The Research Monitor June Quarter 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2015 Annual Results 19 August 2015 Agenda

2015 Annual Results 19 August 2015 Agenda • Merger update and strategic focus Angus McNaughton • Financial results Richard Jamieson Angus McNaughton Richard Jamieson • Portfolio performance Chief Executive Officer CFO and EGM Investments Stuart Macrae • Development update Jonathan Timms • FY16 focus and guidance Stuart Macrae Jonathan Timms Angus McNaughton EGM Leasing EGM Development 2 Merger update and strategic focus Angus McNaughton Cranbourne Park, VIC Merger benefits on track with a strong platform for growth • Strategic focus remains unchanged • Operational cost synergies on track • Over 60% of operational cost savings1 already locked in • Merger financing savings achieved1 with over $100m lower cost • Weighted average cost of debt reduced to 4.2% • Integration is on program • Key operational teams finalised and team co-locations underway • Solid FY15 performance • Statutory net profit of $675.1m • Underlying earnings up 6.2%2 • Development pipeline increased to $3.1b and current projects on or ahead of plan The Myer Centre Brisbane, QLD 1. On a run-rate or annualised basis. 2. On an aggregate basis. 4 Strategic focus remains unchanged Retail real estate • We will own, manage and develop Australian retail assets across the spectrum • Portfolio composition will evolve as developments occur and asset recycling continues Operational excellence • High performance intensive asset management approach • Continuous improvement of systems and processes • Strongly committed to responsible investment and sustainability • Development of a fully -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

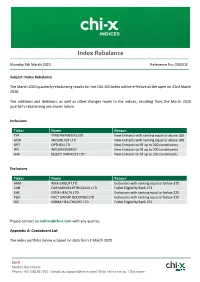

Index Rebalance

Index Rebalance Monday 9th March 2020 Reference No: 0002/20 Subject: Index Rebalance The March 2020 quarterly rebalancing results for the CXA 200 Index will be effective at the open on 23rd March 2020. The additions and deletions, as well as other changes made to the indices, resulting from the March 2020 quarterly rebalancing are shown below. Inclusions Ticker Name Reason TYR TYRO PAYMENTS LTD New Entrants with ranking equal or above 180 MSB MESOBLAST LTD New Entrants with ranking equal or above 180 OPT OPTHEA LTD New Entrants to fill up to 200 constituents IFN INFIGEN ENERGY New Entrants to fill up to 200 constituents SHV SELECT HARVESTS LTD New Entrants to fill up to 200 constituents Exclusions Ticker Name Reason AMA AMA GROUP LTD Exclusions with ranking equal or below 220 CVN CARNARVON PETROLEUM LTD Failed Eligibility Rank 273 EHE ESTIA HEALTH LTD Exclusions with ranking equal or below 220 PGH PACT GROUP HOLDINGS LTD Exclusions with ranking equal or below 220 SIG SIGMA HEALTHCARE LTD Failed Eligibility Rank 252 Please contact [email protected] with any queries. Appendix A: Constituent List The index portfolio below is based on data from 2 March 2020. Chi-X Market Operations Phone: +61 2 8078 1701 | Email: [email protected]| Web: chi-x.com.au | Disclaimer Newly added constituents are in BOLD. Chi-X indices (CXA 200 Index) Ticker Name CBA COMMONWEALTH BANK OF AUSTRAL CSL CSL LTD BHP BHP GROUP LTD WBC WESTPAC BANKING CORP NAB NATIONAL AUSTRALIA BANK LTD ANZ AUST AND NZ BANKING GROUP WOW WOOLWORTHS GROUP LTD MQG MACQUARIE GROUP -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Social Impact Insight Report December 2020

Vicinity Centres Social Impact Insight Report December 2020 Corporate Citizenship - LBG Australia & New Zealand Annual Company Benchmarking Report 2020 2020 Social Impact Insight Report Thank you for participating in the LBG benchmarking for 2020. The LBG methodology allows a company to form a reliable and holistic view of its community investment, from what is contributed, what happens and what changes as a result. LBG is the globally recognised methodology used by hundreds of the world’s leading companies to articulate and measure the positive impact they have in the world. The LBG Framework currently underpins the Community & Philanthropy question in the DJSI questionnaire, is reflected in the GRI standard and is recognised by the UN Global Compact as evidence for a company’s social impact narrative to stakeholders. LBG acts as a; • management tool, • a private benchmark, • and a network of professionals This report is designed to provide you with valuable benchmarking insights for program improvements. We encourage all members to arrange to meet with us to discuss the report in more detail and highlight the opportunities it demonstrates. The infographic page of this report acts as a summary of your results for you to use when sharing your results internally as well as a source of pointers where you could evolve your current program. The seismic events of 2020 such as Covid-19 and the Black Lives Matter movement have accelerated stakeholder expectations for companies to play a leading role in creating a more inclusive and robust society. The ‘S’ in ESG has become even more important. The fact that LBG is transforming in 2021 to provide a holistic management model is timely. -

2019 Annual Report

Discover more Annual Report 2019 Join us as we discover Inside how Vicinity Centres creates market-leading 01 Highlights 42 Our Board 02 Our Value Chain 45 Our Executive Committee destinations. 04 Market-Leading Destinations 48 Tax Transparency 06 Chairman’s Review 52 Sustainability Assurance Destinations that 08 CEO and Managing Statement enhance communities Director’s Review 53 Financial Report 12 Our Operating and 54 Director’s Report and offer so much more Financial Review 58 Remuneration Report than an exceptional 29 Our Portfolio 80 Financial Statements 34 Integrated Energy Platform 122 Independent Auditor’s retail experience. 36 Our Communities Report 38 Our Data and Analytics 128 Summary of Securityholders 40 Our People 129 Corporate Directory About this report This annual report discloses Vicinity’s financial and non- environmentally responsible paper manufactured under This annual report is a summary of Vicinity Centres’ operations, financial performance for FY19 and has been prepared using IAO 14001 environmental standards. activities and financial position as at 30 June 2019. In this elements of the International Integrated Reporting Council The following symbols are used in this report to cross-refer report references to ‘Vicinity’, ‘Group’, ‘we’, ‘us’ and ‘our’ refer (IIRC) Integrated Reporting <IR> framework. More information, to more information on a topic: to Vicinity Centres unless otherwise stated. particularly latest company announcements and detailed sustainability reporting, can be found on Vicinity’s website. References in this report to a ‘year’ and ‘FY19’ refer to the References additional information within financial year ended 30 June 2019 unless otherwise stated. Vicinity is committed to reducing the environmental footprint this Annual Report All dollar figures are expressed in Australian dollars (AUD) associated with the production of the annual report and unless otherwise stated. -

STOXX Australia 150 Last Updated: 02.01.2017

STOXX Australia 150 Last Updated: 02.01.2017 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 97.5 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 74.9 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 61.1 3 3 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 55.9 4 5 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 55.3 5 4 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 41.8 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 32.7 7 7 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 31.4 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 21.3 9 9 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 19.1 10 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 17.4 11 11 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 17.0 12 12 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 15.6 13 13 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 14.5 14 14 AU000000BXB1 B1FJ0C0 BXB.AX 612000 Brambles Ltd. AU AUD Y 13.5 15 16 AU000000WFD0 BMMVVX4 WFD.AX 605414 WESTFIELD CORP AU AUD Y 13.4 16 15 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. -

Dow Jones Sustainability Australia Index

Effective as of 23 September 2019 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia & New Zealand Banking Group Ltd Australia Banks National Australia Bank Ltd Australia Banks Westpac Banking Corp Australia Banks CIMIC Group Ltd Australia Capital Goods Brambles Ltd Australia Commercial & Professional Services Downer EDI Ltd Australia Commercial & Professional Services Addition Star Entertainment Grp Ltd Australia Consumer Services Tabcorp Holdings Ltd Australia Consumer Services Janus Henderson Group PLC United Kingdom Diversified Financials Macquarie Group Ltd Australia Diversified Financials Oil Search Ltd Australia Energy Woodside Petroleum Ltd Australia Energy Coles Group Ltd Australia Food & Staples Retailing Fisher & Paykel Healthcare Corp Ltd New Zealand Health Care Equipment & Services Asaleo Care Ltd Australia Household & Personal Products Insurance Australia Group Ltd Australia Insurance QBE Insurance Group Ltd Australia Insurance BHP Group Ltd Australia Materials Boral Ltd Australia Materials Addition Evolution Mining Ltd Australia Materials Addition Fletcher Building Ltd New Zealand Materials Addition Fortescue Metals Group Ltd Australia Materials Iluka Resources Ltd Australia Materials Incitec Pivot Ltd Australia Materials Independence Group NL Australia Materials Addition Newcrest Mining Ltd Australia Materials Orica Ltd Australia Materials Orocobre Ltd Australia Materials Rio Tinto Ltd Australia Materials Sims Metal Management Ltd Australia Materials South32 Ltd Australia Materials -

SPDR® S&P/ASX 50 Fund

SPDR® S&P/ASX 50 Fund Trade Date: 09-Feb-2017 1N.A.V. per Unit $ 53.30 2N.A.V. per Creation Unit $ 5,330,437.48 Value of Index Basket Shares for 09-Feb-2017 $ 5,330,379.81 3Cash Component per Creation Unit $ 57.67 4N.A.V. of SPDR® S&P/ASX 50 Fund $ 442,122,422.95 Date: 10-Feb-2017 Opening Units on Issue 8,294,299.00 Applications 0.00 Redemptions 0.00 5Ending Units on Issue 8,294,299.00 Index Basket Shares per Creation Unit for 10-Feb-2017 Stock Code Name of Index Basket Share Shares AGL AGL Energy Ltd 2,992 AMC Amcor Ltd 5,147 AMP AMP Ltd 13,145 ANZ Australia New Zealand Banking Group Ltd 13,033 APA APA Group 4,952 ASX ASX Ltd 860 AZJ Aurizon Holdings Ltd 9,119 BHP BHP Billiton Ltd 14,262 BXB Brambles Ltd 7,058 CBA Commonwealth Bank of Australia 7,656 CCL Coca-Cola Amatil Ltd 2,348 CPU COMPUTERSHARE LTD COMMON STOCK NPV 2,225 CSL CSL Ltd 2,029 CTX Caltex Australia Ltd 1,159 DXS Dexus Property Group 4,267 GMG Goodman Group 7,077 GPT GPT Group 7,976 IAG Insurance Australia Group Ltd 10,522 IPL Incitec Pivot Ltd 7,447 JHX JAMES HARDIE INDUSTRIES CDI CDI EUR.59 1,970 LLC Lend Lease Group 2,563 MGR Mirvac Group 16,466 MPL MEDIBANK PRIVATE LTD 12,239 MQG Macquarie Group Ltd 1,512 NAB National Australia Bank Ltd 11,850 SPDR® S&P/ASX 50 Fund Stock Code Name of Index Basket Share Shares NCM Newcrest Mining Ltd 3,392 ORG Origin Energy Ltd 7,749 ORI ORICA LTD 1,666 OSH OIL SEARCH LTD COMMON STOCK NPV 5,198 QAN Qantas Airways Ltd 8,214 QBE QBE INSURANCE GROUP LTD 6,066 RHC Ramsay Health Care Ltd 573 RIO RIO TINTO LTD COMMON STOCK NPV 1,885 S32 SOUTH32 -

(ASX:PCI) June 2019 Annual Report – List of All Investments Perpe

Level 18, 123 Pitt Street, Sydney NSW 2000 www.perpetual.com.au Perpetual Trust Services Limited ACN 000 142 049 ABN 45 000 142 049 AFSL 236648 ASX Announcement 29 June 2020 Perpetual Credit Income Trust (ASX:PCI) June 2019 Annual Report – List of all Investments Perpetual Trust Services Limited, as the Responsible Entity for the Perpetual Credit Income Trust (Trust), notes that under Listing Rule 4.10.20, an entity must lodge with ASX a list of all investments held by the entity as part of its annual report. This list of investments was not included as part of June 2019 Annual Report. Please see attached a list of all investments held by the Trust as at 30 June 2019. This announcement has no impact on the financial accounts within the 2019 Annual Report. Your Sincerely Kevin Razavi Senior Corporate Client Manager Perpetual Trust Services Limited as Responsible Entity for the Perpetual Credit Income Trust. Perpetual Credit Income Trust ARSN 626 053 496 ASX Additional information Fair Value List of all investments held by the Trust as at 30 June 2019 $'000 Unlisted unit trust PERPETUAL LOAN FUND 49,712 Total Unlisted unit trust 49,712 Debt securities AT AND T INC 5,469 AURIZON NETWORK PTY LTD 4,039 AUSGRID FINANCE PTY LTD 5,259 AUSTRALIA PACIFIC AIRPORTS 1,879 AUSTRALIAN PRIME PROPERTY 9,400 BANCO SANTANDER SA 5,148 BANK OF QUEENSLAND LTD 9,047 BARCLAYS PLC 2,519 BARMINCO FINANCE PTY LTD 7,421 BENDIGO AND ADELAIDE BANK 7,685 BENTHAM IMF LTD 2,305 BLUESCOPE FINANCE 10,475 BYRNS SMITH UNIT TRUST 8,908 CALTEX AUSTRALIA LTD 4,879 CENTURIA