL’s Board of Directors and specialised Committees, as well as the rules governing the functioning of these bodies, are laid out in the Corporate Governance Charter (the “Charter”). This document also includes the Dealing Code, which defines the rules applicable to transactions in GBL securities. The Charter was published for the first time at the end of 2005. Since then, the Board of Directors has ensured that this document reflects the various legal developments in the field of corporate governance, including the 2020 Code. The updated document is available on the Company’s website (www.gbl.be). This Corporate Governance Statement describes the composition and functioning of GBL’s administrative bodies and their Committees. It comments on the practical application of GBL’s governance rules during the financial year ended December 31, 2020 and the period between the end of this financial year and the Board of Directors meeting on March 11, 2021. Furthermore, it lists the Company’s deviations from certain provisions of the 2020 Code and explains the reasons behind them. It also includes the remuneration policy and the remuneration report. Lastly, it reflects the principal characteristics of the Company’s internal control and risk management systems. 218 GBL – Annual Report 2020 218 Corporate Governance Statement 220 Board of Directors 233 Board Committees 236 Remuneration of corporate officers 239 Auditing of the financial statements 240 Staff and organisation 243 Risk management and internal control 244 Policy on conflicts of interest 245 Policy relating to transactions in GBL securities 246 Shareholders 249 Other information relating to the Company 251 Mandates held by the Directors between 2016 and 2020 GBL – Annual Report 2020 219 1.